In the world of economics and investment, brokers play a crucial role in connecting investors with financial markets. These entities act as intermediaries between investors and financial markets, providing facilities for individuals to engage in various types of investments. One significant aspect of a forex broker‘s activities is managing and executing financial operations related to investors’ accounts, including deposits and withdrawals. Deposits and withdrawals from investment accounts at brokers are considered vital and essential processes. These operations require careful attention because they directly impact investment performance and success in financial markets. Therefore, today we are here to provide you with a tutorial on OpoFinance deposit and withdrawal.

Brokers often offer various methods for depositing funds into investors’ accounts. These methods can include transferring funds from bank accounts, using credit cards, checks, and even online payment systems. The speed and process of depositing funds usually depend on the settings and policies of each broker and the details of the investment account.

Withdrawing funds from an account is also a crucial and sensitive process, similar to deposits. Investors typically face limitations and regulations that they must adhere to when withdrawing funds. For example, there may be regulations regarding time constraints or withdrawal limits.

Depositing and withdrawing funds from investment accounts at brokers are fundamental and vital operations in investment activities. To achieve success in financial markets, it is essential for investors to be familiar with the process of these operations and comply with the relevant regulations. Brokers also have the responsibility to provide necessary information and guidance to investors to ensure that these operations are carried out correctly and securely.

Step-by-Step Guide to OpoFinance Deposit and Withdrawal

In today’s fast-paced world, investment opportunities in financial markets have become a fundamental aspect. However, one of the most critical factors for capitalizing on these opportunities is mastering financial processes. OpoFinance, as a broker providing investment services in financial markets, pays special attention to the processes of depositing and withdrawing funds. Below, you will become familiar with the steps of OpoFinance deposit and withdrawal.

Instructions for Making a Deposit in OpoFinance

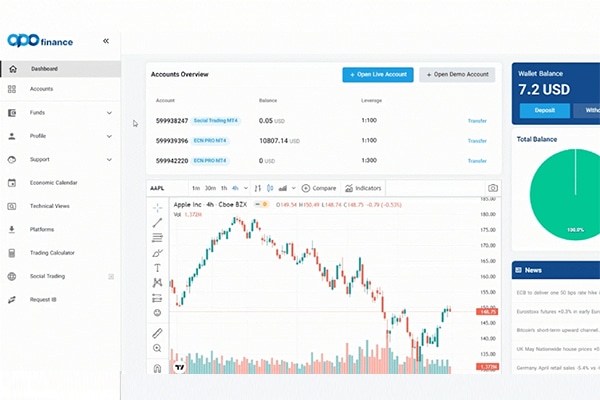

To deposit money into your trading accounts, first log in to your user account. After entering your account, you will be presented with the following page.

The first part is the Wallet section, which is essentially your main wallet in OpoFinance brokerage. For example, the balance in this account’s wallet is $7.20.

The first step after registering and verifying your identity with OpoFinance broker is to deposit your capital. To initiate the deposit process, go to the Funds section and click on the Deposit Funds option.

In this section, various deposit methods are presented to you. You can fund your user account through digital currencies, Perfect Money, and various other methods. Investors residing in Iran often use Tether (USDT) due to restrictions on access to MasterCard and other accounts. Choose your preferred method for transferring funds and click on Continue. For example, we selected cryptocurrency.

In the next step, select the desired amount and currency. Our chosen cryptocurrency is Tether (USDT), so we selected the option USDT-TRC20. After selecting the amount and cryptocurrency, click on Continue.

Finally, the details of this transfer will be displayed to you. Once again, click on Continue.

In this stage, the wallet address for Tether on the TRON network will be displayed to you. Through this wallet, you can deposit your funds. If you intend to transfer funds from other exchanges such as Nobiitex, or if your funds are already in your wallet, use this QR code to deposit the desired amount. The specified amount will be automatically transferred to your account.

Once your capital is credited to your OpoFinance user account, the desired amount will be displayed in the Wallet section. To start trading in financial markets, you need to transfer the desired amount from your wallet to various trading accounts.

For this purpose, you can use the Transfer Funds section. For example, if you plan to engage in social trading, you need to transfer your capital from the Wallet to Social Trading. To do this, select Wallet in the Transfer From section and Social Trading MT4 in the Transfer To section.

In essence, to engage in any of the markets provided by OpoFinance, you must first transfer your capital to your wallet in the broker and then deposit it into the trading account you intend to trade in.

Read More: Understanding Copy Trading on Opofinance

Withdrawal Guide in OpoFinance

Now that you are familiar with the deposit process in OpoFinance, it’s advisable to understand the withdrawal method from this broker. To withdraw funds from OpoFinance, you need to first register your account with the broker and wait for it to be approved. Follow these steps for this purpose:

- Click on “Payment Details” and then on “Upload Payment Details.”

- Depending on your account, enter the required details such as type and address.

- Once your account status changes to “approved,” you can proceed with the withdrawal.

OpoFinance provides various trading accounts and markets, and therefore, for withdrawals, you initially need to transfer your funds from different trading accounts (such as MetaTrader and Social Trading) to your wallet.

