In the fast-paced world of forex trading, understanding the concept of currency pair correlation is essential for optimizing profits and managing risks effectively. This article explores the intriguing topic of forex pairs with the least correlation, providing valuable insights for both beginner and seasoned traders. By choosing the right forex broker and focusing on minimally correlated currency pairs, traders can diversify their portfolios and improve their overall trading strategies.

Forex pairs with least correlation refer to currency pairs that move independently of each other, showing little to no relationship in their price movements. These least correlated forex pairs offer unique opportunities for traders to spread their risk and capitalize on diverse market conditions. Throughout this article, we’ll explore the top seven forex pairs with least correlation, their benefits, and strategies to leverage them effectively.

The Power of Uncorrelated Currency Pairs

Why Correlation Matters in Forex Trading

Before diving into the specific pairs, it’s essential to understand why correlation matters in forex trading. Correlation measures the degree to which two currency pairs move in relation to each other. A high positive correlation means the pairs tend to move in the same direction, while a high negative correlation indicates they move in opposite directions. Pairs with low or no correlation move independently.

Understanding correlation is crucial because it affects the overall risk and potential return of your forex portfolio. When trading multiple currency pairs, knowing their correlations can help you avoid unintentionally increasing your exposure to certain market movements.

Benefits of Trading Least Correlated Forex Pairs

- Diversification: Spread risk across unrelated currency movements

- Reduced overall portfolio volatility

- Increased potential for profit in various market conditions

- Improved risk management through balanced exposure

Trading least correlated forex pairs allows you to create a more robust trading strategy. By diversifying your trades across pairs that move independently, you can potentially offset losses in one pair with gains in another. This approach can lead to more stable returns over time and help protect your trading capital during volatile market conditions.

Read More: Most Correlated Forex Pairs

Top 7 Forex Pairs with Least Correlation

Let’s explore the seven forex pairs that consistently demonstrate low correlation:

1. EUR/USD vs. USD/JPY

The Euro/US Dollar and US Dollar/Japanese Yen pair often show minimal correlation due to their distinct economic drivers and geopolitical influences. While both pairs involve the US Dollar, the EUR/USD is heavily influenced by European economic factors, while the USD/JPY is more sensitive to risk sentiment and interest rate differentials between the US and Japan.

2. GBP/JPY vs. USD/CHF

The British Pound/Japanese Yen and US Dollar/Swiss Franc pair exhibit low correlation, offering diverse trading opportunities. The GBP/JPY is often considered a risk-on pair, influenced by global economic growth prospects, while the USD/CHF is seen as a safe-haven pair, often moving in response to global economic uncertainties.

3. AUD/USD vs. USD/CAD

Despite both being commodity currencies, the Australian Dollar/US Dollar and US Dollar/Canadian Dollar pairs often move independently. The AUD/USD is heavily influenced by Chinese economic data and global risk appetite, while the USD/CAD is more sensitive to oil prices and North American economic factors.

4. NZD/USD vs. EUR/GBP

The New Zealand Dollar/US Dollar and Euro/British Pound pair demonstrate low correlation, reflecting their unique economic factors. The NZD/USD is affected by dairy prices and risk sentiment, while the EUR/GBP is more influenced by European political and economic developments.

5. USD/MXN vs. EUR/CHF

The US Dollar/Mexican Peso and Euro/Swiss Franc pair show minimal correlation due to their distinct regional influences. The USD/MXN is sensitive to emerging market sentiment and US-Mexico relations, while the EUR/CHF is often viewed as a barometer of European economic stability.

6. GBP/AUD vs. USD/SGD

The British Pound/Australian Dollar and US Dollar/Singapore Dollar pair offer diverse trading opportunities with low correlation. The GBP/AUD reflects the relative economic performance of the UK and Australia, while the USD/SGD is influenced by Asian economic trends and global trade dynamics.

7. EUR/NOK vs. AUD/CAD

The Euro/Norwegian Krone and Australian Dollar/Canadian Dollar pair exhibit independent movements, reflecting their unique economic drivers. The EUR/NOK is influenced by oil prices and European economic factors, while the AUD/CAD is affected by commodity prices and the economic relationship between Australia and Canada.

Strategies for Trading Least Correlated Forex Pairs

1. Pair Trading

Capitalize on the divergence between two uncorrelated pairs by going long on one and short on the other. This strategy can be particularly effective when you identify temporary price discrepancies between pairs that typically maintain a certain relationship.

