Tired of guessing when to buy or sell Gold (XAUUSD)? Wish you had a clearer edge in your trading? The Stochastic Oscillator can be that edge. This comprehensive guide dives deep into Stochastic Oscillator Settings for Gold, revealing the secrets to finding the best stochastic oscillator settings for gold trading and implementing effective stochastic oscillator gold trading strategies. Whether you’re trading with a seasoned approach or just exploring the potential with your forex broker, understanding and optimizing your optimal stochastic settings for XAUUSD is key to sharper entries and exits. Let’s uncover how this powerful tool can refine your gold trading decisions.

Stochastic Oscillator for Gold

Gold, with its reputation as a safe-haven asset, attracts traders seeking stability and profit. However, its price movements can be swift and unpredictable. This is where the Stochastic Oscillator becomes an invaluable asset for traders.

What is the Stochastic Oscillator?

The Stochastic Oscillator is a momentum indicator that illustrates where the current price of an asset closes relative to its price range over a defined period. Developed by George Lane, it operates on the observation that in an upward trending market, prices tend to close near their high, and in a downward trending market, prices tend to close near their low. It’s visually represented by two lines oscillating between 0 and 100.

Why for Gold (XAUUSD) Trading?

Gold trading, often represented as XAUUSD, is known for its volatility. The Stochastic Oscillator helps traders navigate this volatility by identifying potential turning points. By highlighting when gold might be overbought or oversold, it provides crucial clues for making informed trading decisions. Many platforms offered by your online forex broker integrate this indicator seamlessly.

Identifying Overbought/Oversold and Reversals

The primary strength of the Stochastic Oscillator lies in its ability to pinpoint potential overbought and oversold conditions. When the oscillator climbs above a certain threshold (typically 80), it suggests gold might be overbought and a price correction could be on the horizon. Conversely, when it dips below a certain level (typically 20), it indicates gold might be oversold, potentially setting the stage for a price increase. Furthermore, the interaction between the oscillator’s two lines can signal potential shifts in trend direction.

Read More: Stochastic Oscillator in Forex

Understanding the Components

To effectively use the Stochastic Oscillator in your gold trading, it’s important to understand the two lines that make it up and what they represent.

Explanation of %K and %D Lines

The Stochastic Oscillator is built upon two key lines:

- %K (Fast Stochastic Line): This line reflects the relationship between the most recent closing price and the high-low range over a specific period. It’s more reactive to price changes.

- %D (Slow Stochastic Line): This line is a moving average of the %K line, typically a 3-period Simple Moving Average (SMA). It smooths out the %K line, providing a less erratic signal.

Measuring Momentum in Gold

The Stochastic Oscillator gauges momentum by assessing the closing price relative to its recent trading range. Strong upward momentum is indicated when the closing price consistently approaches the high of the range, pushing the oscillator upwards. Conversely, strong downward momentum is shown when the closing price gravitates towards the low of the range, pulling the oscillator downwards. The speed and direction of the oscillator’s movement reflect the strength of the current price action in gold.

Overbought and Oversold Levels

The standard thresholds for identifying potential overbought and oversold conditions are 80 and 20, respectively.

- Overbought (Above 80): When the Stochastic Oscillator surpasses 80, it suggests that buying pressure might be excessive, and the price of gold could be due for a pullback. This doesn’t guarantee an immediate price drop, but it signals increased risk.

- Oversold (Below 20): When the Stochastic Oscillator falls below 20, it suggests that selling pressure might be excessive, and the price of gold could be poised for a bounce. Again, this isn’t a definitive buy signal, but it highlights a potential shift in momentum.

Read More: Best Indicator for Gold Scalping

Types of Stochastic Oscillators

While the core principles remain consistent, there are variations of the Stochastic Oscillator that cater to different trading styles and preferences.

Fast Stochastic: Sensitive but Reactive

The Fast Stochastic Oscillator uses the raw %K and %D lines without additional smoothing on the %K. Its high sensitivity allows it to react quickly to price fluctuations, providing potentially early entry and exit signals. However, this heightened sensitivity also makes it more susceptible to generating false signals, particularly in the choppy waters of gold trading. Traders using a broker for forex trading will find this version readily available.

Slow Stochastic: Smoother Signals

The Slow Stochastic Oscillator aims to reduce the occurrence of false signals by applying smoothing to the %K line. In this version, the %K line is the same as the %D line in the Fast Stochastic (a moving average of the original %K), and the %D line is a moving average of this smoothed %K. This smoothing effect results in more reliable, albeit slightly delayed, signals compared to the Fast Stochastic.

