In the dynamic world of Forex trading, staying ahead of the curve is crucial. Enter the ICT Asian Range Strategy – a powerful tool that could revolutionize your approach to the markets. This innovative strategy leverages the often-overlooked Asian trading session to give traders a unique edge in predicting market movements. By focusing on this specific time frame, traders can gain insights that inform their decisions in the more volatile London and New York sessions, which are often characterized by increased activity and price fluctuations. Working with a regulated forex broker can further enhance your trading experience by providing a secure and transparent environment for executing these strategies.

Understanding and mastering the ICT Asian Range Strategy could be the key to elevating your Forex trading to new heights. Whether you’re a seasoned trader looking to refine your approach or a newcomer seeking a solid foundation, this strategy offers something for everyone.

What Exactly is the ICT Asian Range Strategy?

The ICT Asian Range Strategy is a method of trading that focuses on the price action during the Asian trading session, typically from 7:00 PM to midnight New York time. It’s based on the principle that the range established during this period often provides crucial information about potential market movements in the subsequent sessions.

This strategy isn’t just about spotting patterns – it’s about developing a deeper understanding of market psychology and dynamics. By analyzing the Asian Range, traders can anticipate potential breakouts, identify key support and resistance levels, and make more informed trading decisions.

The beauty of this strategy lies in its simplicity and effectiveness. It doesn’t require complex indicators or sophisticated algorithms. Instead, it relies on a trader’s ability to observe and interpret price action within a specific timeframe, enabling a straightforward approach to trading that can yield significant results.

The Nuts and Bolts of the Strategy

To effectively implement the ICT Asian Range Strategy, follow these essential steps:

- Identify the Asian Range: Observe the price action during the Asian session, focusing on key fluctuations.

- Mark the Range: Note the highest high and lowest low of this period, as these levels become critical reference points.

- Analyze Breakouts: Look for price movements beyond the established range, indicating potential market shifts.

- Consider Market Context: Align your analysis with broader market trends to improve the accuracy of your trades.

- Execute Trades: Enter positions based on breakouts or reversals from the range, utilizing clear entry and exit strategies.

Each of these steps is crucial and builds upon the previous one. By following this systematic approach, traders can develop a consistent method for analyzing and trading the Forex market.

Why Should You Care About the Asian Range?

Understanding the Asian Range is not just an academic exercise; it has real implications for your trading success. Here’s why you should care:

- Early Market Insights: The Asian Range often sets the tone for the day’s trading, allowing you to anticipate market sentiment early on.

- Liquidity Indicators: It can reveal where big players are positioning themselves, offering clues about potential price movements.

- Volatility Forecasting: A tight range might indicate an upcoming volatile move, allowing traders to prepare for significant price action.

- Risk Management: The range provides clear levels for setting stop losses and take profits, aiding in effective risk management.

Understanding the Asian Range can give traders a significant advantage. It’s like having a sneak peek at the market’s playbook before the main game begins.

Asian Range Definition

- Timeframe: Typically from 7:00 PM to midnight New York time.

- Identification: The highest high and lowest low within this specific period.

Understanding the precise definition of the Asian Range is crucial for accurately implementing the ICT Asian Range Strategy.

It’s important to note that while these times are typical, they can vary slightly depending on daylight savings time and specific market conditions. Always be prepared to adjust your analysis based on real-time market behavior.

Asian Range Significance

The significance of the Asian Range extends beyond mere observation. Here’s why it matters:

- Correlation with Future Movements: The Asian Range often foreshadows subsequent price action, acting as a barometer for the day’s market behavior.

- Support and Resistance Levels: Range boundaries frequently act as key levels in later sessions, guiding your entry and exit strategies.

- Breakout Potential: A narrow range might indicate an impending significant move, highlighting opportunities for traders.

The Asian Range serves as a springboard for significant price movements, making it a powerful tool for savvy traders. Understanding the significance of the Asian Range can help traders anticipate market movements and position themselves accordingly. It’s like having a roadmap for the day’s trading journey.

The Psychology Behind the Strategy

Understanding the ICT Asian Range Strategy involves getting into the mindset of different market participants:

- Asian Traders: They set the initial tone of the market, influencing price action during the Asian session.

- European Traders: They react to the Asian session and set up for their day, often seeking to exploit any mispricings.

- American Traders: They respond to both Asian and European sessions, amplifying volatility as their session begins.

By understanding these dynamics, traders can better anticipate market movements and position themselves accordingly. This psychological aspect of trading is often overlooked but can be incredibly powerful. By understanding the motivations and behaviors of different market participants, traders can gain a significant edge.

Read more: Mastering the ICT Asian Range Strategy

Implementing the ICT Asian Range Strategy

PART 1 — Utilization in Bullish Conditions

- Extend the Range: Project the Asian Range high and low into future sessions, establishing your trading framework.

- Look for the Drop: Watch for price to initially drop below the Asian Range low, signaling a potential reversal.

- Entry Options: a) Go long below the opening price to capitalize on a reversal. b) Place a buy limit order above the Asian Range high to capture upward momentum. c) Wait for a return to the Asian Range high during the New York open, confirming the breakout.

