Have you ever wondered why some traders seem to consistently outperform the market while others struggle to make headway? The answer often lies in a critical decision made at the very start of their trading journey: choosing the right forex broker. In this comprehensive guide, we explore the types of brokers in forex trading, shedding light on how each model works and which one may best suit your trading style. Whether you’re searching for a reliable online forex broker or a regulated forex broker that provides advanced trading tools, this article is designed to answer your questions and equip you with the knowledge needed for success.

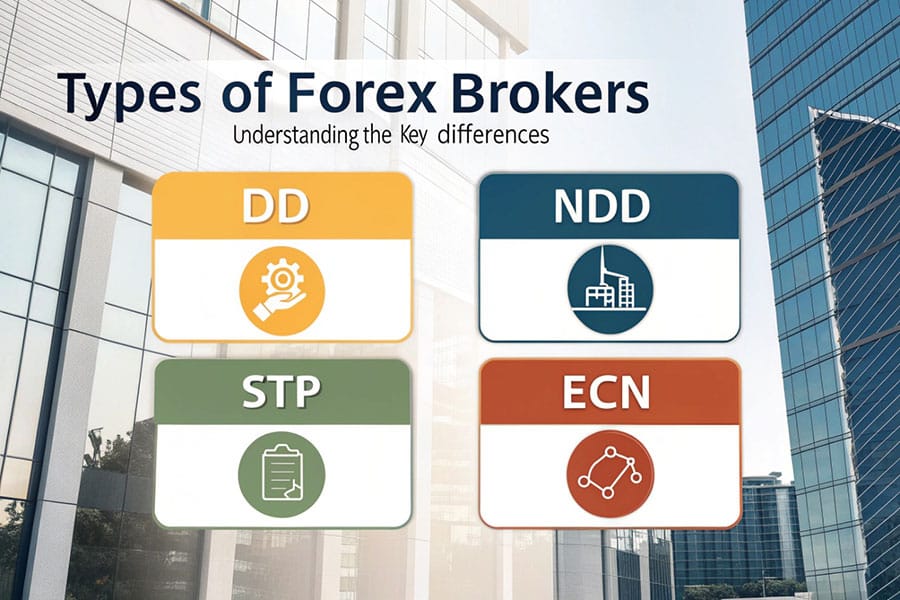

Right from the start, let’s address the most pressing concern: What are the types of brokers in forex trading? Simply put, forex brokers can be broadly categorized into two groups: Dealing Desk (DD) brokers and No Dealing Desk (NDD) brokers. Under the NDD umbrella, you’ll find subtypes such as Straight-Through Processing (STP) and Electronic Communication Network (ECN) brokers. Understanding the type of brokers in forex is essential for every trader—from beginners to seasoned professionals—because the broker you choose will significantly influence your trade execution, cost structures, and overall market experience.

Throughout this article, we’ll delve into each category in detail, provide real-world examples, share valuable statistics, and answer frequently asked questions to help you make an informed choice. Whether you’re trading on MetaTrader 4 (MT4), MetaTrader 5 (MT5), or any other advanced platform, the insights here are tailored to empower you. So, if you’re ready to boost your trading performance by understanding the nuances of each broker type, read on!

Understanding Forex Brokers

Before diving into the specific types of brokers, it’s essential to establish a strong foundation by understanding what a forex broker is and the role they play in the market.

What Is a Forex Broker?

A forex broker acts as an intermediary between retail traders and the interbank market—the global network where currency trading occurs. In essence, a broker for forex trading provides you with the platform, tools, and access to liquidity necessary for executing trades. The role of a forex trading broker includes:

- Market Access: Facilitating access to global currency markets where trading occurs 24 hours a day.

- Trading Platforms: Offering robust platforms like MT4, MT5, or custom solutions that allow traders to analyze charts, execute orders, and manage risk.

- Pricing and Execution: Ensuring that orders are executed at competitive prices, which is critical for maintaining profitability.

- Support Services: Providing customer service, technical support, and educational resources to help traders navigate the market.

For example, if you are considering a broker for forex trading, you want one that is not only regulated but also provides innovative trading tools, reliable execution, and a secure trading environment.

Broker vs. Market Maker

A common source of confusion among traders is the distinction between a broker and a market maker. While both facilitate trading, their functions differ:

Broker: Acts as an intermediary, executing trades on behalf of the trader and typically routing orders to liquidity providers.

Market Maker: Sets bid and ask prices and often takes the opposite side of a trader’s position, effectively creating the market. They ensure there is always a buyer or seller available but might sometimes trade against you.

Understanding these differences is crucial when exploring the types of brokers in forex trading. Knowing whether a broker operates as a market maker or through a no-dealing desk system can directly impact trade execution speed, pricing transparency, and ultimately, your trading outcomes.

