A mental stop loss is a trader’s internal, predetermined price level for exiting a losing trade, which is not physically entered into a broker’s system. It’s a flexible exit strategy that requires immense discipline, making it different from a hard stop loss that executes automatically. For traders choosing an online forex broker, understanding this distinction is crucial for risk management. This guide covers the critical differences between mental and hard stops, explores the psychology of stop loss hunting, and outlines practical strategies for swing traders and others to determine if a mental stop loss is right for them.

Key Takeaways

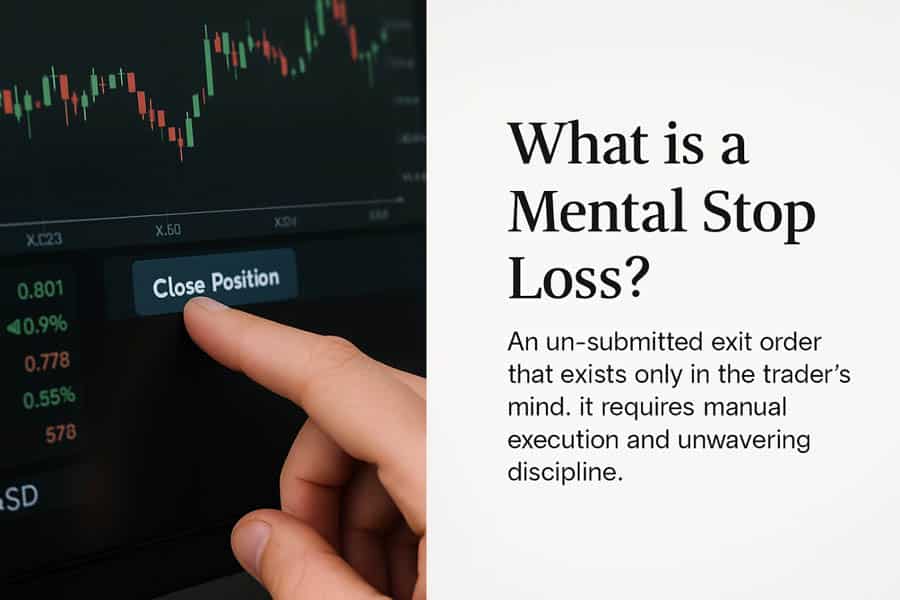

- Definition: A mental stop loss is an un-submitted exit order that exists only in the trader’s mind, based on a pre-analyzed price level.

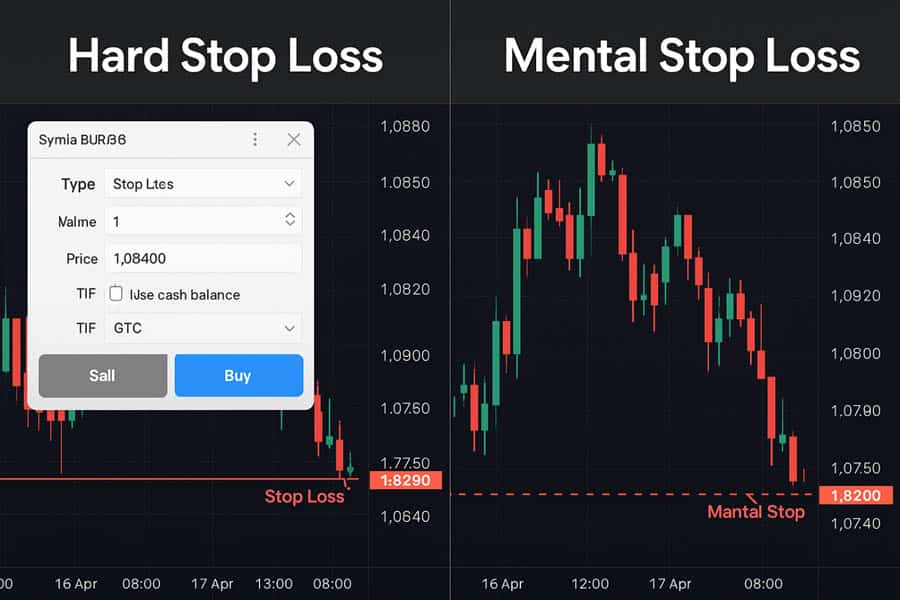

- Core Conflict: The primary difference between mental stop loss and hard stop loss is automation versus discretion. Hard stops are automatic and enforce discipline, while mental stops offer flexibility but demand unwavering psychological control.

