Deciding between ninjatrader vs ctrader is a critical choice for serious traders in 2025. This decision impacts everything from market access to execution speed and the sophistication of your automated strategies. If you’re looking for a top-tier online forex broker, the platform you choose is your gateway to the markets. This article provides a definitive ninjatrader vs ctrader comparison, exploring their user interfaces, charting capabilities, supported markets, and unique features. We will delve into which platform better serves different trading styles, from discretionary futures traders to algorithmic forex experts, helping you make an informed choice for your trading journey.

Key Takeaways:

- Primary Focus: NinjaTrader is predominantly a futures and options trading platform, while cTrader is primarily focused on forex and CFD trading.

- User Interface: cTrader is known for its modern, intuitive, and user-friendly interface, making it a great choice for beginners. NinjaTrader has a steeper learning curve but offers extensive customization.

- Automated Trading: Both platforms offer robust automated trading capabilities. NinjaTrader uses its proprietary, C#-based NinjaScript, while cTrader uses cAlgo, which is also based on C#.

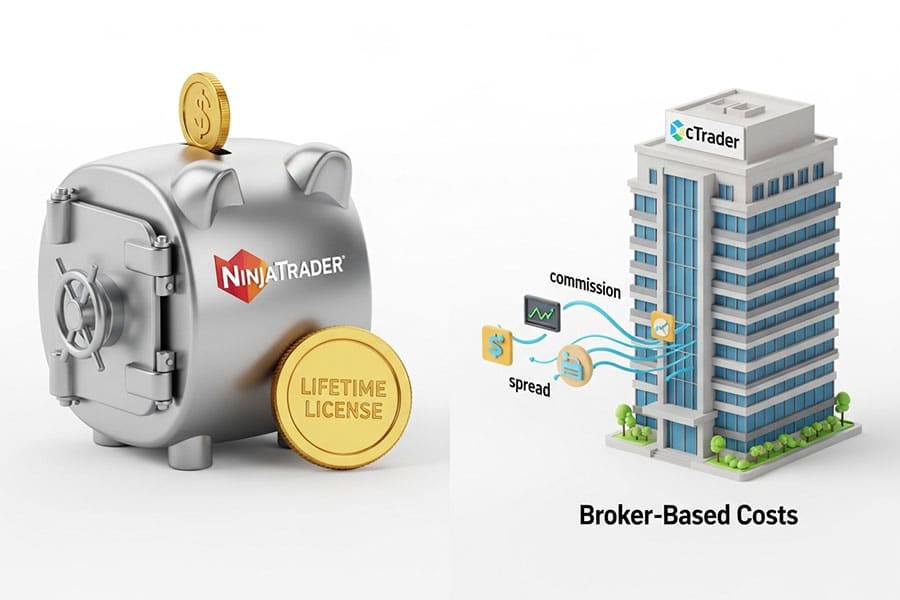

- Pricing: cTrader is typically offered for free by brokers, with costs built into commissions or spreads. NinjaTrader has a free version with limited functionality, but a lifetime license is required to unlock its full potential.

- Broker Integration: cTrader is offered by a wide range of forex brokers. NinjaTrader, while supporting various brokers, is also a brokerage firm itself, offering an integrated experience.

Platform Overview

Before diving deep into a feature-by-feature comparison, it’s essential to understand the fundamental identity of each platform. Their origins and primary target audiences have shaped their development and core strengths.

What is NinjaTrader?

NinjaTrader is a comprehensive trading platform that has been a favorite among futures and options traders for years. It’s renowned for its high-performance charting, advanced analytical tools, and extensive customization options. Beyond being just a platform, NinjaTrader also operates as a futures brokerage, offering an all-in-one solution for its clients. Its powerful backtesting and simulation capabilities make it a top choice for traders who want to develop and test their own strategies with a high degree of precision.

What is cTrader?

cTrader, developed by Spotware Systems, is a premium trading platform primarily designed for forex and CFD traders. It has gained popularity for its sleek, modern interface, and its commitment to transparency and fair trading conditions. cTrader is known for its fast order execution, advanced charting tools, and a user-friendly environment that appeals to both new and experienced traders. It’s a platform offered by numerous online forex brokers, giving traders a wide choice of where to trade.

Who are these platforms best for?

