Deciding between NinjaTrader vs MetaTrader 5 is a critical choice for any serious trader in 2025. While MT5 is a versatile giant favored by many a forex trading broker for its accessibility, NinjaTrader is a powerful specialist renowned for its advanced futures trading capabilities. This comprehensive comparison will dissect their charting tools, automation features, pricing models, and user experience to reveal which platform truly aligns with your trading style and goals, whether you’re a beginner or a seasoned professional navigating the markets.

Key Takeaways:

Here’s a quick summary of the essential points in the NinjaTrader vs MT5 debate:

- Primary Focus: MetaTrader 5 is the go-to platform for forex and CFD traders, offering wide broker integration and a user-friendly interface. NinjaTrader excels in the futures market, providing advanced analytical tools for serious day traders.

- User Profile: MT5 is generally better for beginners and those who want a straightforward, multi-asset platform. NinjaTrader is designed for advanced, discretionary traders who require deep customization and powerful charting.

- Automation: MT5 uses its proprietary MQL5 language and a massive marketplace of ready-made “Expert Advisors” (EAs). NinjaTrader employs the more versatile C#-based NinjaScript, appealing to developers who want to build complex, custom strategies from the ground up.

- Charting Tools: NinjaTrader holds a distinct advantage with superior charting capabilities, including advanced order flow tools, footprint charts, and market depth analysis that are not native to MT5.

- Cost Structure: MetaTrader 5 is typically offered for free by brokers. NinjaTrader provides a powerful free version for charting and simulation but requires a paid license or a funded account with its own brokerage for live trading.

Quick Comparison: NinjaTrader vs MetaTrader 5

To get a clear, at-a-glance overview, here is a side-by-side comparison table that summarizes the core differences in the metatrader 5 vs ninjatrader matchup. This will help you quickly identify which platform’s features align best with your priorities.

| Feature | NinjaTrader | MetaTrader 5 |

|---|---|---|

| Best For | Futures Traders, Advanced Chartists, Developers | Forex & CFD Traders, Beginners, Multi-Asset Traders |

| Supported Markets | Futures, Forex, Stocks, Options, CFDs | Forex, Stocks, Futures, Commodities, Indices, Crypto |

| Automation Language | NinjaScript (C#-based) | MQL5 |

| Charting Tools | Highly advanced, extensive customization, order flow | Comprehensive but more standard; 38 built-in indicators |

| Ease of Use | Steeper learning curve, complex interface | Beginner-friendly, intuitive layout |

| Broker Integration | Limited third-party brokers; best with own brokerage | Extensive support from over 1,200 brokers worldwide |

| Pricing | Free for charting/sim; License fee for live trading | Free through most brokers |

| Mobile App | Yes, with native functionality | Yes, robust and widely used |

| Community | Active but smaller and specialized | Massive global community and marketplace |

Platform Overview: Getting to Know the Contenders

Before diving deeper into the specifics of the ninjatrader vs metatrader 5 comparison, it’s important to understand the identity and history of each platform. They were built with different philosophies and target users in mind, which explains their unique strengths and weaknesses.

What is MetaTrader 5 (MT5)?

Developed by MetaQuotes in 2010, MetaTrader 5 is the successor to the legendary MT4 platform. It was designed as a multi-asset trading platform, expanding beyond forex to include stocks, futures, and commodities. MT5 is not a brokerage itself but rather a third-party platform that brokers license to offer to their clients. Its widespread adoption is due to its reliability, ease of use, and a vast ecosystem of automated trading robots (Expert Advisors) and indicators. For millions of traders, especially in the forex and CFD space, MT5 is the industry standard.

Read More: NinjaTrader vs MetaTrader 4

What is NinjaTrader?

Founded in 2003, NinjaTrader is a US-based company that offers a high-performance trading platform and, more recently, its own brokerage services. It has carved out a strong niche among active day traders, particularly in the futures market. The platform is renowned for its advanced charting, analytics, and strategy development capabilities. Unlike MT5’s “one-size-fits-all” approach, NinjaTrader is built for customization and precision, providing traders with the tools to analyze the market with incredible depth, such as through its order flow and volume profiling features. It’s a platform for traders who view trading as a craft that requires specialized tools.

