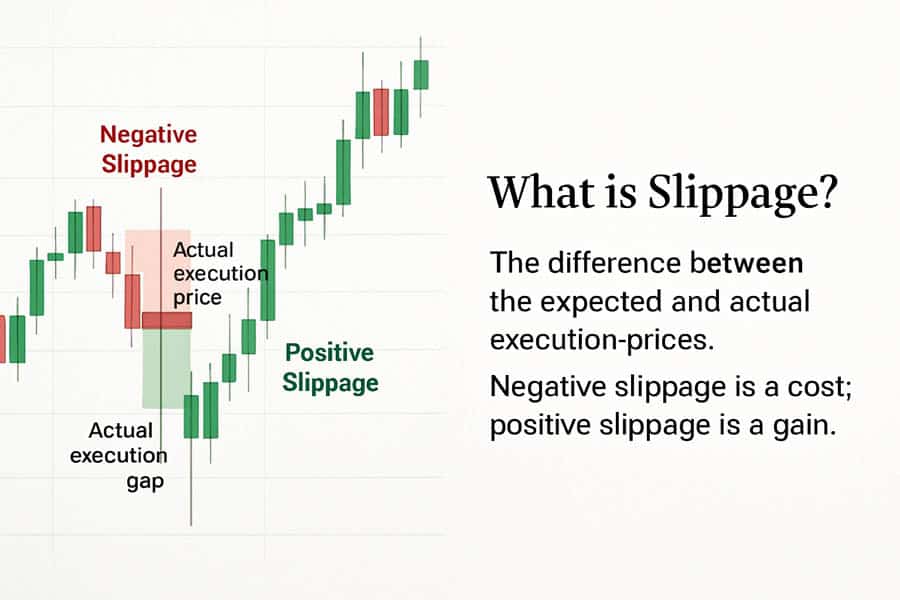

In the fast-paced world of forex trading, unexpected costs can erode profits and even blow a funded challenge account. One of the most critical yet often misunderstood of these costs is slippage. So, what is slippage in forex trading? It’s the difference between the price at which you expect your trade to be executed and the actual price at which it is filled.

This article will not only define this crucial concept but also provide a complete playbook of actionable tactics to manage, mitigate, and even use slippage to your advantage. Whether you’re a new trader or a seasoned pro managing prop firm capital, understanding slippage in forex is non-negotiable for long-term success with your chosen online forex broker.

Key Takeaways

- What is Slippage? Slippage is the difference between the expected execution price of a trade and the actual execution price. It can be negative (worse price), positive (better price), or zero.

- Primary Causes: The main drivers of slippage are high market volatility (especially during news events) and low liquidity (periods of fewer buyers and sellers).

- Risk for Prop Traders: For proprietary firm traders, even minor negative slippage can lead to a breach of strict daily drawdown or maximum loss rules, resulting in account termination.

- Mitigation is Key: You cannot eliminate slippage entirely, but you can significantly reduce its impact by using limit orders, avoiding low-liquidity periods, and choosing a broker with superior execution technology.

- Order Types Matter: Market orders are most vulnerable to slippage. Limit orders and stop-limit orders provide greater control over your entry and exit prices.

- Technology & Broker Choice: A broker’s server latency, execution model (ECN/STP vs. Dealing Desk), and the availability of a Virtual Private Server (VPS) are critical factors in minimizing slippage.

Beat Slippage Before It Beats Your Challenge

For a prop firm trader, managing slippage isn’t just about protecting profit; it’s about survival. The tight risk parameters of funded accounts mean that a few pips of unexpected loss can be the difference between passing a challenge and losing your opportunity. The key is to be proactive, not reactive.

By integrating specific habits and tools into your trading plan, you can build a robust defense against the detrimental effects of negative slippage. Below are proven tactics that successful traders employ to keep their accounts safe and their performance consistent.

Trade Only Peak-Liquidity Windows

Liquidity is the lifeblood of efficient markets and your number one shield against slippage. Liquidity refers to the level of buy and sell orders available at any given time. When liquidity is high, your order can be matched quickly and at a price very close to what you see on your screen.