In essence, NinjaTrader is the go-to platform for dedicated futures traders who require deep analytical tools and extensive customization. It’s particularly well-suited for those who want to build and automate complex trading strategies. On the other hand, cTrader is an excellent choice for forex and CFD traders who value a clean, modern interface, fast execution, and a wide selection of brokers. It’s a more accessible platform for beginners without sacrificing the advanced features that professional traders demand.

Read More: best trading platform for forex

User Interface & Experience

The user interface (UI) and overall user experience (UX) are critical factors in a trader’s daily workflow. A well-designed platform can enhance efficiency and reduce errors, while a clunky one can lead to frustration and missed opportunities.

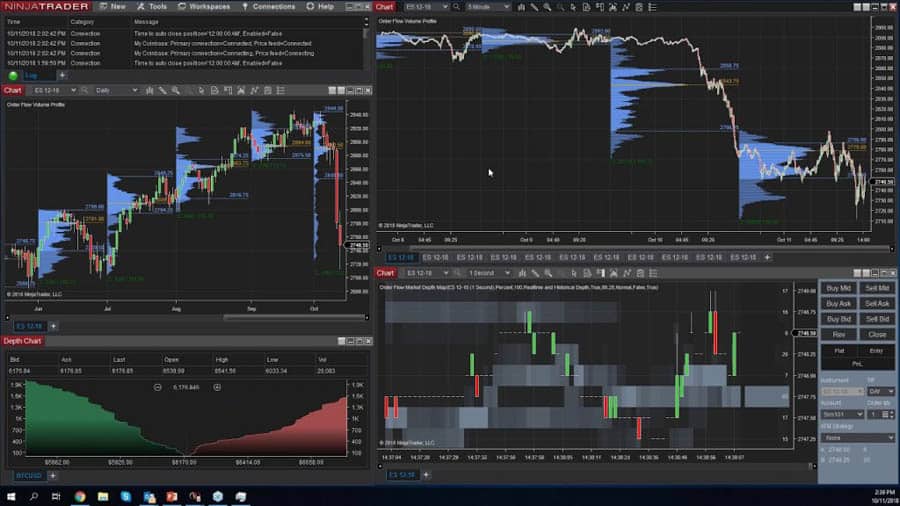

NinjaTrader User Interface

NinjaTrader’s interface is powerful and highly customizable, but it comes with a steeper learning curve. The platform is built around a “workspace” concept, allowing traders to arrange multiple windows, charts, and tools across several monitors. This level of customization is a significant advantage for professional traders who need to monitor multiple instruments and timeframes simultaneously. However, for a beginner, the sheer number of options and settings can be overwhelming. The design, while functional, can feel a bit dated compared to more modern platforms.

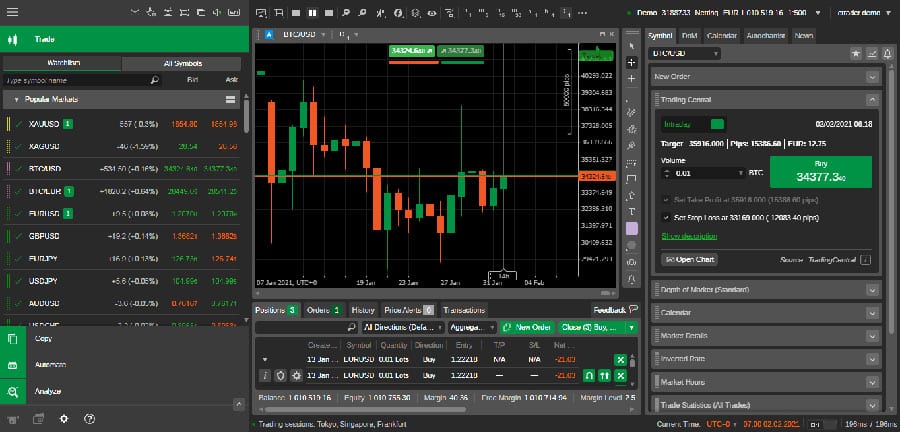

cTrader User Interface

cTrader, in contrast, boasts a modern, clean, and intuitive user interface. It’s designed to be user-friendly from the moment you log in, with a logical layout that is easy to navigate. The platform is available as a desktop application, a web-based platform, and a mobile app, all of which offer a seamless and consistent experience. This accessibility makes cTrader an excellent choice for traders who need to manage their positions on the go. The platform’s out-of-the-box experience is far more welcoming to new traders than NinjaTrader’s.

