The primary difference in the metatrader 4 vs tradingview debate is that TradingView is a superior charting and social analysis platform, while MetaTrader 4 is a dedicated trading platform focused on automated execution and deep broker integration. Your choice depends on whether you prioritize analysis or automated trading. When selecting a platform, it’s also crucial to partner with a reliable online forex broker that supports your trading style. In this ultimate comparison, we’ll dissect every feature, from charting and automation to cost and accessibility, helping you decide which platform is the perfect fit for your trading journey.

Key Takeaways

For those in a hurry, here’s the essential breakdown of the tradingview vs mt4 comparison:

- Best for Charting: TradingView is the undisputed leader, offering a modern interface with vastly superior charting tools, indicators, and drawing capabilities.

- Best for Automation: MetaTrader 4 is the industry standard for automated trading through its Expert Advisors (EAs). It has a massive, mature ecosystem for trading robots.

- Best for Beginners: TradingView is easier for learning analysis due to its intuitive design. MT4 can be simpler for executing first trades because it’s directly provided by the broker.

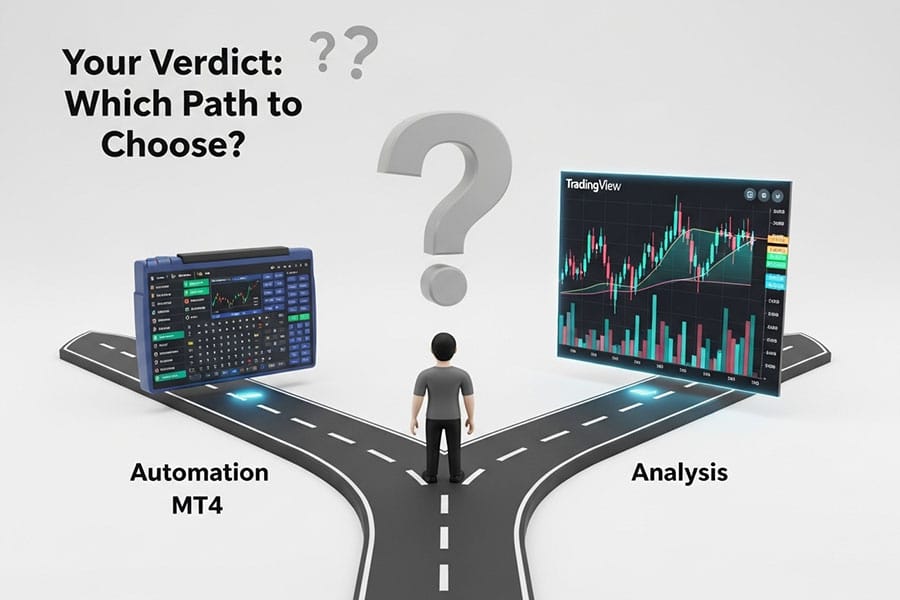

- Core Conflict: Your choice boils down to a trade-off. Do you want the best-in-class analysis and social tools (TradingView) or a stable, execution-focused platform with powerful automation (MT4)?

- The Hybrid Approach: Many professional traders use TradingView for its elite charting and analysis and then place their trades on MT4, getting the best of both worlds.

At a Glance: Key Differences Between MT4 and TradingView

This table gives you an instant overview of the core differences in the metatrader 4 vs tradingview matchup, providing a quick reference before we dive deep into the specifics.

| Feature | MetaTrader 4 (MT4) | TradingView |

| Primary Function | Trading & Execution Platform | Charting & Social Analysis Platform |

| Best For | Automated Forex Traders, EA Users | Technical Analysts, Multi-Asset Traders |

| User Interface | Dated, functional, software-based | Modern, intuitive, web-based |

| Charting Tools | Good, but basic | Industry-leading, highly advanced |

| Automated Trading | Expert Advisors (MQL4) – Industry Standard | Pine Script – More for alerts/strategies |

