Tired of guessing in the forex market? Do you feel like you’re always one step behind, reacting to price changes instead of predicting them? Imagine having a ‘secret weapon’ that allows you to see beneath the surface of price charts, revealing the hidden forces that truly drive market movements. This ‘weapon’ isn’t a complicated indicator or a magical algorithm; it’s understanding order flow in forex trading.

Yes, mastering what is order flow in forex can be the game-changer you’ve been searching for. This in-depth guide will equip you with the knowledge to decipher order flow, transform your trading from reactive to proactive, and ultimately, trade smarter, not harder. If you’re looking for a reliable partner in your trading journey, choosing a reputable forex broker is paramount. A trustworthy forex trading broker not only provides market access but also the essential tools to interpret market dynamics like order flow effectively.

Unveiling Forex Order flow: Beyond Price Action

Think of the forex market as a colossal auction, operating 24/7 across the globe. Every tick, every pip movement, is the result of countless buy and sell orders colliding. This constant interaction, this dynamic exchange of intent, is order flow. It’s the real-time pulse of the market, reflecting the aggregate decisions of everyone from multinational corporations and hedge funds to banks and individual traders. Unlike traditional technical analysis, which often lags behind price, order flow provides a leading perspective. It allows you to glimpse the ‘intent’ behind price movements, offering clues about potential direction before those movements fully materialize.

Consider this: Price action alone is like observing the wake of a ship. It tells you where the ship has been, but not necessarily where it’s going. Order flow, however, is like understanding the ship’s engine room – you see the power driving the vessel, giving you a better sense of its future course. According to a study by the Bank for International Settlements (BIS), the average daily turnover in the global foreign exchange market reached $7.5 trillion in 2022. This staggering figure underscores the sheer volume of orders constantly flowing through the market, shaping price dynamics. For traders seeking a genuine edge, understanding and interpreting this immense order flow is not merely advantageous – it’s indispensable.

Order flow in Action: Uptrends and Downtrends Decoded

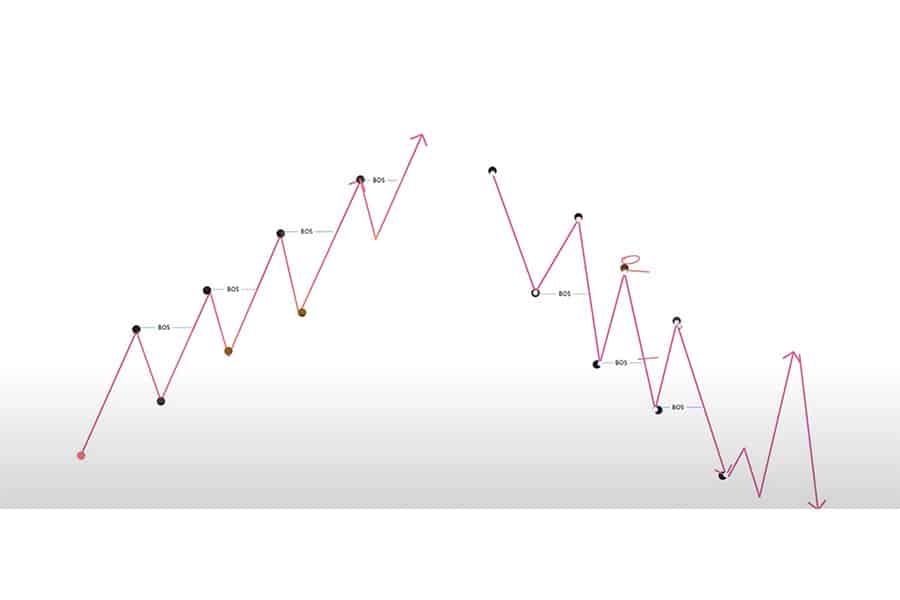

The language of order flow varies depending on whether the market is trending upwards or downwards. Recognizing these distinct dialects is key to fluent interpretation.