Read More: Choosing a Forex Broker

Types of Brokers in Forex Trading

Now that we have a basic understanding of what a forex broker does, let’s explore the main categories and subcategories of brokers in forex trading. Each model comes with its unique characteristics, advantages, and potential drawbacks.

Dealing Desk (DD) Brokers / Market Makers

Definition and Characteristics

Dealing Desk brokers, commonly known as market makers, are the most traditional type of forex broker. They create a market for you by setting their own bid and ask prices. This means that every time you execute a trade, you are trading against the broker rather than the interbank market.

Key Characteristics:

Fixed or Variable Spreads: DD brokers often offer fixed spreads, which can be advantageous for budgeting trading costs.

High Leverage Options: They may provide high leverage, allowing traders to control larger positions with a relatively small amount of capital.

Potential Conflict of Interest: Since the broker is the counterparty to your trades, there can be a conflict of interest, as the broker may profit when you lose.

Simplified Trading Environment: Often favored by beginners due to a more straightforward pricing model and accessible entry points.

Pros and Cons

Pros:

- Predictability: Fixed spreads provide predictability in transaction costs, which is especially helpful for new traders.

- Ease of Use: The trading environment is generally more straightforward, making it easier for beginners to get started.

- Lower Minimum Deposits: Typically, DD brokers require lower initial deposits compared to some NDD brokers.

Cons:

- Conflict of Interest: There is an inherent conflict of interest as the broker may take the opposite side of your trades.

- Price Manipulation Risks: During volatile market conditions, prices set by DD brokers may not always reflect real market conditions.

- Less Transparency: Trade execution and pricing may lack the transparency offered by NDD brokers.

No Dealing Desk (NDD) Brokers

No Dealing Desk brokers operate without the intervention of a dealing desk, offering a more transparent trading environment. NDD brokers are divided into two primary categories: STP and ECN brokers.

STP (Straight-Through Processing) Brokers

Explanation: STP brokers automatically route your orders directly to their liquidity providers without any manual intervention. This system minimizes delays and enhances execution speed, which is crucial in fast-moving forex markets.

Advantages:

- Direct Liquidity Access: Orders are routed to multiple liquidity providers, ensuring that you receive competitive pricing.

- Reduced Conflict of Interest: Since there is no intermediary setting prices, the likelihood of a conflict of interest is minimal.

- Efficient Execution: Automated routing improves execution speed and reduces the risk of price manipulation.

Potential Drawbacks:

- Commission Fees: STP brokers may charge commissions to cover the cost of order routing, which can add up, particularly for high-frequency traders.

- Variable Spreads: While the spreads can be tighter, they are often variable and subject to market conditions, which may increase costs during volatility.

ECN (Electronic Communication Network) Brokers

Explanation: ECN brokers connect traders directly to a network of liquidity providers and other market participants. This creates a highly competitive environment where prices are determined by supply and demand, resulting in some of the tightest spreads available.

Advantages:

- Tight Spreads: Direct market access leads to very competitive pricing, which can significantly reduce trading costs.

- Transparency: Every order is displayed in real-time, ensuring complete transparency in pricing and execution.

- Enhanced Liquidity: ECN brokers offer access to a broad pool of liquidity providers, making it easier to execute large orders without impacting market prices.

Potential Drawbacks:

- Higher Minimum Deposits: ECN brokers often require higher initial deposits, making them less accessible to beginner traders.

- Commission-Based Fees: While the spreads are tight, ECN brokers charge commissions per trade, which might not be ideal for all trading strategies.

- Price Volatility: The direct connection to the market means that prices can fluctuate more dynamically, which may not suit all trading styles.

Read More: Best forex broker for scalping

Comparison Table: DD vs. STP vs. ECN

To further clarify the differences, let’s look at a detailed comparative analysis:

| Feature | Dealing Desk (DD) / Market Maker | Straight-Through Processing (STP) | Electronic Communication Network (ECN) |

| Execution Model | Acts as Counterparty | Routes Orders to Liquidity Providers | Aggregates Prices from Multiple LPs |

| Spread Type | Fixed or Variable | Variable | Variable (Raw) |

| Spread Size | Generally Wider | Tighter than DD, Variable | Tightest, Raw Interbank Spreads |

| Commission | Typically None | May or May Not Charge | Commission Per Trade |

| Execution Speed | Can be Slower | Faster | Fastest |

| Transparency | Lower | Higher | Highest |

| Conflict of Interest | Potential | Lower | None |

| Target Trader | Beginners, Smaller Accounts | Intermediate Traders | Experienced, High-Volume Traders |

| Minimum Deposit | Lower | Medium | Higher |

This comparison table clearly shows that while DD brokers offer a simpler and more accessible trading environment, NDD brokers—especially ECN brokers—provide superior transparency and competitive pricing, which are crucial for experienced traders.

