So, you’ve passed a prop firm challenge and your first payout is on its way. Congratulations! That’s a huge milestone. But right behind that excitement often comes a nagging question: how do I handle the taxes on this? If you’re feeling a bit lost navigating the world of 1099s, quarterly payments, and business deductions, you’re in the right place. Understanding your obligations for Prop firm tax is as crucial as any trading strategy. This article will walk you through exactly what you owe, how to report it, and the key strategies traders use to legally reduce their tax burden, whether you’re trading with a standard online forex broker or a specialized futures prop firm. This guide for 2025 provides hands-on advice for handling your prop firm tax liabilities.

Key Takeaways

- Payouts Are Taxable Income: Any profit split you receive from a prop firm is considered taxable income in the year you receive it. You are responsible for reporting this income to the IRS, even if you don’t receive a tax form.

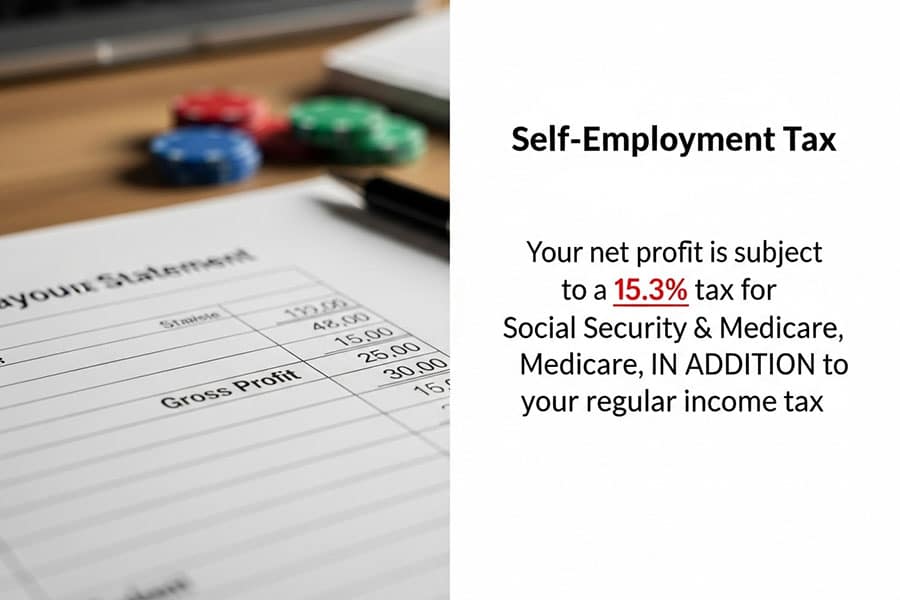

- Self-Employment Tax is Key: As an independent contractor, your net earnings are subject to a 15.3% self-employment tax for Social Security and Medicare, in addition to regular federal and state income tax.

- Tax Forms Vary: You will likely receive a Form 1099-NEC from your prop firm. Some firms may structure their relationship as a partnership, issuing a Schedule K-1 instead, which has different tax implications.

- Deductions Are Your Best Friend: You can lower your taxable income by deducting legitimate business expenses, such as data fees, platform costs, education, and a home office.

- Entity Structure Matters: While starting as a sole proprietor is simplest, forming an LLC or an S-Corporation can offer liability protection and significant tax advantages once your income reaches a certain level.

- Quarterly Payments Are Required: To avoid penalties, you must pay estimated taxes to the IRS throughout the year, typically on a quarterly basis.

Disclaimer: This article is for informational purposes only and does not constitute financial or tax advice. Tax laws are complex and subject to change. Please consult with a qualified tax professional or CPA for advice tailored to your specific situation.

Do I Owe Taxes on Prop Firm Payouts?

Let’s get the most critical question out of the way first. The short answer is a definitive yes. The moment that profit split from your prop firm hits your bank account, it becomes taxable income. I remember the shock after my first big payout; the euphoria of the profit was quickly tempered by the realization that Uncle Sam was my new, silent trading partner. Many new traders make the mistake of thinking it’s “not real” until a tax form arrives, but that’s a dangerous misconception.

The IRS operates on a principle of “constructive receipt,” which means you owe tax on the income when it is made available to you without restriction, not just when you get the paperwork. Here’s the breakdown of what that means for you:

- Taxable on Receipt: Profit splits are taxable income on the day they are credited to your account. It doesn’t matter if the firm is in the US or offshore; if you are a U.S. person, you report it.

