Imagine having the ability to foresee a market reversal with remarkable precision, allowing you to seize profitable trading opportunities while safeguarding your investments. In the ever-evolving landscape of trading, candlestick patterns emerge as indispensable tools for decoding market sentiment and predicting price movements. Among these, the Tweezer Top Candlestick Pattern shines brightly as a formidable indicator for spotting bearish reversals, empowering traders to make strategic and informed decisions. Partnering with a reliable broker for forex can further enhance your trading strategy, ensuring you capitalize on these signals effectively.

Whether you’re collaborating with a regulated forex broker like Opofinance or delving into the intricacies of stock trading, mastering the Tweezer Top Pattern can profoundly enhance your trading strategy. This comprehensive guide delves deep into the Tweezer Top Candlestick Pattern, offering detailed explanations, actionable strategies, and real-world examples to help you harness its full potential. By the end of this article, you’ll be equipped with the knowledge to identify, interpret, and effectively trade using the Tweezer Top Pattern, setting you on a path to trading excellence and financial success.

Overview of Candlestick Patterns in Technical Analysis

Candlestick patterns are the cornerstones of technical analysis, providing traders with visual insights into price movements over specific timeframes. Originating from Japanese rice traders in the 18th century, these patterns have evolved into sophisticated tools for modern trading across various financial markets, including stocks, forex, commodities, and cryptocurrencies.

Each candlestick represents four crucial price points within a given period:

- Open: The price at which the asset begins trading.

- Close: The price at which the asset finishes trading.

- High: The highest price reached during the trading period.

- Low: The lowest price reached during the trading period.

By analyzing the relationship between these points, traders can identify trends, reversals, and potential entry or exit points. The Tweezer Top Candlestick Pattern is one such pattern that signals a possible reversal from an uptrend to a downtrend, making it a valuable addition to any trader’s toolkit.

Importance of Tweezer Top Pattern in Trading

The Tweezer Top Pattern is more than just a visual formation on a chart; it’s a powerful indicator of potential market reversals. Understanding its significance can provide traders with a strategic advantage in anticipating bearish movements and adjusting their positions accordingly.

Key Reasons for Its Importance:

- Early Reversal Signal: Detecting a Tweezer Top Pattern can alert traders to an impending bearish reversal before significant price declines occur.

- Enhanced Decision-Making: By incorporating this pattern into your analysis, you can make more informed decisions about entering or exiting trades.

- Risk Management: Identifying potential reversals allows for better risk management strategies, such as adjusting stop-loss orders to protect profits.

- Versatility Across Markets: Whether trading stocks, forex, or other assets, the Tweezer Top Pattern’s reliability across different markets makes it a versatile tool.

Incorporating the Tweezer Top Pattern into your trading strategy, especially when using a broker for forex trading like Opofinance, can significantly improve your ability to navigate volatile markets and enhance your overall trading performance.

What is a Tweezer Top Candlestick Pattern?