- Discipline is Non-Negotiable: The effectiveness of a mental stop loss is directly tied to the trader’s ability to execute their plan without hesitation or emotion. It is not for beginners.

- Stop Hunting Reality: The stop loss hunting mindset isn’t just a myth; it’s a market function. Large players hunt liquidity pools that form around obvious stop loss levels. A mental stop loss can make you invisible to this hunt, but only if you execute it flawlessly.

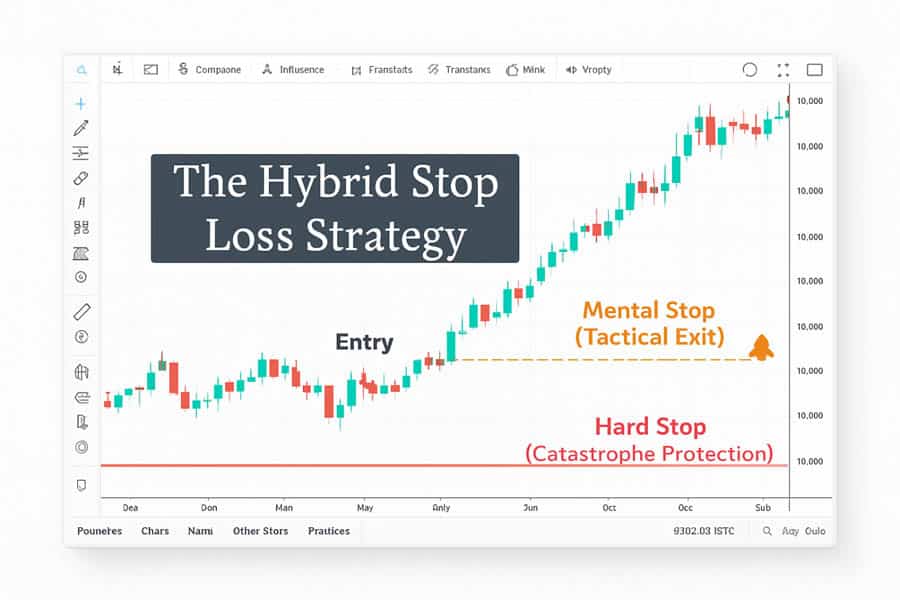

- Best for Swing Traders?: The best stop loss strategy for swing traders often involves a hybrid approach—a wide, “disaster” hard stop combined with a tighter mental stop loss managed via alerts for more precise, discretionary exits.

- Risk Profile Matters: Institutional traders or highly experienced retail traders with a proven psychological edge are the primary candidates for using a mental stop loss. Most retail traders are significantly safer using hard stops.

What is Mental Stop Loss?

A mental stop loss is a price level you decide on before entering a trade, a point where you’ve determined your trade idea is invalidated. If the market hits that price, you manually close the position. That’s it. There’s no order sitting on your broker’s server, no safety net waiting to catch you. It’s just you, the charts, and your commitment to your trading plan. It’s an internal, self-monitored price level for exiting a trade, not entered into the platform.

So, is it a mindset or a tactic? It’s both. The tactic is the price level itself—the line in the sand. The mindset is the iron-clad discipline required to honor that line without question when the time comes. Without the mindset, the tactic is worthless. It becomes a “mental stop-suggestion,” a recipe for disaster. A true mental stop loss is a psychological commitment to an unemotional, pre-planned action. It’s a promise you make to yourself to protect your capital, and breaking that promise is where most traders fail.

Mental vs. Hard Stop Loss—What’s the Difference?

