Want to unlock forex success and master the ICT Market Maker Buy Model in 7 simple steps? You’re in the right place. The ICT Market Maker Buy Model is a powerful trading strategy that can dramatically improve your forex trading accuracy and profitability. Developed by the Inner Circle Trader (ICT), this model helps traders align their actions with institutional players, giving them a significant edge in the market. If you’re looking for a reliable forex broker to implement this strategy, choosing the right platform is crucial for maximizing your results.

In this comprehensive guide, we’ll break down the ICT Market Maker Buy Model into 7 easy-to-follow steps:

- Identify the overall market structure

- Recognize the initial curve

- Locate potential buying areas

- Analyze price action and candlestick patterns

- Confirm with order flow analysis

- Identify the Smart Money Reversal (SMR)

- Apply an entry model

By mastering these steps, you’ll be able to spot high-probability buying opportunities and potentially increase your trading success rate. Whether you’re a forex novice or an experienced trader looking to refine your strategy, this guide will provide you with the knowledge and tools to implement the ICT Market Maker Buy Model effectively.

Are you ready to transform your forex trading and gain a competitive advantage? Let’s dive into the world of institutional trading and uncover the secrets of the ICT Market Maker Buy Model. By the end of this article, you’ll have a clear roadmap to forex success, backed by a strategy used by some of the most successful traders in the industry.

Understanding the ICT Market Maker Buy Model

What is the ICT Market Maker Buy Model?

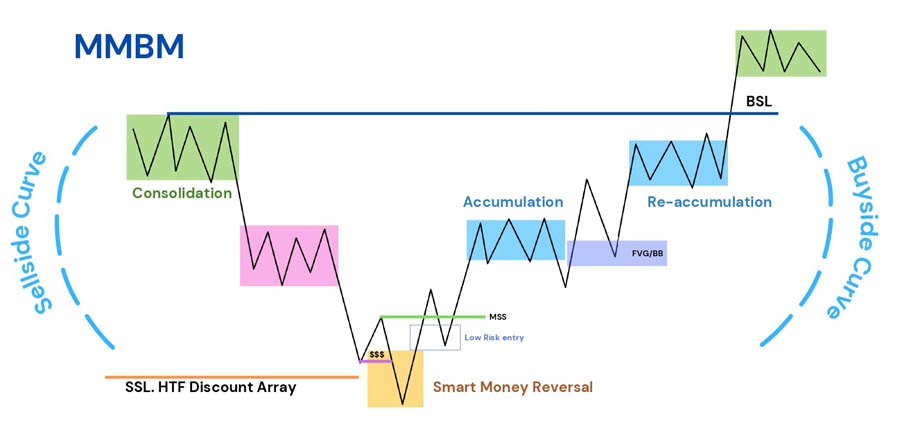

The ICT Market Maker Buy Model is a trading strategy designed to identify and capitalize on potential buying opportunities in the forex market. It’s based on understanding the actions of market makers and aligning trades with their operations. The model consists of three main phases: Sell Program, Smart Money Reversal, and Buy Program.

Key Components of the ICT Market Maker Buy Model

- Sell Program (Net Short):

- Original Consolidation: Engineers Pending Buy Stop Liquidity (BSL) > Pending Sell Stop Liquidity (SSL)

- Distribution: Sell Orders (Through Accumulation at Premium Market) > Buy Orders

- Smart Money Reversal (SMR):

- Institutional Reference Point used for:

- Mitigation of short positions

- Rebalancing an Old Imbalance (Buy-Side Imbalance, Sell-Side Inefficiency)

- Sell-Side Liquidity Raid

- Once at Reference Point, expect a Market Structure Shift / Break = Change in Delivery State (Sell Program -> Buy Program)

- Institutional Reference Point used for:

- Buy Program (Net Long):

- Accumulation (1st leg): Buy Orders > Sell Orders

- Re-Accumulation (2nd leg): Buy Orders > Sell Orders

- Terminus: Orders added to Institutional Positions during Hedging and SMR are now paired with Original Consolidation Liquidity

- Price Action: Analyzing candlestick patterns and chart structures to identify potential reversal points.

