A Trend-Following Strategy is a time-tested trading approach that involves identifying and capitalizing on sustained price movements, or trends, in financial markets. By following the direction of the market’s prevailing trend, traders aim to maximize profits and reduce risks. This strategy is particularly popular among traders due to its simplicity and proven effectiveness across various asset classes, including stocks, forex, cryptocurrencies, and commodities. Whether you’re working with a forex trading broker or trading independently, the trend-following strategy allows you to make informed decisions based on market direction.

In this article, we’ll explore how trend-following works, the key indicators used to identify trends, and how it can be applied across different markets. You’ll also discover essential risk management techniques and learn about popular trend-following strategies that traders rely on to succeed.

How Trend-Following Works

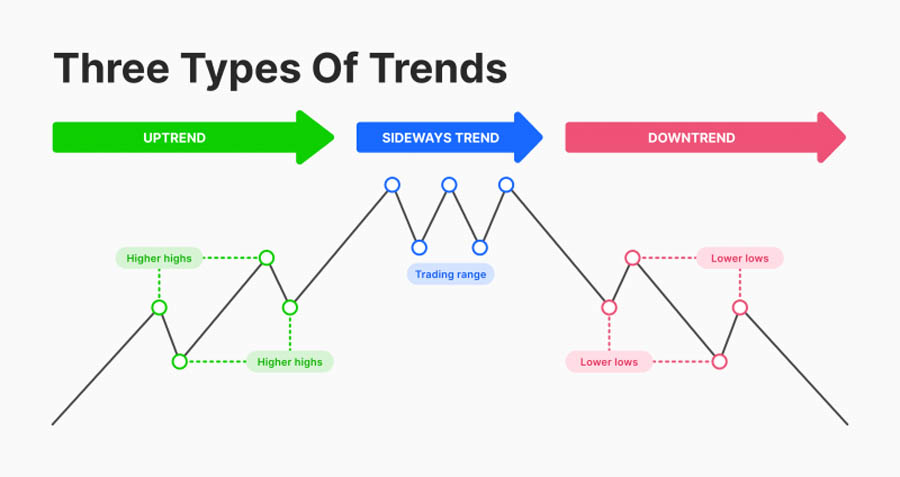

A Trend-Following Strategy revolves around the concept of recognizing the market’s direction and trading in that direction. The market can generally move in one of three ways:

- Uptrend: When prices are consistently rising.

- Downtrend: When prices are consistently falling.

- Sideways/Range-bound: When prices fluctuate within a defined range without a clear direction.

Trend-following traders aim to spot these trends early and ride them until the momentum weakens. The core philosophy is that the market often continues to move in its current direction rather than reverse, so by following the prevailing trend, traders increase their chances of profitability.

Read More: Trend Reversal Trading Strategy

Advantages of Trend-Following

- Simplicity: This strategy relies on market direction, eliminating complex decision-making.

- Less Market Noise: Trend-followers can avoid short-term market fluctuations and focus on the bigger picture.

- Profit Maximization: By staying with the trend, traders can capture larger price movements.

Disadvantages of Trend-Following

- Late Entries and Exits: Traders may enter a trend after it’s already started and exit after it ends.

- False Signals: Market noise and sudden reversals can lead to losses if not managed carefully.

Key Indicators Used in Trend-Following

To succeed in trend-following, traders often rely on technical indicators that help confirm the market’s direction. Below are the most popular indicators used in trend-following strategies.

Moving Averages (MAs)

Moving Averages are one of the most commonly used tools in trend-following. They smooth out price data over time, making it easier to spot trends.

- Simple Moving Average (SMA): Calculates the average price over a set number of periods. For example, a 50-day SMA averages the closing prices of the last 50 days.

- Exponential Moving Average (EMA): Places more weight on recent price changes, reacting faster to new price movements.

Key Moving Average Strategies

- Golden Cross: A bullish signal where a short-term moving average (e.g., 50-day) crosses above a long-term moving average (e.g., 200-day).

- Death Cross: A bearish signal where the short-term moving average crosses below the long-term moving average.

The 50-day and 200-day moving averages are particularly significant for identifying long-term trends in financial markets.