Definition and Basic Explanation

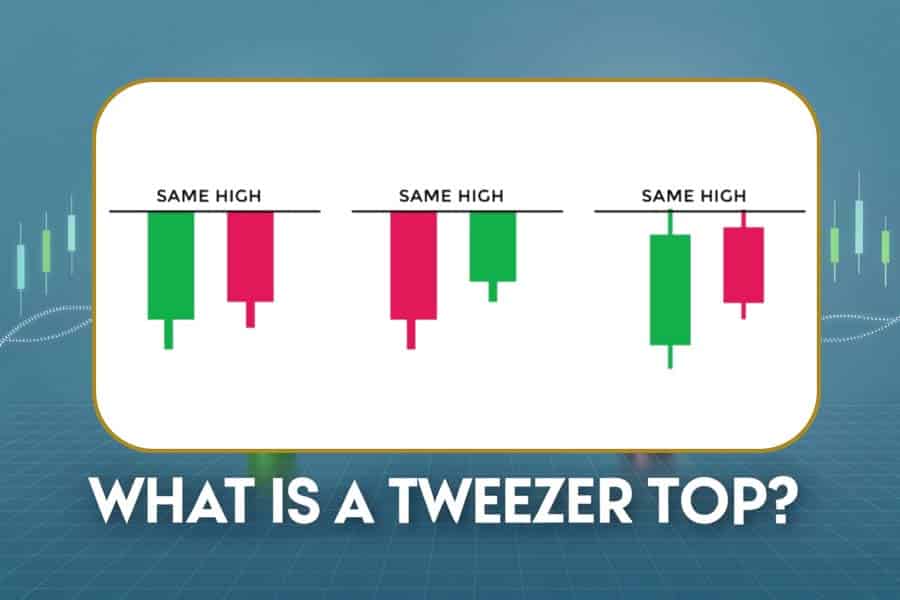

The Tweezer Top Candlestick Pattern is a technical analysis formation that consists of two consecutive candlesticks with matching or nearly matching highs. This pattern typically emerges at the peak of an uptrend, signaling a potential reversal to the downside. The first candlestick is usually bullish, indicating strong buying pressure, while the second candlestick is bearish, failing to surpass the high of the first. This formation suggests that the bullish momentum is weakening, and sellers may be gaining control.

Understand the Tweezer Top candlestick pattern and its role in predicting market trends.

Tweezer Top Candlestick Pattern Meaning

The Tweezer Top Candlestick Pattern meaning lies in its ability to depict a struggle between buyers and sellers at a specific price level. When two candlesticks share the same or nearly identical highs, it highlights a critical juncture where the market’s bullish sentiment is being challenged by bearish forces. This tug-of-war often precedes a significant downward movement, making the Tweezer Top Pattern a reliable bearish reversal signal.

Read More: Tweezer Bottom Candlestick Pattern

Visual Representation of Tweezer Top

Visualize two candlesticks standing side by side with identical or nearly identical high points. This “tweezer” appearance signifies a balance between buying and selling pressures. The prominent upper shadows on both candlesticks indicate that buyers attempted to push the price higher but were ultimately repelled by sellers, suggesting weakening bullish momentum and the potential onset of a bearish trend.

Components of the Tweezer Top Pattern

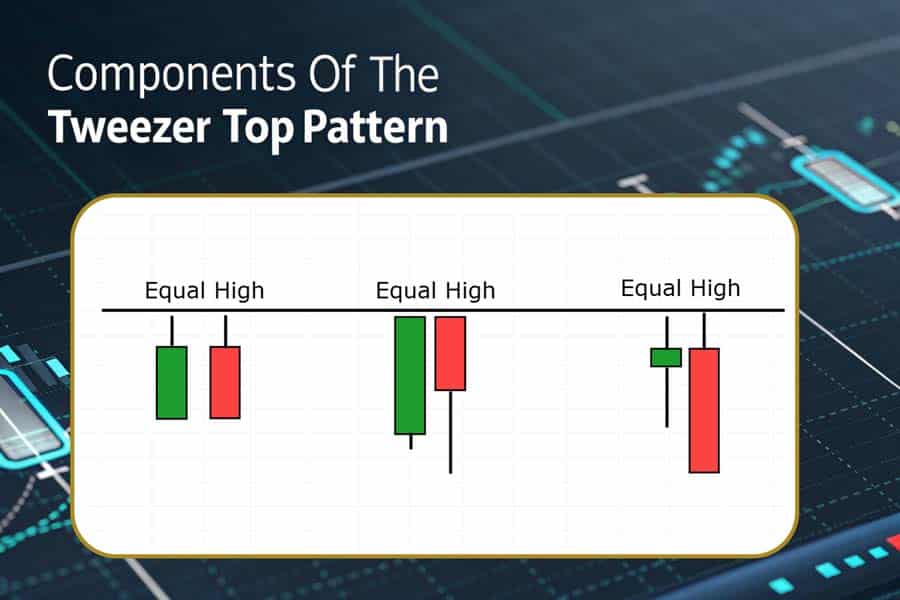

Understanding the individual components of the Tweezer Top Pattern is essential for accurate identification and interpretation. Each element plays a crucial role in signaling a potential market reversal.

Break down the Tweezer Top pattern into its essential components for better understanding.

