Do you find it stressful trying to pick the exact right moment to enter or exit a Forex trade? Many traders do. Putting your full trade size on the line at a single price point can feel risky, particularly when markets are moving quickly. But what if you could manage your trades more flexibly, entering and exiting in stages? This is exactly what scaling in and out of positions in Forex allows you to do. It’s a measured way to handle your trades piece by piece, which can help lower risk and stress. Let’s dive into how this technique of scaling in and out of positions in Forex can improve your trading.

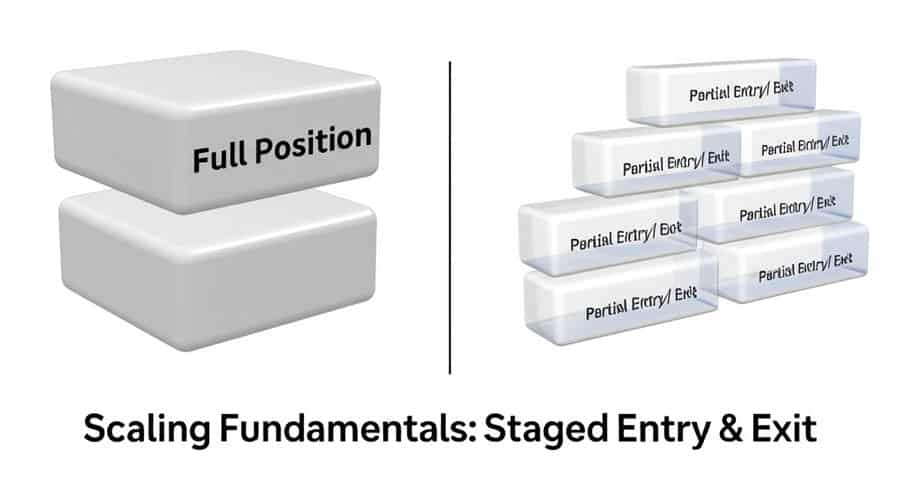

Understanding Scaling Fundamentals

Scaling isn’t about making things complicated; it’s about giving yourself strategic options. Before we get into the specifics, let’s make sure we understand what scaling means in trading and how it differs from other methods.

What is Scaling In and Out?

Scaling in is like testing the water before jumping in. Instead of putting your full planned amount into a trade at one price, you divide it into smaller parts and enter these parts at different price levels. Scaling out is the opposite – when your trade is profitable, you close it out in sections at various price targets instead of exiting completely at one spot. This approach helps manage your market exposure step by step. Understanding this is key to effective scaling in and out of positions in Forex.

Basic Principles of Position Scaling

The main idea behind Forex position scaling strategies is to handle market uncertainty and manage risk better. When you scale in, you risk less money initially. If the price goes against you a little before turning in your favor, later entries can give you a better overall entry price. When you scale out, you lock in profits as you go. This makes it less likely that a sudden market reversal will erase all your gains. It’s a balance between taking profits and aiming for more.

Read More: Risk management principles for both novice and advanced traders

Difference Between Scaling and Other Strategies

It’s important to distinguish planned scaling from simply adding more money to a losing trade without a clear strategy (often called averaging down), which is very risky. Real scaling is planned in advance. You decide your entry or exit levels, how much to trade at each level, and your risk limits before you start. It’s also different from just entering and exiting at single price points, which needs very precise timing. Scaling accepts that perfect timing is hard to achieve and provides a structured way to deal with that uncertainty. Proper scaling in and out of positions in Forex requires this structured approach.