The highest liquidity in the forex market occurs during the overlap of major trading sessions, specifically the London and New York session overlap (approximately 8:00 AM to 12:00 PM EST). During this four-hour window, trading volume is at its peak, which tightens spreads and dramatically reduces the likelihood of significant slippage in trading. Conversely, you should be extremely cautious during low-liquidity times like the Asian session for non-Asian pairs, major holidays, and especially the Sunday market open, which is notorious for gaps and severe slippage.

Use Limit Orders, Not Pure Market Orders

Understanding your order types is fundamental to controlling your execution price. A market order instructs your broker to execute your trade immediately at the best available price. While this ensures your order gets filled, it offers no protection against slippage. In a fast-moving market, “the best available price” could be many pips away from your intended entry.

A limit order, however, provides a safeguard. A buy limit order can only be executed at your specified price or lower, while a sell limit order can only be executed at your specified price or higher. This gives you absolute control over the worst-case price you are willing to accept. The trade-off is that your order may not be filled at all if the market moves away from your limit price, but for a trader focused on risk management, preventing a bad entry due to slippage is often more important than guaranteeing an entry.

Know the Economic Calendar

Major economic news releases are a primary catalyst for extreme volatility and, consequently, severe slippage. Events like the Non-Farm Payrolls (NFP) report, central bank interest rate decisions, and inflation data (CPI) can cause price to gap tens or even hundreds of pips in seconds. During these periods, liquidity providers widen their spreads dramatically or pull out of the market altogether, making it nearly impossible to get filled at your desired price.

The professional approach is to either have a pre-positioned trade with a wide stop loss well ahead of the news or, more prudently, to stay flat (i.e., have no open positions). Attempting to trade the news release itself without a sophisticated strategy is a recipe for disaster, as the ensuing slippage can blow past your stop loss, leading to a much larger loss than anticipated.

Pick Prop Firms with Fast Execution

Not all brokers are created equal, and this is especially true when it comes to execution quality. The technology and infrastructure of your broker or prop firm play a massive role in the amount of slippage you experience. Look for firms that offer an ECN/STP (Electronic Communication Network/Straight Through Processing) execution model. This means your orders are passed directly to a pool of liquidity providers, promoting competition and better fill prices.

Furthermore, investigate their execution speed and server location. A broker whose servers are located in the same data center as major liquidity providers (e.g., London’s LD4 or New York’s NY4) can offer significantly lower latency. Many top-tier prop firms also offer Virtual Private Server (VPS) options, which allow you to run your trading platform on a server in close physical proximity to the firm’s trade server, reducing latency and potential slippage.

Specify Slippage Tolerance in Your Platform

Some trading platforms, like MetaTrader 4/5 and cTrader, have built-in features that allow you to specify a maximum slippage tolerance. This setting, often called “maximum deviation,” lets you define the maximum number of pips away from your requested price that you are willing to accept for a market order fill. For example, if you set a maximum deviation of 2 pips on a buy order at 1.10000, your order will only be filled if the execution price is between 1.10000 and 1.10020. If the market moves beyond that range before your order can be filled, the order is cancelled. This is a powerful tool for preventing catastrophic slippage during volatile conditions.

Read More: Best Forex Broker With Lowest Spread

What Is Slippage in Forex Trading?

Now that we’ve covered how to fight it, let’s break down the opponent. In the simplest terms, slippage in forex is the inevitable reality that the price you click is not always the price you get.

It is the difference, measured in pips, between the price you see on your screen when you hit “buy” or “sell” and the actual price your broker executes the trade at. This discrepancy occurs because there’s a small delay between the moment you send your order and the moment the broker’s server receives and executes it. In that fraction of a second, the market price can change.

- Negative Slippage: This is the most common and feared type. It occurs when your buy order is filled at a higher price than requested, or your sell order is filled at a lower price. For example, you place a buy order for EUR/USD at 1.0850, but it gets filled at 1.0852. You’ve experienced 2 pips of negative slippage.

