Imagine navigating the tumultuous seas of financial markets with a reliable compass that signals when to set sail and when to hold steady. The Rising Three Methods Candlestick Pattern serves as that invaluable compass for traders, providing clear signals amidst market volatility. This powerful continuation pattern is a cornerstone in technical analysis, offering insights that can significantly enhance your trading strategy and profitability.

In the fast-paced world of trading, leveraging patterns like the Rising Three Methods Pattern can transform your approach, whether you’re engaging with a regulated forex broker or diving into stock markets. Understanding this pattern not only aids in identifying continuation signals within an uptrend but also equips traders with the knowledge to make informed, strategic decisions. This comprehensive guide delves deep into the intricacies of the Rising Three Methods Candlestick Pattern, providing you with the tools and strategies needed to harness its full potential. Let’s embark on this journey to elevate your trading prowess and achieve consistent success.

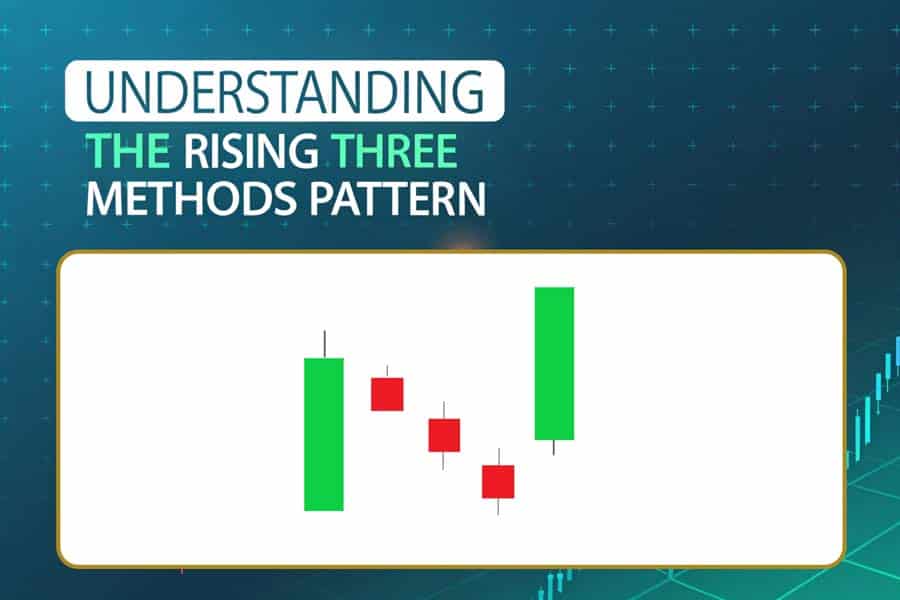

Understanding the Rising Three Methods Pattern

Learn the structure and significance of the Rising Three Methods candlestick pattern.

What is the Rising Three Methods Candlestick Pattern?

The Rising Three Methods Candlestick Pattern is a prominent continuation pattern in technical analysis, signaling that the prevailing uptrend is likely to continue after a brief consolidation phase. This pattern is characterized by a specific arrangement of bullish and bearish candles, reflecting the market’s temporary pause before resuming its upward trajectory.

Structure of the Rising Three Methods Pattern:

- First Candle: A long bullish (green) candle that signifies strong buying pressure and the continuation of an uptrend.

- Middle Candles: Three or more small bearish (red) candles that trade within the range of the first bullish candle, indicating a temporary consolidation or profit-taking phase.

- Final Candle: Another long bullish (green) candle that closes above the first candle’s close, confirming the resumption of the uptrend.

This precise formation showcases how the market absorbs minor pullbacks while maintaining overall bullish momentum, making it a reliable indicator for traders aiming to capitalize on sustained upward movements.

Read More: Forex Trading Discipline

Why is the Rising Three Methods Pattern Important?

