Imagine securing your profits automatically as the forex market moves in your favor, without the need to constantly monitor every tick. This is the transformative power of trailing stops in forex, a game-changing tool that savvy traders leverage to optimize their trading performance. By choosing a reliable forex broker, traders can effectively use trailing stops to safeguard investments while allowing profits to grow dynamically with market movements. In the high-stakes world of forex trading, where every pip counts, understanding and implementing trailing stops can be the difference between substantial gains and missed opportunities.

Whether you are a beginner exploring forex trading or an advanced trader refining your strategies, comprehending trailing stops in forex is essential. This article delves deep into the mechanics, benefits, and best strategies for utilizing trailing stops effectively. By leveraging the advantages of trailing stops, you can navigate the volatile forex markets with greater confidence and precision, ensuring that your trading endeavors are both profitable and secure.

What Are Trailing Stops in Forex?

Understanding Trailing Stops in Forex Trading

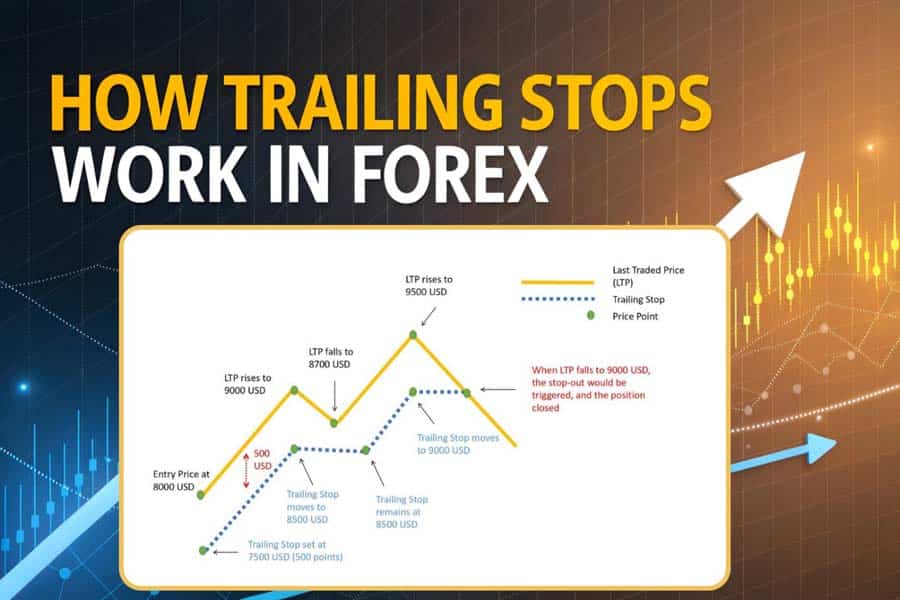

Trailing stops in forex are advanced order types designed to help traders lock in profits while minimizing potential losses. Unlike traditional stop-loss orders, which remain fixed at a predetermined price level, trailing stops adjust dynamically with favorable price movements. This flexibility ensures that as the market moves in your favor, the trailing stop follows, allowing you to capture more profits while maintaining a safety net against adverse price movements.

Why Are Trailing Stops Important in Forex?

- Enhanced Risk Management: Trailing stops allow traders to set a flexible exit point that adjusts based on market movements, providing better protection against sudden market reversals.

- Automation of Trades: By automating the exit strategy, trailing stops eliminate the emotional aspect of trading, ensuring disciplined execution of trading plans.

- Maximizing Profits: As the market trends in a favorable direction, trailing stops help in capturing maximum profits by adjusting the stop-loss level to secure gains.

- Adaptability: Trailing stops adapt to changing market conditions, making them suitable for various trading styles and market environments.

Incorporating trailing stops into your trading strategy can significantly improve your ability to manage risk and enhance overall profitability.

How Trailing Stops Work in Forex

Mechanism of Trailing Stops in Forex Trading

Understanding the mechanics of trailing stops is crucial for effectively implementing them in your trading strategy. Here’s a detailed breakdown of how they function:

Mechanism of Trailing Stop Orders

When placing a trailing stop order in forex, you specify a trailing distance, typically measured in pips or as a percentage of the current price. This distance determines how far the trailing stop will trail the market price. As the price moves in your favor, the trailing stop adjusts accordingly, maintaining the set distance. If the price reverses by the trailing distance, the trailing stop is triggered, closing the trade and securing your profits.

For example, if you enter a long position at 1.2000 with a trailing stop set at 50 pips, and the price rises to 1.2100, the trailing stop will move up to 1.2050. If the price continues to rise to 1.2200, the trailing stop adjusts to 1.2150. Should the price then drop to 1.2150, the trailing stop is activated, and the trade is closed.