- Positive Slippage: This is the happy accident of trading. It happens when your buy order is filled at a lower price, or your sell order is filled at a higher price than requested. For example, you place a sell order for GBP/JPY at 198.20, and it gets filled at 198.23. You’ve gained an extra 3 pips from positive slippage. This is a tangible benefit of trading with a true ECN broker who passes on favorable price improvements.

For a retail trader, a few pips of negative slippage might be an annoyance. For a prop firm trader, it’s a critical threat. Funded accounts operate under strict drawdown rules, often a maximum of 4-5% daily loss. If you plan a trade with a 20-pip stop loss, but 10 pips of slippage on entry and another 10 on exit turn it into a 40-pip loss, you could easily breach your daily limit and lose the account. This makes understanding and controlling slippage in trading a paramount skill.

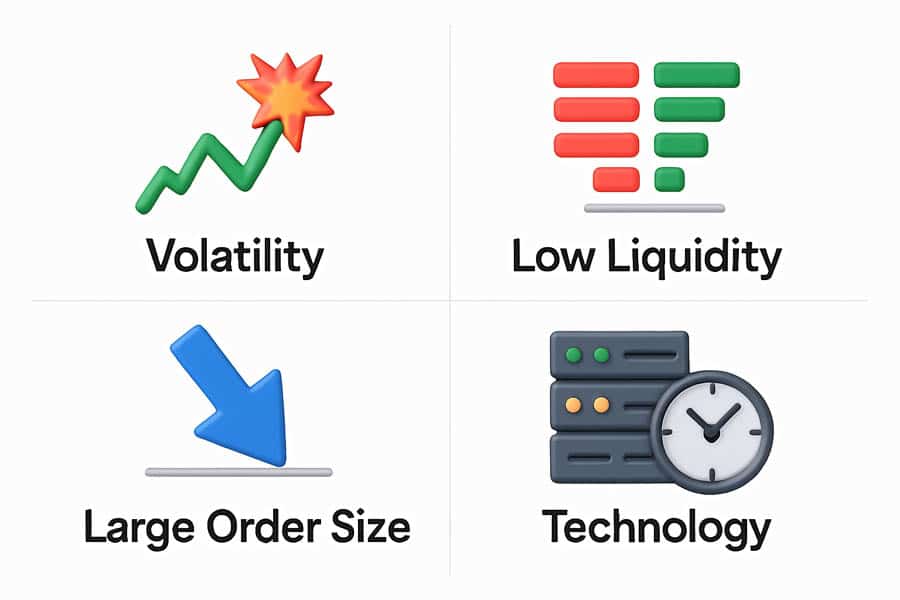

4 Core Causes Every Trader Must Monitor

Slippage is not random; it is caused by specific market conditions and technological factors. By understanding these root causes, you can learn to anticipate when slippage is most likely to occur and take preemptive measures. Monitoring these four core drivers is an essential part of a professional trader’s routine.

High Volatility Spikes

Volatility is a double-edged sword. While it creates profit opportunities, it is also the number one cause of slippage. During periods of high volatility, prices are changing with incredible speed. These spikes are most often triggered by major economic news releases, unexpected geopolitical events, or central bank announcements.

When the market moves dozens of pips in a single second, the price at which you place your order can become stale by the time it reaches the execution server. The market has already moved on, and your order is filled at the next available price, which could be significantly different.

Low Liquidity Periods

Liquidity acts as a buffer against price shocks. When there are many buyers and sellers in the market (high liquidity), large orders can be absorbed without causing a major price shift. However, when liquidity is low, even a moderately sized order can have a significant price impact because there aren’t enough opposing orders to fill it at the current price level.

This forces the execution to “slip” to the next available price levels to find enough volume. This is common with exotic currency pairs, which naturally have less trading volume than majors, and during specific times like the “dead zone” between the New York close and the Tokyo open.