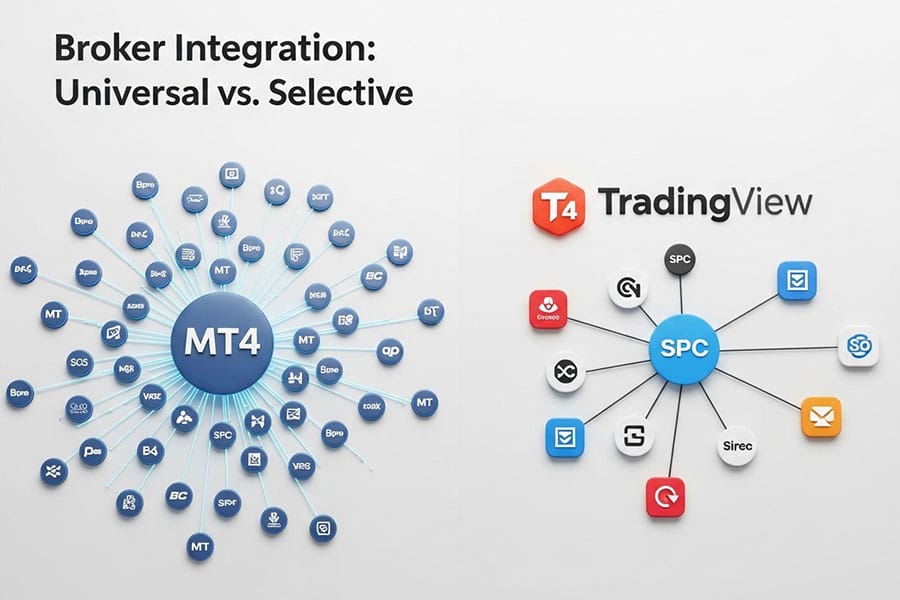

| Broker Integration | Supported by nearly all forex brokers | Supported by a limited but growing list |

| Social/Community | Minimal (MQL5 community) | Massive, integrated social network |

| Cost | Free via brokers | Freemium (Free to $59.95/mo) |

| Platform Access | Desktop (Windows/Mac), Mobile App | Web Browser, Desktop App, Mobile App |

What is MetaTrader 4? The Workhorse

Launched in 2005, MetaTrader 4, or MT4, is less of a platform and more of an institution in the forex trading world. It’s a downloadable software terminal that became the gold standard for retail forex traders. Its reputation is built on stability, reliability, and an unparalleled ecosystem for automated trading. MT4 isn’t designed to be flashy; it’s designed to execute trades efficiently and run trading robots 24/7 without complaint. When you sign up with most forex trading brokers, MT4 is the default platform they will offer you, fully integrated and ready to go.

Pros of MetaTrader 4

The longevity of MT4 is no accident. It excels in several key areas that keep traders loyal. Its primary strengths lie in its widespread adoption by brokers and its powerful automation capabilities, which remain a key differentiator in the metatrader 4 vs tradingview discussion.

- Unmatched Broker Availability: It’s harder to find a forex broker that doesn’t offer MT4 than one that does. This universal access means you can switch brokers without having to learn a new platform.

- Powerful Automated Trading (EAs): This is MT4’s crown jewel. Expert Advisors (EAs) are trading robots that can fully automate your trading strategy. The MQL4 programming language and the massive online marketplace mean you can find, buy, or build an EA for virtually any strategy imaginable.

- High Stability and Low Latency: MT4 is a lightweight program known for its rock-solid stability. It doesn’t consume many system resources, which translates to fast order execution and minimal slippage, a critical factor for scalpers and high-frequency traders.

- Free with most brokers: The platform is free for you because your broker pays the licensing fees. There are no subscriptions or hidden costs to use the standard MT4 platform.

Cons of MetaTrader 4

Despite its strengths, MT4 shows its age in several ways. For modern traders who value user experience and advanced analytical tools, the platform’s weaknesses are significant and can be a deal-breaker, often pushing them to consider alternatives in the tradingview vs mt4 debate.

- Outdated User Interface: The interface looks and feels like software from the early 2000s. It’s clunky, not particularly intuitive, and lacks the sleek, modern design traders have come to expect.

- Basic Charting Capabilities: Compared to modern platforms, MT4’s charting feels limited. It has a decent selection of built-in indicators and tools, but it pales in comparison to the sheer analytical power of TradingView.

- Limited to Broker-Offered Assets: You can only trade the instruments your MT4 broker provides. You can’t use it to analyze stocks, cryptocurrencies, or other assets if your forex broker doesn’t offer them as CFDs.