Full Stochastic: Customizable Flexibility

The Full Stochastic Oscillator offers the greatest degree of customization. It allows traders to adjust the lookback period for the %K calculation and the smoothing periods for both the %K and %D lines. This flexibility enables traders to fine-tune the oscillator to better match specific gold market conditions and their individual trading strategies. This level of control is often valued by traders who have a preferred broker for forex trading.

Best Settings for Gold Trading

Choosing the right settings for your Stochastic Oscillator is crucial for its effectiveness in gold trading. The ideal settings can vary depending on your trading style and the current market environment.

Default Settings and Limitations

The standard default settings for the Stochastic Oscillator are typically (14, 3, 3). This represents a 14-period lookback for calculating the %K, a 3-period SMA for smoothing the %K to derive the %D, and a 3-period smoothing for the %D itself (in the case of the Full Stochastic). While these settings provide a solid foundation, they might not be perfectly optimized for all gold trading scenarios. In the often volatile gold market, these default settings can still produce a number of misleading signals.

Optimal Settings by Trading Style

Different trading styles require different levels of responsiveness from the Stochastic Oscillator.

- Scalping: 5-3-3 or 9-3-3. Scalpers aim to capitalize on very small price changes within short timeframes. For this approach, more sensitive settings like 5-3-3 or 9-3-3 can be advantageous. The shorter lookback period allows the oscillator to react swiftly to minor price fluctuations, potentially providing timely entry and exit points. However, be prepared for a higher volume of signals, some of which may be inaccurate.

- Swing Trading: 14-3-3 or 21-5-5. Swing traders hold positions for several days or weeks, aiming to capture larger price swings. The default settings (14-3-3) can be effective for swing trading. Alternatively, slightly less sensitive settings like 21-5-5 can help filter out some of the short-term noise and provide more reliable signals for longer-term moves.

- Long-term Trading: 21-9-9. Long-term traders focus on capturing major trends over extended periods. For this style, less sensitive settings like 21-9-9 are often preferred. The longer lookback and smoothing periods help to minimize the impact of short-term volatility and emphasize the underlying trend.

Adjusting for Market Volatility

The level of volatility in the gold market significantly impacts the effectiveness of Stochastic Oscillator settings.

- High Volatility: During periods of high volatility in the gold market, it’s often beneficial to use less sensitive settings. Increasing the lookback period and smoothing periods can help reduce the number of false signals generated by rapid price swings.

- Low Volatility: In periods of low volatility, more sensitive settings might be appropriate to capture smaller price movements. However, it’s crucial to be aware of the increased potential for false signals in such conditions.

Applying Settings on Trading Platforms

Implementing your chosen Stochastic Oscillator settings is a straightforward process on most trading platforms.

Step-by-Step for MetaTrader 4/5

MetaTrader 4 and MetaTrader 5 are widely used platforms, often provided by regulated forex broker firms. Here’s how to add and customize the Stochastic Oscillator:

- Open a Chart: Open the chart for the Gold (XAUUSD) trading pair.

- Insert Indicator: Navigate to “Insert” -> “Indicators” -> “Oscillators” -> “Stochastic Oscillator.”

- Customize Settings: A dialog box will appear, allowing you to adjust the parameters. Here, you can modify the “%K period,” “%D period,” and “Slowing” (which corresponds to the smoothing of the %D line in the Full Stochastic). Enter your desired values (e.g., 14, 3, 3 for the default settings).

- Levels Tab: You can also customize the overbought and oversold levels in the “Levels” tab. The default levels are typically set at 20 and 80.

- Click OK: The Stochastic Oscillator will now be displayed at the bottom of your chart with your specified settings.

Customizing on TradingView

TradingView is another popular charting platform among traders. Here’s how to customize the Stochastic Oscillator:

- Open a Chart: Open the chart for the Gold (XAUUSD) pair on TradingView.

- Indicators: Click on the “Indicators” button located at the top of the chart.

- Search for Stochastic: Search for “Stochastic” and select either “Stochastic RSI” or simply “Stochastic.”

- Settings/Inputs: Hover your mouse over the indicator’s name on the chart and click the “Settings/Inputs” gear icon.

- Adjust Parameters: In the settings window, you can adjust the “K length,” “D length,” and “Smooth” parameters to match your preferred settings.

- Style Tab: In the “Style” tab, you can customize the visual appearance of the lines and the overbought/oversold levels.

- Click OK: Your customized Stochastic Oscillator will now be visible on the chart.

Read More: What is xauusd in forex

Trading Strategies for Gold

Once you have the Stochastic Oscillator configured, you can utilize various trading strategies to identify potential opportunities in the gold market.

