Have you ever watched a perfect trade slip away because you hesitated? It’s a scenario that every trader dreads. Trading bots promise to erase that agony with ruthless efficiency, executing trades faster than you can blink. But are these automated systems the holy grail of trading, or are they a ticking time bomb waiting to blow up your portfolio? In this comprehensive deep dive on trading bots pros and cons, we’ll uncover whether these automated wizards are truly worth your time and money.

We’ll address the burning question: are trading bots any good? The answer isn’t black and white—it depends on your strategy, market, and how you use them. Whether you’re partnering with a trusted online forex broker or flying solo in the crypto arena, you’re about to discover jaw-dropping benefits and hidden risks. Get ready for hard-hitting insights, real-world examples, and a no-nonsense guide to mastering trading bots.

Why Trading Bots Are a Trader’s Secret Weapon

Trading bots—software that automates trades using pre-programmed rules—are reshaping the way we approach markets. They aren’t just tools for the tech-savvy; they’re increasingly essential for anyone looking for an edge. Here are some of the reasons why these automated systems are capturing the spotlight:

Speed That Leaves Humans in the Dust

Markets can change in milliseconds. Trading bots are built for this pace—they analyze vast amounts of data and execute trades within fractions of a second. Imagine a scenario in the volatile world of cryptocurrency: while you’re busy reading market news, a bot can scalp a 2% gain on Bitcoin before you even hit refresh. In essence, speed isn’t just a matter of convenience—it’s directly tied to profit. This is one of the key trading bots pros and cons: speed can be your ally, but it also means that any error in the code can execute just as fast.

Emotion-Free Precision

Human emotions can be a trader’s worst enemy. Fear, greed, and anxiety can lead to missed opportunities or disastrous decisions. Trading bots, however, follow your strategy without any second-guessing. By sticking to pre-programmed rules, these bots eliminate the emotional pitfalls that often derail manual trading. Studies suggest that emotionally driven decisions can reduce annual returns by up to 20%. In contrast, a bot’s unwavering logic ensures that a stop-loss is executed at the right moment—even when you’re tempted to hold on for dear life.

Relentless 24/7 Hustle

One of the most attractive features of trading bots is their ability to work around the clock. In markets like forex and crypto, where trading happens 24/7, a bot never sleeps. This means that while you’re resting, your bot is tirelessly monitoring the market and executing trades. Picture a trader in New York waking up to fresh gains from the Asian session’s volatility—all thanks to a bot that never takes a break. This nonstop activity is a major selling point when weighing the trading bots pros and cons.

Backtesting: Your Crystal Ball

Wouldn’t it be great to test a new trading strategy without risking real money? With trading bots, you can. Backtesting allows you to run your strategy on historical data, providing insights into its potential performance before any actual money is put on the line. For example, a forex trader might discover that a moving average crossover strategy nets 15% annual returns over five years of data. This “dress rehearsal” is invaluable in identifying both strengths and weaknesses, ultimately informing more robust live strategies.

Juggling Markets Like a Pro

Humans have cognitive limits, especially when it comes to monitoring multiple assets. Trading bots, however, can keep an eye on stocks, forex pairs, and cryptocurrencies simultaneously—diversifying your risk and maximizing opportunities. Imagine a bot that manages trades on EUR/USD, gold, and Ethereum while you focus on broader market trends. This multi-tasking ability is one of the undeniable trading bots pros and cons—they provide scale that no human trader can match.

Read More:

