Having a clear understanding of your financial flow and regularly reviewing your transaction history are fundamental to smart financial management. The OpoFinance app, by providing transparent and user-friendly access to this information, empowers you to monitor and plan your finances with complete awareness. In this comprehensive guide, we’ll walk you through the steps to access, understand, and make the most of your transaction history within OpoFinance.

Accessing the Transaction History Section in the OpoFinance App

Reaching your financial activity report in OpoFinance is straightforward with these simple steps:

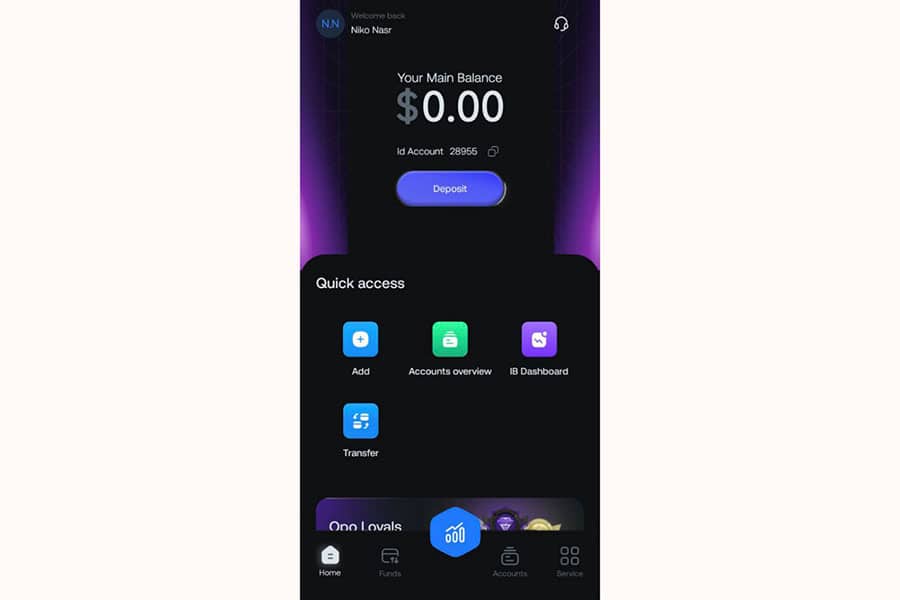

Step 1: Log in to the App and Identify the Main Dashboard

After launching the OpoFinance app and logging into your account, you’ll land on the main page or dashboard. This screen provides an overview of your account status, including your Your Main Balance. You’ll also find Quick access options for common operations like Deposit or Add account. At the bottom of the screen, the main menu bar includes options such as “Home,” “Funds,” “Accounts,” and “Service.” Our focus for accessing financial records will be on the “Funds” option.

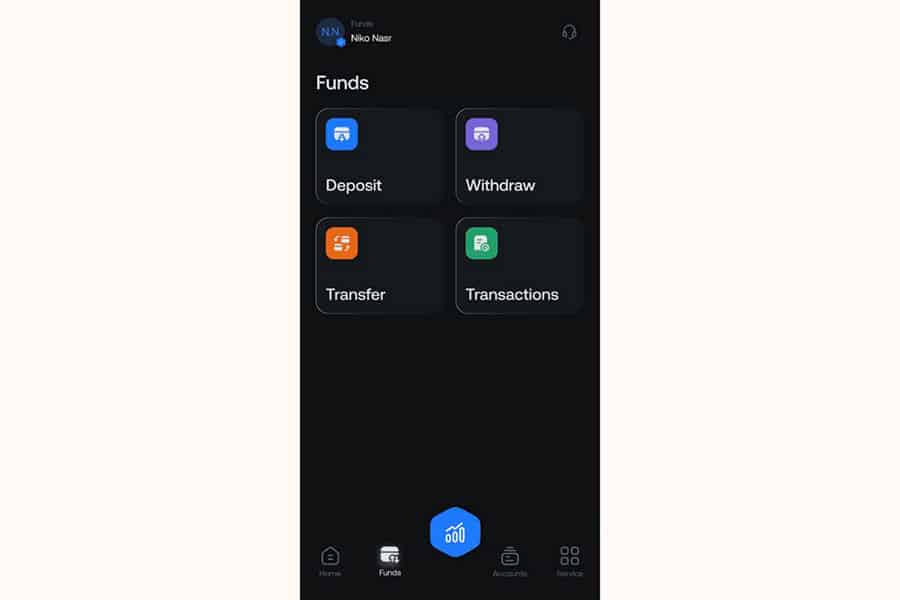

Step 2: Select “Funds” and then “Transactions”