Supported Markets & Asset Classes

A trading platform is only as good as the markets it allows you to access. The difference in market support is a fundamental aspect of the ninjatrader vs mt5 debate and often the first factor that helps a trader lean one way or the other.

MetaTrader 5: The Multi-Asset Powerhouse

MT5 was explicitly designed to be a multi-asset platform, giving traders access to a wide array of financial instruments from a single interface. Its primary strength remains in the forex and CFD markets, but its capabilities extend far beyond. Depending on the broker you choose, you can trade:

- Forex: Major, minor, and exotic currency pairs.

- Stocks: CFDs on stocks from major global exchanges.

- Indices: CFDs on major indices like the S&P 500, NASDAQ, and FTSE 100.

- Commodities: Gold, silver, oil, and other energies and soft commodities.

- Cryptocurrencies: CFDs on popular digital currencies like Bitcoin and Ethereum.

This versatility makes MT5 an excellent choice for traders who want to diversify their portfolios across different asset classes without needing multiple platforms.

NinjaTrader: The Futures Specialist

NinjaTrader is, first and foremost, a dominant force in the futures trading world. It provides direct access to major futures exchanges and is optimized for the speed and data requirements of futures traders. However, its reach isn’t limited to just futures. Through its own brokerage or connections to partner brokers like Interactive Brokers or Forex.com, you can also trade:

- Futures and Options on Futures: Its core offering.

- Forex: Through select forex brokers.

- Stocks: Requires connection to a supported stockbroker.

While NinjaTrader can handle multiple asset classes, it’s clear that its architecture and toolset are purpose-built for futures. Accessing other markets can feel less integrated compared to the seamless experience on MT5.

Read More: what is mt5

User Experience & Interface (UI/UX)

The look, feel, and intuitiveness of a platform can significantly impact your trading efficiency and stress levels. Here, the metatrader 5 vs ninjatrader comparison reveals two very different design philosophies, catering to different types of traders.

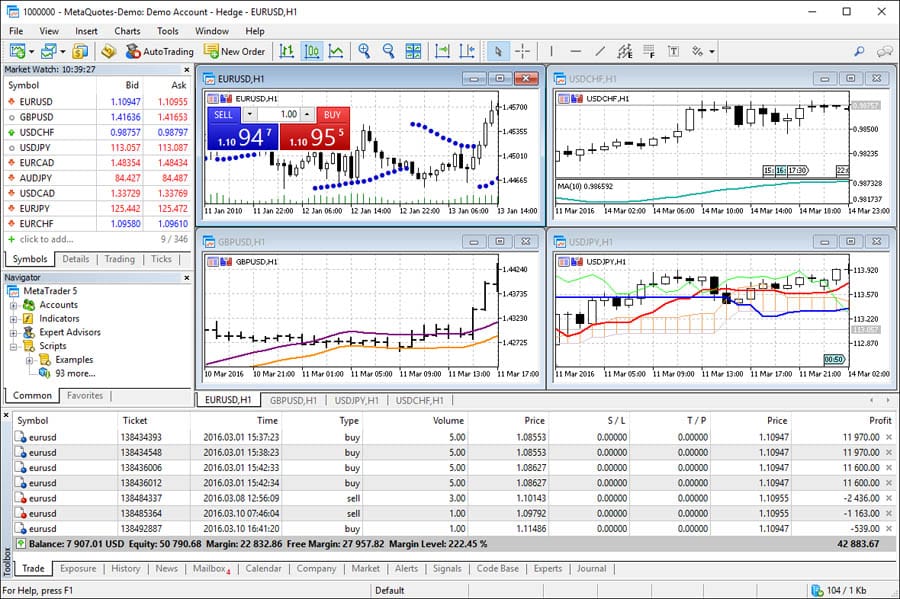

MT5: Simplicity and Familiarity

MetaTrader 5 boasts a clean, traditional interface that is widely considered beginner-friendly. The layout is logical, with the Market Watch window, Navigator, and Terminal neatly organized around the main charting area. Because so many brokers offer it, a vast number of tutorials and guides are available, making the learning process smoother. For a trader just starting, MT5 provides a gentle learning curve. However, this simplicity can be a drawback for advanced users who may find the customization options somewhat rigid and the overall aesthetic a bit dated.