Trend Lines

Trend lines are straight lines drawn on charts to connect a series of price points. They help traders identify uptrends and downtrends.

- Uptrend Line: Drawn by connecting the lows in an upward trend.

- Downtrend Line: Drawn by connecting the highs in a downward trend.

These lines act as dynamic support and resistance levels, helping traders spot potential trend reversals.

Momentum Indicators

Momentum indicators assess the strength of a trend and are often used in conjunction with moving averages and trend lines.

- Relative Strength Index (RSI): Measures the speed and change of price movements. An RSI above 70 indicates an overbought market, while an RSI below 30 indicates an oversold market.

- MACD (Moving Average Convergence Divergence): Shows the relationship between two moving averages, signaling potential trend changes through crossovers.

- Stochastic Oscillator: Used to identify potential reversals in trends by comparing the closing price to a range of prices over a specific period.

Chart Patterns

Traders also rely on chart patterns to recognize trends and predict future price movements.

- Candlestick Patterns: Patterns like Three Black Crows (indicating a downtrend) and Three White Soldiers (indicating an uptrend) provide visual clues about market sentiment.

- Continuation and Reversal Patterns: Patterns like head and shoulders, flags, and pennants signal the continuation or reversal of a trend.

Read More: Range Trading

Implementing the Trend-Following Strategy: Step-by-Step Guide

Implementing a Trend-Following Strategy requires a structured approach to ensure success across different market conditions. Here’s a step-by-step guide to help you implement this strategy effectively in your trading.

Step 1: Choose the Right Market

The first step is selecting the right market for trend-following. While this strategy works across multiple asset classes, some markets are more conducive to trends than others. Trend-following strategies work particularly well in:

- Forex markets: Currency pairs like EUR/USD and GBP/USD often experience clear trends based on economic cycles and central bank policies.

- Stock markets: Individual stocks or sectors tend to move in trends, especially during earnings seasons or economic shifts.

- Cryptocurrency: The volatility of digital assets like Bitcoin and Ethereum can offer significant trending opportunities.

- Commodities: Markets like oil, gold, and silver tend to follow long-term trends due to macroeconomic factors.

Choose a market where you can easily access historical data for backtesting, and where trends tend to be sustained over time.

Step 2: Identify the Trend

Once you’ve chosen your market, the next step is to identify the prevailing trend. Use a combination of the following tools to confirm whether the market is in an uptrend, downtrend, or sideways:

- Moving Averages: Plot both short-term (e.g., 50-day) and long-term (e.g., 200-day) moving averages to determine the market’s direction.

- Trend Lines: Draw trend lines to visualize the market’s highs and lows. An upward trend line indicates an uptrend, while a downward line signals a downtrend.

- Momentum Indicators: Check the RSI or MACD to assess whether the trend has enough momentum to continue or if it’s weakening.

When multiple indicators align, the trend is more likely to be strong.

Step 3: Enter the Trade

After confirming the trend, it’s time to enter the trade. The best entry point is often when the market experiences a pullback or correction within the overall trend. This allows you to enter at a more favorable price while still following the market direction.

- For an uptrend, buy during a pullback to a support level.

- For a downtrend, sell during a rally to a resistance level.

Make sure to wait for confirmation signals from your indicators before entering the trade. For instance, you might wait for a moving average crossover or an RSI reversal to signal that the pullback is over.

Step 4: Set Stop-Loss and Take-Profit Levels

Risk management is critical in trend-following. Setting a stop-loss helps you limit losses if the market moves against you, while a take-profit order ensures you lock in gains once the trend reaches a certain level.

- Place your stop-loss just below a recent support level in an uptrend, or above a resistance level in a downtrend.

- Set your take-profit based on the expected length of the trend. You can use previous price levels or a percentage of the total trend movement to decide where to take profits.

Step 5: Monitor and Adjust

Once your trade is active, it’s important to monitor the market and make adjustments as necessary. Trends can change due to shifts in market sentiment, economic data, or geopolitical events. Use the following methods to stay in control:

- Trailing Stop-Loss: Adjust your stop-loss as the trend progresses to lock in profits while allowing the trend to run.