- Form 1099-NEC, K-1, or No Form: Most prop firms will issue a Form 1099-NEC (Nonemployee Compensation) if you earn over $600 in a year. Some may use a partnership structure and issue a Schedule K-1. But even if you earn less than $600 or the firm fails to send a form, you are still legally required to report that income on your tax return. The burden of compliance is on you.

- Multiple Layers of Tax: The money you receive isn’t just subject to one tax. You need to account for three potential layers: federal income tax, state income tax (unless you live in a no-tax state), and the often-overlooked self-employment tax. This is where many new funded traders get into trouble, underestimating their total liability.

Prop Trading Self-Employment Tax Basics

If the 1099-NEC is the “what” of prop firm taxes, then the prop trading self-employment tax is the “how much” that catches most traders by surprise. Because the prop firm doesn’t consider you an employee, they aren’t withholding any taxes on your behalf. You are treated as a business owner, and that comes with the responsibility of paying both the employee and employer portions of Social Security and Medicare taxes.

This is what the self-employment tax is. For 2025, the rate is 15.3% on your net self-employment earnings. It’s calculated on the first $168,600 of earnings for the Social Security part (12.4%) and has no limit for the Medicare part (2.9%). This is on top of your regular income tax.

- 15.3% on Net Profit: This tax isn’t calculated on your gross payouts. It’s applied to your net business profit after you’ve subtracted all your allowable deductions. This is why tracking expenses is so vital. Your net income is calculated on IRS Schedule C.

- Quarterly Estimated Payments Prevent Penalties: The IRS expects you to pay your taxes as you earn income throughout the year, not all at once in April. To do this, you must make quarterly estimated tax payments. I learned this the hard way my first year when I was hit with an underpayment penalty. The due dates are typically April 15, June 15, September 15, and January 15 of the following year. Use Form 1040-ES to calculate and pay these estimates.

- When a K-1 Can Avoid SE Tax: If your prop firm is structured as a partnership and issues you a Schedule K-1, the income might not be subject to self-employment tax. This can be a huge saving. However, this structure comes at a cost: K-1 income is generally not considered “earned income,” meaning you typically cannot contribute to retirement plans like a Solo 401(k) or deduct self-employed health insurance premiums based on it. It’s a significant trade-off to consider.

Choose the Right Entity: Prop Firm LLC vs Sole Proprietor

When you start trading with a prop firm, you are by default a sole proprietor. It’s the simplest structure—no setup required. Your business income and expenses are reported on a Schedule C attached to your personal 1040 tax return. But as your trading profits grow, the question of business structure becomes critical. The debate over Prop Firm LLC vs Sole Proprietor is one every serious funded trader eventually has.

An LLC (Limited Liability Company) is often the next logical step. Its primary benefit is separating your personal assets from your business liabilities. If your business were to be sued, your personal home and savings would generally be protected. From a tax perspective, a single-member LLC is by default a “disregarded entity,” meaning it’s taxed exactly like a sole proprietorship. So why bother? The real power comes with an S-Corp election.

Sole Proprietor vs. LLC/S-Corp Tax Comparison

| Feature | Sole Proprietor | LLC (Taxed as S-Corp) |

| Liability Protection | None. Personal assets are at risk. | Yes. Personal assets are generally protected from business debts. |

| Self-Employment (SE) Tax | 15.3% tax applies to 100% of net profit. | SE tax (FICA) applies only to the “reasonable salary” you pay yourself. Distributions are not subject to SE tax. |

| Retirement Options | Solo 401(k), SEP IRA available. | Solo 401(k), SEP IRA available. Contributions are based on W-2 salary. |

| Administrative Cost & Complexity | Very low. No setup fees, minimal paperwork. | Higher. State filing fees, potential annual reports, and requires running payroll for salary. |

| Best For | New traders, inconsistent profits, keeping things simple. | Consistent profits over $60,000/year, traders seeking liability protection and tax optimization. |

- When an S-Corp Election Makes Sense: Electing for your LLC to be taxed as an S-Corporation is a powerful strategy, but it’s not for everyone. Generally, it becomes financially viable when your net trading profit consistently exceeds $60,000 to $80,000 per year. At this point, the savings on self-employment tax can outweigh the added costs of payroll and administration. You pay yourself a “reasonable salary” (subject to FICA taxes) and take the rest of the profits as distributions (not subject to FICA taxes). This is one of the most effective ways to reduce your prop firm tax liability as you scale. For 2025, the Qualified Business Income (QBI) deduction of up to 20% on pass-through income adds another layer of potential savings, though it comes with its own set of complex rules.