Understanding the difference between mental stop loss and hard stop loss is fundamental to risk management. One is a rigid rule enforced by your broker; the other is a flexible guideline enforced only by you. A hard stop loss is an order (like a stop-market or stop-limit) that you place with your broker. When the market price touches your specified level, the broker automatically closes your position. It’s your automated defense mechanism. In contrast, the mental stop loss requires your constant attention and manual intervention. The choice between them hinges on your trading style, psychological fortitude, and the market environment you’re trading in. Let’s break down the key distinctions.

| Criteria | Hard Stop Loss | Mental Stop Loss |

| Automation | Yes, broker-enforced and automatic. | No, requires manual execution by the trader. |

| Emotional Discipline | Less required once set. It removes in-the-moment decisions. | Extremely high discipline required to avoid second-guessing. |

| Flexibility | Low. The order is fixed and can be triggered by a temporary wick. | High. Allows the trader to assess market context before exiting. |

| Risk of “Stop Hunting” | Higher. The order is visible to the broker and potentially liquidity providers. | Lower. The stop is invisible to the market, protecting it from targeted hunts. |

| Suitable For | Most retail traders, especially beginners, scalpers, and day traders. | Highly experienced institutional or prop traders with proven discipline. |

| Technology Reliance | Yes. Relies on the broker’s platform and connection to the exchange. | No, but requires the trader to be able to monitor the market and execute. |

| Protection Against Gaps/Slippage | Offers some protection, but can be subject to slippage. | No protection against sudden, large price gaps (e.g., weekend or news gaps). |

Key Decision Factors

When weighing the difference between mental stop loss and hard stop loss, consider these factors:

- Trading Speed: For scalping or high-frequency day trading, the market moves too fast for a mental stop loss. Hard stops are almost mandatory. For swing or position trading, where decisions are made on higher timeframes, a mental stop becomes more feasible.

- Volatility: In highly volatile markets, a hard stop can get you kicked out of a good trade by a meaningless spike. A mental stop loss allows you to wait for a candle close or other confirmation below your level, giving the trade more room to breathe. However, this same volatility can lead to a much larger loss if you fail to act.

- Your Psychology: This is the most important factor. Are you the type of person who hesitates, rationalizes, or moves their stop when a trade goes against them? If so, a mental stop loss is your enemy. You haven’t earned the right to use one yet. Be honest with yourself.

Pros & Cons of Each Stop Loss Type

No tool in a trader’s arsenal is perfect for every situation. Both hard stops and mental stops have distinct advantages and crippling disadvantages. Choosing the right one is about aligning the tool with the task, the market, and most importantly, the trader. Here’s an honest breakdown, moving beyond generic points to actionable insights.

Hard Stop Loss: The Disciplined Protector

Pros:

- Emotion-Free Execution: Its greatest strength. Once set, it works. You can walk away from your screen knowing your maximum defined risk is protected. It removes the temptation to give a losing trade “just a little more room.”

– Defines Risk Quantitatively: It forces you to calculate your exact risk in dollars before you even enter the trade. This is a cornerstone of professional risk management. – Frees Up Mental Capital: By automating your exit, you’re not constantly stressing about the position. This frees you to analyze other opportunities or manage other trades, reducing decision fatigue. – Protects Against Catastrophe: In the event of a system failure, internet outage, or personal emergency, the hard stop is your only defense against a runaway loss.

Cons:

- Vulnerable to Stop Hunting: Your order sits on a server, creating a liquidity target. Unscrupulous brokers or large players can see these clusters of stops and trigger them with a quick spike before the market reverses.