Overbought/Oversold Strategy

This is a foundational strategy based on the oscillator’s ability to identify potential price extremes.

- Buy Signal: When the Stochastic Oscillator dips below the oversold level (20) and then crosses back above it, it can signal a potential buying opportunity. This suggests that selling pressure may be diminishing, and a price increase could be imminent.

- Sell Signal: When the Stochastic Oscillator rises above the overbought level (80) and then crosses back below it, it can signal a potential selling opportunity. This suggests that buying pressure may be weakening, and a price decrease could be on the horizon.

It’s important to remember that overbought or oversold conditions can persist, especially in strong trending markets. Therefore, it’s often prudent to seek confirmation from other indicators or price action before acting solely on these signals.

Crossover Strategy

The intersection of the %K and %D lines is a widely used signal among Stochastic Oscillator traders.

- Buy Signal: When the faster %K line crosses above the slower %D line, it suggests increasing upward momentum, potentially indicating a buying opportunity.

- Sell Signal: When the faster %K line crosses below the slower %D line, it suggests increasing downward momentum, potentially indicating a selling opportunity.

Crossovers are often considered more reliable when they occur within the overbought or oversold zones, providing confluence with the overbought/oversold strategy.

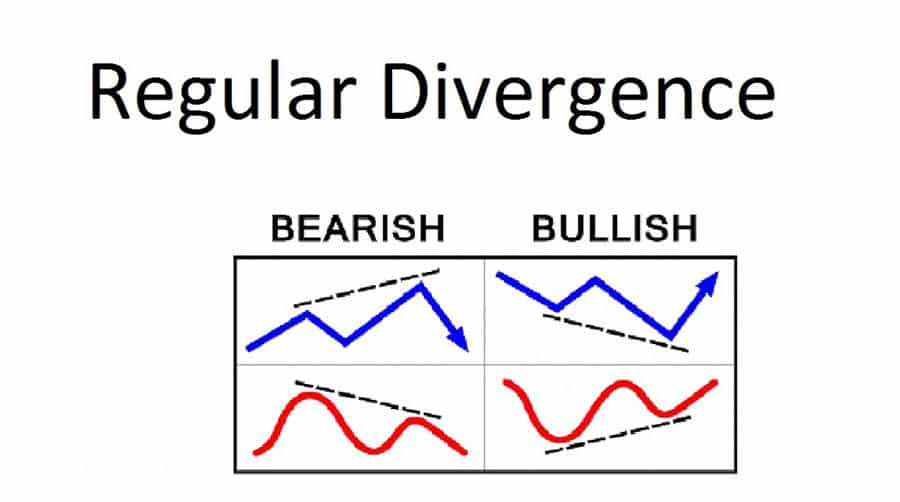

Divergence Strategy

Divergence occurs when the price action and the Stochastic Oscillator move in opposing directions, often signaling a potential trend reversal.

- Bullish Divergence: This occurs when the price of gold makes lower lows, but the Stochastic Oscillator makes higher lows. This suggests that selling pressure is waning, and an upward reversal might be likely.

- Bearish Divergence: This occurs when the price of gold makes higher highs, but the Stochastic Oscillator makes lower highs. This suggests that buying pressure is weakening, and a downward reversal might be likely.

Divergence can be a powerful signal, but it’s important to note that it can sometimes precede a period of consolidation rather than an immediate reversal. Confirmation from other indicators or price action is often recommended.

Common Challenges and Solutions

While the Stochastic Oscillator is a valuable tool, it’s important to be aware of its limitations and how to address common challenges.

Avoiding False Signals in Volatile Markets

Gold’s inherent volatility can lead to numerous false signals from the Stochastic Oscillator, particularly when using more sensitive settings.

- Solution: Consider using less sensitive settings during periods of high volatility. Combine Stochastic signals with other indicators, such as Moving Averages or the Relative Strength Index (RSI), to filter out potentially misleading signals. Focus on signals that align with the prevailing trend. Waiting for price action to confirm a signal can also be beneficial.

Balancing Sensitivity and Reliability

Finding the right balance between the sensitivity of the Stochastic Oscillator and the reliability of its signals is crucial for effective use.

- Solution: Experiment with different settings on a demo account to determine what works best for your trading style and the typical volatility of the gold market. Backtest various settings to evaluate their historical performance. Be prepared to adjust your settings as market conditions evolve.

Combining with Other Indicators

Relying solely on the Stochastic Oscillator can be risky. Integrating it with other indicators can significantly enhance the accuracy of your trading signals.