NinjaTrader: Power and Customization

NinjaTrader presents a more complex and professional-grade interface. It operates on a “workspace” concept, allowing users to create highly customized layouts with multiple detached windows across several monitors. This level of flexibility is a dream for data-driven traders who want to monitor dozens of charts and analytics tools simultaneously. However, this power comes at the cost of a much steeper learning curve. New users can feel overwhelmed by the sheer number of settings and options available. From personal experience, it takes time to get comfortable with NinjaTrader’s workflow, but once mastered, it offers an unparalleled level of control.

Charting & Analytical Tools

For any technical trader, the charting package is the heart of the platform. This is where the ninjatrader vs metatrader 5 battle becomes particularly intense, as both platforms are powerful, but one clearly caters more to the analytical purist.

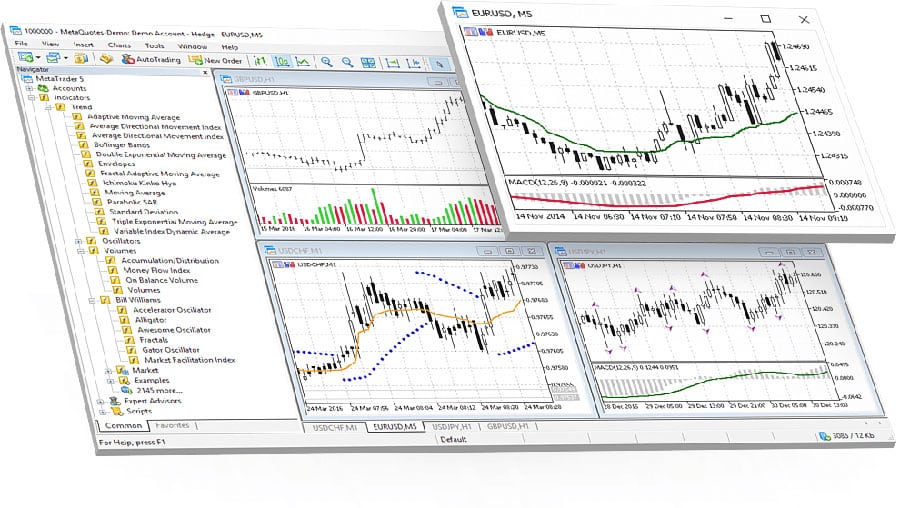

MetaTrader 5 Charting

MT5 offers a robust and capable charting package that satisfies the needs of most traders. It comes equipped with:

- 38 built-in technical indicators, including classics like Moving Averages, RSI, and MACD.

- 44 graphical objects, such as lines, channels, Fibonacci tools, and Elliott waves.

- 21 timeframes, ranging from one-minute to one-month, offering greater granularity than its predecessor, MT4.

Furthermore, the MQL5 marketplace provides access to thousands of free and paid custom indicators. While perfectly functional, the charting experience on MT5 can feel standard. It does the job well but doesn’t offer the cutting-edge analytical tools that some specialist traders demand.

Read More:What is NinjaTrader

NinjaTrader Charting

This is where NinjaTrader truly shines. It is widely regarded as having one of the most powerful charting packages available to retail traders. Key features include:

- Over 100 built-in indicators and hundreds more available through third-party developers.

- Advanced chart types like Footprint, Volume Profile, and Market Profile charts, which provide deep insights into order flow and price action.

- Superior drawing tools and customization, allowing traders to link charts, apply strategies directly from a chart, and visualize data in unique ways.

- The Market Replay function, which lets you download historical tick data and practice trading in a simulated environment as if it were live.