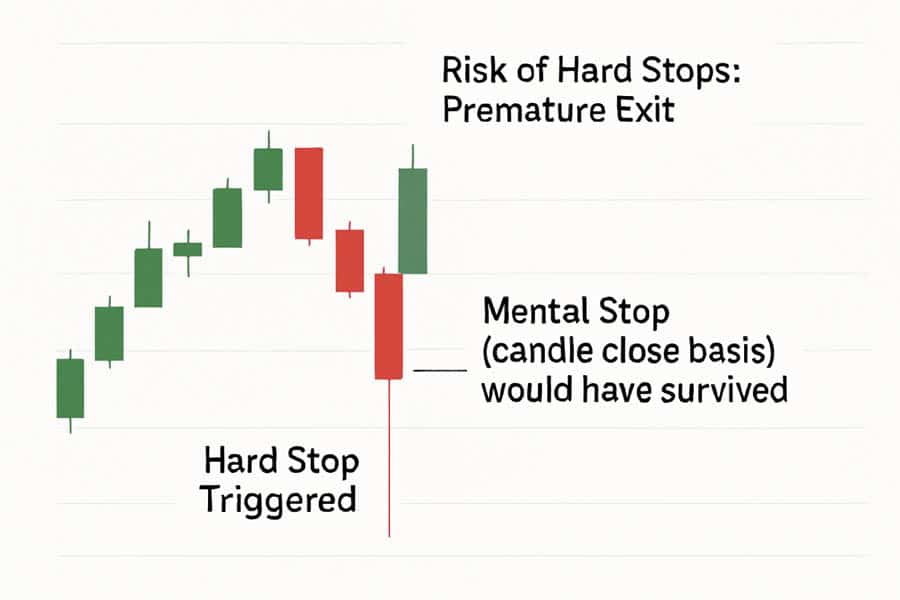

- Inflexibility in Volatile Markets: A sudden, meaningless price wick—a common occurrence around news events—can take you out of a perfectly good trade setup, only for it to immediately move in your favor. This is incredibly frustrating.

- Can Lead to Slippage: In fast-moving markets, the price you get filled at can be significantly worse than your stop price. This is especially true for stop-market orders.

Mental Stop Loss: The Flexible Blade

Pros:

- Avoids Stop Hunting: Since the order doesn’t exist on any server, you are invisible to liquidity hunters. This is a major advantage, especially in markets like Forex and Crypto where this behavior is common. A good stop loss hunting mindset involves being aware of where the hunts are likely to happen and placing your own invisible exit far from the crowd.

- Context-Based Flexibility: It allows you to use your discretion. You can decide to exit based on a candle close below your level, rather than a mere touch. This lets you differentiate between noise and a true change in market structure, potentially saving you from a premature exit.

- Forces Market Engagement: It requires you to be actively monitoring and analyzing the price action, which can lead to a deeper understanding of the market you are trading. You are not a passive participant.

Cons:

- Requires God-Tier Discipline: This is its Achilles’ heel. It is dangerously easy to rationalize moving a mental stop loss. “It’s just a little further,” “The support is just below,” “I’ll give it until the next candle.” This line of thinking has blown up more accounts than any other single mistake.

- No Protection from Gaps or Crashes: A weekend gap or a flash crash can blow right past your mental stop level before you even have a chance to react. The loss can be exponentially larger than you ever intended.

- Emotionally Draining: Constantly monitoring a losing position and debating when to pull the trigger is mentally exhausting. It can lead to poor decision-making and burnout. The psychological toll of a mental stop loss is often underestimated.

Read More: Drawdown Management in Forex

Institutional vs. Retail: The Great Divide

The conversation around the mental stop loss often reveals a stark difference in approach between institutional traders and the average retail trader. While a retail trader might see it as a way to avoid getting “hunted,” an institutional trader views it through a completely different lens of capital size, strategy, and market interaction. Understanding this divide is key to knowing where you, as a trader, should stand.

Why Institutions Might Use Mental Stops

Institutional traders, like those at hedge funds or prop firms, sometimes favor a mental stop loss, but their reasoning is far from the retail trader’s fear of being stopped out.

First, their size is a factor. Placing a massive hard stop order can itself move the market or signal their intentions to other large players. It’s like an elephant trying to hide behind a bush. A mental stop loss, or more often a series of smaller, staggered exit orders executed manually or by an algorithm, allows them to unwind a large position without causing a panic or revealing their entire hand.

Second, many trade on a much longer time horizon and often without leverage. Their “stop” might not be a specific price but a fundamental condition. For example, a fund manager might decide to sell their position in a company only if its quarterly earnings miss expectations by a certain percentage. This is a form of mental stop loss based on data, not just price action.

Finally, and most importantly, they operate within a framework of extreme discipline and accountability. A trader at a prop firm who fails to honor their pre-defined risk parameters—mental or otherwise—will be fired. There is no room for emotion or second-guessing. Their job depends on their ability to execute the plan.