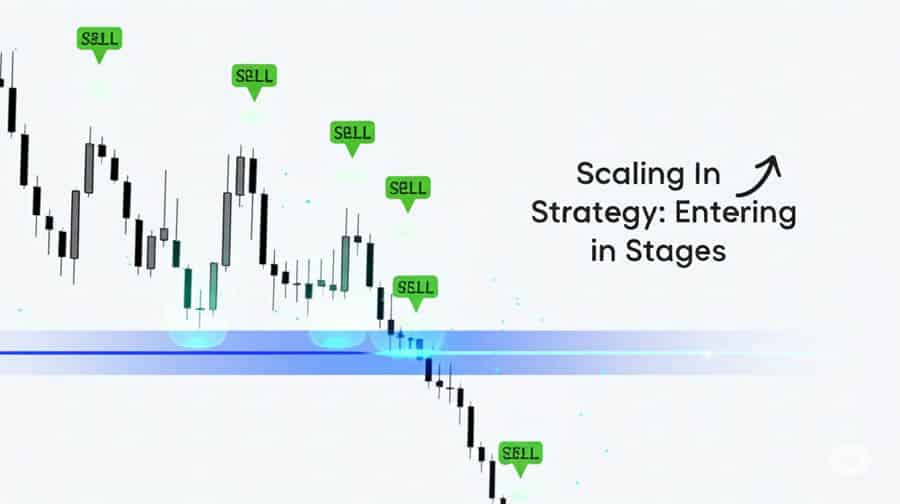

Scaling In Strategy

Scaling into a trade is a planned way to enter the market. It lets you build up your position based on how the market is actually behaving, rather than betting everything on one price level. Applying scaling in and out of positions in Forex starts with understanding how to scale in correctly.

Definition and Mechanics of Scaling In

Scaling in forex trading involves splitting your total desired trade amount into smaller chunks. For example, instead of immediately buying 1 standard lot of USD/JPY, you might plan to buy 0.3 lots first, then another 0.3 lots if the price drops to a support level you’ve identified, and maybe the last 0.4 lots if it reaches a lower support area – assuming your reasons for buying still hold true. Each entry point is chosen based on specific technical signals or levels.

When to Use Scaling In Techniques

This method is especially helpful when:

- You’re uncertain about the exact price where the market might turn near important support or resistance areas.

- The market is pulling back within a trend – scaling in might let you get better prices if the pullback goes a bit deeper.

- You expect a price breakout but want some confirmation before committing your full capital.

- Markets are very choppy and unpredictable (high volatility).

Position Sizing for Scaling In

This is very important: plan your position sizes carefully. First, decide the maximum amount of money you are willing to risk on the entire trade idea (like 1% of your account balance). Then, figure out the total position size you intend to build up. Size each smaller entry so that if all your planned entries get filled and your final stop-loss is hit, the total loss doesn’t go over your preset risk limit. Some traders make all entry sizes equal, while others might slightly increase the size for later entries if their confidence in the trade grows.

Using Technical Indicators for Scaling In Decisions

Technical analysis helps you find sensible price levels for your scale-in entries. Common tools include:

- Support/Resistance Levels: Important price zones where buying or selling activity is expected to increase.

- Fibonacci Retracements: Frequently watched pullback levels (e.g., 50% or 61.8%) within an ongoing trend.

- Moving Averages: Price averages that can act as dynamic support or resistance lines.

- Trendlines: Lines drawn connecting lows (in an uptrend) or highs (in a downtrend) that price might return to.

- Oscillators (like RSI): Indicators that help identify potentially ‘oversold’ conditions in an uptrend or ‘overbought’ conditions in a downtrend, signalling possible pullback entry opportunities.

Using these tools helps structure the process of scaling in and out of positions in Forex.

Benefits of Scaling In

Using a scale-in strategy provides clear benefits that go beyond just the chance of getting a better average entry price. It affects how you manage risk and how you feel emotionally about the trade.

Read More: Drawdown Management in Forex

Risk Management Advantages

The biggest advantage is lower risk at the start. Because you only enter with a part of your intended size, if the market immediately moves against you, your initial loss is smaller than if you had entered with the full amount. This gives your trade more ‘breathing room’ to develop without causing a big initial loss. Effective scaling in and out of positions in Forex always puts risk management first.

Psychological Benefits for Traders

Scaling in can relieve much of the pressure traders feel about finding the ‘perfect’ entry point. It reduces the “Fear Of Missing Out” (FOMO) because you get partially involved sooner rather than later. It also makes committing capital less stressful compared to placing a large bet all at once, which can help you follow your trading plan more calmly and rationally.

Improving Average Entry Price

If the market goes slightly against your first entry before moving in your desired direction (for example, a deeper pullback than expected), adding more parts of your position at these better prices will lower your overall average entry cost. If the trade eventually succeeds, this better average price means potentially higher profits.

Confidence Building Through Gradual Position Building

Successfully adding to your position as the market confirms your initial idea can build trading confidence. Each additional entry feels like proof that your analysis was right. This step-by-step way of building a position often feels less daunting than committing fully from the start, which is especially helpful for newer traders or when trading larger amounts.

Scaling Out Strategy

While scaling in helps manage entries, scaling out helps manage exits and secure profits. It involves systematically closing parts of a winning trade as it progresses. Understanding scaling out is crucial for complete scaling in and out of positions in Forex.

