In the fast-paced world of forex trading, managing multiple accounts has emerged as a popular strategy among traders aiming to diversify their portfolios and boost profits. However, effectively managing multiple forex accounts requires a strategic approach. This comprehensive guide will delve into the intricacies of this advanced trading technique, offering you the knowledge and tools needed to successfully handle multiple accounts in the forex market, all while ensuring you work with a regulated forex broker for a secure trading experience.

Managing multiple forex accounts involves overseeing and operating several trading accounts simultaneously, each with its own set of strategies, risk levels, and objectives. This approach allows traders to spread their risk, test different strategies, and potentially increase their overall returns. However, it also comes with its own set of challenges and complexities that require careful planning and execution.

The Benefits of Managing Multiple Forex Accounts

1. Diversification of Risk

One of the primary advantages of managing multiple forex accounts is the ability to diversify risk across different strategies and market conditions. By spreading your capital across various accounts, you can minimize the impact of potential losses in any single account. This diversification can act as a buffer against market volatility and unexpected events that might negatively impact one particular strategy or currency pair.

2. Strategy Testing

Multiple accounts allow you to test and compare different trading strategies simultaneously. This real-time comparison can help you identify which approaches are most effective in various market conditions. For instance, you could run a trend-following strategy in one account while implementing a mean reversion strategy in another, allowing you to see which performs better under current market circumstances.

3. Increased Profit Potential

With multiple accounts, you can potentially increase your overall profit by capitalizing on different market opportunities and trading styles. By having accounts dedicated to different strategies or time frames, you can take advantage of both short-term fluctuations and long-term trends in the forex market.

4. Flexibility in Fund Allocation

Managing multiple accounts gives you the flexibility to allocate funds based on performance, risk tolerance, and market conditions. You can shift capital to accounts that are performing well or have strategies better suited to current market conditions, optimizing your overall portfolio performance.

5. Regulatory Advantages

In some cases, managing multiple accounts can offer regulatory advantages. For example, you might be able to maintain accounts in different jurisdictions, potentially benefiting from varying regulatory environments or tax structures. However, it’s crucial to ensure full compliance with all applicable laws and regulations.

Key Strategies for Managing Multiple Forex Accounts

1. Develop a Clear Plan for Each Account

To effectively manage multiple forex accounts, it’s crucial to have a clear plan for each one. This includes:

- Defining specific goals and objectives

- Setting risk tolerance levels

- Outlining trading strategies

- Establishing performance metrics

By having a distinct purpose for each account, you can maintain focus and avoid confusing strategies across accounts. For example, one account might be dedicated to day trading major currency pairs, while another focuses on swing trading exotic pairs.

2. Utilize Account Management Software

Investing in robust account management software can significantly streamline the process of managing multiple forex accounts. Look for features such as:

- Real-time monitoring of all accounts

- Automated trade execution

- Risk management tools

- Performance analytics

- Customizable alerts and notifications

These tools can help you stay organized and make data-driven decisions across your accounts. Some popular multi-account management platforms include MultiCharts, cTrader, and MetaTrader 4/5 with multi-account capabilities.

3. Implement Proper Risk Management

Risk management becomes even more critical when dealing with multiple accounts. Consider the following strategies:

- Set stop-loss orders for each trade

- Use appropriate position sizing

- Diversify across different currency pairs

- Monitor overall exposure across all accounts

- Implement a maximum drawdown limit for each account

By maintaining strict risk management protocols, you can protect your capital and ensure long-term sustainability. Remember, the goal is not just to maximize profits but to preserve capital across all your accounts.

4. Maintain Detailed Records

Keeping meticulous records is essential for managing multiple forex accounts effectively. Track the following for each account:

- Trade history

- Performance metrics

- Profit and loss statements

- Strategy adjustments

- Correlation between accounts

This data will help you identify trends, evaluate performance, and make informed decisions about fund allocation and strategy adjustments. Consider using spreadsheets or specialized trading journals to maintain organized records.

5. Regularly Review and Adjust Strategies

The forex market is constantly evolving, and your strategies should adapt accordingly. Schedule regular reviews of each account to:

- Assess performance against benchmarks

- Identify areas for improvement

- Adjust strategies based on market conditions

- Reallocate funds if necessary

- Evaluate the correlation between accounts to ensure true diversification

These reviews will help ensure that your accounts remain optimized for current market conditions. Consider conducting weekly, monthly, and quarterly reviews to maintain a comprehensive understanding of your multi-account performance.