For traders who rely on in-depth analysis of order flow and market dynamics, the charting in the mt5 vs ninjatrader comparison is a clear win for NinjaTrader.

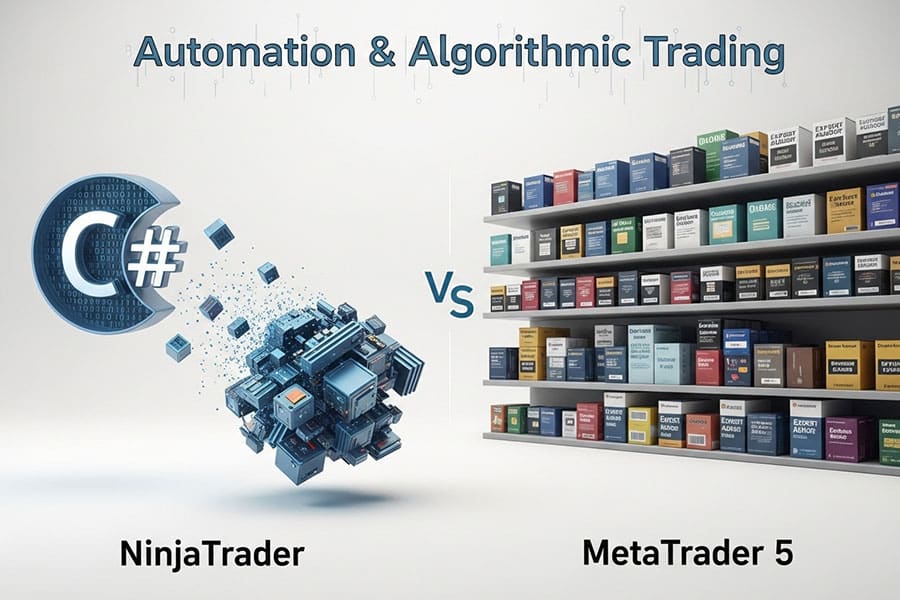

Automation & Algorithmic Trading

Automated trading allows you to execute strategies 24/7 without manual intervention. Both platforms offer powerful automation capabilities, but they approach it from different angles. This is a crucial factor in the ninjatrader vs mt5 decision for systematic traders.

MT5 and Expert Advisors (EAs)

MetaTrader 5’s automation is built around its proprietary MQL5 programming language. This language is used to create Expert Advisors (EAs), which are scripts that can analyze the market and execute trades automatically. The biggest advantage of MT5 is its massive, mature ecosystem. The MQL5 marketplace is the largest of its kind, offering thousands of pre-built EAs, indicators, and scripts for purchase or free download. For traders who don’t want to code, this provides instant access to a world of automation. The platform also includes a powerful Strategy Tester for backtesting EAs against historical data.

NinjaTrader and NinjaScript

NinjaTrader uses NinjaScript, a framework based on the popular and powerful C# programming language. This is a significant advantage for serious developers, as C# is a more modern and versatile language than MQL5. It allows for the creation of extremely complex and sophisticated trading strategies. Key features include:

- Strategy Analyzer: A comprehensive tool for backtesting, optimization, and performance analysis.

- Point-and-Click Strategy Builder: For non-programmers, this tool allows you to build basic automated strategies without writing a single line of code.

- Vibrant Developer Community: A large ecosystem of third-party vendors offers thousands of add-ons, indicators, and automated strategies.

While MT5 has a larger library of ready-made bots, NinjaTrader offers a more powerful and flexible environment for those who want to build their own custom solutions.

Order Types & Execution

The ability to place different types of orders with speed and reliability is fundamental to effective risk management and strategy execution. Both platforms provide the necessary tools, but NinjaTrader offers a more advanced suite for discretionary traders.

Standard and Advanced Orders

MetaTrader 5 supports all the essential order types you would expect: market, limit, stop, and stop-limit orders. It also includes trailing stops. Its one-click trading feature allows for rapid order execution directly from the chart. This is generally sufficient for most trading strategies.