From the menu bar at the bottom of the screen, select the “Funds” option. This will take you to a page featuring four main functions related to fund management: “Deposit,” “Withdraw,” “Transfer” (internal or between accounts), and “Transactions” (history/records). To view your complete financial activity history, tap on the “Transactions” option.

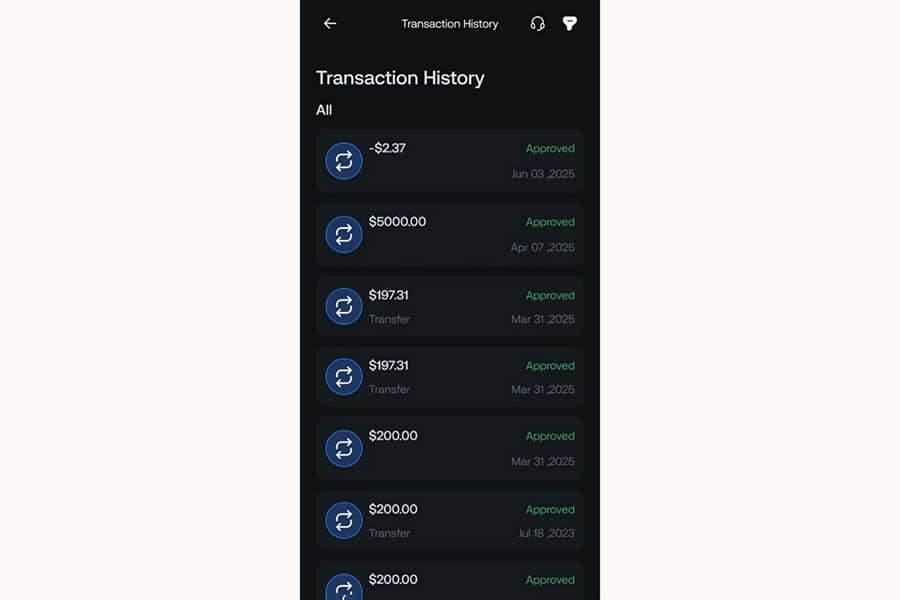

Understanding the Information Displayed in Transaction History

Once you enter the “Transaction History” section, you’ll have access to a comprehensive list of all financial activities recorded in your account. Understanding this information is crucial for an accurate financial analysis:

Read More:OpoFinance Deposit and Withdrawal Tutorial

Details of Each Transaction

Each row in this list represents a distinct financial transaction and typically includes the following information:

- Transaction Amount: The exact amount of money moved in that transaction. This amount is displayed with a plus sign (+) for deposits or other inflows and a minus sign (-) for withdrawals or other outflows.

- Transaction Type: Alongside the amount or in its description, the type of operation performed is mentioned. For example, “Transfer” indicates a fund transfer. Other types like deposits or withdrawals are also usually specified, although the main view might focus on the amount and status.

- Transaction Status: This section shows the final outcome of the transaction. A status of “Approved” (often highlighted in green) means the operation was successful. Other statuses like “Declined” (rejected) or “Pending” (under review) may also appear, each indicating a specific stage of transaction processing.

- Transaction Date: The exact date each financial activity was performed is clearly recorded, allowing you to track the precise timing of each financial event.

Advanced Filters and Search Options

When the number of transactions grows, finding a specific item can be challenging. OpoFinance simplifies this process by providing filter and search tools. By selecting the filter icon (usually at the top of the transaction history page), you can access the following options:

(An image would typically show the filter options available in the transaction history, such as type, status, and date range.)

- Filter by Transaction Type: This allows you to limit the display to “All” (all items), “Deposit” (only deposits), “Withdraw” (only withdrawals), or “Transfer” (only transfers). This feature is very useful for focusing on a specific type of financial activity.