Read More: Understanding Copy Trading on Opofinance

Advanced Techniques for Multi-Account Management

1. Use of Expert Advisors (EAs)

Expert Advisors can automate trading strategies across multiple accounts, allowing for consistent execution and reduced emotional decision-making. When using EAs:

- Thoroughly backtest each EA before implementation

- Monitor performance regularly

- Be prepared to intervene if market conditions change drastically

- Ensure your EAs are compatible with your chosen trading platform

- Regularly update and optimize your EAs to maintain their effectiveness

2. Implement a Master/Slave Account Structure

A master/slave account structure allows you to manage multiple accounts from a single master account. This approach can:

- Streamline trade execution

- Ensure consistency across accounts

- Simplify overall management

- Reduce the time spent on individual account management

However, be sure to comply with all regulatory requirements when using this structure. Some brokers offer specific master/slave account services, which can simplify the setup process.

3. Leverage Copy Trading Platforms

Copy trading platforms can be an effective way to manage multiple accounts, especially for those new to multi-account management. These platforms allow you to:

- Copy trades from successful traders

- Diversify across different trading styles

- Learn from experienced traders

- Allocate different amounts of capital to various trading strategies

Be sure to carefully vet the traders you choose to copy and monitor performance closely. Popular copy trading platforms include eToro, ZuluTrade, and Darwinex.

4. Utilize Virtual Private Server (VPS) Hosting

A VPS can provide several benefits for managing multiple forex accounts, including:

- Reduced latency for trade execution

- 24/7 uptime for EAs and automated strategies

- Enhanced security for your trading operations

- Ability to run multiple trading platforms simultaneously

Consider investing in a reliable VPS service to optimize your multi-account management. Look for VPS providers that specialize in forex trading to ensure they meet the specific needs of traders.

5. Implement Portfolio-Based Management

Instead of viewing each account in isolation, consider implementing a portfolio-based management approach:

- Treat all accounts as part of a single portfolio

- Balance strategies and risk across the entire portfolio

- Use correlation analysis to ensure true diversification

- Implement overall portfolio-level risk management

- Adjust individual account strategies based on their role in the larger portfolio

This approach can help you maintain a more holistic view of your trading activities and ensure that your accounts work together synergistically.

Read More: Understanding Different Types of Forex Account

Overcoming Common Challenges in Multi-Account Management

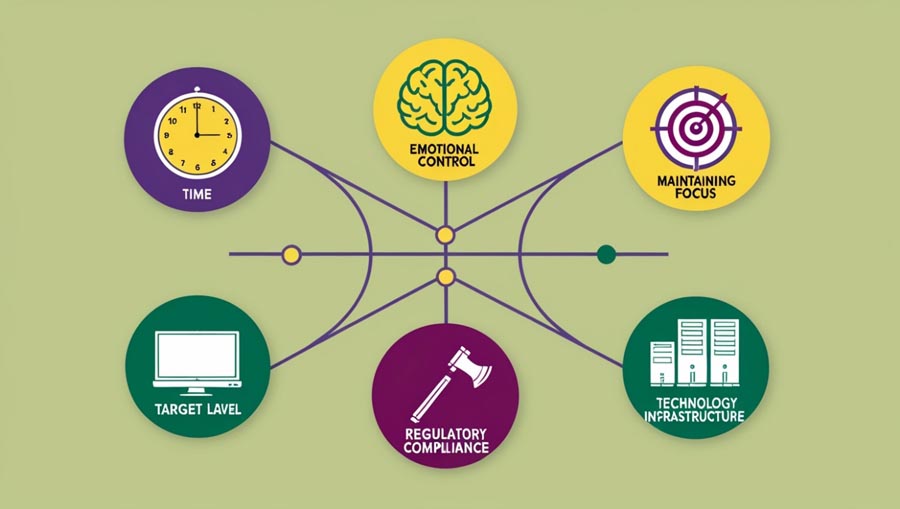

1. Time Management

Managing multiple accounts can be time-consuming. To address this:

- Prioritize accounts based on performance and potential

- Use automation where possible

- Develop efficient workflows for monitoring and analysis

- Set specific times for account review and management

- Consider delegating certain tasks to a team if managing a large number of accounts