Large Order Size vs. Depth of Book

The “depth of market” (DOM) shows the volume of buy and sell orders at different price levels. If you place a very large market order (e.g., 50 standard lots), it may exhaust all the available liquidity at the best price. Your order will then consume liquidity at the next best price, and the next, and so on, until the entire order is filled.

This process, known as “market impact,” results in an average fill price that is worse than the price you initially saw. This is a form of slippage that is directly caused by the trader’s own order size relative to the available liquidity.

Tech and Execution Delays

The final piece of the puzzle is technology. Every step of the trade execution process takes time, albeit milliseconds. The delay includes the time it takes for the signal to travel from your home PC to your broker’s server (latency), the time the broker’s internal systems take to process the order, and the time it takes to confirm the fill with the liquidity provider. A slow internet connection, a distant server location, or an inefficient broker platform can all increase this total delay, providing a larger window for the market price to move and for slippage to occur.

Real-World Case Studies

Theory is important, but seeing how slippage plays out in the real world drives the lesson home. These examples, from major market events to the daily grind of a prop firm trader, illustrate the tangible impact of execution discrepancies and why managing them is so critical.

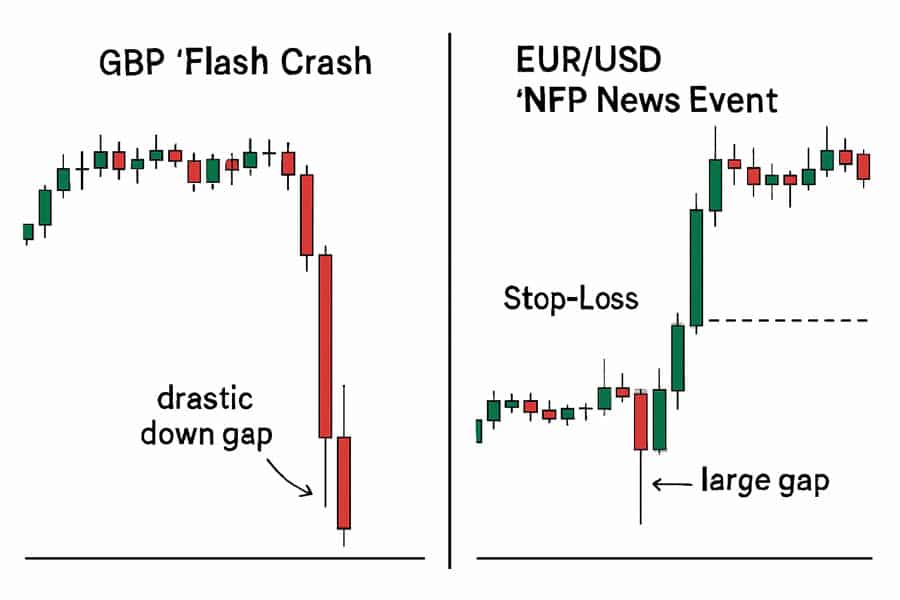

The 2016 GBP “Flash Crash”

One of the most infamous examples of catastrophic slippage occurred on October 7, 2016. In the span of just a few minutes during the illiquid Asian session, the British Pound (GBP) plummeted by more than 6% against the US Dollar. Traders who had stop-loss orders in place found that their orders were not filled anywhere near their specified levels. The speed and severity of the crash created a liquidity vacuum; there were simply no buyers at the stop-loss prices. As a result, stops were “slipped” by hundreds of pips, executing at the first available bid price far below. This event wiped out countless trading accounts and served as a harsh lesson on the dangers of holding positions during extremely low-liquidity periods.

A Prop Firm Trader Blown by NFP

Consider a prop firm trader managing a $100,000 account with a $4,000 maximum daily drawdown. The trader decides to trade the Non-Farm Payrolls (NFP) release, anticipating a move in EUR/USD. They place a buy stop order 5 pips above the current price, with a 15-pip stop loss. At the moment of the release, the data is unexpectedly strong for the USD, and EUR/USD instantly gaps down by 30 pips.