Read More: What Is Prop Firm in Forex

Top Prop Firm Tax Deductions Most Traders Miss

As a self-employed trader, your taxable income is your total payouts minus your business expenses. Every dollar you can legitimately deduct is a dollar you don’t pay tax on. Keeping meticulous records is non-negotiable. I use a dedicated business bank account and a bookkeeping app to track everything, which makes tax time infinitely less stressful. Don’t leave money on the table; track and deduct everything you are entitled to.

Pro Tip: Keep digital receipts for everything! Use a cloud storage service like Google Drive or Dropbox and snap a photo of every receipt. For mileage, use an app like MileIQ to automatically log your business-related trips to meet a CPA or attend a trading seminar. An organized digital trail is your best defense in an audit.

Home Office

- Direct & Indirect Expenses: If you have a dedicated space in your home used exclusively for trading, you can deduct a portion of your household expenses. This includes a percentage of your rent or mortgage interest, utilities, property taxes, and internet bill, based on the square footage of your office.

- Simplified Method: If you don’t want to track actual expenses, you can use the simplified option, which is a deduction of $5 per square foot, up to a maximum of 300 square feet ($1,500 deduction).

Tech & Data

- Platform & Software Fees: Monthly fees for NinjaTrader, TradingView, or other platforms are fully deductible.

- Data Feeds: Subscriptions to real-time data from the CME or other exchanges are a cost of doing business.

- Computers & Equipment: You can often deduct the full cost of computers, monitors, and other hardware in the year of purchase using Section 179 or bonus depreciation.

- VPS Services: If you use a Virtual Private Server for low-latency execution, the monthly cost is deductible.

Education

- Courses & Coaching: Money spent on coaching, courses, or trading rooms to improve your skills in your current business is deductible. Note that education to qualify for a new business is generally not.

- Books & Subscriptions: Subscriptions to financial publications like the Wall Street Journal or trading books are deductible.

Professional Fees

- Evaluation/Challenge Fees: This is a gray area, but many tax professionals advise deducting the cost of failed challenges as a business expense. Fees for challenges you pass, which lead to a funded account, could be argued as a “cost to acquire” that account and should be amortized, but deducting them as a current expense is also a common practice. Consult a CPA on this.

- Tax & Legal Advice: The fees you pay to a CPA or attorney for business-related advice are fully deductible.

State-Level Pitfalls for Funded Traders

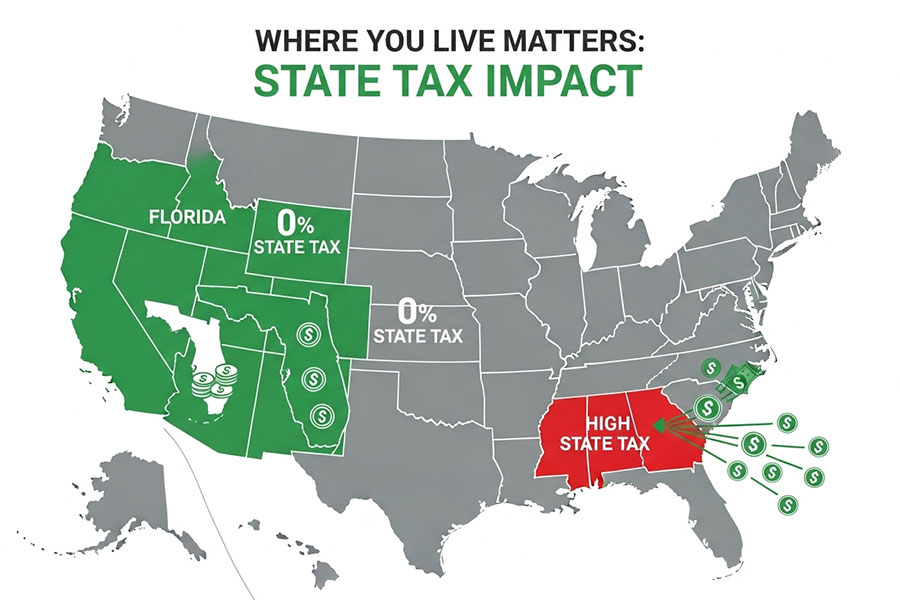

Your federal tax bill is only part of the story. State income tax can take another significant bite out of your payouts, and where you live matters—a lot. This is a crucial factor in your overall prop firm tax planning.

Some states, like Florida, Texas, and Nevada, have no state income tax, making them highly attractive for profitable traders. Other states, like California and New York, have high, progressive tax brackets that can dramatically increase your total tax burden.