2. Emotional Control

With multiple accounts, emotional decision-making can be amplified. Combat this by:

- Sticking to predefined strategies

- Using automated systems to reduce emotional interference

- Practicing mindfulness and stress management techniques

- Maintaining a trading journal to track your emotional states

- Setting clear rules for when to step away from trading

3. Maintaining Focus

It’s easy to lose focus when juggling multiple accounts. Stay on track by:

- Setting clear goals for each account

- Regularly reviewing your overall trading plan

- Avoiding the temptation to over-trade

- Using visual aids like dashboards to maintain an overview of all accounts

- Implementing a routine for account management and review

4. Regulatory Compliance

Ensure you’re complying with all relevant regulations when managing multiple accounts. This may include:

- Proper disclosure of multiple account ownership

- Adhering to capital requirements

- Maintaining accurate records for tax purposes

- Complying with anti-money laundering (AML) regulations

- Understanding and following rules regarding proprietary trading if applicable

Consult with a financial advisor or legal professional to ensure full compliance. Consider joining professional associations for forex traders to stay updated on regulatory changes.

5. Technology and Infrastructure

Managing multiple accounts requires robust technology and infrastructure. Address this by:

- Investing in high-quality hardware and internet connection

- Having backup systems in place to prevent downtime

- Regularly updating and maintaining your trading software

- Implementing strong cybersecurity measures to protect your accounts

- Considering professional IT support for complex setups

Read More: Most Correlated Forex Pairs

Conclusion

Managing multiple forex accounts can be a powerful strategy for experienced traders looking to diversify their portfolios and maximize their profit potential. By implementing the strategies and techniques outlined in this guide, you can effectively navigate the complexities of multi-account management and potentially achieve greater success in the forex market.

Remember, successful multi-account management requires discipline, organization, and continuous learning. Stay informed about market trends, regularly review your strategies, and always prioritize risk management. With dedication and the right approach, managing multiple forex accounts can open up new opportunities for growth and profitability in your trading career.

As you embark on your journey of managing multiple forex accounts, keep in mind that it’s a skill that develops over time. Start small, stay focused, and gradually expand your multi-account portfolio as you gain confidence and expertise. With patience and persistence, you can master the art of managing multiple forex accounts and take your trading to new heights.

In the ever-evolving world of forex trading, those who can effectively manage multiple accounts will have a significant advantage. By diversifying your strategies, spreading risk, and capitalizing on various market opportunities, you can create a robust and potentially more profitable trading operation. Remember to stay compliant with all regulations, continuously educate yourself, and adapt your strategies as market conditions change. With the right mindset and tools, managing multiple forex accounts can be not just a challenge, but an exciting opportunity to grow as a trader and potentially increase your forex trading success.

Is it legal to manage multiple forex accounts?

Yes, it is generally legal to manage multiple forex accounts. However, there are important regulatory considerations to keep in mind. Different jurisdictions may have specific rules regarding multiple account ownership and management. It’s crucial to disclose all accounts to your broker and ensure compliance with local regulations. Some regions may require you to register as a money manager if you’re handling accounts for other individuals. Always consult with a legal professional or regulatory expert to ensure you’re operating within the bounds of the law.

How many forex accounts should I manage simultaneously?

The number of forex accounts you should manage simultaneously depends on your experience, available time, and resources. For beginners, it’s advisable to start with just two or three accounts to avoid becoming overwhelmed. As you gain experience and develop efficient management systems, you can gradually increase the number of accounts. Some professional traders manage dozens of accounts, but this requires significant expertise and often a team of analysts. It’s essential to only manage as many accounts as you can effectively monitor and control without compromising your trading performance or risk management.

Can I use the same strategy across all my forex accounts?

While it’s possible to use the same strategy across all your forex accounts, it’s generally not recommended. One of the primary benefits of managing multiple accounts is the ability to diversify your strategies and risk. By employing different strategies across your accounts, you can:

Spread risk more effectively

Capitalize on various market conditions

Test and compare different approaches

Potentially increase overall profitability

However, if you have a particularly successful strategy, you might consider using it as a base strategy across accounts while making slight modifications to suit different risk profiles or market segments. Always ensure that each account has a clear purpose and that your overall portfolio of accounts is well-balanced and diversified.

2 Responses

How get this software

send detail how to get this service