Trading the Federal Open Market Committee (FOMC) news is a crucial skill for forex traders who want to maximize their potential during high-impact economic events. Collaborating with a reliable forex broker can play a pivotal role in navigating these opportunities effectively. Knowing how to trade FOMC news in forex can significantly enhance your trading strategy, as the FOMC’s decisions on U.S. monetary policy have a direct influence on currency markets. This guide offers a comprehensive approach to preparation, strategic execution, technical analysis, and risk management, equipping you with the tools to trade FOMC events confidently and profitably.

Understanding FOMC and Its Impact on Forex

What is the FOMC?

The Federal Open Market Committee (FOMC) is a crucial component of the Federal Reserve, the central bank of the United States. The FOMC is tasked with setting U.S. monetary policy, which includes managing interest rates and influencing the money supply to achieve goals like maximum employment and price stability. The committee meets eight times a year to review economic conditions and make decisions that impact the broader economy and global financial markets.

The FOMC’s decisions are closely watched by forex traders because they can lead to significant fluctuations in currency values. An understanding of the FOMC’s objectives and actions is essential for developing effective trading strategies.

Read More: how to trade nfp news in forex

How FOMC Decisions Affect Currency Markets

Interest Rate Changes

Interest rate adjustments are the primary tool the FOMC uses to influence the economy. When the FOMC raises interest rates, the U.S. dollar (USD) usually strengthens because higher rates attract foreign investment seeking better returns. Conversely, when the FOMC lowers rates, the USD typically weakens as lower rates make USD-denominated assets less attractive. For instance, when the FOMC raised rates in December 2015, the USD appreciated significantly against major currencies.

Real-World Example: In March 2022, the FOMC’s decision to raise rates for the first time in three years resulted in a sharp appreciation of the USD as traders anticipated a tightening of monetary policy.

Monetary Policy Statements

The FOMC releases statements that offer insights into its economic outlook and future policy direction. A hawkish statement, suggesting the committee might raise rates further, can strengthen the USD. In contrast, a dovish statement, indicating potential rate cuts, can weaken the USD. For example, during the early stages of the COVID-19 pandemic in 2020, the FOMC’s dovish statements and rate cuts led to a weaker USD.

Real-World Example: In January 2023, a hawkish statement from the FOMC about continued rate hikes contributed to a strengthening of the USD against other currencies.

Economic Projections

The FOMC’s economic projections include forecasts for GDP growth, inflation, and unemployment. These projections provide insights into the committee’s view of economic conditions and can influence market sentiment. For example, an optimistic growth forecast can lead to a stronger USD, while a pessimistic outlook can weaken the USD.

Real-World Example: In September 2022, the FOMC’s revised GDP growth projections and increased inflation expectations contributed to heightened market volatility and a stronger USD.

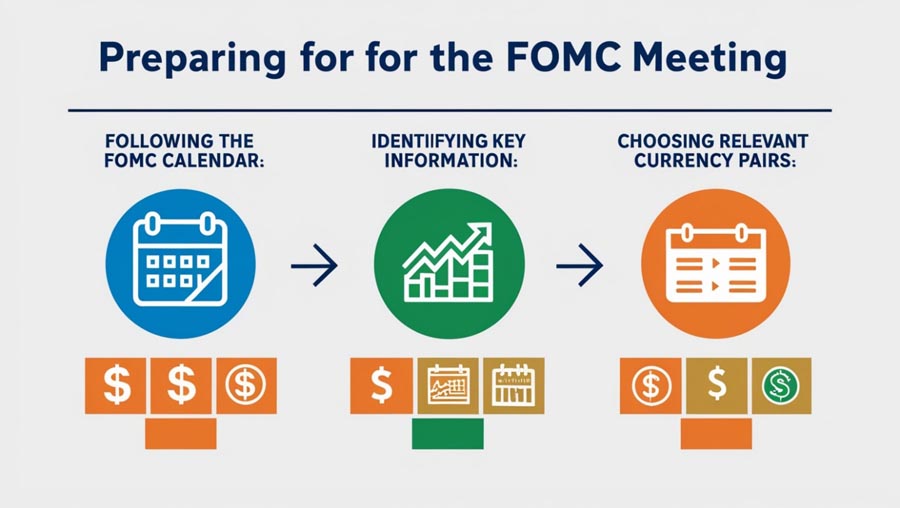

Preparing for the FOMC Meeting

Following the FOMC Calendar

Meeting Schedule

The FOMC holds meetings eight times a year, with each meeting concluding with a statement on monetary policy. These meetings are typically scheduled in January, March, May, June, July, September, November, and December. Knowing these dates allows traders to anticipate when significant announcements will be made.