- No Social/Community Features: MT4 is a solitary experience. There are no integrated social feeds, chat rooms, or idea-sharing functionalities.

Read More: MetaTrader 5 vs TradingView

What is TradingView? The Analyst’s Choice

TradingView burst onto the scene in 2011 and fundamentally changed the game. It is a web-based platform that prioritized one thing above all else: providing the best charting and analysis experience in the world. Its interface is clean, modern, and incredibly powerful. Beyond charts, TradingView built a massive social network where traders can share ideas, scripts, and analysis in real-time. It’s a one-stop shop for market analysis across thousands of assets, including stocks, crypto, futures, and of course, forex. The core of the tradingview vs metatrader 4 for forex argument often hinges on TradingView’s superior analytical environment.

Pros of TradingView

TradingView’s rapid rise in popularity is a testament to its modern approach and focus on what technical analysts truly need. Its feature set is built for the digital age of trading.

- World-Class Charting and Analysis Tools: This is its biggest advantage. With over 100 drawing tools, 400+ built-in indicators, smart drawing tools that adapt to price action, and community-built scripts, its charting capabilities are unmatched.

- Modern, Intuitive User Experience: The platform is beautifully designed, runs smoothly in any web browser, and is a pleasure to use. Features like multiple chart layouts, custom timeframes, and synchronized crosshairs make analysis seamless.

- Huge Social & Idea-Sharing Community: You can follow top traders, see their live analysis, share your own charts, and get instant feedback. This social ecosystem is an invaluable learning tool.

- Covers Thousands of Markets: Unlike MT4, which is tied to your broker, TradingView provides data for virtually every tradable asset on the planet, making it the ultimate tool for multi-market analysis.

Cons of TradingView

While dominant in analysis, TradingView has some notable drawbacks, particularly when it comes to the practical execution of trades. These limitations are crucial to understand when comparing metatrader 4 vs tradingview.

- Limited Broker Integration for Live Trading: While the list is growing, only a select number of brokers allow you to trade directly from TradingView’s charts. For most traders, it remains an analysis platform, not an execution one.

- Key Features Require a Paid Subscription: The free plan is excellent but comes with ads, a limit of three indicators per chart, and restrictions on advanced features. To unlock its full power (multiple charts, more indicators, faster data), you need a paid plan.

- Automation is Less Robust for Execution: Its Pine Script language is fantastic for creating custom indicators and sophisticated alert systems. However, it’s not designed for the kind of “set-and-forget” automated trade execution that MT4’s EAs provide.

Head-to-Head: TradingView vs MT4

Now, let’s put the two platforms side-by-side in a detailed feature breakdown. This is where the nuances of the metatrader 4 vs tradingview choice become clear, helping you align a platform’s strengths with your personal trading style. We will explore the most critical aspects for any trader, from charting to automation.

Charting & Technical Analysis

This is arguably the most significant point of difference. For a technical trader, the quality of their charts is paramount. When it comes to tradingview vs mt4 on charting, there is a clear winner. TradingView was built from the ground up to be a charting platform, and it shows. It offers a fluid, responsive experience with an arsenal of tools that leaves MT4 far behind. You get access to hundreds of indicators and drawing tools, from simple trend lines to complex Gann and Fibonacci patterns. The ability to layer multiple indicators, use community-built scripts, and set up multiple chart layouts on a single screen is a game-changer for serious analysis.

MT4, on the other hand, provides a functional but basic charting package. It comes with around 30 built-in indicators and a standard set of drawing tools. While perfectly adequate for simple analysis, it feels restrictive and cumbersome compared to TradingView. The charts can feel clunky, and applying multiple analytical models is less intuitive. For traders who see the chart as their primary workspace, the experience on TradingView is simply in a different league.

Pro Tip: My personal workflow, like that of many pros, involves doing 100% of my analysis on TradingView. I use its advanced tools to identify setups across multiple timeframes. Once I have a trade signal, I simply switch to my MT4 terminal to execute the trade. This hybrid approach gives me the best of both worlds.