Supported Markets & Asset Coverage

The range of available markets and financial instruments is a crucial consideration when choosing a trading platform. Your trading strategy and goals will dictate which platform offers the asset coverage you need.

Market Access

NinjaTrader’s primary strength lies in its access to the futures and options markets. It provides connectivity to major exchanges like the CME, CBOT, and Eurex, offering a vast selection of futures contracts on indices, commodities, currencies, and more. While it can be used for forex and stock trading through integrations with certain brokers, its core focus remains on futures.

Instrument Diversity and Liquidity

cTrader, on the other hand, is a dominant force in the forex and CFD space. Brokers offering cTrader typically provide a wide range of currency pairs, including majors, minors, and exotics. In addition, you’ll find CFDs on indices, stocks, commodities, and cryptocurrencies. The liquidity available on cTrader is generally excellent, as it’s offered by numerous top-tier brokers who aggregate liquidity from multiple providers.

Charting & Technical Analysis Tools

Advanced charting and a comprehensive suite of technical analysis tools are the bedrock of any serious trading platform. This is an area where both ninjatrader vs ctrader excel, albeit with different approaches.

Built-in Indicators and Drawing Tools

Both platforms come equipped with a vast library of built-in technical indicators and drawing tools. You’ll find everything from moving averages and MACD to Fibonacci retracements and trend lines. NinjaTrader, however, has a slight edge in the sheer number of third-party indicators available through its ecosystem. The NinjaTrader community is vast and has produced thousands of custom indicators, many of which are available for free or for purchase.

Chart Types and Customization

cTrader offers a good selection of chart types, including the standard line, bar, and candlestick charts, as well as tick and Renko charts. The customization options are user-friendly, allowing you to change colors, timeframes, and other visual settings with ease. NinjaTrader takes chart customization to another level. It offers a wider array of chart types, including range and volume charts, and allows for much more granular control over every aspect of the chart’s appearance and behavior. This is a significant plus for traders who rely on highly specific chart setups.

Unique Features

NinjaTrader’s “SuperDOM” (Depth of Market) is a standout feature, providing a dynamic and intuitive interface for order entry and management directly from the price ladder. This is an invaluable tool for scalpers and day traders who need to execute trades with speed and precision. cTrader’s “Market Depth” feature is also robust, offering three different views (Standard, Price, and VWAP) to give traders a comprehensive understanding of market liquidity.

Read More: what is mt5

Order Execution & Trading Tools

The speed and reliability of order execution are paramount in trading. Both platforms are designed for high performance, but they have different execution models and risk management features.

Speed, Reliability, and Order Types

cTrader is renowned for its fast execution speeds, as it’s designed to connect directly to a broker’s ECN (Electronic Communication Network). This direct market access (DMA) model ensures that trades are filled quickly and with minimal slippage. It supports a wide range of order types, including market, limit, stop, and stop-limit orders. NinjaTrader also offers excellent execution speed, particularly when used with its own brokerage service. It supports a similar range of order types and also allows for advanced order strategies like OCO (One-Cancels-the-Other) orders.

Risk Management Features

Both platforms provide essential risk management tools like stop-loss and take-profit orders. NinjaTrader’s “Advanced Trade Management” (ATM) feature is particularly noteworthy. It allows traders to pre-define complex risk management strategies that are automatically applied to their trades. This can include multiple profit targets, trailing stops, and automatic break-even stops. cTrader also offers robust risk management features, including trailing stops and the ability to set stop-loss and take-profit levels in pips or as a percentage of the account balance.

Automated Trading & Algorithmic Features

For many modern traders, the ability to automate their strategies is a key requirement. This is a core strength of both platforms, making the ctrader vs ninjatrader review a close one in this category.

cTrader Automate (cAlgo) and Supported Languages

cTrader’s automated trading suite is called “cTrader Automate” (formerly known as cAlgo). It allows traders to build, backtest, and optimize their own trading robots (cBots) and custom indicators using the C# programming language. The platform includes a built-in code editor and provides access to a rich API, giving developers a high degree of control over their automated strategies. The “plug and play” functionality makes it relatively easy to get started with algorithmic trading.

NinjaTrader Strategy Builder and NinjaScript

NinjaTrader’s automated trading capabilities are powered by “NinjaScript,” its proprietary, C#-based scripting language. NinjaScript is incredibly powerful and flexible, allowing traders to develop highly complex and sophisticated automated strategies. For those who are not proficient in coding, NinjaTrader also offers a “Strategy Builder” that allows you to create strategies using a point-and-click interface. This makes automated trading more accessible to a wider range of traders.