Pro Tip: Use economic calendars from reliable sources like Forex Factory or Investing.com to track meeting dates and other key economic events.

Press Conferences

After some FOMC meetings, the Chair of the Federal Reserve holds a press conference to discuss the committee’s decision and provide further insights. These press conferences are crucial for understanding the rationale behind policy decisions and can lead to significant market movements.

Pro Tip: Pay close attention to the Chair’s tone and responses during the press conference, as these can provide additional clues about future policy directions.

Meeting Minutes

The minutes of the FOMC meetings are released three weeks after each meeting. These minutes offer a detailed account of the committee’s discussions and decision-making process. Analyzing the minutes can provide valuable insights into the committee’s views and future policy intentions.

Pro Tip: Review FOMC minutes to understand the underlying factors influencing the committee’s decisions, helping you anticipate future market reactions.

Read More: how to trade ppi news in forex

Identifying Key Information to Watch For

Interest Rate Announcements

The decision on whether to raise, lower, or maintain interest rates is the most critical information. Traders should closely monitor the announcement for any surprises or deviations from market expectations. For example, if the FOMC raises rates unexpectedly, the USD might experience rapid appreciation.

Pro Tip: Use historical data to assess how similar rate changes have impacted currency pairs in the past.

Economic Forecasts

The FOMC’s updated economic forecasts provide insights into the committee’s view on economic conditions. Focus on changes in GDP growth, inflation expectations, and unemployment projections, as these can significantly influence market reactions.

Pro Tip: Compare the FOMC’s forecasts with other economic data and forecasts from sources like the IMF or World Bank to gauge market sentiment.

Policy Changes

Any new policy initiatives or adjustments to existing policies can impact market sentiment. For example, announcements regarding quantitative easing or tightening measures can lead to substantial market movements.

Pro Tip: Analyze the potential impact of new policies on currency markets and adjust your trading strategy accordingly.

Choosing Relevant Currency Pairs

When trading FOMC news, focus on USD-related currency pairs, as these are directly impacted by U.S. monetary policy:

- EUR/USD: The most traded forex pair, highly sensitive to changes in USD interest rates. For example, if the FOMC raises rates, the EUR/USD pair may decline as the USD strengthens.

Pro Tip: Monitor economic data from the Eurozone as well, as it can influence the EUR/USD pair’s movement.

- USD/JPY: Reflects the impact of USD interest rate changes on the Japanese yen. A rate hike by the FOMC can lead to an appreciation of the USD against the JPY.

Pro Tip: Keep an eye on Japan’s economic indicators, such as GDP and inflation, as they can also affect the USD/JPY pair.

- GBP/USD: Shows how the USD impacts the British pound. Changes in the FOMC’s policy can lead to significant movements in this pair.

Pro Tip: Watch for economic news from the UK, such as the Bank of England’s policy decisions, which can impact the GBP/USD pair.

Additionally, consider counter-currencies that may react strongly to FOMC decisions, such as the Canadian dollar (USD/CAD) or the Australian dollar (USD/AUD).

Trading Strategies for FOMC Events

Pre-Meeting Positioning

Market Expectations

Analyze market expectations leading up to the FOMC meeting by reviewing economic data, market sentiment, and previous FOMC statements. Understanding what the market expects can help you position your trades effectively before the announcement.

Pro Tip: Use tools like sentiment indicators and market forecasts to gauge investor expectations and prepare your strategy.

Volatility Preparation

Expect increased volatility around the FOMC announcement. Ensure your trading strategy accounts for potential price swings and be prepared to adjust your positions as needed. Tools like volatility indicators and pre-announcement trading strategies can help manage risk.