PART 2 — Utilization in Bearish Conditions

- Extend the Range: As before, project the range into future sessions to set up your trades.

- Look for the Break: Watch for price to initially break above the Asian Range high, indicating potential bearish sentiment.

- Entry Options: a) Sell short above the opening price to take advantage of downward movement. b) Place a sell limit order below the Asian Range low to catch a potential reversal. c) Wait for a return to the Asian Range low during the New York open, confirming the bearish signal.

These implementation strategies provide a structured approach to trading based on the Asian Range. They offer flexibility while maintaining a consistent methodology, allowing traders to adapt to various market conditions.

Trading Strategies

Incorporating the ICT Asian Range Strategy into your trading can be enhanced by various techniques:

- Breakout/Breakdown Strategy:

- Enter trades when price convincingly breaks the Asian Range, signaling a clear market direction.

- Use volume or other indicators to confirm the breakout, increasing the likelihood of successful trades.

- Fair Value Gap Strategy:

- Identify significant price gaps that form during breakouts, as these gaps often indicate strong market interest.

- Use these gaps as potential entry or exit points, capitalizing on price discrepancies.

- Integration with Technical Indicators:

The versatility of the ICT Asian Range Strategy allows it to be adapted to various trading styles and market conditions. These strategies provide different ways to leverage the Asian Range in your trading. By mastering these approaches, traders can develop a versatile toolkit for navigating the Forex market.

Fine-Tuning Your Approach

To maximize the effectiveness of the ICT Asian Range Strategy, consider the following tips:

- Use Confluence: Combine your strategy with other analysis methods for stronger signals and better decision-making.

- Monitor Volume: Unusual volume can provide additional insights and help confirm your trading ideas.

- Be Patient: Not every day will present ideal setups; waiting for the right conditions can lead to better trades.

- Practice Risk Management: Always use stop losses and manage position sizes to protect your capital.

- Keep a Trading Journal: Record observations and outcomes to refine your strategy over time and learn from your experiences.

Fine-tuning your approach is an ongoing process. As you gain experience with the ICT Asian Range Strategy, you’ll develop a nuanced understanding of how to apply it in different market conditions.

Read more: Mastering ICT Optimal Trade Entry

Common Pitfalls to Avoid

While trading the ICT Asian Range Strategy, be mindful of these common pitfalls:

- Overtrading: Resist the urge to force trades when conditions aren’t ideal; patience is key.

- Ignoring the Bigger Picture: Always consider broader market trends and economic events that can impact price action.

- Emotional Trading: Stick to your plan; avoid impulsive decisions driven by fear or greed.

- Neglecting Practice: Thoroughly test the strategy in a demo account before using real money to build confidence and experience.

Being aware of these pitfalls can help you avoid common mistakes and improve your trading results. Remember, successful trading is as much about avoiding losses as it is about making profits.

The Role of Market Structure

Understanding how the Asian Range fits into larger market structures is crucial for effective trading:

- Trend Analysis: Align your Asian Range trades with the overall market trend to increase the probability of success.

- Support and Resistance: Use the Asian Range in conjunction with key support and resistance levels to enhance your trading decisions.

- Market Cycles: Recognize different market cycles (accumulation, distribution, expansion) to adapt your strategy accordingly.

Market structure analysis provides context for your trades, allowing you to make more informed decisions. By integrating this analysis with the ICT Asian Range Strategy, traders can develop a comprehensive approach to Forex trading.

Risk Management Considerations

Effective risk management is essential for long-term trading success. When trading the ICT Asian Range Strategy, keep these points in mind:

- Position Sizing: Adjust your position size based on your risk tolerance and the size of your trading account.

- Stop Loss Placement: Use the Asian Range boundaries to set logical stop loss levels, protecting your capital.

- Risk-Reward Ratio: Aim for trades with a favorable risk-reward ratio to ensure that your potential rewards outweigh the risks.

Risk management is the cornerstone of successful trading. By applying these principles to the ICT Asian Range Strategy, traders can protect their capital while pursuing profitable opportunities.

Backtesting the ICT Asian Range Strategy

Before implementing the ICT Asian Range Strategy in live trading, it’s crucial to backtest it:

- Historical Data: Analyze past market data to see how the strategy would have performed in different market conditions.

- Simulated Trading: Use a demo account to practice the strategy in real-time, refining your approach without risking real money.

- Review and Adjust: Continuously review your results and make necessary adjustments to improve performance.

Backtesting is a critical step in developing confidence in your strategy. By thoroughly testing the ICT Asian Range Strategy, traders can ensure that they are prepared to execute it effectively in live market conditions. This process not only helps you understand the nuances of the strategy but also allows you to identify any potential weaknesses or areas for improvement.