Understanding the Rising Three Methods Pattern is essential for several reasons:

- Confirmation of Trend Strength: It reassures traders that the existing uptrend has strong underlying support and is likely to continue.

- Low-Risk Entry Points: The pattern provides strategic entry points with favorable risk-reward ratios, allowing traders to enter positions with minimized risk.

- Market Sentiment Insight: It offers a glimpse into market psychology, highlighting how bullish sentiment persists even during brief consolidations.

- Versatility Across Markets: This pattern is applicable across various financial instruments, including stocks, forex, commodities, and indices, making it a versatile tool in any trader’s arsenal.

By recognizing and interpreting this pattern, traders can enhance their decision-making process, leading to more informed and profitable trades.

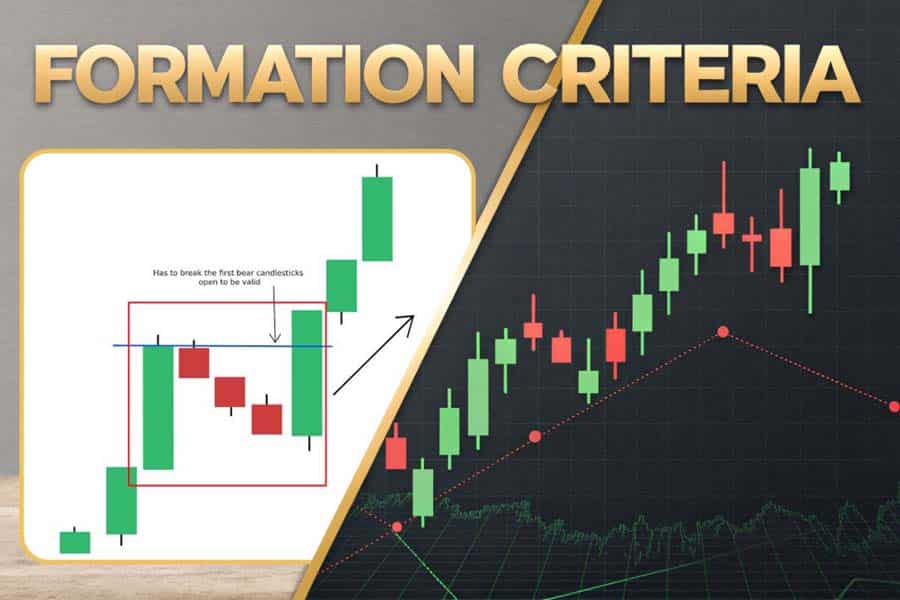

Formation Criteria of the Rising Three Methods Pattern

To effectively identify and trade the Rising Three Methods Pattern, it’s crucial to understand the specific conditions required for its formation. These criteria ensure that the pattern’s reliability is maintained, reducing the likelihood of false signals.

Understand the key formation criteria to identify the Rising Three Methods pattern.

1. Existing Uptrend

The Rising Three Methods Pattern exclusively forms within a strong bullish uptrend. An established uptrend is characterized by higher highs and higher lows, indicating sustained buying pressure. This context is essential because the pattern serves as a continuation signal rather than a reversal indicator.

Pro Tip: Utilize trend indicators like Moving Averages or the ADX (Average Directional Index) to confirm the strength and direction of the prevailing trend before identifying the pattern.

2. Characteristics of the Middle Candles

The middle segment of the pattern consists of three or more small bearish candles. These candles should:

- Trade Within the Range of the First Bullish Candle: Each bearish candle must remain within the high and low boundaries set by the initial long bullish candle.

- Exhibit Small Bodies: The bearish candles should have smaller real bodies compared to the first and final bullish candles, indicating limited selling pressure and temporary consolidation.

- Lack of Significant Movement: These candles reflect a pause in the market, where sellers take profits, but buyers remain in control.

This phase represents a consolidation or a minor pullback, where the market tests the strength of the uptrend without reversing its direction.

