Price action swing trading strategy is a highly effective trading method that enables traders to capitalize on market movements by analyzing raw price action rather than relying on complex indicators. This approach offers a clear, unfiltered view of market behavior, allowing traders to make well-informed decisions. The key advantage of price action swing trading is that it focuses on understanding market structure, candlestick patterns, and support and resistance levels, rather than lagging indicators.

By mastering these seven powerful price action swing trading strategies, you can significantly improve your trading game in 2024. Whether you’re using a regulated forex broker or searching for the best price action strategy for swing trading, this guide will provide actionable insights and practical steps to help you succeed in the forex market.

What Is Price Action Swing Trading?

Price action swing trading is a method that focuses on analyzing pure price movements to spot high-probability trading opportunities. Unlike strategies that rely heavily on indicators, price action trading is based on candlestick patterns, market structure, and key support and resistance levels. This allows traders to make decisions based on the actual behavior of the market, rather than relying on lagging indicators.

Price action traders focus on the core principles of market structure, such as understanding the direction of trends and identifying potential reversals. By focusing on raw price data, traders gain a clearer perspective of market movements and can execute trades with more confidence.

Key Elements of Price Action Swing Trading

- Market Structure: Recognizing trends, retracements, and continuation patterns.

- Candlestick Patterns: Using patterns like pin bars, engulfing patterns, and inside bars for trade entries.

- Support and Resistance: Identifying key levels where the price is likely to react.

- Momentum: Observing the speed of price movements to gauge the strength of trends.

Read More: 200 EMA Swing Trading

What Is Swing Trading?

Swing trading is a strategy where traders hold positions for several days or weeks to profit from market “swings.” Unlike day trading, swing traders focus on capturing larger price movements by analyzing technical patterns such as support and resistance levels. This approach allows traders to act on trends without needing to constantly monitor the market.

It’s a flexible strategy, ideal for those seeking to profit from medium-term market moves.

Benefits of Swing Trading

1. Time Efficiency

Swing trading reduces the need for constant market monitoring. Traders can manage trades in just a few check-ins a day, making it ideal for those with busy schedules.

2. Higher Profit Potential

Swing traders hold positions longer, allowing them to capture larger price movements. Using the best price action strategy for swing trading increases the potential for significant gains.

3. Lower Emotional Stress

With more time to make decisions, swing traders experience less stress than day traders. This relaxed pace encourages better decision-making and discipline.

4. Flexible Analysis

Swing trading allows the use of both technical and fundamental analysis, enabling traders to adapt their strategy based on market conditions.

5. Better Risk Management

Swing trading offers enhanced risk management by allowing the placement of stop-loss orders at key price levels, especially in price action swing trading strategies.

Benefits of Price Action Swing Trading

1. Simplicity

Price action trading cuts out complex indicators, focusing purely on price movements, which makes it easier to make decisions.

2. Timeliness

Reacting directly to price action allows swing traders to respond quickly to market changes, making the price action swing trading strategy highly effective.

3. Versatility

This strategy works across different markets like forex, stocks, and commodities, allowing traders to adapt to various assets.

4. Self-Sufficiency

Traders rely on their ability to read the market rather than external tools, enhancing decision-making and confidence.

Swing trading with a price action focus simplifies your approach while maximizing potential profits across multiple markets.

The Psychology Behind Price Action Swing Trading

Successful price action swing trading is deeply rooted in understanding market psychology. Traders’ emotions such as fear, greed, and excitement often drive price movements. This human element is a critical factor in price action trading, as it reveals market sentiment and provides valuable insights into potential reversals or continuations.

Understanding Market Psychology

- Fear and Greed Cycles: Traders’ emotional responses create repetitive price patterns. When fear dominates, the market tends to drop sharply, while greed leads to rapid price increases.

- Market Sentiment: Tracking the general mood of traders can provide clues about market direction.

- Order Flow: Understanding how large institutional players move the market through their buying and selling orders helps traders stay on the right side of the trend.

Mastering market psychology enables traders to anticipate market movements more effectively and avoid common emotional pitfalls that lead to impulsive trades.