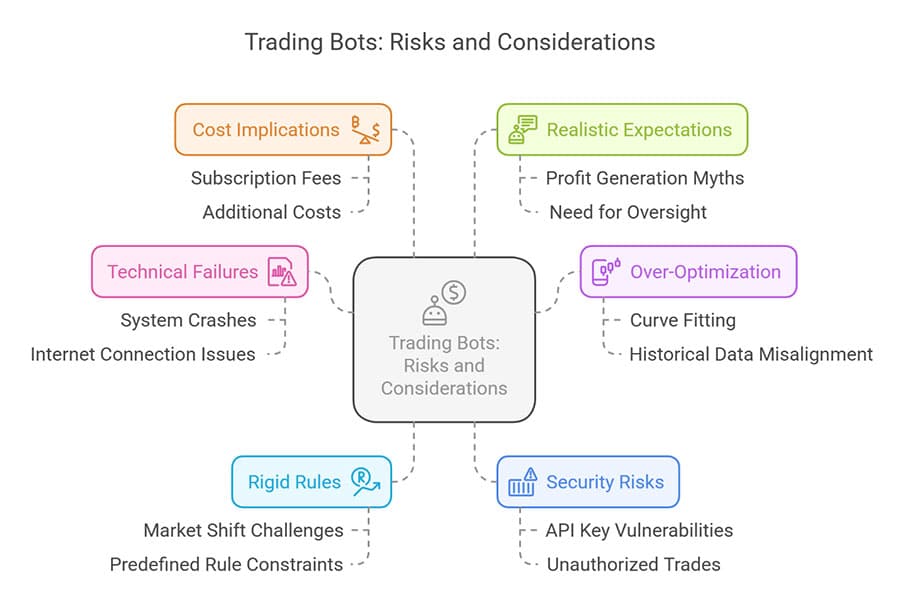

The Hidden Dangers: Trading bots pros and cons You Need to Know

While the benefits of trading bots are enticing, there are significant risks that every trader must consider. Understanding these pitfalls is crucial to determine whether are trading bots any good for your specific needs.

Tech Fails That Hit Hard

Even the most sophisticated trading bots are not immune to technical failures. Bugs in the code, system crashes, or even a simple dropped internet connection can result in catastrophic losses. Imagine a scenario where a bot, due to a glitch, repeatedly executes trades at unfavorable prices. In a 2023 survey, 18% of users reported losing significant capital due to such technical snafus. This risk emphasizes the need for robust system architecture, including backup servers and fail-safes, to mitigate potential damages.

Over-Optimization: The Silent Killer

Backtesting is a double-edged sword. Over-optimizing a trading bot on historical data can lead to what is known as “curve fitting” where the bot performs exceptionally well on past data but fails under live market conditions. For example, a bot tuned to 2022’s crypto trends might underperform in a radically different market environment in 2025. This pitfall is a classic example of trading bots pros and cons—while backtesting can offer a glimpse into future performance, it also carries the risk of overfitting to historical anomalies.

Rigid Rules, Rigid Losses

Trading bots operate strictly within the confines of their programming. They do not possess the ability to interpret market sentiment or adapt to unexpected events. In the case of a sudden market shift, such as an unexpected Fed rate hike, a human trader might pivot quickly, whereas a bot will stick to its predetermined rules. This rigidity can result in substantial losses, particularly in fast-moving or news-driven markets. It’s important to understand that while trading bots pros and cons include consistency, they also come with an inherent lack of flexibility.

Hackers’ Favorite Target

Security is a major concern when it comes to trading bots. These systems require API keys to access trading platforms, and if these credentials fall into the wrong hands, it could lead to unauthorized trades and substantial financial loss. In 2022 alone, hacks and security breaches resulted in a loss of over $2 billion on various crypto platforms. To mitigate this risk, always choose bots with robust security features like two-factor authentication and encrypted data transmissions.

Costs That Sneak Up

While there are free trading bots available, most high-quality bots come with a price tag. Premium trading bots often require an upfront payment, along with monthly subscription fees, server hosting costs, and sometimes additional API charges. For smaller traders, these costs can quickly eat into profits. If your bot is costing you $50 per month, it better be generating returns that far exceed this fee. This financial aspect is a crucial part of the trading bots pros and cons discussion—balancing cost against potential profit is essential.

No Golden Ticket

Perhaps the most sobering reality is that no trading bot is infallible. They do not magically generate profits, and even the best algorithms can fail in unpredictable market conditions. A trader who treats a bot as a “set and forget” solution might wake up to find their account severely depleted. This final point in the trading bots pros and cons list reinforces that while bots can enhance your trading strategy, they are not a substitute for informed decision-making and diligent oversight.

Are trading bots any good? The Verdict

So, are trading bots any good? The answer is nuanced. For traders who value speed, precision, and round-the-clock market monitoring, bots can be a game changer. They are particularly effective for high-frequency trading, scalping strategies, and markets that never sleep—like forex and cryptocurrency.

Success Stories and Cautionary Tales

Real-world examples highlight the mixed results of trading bots. For instance, one forex trader managed to double his account in just six months by rigorously backtesting his strategy and making regular tweaks. Conversely, another trader lost $5,000 when his bot misinterpreted a sudden flash crash. These case studies underscore that while trading bots have enormous potential, they must be used with care, constant oversight, and continual adjustment to changing market conditions.