Bullish Order flow: Riding the Rising Tide

In an uptrend, the market carves out a staircase of higher highs and higher lows. This is the visual signature of bullish order flow, where buyers are consistently more aggressive than sellers, driving prices upwards. Let’s dissect how to identify this bullish order flow:

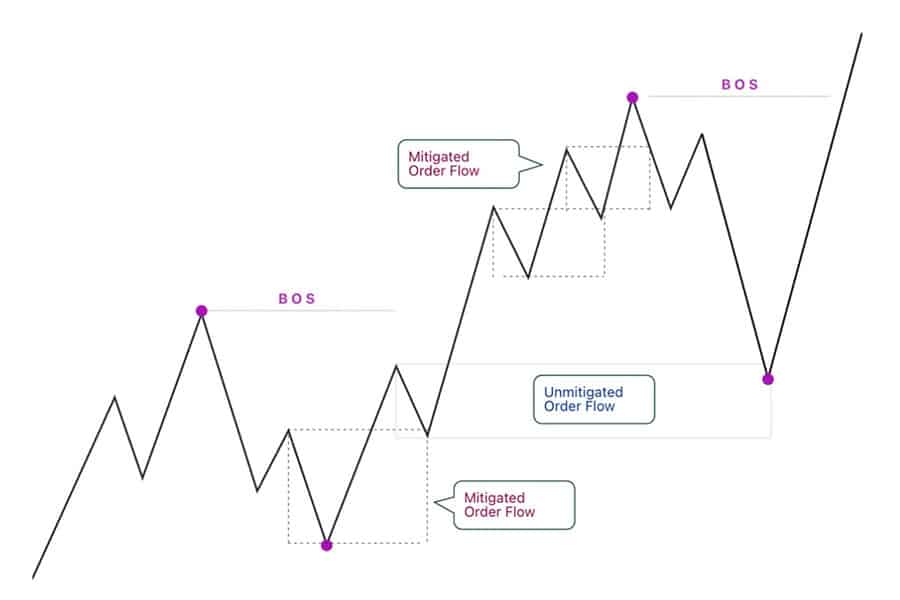

- Spot the Break of Structure (BOS): An uptrend gains confirmation when price decisively breaks above a previous significant high. This breakout is a powerful signal of continued bullish momentum. Imagine a dam breaking – the pent-up buying pressure surges through, pushing prices to new heights.

- Mark the Bullish Order flow Zone (The Pullback): Following a BOS, identify the most recent pullback – the temporary dip or consolidation that occurred before the price surged upwards to break the structure. This pullback zone is your bullish order flow area. It represents a region where buyers stepped in previously and are likely to do so again. Think of it as marking the ‘launchpad’ from which the price previously ascended.

- Anticipate Order flow Mitigation for Long Entries: Price often retraces back to this marked order flow zone. This isn’t random noise; it’s the market ‘mitigating’ or ‘filling’ unfilled buy orders within that zone before the next leg up. This retracement offers astute traders prime entry points for long (buy) positions, allowing them to join the established uptrend at a strategic level. Statistically, uptrends tend to persist, making these pullbacks high-probability entry zones.

Let’s visualize this: Envision a rocket launching into space. The initial powerful thrust (BOS) propels it upwards. Then, there might be brief periods of stabilization or minor descent (pullback – the order flow zone) before the next powerful engine burn reignites the ascent. By identifying these stabilization phases (pullbacks), you can strategically board the rocket at an optimal moment, riding the powerful upward trajectory.

Read More: The Smart Money Concept

Bearish Order flow: Navigating the Downward Current

Conversely, a downtrend paints a picture of lower highs and lower lows. This is the hallmark of bearish order flow, where sellers are in control, overpowering buyers and forcing prices downwards. Identifying bearish order flow mirrors the uptrend process, but in reverse:

- Identify the Bearish Break of Structure (BOS): A downtrend strengthens its grip when price convincingly breaks below a prior significant low. This breakdown confirms the continuation of bearish momentum. Picture a landslide – the relentless selling pressure overwhelms support, cascading prices downwards.

- Mark the Bearish Order flow Zone (The Pullback): After a bearish BOS, pinpoint the most recent pullback – the temporary rally or consolidation that preceded the price decline that broke the structure. This upward wiggle is your bearish order flow zone. It signifies an area where sellers previously dominated and are poised to do so again. Think of it as marking the ‘cliff edge’ from which price previously plunged.