To do this, use the “Transfer Funds” section to transfer the desired amounts to your wallet. In the “Transfer From” section, select the source account, and in the “Transfer To” section, choose the destination account, which, in this case, is the wallet.

After transferring the desired funds to your wallet, select “Withdrawal Funds” from the Withdrawal section. In the “Initial Information” section, your wallet details are displayed. Click on Continue.

In the “Select Payment” section, choose your preferred withdrawal method; for example, we are selecting cryptocurrency.

In the “Transfer Details” section, in the Withdrawal Amount field, enter the desired amount and click on Continue. After completing this step, a PIN code will be sent to your email.

In the “Confirmation” section, enter the PIN code sent to your email and click on the Continue option.

In the “Transactions History” section, details of deposits and withdrawals in your account are displayed, allowing you to view the transaction history of your account.

Limitations and Conditions of Deposit and Withdrawal in OpoFinance

In OpoFinance broker, policies related to the minimum deposit and withdrawal amounts are established to manage financial transactions and facilitate investors. These policies are designed to provide suitable financial opportunities for investors.

Forex trading low minimum deposit in OpoFinance:

The minimum deposit amount is $15. However, to activate a trading account, investors need to deposit a minimum of $100 for any brokers with low minimum deposit,. This amount is set as the minimum requirement to enter the world of investment, providing investors with the opportunity to engage in various activities in financial markets.

Minimum Withdrawal Amount in OpoFinance:

A minimum withdrawal of $50 means that after conducting transactions and earning profits in the investment account, investors can withdraw a minimum amount of $50 from their accounts. This option allows investors to consistently utilize their profits and make withdrawals from their accounts for better financial management.

These policies related to the minimum deposit and withdrawal amounts reflect OpoFinance’s focus on facilitating entry into financial markets and withdrawing profits from investors’ activities. These policies aim to create a suitable environment for investment.

Read More: Futures Trading in Forex

Withdrawal and Deposit Times:

In OpoFinance broker, withdrawal and deposit policies are configured to allow investors to perform transactions quickly and efficiently.

- Instant Deposits: Instant deposit means that when an investor deposits their desired amount, the deposited amount is immediately credited to their account in OpoFinance broker. This feature provides investors with the assurance that they can quickly engage in financial market activities after completing a transaction.

- Withdrawal within 24 Hours: Withdrawal of funds takes up to 24 hours, meaning that after requesting a withdrawal from the investor’s account, it may take up to 24 hours for the funds to be transferred to the investor’s bank account or payment service. One reason for this is a thorough examination for the security of the trader’s account.

These policies indicate OpoFinance’s efforts to provide fast and reliable services to investors. The emphasis on transaction speed and convenience reflects the broker’s concern for a positive experience for investors on this platform. With these features, investors can confidently manage their accounts and conduct transactions in financial markets, benefiting from the capabilities of OpoFinance broker.

Various Deposit and Withdrawal Methods in OpoFinance:

As a representative in financial markets, OpoFinance provides a variety of deposit and withdrawal methods for its investors to facilitate the investment process and account management seamlessly. Below is an overview of the different deposit and withdrawal methods in OpoFinance:

- Digital Currencies: OpoFinance offers the possibility of depositing and withdrawing digital currencies such as Bitcoin, Ethereum, and other popular currencies. This method is suitable for those interested in trading with digital currencies.

- UnionPay: UnionPay is an international payment network that enables deposit and withdrawal using Visa and MasterCard credit cards.

- Advcash: Advcash is an online payment platform that allows investors to deposit and withdraw funds from their accounts.

- Visa/Master Cards: OpoFinance facilitates the deposit and withdrawal of funds through Visa and MasterCard credit cards, a widely used and popular method.

- Perfect Money: Perfect Money is an electronic payment system that provides the option to deposit and withdraw funds.

- TopChange: TopChange is a digital currency exchange service that allows investors to convert digital currencies to each other.

- Local Bank Transfer: OpoFinance enables fund transfer through local banks, allowing investors to directly deposit and withdraw from their bank accounts.

- Wire Transfer (Electronic Transfer): Depositing funds through wire transfer is a secure and stable method for directly transferring funds from a bank account to the investor’s account in OpoFinance.

- Fasapay: Fasapay is an online electronic payment service that allows investors to quickly and securely deposit and withdraw funds.

In this guide, you have become familiar with the deposit and withdrawal processes in OpoFinance. The broker aims to simplify processes for investors by offering various deposit and withdrawal methods, allowing them to engage in financial markets with ease and confidence.

Common questions related to deposit and withdrawal methods in OpoFinance include:

- Can I transfer money from one trading account to another?

Yes! You can have internal transfers in your trading accounts. For example, you can transfer your funds from MetaTrader to Social Trading.

- Can I use a credit card for deposit and withdrawal?

Yes! The option to use credit cards for deposit and withdrawal of funds is available.

- Are there any fees for deposit and withdrawal?

Costs may vary depending on the payment method and the amount of transactions.

- Does OpoFinance support the deposit and withdrawal of digital currencies?

Yes! Broker Apofinance provides the possibility to deposit and withdraw popular digital currencies such as Bitcoin and Ethereum

- Is identity verification required for withdrawals?

Yes! In order to protect financial security and prevent fraud, identity verification is required.

One Response

Am new here