Making the Most of Trading Bots

To maximize the advantages and minimize the risks, here are some best practices for advanced traders:

- Vet Your Bot Thoroughly: Look for in-depth reviews, test free trials when available, and choose bots with transparent performance metrics. A well-reviewed bot with active developer support is a safer bet than an untested, flashy alternative.

- Backtest Intelligently: Run your strategy on extensive historical data that covers multiple market cycles. Avoid overfitting by validating your bot’s performance with out-of-sample data.

- Stay Engaged: Even the most autonomous bot needs regular monitoring. Check logs daily, and be ready to step in if market conditions shift unexpectedly.

- Cap Your Exposure: Limit each trade to a small percentage of your overall capital. Diversify your bot’s strategy across multiple assets to manage risk.

- Understand Your Market: The best bot cannot compensate for a lack of market knowledge. Study the factors that influence price movements, such as volatility, liquidity, and news events, to better configure your bot’s parameters.

In summary, are trading bots any good? Yes—they can be extremely effective when paired with a well-thought-out strategy and disciplined risk management. However, they are not a magic bullet. Their performance depends on how they’re used, the quality of the underlying strategy, and the ever-changing dynamics of the financial markets.

Read More: copy trading vs bot trading

Advanced Strategies and Additional Insights

Leveraging Artificial Intelligence and Machine Learning

In recent years, the evolution of trading bots has been marked by the incorporation of artificial intelligence (AI) and machine learning (ML). These advanced systems are capable of analyzing vast datasets and identifying patterns that are invisible to traditional algorithmic trading models. AI-driven bots can learn from past trades and adapt to new market conditions, which may answer the question, are trading bots any good in the modern trading landscape? When properly implemented, these technologies can offer a significant advantage, although they still require careful calibration and oversight.

Integrating Fundamental and Technical Analysis

Another layer of sophistication in modern trading bots is the integration of both technical and fundamental analysis. While many bots rely solely on technical indicators (like moving averages, RSI, or MACD), some advanced systems incorporate economic data, earnings reports, and other fundamental indicators into their decision-making process. This hybrid approach helps bots adapt to both trending and volatile market conditions, potentially reducing the inherent risks listed among the trading bots pros and cons.

Customization and Algorithmic Flexibility

Customization is key in an ever-changing market. Many trading bots now offer customizable modules where traders can adjust parameters on the fly. Whether it’s tweaking the algorithm’s sensitivity to market noise or altering risk management thresholds, this flexibility can make a significant difference. Traders who take the time to fine-tune their bots will likely find that the advantages outweigh the risks. In this way, savvy traders can answer affirmatively when asked, are trading bots any good? The answer lies in the adaptability of the system to the trader’s specific needs.

The Role of Broker Integration

An essential factor in successful automated trading is choosing the right broker. A well-integrated trading platform can enhance a bot’s performance by reducing latency, offering advanced trading tools, and providing robust security measures. Brokers like Opofinance, for instance, offer platforms designed for precision trading—MT4, MT5, cTrader, and proprietary tools that are optimized for bot trading. This integration is pivotal in tipping the scales in favor of the trading bots pros and cons by ensuring that technical glitches or delays are minimized.

Practical Tips for New Bot Traders

Start Small and Scale Gradually

For those new to automated trading, it is crucial to begin with a small investment. Testing your bot on a smaller scale allows you to observe its performance without risking significant capital. Once you are confident in its performance, you can gradually increase your exposure.

Monitor Market Conditions Regularly

Even though trading bots are designed to operate autonomously, they are not a substitute for market awareness. Regularly review market news and adjust your bot’s settings as necessary. This constant vigilance can help prevent the pitfalls of rigid rules and unexpected market events—a key aspect of the trading bots pros and cons.

Keep Detailed Records

Document every change you make to your trading strategy. Keeping detailed logs of your bot’s performance, including backtesting results and live trading outcomes, will help you fine-tune your approach and avoid repeating past mistakes.

Emphasize Security

Given the risks associated with API keys and potential hacks, it’s imperative to prioritize security. Use strong passwords, enable two-factor authentication, and if possible, utilize cold storage for your funds. Remember, even the most promising system can be undermined by a security breach.

Industry Trends and Future Outlook

Regulatory Developments

As trading bots become more prevalent, regulatory bodies around the world are beginning to scrutinize their usage more closely. While regulations are intended to protect traders, they also add an extra layer of complexity. Staying informed about these changes is vital. Future regulations may require more transparency from bot developers or impose stricter standards on algorithmic trading—factors that will influence the ongoing debate over the trading bots pros and cons.