Trailing Stops vs. Traditional Stop-Loss Orders

| Aspect | Trailing Stops | Traditional Stop-Loss |

| Flexibility | Adjusts with favorable price movements | Fixed at a predetermined price level |

| Profit Protection | Locks in profits as the market moves in your favor | Only limits losses |

| Automation | Requires no manual adjustment once set | Needs manual changes to align with market shifts |

| Adaptability | Responds dynamically to market trends | Static and unresponsive to market movements |

Trailing stops offer a more adaptable and automated approach to risk management compared to traditional stop-loss orders, making them a preferred choice for many forex traders.

Setting Up Trailing Stops in Forex Trading

Effectively setting up trailing stops requires a strategic approach to ensure they align with your trading objectives and market conditions. Here’s how to get started:

Determining the Appropriate Trailing Stop Distance

Choosing the right trailing stop distance is critical for balancing risk and reward. An optimal trailing distance ensures that you protect your profits without exiting trades prematurely. Consider the following factors when determining the trailing stop distance:

- Market Volatility: High-volatility pairs may require a wider trailing stop to avoid being triggered by normal market fluctuations, while low-volatility pairs can function effectively with tighter stops.

- Trading Strategy: The type of trading strategy you employ—whether scalping, swing trading, or long-term investing—should influence your trailing stop distance. Short-term strategies may benefit from tighter stops, whereas longer-term strategies might require more flexibility.

- Average True Range (ATR): Utilizing indicators like ATR can help gauge market volatility and set trailing stops accordingly. For instance, a trailing stop set at 1.5 times the ATR can adapt to varying market conditions.

Utilizing Trading Platforms to Implement Trailing Stops

Most modern forex trading brokers provide platforms like MetaTrader 5 (MT5) that support the implementation of trailing stops. Here’s a step-by-step guide to setting them up:

- Open a Trade Order: Initiate a new trade or select an existing open position where you want to apply a trailing stop.

- Locate the Trailing Stop Feature: In the trading platform, find the trailing stop option, usually accessible through the order management interface.

- Set the Trailing Distance: Define the trailing distance in pips or as a percentage. Ensure this distance aligns with your trading strategy and market volatility.

- Activate the Trailing Stop: Enable the trailing stop feature, allowing the platform to automatically adjust the stop-loss level as the market price moves in your favor.

- Monitor and Adjust: While trailing stops automate the exit process, it’s essential to monitor your trades and adjust the trailing distance if necessary based on changing market conditions.

Properly setting up trailing stops can streamline your trading process, making it more efficient and less reliant on constant manual adjustments.

Strategies for Using Trailing Stops

Effective Strategies for Using Trailing Stops

Implementing effective forex trailing stop strategies can significantly enhance your trading performance. Here are two advanced strategies to consider:

Applying the ATR Indicator for Trailing Stops

The Average True Range (ATR) is a popular volatility indicator that measures market volatility by calculating the average range of price movements over a specific period. Using ATR to set trailing stops can help ensure that your stops are adaptive to current market conditions.

- High Volatility Conditions: In markets with high volatility, use a larger ATR-based trailing stop to accommodate larger price swings without triggering premature exits.

- Low Volatility Conditions: In more stable markets, a smaller ATR-based trailing stop can effectively protect profits without being overly restrictive.

By aligning trailing stops with ATR, traders can create a more responsive and effective risk management system.

Using Moving Averages as Dynamic Stop-Loss Levels

Moving averages can serve as dynamic levels for setting trailing stops, providing a trend-based approach to risk management. Here’s how to implement this strategy:

- Identify Key Moving Averages: Choose moving averages that align with your trading timeframe, such as the 50-day or 200-day moving averages for longer-term trades.

- Set Trailing Stops Based on Moving Averages: Position your trailing stop just below a significant moving average level. As the price moves in your favor, the moving average will adjust, and so will your trailing stop.

- Exit on Crossovers: If the price crosses below the moving average, your trailing stop can act as a signal to exit the trade, ensuring you capture profits before a potential trend reversal.

Utilizing moving averages for trailing stops integrates trend-following principles into your risk management strategy, enhancing its effectiveness.

Read More: Stop Loss in Forex

Advantages and Disadvantages of Trailing Stops

While trailing stops in forex offer numerous benefits, it’s essential to understand their potential drawbacks to use them effectively.

Advantages of Trailing Stops in Forex

- Dynamic Risk Management: Trailing stops automatically adjust to favorable price movements, allowing for real-time risk management that adapts to market conditions.

- Emotion-Free Trading: By automating exit strategies, trailing stops help eliminate emotional decision-making, promoting disciplined trading practices.

- Profit Maximization: Trailing stops enable traders to lock in profits as the market moves in their favor, ensuring that gains are secured without requiring constant monitoring.