Why Retail Is Safer with Hard Stops

For the vast majority of retail traders, the story is completely different. The emotional pressures of trading your own money, combined with a lack of a rigid professional framework, make the mental stop loss a dangerous tool.

Hope is the retail trader’s worst enemy. When a trade goes into the red, the hope that it will “turn around” is powerful. A hard stop is the logical circuit-breaker that saves you from this emotional bias. A mental stop loss, for an undisciplined trader, is an open invitation to let hope drain their account. You tell yourself you’ll exit at $50. Then at $49.50, you rationalize waiting for $49. Soon, you’re down 50% on the position, holding a bag you never intended to own.

The difference between mental stop loss and hard stop loss for a retail trader is often the difference between a small, manageable loss and a catastrophic one. Until you have backtested a strategy and proven to yourself, over hundreds of trades in a simulated environment, that you can execute your exits flawlessly, you should always use a hard stop. It’s the safety harness that lets you learn to climb without the risk of a fatal fall.

Stop Loss Hunting: Mindset and Reality

Ah, “stop loss hunting.” It’s a phrase you’ll hear in every trading forum, often blamed for a string of losses. But what is it really? Is it a myth created by traders who can’t accept a loss, or a genuine market phenomenon? The truth, as is often the case, lies somewhere in the middle. Developing a professional stop loss hunting mindset isn’t about paranoia; it’s about understanding market mechanics.

What is Stop Loss Hunting?

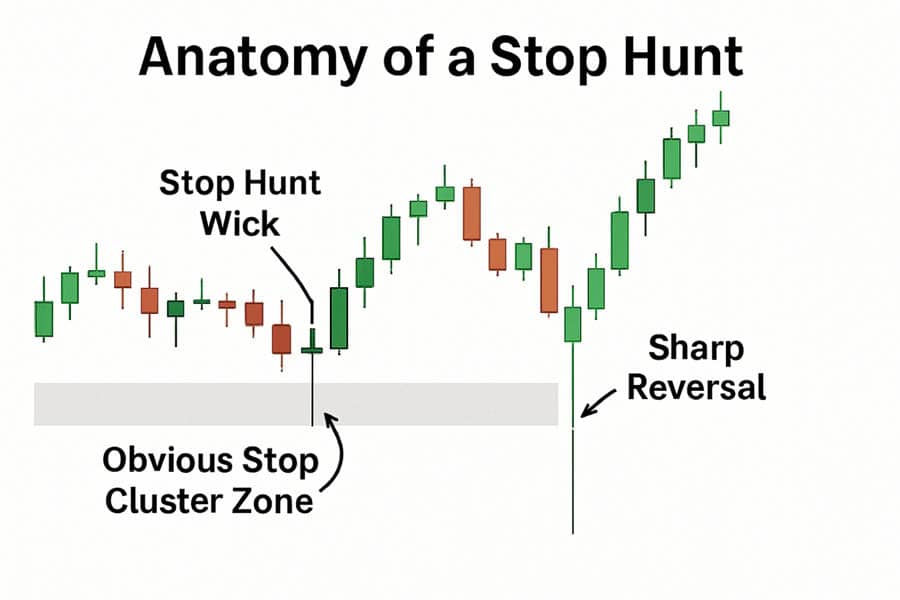

Stop loss hunting is the practice of pushing the price to a level where a large number of stop loss orders are known to be clustered, triggering them to create a cascade of selling (or buying) pressure. This allows large players (like market makers or institutional funds) to either enter a position at a more favorable price or to fuel a move in their desired direction. It’s not necessarily a malicious conspiracy against you personally. It’s a function of liquidity. Your stop order is, by definition, a promise to sell into a falling market (or buy into a rising one). A cluster of these promises creates a pool of liquidity that big money needs to fill its large orders.

The stop loss hunting mindset that many losing traders have is one of victimization. “They are hunting MY stop!” The professional mindset is one of awareness. “I know where the liquidity pools are, so I will either place my stop far away from them or use a technique that makes me invisible.” This is where a mental stop loss can be a powerful tool. If your stop only exists in your head, it cannot be hunted.