- Anticipate Order flow Mitigation for Short Entries: Price often rallies back to this bearish order flow zone to mitigate existing sell orders before resuming its downward spiral. These rallies become strategic entry points for short (sell) positions, enabling traders to align with the prevailing downtrend at advantageous levels. Downtrends, like uptrends, exhibit persistence, making these pullbacks high-potential shorting opportunities.

Imagine a waterfall cascading down a cliff. Each major plunge (lower low) might be preceded by a brief upward surge of water (pullback – the order flow zone) before gravity reasserts its dominance, pulling the water downwards again. By recognizing these upward surges (pullbacks), you can strategically position yourself to ‘ride the waterfall’ downwards, capitalizing on the powerful bearish momentum.

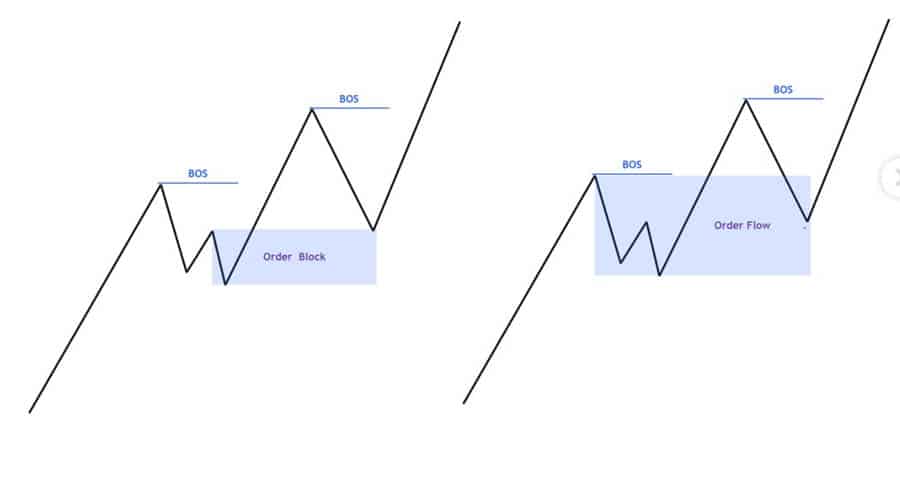

Refining Precision: Order Blocks and Points of Interest (POIs) within Order flow

While order flow zones provide a valuable roadmap, pinpointing specific order blocks and Points of Interest (POIs) within these zones is akin to using a GPS for ultra-precise navigation. Order blocks are highly concentrated areas within the order flow pullback where large institutional orders are likely clustered. POIs are broader, more general zones within the order flow pullback where price is statistically more likely to react. These zones often represent imbalances between supply and demand, areas where big players are likely to have entered or are waiting to enter the market.

In a bullish order flow pullback, demand zones and bullish order blocks become your high-probability POIs. Conversely, in a bearish order flow pullback, supply zones and bearish order blocks take center stage. By focusing on these refined zones within the larger order flow context, you dramatically increase the accuracy and risk-reward profile of your trades. It’s like zooming in on a map to find the exact street address instead of just knowing the general neighborhood.

Identifying POIs and order blocks within order flow zones involves a combination of art and science. Advanced techniques include analyzing candlestick patterns within the zone for rejection signals, observing volume spikes that confirm institutional activity, and drilling down to lower timeframes to identify precise structural refinements and high-probability entry triggers. Mastering these techniques, in conjunction with robust order flow analysis, empowers you to pinpoint high-conviction trading setups with remarkable accuracy.

Read More: Unlock the Power of Institutional Order Flow

Pro Tips: Elevating Your Order flow Expertise

For traders striving for mastery in order flow analysis, consider these advanced techniques to further refine your edge:

- Layer Timeframes for Order flow Harmony: Conduct multi-timeframe analysis to gain a holistic view of order flow. Start by identifying major order flow trends on higher timeframes (daily, 4-hour). Then, drill down to lower timeframes (1-hour, 15-minute) to pinpoint precise entry triggers within those higher timeframe order flow zones. This top-down approach ensures you’re trading in alignment with the dominant order flow direction while optimizing your entry timing. For instance, you might identify a bullish order flow zone on the 4-hour chart and then look for bullish candlestick patterns or order block formations on the 15-minute chart within that zone to trigger your long entry.