- Solution: Use the RSI to confirm overbought or oversold conditions identified by the Stochastic Oscillator. Employ Moving Averages to identify the dominant trend and prioritize Stochastic signals that align with that trend. Consider using volume indicators to assess the strength of potential reversals signaled by divergence.

Backtesting and Optimizing Settings

Before deploying any Stochastic Oscillator settings in live trading, it’s essential to backtest them and optimize them for the specific characteristics of the gold market.

Importance of Backtesting

Backtesting involves applying your chosen Stochastic Oscillator settings to historical gold price data to assess how they would have performed in the past. This process helps you gauge the potential profitability and reliability of your settings before risking real capital.

Tips for Optimizing Settings

- Analyze Different Timeframes: Backtest your settings across various timeframes (e.g., hourly, daily) to understand their performance across different trading horizons.

- Consider Different Market Regimes: Evaluate how your settings perform during periods of high volatility, low volatility, and trending markets.

- Utilize Optimization Tools: Many trading platforms offer built-in optimization tools that can automatically test different parameter combinations to identify potentially more profitable settings for a given historical period.

- Avoid Over-Optimization: Be cautious of over-optimizing your settings to perfectly fit past data, as this can lead to poor performance in live trading due to curve fitting.

Opofinance Services

Looking for a dependable and regulated broker for forex to trade gold and other assets? Consider Opofinance, an ASIC-regulated broker dedicated to providing a secure and efficient trading environment.

- ASIC Regulated: Trade with confidence knowing Opofinance adheres to the strict regulatory standards of the Australian Securities and Investments Commission (ASIC).

- MT5 Platform: Opofinance is officially listed among MT5 brokers, offering access to the powerful MetaTrader 5 platform with advanced charting tools, including the Stochastic Oscillator.

- Social Trading: Benefit from the expertise of seasoned traders with Opofinance’s social trading features. Learn from their strategies and potentially replicate their trades.

- Safe and Convenient Deposits and Withdrawals: Experience hassle-free transactions with a variety of secure deposit and withdrawal methods.

Ready to enhance your gold trading? Start trading with Opofinance today!

Conclusion

Mastering Stochastic Oscillator Settings for Gold is an ongoing process of learning, experimentation, and adaptation. By understanding its components, exploring different settings, and implementing effective trading strategies, you can significantly improve your ability to identify profitable opportunities in the gold market. Remember that the best stochastic oscillator settings for gold trading are not fixed; they require adjustments based on your trading style and the ever-changing dynamics of the market. Embrace the power of this versatile indicator, combine it with other analytical tools, and continuously refine your approach to unlock your gold trading potential.

Key Takeaways

- The Stochastic Oscillator is a valuable momentum indicator for identifying potential overbought and oversold conditions and trend reversals in gold trading.

- Understanding the %K and %D lines, as well as the significance of overbought (above 80) and oversold (below 20) levels, is essential.

- Different types of Stochastic Oscillators (Fast, Slow, Full) offer varying degrees of sensitivity.

- Optimal settings depend on your trading style (scalping, swing trading, long-term investing) and prevailing market volatility.

- Combining the Stochastic Oscillator with other indicators like the RSI and Moving Averages can enhance the accuracy of trading signals.

- Backtesting and optimizing your settings are crucial steps before engaging in live trading.

Can I Trade Gold Profitably Using Only the Stochastic Oscillator?

While the Stochastic Oscillator offers valuable insights, relying solely on it for trading decisions is generally not recommended. Integrating it with other forms of analysis, such as observing price action patterns, conducting trend analysis, and utilizing other technical indicators, can significantly increase the probability of successful trades. Think of it as a valuable component of a comprehensive trading strategy, rather than a standalone solution.

Which Timeframe is Best for the Stochastic Oscillator in Gold Trading?

The ideal timeframe for using the Stochastic Oscillator depends on your individual trading style and objectives. Scalpers might find shorter timeframes like the 5-minute or 15-minute charts more beneficial for identifying quick opportunities, while swing traders might prefer hourly or daily charts for capturing larger price movements. Long-term investors might even consider weekly or monthly charts for a broader perspective. Experimenting with different timeframes can help you determine which aligns best with your trading strategy and risk tolerance.

How Often Should I Adjust My Stochastic Oscillator Settings?

You don’t need to make constant adjustments to your Stochastic Oscillator settings. However, it’s prudent to review and potentially adjust them periodically, especially when there are significant changes in market volatility or when you are evaluating the performance of your current settings. Regularly backtesting your settings can provide valuable insights into whether adjustments are necessary to maintain their effectiveness.