NinjaTrader supports these standard orders as well but goes a step further with its Advanced Trade Management (ATM) feature. This powerful module allows traders to pre-define complex order entry and exit strategies. For instance, you can create a template that automatically places a profit target and a stop-loss order the moment you enter a trade. It also supports sophisticated orders like One-Cancels-Other (OCO), which is crucial for breakout strategies. This level of control gives discretionary traders a significant edge in managing their trades dynamically.

Broker Integration & Accessibility

Your choice of platform can be heavily influenced by which brokers support it. Here, the metatrader 5 vs ninjatrader landscape is vastly different, reflecting their different business models.

MetaTrader 5: Universal Access

MT5’s greatest strength is its near-universal support among forex and CFD brokers. With over 1,200 brokers offering the platform, traders have an enormous amount of choice. You can easily switch brokers without having to learn a new platform. MT5 is available as a desktop application for Windows, a web-based platform accessible from any browser, and a highly-rated mobile app for both iOS and Android, ensuring you can manage your trades from anywhere.

NinjaTrader: A More Focused Ecosystem

NinjaTrader offers its own brokerage services, which provide the most seamless and cost-effective way to use the platform for live futures trading. While it does support a selection of third-party brokers (like Interactive Brokers, TD Ameritrade, and Forex.com), the list is much smaller than MT5’s. Connecting to an external broker may also require an additional fee. NinjaTrader also offers a desktop platform (Windows-native, but can run on Mac/Linux with workarounds) and a fully functional mobile app, giving traders flexibility in how they access the markets.

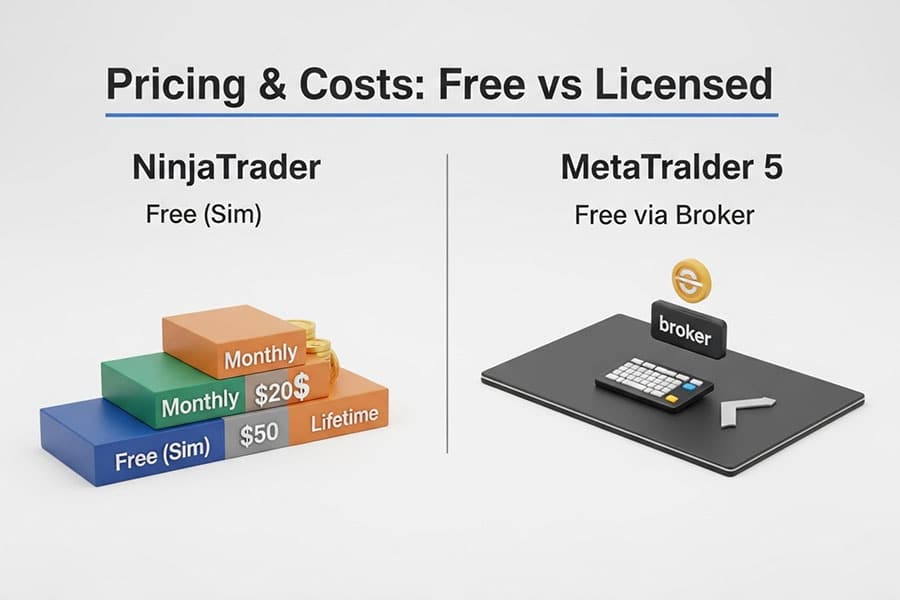

Pricing & Costs: Free vs. Licensed

Understanding the cost structure is vital. The ongoing debate of ninjatrader vs metatrader 5 often boils down to whether you prefer a “free” platform with embedded costs or a licensed model with transparent fees.

The MT5 Model: Free via Your Broker

MetaTrader 5 is almost always free for the end-user. The broker pays the licensing fee to MetaQuotes, and you, the trader, get to use the platform at no direct cost. The broker makes its money from the spreads and commissions on your trades. While the platform is free, many of the high-quality EAs and custom indicators in the marketplace come at a price.

The NinjaTrader Model: License Tiers

NinjaTrader’s pricing is more complex. It offers several options:

- Free Plan: You can use the full platform for free for advanced charting, strategy backtesting, and trade simulation. This is an excellent way to learn.