- Indicator Confirmation: Keep an eye on momentum indicators like the RSI or MACD to ensure the trend is still valid.

- Exit Signals: Be ready to exit if the market breaks key trend lines or if your moving averages cross in the opposite direction.

Step 6: Review and Improve

Once your trade concludes, whether profitable or not, review the performance of your trend-following strategy. Analyze the indicators, market conditions, and your risk management decisions. Use this feedback to improve your approach for future trades.

- Backtest your strategy using historical data to see how it performs over different market environments.

- Journal your trades to identify patterns in your decision-making that could be improved.

By following this systematic approach, you can implement a Trend-Following Strategy effectively across various markets and improve your trading outcomes over time.

Trend-Following in Different Markets

A Trend-Following Strategy can be applied across a wide range of markets. Here’s how it works in some of the most popular asset classes.

Stocks

Stock traders rely on price action and volume to identify trends. Common trend-following systems in stocks include moving average crossovers and breakout strategies.

Forex

In the forex market, the Trend-Following forex Strategy involves analyzing currency pairs like EUR/USD, GBP/USD, and JPY/USD. Traders use economic data, interest rate changes, and geopolitical events to gauge the strength of currency trends. Indicators like RSI and MACD can be particularly useful for confirming trends in forex.

Cryptocurrency

Due to the high volatility of cryptocurrencies, a Trend-Following Strategy helps traders manage risk by sticking to clear trends. Popular cryptos like Bitcoin (BTC) and Ethereum (ETH) often experience extended trends that can be capitalized on using technical analysis tools.

Commodities and Futures

In commodities markets, trend-following works well for assets like gold, silver, and oil. Futures traders also benefit from following trends in contracts that track the movement of commodities or indices.

Risk Management in Trend-Following

Effective risk management is critical for success in trend-following. Here are some important techniques.

Stop-Loss Orders

Setting stop-loss orders ensures that your trades automatically close once the market moves against you by a predetermined amount. This helps you limit losses and protect your capital.

Position Sizing

Proper position sizing is essential to avoid overexposure to any single trade. The size of your position should be based on your risk tolerance and the volatility of the asset you’re trading.

Diversification

Diversifying your portfolio across different markets and asset classes can help mitigate losses when trends don’t go your way.

Backtesting

Before implementing a trend-following strategy, it’s important to backtest it using historical data. This allows you to assess the strategy’s performance in various market conditions.

Common Trend-Following Strategies

Below are some of the most widely used trend-following strategies.

Moving Average Crossover Strategy

This strategy involves using two moving averages—a short-term and a long-term one—and entering trades when they cross. For example, when the 50-day moving average crosses above the 200-day moving average (Golden Cross), it signals a buy. When the reverse happens (Death Cross), it signals a sell.

Turtle Trading Strategy

The Turtle Trading Strategy, popularized in the 1980s, is a famous trend-following system that uses breakouts and position sizing rules to follow long-term trends. Traders buy when the price breaks out of a recent high and sell when it breaks a recent low.

Donchian Channel Strategy

The Donchian Channel Strategy uses price channels to identify breakouts. When the price moves above the upper boundary of the channel, it signals a buy. When it moves below the lower boundary, it signals a sell.

Trade Smarter with Opofinance: Your Trusted ASIC-Regulated Broker

Ready to take your trend-following strategy to the next level? Opofinance, an ASIC-regulated broker, provides a secure and transparent trading environment for traders of all levels. Whether you’re trading forex, stocks, or cryptocurrencies, Opofinance ensures you have the tools and resources needed to succeed in today’s fast-paced markets.

What sets Opofinance apart?

- MT5 Platform Access: As an officially featured broker on the MT5 brokers list, Opofinance gives you access to advanced charting tools, lightning-fast execution, and a seamless trading experience.

- Social Trading: Learn from the best with Opofinance’s social trading service—mirror the strategies of top traders, including trend-followers, and enhance your own performance without starting from scratch.

- Safe and Convenient Transactions: Enjoy peace of mind with secure deposits and withdrawals, ensuring your funds are always safe and accessible when you need them.