Read More: Pivot Point Swing Trading Strategy

Key Components of Price Action Swing Trading

1. Market Structure Analysis

Market structure refers to the overall pattern and direction of price movements. Traders analyze whether the market is in a trend, consolidation, or reversal phase.

- Identifying Higher Highs and Lower Lows: Understanding how these formations signify uptrends or downtrends.

- Recognizing Trend Channels: Using trendlines to define channels and ranges where prices typically move.

- Momentum and Phases: Recognizing when momentum is weakening, signaling potential reversals.

- Volume Analysis: Understanding the relationship between price and volume to confirm market strength.

Mastering market structure allows traders to identify high-probability trading opportunities by staying in tune with the market’s natural rhythm.

2. Support and Resistance Levels

Support and resistance are critical levels where price reacts. Knowing how to identify and trade these levels is essential for price action swing trading.

- Horizontal Support and Resistance: These are key price levels where the market tends to reverse or stall.

- Dynamic Support/Resistance: Moving averages can act as dynamic support or resistance as the price trends.

- Psychological Levels: Round numbers, such as 1.3000 in forex, often act as significant support or resistance.

- Supply and Demand Zones: These are areas where buying or selling pressure is expected to emerge.

By effectively identifying these zones, traders can predict potential turning points in the market and enter trades with more confidence.

3. Candlestick Patterns

Candlestick patterns are at the heart of price action analysis. They provide visual cues about potential market reversals or continuations.

- Reversal Patterns: Patterns like pin bars, engulfing bars, and hammer formations are critical for spotting turning points.

- Continuation Patterns: Inside bars and other multi-bar patterns help traders stay in trades during a trend.

- Multiple Candlestick Formations: A series of candles often gives more reliable signals than a single candle.

- Japanese Candlestick Techniques: Traditional methods like Doji, Marubozu, and Harami are used to gauge sentiment and predict market movement.

Understanding candlestick patterns allows traders to interpret market behavior with greater accuracy.

Top 7 Price Action Swing Trading Strategies

1. Trend-Following Strategy

The trend-following strategy is one of the most reliable methods for swing trading. The goal is to ride the wave of an established trend, making entries on pullbacks to key support or resistance levels.

How to Implement Trend-Following

- Identify the Prevailing Trend: Use higher timeframes to confirm the primary trend direction.

- Look for Pullbacks: Enter the trade after a retracement to key support or resistance levels.

- Enter Trades in the Direction of the Main Trend: Ensure that you are trading with the trend, not against it.

- Set Stop Losses: Place stop-loss orders below significant swing points to protect against reversals.

This strategy has a success rate of approximately 60-65% when executed properly, making it one of the most reliable swing trading methods.

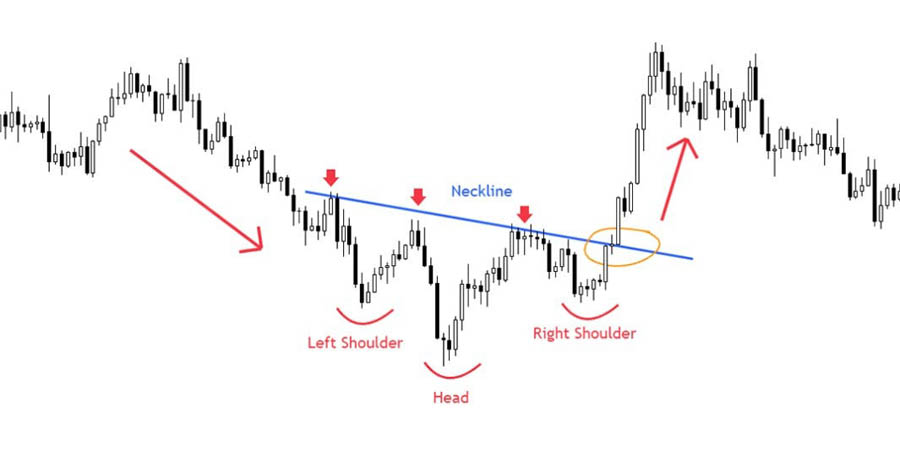

2. Counter-Trend Reversal Strategy

The counter-trend strategy seeks to capitalize on potential reversals. This approach is riskier than trend-following but can yield significant rewards when used carefully.