Sample Tax on a $10,000 Payout: FL vs. CA vs. TX

| State | State Income Tax Rate (Approx. for this bracket) | Estimated State Tax on $10,000 |

| Florida (FL) | 0% | $0 |

| California (CA) | ~9.3% (depending on total income) | ~$930 |

| Texas (TX) | 0% | $0 |

- Zero-Tax vs. Graduated Brackets: The table illustrates the stark difference. A trader in California could easily pay nearly 10% more in taxes than a trader in Florida on the same payout. This is why some high-earning traders consider relocating. California’s tax rates are graduated, meaning the rate increases as your income climbs, reaching as high as 13.3% for top earners.

- Don’t Forget City Taxes: To make matters more complex, some cities levy their own income taxes on top of federal and state taxes. Traders living in places like New York City or Philadelphia need to account for this additional layer, which can often be overlooked in initial planning.

Read More: Tax Implications of Forex Trading

International Payouts & Double-Tax Traps

The prop firm world is global, and so are many of its traders. This introduces another layer of complexity, particularly for U.S. citizens living abroad or non-residents trading with U.S. firms.

- FEIE for U.S. Digital Nomads: If you are a U.S. citizen living and trading from outside the country, you may qualify for the Foreign Earned Income Exclusion (FEIE). For 2025, this allows you to exclude a significant amount of your foreign-earned income from U.S. income tax. However, this income is often still subject to U.S. self-employment tax.

- FBAR/FATCA Reporting: If your prop firm is wiring payouts to a foreign bank or brokerage account and the aggregate value of your foreign accounts exceeds $10,000 at any point during the year, you have an FBAR (Foreign Bank Account Report) filing requirement with FinCEN. FATCA (Foreign Account Tax Compliance Act) rules add further reporting for larger account balances. Failure to file these can result in severe penalties.

- Quick Notes for Non-U.S. Traders:

- United Kingdom: For UK residents, prop firm payouts are typically treated as trading income and subject to Income Tax and National Insurance, not the more favorable Capital Gains Tax (CGT).

- Canada: The Canada Revenue Agency (CRA) generally views prop trading profits as business income, which is fully taxable at your marginal rate.

Record-Keeping Workflow to Pass an Audit

The best way to feel confident about your tax filing is to have bulletproof records. An audit is unlikely, but if it happens, organized documentation turns a potential nightmare into a minor inconvenience. Your goal is to be able to substantiate every number on your tax return.

- Daily/Weekly Payout Downloads: Don’t rely on the prop firm to keep perfect records for you. Download or screenshot every payout confirmation statement and save it in a dedicated folder on your cloud drive, named by date.

- Tag Challenge Fees Correctly: In your bookkeeping software, create a specific expense category for “Evaluation Fees.” At the end of the year, you and your CPA can decide on the most appropriate tax treatment (current expense vs. amortization), but having the data clearly separated is the critical first step.

- Cloud Storage + Bookkeeping App is a Must: My system involves a combination of QuickBooks Self-Employed and Google Drive. All digital receipts are saved to a dated folder in the cloud. QuickBooks syncs with my business bank account and credit card, allowing me to categorize transactions weekly. This 30-minute weekly habit saves me dozens of hours of stress at year-end.

Pro Tax Strategies for 2025 and Beyond

Once you have consistent profitability and have mastered the basics, you can move on to more advanced tax planning strategies to maximize what you keep.

- Solo 401(k) to Shelter Income: The Solo 401(k) is arguably the most powerful retirement savings tool for a self-employed trader. As both “employee” and “employer,” you can make significant contributions. For 2025, you can contribute up to $23,500 as an employee deferral, plus an “employer” profit-sharing contribution of up to 25% of your net adjusted self-employment income, not to exceed a combined total of $69,000. These contributions are tax-deductible, directly reducing your taxable income. I opened one as soon as my income stabilized, and it’s a cornerstone of my financial plan.

- Loss Harvesting in Personal Accounts: While you can’t deduct prop trading losses against your payouts (the firm absorbs the loss), you can use losses from a separate, personal trading account. You can deduct up to $3,000 in net capital losses against your ordinary income (including your prop firm payouts) each year. This can be a smart way to offset some of the tax liability from your funded trading.

- Negotiating K-1 Status: With some boutique or physical prop trading desks, there may be an opportunity to negotiate your relationship. If you are a high-volume, highly profitable trader, some firms may be willing to structure you as a partner (LLC member) issuing a K-1 instead of a contractor. As discussed, this can save you the 15.3% self-employment tax, a massive saving at higher income levels.

