Ever felt like the forex market is rigged? Trades hitting stop loss, reversals at the worst times? Frustration is a common companion for many traders, be they beginners or veterans. The unseen hand manipulating price might not be conspiracy, but something far more fundamental: types of liquidity in forex. Are you ready to finally understand how this works, and use it to your advantage?

Liquidity, in the dynamic realm of forex, isn’t just jargon; it’s the life force of every market fluctuation, the silent architect of price movement. For the astute trader, deciphering the different type of liquidity in forex isn’t merely advantageous—it’s transformational. It’s the secret weapon that unveils hidden market dynamics, converting you from a reactive bystander to a strategic mastermind. Imagine trading not by chance, but with calculated precision, predicting market shifts, setting targets with conviction, and sidestepping those dreaded stop-loss hunts. To truly capitalize on this, partnering with a reputable forex trading broker like Opofinance, known for its cutting-edge platforms and analytical tools, is not just wise—it’s strategic.

This isn’t just another article on forex; it’s your in-depth blueprint to mastering types of liquidity in forex. We’re dismantling the complexities, spotlighting the three pivotal forms of liquidity that separate consistently profitable traders from the rest. Prepare for a trading metamorphosis. Let’s begin this enlightening journey.

What is Forex Liquidity and Why Should You Care?

Before we dissect the nuances, let’s define our battleground. In forex, liquidity is the unsung hero, representing the degree to which a currency pair can be bought or sold rapidly, at stable prices. Picture a vibrant exchange floor – the more participants actively trading, the more robust the liquidity.

Consider this: needing to exchange a substantial sum from Japanese Yen to US dollars. A highly liquid market ensures seamless execution at competitive rates, with minimal impact on the JPY/USD rate. Conversely, in an illiquid scenario, your significant order could trigger price volatility, potentially eroding your capital through unfavorable prices and slippage. This is critical to understand when mastering types of liquidity in forex.

The forex arena, celebrated as the globe’s most liquid financial marketplace, witnesses daily transactions soaring into the trillions. This monumental liquidity originates from key players: central banks, multinational corporations, and institutional giants, alongside individual retail traders like yourself. Yet, liquidity isn’t a constant; it fluctuates across currency pairs and trading sessions, creating both strategic opportunities and perilous traps. The informed trader learns to discern these tides.

Read More: Identify Liquidity Zones in Forex

Liquidity: Your Strategic Advantage in Forex

Why obsess over liquidity in your forex trading? Because understanding liquidity is akin to wielding market foresight. Mastering where and when liquidity converges enables you to:

- Identify Prime Trade Entry Zones: Liquidity zones are market magnets, compelling price action. Identifying these zones refines your ability to anticipate price movements, optimizing your trade entries with exceptional timing.

- Strategically Set Profit Objectives: Recognizing high-density order areas allows for informed profit target placements. This dramatically increases the probability of your trades hitting intended profit levels with precision, a core skill in understanding type of liquidity in forex.

- Anticipate Key Reversal Points: Liquidity sweeps often herald significant market direction changes. Spotting these sweeps early equips you to foresee trend reversals and capitalize on nascent directional shifts at their inception.

- Navigate Stop-Loss Pitfalls: The infamous stop-loss hunt becomes a relic of the past when you understand liquidity dynamics. Strategic stop placement, away from obvious liquidity concentrations, becomes second nature, safeguarding your trading capital effectively.

Liquidity intelligence transforms your trading approach from reactive guessing to proactive strategy. It’s about trading with insight, leveraging the market’s intrinsic order flow to make informed, high-probability decisions. This is the power of understanding types of liquidity in forex.