How to Minimize Your Vulnerability

Whether you use a hard stop or a mental stop loss, you can take steps to avoid being easy prey:

- Avoid Obvious Levels: Don’t place your stop *exactly* at the swing low or high, or right on a major round number (like $100.00). Everyone else is doing that. Place it a bit further, based on the Average True Range (ATR) or beyond a clear structural point. Give the trade room to breathe.

- Time Your Entries: Stop hunts often occur during session overlaps (like London-New York) or right before major news releases when liquidity is thin and volatility is high. Be extra cautious during these periods.

- Use Alerts, Not Just Stops: Set an alert at your intended exit level. If it triggers, you can then pull up the chart and assess the situation. Is it a violent, high-volume plunge, or a weak, low-volume drift? This context, which a hard stop ignores, can inform a better exit decision. This is a core component of using a mental stop loss effectively.

- Think in Zones, Not Lines: Instead of a single price, think of your stop loss area as a zone of support or resistance. Your exit trigger shouldn’t be a mere touch of this zone, but a confirmed break and close beyond it. This mindset shift alone can save you from countless frustrating stop-outs.

Read More: Risk management principles for both novice and advanced traders

Real Trading Examples & Strategy

Theory is great, but application is what matters. Let’s move beyond the abstract and into concrete scenarios. How does a trader actually apply a mental stop loss in the real world? The approach differs dramatically based on your trading style. Here, we’ll focus on what is often considered the best stop loss strategy for swing traders, as their timeframe allows for the kind of analysis a mental stop requires.

Swing Trader Scenario

Imagine you’re a swing trader looking at a stock that has pulled back to a key daily support level at $150, which also lines up with a 50-day moving average. Your thesis is that the stock will bounce from here and resume its uptrend. You enter a long position at $152.

Now, where does the stop go? The obvious place for a hard stop is just below the support level, say at $149. But you know this is exactly where everyone else’s stops are—a prime target for a stop hunt. A quick spike down to $148.90 could take you out before the price screams back up to $160.

The Hybrid Strategy: Hard + Mental Stop

This is where the best stop loss strategy for swing traders often comes in: the hybrid approach. It combines the safety of a hard stop with the flexibility of a mental stop loss.

- The Hard Stop (The “Disaster” Stop): You place a wide hard stop loss much further down, at a level that would completely invalidate the entire uptrend structure, for example, at $144.50. This is your catastrophe insurance. If there’s a flash crash or some terrible news overnight, you are protected from a devastating loss. You can sleep at night knowing your maximum risk is capped.

- The Mental Stop (The “Tactical” Stop): Your actual, intended exit point is a daily candle *closing* below the $150 support level. This is your mental stop loss. A quick wick below $150 during the day doesn’t trigger your exit. You are giving the market a chance to prove the bears are actually in control, not just taking a quick jab.

- The Alert System: You don’t just sit and watch the screen all day. You set a price alert at $149.75. If that alert triggers, you get a notification on your phone. This prompts you to open your charts and pay close attention as the daily candle nears its close. If it closes below $150, you manually exit the trade, honoring your mental stop loss, long before your hard stop at $144.50 is ever threatened.

This hybrid model gives you the best of both worlds. You avoid getting wicked out by noise, you benefit from the flexibility of a mental stop loss, and you’re still protected from a black swan event. This demonstrates a key difference between mental stop loss and hard stop loss application: they don’t have to be mutually exclusive.

Specific Strategy Block

- Combine Hard & Mental Stops: For non-scalping strategies, always consider the hybrid model. Use a wide hard stop for ultimate protection and a tighter mental stop loss based on specific criteria (e.g., candle closes, moving average crosses) for tactical management.

- Use Technology as Your Partner: Your platform’s alert function is your best friend when using a mental stop loss. Set alerts above/below your key levels so you are prompted to analyze the market at the critical moment, without having to be glued to the screen.

- Schedule Your Check-ins: If you are a swing or position trader, you don’t need to watch every tick. Your analysis is on the daily or 4-hour chart. Schedule specific times (e.g., after the daily close) to review your open positions and see if any of your mental stop loss conditions have been met. Routine builds discipline.