- Monthly Plan: For a monthly fee (around $99), you can lease a license for live trading with advanced features.

- Lifetime License: For a one-time payment (currently $1,499), you own the platform license outright. This is the most popular option for serious traders as it unlocks the lowest commission rates through NinjaTrader Brokerage.

- Funded Account: If you use NinjaTrader’s own brokerage and fund an account, you can get the platform for free for live trading.

This model gives traders choices but requires an upfront investment for the best features and pricing.

Community, Support & Resources

A strong community and reliable support can be invaluable, especially when you’re learning a new platform or troubleshooting a complex strategy. Both platforms have active communities, but their scale and focus differ.

MT5, being the industry standard for so long, boasts a massive global community. There are countless forums, websites, and YouTube channels dedicated to it. The official MQL5.community website is a treasure trove of articles, documentation, and a forum where you can interact with millions of other users and developers.

NinjaTrader has a smaller but incredibly active and helpful user community. The official NinjaTrader Support Forum is an excellent resource for getting answers from both experienced users and the company’s support staff. The community is highly focused on platform development and strategy sharing, particularly related to futures trading. You’ll find a wealth of third-party vendors and developers creating innovative add-ons.

Security & Regulation

When it comes to the security of your funds and data, it’s important to understand the role of the platform versus the broker. Both NinjaTrader and MetaTrader 5 are technology providers, not financial institutions that hold your money. Security and regulation are primarily the responsibility of the brokerage firm you choose.

Both platforms use robust encryption to protect the data transmitted between your computer and the broker’s servers. Your funds are held by your broker, so it is crucial to select a well-regulated firm. For example, if you use NinjaTrader Brokerage, it is regulated in the U.S. by the National Futures Association (NFA) and the Commodity Futures Trading Commission (CFTC). If you use MT5, you must ensure the broker you select is regulated by a top-tier authority like the FCA (UK), ASIC (Australia), or CySEC (Cyprus).

Pros & Cons: Experience-Based Insights

After using both platforms extensively, certain strengths and weaknesses become very clear. Here is a summary of the pros and cons from a real trader’s perspective in the ongoing mt5 vs ninjatrader analysis.

NinjaTrader

- Pros: Unmatched charting and analytical tools, especially for order flow. Powerful and flexible C#-based automation. Highly customizable interface. Strong focus on the futures market.

- Cons: Steep learning curve for beginners. Limited choice of third-party brokers. The licensing fee for live trading can be a barrier for some.

MetaTrader 5

- Pros: Extremely easy to use and beginner-friendly. Massive broker support gives you endless choice. Huge marketplace for automated bots and indicators. Completely free to use.

- Cons: Charting is less advanced than NinjaTrader’s. MQL5 language is less versatile than C#. Customization options are more limited.