Definition and Mechanics of Scaling Out

Scaling out trading techniques mean closing portions of your open trade at different, predetermined profit levels. For instance, if you are holding a long position of 1 lot on GBP/CAD and it moves 75 pips in your favor, you might close 0.4 lots. If it then reaches 150 pips profit, you could close another 0.3 lots, leaving the final 0.3 lots running with a tighter stop loss to capture potentially more gains. You are banking profits along the way.

Methods to Exit Positions Partially

How do you decide where to take these partial profits? Common methods are:

- Fixed Pip or Risk/Reward Targets: Closing parts at specific pip intervals or when certain risk/reward ratios are met (like closing the first part at 1:1 R/R).

- Technical Levels: Taking profits near key resistance zones (for long trades) or support zones (for short trades).

- Fibonacci Extensions: Using calculated price projection levels (like 1.618 or 2.0) as potential exit targets.

- Volatility-Based Targets: Setting targets based on multiples of the Average True Range (ATR) indicator.

- Chart Patterns: Exiting when price reaches the target implied by a completed chart pattern.

Setting Profit Targets for Scaling Out

It’s essential that you decide on these partial profit targets before you enter the trade, as part of your overall plan. Targets should be realistic and based on market structure and how much the price is likely to move. The first target is often set at a point where the initial risk can be covered, making the rest of the trade feel less risky.

Multiple Exit Points Strategy

Using several exit points allows you to balance taking profits now versus potentially making much larger profits later. Securing some profit early makes the trade less stressful and reduces the risk of giving everything back if the market reverses. This makes it easier psychologically to hold the remaining part of the position for a bigger move. It’s a key element in many Forex position scaling strategies.

Practical Implementation

Knowing the theory is good, but applying it well needs a clear plan and discipline. Let’s outline the steps for putting scaling in and out of positions in Forex into practice.

Step-by-Step Guide for Scaling In

- Define Total Risk: Decide the maximum percentage or dollar amount of your capital you’ll risk on this entire trade idea.

- Determine Max Position Size: Calculate the total position size you plan to build based on your risk limit and stop-loss distance.

- Identify Scale-In Levels: Use technical analysis (support, resistance, Fibonacci, etc.) to choose logical entry price points.

- Allocate Size per Entry: Decide how much of the total size to enter at each level (e.g., evenly divided, or weighted differently).

- Set Initial Stop Loss: Place your stop loss for the first part of the trade.

- Manage Overall Stop: As you add more parts, ensure your main stop loss (often placed beyond the last potential entry level) keeps the total potential loss within your initial risk budget.

- Execute: Place your orders (limit or market) as price reaches your planned levels and stick to your sizing plan.

Step-by-Step Guide for Scaling Out

- Define Profit Targets: Before trading, set multiple, realistic take-profit levels based on your analysis (resistance, extensions, etc.).

- Allocate Size per Exit: Decide what fraction or percentage of your position to close at each target level (e.g., 50% at TP1, 30% at TP2, leave 20% running).

- Set Take Profit Orders: Place these orders in your trading platform so the partial closes happen automatically.

- Manage Stop Loss for Remainder: Very important! As you take profits, adjust the stop loss for the part still open – often moving it to breakeven after the first target is hit, and then possibly trailing it.

- Execute: Let the market hit your take-profit orders, or manually close parts if your plan requires it.

FIFO Rule Considerations

Important note, especially for US traders: The First-In, First-Out (FIFO) rule states that if you have multiple trades open in the same currency pair, you have to close the oldest one first. This affects scaling out trading techniques if you wanted to close a newer part of your position first. You need to plan your exits knowing you’ll close the earliest entries first, or use brokers/platforms that handle FIFO automatically.

Position Management Techniques

Scaling isn’t a ‘set it and forget it’ strategy. It needs active management. This includes watching how the trade develops, adjusting stop losses (especially after taking partial profits), and being ready to close the entire position if the market conditions change significantly against your original idea. Consistent scaling in and out of positions in Forex requires this ongoing attention.

Advanced Scaling Techniques

Once you’ve mastered the basics of scaling, you can explore more advanced methods to fine-tune your approach for different market situations and analysis styles. These advanced techniques enhance the flexibility of scaling in and out of positions in Forex.

Using Fibonacci Levels for Scaling

Fibonacci tools work very well with scaling. Retracement levels (like 50% and 61.8%) are commonly used to find potential areas to scale into trades during pullbacks in a trend. Extension levels (like 1.618 and 2.0) offer logical price targets for scaling out of winning trades, suggesting where a price move might run out of steam.