2. Portfolio Diversification

Incorporate least correlated pairs to balance your forex portfolio and reduce overall risk. By spreading your investments across pairs that move independently, you can potentially smooth out your returns and minimize the impact of adverse market movements on your entire portfolio.

3. Trend Following

Identify and trade strong trends in uncorrelated pairs to maximize profit potential. When you spot a strong trend in one pair, you can potentially capitalize on it without worrying about how it might affect your positions in other uncorrelated pairs.

4. Breakout Trading

Exploit breakouts in least correlated pairs to capture significant price movements. By focusing on uncorrelated pairs, you can increase your chances of finding multiple breakout opportunities across different currency pairs.

5. Fundamental Analysis

Focus on the unique economic factors driving each currency in uncorrelated pairs. This approach allows you to make informed trading decisions based on the specific economic conditions affecting each currency, rather than broad market trends.

Read More: Exotic Currency Pairs in Forex

Analyzing Correlation: Tools and Techniques

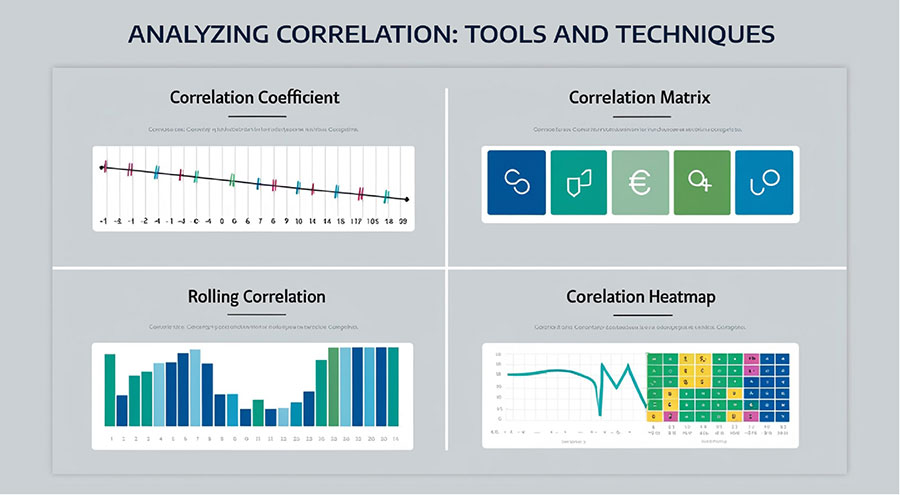

Correlation Coefficient

Understand how to interpret correlation coefficients ranging from -1 to +1. A coefficient of +1 indicates perfect positive correlation, -1 indicates perfect negative correlation, and 0 indicates no correlation. Most forex platforms and analysis tools provide correlation coefficients for various currency pairs.

Correlation Matrix

Utilize correlation matrices to visualize relationships between multiple currency pairs. These matrices provide a comprehensive overview of how different pairs correlate with each other, helping you identify potential trading opportunities and risks.

Rolling Correlation

Analyze how correlation changes over time using rolling correlation calculations. This technique involves calculating correlation over a moving window of time, allowing you to spot emerging trends or shifts in the relationship between currency pairs.

Correlation Heatmaps

Leverage visual representations of correlation data to identify opportunities quickly. Heatmaps use color-coding to display correlation strength, making it easy to spot pairs with low correlation at a glance.

Risk Management with Least Correlated Forex Pairs

Position Sizing

Adjust position sizes based on the correlation between your open trades. When trading multiple pairs, consider reducing position sizes for pairs that show some degree of correlation to avoid overexposure to similar market movements.

Stop Loss Placement

Set appropriate stop losses considering the independent movements of uncorrelated pairs. Remember that uncorrelated pairs may react differently to market events, so tailor your stop loss levels to each pair’s specific characteristics.

Correlation-Based Hedging

Use least correlated pairs to hedge against potential losses in other positions. For example, if you have a long position in a pair that’s sensitive to risk sentiment, you might consider a small position in a safe-haven pair as a hedge.

Monitoring Correlation Changes

Regularly reassess correlations as market conditions evolve. Correlations can change over time, so it’s important to stay vigilant and adjust your trading strategy accordingly.

Advanced Techniques for Exploiting Low Correlation

Multi-Timeframe Analysis

Combine correlation data across different timeframes for more robust trading decisions. Correlations may vary depending on the timeframe you’re analyzing, so considering multiple timeframes can provide a more comprehensive view.