Upper Shadows

Both candlesticks in the Tweezer Top Pattern feature prominent upper shadows. These shadows represent the highest price points reached during the trading period. The length and symmetry of these upper shadows are critical in confirming the pattern’s validity. Long upper shadows indicate that buyers made significant attempts to drive the price up but were ultimately repelled by sellers, suggesting weakening bullish momentum.

Body Characteristics of the Candlesticks

- First Candlestick: Typically a long-bodied bullish candlestick, showcasing strong buying pressure and sustained upward movement.

- Second Candlestick: A bearish candlestick with a smaller body that fails to exceed the high of the first candlestick. This contrast highlights the shift in market sentiment from bullish to bearish.

Confirmation Candlestick

A confirmation candlestick often follows the Tweezer Top Pattern, ideally a bearish candlestick that closes below the low of the Tweezer Top. This confirmation reinforces the likelihood of a trend reversal, providing traders with a more reliable signal to act upon. Without confirmation, the pattern may result in false signals, reducing its effectiveness.

How to Identify a Tweezer Top Pattern

Accurate identification of the Tweezer Top Pattern is crucial for leveraging its predictive power. Here’s a step-by-step guide to spotting this pattern on your trading charts.

Learn to accurately identify Tweezer Top patterns on trading charts with this step-by-step guide.

Step-by-Step Identification Process

- Identify an Uptrend: Look for a clear and sustained upward movement in the price chart, indicating a strong bullish trend.

- Spot the First Candlestick: Find a strong bullish candlestick with a substantial body, reflecting significant buying interest.

- Locate the Second Candlestick: Identify a bearish candlestick that forms immediately after the first, with a body that matches or nearly matches the high of the first candlestick.

- Check for Upper Shadows: Ensure that both candlesticks have prominent upper shadows, signaling that buyers attempted to push the price higher but were met with selling pressure.

- Look for Confirmation: Seek a bearish confirmation candlestick following the Tweezer Top Pattern, ideally one that closes below the low of the Tweezer Top.

Common Chart Timeframes for Tweezer Top

The Tweezer Top Pattern can be observed across various timeframes, each offering different insights:

- Daily Charts: Ideal for medium to long-term traders, providing a clear view of significant market movements.

- Weekly Charts: Useful for long-term investors looking to identify major trend reversals.

- Intraday Charts (e.g., 1-hour, 4-hour): Suitable for short-term traders aiming to capitalize on quick market movements.

While the pattern can appear on any timeframe, it tends to carry more weight and reliability on higher timeframes, where patterns are less susceptible to noise and false signals.

Significance in Market Trends

The Tweezer Top Pattern holds substantial significance in understanding and anticipating market trends. Its primary role is to signal potential bearish reversals, allowing traders to adjust their strategies accordingly.

Indication of Bearish Reversal

The Tweezer Top Pattern is a strong indicator of a bearish reversal, signaling that the prevailing uptrend may be losing momentum and is poised to reverse. When this pattern forms, it suggests that buyers are no longer able to sustain the upward momentum, and sellers are beginning to exert more influence, potentially leading to a price decline.

Comparison with Other Reversal Patterns

When compared to other reversal patterns like the Head and Shoulders or Double Top, the Tweezer Top Pattern offers a more straightforward and quicker identification process. Its immediate visual cues make it a preferred choice for traders who need swift and reliable signals to make timely trading decisions. However, while it is simpler, it should ideally be used in conjunction with other patterns and indicators to enhance its reliability and reduce the risk of false signals.

Trading Strategies Using Tweezer Top

Implementing effective trading strategies using the Tweezer Top Pattern can significantly improve your trading performance. Below are key strategies to consider.

Enhance your trading strategies with actionable insights using the Tweezer Top pattern.

Entry and Exit Points

- Entry Point: Enter a short position when the confirmation candlestick closes below the low of the Tweezer Top Pattern. This action capitalizes on the anticipated downward movement.

- Exit Point: Set a target based on previous support levels or a predefined risk-reward ratio. For instance, if your risk is 50 pips, you might set a target of 100 pips to maintain a 2:1 reward-to-risk ratio.