Evolving Technologies

The rapid pace of technological advancement means that trading bots are constantly evolving. In the near future, we can expect further integration of big data analytics, quantum computing, and even more sophisticated AI algorithms. As these tools become more advanced, the question, are trading bots any good? will likely be answered with even more nuanced insights as the technology continues to improve and adapt to new market realities.

The Growing Community and Shared Knowledge

Online communities and forums are increasingly becoming hubs for sharing insights about trading bots. These platforms allow traders to discuss strategies, share experiences, and provide critical feedback on different systems. This collective intelligence not only helps individual traders but also drives the industry forward, ensuring that the pros are continually enhanced and the cons are better managed.

Read More: create forex trading robot

Opofinance Services: Elevate Your Trading Game

Opofinance provides a solid foundation for both manual and automated trading, offering features and platforms that cater to a variety of needs:

- Advanced Trading Platforms: Choose from leading platforms like MT4, MT5, cTrader, and OpoTrade, each offering robust charting and analytical tools.

- Innovative AI Tools: Access AI-powered market analysis tools to gain an edge in your trading decisions.

- Social & Prop Trading: Explore social trading options to learn from experienced traders, and potentially participate in prop trading programs.

- Secure and Flexible Transactions: Enjoy secure and convenient deposit and withdrawal options.

- ASIC Regulated: Trade with confidence knowing Opofinance is regulated by ASIC, ensuring adherence to high standards of transparency and security.

Visit opofinance.com today to discover how Opofinance can empower your trading journey.

Conclusion

The landscape of automated trading is complex and ever-evolving. The trading bots pros and cons paint a vivid picture: these systems offer unprecedented speed, discipline, and round-the-clock operation, but they also come with technical risks, potential security breaches, and a steep learning curve. So, are trading bots any good? The answer is yes—provided you use them wisely, continuously monitor their performance, and remain aware of market dynamics. They are powerful tools that, when paired with a robust strategy and careful oversight, can elevate your trading game to new heights.

Key Takeaways

- Speed and Efficiency: Trading bots execute orders in milliseconds, capturing opportunities that manual trading would miss.

- Emotion-Free Trading: Bots stick to predefined strategies, removing the human error associated with emotional decision-making.

- 24/7 Market Access: They allow you to trade continuously across global markets, even when you sleep.

- Backtesting Capabilities: Bots enable you to test your strategy against historical data, revealing strengths and potential weaknesses.

- Risks and Downsides: Technical failures, over-optimization, rigid programming, security concerns, and costs are critical factors to consider.

- Customization and Adaptability: Advanced traders can fine-tune bots to respond to changing market conditions, making them a flexible tool when used correctly.

- Broker Integration: Choosing a robust, bot-friendly broker like Opofinance can significantly enhance performance and reliability.

Ultimately, trading bots are not a golden ticket to instant wealth; they are a powerful instrument that requires a sophisticated approach and continuous refinement. Test rigorously, monitor closely, and integrate them into a well-planned trading strategy for the best results.

How long does it take to set up a trading bot?

Setup time can vary significantly—pre-built bots may be up and running in just a few hours, while custom-built solutions might require weeks of coding, testing, and integration.

Can trading bots handle news events?

Standard bots typically follow technical indicators and may not react to sudden news events. However, some advanced bots incorporate news feeds, although these systems usually come at a premium and require constant tuning.

What’s the biggest mistake bot traders make?

Standard bots typically follow technical indicators and may not react to sudden news events. However, some advanced bots incorporate news feeds, although these systems usually come at a premium and require constant tuning.

Are trading bots any good for beginners?

Yes, provided you start small, invest time in learning, and use bots as a supplementary tool rather than a complete replacement for your own market analysis.

How can I ensure my trading bot stays secure?

Prioritize security measures like using strong passwords, enabling two-factor authentication, and keeping your API keys secure. Choose reputable bots and brokers that emphasize security.

3 Responses

While trading bots can provide speed and efficiency, I’m always a bit concerned about relying solely on algorithms. How do bots handle sudden, unexpected market events like news releases or political events?

Bots cannot predict unforeseen events (e.g., geopolitical crises) and may underperform if rules aren’t optimized for such scenarios. Human oversight remains critical.

Running a blog does take some work, but it doesn’t have to be overwhelming, even if you’re not a coder.