Backtesting and Optimization Tools

Both platforms offer robust backtesting and optimization engines. NinjaTrader’s “Strategy Analyzer” is particularly powerful, allowing for detailed performance analysis and multi-threaded optimization. cTrader’s backtesting tools are also comprehensive, providing detailed statistics and visual representations of a strategy’s performance. The choice between the two often comes down to a trader’s personal preference and their familiarity with the respective development environments.

Read More: What is NinjaTrader

Social & Copy Trading

Social and copy trading have become increasingly popular, allowing traders to follow and replicate the strategies of more experienced market participants.

cTrader Copy Trading

cTrader has a built-in copy trading feature called “cTrader Copy.” It allows traders to browse through a list of strategy providers, view their performance statistics, and choose to automatically copy their trades. This is a fully integrated and user-friendly solution that is ideal for those who are new to trading or who don’t have the time to develop their own strategies.

NinjaTrader Integrations

NinjaTrader does not have a native copy trading feature. However, it can be integrated with various third-party social and copy trading platforms. This requires a bit more setup and is not as seamless as cTrader’s integrated solution, but it does provide a degree of flexibility for traders who want to access a wider range of strategy providers.

Broker Integration & Accessibility

The ease of connecting a platform to a broker and accessing it across different devices is a practical consideration that can significantly impact a trader’s experience.

Broker Compatibility and Account Setup

cTrader is offered by a wide range of forex and CFD brokers, giving traders plenty of choices. The account setup process is typically straightforward and can be completed online. NinjaTrader, while also compatible with a number of brokers, is often used in conjunction with its own brokerage service. This integrated approach can simplify the account setup process and provide a more seamless trading experience.

Desktop, Web, and Mobile Access

cTrader is a clear winner in terms of cross-platform accessibility. It offers a consistent and full-featured experience across its desktop, web, and mobile applications. This is a major advantage for traders who need to monitor the markets and manage their trades from anywhere. NinjaTrader’s primary strength is its desktop platform. While it does offer a mobile app, it is not as full-featured or as user-friendly as cTrader’s mobile offering.

Pricing & Costs

The cost of using a trading platform can have a significant impact on a trader’s profitability. The pricing models for ninjatrader vs ctrader are quite different.

Platform Fees, Commissions, and Add-ons

cTrader is typically offered for free by brokers. The broker’s costs are usually built into the spreads or commissions they charge on trades. This makes it a very cost-effective option for many traders. NinjaTrader has a more complex pricing structure. It offers a free version of the platform that is suitable for basic charting and trade simulation. However, to unlock the platform’s full potential, including its advanced trading and automated strategy features, you’ll need to purchase a lifetime license or lease the platform on a quarterly or annual basis. In addition to the platform fees, you’ll also have to pay commissions and data fees, which can vary depending on your broker and the markets you trade.

Cost Transparency and Value for Money

cTrader’s pricing model is generally more transparent and straightforward. The costs are clearly outlined by the broker, and there are no hidden platform fees. NinjaTrader’s pricing, while more complex, can offer good value for money for serious futures traders who can take advantage of its advanced features and potentially lower commissions through its brokerage service. The “Free” version of NinjaTrader is a great way to get started, but it’s important to factor in the cost of a license if you plan to trade live with advanced features.

Community, Support & Resources

A strong community and reliable customer support can be invaluable resources, especially when you’re learning a new platform or troubleshooting a technical issue.

Official Support Channels

Both platforms offer official support through various channels, including email, phone, and live chat. NinjaTrader’s support is generally considered to be very good, with a dedicated team that is knowledgeable about the platform and the futures markets. cTrader’s support is also responsive, but the quality can vary depending on the broker you’re using.

Community Forums and Educational Resources

NinjaTrader has a large and active community forum where traders can share ideas, ask questions, and get help from other users. The company also provides a wealth of educational resources, including video tutorials, webinars, and a comprehensive help guide. cTrader also has a community forum and a good selection of educational materials, but its community is not as large or as active as NinjaTrader’s.