3. Confirmation by the Final Bullish Candle

The pattern is confirmed when a final long bullish (green) candle closes above the close of the first bullish candle. This candle signifies renewed buying interest and the resumption of the uptrend.

- Closing Above the First Candle’s Close: This is a crucial confirmation that the uptrend is intact and the consolidation phase has ended.

- Volume Confirmation (Optional): Increased volume during the final bullish candle can add further confirmation, indicating strong buying pressure.

This confirmation ensures that the temporary consolidation was not a sign of trend reversal but rather a healthy pause before continuing higher.

The Psychology Behind the Rising Three Methods Pattern

Understanding the Rising Three Methods Candlestick Pattern goes beyond recognizing its structural components. It delves into the market psychology that drives the formation of this pattern, offering insights into the behavior of traders and investors during different phases of the pattern.

1. Initial Bullish Surge

The formation begins with a strong bullish candle, reflecting robust buying pressure. This surge is typically driven by positive news, strong fundamentals, or overall market optimism, pushing prices higher and establishing the initial uptrend.

This phase showcases the dominance of buyers in the market, setting the stage for the subsequent consolidation.

2. Temporary Consolidation or Pullback

Following the initial surge, the market enters a phase of temporary consolidation, represented by the small bearish candles. This phase can be attributed to:

- Profit-Taking: Traders who entered early in the uptrend begin to take profits, causing slight selling pressure.

- Market Uncertainty: Minor economic indicators or short-term uncertainties may lead to a temporary pause as the market digests recent gains.

- Balance Between Buyers and Sellers: During this phase, the balance shifts briefly as sellers attempt to push prices lower, but buyers maintain overall control.

This consolidation is not a reversal but a healthy pause, allowing the market to absorb gains and build a foundation for the next bullish move.

3. Resumption of the Uptrend Indicating Bullish Strength

The final bullish candle signifies a resumption of the uptrend, indicating that buying pressure has regained strength after the temporary consolidation. This renewed buying interest confirms the overall bullish sentiment and suggests that the uptrend will continue.

The successful formation of this pattern reflects the resilience of the uptrend and the underlying bullish conviction among traders.

Read More: Forex Trading Tools

Trading the Rising Three Methods Pattern

Effectively trading the Rising Three Methods Candlestick Pattern involves a strategic approach that encompasses entry points, stop-loss placement, and profit targets. By adhering to proven strategies, traders can maximize their potential gains while minimizing risks.

Master trading strategies with the Rising Three Methods candlestick pattern.

Entry Strategies

1. Entering at the Close of the Final Bullish Candle

This is the most straightforward entry strategy. Traders enter a long position immediately after the final bullish candle closes above the first candle’s close. This approach ensures that the pattern is confirmed before committing to a trade.

Advantages:

- Clear confirmation of the pattern.

- Immediate entry allows capturing the subsequent upward movement.

2. Waiting for Confirmation Above the High of the Pattern

A more conservative approach involves waiting for the price to break above the highest point of the pattern before entering. This additional confirmation can reduce the likelihood of false signals.

Advantages:

- Increased confirmation reduces risk.

- Potential for higher entry price aligns with stronger bullish momentum.

Pro Tip: Combine these entry strategies with other indicators, such as Moving Averages or RSI, to enhance confirmation and improve trade accuracy.

Stop-Loss Placement

Effective risk management is crucial when trading the Rising Three Methods Pattern. Proper stop-loss placement can protect against significant losses in case the market moves against the trade.

1. Below the Low of the Entire Pattern

Placing the stop-loss below the lowest point of the consolidation phase ensures that if the price breaks below this level, the pattern’s validity is questioned, and the trade is exited to prevent further losses.

2. Below the Low of the First Bullish Candle

For tighter risk management, placing the stop-loss below the low of the first bullish candle can be effective. This approach assumes that if the price falls below this level, the uptrend may be weakening.

This method offers a balance between risk and reward, allowing for manageable stop-loss levels while maintaining the potential for significant gains.