Trend-Based Scaling Strategies

In markets with strong trends, a dynamic scaling strategy can be effective. You might scale in during small pullbacks to a key moving average. Then, as the trend continues, you could use scaling out trading techniques by taking partial profits at significant price levels or using a trailing stop loss for the remaining part to capture as much of the trend movement as possible. This method aligns well with the goals of many Forex position scaling strategies.

Scaling During Consolidation Periods

Scaling can also be used in markets moving sideways (ranging), but it requires extra care. A trader might scale into short positions near the top of the expected range, adding more if the price pushes a little higher but stays within the resistance zone. Or they might scale into long positions near the range bottom. Scale-out points would likely be near the middle of the range or the opposite boundary. The main risk here is the price breaking out of the range unexpectedly.

Adapting Scaling to Market Volatility

The market’s current volatility (how much prices are swinging) should influence your scaling plan. When volatility is high (you can measure this with indicators like ATR), you should probably set your scale-in entry points and scale-out targets further apart. You might also need to use smaller position sizes for each part to manage the higher risk. In low-volatility markets, these points can be closer together. Adjusting your scaling in and out of positions in Forex based on volatility makes the strategy more adaptable.

Risk Management with Scaling

Although scaling offers risk benefits, it also creates specific challenges that must be managed carefully. If risk isn’t controlled properly, the advantages of scaling in and out of positions in Forex can disappear.

Read More: Stop Loss in Forex

Setting Appropriate Stop Losses When Scaling

This is one of the most critical parts of risk management when scaling. If you have multiple entry prices, where should the stop loss go? Common ways to handle this:

- One Main Stop Loss: Set a single stop for the entire potential position, placed beyond the last likely scale-in level (below support for longs, above resistance for shorts). Your total risk calculation must use this stop level and your maximum planned total size.

- Constant Dollar Risk: Keep the stop-loss price the same, but carefully calculate the size of each added part so that the total dollar amount you risk never exceeds your initial plan, even as your average entry price changes.

The number one rule is to ensure the total potential loss, if all planned entries are filled and the stop loss is triggered, stays within your acceptable risk limit.

Position Sizing Calculations

Accurate calculations are essential. You need to determine the size for each entry portion based on its entry price, the location of your overall stop loss, and your total risk budget for that specific trade. This prevents accidentally risking too much money if multiple entries get triggered. This precision is vital for responsible scaling in and out of positions in Forex.

Managing Overall Exposure

Scaling in can lead to a larger final position size than you might normally take with a single entry. Always be aware of your total potential exposure compared to your account size. Make sure the maximum position doesn’t put your account at excessive risk, especially if you are scaling into trades on multiple currency pairs at the same time.

Avoiding Common Scaling Mistakes

Be careful to avoid these common errors:

- Chasing Price: Adding more to your position impulsively as the price moves, instead of at your pre-planned levels.

- Bad Averaging Down: Mistaking strategic scaling for adding to a losing trade without a good reason, just hoping it will turn around. This is dangerous gambling, not scaling.

- Ignoring Stop Loss Adjustments: Forgetting to manage your stop loss properly as your position size and average price change.

- Overlooking Rules (like FIFO): For traders affected, not accounting for rules like FIFO can cause problems when trying to close specific parts of a trade.

- Trading Without a Plan: Trying to scale without first defining your entry levels, exit targets, position sizes, and risk controls. Successful scaling in forex trading requires a clear plan.

Real-World Examples

Let’s look at how scaling might work in practice:

Currency Pair Specific Examples

- EUR/USD Bullish Example: Imagine EUR/USD is trending up and pulls back near 1.0800 support. You plan to scale in: Buy 0.2 lots at 1.0810, add 0.3 lots at 1.0800 (key support). Your total size is 0.5 lots. The stop loss for the whole trade might be at 1.0770. You could plan to scale out by closing 0.2 lots at 1.0880 (first target) and the remaining 0.3 lots at 1.0950 (second target). This is a practical example of scaling in and out of positions in Forex.

- GBP/JPY Bearish Example: Suppose GBP/JPY hits resistance at 198.50. You decide to scale into a short: Sell 0.5 lots at 198.40, add another 0.5 lots if it briefly touches 198.50. Total size 1.0 lot. Stop loss above 198.80. Scale-out targets might be 197.50 and 196.80.

Trending Market Scaling Example

Consider CAD/CHF in a clear downtrend, pulling back to the 50-day moving average. A trader might scale in short: first entry when price touches the MA, second entry if it pushes slightly above but fails to hold. As the downtrend resumes, they use scaling out trading techniques: take profit 1 at 1:1 risk/reward, take profit 2 at the previous low, and trail the stop loss on the final portion. This illustrates applying scaling in and out of positions in Forex within a trend.