Automated Trading: EAs vs Pine Script

Here, the tables turn dramatically. If your goal is automated trading, the metatrader 4 vs tradingview debate heavily favors MT4. MetaTrader 4’s Expert Advisors (EAs) are the industry’s undisputed standard for algorithmic trading. EAs are true trading robots written in the MQL4 language. They can analyze the market and execute and manage trades on your behalf, 24/5, without any manual intervention. There is a vast commercial and free marketplace with thousands of pre-built EAs, and a huge community of developers who can code a custom strategy for you. MT4 is built to run these EAs with stability on a VPS (Virtual Private Server).

TradingView’s Pine Script is powerful but serves a different purpose. It’s primarily designed for creating custom indicators and setting up highly complex server-side alerts. For example, you can create an alert that triggers when RSI crosses above 30 *and* price closes above the 50-day moving average. While you *can* use these alerts to trigger trades via a third-party webhook service that connects to your broker or exchange, it is a more technical and less seamless process than running an EA on MT4. It’s less of a “set-and-forget” solution and more of a powerful alert system for discretionary traders.

Platform Accessibility & Ease of Use

How you access and interact with your platform is a daily consideration. TradingView offers superior accessibility. Being web-based, you can log in from any computer with an internet browser and immediately see your charts, layouts, and analysis exactly as you left them. There is nothing to install. It also has excellent desktop and mobile apps that sync perfectly. Its modern, clean interface is generally considered far more intuitive and user-friendly, especially for beginners learning the ropes of technical analysis.

MetaTrader 4 requires a software installation on your Windows or Mac computer. Your platform instance is tied to that specific installation. While it also has mobile apps, syncing your chart analysis (like trend lines) between desktop and mobile is not a built-in feature. The learning curve for MT4 can be steeper due to its dated design. Simple tasks can sometimes require navigating through unintuitive menus. However, for the simple act of placing a trade, MT4 can be more straightforward as the buy/sell buttons are always front and center, integrated directly by the broker for forex trading.

Broker Integration & Trade Execution

This is a fundamental and often misunderstood difference. The choice between tradingview vs metatrader 4 for forex can be dictated by your broker. MetaTrader 4 does not exist on its own; it is the platform *provided to you by your broker*. Your broker owns the license and gives you a branded version of MT4 that is directly connected to their servers. This guarantees deep integration, stability, and fast execution because the platform and the broker are a single unit. Nearly every forex broker in the world offers MT4.

Read More: What is TradingView

TradingView, in contrast, is an independent, third-party platform. It *connects to* brokers via an API. This means you must have an account with a broker that is an official partner of TradingView to trade directly from its charts. While the list of partners is growing and includes some major names, it is still a small fraction of the thousands of brokers that offer MT4. For most traders, TradingView remains an analytical tool, and a separate MT4 or MT5 platform is needed for the actual execution.

The Cost Factor

Is MT4 truly free? For the trader, yes. The broker absorbs the cost of the platform license as a cost of doing business. You can download and use a fully functional, real-money MT4 platform from any broker without paying any fees or subscriptions for the software itself. The only costs you incur are the normal trading costs, like spreads and commissions.

TradingView operates on a “freemium” model. Its free plan is remarkably capable for beginners and casual analysts. However, it’s supported by ads and has limitations, such as a maximum of three indicators per chart and one saved chart layout. To unlock its true potential—more indicators, multiple chart layouts, faster data, and no ads—you must subscribe to one of its paid plans (Pro, Pro+, or Premium), which range from around $15 to $60 per month. For serious analysts, a paid plan is almost essential, making it a key budget consideration in the metatrader 4 vs tradingview choice.

The Final Verdict: Which One Is For You?

The best platform is not the one with the most features, but the one that best suits your individual trading needs and style. Having explored the critical differences, the decision in the metatrader 4 vs tradingview battle should be clearer. Let’s break it down into simple user profiles to help you make the final call.

Choose MetaTrader 4 If You:

- Prioritize Automated Trading: If your primary goal is to use or develop Expert Advisors (EAs) for hands-off trading, MT4 is the only serious choice. Its infrastructure and community are built for it.

- Are a Forex-Focused Trader: If you exclusively trade forex and your strategy doesn’t require hyper-advanced charting, MT4 provides a stable, fast, and reliable environment for execution.

- Need a Specific Broker: If your preferred broker for forex only offers MT4 (which is very common), then your choice is made for you. Its universal availability is a major practical advantage.

- Are Sensitive to Cost: If you want a powerful execution platform with zero subscription fees, MT4 is the way to go.