Read More: Forex Tax in Dubai

Final Checklist: File Confidently

Navigating the world of prop firm tax can feel daunting, but a systematic approach makes it manageable. Follow these steps to ensure you file correctly and confidently.

- Gather Your Documents: Collect all 1099-NECs, K-1s, or payout summaries from your prop firms. If a firm didn’t send a form, use your own bank statements and records to determine your gross income.

- Tally Your Deductions: Go through your bank and credit card statements. Sum up all your legitimate business expenses for the year (software, data, fees, home office, etc.).

- Calculate Your Net Income: Subtract your total deductions from your gross payouts. This is your net self-employment income, which you will report on Schedule C.

- Calculate and Pay Your Taxes: Use your net income to calculate your self-employment tax (on Schedule SE) and your regular income tax. Ensure your quarterly estimated payments for the current year are on track.

- Know When to Hire a CPA: If you are dealing with multiple six-figure payouts, have formed an LLC/S-Corp, or are using advanced strategies, don’t go it alone. The cost of a good trader-focused CPA is a deductible expense and can save you thousands in taxes and potential penalties.

Unlock Your Trading Potential with Opofinance

As an ASIC-regulated broker, Opofinance provides a secure and advanced trading environment. Benefit from our comprehensive suite of tools designed for the modern trader:

- Advanced Trading Platforms: Choose from MT4, MT5, cTrader, and the exclusive OpoTrade platform.

- Innovative AI Tools: Leverage our AI Market Analyzer, AI Coach, and AI-powered support for smarter trading decisions.

- Flexible Trading Options: Explore opportunities in Social & Prop Trading.

- Secure & Flexible Transactions: Enjoy safe and convenient deposits and withdrawals, including crypto payments with zero fees.

Conclusion

Successfully navigating the world of prop firm tax is a critical skill for any funded trader. By understanding that your payouts are taxable business income, diligently tracking your expenses, and making timely quarterly payments, you can stay compliant and avoid costly penalties. As your profitability grows, strategically choosing a business entity like an LLC with an S-Corp election can unlock significant tax savings. Treat your tax planning with the same discipline you apply to your trading, and you’ll be well on your way to long-term success.

What is the best state to live in for a prop trader?

States with no state income tax, such as Florida, Texas, Nevada, or Wyoming, are financially the most advantageous as they eliminate one layer of taxation on your payouts.

Can I pay my spouse a salary from my trading business?

If your spouse performs legitimate work for your trading business (e.g., bookkeeping, administrative tasks), you can pay them a reasonable salary, which is a deductible expense for the business.

How are futures trading payouts taxed differently?

For prop traders receiving a 1099-NEC, the underlying instrument (futures vs. forex) doesn’t change the tax treatment. The income is self-employment income. The unique 60/40 tax rule for futures applies to traders with personal accounts, not typically to prop firm payouts.

What is the difference between a 1099-NEC and a 1099-MISC?

Form 1099-NEC is now used specifically to report nonemployee compensation. Form 1099-MISC is for other miscellaneous income like rents or prizes. As a prop trader, you should receive a 1099-NEC.

Can I amend a tax return if I made a mistake?

Yes, you can file an amended tax return using Form 1040-X to correct errors or claim missed deductions from a previously filed return, generally within three years of the original filing date.

Do I pay taxes if my prop firm is in another country?

Yes. If you are a U.S. citizen or resident, you are taxed on your worldwide income. The location of the prop firm does not change your U.S. tax obligations.

Can I deduct the cost of a failed prop firm challenge?

Most tax experts agree that fees for failed challenges can be deducted as a normal business expense, as they are a cost incurred in the attempt to generate income.

What if I receive payouts in cryptocurrency?

Receiving crypto is a taxable event. You have income equal to the fair market value of the crypto on the day you received it. You must report this value in USD on your tax return.

Is prop trading income eligible for the QBI deduction?

Yes, as self-employment income from a qualified trade or business, your net prop trading profit is generally eligible for the 20% Qualified Business Income (QBI) deduction, subject to income limitations.

Do I need an EIN to be a prop trader?

If you operate as a sole proprietor, you can use your Social Security Number. You will only need an Employer Identification Number (EIN) if you form an LLC, corporation, or hire employees.

What happens if I don’t pay quarterly estimated taxes?

If you owe more than $1,000 in tax for the year and didn’t pay sufficient estimated taxes, the IRS will likely charge you an underpayment penalty plus interest.