Read More: Identify liquidity in forex

The Trinity of Forex Liquidity Types: A Trader’s Definitive Guide

Liquidity in forex manifests in diverse forms, yet we can distill it into three dominant types. These are the recurring liquidity patterns that consistently impact forex price action, and understanding them is paramount for any aspiring professional trader:

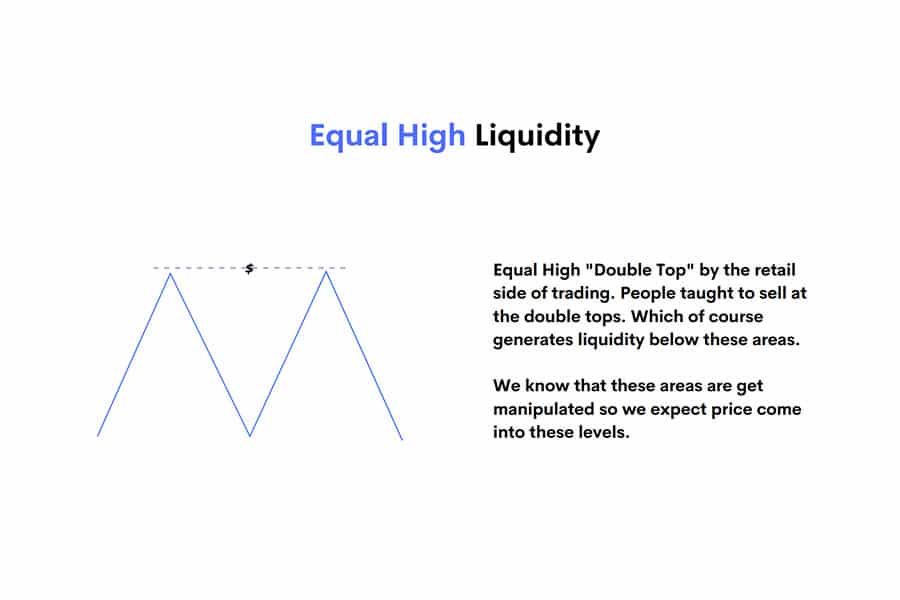

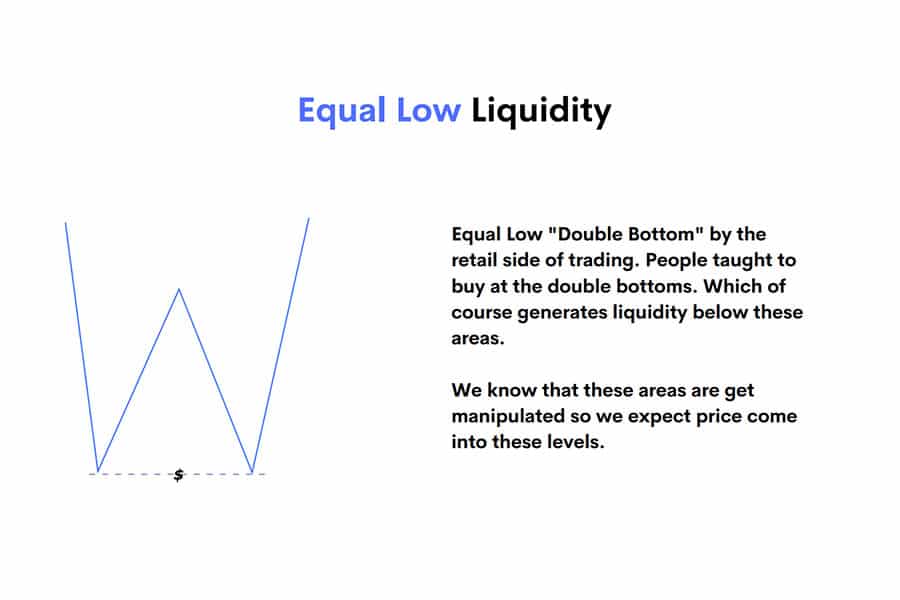

1. Equal Highs and Equal Lows Liquidity: The Allure of Obvious Levels

Envision a chart pattern so universally recognized, so fundamentally ingrained in trading lore – equal highs and equal lows. These formations, the very embodiment of resistance and support, epitomize a crucial type of liquidity in forex. Traditional trading dictates a rigid rule: position stop-loss orders just beyond these seemingly impenetrable levels.

