In the competitive realm of Forex trading, understanding and utilizing effective strategies is crucial for success. One such strategy that has gained significant attention is mastering ICT rejection blocks. But what exactly are ICT rejection blocks, and how can they improve your Forex trading success?

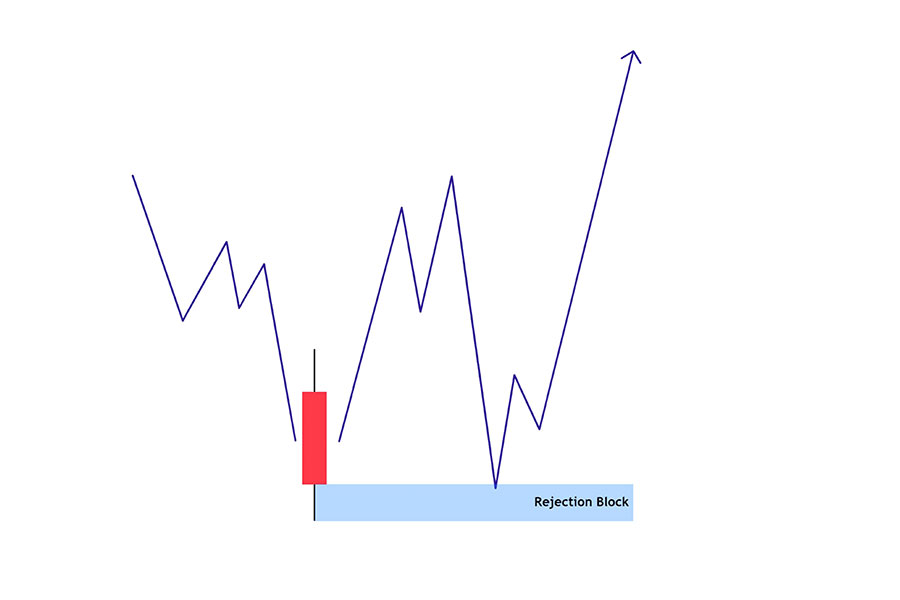

ICT rejection blocks are specific price structures that indicate potential market reversals, offering traders valuable signals for strategic entry and exit points. These blocks form when the market tests key levels—such as previous highs or lows—before swiftly reversing direction. Partnering with a regulated Forex broker can enhance your ability to capitalize on these opportunities, as it provides a secure trading environment and access to essential tools. This behavior highlights areas where liquidity is trapped, often signaling that institutional traders are stepping in to influence the market.

By recognizing and effectively using ICT rejection blocks, traders can enhance their ability to predict price movements, avoid common pitfalls associated with false breakouts, and ultimately improve their trading performance. This article serves as a comprehensive guide to understanding ICT rejection blocks, detailing how to identify them, why they are essential in Forex trading, and actionable strategies to incorporate them into your trading plan.

Whether you are a novice trader looking to build a solid foundation or an experienced trader seeking to refine your skills, this guide will provide you with the insights and tools needed to leverage ICT rejection blocks for greater success in the Forex market. Additionally, for those interested in pairing their trading strategies with a reliable platform, we will also discuss the importance of choosing a regulated forex broker to support your trading endeavors.

What Are ICT Rejection Blocks?

ICT rejection blocks are price formations in Forex trading that indicate potential reversals. Typically, these blocks form when the market tests a key level, such as a previous high or low, and swiftly reverses. This occurs because liquidity is trapped above or below these levels, and the rejection signals that smart money traders are stepping in to reverse the market.

Understanding these blocks is crucial because they help traders enter or exit trades more effectively. Rather than chasing price after a breakout, traders who recognize rejection blocks can capitalize on reversal points where price is likely to pivot.

The key to mastering ICT rejection blocks is to learn how they reflect market sentiment and where institutional traders place their orders.

How to Identify ICT Rejection Blocks

To effectively identify rejection blocks, you need to be familiar with price action and understand key concepts in market structure. Below are the primary steps to spotting ICT rejection blocks:

1. Recognize Key Levels

The first step is identifying significant highs or lows on your price chart. These levels often act as psychological points where the price either reverses or breaks out. ICT rejection blocks are likely to form around these areas, where liquidity resides.

Key levels can be identified through historical price action, pivot points, or Fibonacci retracement levels. The more times a price level has been tested, the stronger it is likely to be.

2. Watch for False Breakouts

One characteristic of rejection blocks is a false breakout. The price may break above or below a key level, only to swiftly reverse direction. This reversal forms a rejection block. Recognizing these false breakouts can help traders avoid common pitfalls and capitalize on reversal opportunities.

False breakouts often trap traders who enter positions based on the initial breakout. By waiting for confirmation of a rejection block, you can position yourself to take advantage of the subsequent reversal rather than being caught in the breakout trap.

3. Look for Long Wicks on Candles

Candles with long wicks, particularly at major levels, are a strong indication that a rejection block is forming. The wicks represent attempts to push past a level, but the quick reversal shows that the market isn’t ready to sustain the breakout.