Ranging Market Scaling Example

If AUD/NZD is stuck between 1.0900 and 1.1000, a trader might scale into longs near the bottom: buy a part at 1.0910, add more at 1.0900 if it holds. Stop loss just below 1.0900 (e.g., 1.0885). Scaling out could occur near the middle (1.0950) and near the top (1.0990). Careful stop management is key here.

Scaling During News Events

Using scaling around major news (like employment reports or central bank announcements) is very risky due to potential high volatility. A cautious trader might enter a very small position before the news. If the news causes a spike against them but the price holds at a key level, they might consider scaling in (with strict risk control). If the news confirms their view, they could scale in on a pullback after the initial chaotic move. Quickly scaling out during news-driven spikes is also common to lock in fast profits.

Trade with Confidence with Opofinance

Thinking about using strategies like scaling? Opofinance, regulated by ASIC, offers a secure and feature-rich platform to support your Forex trading activities.

- Advanced Trading Platforms: Use popular platforms like MT4, MT5, cTrader, or the unique OpoTrade platform – choose what works best for your trading style.

- Innovative AI Tools: Get insights and support from AI-powered tools including the Market Analyzer, AI Coach, and AI Support features.

- Diverse Trading Options: Explore different ways to trade with Social Trading and Prop Trading programs alongside standard Forex trading.

- Secure & Flexible Transactions: Fund your account easily and securely, including with crypto payments. Enjoy convenient withdrawals with zero fees charged by Opofinance.

Improve your trading experience with reliable technology and helpful resources.

Conclusion: Integrating Scaling Wisely

In summary, scaling in and out of positions in Forex is a flexible technique, not a guaranteed winning formula. Used correctly, it provides real benefits for managing risk, handling entries and exits more dynamically, and lowering trading stress. Success depends heavily on careful planning – defining your levels, sizes, and risk strategy beforehand – and disciplined execution. Consider scaling as a valuable addition to your trading methods, integrated within your overall plan, to help navigate the Forex market more effectively. Smart scaling in and out of positions in Forex can be a useful skill.

Key Takeaways

- What It Is: Scaling in means entering trades in parts; Scaling out means exiting trades in parts.

- Why Do It: Better risk control, potential for better average entry (scaling in), secures profits (scaling out), less emotional pressure.

- Scaling In Needs: Planned entry levels, calculated size for each part, clear total risk limit.

- Scaling Out Needs: Planned profit targets, decisions on how much to close, active stop-loss updates for the rest.

- Plan First: Define risk, size, levels, and stops before trading. Avoid unplanned scaling.

- Control Risk: Keep total potential loss within limits. Know rules like FIFO if they apply to you.

- Flexible: Can be used with technical analysis, adapted for trends or ranges, and adjusted for market volatility. This adaptability is key to scaling in and out of positions in Forex.

- Not for Everyone: Might not fit very short-term (scalping) strategies well.

Is scaling suitable for beginner Forex traders?

It can be, but requires extra care. The smaller initial risk when scaling in can seem attractive to beginners. However, managing multiple entries, calculating the right size for each, and adjusting the overall stop loss correctly adds layers of complexity compared to a single entry/exit. Beginners must fully grasp position sizing and risk management across multiple entries before trying it. Perhaps starting with scaling out (taking partial profits) is a simpler first step.

Does scaling work better in trending or ranging markets?

Scaling strategies can be adjusted for both market types. In trends, scaling in on pullbacks helps traders join the move, and scaling out can maximize profit potential. In ranges, traders might scale in near the edges and scale out towards the middle or opposite edge. Each market condition needs a tailored approach for setting levels and managing risk, but Forex position scaling strategies offer this flexibility.

How does the FIFO rule specifically impact scaling out?

The First-In, First-Out (FIFO) rule, which mainly affects US traders, requires that if you entered a trade in multiple parts (say, Buy 1, Buy 2, Buy 3), you must close Buy 1 first when you decide to scale out. You cannot choose to close Buy 3 first, even if it has the worst entry price. This means your plan for taking partial profits must account for closing the oldest parts first, which might differ from closing the parts you ideally wanted to exit based purely on price.

One Response

Great breakdown on scaling strategies – it’s often overlooked how exiting in portions can help lock in gains while letting the rest run. Timing the exits, though, still seems like more art than science!