Key Reversal Patterns

- Head and Shoulders: Indicates a major trend reversal.

- Double Tops and Bottoms: Signals potential reversal zones.

- Falling and Rising Wedges: Show signs of trend exhaustion.

- Divergence: Occurs when price action moves in the opposite direction of indicators like RSI, signaling potential reversals.

Counter-trend trading requires precision and discipline to manage the risks inherent in betting against the trend.

3. Range Trading Strategy

Range trading is ideal when the market is moving sideways, bouncing between support and resistance.

Range Trading Tips

- Define Clear Support and Resistance Levels: Look for multiple touches to confirm a range.

- Enter Long at Support, Short at Resistance: Buy at the bottom of the range and sell at the top.

- Set Profit Targets Within the Range: Aim for a predefined profit level rather than waiting for a breakout.

This strategy works best in stable, low-volatility environments.

4. Breakout Trading Strategy

Breakout trading involves entering trades when the price breaks through a key support or resistance level, usually with increased volume.

Avoiding False Breakouts

- Volume Confirmation: Ensure that the breakout is supported by high trading volume.

- Market Context: Analyze the overall trend and market conditions to validate the breakout.

- Time of Day: Certain times, such as during major news events, are more likely to produce false breakouts.

Breakouts can lead to significant gains, but false breakouts are common, so caution is necessary.

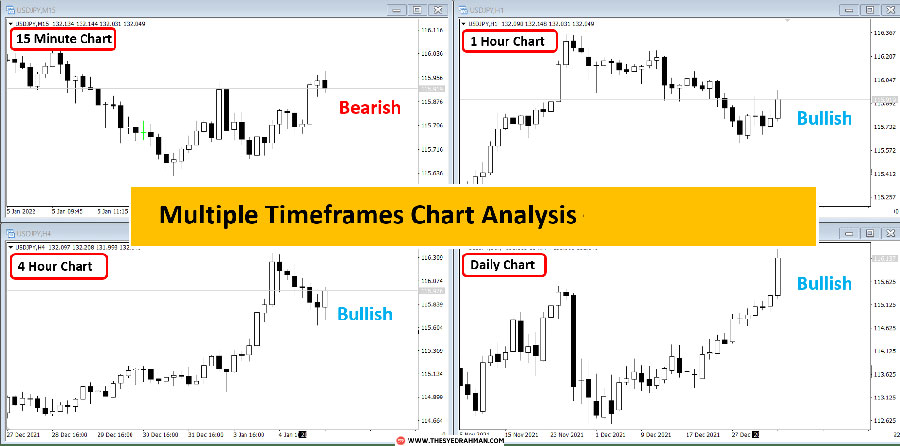

5. Multiple Timeframe Strategy

This strategy involves analyzing multiple timeframes to gain a more comprehensive view of the market.

Timeframe Correlation

- Higher Timeframes for Trend Direction: Use daily or weekly charts to confirm the broader trend.

- Lower Timeframes for Entry Points: Use smaller timeframes, like the 1-hour chart, to find optimal entry points.

- Align Trades with the Higher Timeframe Trend: This ensures that your trades are in sync with the broader market movement.

Using multiple timeframes gives you a more complete picture of the market.

Read More: Bollinger Bands swing trading strategy

Additional Considerations for Price Action Swing Trading

When implementing a price action swing trading strategy, several additional factors can significantly impact your trading success. Here are key considerations to keep in mind:

Timeframe

The timeframe you choose can have a profound effect on your price action signals. Different timeframes offer varying perspectives on market movements and can influence your trading strategy:

- Longer Timeframes (Daily, Weekly): These are ideal for swing traders aiming to capture substantial market moves. Price action signals on longer timeframes tend to be more reliable, as they filter out noise and short-term fluctuations. However, they require more patience and may lead to fewer trades.

- Shorter Timeframes (1-Hour, 4-Hour): These can provide more frequent trading opportunities, allowing you to react quickly to market changes. However, signals may be less reliable due to market noise, and traders might experience emotional stress from rapid price fluctuations.

Ultimately, aligning your trading strategy with the appropriate timeframe enhances your ability to interpret price action effectively.