With Opofinance, you can focus on what really matters: making informed trading decisions and capitalizing on market trends. Join thousands of traders who trust Opofinance for their trading journey. Experience the perfect blend of reliability, innovation, and safety. Start trading with Opofinance today!

Conclusion

The Trend-Following Strategy is a time-tested approach used by traders across various markets—whether you’re trading forex, stocks, or commodities. Its core principle is simple yet powerful: identify the prevailing trend and follow it. By doing so, traders can capitalize on sustained price movements, manage risks effectively, and improve their chances of long-term success.

However, mastering trend-following requires more than just identifying trends; it involves using the right combination of tools and indicators, such as moving averages, trend lines, and momentum indicators, to confirm market direction. Additionally, implementing sound risk management practices—from setting stop-losses to position sizing—is crucial to minimize losses and maximize gains.

Traders must also recognize that the market can be unpredictable. No strategy is foolproof, and trends can shift unexpectedly due to various factors, including economic news, geopolitical events, and market sentiment. That’s why patience, discipline, and continuous learning are essential in refining your Trend-Following Strategy over time. Backtesting, reviewing past trades, and staying adaptable are key to improving your overall performance.

Whether you’re new to trading or a seasoned trader, the Trend-Following Strategy offers a reliable framework for capitalizing on market movements. Its versatility across different asset classes—forex, cryptocurrencies, stocks, and commodities—makes it a favorite among both retail and institutional traders. By following the principles outlined in this guide and staying committed to risk management, you can build a successful trading strategy that withstands market fluctuations and positions you for sustained profitability.

Remember, trend-following is not about predicting the future—it’s about responding to what the market is telling you. By aligning yourself with the current market direction and using a disciplined, data-driven approach, you’ll give yourself the best chance to succeed in any market environment.

Incorporating the tools and strategies discussed in this article will help you not only identify trends but also maximize your profit potential while safeguarding your capital. Embrace the trend, follow it with confidence, and unlock your full trading potential.

Can the Trend-Following Strategy be used in volatile markets like cryptocurrency?

Absolutely. The Trend-Following Strategy can be particularly effective in volatile markets like cryptocurrency, where sharp price movements can often develop into sustained trends. Cryptocurrencies such as Bitcoin and Ethereum are known for their volatility, but this volatility can create significant profit opportunities for trend-followers. By identifying and following the prevailing market trend—whether bullish or bearish—traders can capitalize on these price movements. However, due to the unpredictable nature of cryptocurrencies, it’s crucial to employ robust risk management, such as setting stop-loss orders and using appropriate position sizing to mitigate the risks associated with sudden reversals.

What is the best time frame for applying the Trend-Following Strategy in forex trading?

The best time frame for applying the Trend-Following Strategy in forex trading depends on your trading style and objectives. For long-term traders (swing traders), daily and weekly charts are most suitable as they reflect broader, more sustained market trends. These time frames allow traders to ride trends for weeks or even months, which aligns with the essence of trend-following. On the other hand, for short-term traders (day traders), 1-hour and 4-hour charts are more appropriate as they capture smaller, yet still significant, trends within a day or a few days. Ultimately, choosing the right time frame should depend on your trading style, market analysis, and the currency pairs you are trading.

How can I avoid false signals when using a Trend-Following Strategy?

face when using a Trend-Following Strategy. To reduce the likelihood of acting on false signals, traders can implement the following techniques:

Combine multiple indicators: Instead of relying on a single indicator, use a combination of trend-following tools, such as moving averages, the MACD, and momentum indicators like the RSI. When several indicators align, the trend signal is more likely to be reliable.

Wait for confirmation: Rather than jumping into a trade as soon as a trend appears, wait for confirmation. For example, in a moving average crossover strategy, wait for the price to clearly move in the trend’s direction after the crossover occurs.

Use filters: Employ filters like volume analysis or economic news to validate the trend. Increased volume during an uptrend, for instance, can indicate that the trend is gaining strength.

By using these techniques, traders can significantly reduce the chances of entering trades based on false trends, improving their overall success with trend-following strategies.