Profit Targets

Setting clear profit targets helps traders lock in gains and manage their trades effectively.

1. Using Risk-Reward Ratios

A common practice is to set a profit target based on a favorable risk-reward ratio, such as 1:2 or 1:3. This means for every dollar risked, the trader aims to gain two or three dollars.

2. Identifying Resistance Levels

Traders can also identify key resistance levels or Fibonacci extension levels as potential exit points. These levels often act as barriers where the price may encounter selling pressure, providing natural points to take profits.

Pro Tip: Trailing stop-loss orders can be employed to lock in profits as the price moves in favor of the trade, allowing for potential upside while protecting against reversals.

Pro Tips: Advanced Strategies for the Rising Three Methods Pattern

For seasoned traders looking to refine their approach to the Rising Three Methods Candlestick Pattern, here are some advanced strategies to enhance trading effectiveness:

1. Combine with Volume Analysis

Analyzing trading volume alongside the pattern can provide deeper insights into the strength of the move. Higher volume during the final bullish candle confirms strong buying interest, increasing the reliability of the pattern.

Why It Matters: Volume is a key indicator of market participation and conviction. High volume during the final bullish candle suggests that a significant number of traders are supporting the uptrend, reducing the likelihood of a false breakout.

2. Utilize Multiple Time Frames

Examining the pattern across different time frames can improve trade precision. For instance, identifying the pattern on a daily chart and then fine-tuning entries on a 4-hour chart can enhance timing and execution.

Strategy: Use higher time frames to identify the overall trend and lower time frames to pinpoint optimal entry and exit points, ensuring that trades align with both short-term and long-term market movements.

3. Integrate with Other Technical Indicators

Enhancing the pattern with complementary indicators such as the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), or Bollinger Bands can provide additional confirmation and reduce the risk of false signals.

Example: If the RSI is in the overbought territory while the Rising Three Methods Pattern forms, it may indicate strong bullish momentum, reinforcing the pattern’s validity.

4. Diversify Across Markets

Applying the Rising Three Methods Pattern across various markets and instruments can diversify trading opportunities. Whether trading forex, stocks, or commodities, the pattern’s principles remain consistent, offering versatile application.

Benefits: Diversification reduces dependency on a single market and spreads risk, allowing traders to capitalize on multiple uptrends simultaneously.

5. Implement Automated Trading Systems

For those comfortable with technology, automating the detection and trading of the Rising Three Methods Pattern can streamline the process. Using platforms like MetaTrader 5, offered by Opofinance, traders can set up automated strategies to capitalize on the pattern efficiently.

Pro Tip: Regularly backtest and optimize automated strategies to ensure they remain effective under changing market conditions. Automation can eliminate emotional biases, ensuring consistent application of trading rules.

Comparison with Similar Patterns

Differentiating the Rising Three Methods Pattern from other candlestick and chart patterns is essential to avoid confusion and ensure accurate trade identification. Let’s compare it with the Falling Three Methods Pattern and the Bullish Flag.

Piece together how the Rising Three Methods compares with similar trading patterns.

Rising Three Methods vs. Falling Three Methods

Rising Three Methods Pattern:

- Direction: Bullish continuation.

- Structure: One long bullish candle, followed by three or more small bearish candles within the first candle’s range, and a final bullish candle.

- Market Sentiment: Buyers maintain control after a brief consolidation.

Falling Three Methods Pattern:

- Direction: Bearish continuation.

- Structure: One long bearish candle, followed by three or more small bullish candles within the first candle’s range, and a final bearish candle.

- Market Sentiment: Sellers maintain control after a brief consolidation.

Both patterns serve as continuation signals within their respective trends, but they operate in opposite directions, reflecting the prevailing market sentiment.

Rising Three Methods vs. Bullish Flag

Rising Three Methods Pattern:

- Nature: Candlestick-specific pattern.

- Formation: Detailed arrangement of bullish and bearish candles within a specific range.

- Usage: Primarily used for identifying continuation in uptrends.