- Filter by Transaction Status: Using this filter, you can sort transactions by their final status (“All” statuses, “Approved,” “Declined,” “Cancelled”). This option is particularly helpful for quickly tracking the status of deposit or withdrawal requests.

- Filter by Date Range: One of the most powerful filtering tools is the ability to select a specific time period. By setting a start date (“From”) and an end date (“To”), you can view only the transactions conducted within that particular period. This feature is excellent for reviewing monthly, quarterly, or annual financial performance.

How to Use Transaction History Information for Financial Performance Analysis

Your transaction history is more than just a simple report; it’s an analytical tool for a deeper understanding of your financial situation and making informed decisions. Here are some practical applications of this information:

- Cash Flow Management: By regularly reviewing deposits and withdrawals, you can get an accurate picture of your money inflows and outflows. This is the first step towards effective financial planning and preventing budget deficits.

- Budget Control and Adherence: If you have a specific budget for your expenses, the transaction history shows you how well you’ve stuck to it. Identifying areas where you’ve overspent allows for adjustments in spending patterns.

- Identifying Financial Patterns and Spending Habits: Periodically reviewing transactions can reveal recurring patterns in expenses or income. For instance, you might notice certain expenses increase on specific days of the month, or that your income has seasonal fluctuations.

- Verifying Transaction Authenticity and Accuracy: Carefully checking your records helps ensure the accuracy of all logged transactions. This is vital for identifying any unauthorized activity or potential errors.

- Preparing for Tax Matters and Reporting: Having a well-documented and accurate financial history makes preparing tax returns and other financial reports much simpler and more precise.

- Evaluating Investment and Trading Performance (if applicable): For users engaged in trading or investment activities on the OpoFinance platform, reviewing inflows (potential profits) and outflows (potential losses or profit withdrawals) can help assess the effectiveness of trading strategies.

- Tracking Forgotten Expenses or Recurring Subscriptions: Sometimes, small expenses like monthly subscriptions or automatic payments can be overlooked. The transaction history helps identify these items.

- Comparing Against Financial Goals: By reviewing your spending and savings in the transaction history, you can assess your progress towards achieving short-term and long-term financial goals.

Read More: What Is Forex Factory

Important Security Tips for Reviewing Transaction History

Using digital financial services requires adherence to security measures to protect your information and assets. Keep the following in mind when reviewing your transaction history on OpoFinance and similar platforms:

- Regular and Periodic Review: It’s recommended to review your transaction history regularly (at least once a week). This helps in quickly identifying any suspicious activity or unrecognized transactions.

- Reconcile with Other Financial Records: If possible, compare the information in your OpoFinance transaction history with your other financial records, like bank statements, to ensure consistency.

- Maintain Account Security: Use a strong, unique, and hard-to-guess password for your OpoFinance account. If the platform supports it, enable two-factor authentication (2FA) and never share your login credentials with anyone under any circumstances.

- Be Vigilant Against Phishing Scams: Never respond to emails, text messages, or calls claiming to be from OpoFinance that ask for sensitive account information (like passwords or one-time codes) or transaction details. OpoFinance typically communicates with users through official and secure in-app channels or its website.

- Report Suspicious Activity Immediately: If you notice any unrecognized transactions, unusual activity, or anything suspicious in your account, report it immediately through OpoFinance’s official support channels.

- Use Secure Internet Networks: As much as possible, avoid accessing your account and reviewing financial information over public and unsecured Wi-Fi networks. Always ensure you are connected to the internet via a secure and trusted network.

- Keep Software Updated: Ensure that the OpoFinance app and your device’s operating system are always updated to the latest available versions to benefit from the newest security patches.

Practical Tip: Many financial applications allow you to export transaction history (e.g., in CSV or PDF format). Check if OpoFinance offers this feature, as it can be very useful for archiving or more advanced analysis.

Read More: How to Activate Two Factor Authentication 2FA on Opofinance

Final Thoughts

As you’ve seen, the OpoFinance app, with its user-centric design and efficient tools, has made accessing transaction history a simple and transparent process. By correctly utilizing this information, you can gain greater insight into your financial status, have better control over your resources, and move towards your financial goals with increased confidence and awareness.