Risk Management Techniques

Effective risk management is crucial to protect your trading capital. Here are some techniques to consider:

- Stop-Loss Orders: Place stop-loss orders above the high of the Tweezer Top Pattern to limit potential losses if the market moves against your position.

- Position Sizing: Use position sizing strategies to ensure that no single trade disproportionately impacts your portfolio. For example, risking only 1-2% of your trading capital on any given trade.

- Diversification: Spread your investments across different assets to mitigate risk and reduce exposure to any single market movement.

Combining Tweezer Top with Other Indicators

Enhancing the reliability of the Tweezer Top Pattern can be achieved by combining it with other technical indicators:

- Moving Averages: Use moving averages to identify the overall trend and confirm the potential reversal indicated by the Tweezer Top.

- Relative Strength Index (RSI): An RSI divergence can provide additional confirmation of a bearish reversal.

- Volume Indicators: Increased trading volume during the formation of the Tweezer Top can strengthen the reversal signal, indicating significant selling interest.

By integrating these indicators, you can create a more robust trading strategy that reduces the likelihood of false signals and enhances your decision-making process.

Examples of Tweezer Top in Real Markets

Real-world examples provide valuable insights into the practical application and effectiveness of the Tweezer Top Pattern. Below are two case studies illustrating its use in different markets.

Case Study 1: Tweezer Top in Stock Trading

In early 2023, Stock XYZ exhibited a clear Tweezer Top Pattern after a sustained uptrend. Over several weeks, the stock price climbed steadily, reflecting strong bullish momentum. On January 15th, a long bullish candlestick formed, followed by a bearish candlestick with a matching high. The upper shadows of both candlesticks were prominent, signaling weakening buying pressure.

Subsequently, a confirmation candlestick closed below the low of the Tweezer Top Pattern, prompting traders to enter short positions. Within two weeks, the stock experienced a significant decline of 15%, validating the pattern’s effectiveness as a bearish reversal signal. Traders who acted on the Tweezer Top Pattern in stock trading were able to maximize their profits while minimizing potential losses.

Case Study 2: Tweezer Top in Forex Market

During the EUR/USD rally in mid-2023, a Tweezer Top Pattern emerged on the daily chart. The pair had been in a strong uptrend, supported by positive economic indicators and investor sentiment. On June 10th, a bullish candlestick with a substantial body formed, followed by a bearish candlestick that failed to surpass the previous high, creating the Tweezer Top.

Traders observed that the upper shadows were equally prominent, indicating a struggle between buyers and sellers. A confirmation candlestick closed below the low of the Tweezer Top, signaling a potential reversal. Traders who entered short positions at this point saw the EUR/USD pair decline by 120 pips over the next week, resulting in profitable trades.

These case studies demonstrate how the Tweezer Top Pattern Example can be effectively used across different markets to anticipate bearish reversals and execute profitable trades.

Read More: Piercing Line Candlestick Pattern

Common Mistakes to Avoid

While the Tweezer Top Pattern is a reliable indicator, traders must be aware of common pitfalls that can undermine its effectiveness. Avoiding these mistakes can enhance your trading accuracy and overall performance.

Misidentifying the Pattern

One of the most common mistakes is confusing the Tweezer Top with other candlestick patterns. To accurately identify the Tweezer Top Pattern, ensure that both candlesticks have matching or nearly matching highs with prominent upper shadows. Misidentifying the pattern can lead to incorrect trading decisions and potential losses.

Ignoring Confirmation Signals

Another frequent error is acting solely on the Tweezer Top without waiting for confirmation. Without a confirmation candlestick that closes below the low of the Tweezer Top, the pattern’s reliability diminishes. Ignoring confirmation signals can result in false positives, where the anticipated reversal does not materialize, leading to unnecessary losses.

Overlooking Market Context

Failing to consider the broader market context can also compromise the effectiveness of the Tweezer Top Pattern. Always assess other factors such as overall trend direction, economic indicators, and news events that may influence market sentiment. Overlooking these elements can result in misinterpretation of the pattern and misguided trading actions.