Pros & Cons Table: ninjatrader vs ctrader

| NinjaTrader | cTrader |

|---|---|

| Pros: | Pros: |

| – Excellent for futures and options trading | – Modern and intuitive user interface |

| – Highly customizable platform | – Excellent for forex and CFD trading |

| – Powerful automated trading with NinjaScript | – Fast order execution with DMA |

| – Advanced charting and analytical tools | – Integrated copy trading feature |

| – Large and active community | – Free to use with most brokers |

| Cons: | Cons: |

| – Steep learning curve for beginners | – Limited to forex and CFDs |

| – Can be expensive with license and data fees | – Fewer third-party add-ons than NinjaTrader |

| – Mobile app is less developed | – Customization is not as extensive as NinjaTrader |

Best Use Cases & Who Should Choose Which Platform?

The choice between ninjatrader vs ctrader ultimately depends on your individual needs and trading style. Here are some scenario-based recommendations:

- For Beginners: cTrader is the clear winner for beginners. Its intuitive interface and user-friendly design make it easy to get started with trading.

- For Algorithmic Traders: This is a close call. Both platforms offer powerful automated trading capabilities. If you’re a C# developer, you’ll feel at home with either platform. NinjaTrader’s Strategy Builder gives it a slight edge for non-coders.

- For Futures Traders: NinjaTrader is the undisputed champion for futures trading. Its advanced tools, deep market access, and dedicated focus on the futures markets make it the superior choice.

- For Forex Traders: cTrader is the better option for most forex traders. Its fast execution, transparent pricing, and wide selection of forex brokers make it an ideal platform for trading currencies.

Real User Experiences & Expert Opinions

A ctrader vs ninjatrader review wouldn’t be complete without considering what real users have to say. Generally, users praise cTrader for its ease of use and modern design. Many traders who have switched from other platforms to cTrader comment on its superior user experience. Expert opinions often highlight cTrader’s “trader-first” approach, with features designed to create a fair and transparent trading environment.

NinjaTrader, on the other hand, is lauded by experienced traders for its power and flexibility. User reviews often mention the platform’s extensive customization options and the strength of its analytical tools. While many acknowledge the steep learning curve, they also say that the effort is well worth it for the level of control and sophistication that NinjaTrader provides.

Opofinance: Your Gateway to Advanced Trading

As you weigh your options in the ninjatrader vs ctrader debate, consider a broker that offers a cutting-edge trading environment. Opofinance, a regulated forex broker under ASIC, provides a suite of advanced tools and platforms to elevate your trading experience.

- Advanced Trading Platforms: Choose from a range of top-tier platforms, including MT4, MT5, cTrader, and the proprietary OpoTrade.

- Innovative AI Tools: Gain a competitive edge with our AI Market Analyzer, AI Coach, and AI Support.

- Social & Prop Trading: Explore the world of social trading and take advantage of our prop trading opportunities.

- Secure & Flexible Transactions: Enjoy safe and convenient deposits and withdrawals, including crypto payments with zero fees.

Discover the future of trading with Opofinance.

Conclusion: ninjatrader vs ctrader – Which Is Right for You?

The ninjatrader vs ctrader debate doesn’t have a one-size-fits-all answer. The right platform for you depends on your trading style, the markets you trade, and your level of experience. If you are a dedicated futures trader who values power, customization, and advanced analytics, NinjaTrader is likely the better choice. If you are a forex or CFD trader who prioritizes a modern, user-friendly interface, fast execution, and a wide selection of brokers, cTrader is the clear winner. By carefully considering the points in this ninjatrader vs ctrader comparison, you can choose the platform that best aligns with your trading goals for 2025 and beyond.

Is NinjaTrader better than cTrader for algorithmic trading?

Both platforms are excellent for algorithmic trading. NinjaTrader’s Strategy Builder makes it more accessible for non-coders, while cTrader’s cAlgo is a powerful tool for C# developers.

Which platform has lower fees?

cTrader is generally the more cost-effective option, as it’s typically offered for free by brokers. NinjaTrader can be more expensive due to its licensing and data fees.

Can I use both platforms with the same broker?

It’s rare to find a broker that offers both NinjaTrader and cTrader. You’ll typically need to choose a broker that specializes in one platform or the other.

What’s the learning curve for each?

cTrader has a much gentler learning curve and is more suitable for beginners. NinjaTrader is more complex and requires more time to master.

Which platform is better for mobile trading?

cTrader has a superior mobile trading experience, with a full-featured and user-friendly app that is consistent with its desktop and web platforms.