- Harness the Power of Volume Confirmation: Integrate volume analysis as a crucial confirmation tool for your order flow setups. Look for volume spikes that coincide with price reactions within your identified order flow zones. Increased volume during a pullback into a bullish order flow zone, followed by a surge in volume on the subsequent breakout, provides strong confirmation of genuine buying interest and strengthens the validity of your long entry. Conversely, high volume on rallies into bearish order flow zones, followed by increased volume on the breakdown, reinforces the bearish scenario for short trades. Volume acts as a ‘lie detector’ for order flow, helping you distinguish between genuine institutional activity and potential false signals.

- Master Order flow-Based Risk Management: Order flow analysis provides inherent advantages for risk management. By placing your stop-loss orders just beyond the boundaries of identified order flow zones or order blocks, you can define relatively tight risk parameters. For example, in a long trade triggered from a bullish order flow zone, placing your stop-loss just below the low of that zone logically limits your potential loss if the order flow interpretation proves incorrect. Furthermore, order flow analysis can help you identify high-probability profit targets. Projecting price movements based on the strength and momentum of order flow allows for more informed profit-taking decisions, optimizing your risk-reward ratios.

- Adapt Order flow Strategies to Market Volatility: Market volatility significantly impacts order flow dynamics. In periods of low volatility and range-bound conditions, order flow zones may act more as areas of consolidation or potential reversals. Conversely, in highly volatile, trending markets, order flow zones often become powerful continuation patterns. Adapt your order flow trading strategies to the prevailing market volatility. In low volatility, focus on smaller, quicker trades within order flow ranges. In high volatility, trending markets, capitalize on larger, momentum-driven moves originating from order flow zones. Understanding and adapting to market volatility is crucial for consistent profitability with order flow trading.

Opofinance: Your Gateway to Advanced Forex Trading Tools

To truly capitalize on the sophisticated world of order flow in forex trading, partnering with the right broker for forex trading is not just beneficial – it’s essential. Opofinance, a leading and regulated forex broker (ASIC regulated), offers a comprehensive suite of services and cutting-edge tools specifically designed to empower traders who demand precision and insight.

- Advanced Trading Platforms for Order flow Analysis: Execute your order flow strategies with unparalleled precision on a range of powerful platforms:

- MT4 and MT5: Industry-standard platforms renowned for their robust charting capabilities, technical indicators, and Expert Advisors (EAs) for automated trading.

- cTrader: A platform favored by experienced traders for its depth of market analysis, Level II pricing, and advanced order types, providing granular insights into order flow.

- OpoTrade: Opofinance’s proprietary platform, designed for intuitive navigation and seamless execution, offering a user-friendly environment for order flow-focused trading.

- Innovative AI-Powered Trading Tools: Gain a significant analytical edge with Opofinance’s suite of AI-driven tools, designed to augment your order flow analysis:

- AI Market Analyzer: Leverage artificial intelligence to scan the market for potential order flow setups, identify emerging trends, and filter trading opportunities based on your specific criteria.

- AI Coach: Receive personalized, AI-powered guidance and insights to refine your order flow trading skills, optimize your strategies, and improve your decision-making process.

- AI Support: Access 24/7 AI-powered support to answer your questions about order flow concepts, platform functionalities, and trading strategies, ensuring you have constant assistance on your trading journey.

- Social & Prop Trading Opportunities:

- Social Trading: Connect with a community of order flow traders, share insights, learn from experienced professionals, and potentially copy successful trading strategies to accelerate your learning curve.

- Prop Trading: Explore opportunities to trade with Opofinance’s capital, demonstrating your order flow trading skills and gaining access to larger trading accounts and profit-sharing arrangements.