Poor Risk Management

Neglecting proper risk management techniques, such as setting appropriate stop-loss orders and managing position sizes, can amplify potential losses. Ensure that you implement robust risk management strategies to protect your trading capital, especially when trading based on reversal patterns like the Tweezer Top.

Advantages and Limitations of the Tweezer Top Pattern

Understanding the strengths and weaknesses of the Tweezer Top Pattern is essential for leveraging its benefits while mitigating potential drawbacks.

Benefits for Traders

- Simplicity: The Tweezer Top Pattern is easy to identify and understand, making it accessible for traders of all experience levels.

- Reliability: When confirmed with additional signals or indicators, the pattern offers high accuracy in predicting bearish reversals.

- Versatility: Applicable across various markets and timeframes, the Tweezer Top Pattern is a versatile tool for different trading strategies.

- Early Warning: It provides an early indication of a potential trend reversal, allowing traders to act proactively rather than reactively.

Potential Drawbacks and When It May Fail

- False Signals: The pattern can sometimes produce false positives, especially in highly volatile or sideways markets where price movements are unpredictable.

- Requires Confirmation: Without a confirmation candlestick, the pattern’s reliability is significantly reduced, necessitating additional analysis to validate the signal.

- Limited Predictive Power: The Tweezer Top Pattern does not account for broader market fundamentals or external factors that can influence price movements, potentially limiting its predictive power in certain scenarios.

- Dependence on Market Conditions: Its effectiveness can vary based on market conditions, making it less reliable in markets with low liquidity or high manipulation.

By being aware of these limitations, traders can use the Tweezer Top Pattern Meaning more effectively, incorporating it into a broader, well-rounded trading strategy that accounts for various market dynamics.

Pro Tips for Advanced Traders

For seasoned traders looking to maximize the potential of the Tweezer Top Pattern, here are some advanced strategies and insights to consider:

Integrate Multiple Timeframes

Analyzing the Tweezer Top Pattern across different timeframes can provide a more comprehensive view of the market. For example, confirming a Tweezer Top on both daily and weekly charts can enhance the pattern’s reliability and offer a clearer picture of the impending trend reversal.

Leverage Volume Indicators

Incorporating volume analysis can strengthen the confirmation of the Tweezer Top Pattern. High trading volumes during the formation of the pattern indicate significant selling interest, reinforcing the bearish reversal signal. Conversely, low volumes may suggest a lack of conviction among sellers, potentially weakening the pattern’s validity.

Utilize Automated Trading Systems

Implementing automated trading systems or algorithms can help detect Tweezer Top Patterns swiftly and execute trades with precision. Automated systems can monitor multiple assets and timeframes simultaneously, ensuring that no trading opportunity is missed. Additionally, they can help eliminate emotional biases, ensuring that trading decisions are based solely on predefined criteria.

Combine with Fibonacci Retracement Levels

Using Fibonacci retracement levels in conjunction with the Tweezer Top Pattern can provide additional support and resistance levels. These levels can help identify potential entry and exit points, as well as price targets, enhancing the overall trading strategy.

Employ Divergence Analysis

Analyzing divergences between the price action and momentum indicators like the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD) can offer deeper insights into the strength of the reversal signal. For instance, if the price forms a Tweezer Top while the RSI shows bearish divergence, the likelihood of a successful reversal increases.

Practice Strict Discipline and Patience

Advanced trading requires a disciplined approach and patience. Avoid the temptation to rush into trades based solely on the Tweezer Top Pattern without proper analysis and confirmation. Maintaining discipline ensures that trading decisions are strategic and well-founded, reducing the risk of impulsive actions that can lead to losses.

Opofinance Services

Discover the unparalleled advantages of trading with Opofinance, an ASIC regulated broker renowned for its exceptional services and trader-centric approach. Whether you’re a novice or an experienced trader, Opofinance offers a suite of features designed to enhance your trading experience.

Key Features of Opofinance:

- Social Trading Services:

- Connect with top traders and mirror their strategies for enhanced trading performance.

- Access to a community of experienced traders for insights and collaboration.

- Real-time trade copying ensures you stay aligned with market leaders.

- Featured on MT5 Brokers List:

- Benefit from the advanced MetaTrader 5 (MT5) platform, known for its robust tools and user-friendly interface.