- Automation: They provide a set-and-forget mechanism, allowing traders to focus on other aspects of their trading strategy while the trailing stop manages the exit.

- Adaptability: Trailing stops can be customized based on various indicators and strategies, making them suitable for different trading styles and market conditions.

Disadvantages of Trailing Stops

- Premature Exits: Tight trailing stops may result in trades being closed before significant price movements occur, potentially limiting profit potential.

- Market Volatility: In highly volatile markets, trailing stops can be triggered by normal price fluctuations, leading to frequent trade closures.

- Complexity for Beginners: Setting up and managing trailing stops requires a good understanding of market dynamics and trading platforms, which can be challenging for novice traders.

- Over-Reliance on Automation: Relying solely on trailing stops without considering broader market trends and indicators can lead to suboptimal trading decisions.

- Potential Slippage: In fast-moving markets, trailing stops may experience slippage, resulting in execution at a less favorable price than intended.

Balancing the advantages and disadvantages is crucial for leveraging trailing stops effectively within your trading strategy.

Best Practices for Implementing Trailing Stops

To maximize the effectiveness of implementing trailing stops in forex trading, consider the following best practices:

- Align Stops with Market Conditions: Tailor your trailing stop distance based on current market volatility, trend strength, and relevant news events. This alignment ensures that your trailing stops are neither too tight nor too loose.

- Regularly Review and Adjust Strategies: Periodically assess the performance of your trailing stop strategies. Adjust the trailing distance and strategy parameters based on changing market dynamics and your trading performance.

- Combine Indicators for Confirmation: Use additional technical indicators, such as ATR or Fibonacci retracement levels, to validate your trailing stop settings. This combination enhances the reliability of your risk management approach.

- Diversify Trailing Stop Strategies: Implement different trailing stop strategies across various trades to mitigate the risk of overexposure to a single strategy’s weaknesses.

- Maintain Consistent Position Sizing: Ensure that your position sizes are consistent with your trailing stop distances to maintain a balanced risk-reward ratio across all trades.

- Educate Yourself Continuously: Stay informed about new developments and advanced techniques in trailing stops to continuously refine and enhance your trading strategy.

- Use Technology to Your Advantage: Leverage automated trading systems and advanced trading platforms to efficiently implement and manage trailing stops without constant manual intervention.

- Backtest Your Strategies: Before deploying trailing stops in live trading, backtest your strategies using historical data to evaluate their effectiveness and make necessary adjustments.

Adhering to these best practices ensures that your trailing stop implementation remains effective and adaptable to evolving market conditions.

Read More: Risk management principles for traders

Pro Tips for Advanced Traders

For those who have mastered the basics and are looking to elevate their trading strategies, here are some pro tips for using trailing stops in forex:

- Blend Trailing Stops with Position Sizing: Adjust your position sizes based on the trailing stop distance and market volatility. This approach ensures that your risk per trade remains consistent, regardless of market conditions.

- Optimize with Backtesting: Use historical data to backtest different trailing stop strategies. Analyzing past performance can help identify the most effective trailing stop settings for various market scenarios.

- Integrate with Automated Trading Systems: Leverage platforms like MetaTrader 5 to automate trailing stop adjustments based on predefined criteria. Automated systems can execute trailing stops with precision and speed, reducing the likelihood of human error.

- Use Multi-Tiered Trailing Stops: Implement multiple trailing stops at different intervals to manage risk progressively. For example, set an initial trailing stop to secure early profits and a secondary trailing stop to capture larger gains.

- Monitor Correlations and Diversify: Be aware of correlations between different currency pairs and diversify your trailing stop strategies accordingly. This diversification helps reduce the risk of simultaneous stop-outs in correlated trades.

- Incorporate News Events Strategically: Temporarily widen trailing stops ahead of major news releases to avoid being stopped out by sudden volatility, then tighten them post-event based on the market’s reaction.

- Leverage Volatility Indicators: Use advanced volatility indicators like Bollinger Bands or Keltner Channels in conjunction with trailing stops to better adapt to changing market conditions.

- Implement Time-Based Trailing Stops: In addition to price-based trailing stops, consider setting time-based trailing stops to exit trades after a certain period, ensuring that trades do not overstay their expected duration.

- Customize for Different Currency Pairs: Tailor your trailing stop strategies to the specific characteristics of each currency pair, as different pairs exhibit varying levels of volatility and trend behavior.

- Continuously Analyze Performance Metrics: Regularly evaluate key performance indicators (KPIs) such as win rate, average profit per trade, and maximum drawdown to fine-tune your trailing stop strategies for optimal performance.

These advanced strategies can enhance your ability to manage risk and maximize profits, giving you a competitive edge in the forex market.

