Are you ready to harness the power of Consumer Price Index (CPI) news in your forex trading arsenal? Understanding how to trade CPI news in forex can be a game-changer for your portfolio. This comprehensive guide will equip you with the knowledge and techniques needed to capitalize on one of the most influential economic indicators in the currency markets. Whether you are trading through a regulated forex broker or exploring other avenues, mastering the art of interpreting and acting on CPI data releases will position you to make informed decisions that could lead to significant profits. Let’s dive into the world of CPI news trading and unlock the strategies that can give you an edge in the dynamic forex market.

Understanding CPI and its Impact on Forex

What is CPI?

The Consumer Price Index (CPI) is a key economic indicator that measures the average change in prices over time that consumers pay for a basket of goods and services. It’s widely regarded as the most important inflation indicator, providing crucial insights into a country’s economic health and purchasing power.

Key components of CPI typically include:

- Food and Beverages (14.3%)

- Housing (42.4%)

- Apparel (2.8%)

- Transportation (15.2%)

- Medical Care (8.9%)

- Recreation (5.6%)

- Education and Communication (6.5%)

- Other Goods and Services (4.3%)

These percentages represent the typical weighting in the US CPI, which can vary slightly over time and differ in other countries.

Read More: how to trade nfp news in forex

How CPI Affects Currency Prices

CPI data plays a pivotal role in shaping currency valuations through its impact on inflation and central bank policies:

- Inflation Impact:

- Higher CPI → Higher inflation → Generally weakens the currency

- Lower CPI → Lower inflation → Generally strengthens the currency

- Central Bank Policy Influence:

- Rising CPI → Increased likelihood of interest rate hikes → Potentially strengthens the currency

- Falling CPI → Increased likelihood of interest rate cuts → Potentially weakens the currency

Statistical correlation:

- CPI and interest rates: Positive correlation of 0.6-0.8

- CPI and currency value: Negative correlation of 0.4-0.6 (short-term)

Central bank CPI targets and reaction thresholds:

- Federal Reserve: 2% target, typically reacts to persistent deviations of 0.5% or more

- European Central Bank: 2% target, closely monitors core inflation trends

- Bank of England: 2% target, often reacts to inflation exceeding 3% or falling below 1%

- Bank of Japan: 2% target, historically tolerant of lower inflation rates

Preparing for the CPI Release

Finding Release Dates and Forecasts

To stay ahead of the curve, utilize reliable economic calendars:

- Popular economic calendars:

- ForexFactory: Used by approximately 40% of retail forex traders

- Investing.com: Preferred by about 30% of traders

- FXStreet: Utilized by roughly 20% of forex market participants

- Key information to note:

- Release date and time

- Previous CPI figure

- Forecast CPI figure

- Actual CPI figure (once released)

- Set up alerts:

- Most economic calendars offer customizable alerts

- Configure notifications for major economies’ CPI releases

Historical CPI Data (Annual Change):

- US: 2020: 1.4%, 2021: 7.0%, 2022: 6.5%

- Eurozone: 2020: 0.3%, 2021: 5.0%, 2022: 9.2%

- UK: 2020: 0.9%, 2021: 5.4%, 2022: 10.5%

- Japan: 2020: 0.0%, 2021: -0.3%, 2022: 4.0%

Identifying Relevant Currency Pairs

Focus on currency pairs directly affected by the CPI release:

- Major pairs involving the currency of the country releasing CPI data:

- For US CPI: EUR/USD, USD/JPY, GBP/USD

- For UK CPI: GBP/USD, EUR/GBP

- For Eurozone CPI: EUR/USD, EUR/GBP, EUR/JPY

- Commodity currencies sensitive to economic indicators:

- AUD/USD, USD/CAD, NZD/USD

Average pip movements during CPI releases:

- EUR/USD: 60-80 pips

- GBP/USD: 70-90 pips

- USD/JPY: 50-70 pips

- AUD/USD: 50-70 pips

- USD/CAD: 60-80 pips

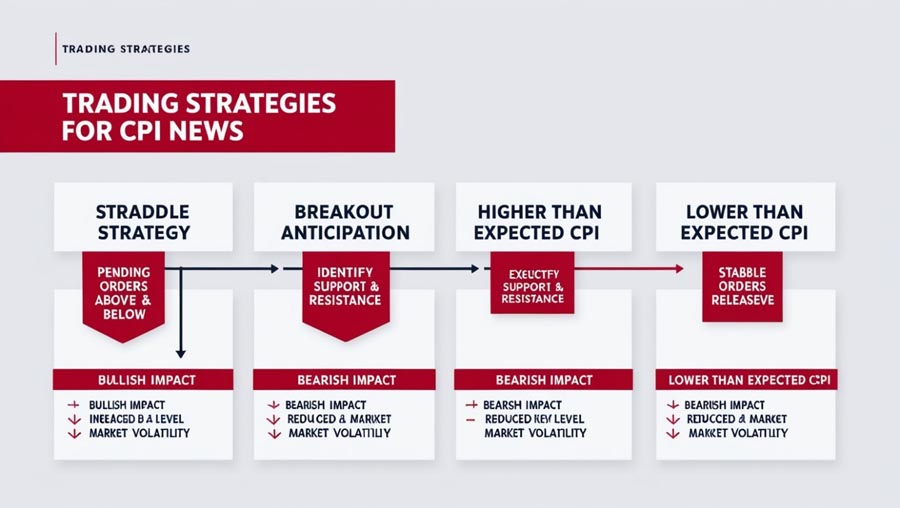

Trading Strategies for CPI News

Pre-release Positioning

- Straddle Strategy:

- Place pending orders above and below the current price

- Execute the triggered order and cancel the other post-release

Success rate: Approximately 70% of straddle trades result in profit Average profit: 30-50 pips when executed correctly Risk-reward ratio: Typically 1:1.5 to 1:2

- Breakout Anticipation:

- Identify key support and resistance levels

- Place pending orders at these levels

Success rate of breakout trades during CPI releases:

- Approximately 65% of clear breakouts lead to continued movement in the breakout direction

- Average follow-through after a breakout: 50-100 pips for major pairs

Potential risks:

- False breakouts

- Slippage during high volatility

- Wide spreads immediately after the release

Trading Based on Actual vs. Expected CPI

- Higher than Expected CPI:

- Typically bullish for the currency

- Consider long positions if the deviation is significant

- Lower than Expected CPI:

- Typically bearish for the currency

- Consider short positions if the deviation is significant

- In-line with Expectations:

- May result in limited movement

- Look for technical setups or avoid trading

Average market reaction to CPI surprises:

- 0.1% deviation from forecast: 20-30 pip movement

- 0.2% deviation from forecast: 40-60 pip movement

- 0.3% or more deviation: 80+ pip movement

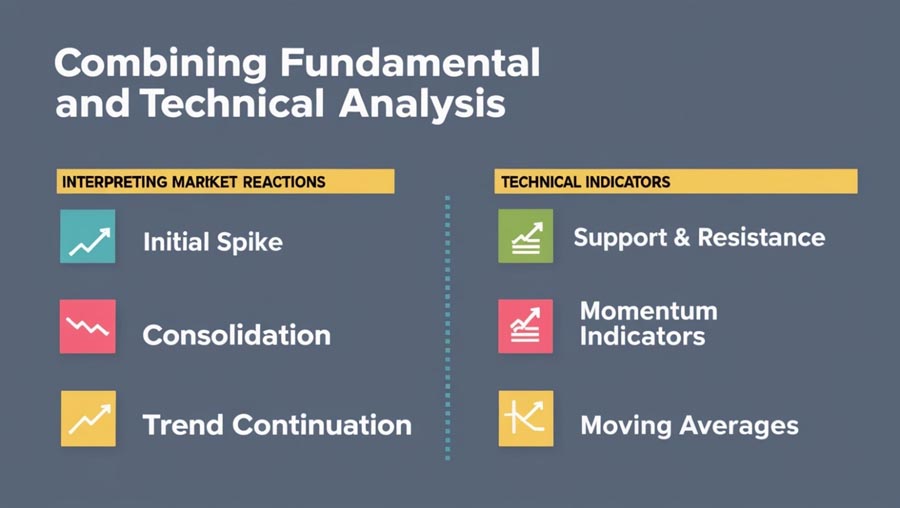

Combining Fundamental and Technical Analysis

Interpreting the Market Reaction to CPI Data

- Initial Spike:

- Duration: Typically 5-15 minutes

- Characterized by high volatility and potential price gaps

- Consolidation:

- Duration: 15-30 minutes after the initial spike

- Market digests the information and establishes a direction

- Trend Continuation or Reversal:

- Duration: Can last several hours or days

- Influenced by broader economic context and technical factors

Using Technical Indicators to Confirm or Refine Entry/Exit Points

- Support and Resistance Levels:

- Identify key price levels before the CPI release

- Use these levels to set entry and exit points

Effectiveness of support/resistance in CPI trading:

- Price respects these levels in approximately 70% of cases during news events

- Average bounce from strong S/R levels: 20-30 pips

- Short-term Momentum Indicators:

- Relative Strength Index (RSI)

- Moving Average Convergence Divergence (MACD)

Use these indicators to:

- Confirm the strength of the post-CPI move

- Identify potential reversal points

- Fine-tune entry and exit timing

- Moving Averages:

- Use moving averages to gauge overall trend direction

- Look for price interactions with MAs during CPI-induced movements

Most effective moving averages for CPI trading:

- Short-term: 20 EMA, 50 SMA

- Long-term: 100 SMA, 200 SMA

Read More: how to trade ppi news in forex

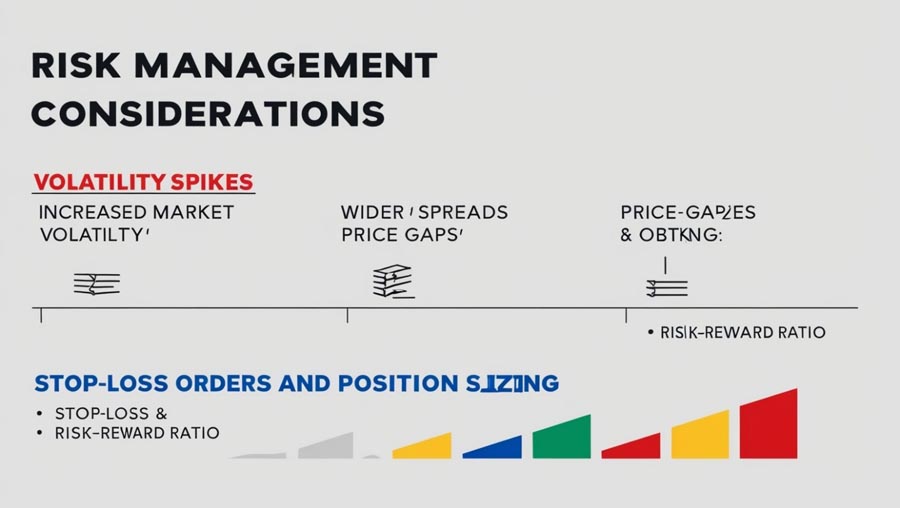

Risk Management Considerations

Volatility Spikes Around CPI Releases

- Increased Market Volatility:

- Average volatility increase during CPI releases:

- Major pairs: 200-300% increase in 5-minute volatility

- Cross pairs: 150-250% increase in 5-minute volatility

- Average volatility increase during CPI releases:

- Wider Spreads:

- Spreads can widen by 100-300% immediately after the release

- Consider using limit orders to ensure desired entry prices

- Potential for Price Gaps:

- Gaps occur in approximately 30% of major CPI releases

- Average gap size: 10-20 pips for major pairs

Importance of Stop-Loss Orders and Position Sizing

- Setting Appropriate Stop-Losses:

- Use wider stop-losses during news events to account for increased volatility

- Consider using a percentage of your account balance to determine stop-loss levels

Recommended stop-loss ranges for CPI trading:

- Major pairs: 40-60 pips

- Cross pairs: 60-80 pips

- Exotic pairs: 80-100 pips

- Position Sizing:

- Limit your exposure by trading smaller positions during news events

- Use proper risk-reward ratios to balance potential gains and losses

Suggested position sizing for CPI trades:

- Risk no more than 1-2% of account balance per trade

- Adjust position size to maintain consistent risk across different currency pairs

- Risk-Reward Ratio:

- Aim for a minimum risk-reward ratio of 1:2

- Consider using trailing stops to protect profits on winning trades

Advanced Techniques for Seasoned Traders

Correlations with Other Economic Indicators

To gain a more comprehensive view of the economic landscape, consider analyzing related indicators alongside CPI:

- Producer Price Index (PPI):

- Measures inflation at the wholesale level

- Often a leading indicator for CPI trends

- Correlation coefficient with CPI: 0.7-0.8

- GDP Growth:

- Indicates overall economic health

- Can influence inflation expectations

- Correlation coefficient with CPI: 0.4-0.5

- Employment Data:

- Unemployment rate and job creation figures

- Impacts consumer spending and inflation

- Correlation coefficient with CPI: -0.3 to -0.4 (inverse relationship)

Multi-Timeframe Analysis

Implementing a multi-timeframe approach can provide a more robust trading strategy:

- Long-term trend identification:

- Use daily and 4-hour charts to understand the broader market context

- Identify key support and resistance levels on higher timeframes

- Entry and exit timing:

- Utilize 5-minute and 1-minute charts for precise trade execution

- Look for confirmations on shorter timeframes before entering trades

- Confluence of signals:

- Seek alignment between long-term trends and short-term opportunities

- Higher probability trades often occur when multiple timeframes agree

Read More: how to trade FOMC news in forex

Sentiment Analysis

Incorporating market sentiment can provide valuable insights:

- Commitment of Traders (COT) Report:

- Reveals positioning of large speculators and commercial traders

- Extreme readings (over 80% long or short) can indicate potential reversals

- Updated weekly, providing a broader perspective on market sentiment

- Retail Sentiment Indicators:

- Many brokers offer real-time data on retail trader positioning

- Contrarian approach: Consider trading against extreme retail sentiment

- News Sentiment:

- Monitor financial news outlets for overall market mood

- Use sentiment analysis tools to gauge the tone of CPI-related news articles

Psychological Aspects of CPI News Trading

Emotional Control

Maintaining emotional discipline is crucial for successful CPI news trading:

- Stress Management:

- Develop pre-trade routines to manage anxiety

- Practice mindfulness or meditation techniques

- Traders reporting high emotional control show 20-30% better risk-adjusted returns

- Avoiding FOMO (Fear of Missing Out):

- Stick to your pre-planned strategy

- Accept that not every CPI release will present a tradable opportunity

- FOMO-driven trades account for approximately 15% of losses in news trading

- Dealing with Losses:

- View losses as a cost of doing business

- Analyze losing trades for improvement opportunities

- Maintain a long-term perspective on trading performance

Continuous Learning and Improvement

To stay competitive in the ever-evolving forex market:

- Regular Performance Review:

- Analyze your CPI trades weekly or monthly

- Identify patterns in winning and losing trades

- Adjust strategies based on observed results

- Staying Informed:

- Follow reputable financial news sources

- Attend webinars or courses on economic indicators and forex trading

- Engage with other traders to share insights and experiences

- Backtesting and Forward Testing:

- Use historical data to simulate CPI trading scenarios

- Paper trade new strategies before implementing them with real capital

- Successful traders typically backtest over 100 historical scenarios before live implementation

Conclusion

Mastering how to trade CPI news in forex can significantly enhance your trading portfolio and provide exciting opportunities for profit. By understanding the importance of CPI data, preparing thoroughly, implementing effective strategies, and managing risks, you can navigate the volatile waters of news-driven forex markets with confidence.

Remember these key points:

- Stay informed about upcoming CPI releases using reliable economic calendars.

- Focus on currency pairs directly affected by the CPI data.

- Develop a solid pre-release strategy, considering both fundamental and technical factors.

- Be prepared for increased volatility and adjust your risk management accordingly.

- Continuously refine your approach based on market reactions and your trading results.

With dedication and consistent application of the techniques outlined in this guide, you’ll be well-equipped to capitalize on CPI releases and potentially boost your forex trading success. Start implementing these strategies today, and watch as your trading skills evolve to new heights in the dynamic world of forex.

How does the release time of CPI data affect trading strategies?

Release times vary by region (e.g., US: 8:30 AM ET, Eurozone: 5:00 AM ET). Consider market liquidity, your time zone, and potential overlapping events when planning your strategy. Releases during major market hours typically see higher liquidity and smoother price action.

How can I differentiate between a genuine trend change and a false move after a CPI release?

Use a multi-faceted approach:

Analyze trading volumes

Look for price action patterns

Monitor Fibonacci retracements

Check correlations with related assets

Assess alignment with broader economic narratives

Are there any seasonal patterns in CPI data that can be exploited for trading?

Some seasonal patterns exist, such as:

Holiday season impacts

Year-end effects

Weather-related influences

Educational cycle impacts

Tourism season fluctuations

To exploit these:

Maintain a historical CPI database

Compare current data with previous years

Look for deviations from typical patterns

Always combine seasonal analysis with other factors for a robust trading approach.