- Access a wide range of technical indicators, automated trading capabilities, and customizable charts.

- Seamless integration with various financial instruments for diversified trading opportunities.

- Safe and Convenient Deposits and Withdrawals:

- Multiple Payment Methods: Choose from a variety of secure payment options, including bank transfers, credit/debit cards, and e-wallets.

- Secure Transactions: Advanced encryption and security protocols ensure your funds and personal information are protected.

- Fast Processing Times: Enjoy swift deposit and withdrawal processing, minimizing delays and enhancing your trading efficiency.

Why Choose Opofinance?

- Regulated and Trusted: As an ASIC regulated broker, Opofinance adheres to stringent regulatory standards, ensuring a safe and transparent trading environment.

- Exceptional Customer Support: Dedicated support teams are available to assist you with any queries or issues, providing a seamless trading experience.

- Competitive Spreads and Low Fees: Benefit from competitive spreads and minimal fees, maximizing your trading profitability.

- Educational Resources: Access a wealth of educational materials, including webinars, tutorials, and market analysis, to enhance your trading knowledge and skills.

Ready to elevate your trading game? Join Opofinance today and experience unparalleled trading excellence with a broker you can trust!

Conclusion

The Tweezer Top Candlestick Pattern is an indispensable tool for traders aiming to identify and capitalize on bearish reversals in the market. By understanding its components, accurately identifying the pattern, and integrating it with robust trading strategies and additional indicators, you can significantly enhance your trading effectiveness and achieve greater success in the financial markets.

However, it’s crucial to remain vigilant against common mistakes, such as misidentifying the pattern or ignoring confirmation signals, to maintain the pattern’s reliability. Incorporating advanced strategies and leveraging the services of a regulated broker like Opofinance can further bolster your trading approach, ensuring that you are well-equipped to navigate the complexities of the market.

Embrace the power of the Tweezer Top Pattern, refine your trading strategies, and take decisive steps towards trading excellence. With the right knowledge and tools at your disposal, you can turn market reversals into profitable opportunities and achieve your financial goals with confidence.

Key Takeaways

- Tweezer Top Pattern: A reliable bearish reversal indicator characterized by two candlesticks with matching highs.

- Accurate Identification: Requires matching or nearly matching highs with prominent upper shadows and a confirmation candlestick.

- Enhanced Strategies: Combining the pattern with other technical indicators and advanced strategies increases its reliability.

- Risk Management: Implementing stop-loss orders and proper position sizing is essential to protect trading capital.

- Opofinance Advantage: Trading with a regulated broker like Opofinance offers secure, efficient, and advanced trading solutions to maximize your potential.

Can the Tweezer Top Pattern be used in all financial markets?

Yes, the Tweezer Top Pattern is highly versatile and can be effectively applied across various financial markets, including stocks, forex, commodities, and cryptocurrencies. Its reliability, however, may vary depending on the specific asset and prevailing market conditions. Traders should always consider the broader market context and combine the pattern with other indicators to enhance its effectiveness.

How reliable is the Tweezer Top Pattern compared to other candlestick patterns?

The Tweezer Top Pattern is considered highly reliable, particularly when it is confirmed with additional signals or technical indicators. While no candlestick pattern guarantees success, the Tweezer Top’s clear visual cues and simplicity make it a favored choice among traders for identifying bearish reversals. When used in conjunction with other analysis tools, its reliability increases significantly compared to more complex patterns.

What are the best practices for trading the Tweezer Top Pattern?

Best practices for trading the Tweezer Top Pattern include:

Wait for Confirmation: Always seek a confirmation candlestick that closes below the low of the Tweezer Top before entering a trade.

Combine with Other Indicators: Use additional technical indicators like Moving Averages, RSI, or Volume to validate the pattern.

Implement Strict Risk Management: Set stop-loss orders above the high of the Tweezer Top and use appropriate position sizing to manage risk.

Analyze Multiple Timeframes: Examine the pattern across different timeframes to gain a comprehensive view of the market trend.

Stay Informed: Keep abreast of market news and economic indicators that may influence price movements and the reliability of the pattern.