Bullish Flag Pattern:

- Nature: Chart pattern involving trendlines.

- Formation: A sharp upward movement (flagpole) followed by a consolidation phase (flag) that typically slopes against the trend.

- Usage: Indicates potential continuation after the consolidation, similar to the Rising Three Methods Pattern.

While both patterns signal bullish continuation, the Rising Three Methods Pattern is more focused on candlestick arrangements, whereas the Bullish Flag incorporates broader charting elements like trendlines and price channels.

Rising Three Methods vs. Bullish Engulfing

Rising Three Methods Pattern:

- Duration: Typically spans over several trading periods.

- Structure: One long bullish candle, followed by multiple small bearish candles, and a final bullish candle.

- Signal: Continuation of the existing uptrend.

Bullish Engulfing Pattern:

- Duration: Usually spans two trading periods.

- Structure: A small bearish candle followed by a larger bullish candle that completely engulfs the previous candle.

- Signal: Potential reversal from a downtrend to an uptrend.

The Bullish Engulfing Pattern is a reversal pattern, whereas the Rising Three Methods Pattern is a continuation pattern, serving different purposes in trading strategies.

Read More: Falling Three Methods Candlestick Pattern

Limitations and Considerations

While the Rising Three Methods Candlestick Pattern is a potent tool for traders, it’s essential to recognize its limitations and the factors that can influence its effectiveness.

1. Rarity of the Pattern in Historical Data

The Rising Three Methods Pattern is relatively uncommon, especially compared to other candlestick patterns. Its rarity means that traders might not encounter it frequently, requiring patience and diligent chart analysis to identify opportunities.

Patience is key; waiting for the right setup ensures higher quality trades.

2. Potential for False Signals

Like all technical patterns, the Rising Three Methods Pattern is not infallible. False signals can occur, especially in volatile or low-volume markets where price movements are erratic and less reliable.

Implementing confirmation techniques and additional indicators can mitigate the risk of acting on false signals.

3. Importance of Combining with Other Technical Indicators

Relying solely on the Rising Three Methods Pattern can increase the risk of errors. Combining it with other technical tools enhances trade accuracy and confidence.

Recommended Indicators:

- Relative Strength Index (RSI): Helps identify overbought or oversold conditions.

- Moving Averages: Confirm trend direction and strength.

- MACD (Moving Average Convergence Divergence): Provides momentum confirmation.

- Volume Indicators: Validate the strength of the pattern through trading volume.

Integrating multiple indicators creates a robust trading strategy, increasing the likelihood of successful trades.

4. Market Conditions and External Factors

External factors such as economic news, geopolitical events, and market sentiment shifts can impact the reliability of the pattern. Sudden news releases or unexpected events can cause significant price swings, potentially disrupting the pattern’s effectiveness.

Stay informed about market news and be prepared to adjust your trading strategy accordingly.

5. Time Frame Sensitivity

The effectiveness of the Rising Three Methods Pattern can vary across different time frames. Patterns identified on longer time frames (daily, weekly) tend to carry more weight than those on shorter time frames (intraday charts).

Choose a time frame that aligns with your trading style and the pattern’s reliability within that frame.

Opofinance Services: A Trusted Partner for Traders

When navigating the complexities of trading patterns like the Rising Three Methods Candlestick Pattern, having a reliable broker is paramount. Opofinance, an ASIC-regulated forex broker, offers a suite of services tailored to empower traders at every level. Here’s why Opofinance stands out as a premier choice for traders:

- Featured on the MT5 Brokers List: Gain access to the advanced MetaTrader 5 platform, renowned for its comprehensive trading tools, seamless execution, and robust analytical capabilities.

- Social Trading Services: Learn from and emulate the strategies of experienced traders. Opofinance’s social trading platform allows you to follow top performers, enhancing your trading knowledge and performance.

- Safe and Convenient Deposits and Withdrawals: Enjoy a variety of secure and efficient transaction methods, ensuring that your funds are accessible when you need them without hassle.