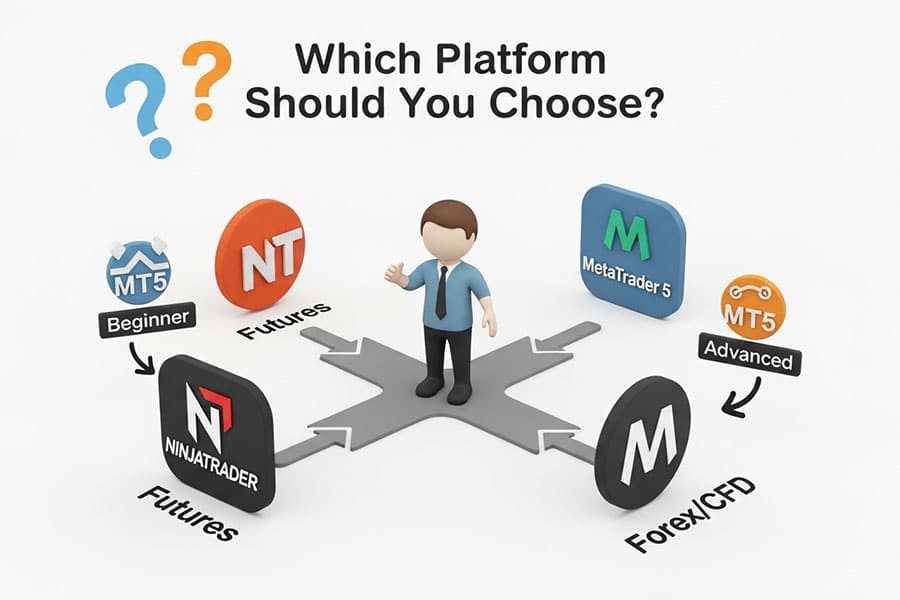

Which Platform Should You Choose?

Ultimately, the best choice in the NinjaTrader vs MetaTrader 5 debate depends entirely on you. Your preferred market, trading style, and technical expertise will guide your decision.

Best for Forex Traders

MetaTrader 5 is the clear winner for the majority of forex and CFD traders. Its vast broker network, ease of use, and massive library of forex-specific tools and EAs make it the logical choice.

Best for Futures Traders

NinjaTrader is purpose-built for futures trading. Its superior charting, order flow analysis, and advanced trade management tools give futures traders a distinct advantage.

Best for Beginners

MetaTrader 5 is more suitable for beginners due to its simpler interface, gentle learning curve, and the wealth of free educational resources available.

Best for Advanced Traders & Developers

NinjaTrader is the preferred platform for advanced discretionary traders who need deep analytical tools and developers who want the power of C# to build custom strategies.

Trade with Opofinance

Elevate your trading experience with an ASIC-regulated broker like Opofinance. Gain access to a suite of powerful tools and platforms to suit your strategy.

- Advanced Trading Platforms: Choose from MT4, MT5, cTrader, and the proprietary OpoTrade platform.

- Innovative AI Tools: Leverage the AI Market Analyzer, AI Coach, and 24/7 AI Support for smarter trading decisions.

- Social & Prop Trading: Join a community of traders and explore proprietary trading opportunities.

- Secure & Flexible Transactions: Enjoy safe and convenient deposits and withdrawals, including crypto payments with zero fees.

Discover a better way to trade. Get started with Opofinance today.

Conclusion: Final Thoughts

The ninjatrader vs metatrader 5 decision is not about which platform is objectively “better,” but which is better for you. MetaTrader 5 offers unparalleled accessibility and a gentle entry into the world of multi-asset and automated trading, making it a fantastic choice for beginners and forex specialists. NinjaTrader is a professional-grade toolkit for the serious futures trader, offering depth, power, and customization that advanced users will appreciate. By evaluating your own needs against the strengths of each platform, you can make an informed choice for your trading journey.

Is NinjaTrader really free to use?

Yes, NinjaTrader is free for advanced charting, strategy backtesting, and simulated trading. However, to execute live trades, you must either purchase a license (monthly or lifetime) or open and fund a brokerage account with NinjaTrader Brokerage.

Can I trade stocks on both NinjaTrader and MT5?

Yes, but in different ways. MT5 allows you to trade stock CFDs through many brokers. NinjaTrader can be connected to stockbrokers like Interactive Brokers or TD Ameritrade to trade actual stocks, but its primary focus remains on futures.

Which platform is better for building my own robot?

It depends on your coding skill. If you are a developer comfortable with C#, NinjaTrader offers a more powerful and flexible environment with NinjaScript. If you prefer a simpler, proprietary language with a massive existing code base and community support, MT5’s MQL5 is an excellent choice.

Is the learning curve for NinjaTrader very difficult?

NinjaTrader has a steeper learning curve than MT5, especially for those new to trading. Its interface is more complex and offers more professional-grade features. However, there are many educational resources available, and the free simulation mode allows you to learn without risking capital.

Does MT5 support order flow trading?

Not natively. While MT5 is a powerful platform, it does not include built-in order flow, volume profile, or footprint charts. These advanced analytical tools are a key advantage of the NinjaTrader platform. Some third-party plugins may add similar functionality to MT5, but often for an extra cost.