When you see a long wick, it indicates that buyers or sellers attempted to push the price in one direction but were met with significant opposition. This behavior often precedes a reversal, making it a critical signal for traders.

4. Combine with Other Indicators

To increase the reliability of your trades, combine ICT rejection block analysis with other technical indicators such as moving averages, Fibonacci retracements, or volume analysis. This multi-indicator approach can enhance your accuracy and reduce the chances of false signals.

For example, if a rejection block forms near a 50% Fibonacci retracement level, the confluence of these two signals strengthens the case for a potential reversal. Similarly, using moving averages can help confirm the overall trend direction, providing a clearer context for your trades.

By honing your ability to identify these blocks, you can become more proficient at predicting market movements before they happen.

Why ICT Rejection Blocks Are Vital in Forex Trading

ICT rejection blocks are a staple of price action trading for several reasons:

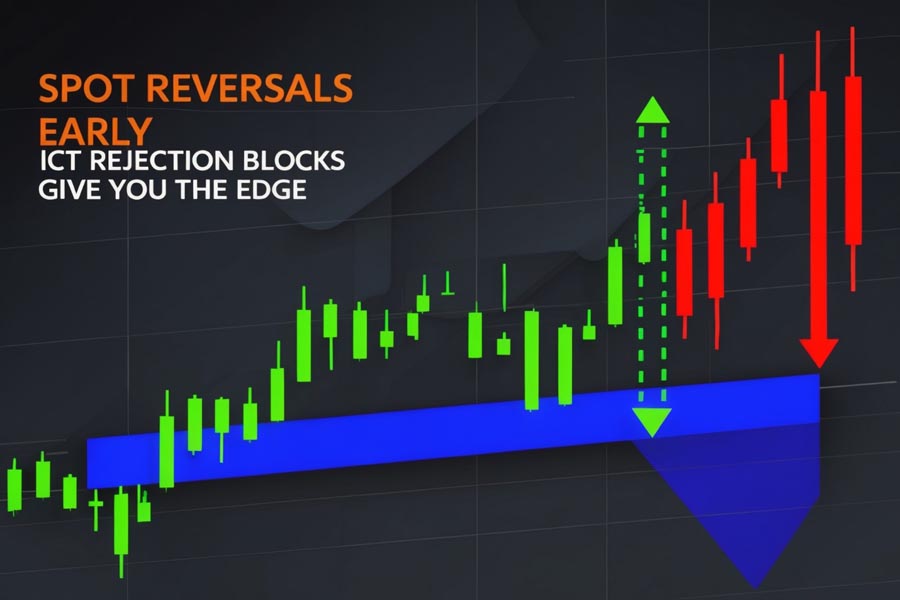

1. Early Detection of Reversals

Rejection blocks allow traders to spot reversals early. This means you can enter a trade before the market fully reverses, securing a better entry point and maximizing potential profits. Early detection is crucial in Forex trading, where price movements can be swift and unpredictable.

By entering trades at the formation of a rejection block, you position yourself advantageously, giving you more room for profit before the market moves significantly against you.

2. Clear Risk Management

Because rejection blocks occur around key levels, they naturally provide clear areas to place your stop loss. If the block fails and the price continues to break out, you can exit the trade quickly with minimal loss.

Setting your stop loss just beyond the rejection block helps you maintain a favorable risk-to-reward ratio. This clear risk management strategy is essential for long-term trading success.

3. Greater Insight into Market Sentiment

Rejection blocks give you a window into market sentiment. They show where institutional traders are likely to place their orders, allowing retail traders to follow the “smart money.”

Understanding market sentiment is critical in Forex trading. Rejection blocks often indicate a shift in buyer and seller strength, providing insights into potential future price movements.

ICT rejection blocks aren’t just another technical analysis tool; they provide deep insights into market behavior and allow traders to make informed decisions.

Trading Strategies Using ICT Rejection Blocks

Now that you understand what ICT rejection blocks are, let’s explore how you can use them effectively in your trading strategy. Below are three actionable strategies to implement:

1. Aggressive Entry Strategy

For aggressive traders, entering a trade as soon as a rejection block forms can be highly rewarding. This strategy involves identifying a rejection block and placing an entry order immediately at the formation. Set a tight stop loss just beyond the block to manage your risk effectively.

Aggressive traders thrive on quick movements and often benefit from the volatility that accompanies rejection blocks. However, this strategy requires discipline and a strong understanding of market dynamics, as it can lead to higher exposure.

2. Wait for Confirmation Strategy

A more conservative approach involves waiting for confirmation. After the price forms a rejection block, wait for the price to move slightly away from the block to confirm the reversal before entering a trade. This approach offers added assurance but may slightly reduce your potential profit.

Confirmation can come in various forms, such as a break of a minor trend line, a specific candlestick pattern, or a shift in volume. By waiting for confirmation, you can mitigate some risks associated with false signals.