- Market Structure: Understanding the overall trend and identifying key support and resistance levels.

- Order Flow: Recognizing areas of high liquidity where market makers are likely to accumulate positions.

- Time Frames: Utilizing multiple time frames to confirm trade setups and improve entry timing.

- Fair Value Gaps (FVGs): Identifying price imbalances that are likely to be filled by market makers.

- Breaker Blocks: Recognizing key levels where price is likely to reverse after breaking through previous support or resistance.

- Liquidity Pools: Identifying areas of concentrated stop losses that market makers may target.

Implementing the ICT Market Maker Buy Model: A Step-by-Step Guide

Step 1: Identify the Overall Market Structure

Before applying the ICT Market Maker Buy Model, it’s crucial to understand the bigger picture:

- Identify Higher Time Frame (HTF) Institutional Order Flow (IOF) as Bullish

- Look for a Higher Directional Order Flow (DOL)

- Analyze higher time frames (e.g., daily or weekly charts) to determine the overall market trend

- Look for higher highs and higher lows in an uptrend, or lower highs and lower lows in a downtrend

- Identify key support and resistance levels that may influence price action

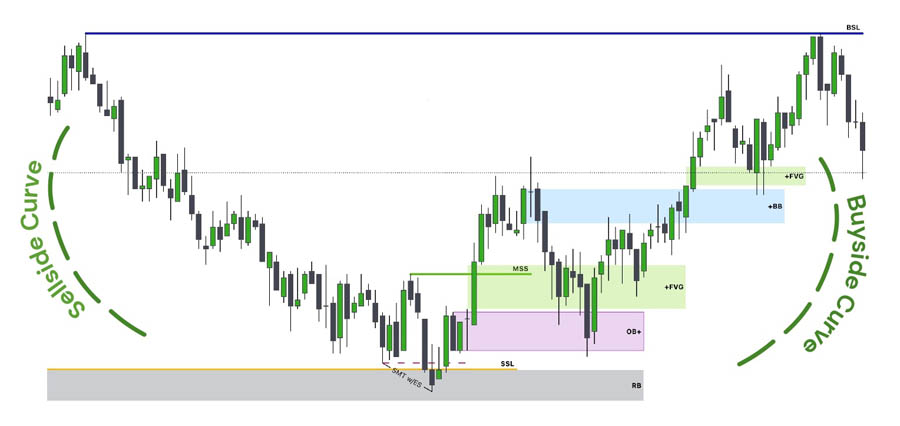

Step 2: Recognize the Initial Curve

Identify the Sell Program with Distribution / Redistribution. The Buy Model’s purpose is to deliver Price efficiently to the HTF Draw while generating Liquidity Pools above the marketplace during the Sell Curve.

Step 3: Locate Potential Buying Areas

Once you’ve established the market structure, focus on finding potential buying areas:

- Look for areas of previous support that have been broken and may now act as resistance

- Identify fair value gaps (FVGs) on lower time frames, which represent imbalances in price action

- Spot breaker blocks, which are areas where price has broken through significant levels and may return to test them

Step 4: Analyze Price Action and Candlestick Patterns

Pay close attention to price action near your identified buying areas:

- Look for bullish candlestick patterns such as hammers, engulfing patterns, or morning stars

- Identify areas of price consolidation or compression, which may indicate accumulation by market makers

Step 5: Confirm with Order Flow Analysis

To increase the probability of your trades, incorporate order flow analysis:

- Look for areas of high volume, which may indicate institutional interest

- Identify regions where stop losses are likely to be clustered, as these may be targets for market makers

Step 6: Identify the Smart Money Reversal (SMR)

Look for signs of a Market Structure Shift (MSS) or Market Structure Break, indicating a change from Sell Program to Buy Program. This is a crucial point where Institutional Reference Points are utilized for position mitigation, rebalancing, or liquidity raids.