Pro Tip: Consider using options strategies, such as straddles or strangles, to hedge against potential volatility.

Reacting to the FOMC Statement

Hawkish vs. Dovish Language

Analyze the tone of the FOMC statement. A hawkish tone, indicating that the committee is likely to raise rates further, can strengthen the USD. A dovish tone, suggesting potential rate cuts, can weaken the USD.

Pro Tip: Pay attention to specific language and keywords in the statement that indicate the committee’s future policy direction.

Market Reaction

Monitor how the market reacts immediately after the FOMC announcement. Prices can move rapidly, and it’s essential to act quickly based on the information provided. Use real-time news feeds and trading platforms to stay updated on market reactions and adjust your trades accordingly.

Pro Tip: Utilize order types like market orders and limit orders to execute trades efficiently during volatile conditions.

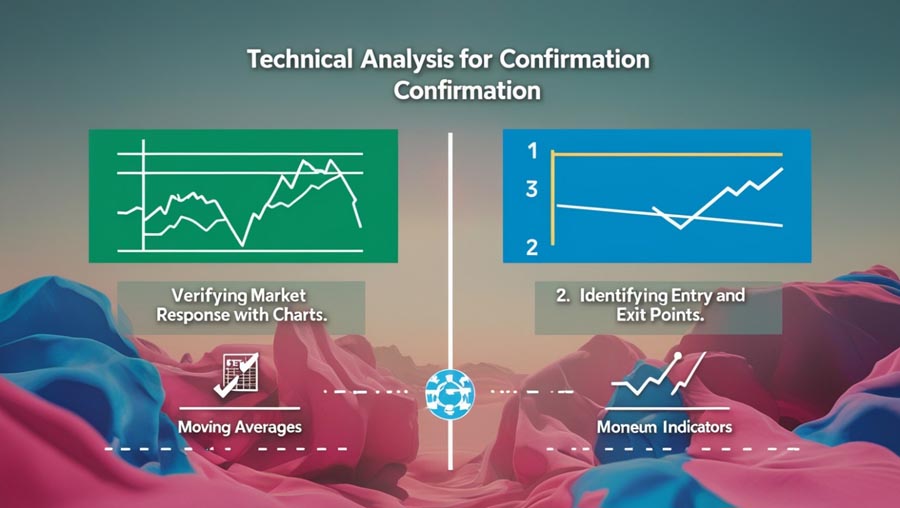

Technical Analysis for Confirmation

Verifying Market Response with Charts

Support and Resistance

Use charts to identify key support and resistance levels that can act as entry and exit points. For example, if the USD strengthens post-announcement, watch for resistance levels where the currency might face selling pressure.

Pro Tip: Look for chart patterns such as triangles or flags that can signal potential breakouts or reversals.

Price Patterns

Analyze price patterns like head and shoulders, double tops, or bottoms to confirm market responses to FOMC announcements. These patterns can provide insights into potential price movements and help refine your trading strategy.

Pro Tip: Combine chart patterns with technical indicators for more robust trading signals.

Identifying Entry and Exit Points Using Technical Indicators

Moving Averages

Utilize moving averages to determine trends and confirm trade signals. For example, if the short-term moving average crosses above the long-term moving average, it may signal a buy opportunity.

Pro Tip: Use moving average crossovers in conjunction with other indicators, such as the Relative Strength Index (RSI), for more accurate signals.

Momentum Indicators

Apply momentum indicators like the RSI or Stochastic Oscillator to identify overbought or oversold conditions. These indicators can help you determine when to enter or exit trades based on market momentum.

Pro Tip: Monitor divergence between momentum indicators and price action to identify potential trend reversals.