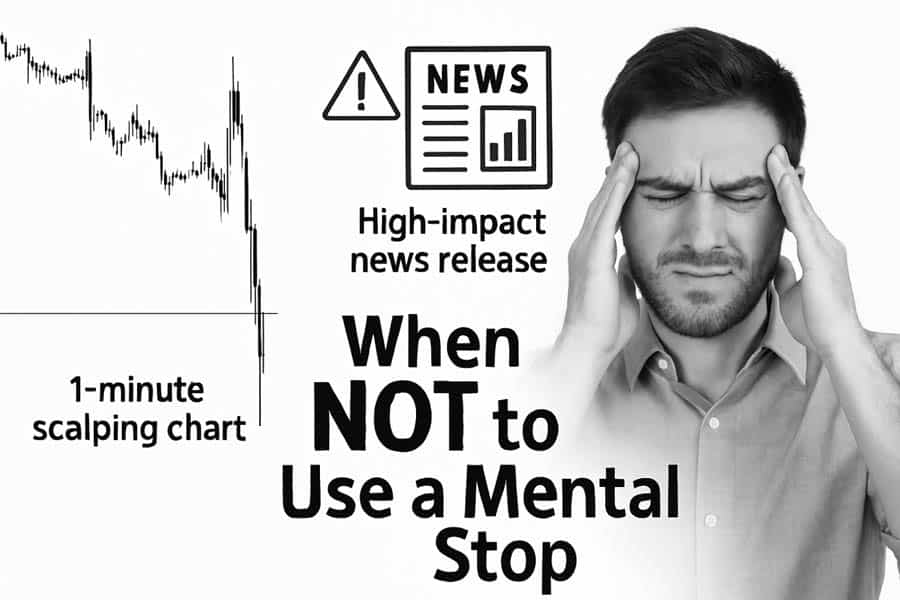

When NOT to Use Mental Stops

A mental stop loss is a specialized tool, like a scalpel. In the hands of a skilled surgeon, it’s precise and effective. In the hands of a novice, it’s a dangerous weapon that can cause immense damage. It’s crucial to be brutally honest with yourself and recognize the situations where using a mental stop loss is simply a bad idea. For many traders, these conditions apply 100% of the time.

- If You Lack Discipline: This is the number one reason. If you have ever moved a stop loss “just a little bit further” to avoid a loss, you are not ready. If you rationalize holding a loser, you are not ready. If you feel a surge of hope when a trade goes against you, you are not ready. A mental stop loss requires you to execute your plan with the cold, emotionless precision of a machine.

- If You Are a New Trader: New traders should *always* use hard stops. Period. Your first year of trading is about survival and learning. You need to build good habits, and the most important habit is respecting risk. A hard stop forces you to do this. Using a mental stop loss as a beginner is like trying to learn to drive in a Formula 1 car.

- If You Cannot Monitor the Market: A mental stop loss is not a “set it and forget it” tool. If your job, sleep schedule, or lifestyle prevents you from being able to monitor the market and execute an exit when your level is hit, you cannot use one. It is not an option.

- During High-Impact News Events: The moments before and after a major economic data release (like NFP or CPI) are chaos. Prices can move hundreds of pips in seconds. Relying on your ability to manually click a button in that environment is a recipe for extreme slippage and massive losses.

- In Scalping or High-Frequency Trading: The timeframe for these strategies is simply too short. Decisions must be made in seconds or milliseconds. You need the automated, instantaneous execution of a hard stop. There is no time to think or act on a mental stop loss.

- If You Are Prone to Emotional Conflict: Trading is a psychological battlefield. If you are already struggling with fear, greed, or anxiety, adding the burden of a mental stop loss is like throwing gasoline on a fire. It will amplify every negative emotion you have and lead to impulsive, disastrous decisions.

Read More: Stop Loss in Forex

Who Should (and Shouldn’t) Use It?