3. Rejection Block with Candlestick Patterns

Combining rejection blocks with candlestick patterns, such as hammer or engulfing candles, can significantly increase the reliability of your trades. Look for a strong reversal candlestick formation immediately following a rejection block to confirm your entry.

For instance, if a rejection block forms followed by a bullish engulfing candle, this combination suggests strong buying pressure and increases the likelihood of a sustained upward move.

Applying these strategies can help traders improve their trade execution and overall performance, especially when dealing with volatile market conditions.

Common Mistakes Traders Make with ICT Rejection Blocks

While ICT rejection blocks offer valuable insights, traders often make mistakes when using them. Below are some common errors and how to avoid them:

1. Overtrading

One mistake traders often make is overtrading rejection blocks. Not every rejection block is a strong signal, so it’s essential to confirm the validity of the block before entering a trade.

Overtrading can lead to increased transaction costs and emotional fatigue. Instead, focus on quality setups that align with your trading plan and risk tolerance.

2. Ignoring Market Context

Another common error is ignoring the broader market context. Rejection blocks are most effective when analyzed in conjunction with other market factors, such as the overall trend or major news events. Always consider the bigger picture before making a decision.

For example, if the market is in a strong uptrend, a rejection block forming at a resistance level may have a different implication than if the market were in a downtrend. Keeping an eye on broader market trends can enhance your decision-making.

3. Using Blocks in Isolation

Finally, relying solely on ICT rejection blocks without other indicators can lead to poor trading decisions. For example, combining these blocks with trend lines or support and resistance zones increases their effectiveness.

Using multiple tools and indicators in your analysis provides a more comprehensive view of market conditions, allowing you to make well-informed trading decisions.

OpoFinance Services: A Reliable Trading Partner

When looking for a regulated forex broker, it’s essential to choose one that offers superior service and tools. OpoFinance, an ASIC-regulated broker, is a top choice for traders of all experience levels. Offering competitive spreads, fast execution, and advanced tools, OpoFinance ensures that traders have everything they need for success.

Additionally, OpoFinance’s social trading feature allows traders to follow the strategies of successful traders, providing a valuable learning opportunity for those looking to improve their skills. With regulatory protection and an intuitive platform, OpoFinance is a trusted partner in navigating the complexities of the Forex market.

Moreover, OpoFinance provides a wealth of educational resources, including webinars, articles, and tutorials, to help traders understand key concepts like ICT rejection blocks. This commitment to trader education sets OpoFinance apart as a broker that genuinely cares about its clients’ success.

Advanced Trading Tools

OpoFinance offers advanced trading tools that can help traders analyze market conditions more effectively. Features like customizable charts, technical indicators, and real-time market data empower traders to make informed decisions based on current market dynamics. The ability to tailor your trading platform to fit your individual needs can significantly enhance your trading experience.

Risk Management Features

Effective risk management is crucial for long-term trading success. OpoFinance provides various tools to help traders manage their risk effectively, including stop-loss orders, take-profit levels, and position sizing calculators. These features allow traders to protect their capital and minimize losses, which is especially important when trading volatile markets.

Conclusion

Mastering ICT rejection blocks is a valuable skill for any Forex trader. These price structures offer an early indication of market reversals, providing traders with a critical edge. By learning how to identify and implement rejection blocks in your trading strategy, you can make more informed decisions and increase your chances of success.

Remember, consistent practice and refinement of your strategy are key to mastering this technique. Whether you’re an aggressive trader or prefer waiting for confirmation, ICT rejection blocks can enhance your trading approach.

As you continue to develop your skills, consider keeping a trading journal to track your trades and analyze your performance. Documenting your experiences with ICT rejection blocks will help you refine your strategy over time and identify areas for improvement.

Additionally, engaging with trading communities or forums can provide valuable insights and different perspectives on using ICT rejection blocks. Sharing experiences and learning from other traders can accelerate your growth and deepen your understanding of market dynamics.

Can I use ICT rejection blocks in markets other than Forex?

Yes, ICT rejection blocks are applicable across various markets, including stocks, commodities, and cryptocurrencies. The price behavior and structure remain consistent, making them a versatile tool.

What time frame is best for identifying ICT rejection blocks?

The best time frame depends on your trading style. Day traders may use shorter time frames like 15-minute or hourly charts, while swing traders might find daily or weekly charts more effective.

Experimenting with different time frames can help you find what works best for your trading strategy and risk tolerance. It’s essential to align your time frame with your overall trading goals and objectives.

Can I combine ICT rejection blocks with other trading strategies?

Absolutely! ICT rejection blocks are most effective when combined with other technical indicators, such as moving averages or Fibonacci retracements. This combination can provide stronger trade confirmations and improve overall accuracy.

Additionally, integrating fundamental analysis into your trading can give you a more comprehensive understanding of market dynamics, further enhancing your trading strategy. Understanding economic indicators and news events can provide context for the price movements you observe.