How to Choose the Right Broker

Selecting the right forex broker can seem daunting, but by focusing on a few critical factors, you can make a decision that will enhance your trading experience and profitability. Here’s how you can evaluate the type of brokers in forex to find the best match for your needs.

Key Factors to Consider

- Regulation and Safety:

Always prioritize brokers that are regulated by respected financial authorities such as ASIC, FCA, or CySEC. A regulated forex broker adheres to stringent financial standards, ensuring the safety of your funds and fair trading practices. - Spreads and Commissions:

Compare the pricing models of different brokers. DD brokers might offer fixed spreads, which are easier to calculate, but NDD brokers—especially ECN types—often provide lower variable spreads. Consider your trading frequency and volume to decide which fee structure is more cost-effective. - Execution Speed:

In the fast-paced world of forex trading, execution speed is critical. NDD brokers generally provide faster and more reliable execution, which is essential for high-frequency traders or those executing complex strategies. - Trading Platforms and Tools:

Evaluate the trading platforms offered by each broker. Whether you favor MT4, MT5, or more advanced platforms with integrated AI tools, ensure the platform is intuitive, stable, and packed with the features you need. - Customer Support:

Outstanding customer service is non-negotiable. Choose brokers that offer 24/7 support through multiple channels (live chat, phone, email) to ensure you get assistance when you need it most. - Deposit and Withdrawal Methods:

Look for brokers that provide safe, convenient, and flexible deposit and withdrawal options. Modern traders often expect methods that include bank transfers, credit cards, and even cryptocurrency payments. A broker offering zero fees on deposits and withdrawals is a significant advantage.

Questions to Ask When Evaluating Brokers

- What regulatory bodies oversee the broker’s operations, and how do they ensure fund safety?

- How does the broker manage trade execution, and what are the average execution speeds?

- Are there any hidden fees or conditions that could affect my profitability?

- What advanced tools and resources are provided to help me optimize my trading strategy?

- How does the broker handle market volatility, and what protections are in place for traders?

Verifying Broker Legitimacy

Before committing to a broker, make sure to:

- Check Regulatory Credentials: Verify licenses on the broker’s website and through official regulatory body databases.

- Read Reviews: Consult reputable review sites and forums where experienced traders share their experiences.

- Test Customer Support: Reach out with questions to assess responsiveness and professionalism.

- Start with a Demo Account: Utilize demo accounts to test the platform’s functionality and assess the overall trading experience before committing real funds.

By carefully considering these factors, you can ensure that the broker you choose not only meets your current trading needs but also supports your long-term growth as a trader.

Read More: Best Forex Broker With Lowest Spread

Real-World Examples and Case Studies

Understanding the theory behind different types of brokers in forex trading is valuable, but real-world examples offer practical insights that can significantly influence your decision. Let’s explore a few case studies that highlight the distinct experiences traders have had with various broker types.

The Beginner’s Journey with a DD Broker

Michael, a novice trader, opted for a well-known Dealing Desk broker attracted by the fixed spreads and lower deposit requirements. With limited initial capital, Michael found the predictable costs appealing.

Outcome:

Initially, Michael experienced a smooth entry into forex trading due to the simplicity of the trading environment. However, as he began trading during volatile market periods, he encountered occasional slippage and less transparent pricing. While Michael appreciated the ease of use, he eventually realized that the potential conflict of interest inherent in DD brokers might impact his long-term profitability.

Key Learnings:

- Fixed spreads are beneficial for budgeting, especially for beginners.

- Volatile markets can expose the limitations of DD brokers.

- Understanding the hidden costs and execution nuances is crucial.

The Efficiency of an STP Broker

Linda, an intermediate trader, decided to switch to an STP broker to benefit from direct order routing to multiple liquidity providers. Her goal was to achieve faster execution and more competitive pricing.

Outcome:

Linda experienced significantly reduced slippage and better pricing during high-volume trading sessions. Although she incurred commission fees, the overall cost was offset by the improved trade execution. Linda’s enhanced performance reaffirmed the advantages of an STP broker for traders who demand efficiency and transparency.

Key Learnings:

- Direct routing improves execution speed and reduces slippage.

- Competitive pricing can justify the commission fees.

- STP brokers offer a balanced option between cost and performance.

High-Frequency Trading with an ECN Broker

David, a high-frequency trader, required a broker that could offer extremely tight spreads and near-instant execution times. He opted for an ECN broker that connects him directly to a network of liquidity providers.

Outcome:

David benefited from the best possible market pricing, with execution speeds that allowed him to capitalize on even the smallest price fluctuations. Although the higher commission fees initially concerned him, the overall profitability of his high-frequency trading strategy improved markedly due to the minimized spreads and complete transparency.

Key Learnings:

- ECN brokers are ideal for high-frequency trading and large order volumes.

- Tight spreads and transparency significantly boost trade performance.