- 24/7 Customer Support: Benefit from professional and responsive customer service that’s available five days a week, ready to assist with any trading inquiries or issues.

- Educational Resources: Access a wealth of educational materials, including webinars, tutorials, and market analysis, to enhance your trading skills and knowledge.

Choosing Opofinance as your forex broker means partnering with a platform that prioritizes your trading success and provides the tools and support needed to thrive in the markets.

Elevate your trading journey with Opofinance today! Sign up now to access exclusive trading tools and start mastering patterns like the Rising Three Methods Candlestick Pattern.

Conclusion

The Rising Three Methods Candlestick Pattern is a powerful continuation signal that offers traders a strategic advantage in identifying and capitalizing on sustained uptrends. By understanding its structure, the psychology behind it, and implementing effective trading strategies, traders can enhance their market analysis and improve their trading outcomes.

However, it’s essential to recognize the pattern’s limitations and complement it with other technical indicators to ensure higher accuracy and reduce the risk of false signals. Leveraging reliable trading platforms and brokers, such as Opofinance, further amplifies the potential for trading success by providing robust tools, secure trading environments, and valuable educational resources.

Incorporate the Rising Three Methods Pattern into your trading strategy today and unlock the potential for consistent, profitable trades.

Key Takeaways

- Rising Three Methods Pattern: A bullish continuation pattern indicating a pause in an uptrend before resuming higher.

- Structure: Consists of one long bullish candle, three or more small bearish candles within the first candle’s range, and a final bullish candle closing above the initial close.

- Trading Strategy: Utilize strategic entry points, place stop-loss orders below the pattern’s low, and set profit targets based on risk-reward ratios or resistance levels.

- Advanced Tips: Combine with volume analysis, use multiple time frames, integrate other technical indicators, diversify across markets, and consider automated trading systems.

- Reliable Broker: Partner with Opofinance, an ASIC-regulated broker, for secure trading, advanced platforms, social trading, and excellent customer support.

- Limitations: The pattern is rare and can produce false signals; always confirm with additional indicators and consider market conditions.

How Does the Rising Three Methods Pattern Differ in Various Markets?

The Rising Three Methods Pattern maintains its core structure across different markets, whether in stocks, forex, or commodities. However, its reliability can vary based on market volatility, liquidity, and the specific characteristics of the asset being traded. In highly liquid markets like forex, the pattern may offer more reliable signals due to the consistent participation of traders and smoother price movements. Conversely, in less liquid or highly volatile markets, the pattern may produce more false signals, requiring additional confirmation from other indicators.

Ensuring the pattern aligns with the overall market conditions enhances its effectiveness and reduces the likelihood of false signals.

Can the Rising Three Methods Pattern Indicate Reversals in Trends?

No, the Rising Three Methods Pattern is fundamentally a continuation pattern, signaling the persistence of an existing uptrend rather than indicating a reversal. If you’re looking for reversal signals, other patterns like the Hammer, Hanging Man, or Engulfing patterns are more appropriate. However, it’s crucial to ensure that the market context aligns with the pattern’s intended signal to avoid misinterpretation.

Always consider the prevailing trend and market conditions when interpreting candlestick patterns to ensure accurate trading decisions.

What Time Frames are Most Effective for Trading the Rising Three Methods Pattern?

he Rising Three Methods Pattern can be effectively identified and traded across various time frames, from intraday charts (such as 15-minute or hourly) to daily and weekly charts. The choice of time frame depends on your trading style:

Day Traders: May prefer shorter time frames like 15-minute or 1-hour charts to capitalize on quick price movements.

Swing Traders: Often use 4-hour or daily charts to capture medium-term trends.

Long-Term Investors: Might analyze weekly or monthly charts to identify significant trend continuations.

Selecting the appropriate time frame that aligns with your trading strategy and risk tolerance is essential for optimizing the pattern’s effectiveness.