- Secure and Flexible Transactions: Enjoy seamless and secure financial transactions with Opofinance:

- Safe and Convenient Deposits & Withdrawals: Choose from a variety of secure and convenient deposit and withdrawal methods, including traditional options and cutting-edge crypto payments, ensuring hassle-free fund management.

- Zero Fees on Deposits & Withdrawals: Maximize your trading capital with zero deposit and withdrawal fees from Opofinance, allowing you to focus on your order flow trading performance without unnecessary cost burdens.

Read More: Identify Order Blocks in Forex

Ready to experience the Opofinance advantage and unlock the full potential of order flow trading? Click here to explore Opofinance and elevate your forex trading journey today!

Conclusion: The Order flow Advantage in Forex Trading

Mastering order flow in forex trading represents a paradigm shift for traders. It moves you from passively reacting to price charts to actively interpreting the market’s underlying intentions. By diligently learning to identify order flow zones, anticipating mitigation patterns, and refining your entries with order blocks and POIs, you gain a significant and sustainable trading advantage. The journey to order flow mastery demands commitment, practice, and continuous learning.

However, the rewards – a deeper understanding of market dynamics, enhanced trade timing precision, and ultimately, improved profitability – are substantial and transformative. Embrace the power of order flow, and you’ll not only trade smarter, but you’ll also trade with greater confidence and control in the dynamic and ever-evolving forex market. Remember to select a regulated forex broker, like Opofinance, to support your advanced trading endeavors.

Key Takeaways:

- Order flow is the driving force behind price movements, representing the continuous stream of buy and sell orders.

- Identifying order flow involves recognizing pullbacks after breaks of structure in both uptrends and downtrends.

- Order blocks and Points of Interest (POIs) pinpoint high-probability zones within order flow pullbacks for refined entries.

- Volume confirmation, multi-timeframe analysis, and adapting to market volatility are advanced techniques for order flow trading.

- Consistent practice, combined with the right broker for forex trading like Opofinance, are crucial for order flow mastery and forex trading success.

Does Order flow Analysis Work for All Forex Currency Pairs?

Yes, the principles of order flow analysis are universally applicable across all forex currency pairs. Whether you’re trading major pairs like EUR/USD or GBP/JPY, or exotic pairs, the fundamental dynamics of buy and sell orders driving price movements remain consistent. However, the liquidity of a currency pair can influence how clearly order flow patterns manifest. Major pairs, with their higher liquidity and tighter spreads, often exhibit cleaner and more readily identifiable order flow structures compared to less liquid exotic pairs. According to data from the BIS, major currency pairs like EUR/USD, USD/JPY, GBP/USD, and AUD/USD consistently account for the largest share of global forex trading volume, indicating robust order flow activity in these pairs.

How Does News and Fundamental Events Impact Order flow?

News releases and fundamental economic events are significant catalysts that can dramatically impact order flow. Major news announcements, such as interest rate decisions, GDP releases, or employment reports, can trigger massive surges in trading volume and alter the prevailing order flow almost instantaneously. For example, a surprise interest rate hike by a central bank can lead to a sudden influx of buy orders for that currency, creating a powerful bullish order flow. Conversely, negative economic data can spark a wave of sell orders, generating bearish order flow. Traders utilizing order flow analysis must always be mindful of the economic calendar and be prepared for potential order flow shifts around major news events. Trading during high-impact news requires heightened awareness and potentially adjusted risk management strategies to account for increased volatility and rapid order flow changes.

Can Order flow Analysis Be Automated with Trading Software?

While the core concepts of order flow analysis involve visual interpretation of price charts, there are indeed software tools and platforms designed to assist traders in automating certain aspects of order flow analysis. These tools often incorporate features like volume profile indicators, order book visualization, and heatmap displays to provide a more granular view of order flow dynamics. However, it’s crucial to understand that no software can fully automate the nuanced interpretation of order flow. Human judgment, experience, and contextual understanding remain essential components of effective order flow trading. Software tools can be valuable aids in order flow analysis, but they should not replace the trader’s own analytical skills and discretionary decision-making. The best approach often involves a hybrid model – leveraging software to highlight potential order flow zones while applying human analysis to validate and refine trading decisions.