The decision to use a mental stop loss is deeply personal and depends entirely on the trader’s experience, psychology, and chosen strategy. There is no one-size-fits-all answer. The following table breaks down the typical recommendations for different types of traders, providing a clearer picture of where this tool fits—and where it absolutely does not.

| Trader Type | Recommendation | Reasoning & Examples |

| Scalper | Hard Stops Only | Trades last seconds to minutes. There is zero time for discretionary thought on an exit. Risk must be pre-defined and automated. A mental stop loss is impractical and reckless. |

| Day Trader | Mostly Hard Stops | While some extremely experienced day traders might use mental stops based on intraday price action, 99% are better off with hard stops. The speed of the market still favors automation over discretionary hesitation. |

| Swing Trader | Hybrid Model Recommended | This is the sweet spot. The best stop loss strategy for swing traders is often a wide, disaster hard stop combined with a tactical mental stop loss managed with alerts based on daily closes. |

| Investor / Position Trader | Mental Stops Possible | For long-term holds, the exit might be based on fundamental data (e.g., a change in company outlook) rather than a price. This is a form of mental stop loss, but it requires deep conviction and should be part of a well-diversified portfolio. |

Best Practices and Myths

Even after a deep dive, specific questions often remain about the practical use of a mental stop loss. Here are some common queries, stripped of fluff and answered directly.

- When should you use both stops in combination?

The hybrid approach is ideal for swing and position trading. Use a wide hard stop to protect against catastrophic events (news gaps, flash crashes) and a tighter mental stop loss, managed with alerts, for your tactical, day-to-day trade management based on specific criteria like candle closes.

- Is a hard stop always “the best”?

No. For a highly disciplined, experienced trader in certain market conditions, a mental stop loss can be superior as it avoids premature exits from stop hunts. However, for the vast majority of traders (over 90%), the hard stop is “best” because it enforces the discipline they lack.

- Can a mental stop loss alone be a full risk strategy?

Rarely. This approach should only be considered by elite institutional-level traders who have years of proven experience, operate within a strict professional risk framework, and likely aren’t using high leverage. For a retail trader, relying solely on a mental stop loss is an incomplete and high-risk strategy.

Trade with an Edge at Opofinance

Elevate your trading with a broker that provides superior tools and security. Opofinance, regulated by ASIC, offers a comprehensive trading experience designed for modern traders.

- Advanced Trading Platforms: Choose from MT4, MT5, cTrader, and the proprietary OpoTrade platform.

- Innovative AI Tools: Leverage the AI Market Analyzer, AI Coach, and 24/7 AI Support to sharpen your strategy.

- Flexible Trading Styles: Explore opportunities in Social Trading and Prop Trading.

- Secure & Flexible Transactions: Enjoy safe, convenient deposits and withdrawals, including crypto payments with zero fees.

Take your trading to the next level. Discover the difference with Opofinance today!

Conclusion

The mental stop loss is a tool of immense flexibility and significant danger. It is not a beginner’s tool. Its effectiveness hinges entirely on a trader’s unwavering discipline and self-awareness. While it offers a defense against stop hunting, its potential for catastrophic failure in the face of emotional decision-making is profound. For most traders, the rigid, unemotional protection of a hard stop is the superior choice. For the few who have mastered their psychology, the hybrid model offers the best stop loss strategy for swing traders, blending automated safety with discretionary precision.

How do I practice using a mental stop loss?

Use a demo account for several months. Treat it like real money. Keep a detailed journal of every trade where you intended to use a mental stop loss and see if you honored it every single time without hesitation. Honesty here is critical.

Can a trailing stop be mental?

Yes, but it adds another layer of complexity and potential for error. A mental trailing stop would involve manually adjusting your exit price as the trade moves in your favor based on pre-set rules (e.g., “I will move my stop to below the previous day’s low”). It requires even more discipline than a fixed mental stop.

Does using a mental stop loss reduce anxiety?

For most people, it does the opposite. It dramatically increases anxiety because the responsibility for the exit is 100% on you in real-time. A hard stop allows you to “set it and forget it,” which typically reduces stress.

What’s the biggest mistake traders make with a mental stop?

The single biggest mistake is rationalization. When the price hits their level, instead of exiting, they create a new reason to stay in the trade (“It’s just a wick,” “It will bounce back”). This turns a small, planned loss into a large, uncontrolled one.

Is a mental stop the same as having no stop?

For an undisciplined trader, yes, it is effectively the same as having no stop at all. For a disciplined, professional trader, it is a very deliberate risk management technique. The difference between mental stop loss and hard stop loss is only meaningful if the mental one is actually executed.

References: +