The trader’s buy stop is never triggered. However, had they been in a long position, their 15-pip stop loss at, say, 1.0950 would have been gapped through. The first available price might have been 1.0920, resulting in a 30-pip loss instead of the planned 15. This 30-pip loss on a moderately sized position could easily exceed the $4,000 daily loss limit, instantly failing the challenge due to slippage.

Positive Slippage: A Welcome Surprise

It’s not all doom and gloom. Imagine a trader places a buy limit order on USD/JPY at 155.50 during a period of high liquidity. A sudden surge of selling pressure pushes the price down rapidly through their limit price. A high-quality ECN broker, committed to price improvement, fills the trader’s order at 155.45, the best available price at that moment. The trader has just benefited from 5 pips of positive slippage, getting a better entry than they had hoped for. This demonstrates that while you must protect against the downside, a good execution environment can sometimes reward you.

Read More: What Is the Spread in Forex and How do you Calculate It?

Toolbox: Practical Ways to Minimise Slippage

Arming yourself with the right knowledge and tools can transform slippage from a dreaded enemy into a managed business expense. This section provides a practical toolbox of checklists, worksheets, and testing methods to help you systematically reduce the impact of slippage on your trading performance.

Checklist for Order Type Selection

- Is the market calm and liquid? A market order is generally safe.

- Is the market volatile or gapping? Use a limit order to define your maximum entry price or a stop-limit order to control your exit. Avoid market orders.

- Are you trying to enter a breakout? A buy-stop or sell-stop order is necessary, but be aware of the high slippage risk. Consider reducing position size.

- Are you trading during a major news release? The safest option is to not place any orders. If you must, use a limit order with a price far from the current market.

VPS vs. Home Internet: Latency Benchmarks

Latency is the delay between your trading terminal and the broker’s server. Higher latency means a higher chance of slippage. You can test your latency by pinging your broker’s server IP address (often provided on their website or by support).

- Good Home Internet: Latency of 50-100ms.

- Poor Home Internet: Latency of >150ms.

- Good VPS (located in the same data center as the broker): Latency of 1-5ms.

As you can see, a VPS can reduce your latency by over 95%. In my own testing, moving from a 38ms home connection to a London-based VPS with a 2ms connection to my broker’s server reduced my average slippage on EUR/USD by approximately 0.4 pips per trade. This small edge adds up significantly over hundreds of trades.

Back-testing: Adding Slippage into Your Formula

Your back-tested strategy results are often overly optimistic because they assume perfect execution. To get a more realistic picture of your strategy’s expectancy, you must account for transaction costs, including slippage. After a month of live trading, review your trade history and calculate your average slippage per trade. Then, subtract this average cost from every trade in your back-test.

For example, if your strategy’s back-test shows a profit of $10,000 over a year, but you find you average 0.5 pips of negative slippage per trade, you must add this cost in. You might find that the strategy is no longer profitable once real-world costs are factored in.

Broker and Prop-Firm Factors

Your choice of a trading partner is one of the most significant decisions you will make in your career. The business model, technology, and transparency of your broker or prop firm directly influence the amount of slippage you will encounter. A trader must look beyond marketing claims and investigate the underlying factors that determine execution quality.