- Higher minimum deposits and commissions are balanced by superior market access.

Pro Tips for Advanced Traders

For experienced traders who already have a strong grasp of the forex market, here are some advanced strategies to further enhance your trading edge:

- Leverage Advanced Analytics:

Embrace cutting-edge charting tools, custom indicators, and AI-powered market analyzers to spot trends and anticipate market movements. Use these tools to fine-tune your trading strategies and manage risk more effectively. - Diversify Trading Accounts:

Consider holding accounts with multiple brokers. This diversification allows you to exploit different fee structures and take advantage of varying liquidity conditions. It also acts as a safeguard against technical issues or downtime with any single broker. - Stay Updated on Market News:

Subscribe to high-quality financial news services and market analysis platforms. Staying informed on geopolitical events, economic data releases, and central bank policies can give you a significant edge. - Refine Risk Management:

Constantly review and adjust your stop-loss orders, position sizing, and overall risk-reward ratios. Advanced traders often utilize trailing stops and dynamic risk management strategies to protect gains while limiting losses. - Utilize Demo Accounts for New Strategies:

Even if you’re experienced, test new strategies on demo accounts before deploying them in live trading. This not only minimizes risk but also allows you to adapt to new market conditions without jeopardizing your capital.

Opofinance Services: Your Partner in Forex Trading

For traders seeking a robust, innovative, and secure trading experience, consider exploring the services of an ASIC regulated forex broker like Opofinance. Their comprehensive suite of features is designed to meet the needs of both novice and advanced traders.

- Advanced Trading Platforms:

Trade on MT4, MT5, cTrader, and OpoTrade for a versatile and responsive trading environment that caters to various trading styles. - Innovative AI Tools:

Utilize cutting-edge tools such as the AI Market Analyzer, AI Coach, and AI Support to receive intelligent trade suggestions, market insights, and personalized coaching. - Social & Prop Trading:

Engage with a community of traders and benefit from secure and flexible transaction methods. This social trading network allows you to learn from the best and potentially mirror successful trading strategies. - Safe and Convenient Transactions:

Enjoy zero fees on deposits and withdrawals, including crypto payment options, ensuring that your funds are managed safely and efficiently.

Ready to take your trading to the next level? Visit opofinance.com now to explore their advanced features and secure your trading future!

Conclusion

Choosing the right forex broker is a decision that can dramatically influence your trading success. By understanding the types of brokers in forex trading—whether you lean toward a Dealing Desk broker for its simplicity or prefer the transparency and efficiency of an NDD broker (STP or ECN)—you equip yourself with the knowledge to make smarter, more informed choices.

This guide has explored the critical distinctions among broker types, provided practical case studies, and highlighted essential criteria for selecting a broker. Remember, the ideal broker for forex trading is one that aligns with your specific trading strategy, offers reliable execution, and provides the advanced tools necessary for managing risk effectively. With the right insights, you can confidently navigate the complexities of the forex market and enhance your overall trading performance.

Key Takeaways

- Understanding the types of brokers in forex trading is vital for aligning your trading strategy with the right execution environment.

- Dealing Desk brokers provide fixed spreads and simplicity but may present a conflict of interest.

- No Dealing Desk brokers (STP and ECN) offer transparency, faster execution, and competitive pricing, especially beneficial for experienced traders.

- Key considerations include regulation, spreads, execution speed, trading platforms, customer support, and secure transaction methods.

- Real-world case studies reveal the practical impact of each broker type on trading performance.

- Advanced traders should leverage sophisticated tools, diversify broker relationships, and refine risk management strategies.

- Opofinance, as an ASIC regulated broker, stands out with advanced platforms, AI tools, social trading features, and safe, fee-free transactions.

What distinguishes an online forex broker from a traditional forex broker?

An online forex broker leverages digital platforms to provide traders with seamless access to the forex market. They typically offer advanced trading tools, real-time market data, and streamlined account management. In contrast, traditional brokers might rely more on manual intervention and may not provide the same level of technological integration, making online forex brokers generally more attractive for modern, tech-savvy traders.

Can the type of broker I choose affect my risk management strategies?

Absolutely. The type of broker you select can significantly impact how you manage risk. For instance, ECN brokers, with their tight spreads and rapid execution, may reduce slippage, allowing for more precise stop-loss orders. On the other hand, a Dealing Desk broker might expose you to less transparent pricing during volatile periods, potentially affecting your risk management. Choosing the right broker that aligns with your risk tolerance is essential for long-term success.

How do advanced trading tools provided by brokers improve my trading outcomes?

Advanced trading tools, such as AI market analyzers, custom indicators, and automated trading systems, enable you to make faster, data-driven decisions. These tools help you identify trends, manage risk, and optimize trade execution, ultimately leading to improved performance. When a broker integrates these innovative features, it can transform your approach to the market and offer a competitive edge.