Correlation Divergence

Identify and capitalize on temporary divergences in typically correlated pairs. When pairs that usually move together start to diverge, it could signal a potential trading opportunity as they revert to their normal relationship.

Seasonal Correlation Patterns

Explore how correlations may change during specific seasons or market cycles. Some pairs may show different correlation patterns during certain times of the year due to seasonal economic factors or regular market events.

Machine Learning Applications

Leverage AI and machine learning algorithms to predict correlation changes and optimize trading strategies. Advanced technologies can help process vast amounts of data to identify subtle shifts in correlation that might be difficult to spot manually.

Read More: Major Currency Pairs in Forex

Common Pitfalls to Avoid

- Overlooking fundamental factors: Don’t rely solely on correlation data; always consider the underlying economic factors driving each currency.

- Assuming correlations remain constant: Remember that correlations can and do change over time.

- Overtrading based solely on correlation data: Use correlation as one tool among many in your trading toolkit, not as the sole basis for decisions.

- Neglecting proper risk management: Always maintain disciplined risk management practices, regardless of correlation levels.

- Failing to consider transaction costs: Be mindful of spread and commission costs when trading multiple currency pairs.

Future Trends in Forex Correlation Trading

Impact of Cryptocurrencies

Explore how the rise of digital currencies may influence forex correlations. As cryptocurrencies become more mainstream, they could start affecting traditional currency relationships in new and unexpected ways.

Geopolitical Shifts

Anticipate how changing global dynamics may affect currency relationships. Major geopolitical events can reshape economic relationships between countries, potentially altering long-standing currency correlations.

Technological Advancements

Stay ahead of the curve with emerging tools and platforms for correlation analysis. As technology evolves, new tools and techniques for analyzing and exploiting correlations are likely to emerge.

Conclusion

Mastering the art of trading forex pairs with least correlation can significantly enhance your forex trading strategy. By understanding and leveraging these uncorrelated currency pairs, traders can diversify their portfolios, reduce overall risk, and potentially increase profit opportunities. Remember, successful trading with least correlated forex pairs requires continuous learning, adaptation, and disciplined risk management.

As you incorporate these insights into your trading approach, stay vigilant to market changes and emerging trends. The world of forex is dynamic, and correlations can shift over time. By staying informed and flexible in your strategies, you’ll be well-positioned to capitalize on the unique opportunities presented by least correlated currency pairs.

Take action today: analyze your current portfolio, identify opportunities to incorporate least correlated forex pairs, and start reaping the benefits of a more diversified and resilient trading strategy. With patience, practice, and perseverance, you can unlock the full potential of forex trading and work towards achieving your financial goals.

Remember, while trading least correlated forex pairs can offer significant advantages, it’s not a guarantee of success. Always combine this approach with thorough market analysis, robust risk management, and continuous education. By doing so, you’ll be better equipped to navigate the complex world of forex trading and potentially achieve consistent, long-term success.

How often should I reassess currency pair correlations?

It’s crucial to regularly reassess currency pair correlations as market conditions can change rapidly. While there’s no one-size-fits-all approach, many professional traders recommend reviewing correlations at least weekly, if not daily. Additionally, significant economic events or geopolitical developments may warrant immediate reassessment. By staying vigilant and adapting to changing correlations, you can maintain an edge in your trading strategy and capitalize on emerging opportunities.

Can correlations between forex pairs change over time?

Absolutely. Correlations between forex pairs are not static and can indeed change over time. Various factors influence these shifts, including changes in economic policies, global events, and market sentiment. For instance, pairs that historically showed low correlation might become more correlated during times of global economic stress. Conversely, typically correlated pairs might diverge due to country-specific events. This dynamic nature of correlations underscores the importance of continuous monitoring and adapting your trading strategies accordingly.

Are there any risks specific to trading least correlated forex pairs?

While trading least correlated forex pairs offers diversification benefits, it comes with its own set of risks. One primary risk is the potential for unexpected correlation shifts, which could invalidate your trading strategy. Additionally, focusing solely on correlation without considering fundamental and technical factors can lead to poor trading decisions. There’s also the risk of overtrading or overexposure if not managed properly. Lastly, transaction costs can eat into profits when trading multiple uncorrelated pairs. To mitigate these risks, maintain a balanced approach, stay informed about market conditions, and always adhere to sound risk management principles.