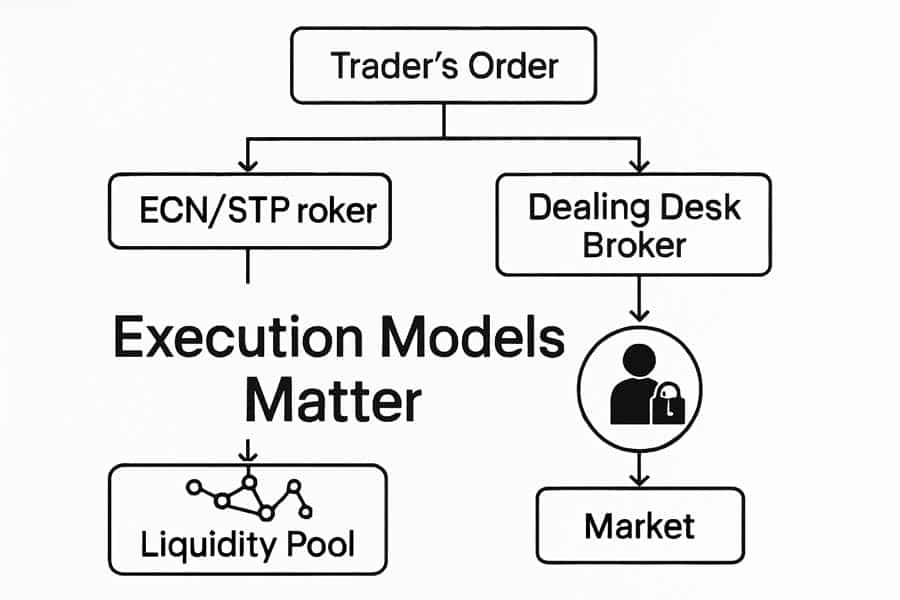

Execution Model: ECN vs. Dealing Desk

A dealing desk broker (or “market maker”) takes the other side of your trades. This creates an inherent conflict of interest. They may profit from your losses, and there can be an incentive to create artificial delays or price requotes, which can lead to worse slippage for the client.

An ECN/STP broker, on the other hand, simply acts as an intermediary, passing your order to a network of liquidity providers. Their profit comes from a small commission or a markup on the spread. Because their interests are aligned with yours (they want you to trade more), they are incentivized to provide the fastest execution and best possible fill prices, including positive slippage. For any trader serious about minimizing slippage, an ECN broker is the superior choice.

Average Fill Speed and Re-quote Policies

Before committing to a broker or prop firm, do your due diligence. Ask their support team for their average execution speed in milliseconds. Top-tier brokers are proud of these stats and will readily provide them. Anything under 100ms is considered good.

Also, read the fine print in their client agreement regarding their slippage and re-quote policies. A re-quote happens when your broker is unable to fill your market order at the requested price and instead offers you a new price, which you must accept or decline. While this prevents slippage, the delay can cause you to miss the trade entirely. A good broker will have a clear policy and should be transparent about how they handle off-quote orders.

Read More: Forex Trading Costs

Risk Management Settings that Absorb Slippage

Since slippage can never be 100% avoided, your risk management plan must be robust enough to absorb the inevitable unexpected costs. A strategy that is profitable on paper but shatters at the first sign of a slipped stop loss is not a viable strategy. True risk management anticipates and accounts for these real-world imperfections.