Step 7: Apply an Entry Model

Once the Smart Money Reversal has been identified, it’s time to apply one of the entry models. This step is crucial for timing your entry into the market. The ICT Market Maker Buy Model proposes three main entry models:

- 2022 Model:

- This model focuses on identifying key institutional levels and entering trades when price retests these levels.

- Look for a strong move away from a significant support or resistance level.

- Wait for a pullback to this level, which should now act as support (for buys) or resistance (for sells).

- Enter the trade when price shows signs of respecting this level, often with a confirmation candle.

Read more: Mastering the ICT New York Open Strategy

- IOFED (Institutional Order Flow Entry Derivative):

- This model is based on recognizing institutional order flow and entering trades in alignment with it.

- Identify areas of high volume and price rejection, which may indicate institutional activity.

- Look for a series of higher lows (for buys) or lower highs (for sells) forming after the SMR.

- Enter the trade when price breaks above the most recent high (for buys) or below the most recent low (for sells).

- Breaker + Fair Value Gap:

- This model combines two key concepts: breaker blocks and fair value gaps.

- Identify a breaker block, which is an area where price has broken through a significant level and may return to test it.

- Look for a fair value gap (FVG) near the breaker block. An FVG is a gap in price action that represents an imbalance.

- Enter the trade when price returns to the FVG and shows signs of respecting the breaker block level.

When applying these entry models, always consider the following:

- Ensure that your entry aligns with the overall market structure and trend identified in earlier steps.

- Use multiple time frame analysis to confirm your entry point.

- Always have a clear stop loss and take profit levels before entering the trade.

- Be patient and wait for all conditions of your chosen entry model to be met before entering the market.

Step 8: Plan Your Entry and Exit Strategy

Develop a clear plan for entering and exiting your trades:

- Set specific entry criteria based on your chosen entry model

- Determine your stop loss level, considering the identified support and resistance levels

- Establish profit targets based on potential resistance levels or using a risk-reward ratio

Step 9: Manage Your Risk and Position Size

Proper risk management is crucial for long-term success:

- Never risk more than 1-2% of your trading capital on a single trade

- Calculate your position size based on your account balance and the distance to your stop loss

- Consider scaling into positions to reduce risk and improve your average entry price

Advanced Techniques for the ICT Market Maker Buy Model

Incorporating Fibonacci Retracements

Fibonacci retracements can enhance your ICT Market Maker Buy Model strategy:

- Use Fibonacci levels to identify potential reversal points within the larger trend

- Look for confluence between Fibonacci levels and other key components of the model, such as FVGs or breaker blocks

Utilizing Volume Profile

Volume profile analysis can provide additional insights:

- Identify high-volume nodes that may act as support or resistance

- Look for volume gaps that could indicate potential areas for price to fill

Read more: Mastering the ICT London Open Strategy

Implementing Order Flow Footprint Charts

Footprint charts offer a deeper understanding of order flow:

- Analyze delta (the difference between buying and selling volume) to gauge market sentiment

- Identify areas of absorption, where large volumes are traded with minimal price movement, potentially indicating accumulation

Common Pitfalls to Avoid When Using the ICT Market Maker Buy Model

- Overtrading: Avoid taking every potential setup. Focus on high-probability trades that meet all your criteria.

- Ignoring the bigger picture: Don’t get caught up in lower time frames without considering the overall market structure.

- Neglecting risk management: Always prioritize protecting your capital over chasing profits.

- Emotional trading: Stick to your trading plan and avoid making impulsive decisions based on fear or greed.

- Lack of patience: Wait for all components of the model to align before entering a trade. Don’t force setups.