Choose TradingView If You:

- Prioritize Elite Charting: If you are a serious technical analyst who lives and breathes charts, TradingView is non-negotiable. Its tools will elevate your analysis.

- Analyze Multiple Asset Classes: If you want to track ideas in stocks, crypto, commodities, and forex from a single platform, TradingView is the ultimate analytical hub.

- Value Community and Learning: If you want to share ideas, learn from thousands of other traders, and stay on top of market sentiment, TradingView’s social features are invaluable.

- Want a Modern User Experience: If you prefer a clean, intuitive, web-based interface that works seamlessly across all your devices, TradingView provides a superior user experience.

Bridging the Gap: Using Both Platforms

For many traders, the metatrader 4 vs tradingview debate doesn’t have to be an either/or decision. A highly effective and popular strategy is to use both platforms in tandem, leveraging the strengths of each. This “hybrid” approach is often considered the professional’s choice.

Here’s how it works: You use TradingView (often the paid version for maximum benefit) for all of your charting, screening, and analysis. You build your watchlists, draw your key levels, apply your complex indicators, and identify your exact entry and exit points on its superior interface. Once your analysis leads to a trading decision, you simply open your MT4 terminal—which is running quietly in the background—and execute the trade. This workflow allows you to benefit from TradingView’s world-class analysis without being limited by its broker integrations, while still capitalizing on MT4’s execution speed and stability provided by your chosen regulated forex broker. It truly is the best of both worlds.

Read More: What is MT4

Opofinance Services

When choosing your broker, consider one that offers a comprehensive suite of tools. ASIC-regulated Opofinance bridges the gap by providing powerful platforms and innovative technology to support every trading style.

- Advanced Trading Platforms: Trade on MT4, MT5, cTrader, and their proprietary OpoTrade.

- Innovative AI Tools: Leverage their AI Market Analyzer, AI Coach, and AI Support for a smarter trading experience.

- Social & Prop Trading: Engage with the community and explore proprietary trading opportunities.

- Secure & Flexible Transactions: Enjoy safe and convenient deposits and withdrawals, including crypto payments, with zero fees from Opofinance.

Explore a broker that enhances your trading, regardless of the platform you choose. Discover Opofinance today!

Conclusion

Ultimately, the metatrader 4 vs tradingview debate is about function. MetaTrader 4 is the undisputed king of automated trading and direct broker execution, a battle-tested workhorse. TradingView is the modern champion of charting, analysis, and community. Your decision hinges on a simple question: Is your priority hands-off automation and execution (MT4), or is it world-class analysis and idea generation (TradingView)? By understanding this core trade-off, you can confidently choose the platform that will best serve your path to trading success.

Why do so many forex brokers still offer MT4 if MT5 is newer?

MetaTrader 4 remains immensely popular primarily because of its vast ecosystem of existing Expert Advisors (EAs). Many traders and developers have invested years into MQL4 code, and there isn’t always a compelling reason for a forex-focused trader to switch, so brokers continue to support the massive MT4 user base.

Is Pine Script from TradingView harder to learn than MQL4 from MT4?

Generally, Pine Script is considered easier to learn for beginners, especially for writing indicators and alerts. Its syntax is more modern and forgiving. MQL4 is a more complex, C++ like language designed for building robust, stand-alone trading applications (EAs), giving it a steeper learning curve.

Does TradingView have better backtesting than MT4?

They serve different purposes. MT4’s “Strategy Tester” is more robust for backtesting automated EAs, providing detailed reports on execution, drawdown, and profit factors. TradingView’s backtesting is excellent for testing indicator-based strategies and provides a quick visual representation of trades on the chart, but it’s generally less comprehensive for full EA simulation.

Which platform is better for mobile trading?

TradingView’s mobile app is superior for charting and analysis on the go, as it syncs perfectly with your desktop analysis. However, MT4’s mobile app is often more direct and streamlined for the simple act of executing and managing trades, as it’s a dedicated execution tool.

Can I use my MetaTrader 4 account login on TradingView?

No, you cannot use your MT4 account credentials to log into TradingView directly. They are separate systems. To trade on TradingView, your broker must be an officially supported partner, and you must connect your account through TradingView’s trading panel, which is a separate process from logging into MT4.