Read More: how to trade cpi news in forex

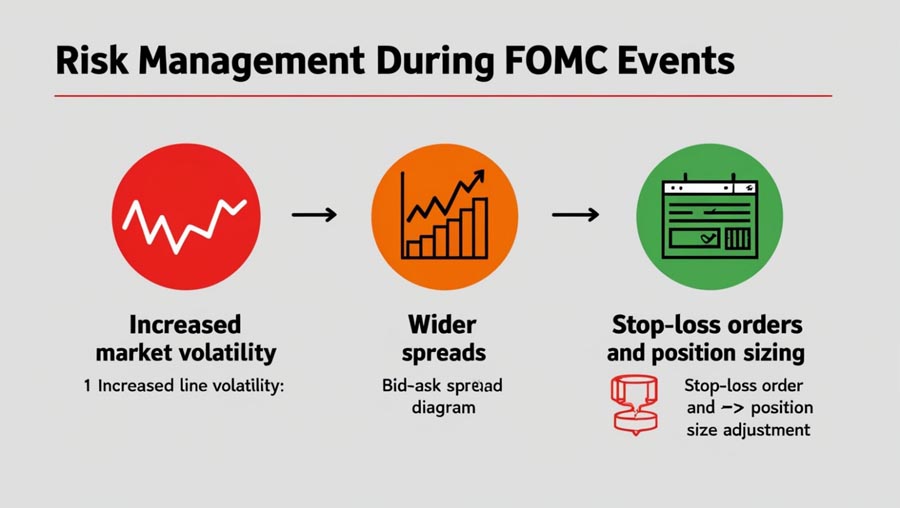

Risk Management During FOMC Events

Increased Market Volatility and Wider Spreads

Managing Volatility

The FOMC announcement often leads to increased market volatility and wider spreads. Ensure that your trading strategy accounts for these factors by using tools like volatility stops or wider stop-loss orders.

Pro Tip: Consider using a trailing stop to lock in profits and manage risk during volatile conditions.

Spread Impact

Wider spreads can impact trade execution and profitability. Be aware of the spread changes during the FOMC announcement and adjust your trading strategy accordingly.

Pro Tip: Choose a trading broker with competitive spreads and ensure that your trading platform is equipped to handle high volatility.

Importance of Stop-Loss Orders and Position Sizing

Stop-Loss Orders

Implement stop-loss orders to manage potential losses and protect your trading capital. During FOMC events, setting wider stop-loss orders may be necessary to accommodate increased volatility.

Pro Tip: Use a combination of fixed and trailing stop-loss orders to manage risk effectively during FOMC announcements.

Position Sizing

Adjust your position size based on the increased risk associated with FOMC events. Smaller position sizes can help manage exposure and reduce the impact of potential losses.

Pro Tip: Use a risk management calculator to determine appropriate position sizes based on your risk tolerance and trading strategy.

Conclusion

Mastering how to trade FOMC news in forex requires a comprehensive understanding of the FOMC’s impact on currency markets, thorough preparation, and effective trading strategies. By analyzing interest rate decisions, monetary policy statements, and economic forecasts, traders can better anticipate market reactions and make informed decisions. Implementing robust trading strategies, such as pre-meeting positioning, analyzing FOMC statements, and using technical analysis for confirmation, can enhance your trading success.

In addition to these strategies, managing risk effectively during FOMC events is crucial. This includes preparing for increased market volatility, adjusting position sizes, and using appropriate stop-loss orders. By integrating these practices, you can navigate FOMC announcements with greater confidence and capitalize on market movements, ultimately improving your forex trading performance. Stay informed, stay prepared, and apply these insights to master how to trade FOMC news in forex and achieve your trading goals.

What Are the Key Factors to Consider Before Trading FOMC News?

Before trading FOMC news, consider factors such as market expectations, previous FOMC statements, economic indicators, and potential volatility. Understanding these elements can help you anticipate market reactions and develop a well-informed trading strategy.

What Are Some Common Mistakes Traders Make During FOMC Announcements?

Common mistakes include overreacting to initial market moves, failing to adjust stop-loss orders for increased volatility, and neglecting to consider market expectations before the announcement. Traders should avoid impulsive decisions and focus on well-researched strategies to manage risks effectively.

How Can I Use Economic Data to Prepare for FOMC Meetings?

Analyze economic data releases such as GDP growth, inflation rates, and employment figures leading up to the FOMC meeting. These indicators provide insights into the economic conditions that influence the FOMC’s policy decisions. By understanding these data points, you can better anticipate the committee’s actions and adjust your trading strategy accordingly.