Optimizing Your ICT Market Maker Buy Model Strategy

Backtesting and Journaling

To refine your approach:

- Backtest the model on historical data to assess its effectiveness

- Keep a detailed trading journal to track your performance and identify areas for improvement

Continuous Learning and Adaptation

Stay ahead of the curve:

- Stay updated on market conditions and adapt your strategy accordingly

- Continuously educate yourself on new trading concepts and techniques

Read more: Mastering the ICT Market Maker Model

Psychological Preparation

Develop a trader’s mindset:

- Practice mindfulness and emotional control to make better trading decisions

- Develop a routine to maintain focus and discipline in your trading

OpoFinance: Your Trusted Partner for ICT Market Maker Buy Model Trading

Before we conclude, let’s explore how OpoFinance can support your journey in mastering the ICT Market Maker Buy Model.

OpoFinance is an ASIC-regulated broker that offers a secure and advanced trading environment for forex traders. With its cutting-edge platforms, competitive spreads, and exceptional customer support, OpoFinance provides the perfect foundation for implementing the ICT Market Maker Buy Model.

Key benefits of trading with OpoFinance include:

- Advanced Trading Platforms: Access state-of-the-art charting tools and analysis features to identify ICT setups effectively.

- Fast Execution: Benefit from lightning-fast trade execution, crucial for capitalizing on ICT Market Maker Buy Model opportunities.

- Educational Resources: Enhance your trading skills with comprehensive educational materials and webinars.

- Regulatory Compliance: Trade with peace of mind knowing that OpoFinance is regulated by ASIC, ensuring the highest standards of security and transparency.

- Competitive Spreads: Minimize trading costs with tight spreads, maximizing your potential profits from ICT-based trades.

By choosing OpoFinance as your broker, you’ll have access to the tools and support needed to successfully implement the ICT Market Maker Buy Model and take your trading to the next level.

Conclusion

The ICT Market Maker Buy Model offers a powerful framework for identifying high-probability buying opportunities in the forex market. By understanding the three main phases – Sell Program, Smart Money Reversal, and Buy Program – and aligning your trades with market maker actions, you can significantly improve your trading performance.

Remember, success with this model requires patience, discipline, and continuous learning. Focus on mastering each component of the strategy, from analyzing market structure to applying the appropriate entry model. As you implement the ICT Market Maker Buy Model, keep refining your approach through backtesting and journaling. Stay adaptable to changing market conditions and never stop educating yourself on new trading concepts.

With dedication and practice, the ICT Market Maker Buy Model can become a valuable tool in your trading arsenal, helping you navigate the forex markets with greater confidence and profitability.

How long does it typically take to become proficient in using the ICT Market Maker Buy Model?

Becoming proficient in the ICT Market Maker Buy Model varies from trader to trader, but generally, it takes several months of dedicated study and practice. Consistency is key – aim to spend at least 1-2 hours daily analyzing charts, studying market behavior, and paper trading to internalize the concepts. Many traders report significant improvements in their trading after 3-6 months of focused learning and application. However, true mastery can take years of experience in various market conditions.

Can the ICT Market Maker Buy Model be applied to other financial markets besides forex?

Yes, the principles of the ICT Market Maker Buy Model can be applied to other financial markets, including stocks, commodities, and cryptocurrencies. However, it’s important to note that the model was primarily developed for the forex market, which has unique characteristics such as 24-hour trading and high liquidity. When applying the model to other markets, you may need to make adjustments to account for differences in market structure, liquidity, and order flow dynamics. It’s recommended to thoroughly understand how the model works in forex before attempting to adapt it to other markets.

Are there any specific indicators or tools that complement the ICT Market Maker Buy Model?

While the ICT Market Maker Buy Model primarily relies on price action and market structure analysis, certain indicators and tools can complement the strategy. Volume indicators can be helpful for confirming order flow analysis. The Volume Weighted Average Price (VWAP) indicator can assist in identifying fair value levels. Order flow tools like footprint charts or market depth indicators can provide additional insights into buying and selling pressure. However, it’s crucial to remember that these tools should support your analysis, not replace the core principles of the ICT model. Always prioritize price action and market structure in your decision-making process.