Risk Management

Risk management is a cornerstone of successful trading, especially in price action strategies. Implementing proper risk management techniques helps safeguard your capital and ensures long-term success. Key components include:

- Stop-Loss Orders: Always set a stop-loss order to limit potential losses on any trade. This pre-defined exit point is crucial for protecting your account from significant drawdowns.

- Take-Profit Orders: Establishing take-profit levels allows you to lock in profits when price targets are reached. This disciplined approach helps avoid emotional decision-making during market volatility.

By prioritizing risk management, you can trade with confidence and reduce the impact of losing trades on your overall performance.

Backtesting and Paper Trading

Before diving into live trading, consider backtesting your strategies using historical data. This process allows you to:

- Analyze how your price action swing trading strategies would have performed in various market conditions.

- Identify strengths and weaknesses in your approach, enabling you to refine your strategy before risking real capital.

Additionally, engaging in paper trading lets you practice executing trades in a risk-free environment. This hands-on experience helps build your skills and confidence, ensuring you’re well-prepared for live trading.

By incorporating backtesting and paper trading into your routine, you can develop a more robust trading plan and enhance your overall performance in the market.

These additional considerations—timeframe, risk management, and practice through backtesting—are vital elements that contribute to your success in price action swing trading.

Choose Opofinance for Your Price Action Trading Needs

Unlock your trading potential with Opofinance, a regulated forex broker designed to elevate your price action swing trading strategy. With a commitment to providing the best trading experience, Opofinance offers a range of features tailored to meet the needs of both novice and experienced traders.

Why Choose Opofinance?

- Advanced Charting Tools

- Gain an edge with our state-of-the-art charting tools. Access multiple timeframes and custom indicators to analyze price movements effectively and make informed trading decisions.

- Secure Trading Platforms

- Experience lightning-fast execution speeds and tight spreads with our secure trading platforms. Our infrastructure is designed to minimize latency and slippage, ensuring you never miss an opportunity.

- Educational Resources

- Enhance your trading skills with our extensive educational resources. Participate in free webinars and tutorials specifically focused on price action trading to refine your strategies and stay ahead in the market.

Take the Next Step in Your Trading Journey

Choosing Opofinance means partnering with a broker that prioritizes your success. Our robust tools and resources empower you to execute your price action swing trading strategies with confidence.

Join Opofinance today and start transforming your trading experience! With our comprehensive support, you can navigate the forex market and achieve your trading goals.

Conclusion

Price action swing trading strategies present a unique opportunity for traders to engage with the markets through a clear and direct lens. By prioritizing raw price movements and market structure, these strategies establish a high-probability framework for making informed trading decisions.

One of the primary advantages of using price action techniques is their simplicity. Traders can eliminate the clutter of complex indicators and focus on what truly matters—the price itself. This not only streamlines the decision-making process but also enhances the ability to react promptly to market conditions.

For those seeking the best price action strategy for swing trading, this guide has outlined several effective approaches, such as trend-following, counter-trend reversal, and breakout trading strategies. Each of these methods provides traders with a systematic way to identify high-probability entry and exit points, ultimately contributing to improved trading performance.

Furthermore, embracing price action swing trading allows for greater versatility across various financial markets, including forex, stocks, and commodities. This adaptability means that traders can implement these strategies in multiple contexts, maximizing their opportunities for profit.

As you look to improve your trading skills in 2024, remember that mastering price action swing trading techniques can significantly enhance your ability to navigate the complexities of the market. Whether you’re a novice trader or an experienced professional, these strategies can help you develop a more disciplined and effective trading approach.

In summary, the principles of price action swing trading empower you to take charge of your trading decisions. By focusing on price movements and market dynamics, you can create a robust trading strategy that leads to consistent profits and long-term success.

How long should I hold swing trades based on price action?

The typical holding period for swing trades ranges from a few days to several weeks, depending on the market and strategy. Price action signals should guide your exit strategy.

Can price action swing trading be combined with indicators?

Yes, price action can be enhanced with indicators like moving averages or RSI, but keep the focus on the price itself for decision-making.

What is the best timeframe for price action swing trading?

Most traders prefer the 4-hour and daily charts for swing trading, but combining multiple timeframes can provide a clearer view of the market.