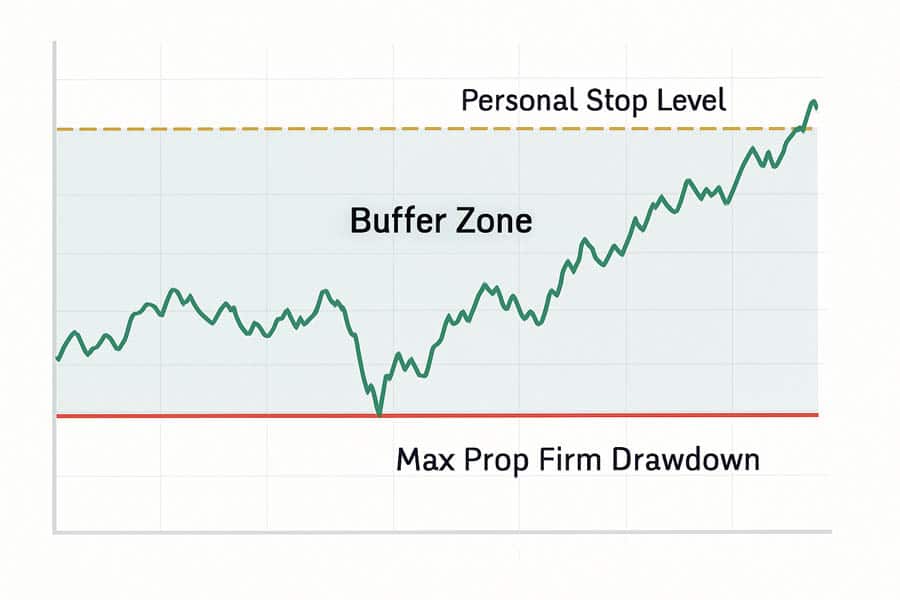

This means not setting your stop loss at the absolute last pip before your prop firm’s daily drawdown limit. You must build in a buffer. If your daily loss limit is $4,000, your personal maximum loss for the day should be closer to $3,500. This $500 buffer gives you room to absorb negative slippage on a stop loss without it causing a catastrophic account breach. It’s about planning for failure to ensure success. Furthermore, scaling down your position size during volatile or illiquid periods is a simple yet powerful way to reduce the dollar impact of any potential slippage.

Advanced: Algorithmic Filters

For traders who use automated trading systems (Expert Advisors or EAs), you can code specific filters to protect your strategy from unfavorable conditions that lead to slippage. For example, you can program your EA to measure the current spread before placing a trade. If the spread is wider than a predefined threshold (e.g., more than twice its 20-period average), the EA will refrain from opening a new position.

This simple line of code can prevent your algorithm from taking trades during high-cost, high-slippage news events. More advanced models can even incorporate historical slippage data to create a dynamically adjusted back-testing model, providing a far more accurate picture of how a strategy would perform in live market conditions.

Your ASIC-Regulated Trading Partner

Elevate your trading experience with Opofinance, an ASIC-regulated forex trading broker dedicated to trader success. Benefit from a suite of powerful tools and platforms.

- Advanced Trading Platforms: Choose from MT4, MT5, cTrader, and the proprietary OpoTrade platform.

- Innovative AI Tools: Gain an edge with our AI Market Analyzer, AI Coach, and instant AI Support.

- Social & Prop Trading: Join a community of traders and explore opportunities in prop trading.

- Secure & Flexible Transactions: Enjoy safe and convenient deposits and withdrawals, including crypto payments with zero fees.

Start Trading with Opofinance Today!

Conclusion

Ultimately, slippage is an unavoidable part of the trading landscape. It is a cost of doing business in decentralized, fast-moving markets. However, it is not something you are powerless against. By understanding the causes of slippage—volatility, liquidity, and technology—you can move from being a victim of circumstance to a proactive risk manager. Applying the tactics discussed, from trading at optimal times to using the right order types and choosing a high-quality broker, will dramatically reduce its negative impact and protect your hard-won capital.

Can slippage be 100% avoided?

No, slippage cannot be completely avoided, as it is a natural feature of market dynamics. However, its frequency and magnitude can be significantly minimized by using limit orders, avoiding volatile news events, and trading with a low-latency ECN broker.

Why do I get more slippage on MT5 than cTrader?

This is typically not due to the platform itself but rather the broker’s back-end infrastructure connected to that platform. Some brokers may have better server integration or liquidity feeds for their cTrader offering compared to their MT5 offering, or vice-versa. The underlying execution model is the more critical factor.

What is acceptable slippage for a prop account?

For a prop firm account, an acceptable average slippage on major pairs during liquid hours should be less than 0.5 pips per trade. During news events, this can understandably increase, but consistent, high slippage outside of these events is a red flag about the firm’s execution quality.

Does positive slippage really exist?

Yes, positive slippage is real and occurs when your order is filled at a better price than requested. It is a key benefit of trading with a true ECN/STP broker that is committed to price improvement and passes on favorable execution to their clients.

How does slippage differ from the spread?

The spread is the difference between the bid and ask price and is a known, visible cost of opening a trade. slippage, on the other hand, is the unknown difference between your expected execution price and the actual execution price. The spread is a guaranteed cost, while slippage is a potential cost (or gain).