Opofinance Services: Your Trusted Forex Broker

When it comes to implementing effective trailing stop loss in forex, partnering with a reliable broker is paramount. Opofinance, an ASIC-regulated forex broker, offers a suite of services designed to empower traders with the tools and support they need to succeed in the forex market. Here’s why Opofinance stands out:

- Safety and Convenience:

- Secure Deposits and Withdrawals: Opofinance provides safe and convenient methods for depositing and withdrawing funds, ensuring your transactions are seamless and secure.

- Regulated Environment: As an ASIC-regulated broker, Opofinance adheres to strict regulatory standards, providing transparency and peace of mind for traders.

- Advanced Trading Platforms:

- MT5 Official Listing: Opofinance is officially featured on the MetaTrader 5 brokers list, offering access to advanced trading tools, automated trading capabilities, and comprehensive charting features.

- Social Trading Services:

- Copy Successful Traders: With Opofinance’s social trading services, you can replicate the trades of experienced and successful traders, leveraging their expertise to enhance your own trading performance.

- Comprehensive Support:

- Dedicated Customer Service: Opofinance offers exceptional customer support to assist you with any trading-related inquiries or issues.

- Exclusive Trading Tools:

- Proprietary Tools and Indicators: Gain access to exclusive trading tools and indicators designed to optimize your trading strategies and improve decision-making.

- Unique Features:

- Competitive Spreads and Leverage: Benefit from competitive spreads and flexible leverage options tailored to suit both beginner and professional traders.

- Educational Resources: Access a wealth of educational materials, including webinars, tutorials, and market analysis, to enhance your trading knowledge and skills.

Join Opofinance today and take advantage of our cutting-edge trading platforms, secure transactions, and expert social trading services to elevate your forex trading journey!

Conclusion

Trailing stops in forex are indispensable tools for traders seeking to optimize their risk management and maximize their profit potential. By dynamically adjusting your stop-loss levels in response to favorable price movements, trailing stops offer a sophisticated way to protect gains while allowing your trades to flourish. Whether you’re a novice aiming to build a solid trading foundation or an experienced trader looking to refine your strategies, mastering trailing stops can significantly enhance your trading performance.

Implementing effective forex trailing stop strategies involves understanding market volatility, selecting appropriate trailing distances, and leveraging technical indicators to inform your decisions. By adhering to best practices and incorporating advanced techniques, you can navigate the complexities of the forex market with greater confidence and precision.

Embrace the power of trailing stops to transform your trading approach, ensuring that you stay ahead in the ever-evolving forex landscape. With the right tools and strategies, you can achieve a balanced and profitable trading journey, turning every market movement into an opportunity for success.

Key Takeaways

- Definition: Trailing stops are dynamic stop-loss orders that adjust with favorable price movements, enhancing risk management and profit protection.

- Benefits: Trailing stops offer dynamic risk management, emotion-free trading, and the ability to maximize profits by locking in gains as the market moves in your favor.

- Strategies: Utilize indicators like ATR and moving averages to set optimal trailing stop distances, and implement advanced strategies such as multi-tiered stops and automated adjustments.

- Best Practices: Align trailing stops with market conditions, regularly review and adjust strategies, and combine trailing stops with other technical indicators for enhanced effectiveness.

- Pro Tips: Blend trailing stops with position sizing, optimize strategies through backtesting, and integrate trailing stops with automated trading systems for superior performance.

Incorporating trailing stops into your forex trading strategy can significantly improve your ability to manage risk and capture profits, making it a vital component of successful trading.

How Can Trailing Stops Enhance My Forex Trading Strategy?

Trailing stops enhance your forex trading strategy by allowing your trades to run while automatically securing profits as the market moves in your favor. This dynamic approach helps in maximizing gains and minimizing losses without the need for constant monitoring. By adjusting your stop-loss level as the market progresses, trailing stops enable you to stay in profitable trades longer while protecting against adverse movements.

What Are the Best Indicators to Use with Trailing Stops?

The Average True Range (ATR) and moving averages are among the best indicators to use with trailing stops. ATR helps gauge market volatility, allowing you to set appropriate trailing distances based on current market conditions. Moving averages provide trend-based levels for dynamic stop-loss adjustments, ensuring that your trailing stops align with the overall market trend. Combining these indicators can enhance the effectiveness of your trailing stop strategy.

Can Trailing Stops Be Used in Automated Trading Systems?

Yes, trailing stops can be seamlessly integrated into automated trading systems. Platforms like MetaTrader 5 support the automation of trailing stops, enabling traders to execute their risk management strategies with precision and without manual intervention. Automated trailing stops ensure that your exit strategies are consistently applied, reducing the likelihood of human error and allowing for more disciplined trading.