Read more: Decoding SMT Divergence

Real-Life Example of the ICT Asian Range Strategy

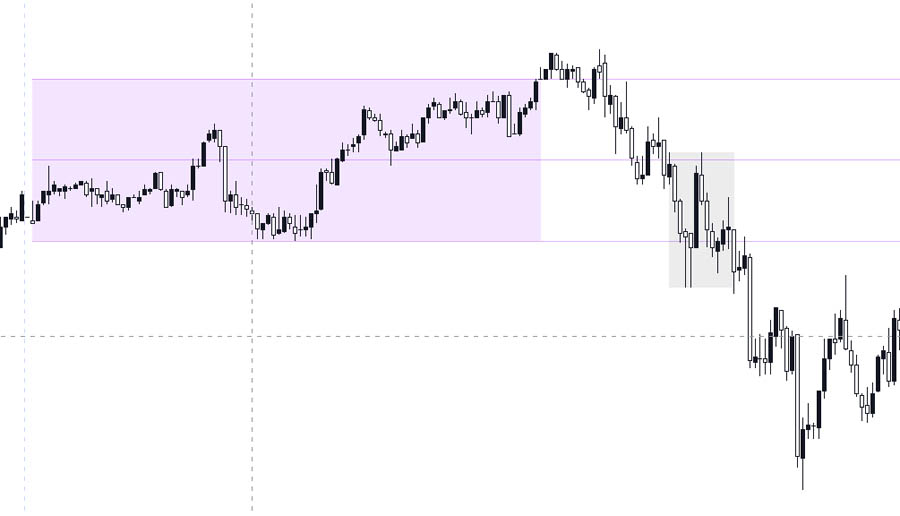

To bring the ICT Asian Range Strategy to life, let’s walk through a real-life example.

Scenario:

Imagine it’s a Tuesday, and the Asian trading session has just closed. During this session, the GBP/USD pair has established an Asian Range with a high of 1.3250 and a low of 1.3220.

Step 1: Identify the Range

You’ve marked the 1.3250 high and 1.3220 low as your key levels to watch as the London session approaches.

Step 2: Analyze the Breakout Potential

As the London session begins, you notice that the price action is hovering near the upper boundary of the Asian Range. The market is showing signs of potential bullish momentum, with several attempts to break above 1.3250.

Step 3: Execute the Trade

You decide to place a buy stop order slightly above the 1.3250 level at 1.3255 to catch a potential breakout. Shortly after, the price surges past 1.3250, triggering your order. The breakout is confirmed with increasing volume, indicating strong buying interest.

Step 4: Manage the Trade

As the trade progresses, you set your stop loss just below the Asian Range low at 1.3215, minimizing your risk. You also identify a potential take-profit level around 1.3300, where previous resistance has been observed.

Step 5: Exit the Trade

The price continues to rise, reaching 1.3300 within the first few hours of the London session. You decide to exit the trade at this level, securing a 45-pip gain.

Outcome:

In this scenario, the ICT Asian Range Strategy successfully identified a high-probability trade setup, allowing you to capitalize on the breakout with a well-managed risk-reward ratio.

This example demonstrates the practical application of the strategy and highlights the importance of patience, discipline, and proper trade management.

Elevate Your Trading with OpoFinance

If you’re looking to enhance your Forex trading experience, consider partnering with OpoFinance. As a leading provider of trading solutions, OpoFinance offers:

- Advanced Trading Platforms: State-of-the-art technology to execute your strategies with precision.

- Educational Resources: In-depth tutorials and webinars to help you master the ICT Asian Range Strategy and other trading techniques.

- Competitive Spreads: Lower trading costs mean more profits for you.

- 24/7 Customer Support: Expert assistance whenever you need it.

Join OpoFinance today and take your trading to the next level with tools and resources designed to support your success.

Conclusion

Mastering the ICT Asian Range Strategy can be a game-changer in your Forex trading journey. By focusing on the price action during the Asian session, this strategy provides early insights into potential market movements, allowing you to anticipate and capitalize on breakouts, reversals, and other key trading opportunities.

Whether you’re a novice trader looking for a solid entry point into the markets or an experienced trader seeking to refine your approach, the ICT Asian Range Strategy offers a unique and effective way to enhance your trading performance. By incorporating the principles outlined in this guide, practicing in a demo environment, and continuously refining your approach, you can unlock new levels of success in the Forex market.

Remember, the key to success with this strategy, like any other, lies in discipline, patience, and continuous learning. Stay committed to your trading plan, keep emotions in check, and always prioritize risk management. With these principles in mind, the ICT Asian Range Strategy can become a powerful tool in your trading arsenal.

What Makes the ICT Asian Range Strategy Unique?

The ICT Asian Range Strategy is unique because it focuses on a specific, often overlooked timeframe in the Forex market – the Asian session. By analyzing this early period, traders can gain insights into potential market movements in later sessions, providing a strategic advantage.

Can the ICT Asian Range Strategy Be Used on All Currency Pairs?

Yes, the strategy can be applied to any currency pair. However, it tends to be most effective on major pairs, such as GBP/USD, EUR/USD, and USD/JPY, where liquidity is highest and price action is more predictable.

How Do I Know When to Avoid Using the ICT Asian Range Strategy?

Avoid using the strategy during periods of major news events or when market sentiment is extremely volatile. These conditions can lead to erratic price movements that may not align with the typical patterns observed in the Asian Range.