Consider the psychology: sellers at resistance instinctively cluster their stops above equal highs; buyers at support anchor theirs beneath equal lows. This creates a highly concentrated order zone – a palpable pool of liquidity – primed for activation. Breakout traders, adding fuel to the fire, strategically deploy buy stop orders above resistance and sell stop orders below support, eagerly anticipating explosive price surges beyond these lines. This collective behavior inadvertently magnifies the liquidity magnet around these levels, making type of liquidity in forex around equal highs and lows incredibly potent.

Trading Strategy: Executing the Precision Liquidity Sweep

The enlightened liquidity trader transcends conventional wisdom. Rather than blindly mirroring the masses by selling at resistance or buying at support, they anticipate and capitalize on the inevitable liquidity sweep. This strategy involves patiently awaiting the precise moment when price momentarily breaches these obvious levels—a strategic “hunt” for stop-losses and a trigger for breakout orders—before executing a reversal trade.

This “stop-loss hunt” isn’t some shadowy market manipulation conspiracy; it’s the market’s intrinsic mechanism for efficiency, a way to organically gather and absorb readily available liquidity. This absorption is crucial for facilitating large-scale institutional orders, ensuring they are filled without causing undue price disruption prematurely. Once this critical mass of liquidity is consumed, the market often rebounds sharply, presenting lucrative trading setups for those astute enough to recognize the liquidity dynamics at play, and understand the nuanced type of liquidity in forex being exploited.

Illustrative Scenario: Mastering Equal Lows Liquidity Trading

Imagine identifying a currency pair meticulously etching out a series of equal lows, forming a seemingly robust support foundation. Standard trading dogma would emphatically recommend “buy the dip at support!” But you, armed with advanced liquidity insight, exercise disciplined patience. You keenly observe as price strategically probes below these equal lows, a calculated maneuver designed to activate sell stops and trigger stop-loss orders. Instead of succumbing to panic, you interpret this dip as a high-probability liquidity sweep in progress.

You now vigilantly monitor for decisive bullish reversal confirmations—a compelling bullish candlestick formation, a definitive break in short-term bearish market structure. Only upon witnessing these confirmations do you strategically initiate a long position, meticulously placing your stop-loss just beneath the swept lows, in a zone now validated as liquidity-rich. Your profit objective? The strategically significant equal highs looming above, now recognized as the next prime target, as the market is likely to gravitate towards and ultimately surpass this readily available liquidity pool. This patient, informed approach is the hallmark of a trader who truly understands types of liquidity in forex.

2. Trendline Liquidity: Capitalizing on Retail Trend Bias

Trendlines, those ubiquitous tools in the arsenal of technical analysts, emerge as highly fertile zones for type of liquidity in forex. The sheer volume of retail traders diligently plotting trendlines, predicting bounces and breakouts, inadvertently lays down predictable patterns of order concentrations ripe for strategic exploitation.

Traditional trendline trading methodologies advocate selling on precise trendline retests within established downtrends, and conversely, buying on retests during uptrends. Stop-loss orders, almost uniformly, are placed immediately beyond the trendline’s perceived safety. Breakout traders amplify the liquidity narrative, strategically positioning buy stop orders above downtrend lines and sell stop orders below uptrend lines, all anticipating definitive trend reversals heralded by trendline breaches. This collective and predictable behavior around trendlines essentially paints a liquidity map for astute, liquidity-focused traders.

Trading Strategy: The Art of Fading Trendline Breakouts

The liquidity-savvy trader regards trendlines not with blind faith, but with calculated skepticism. They comprehend that apparent trendline breaks often serve as sophisticated liquidity harvesting operations, rather than genuine harbingers of trend reversals. Thus, instead of impulsively embracing breakouts or mechanically selling retests, they master the art of “fading” the trendline breakout.

This advanced tactic entails anticipating that an initial trendline breach is frequently a meticulously engineered liquidity sweep, specifically designed to trigger masses of stop-loss orders and activate queued breakout entries. The liquidity trader patiently observes price action as it deliberately extends beyond the trendline—a clear signal of a liquidity sweep in progress—and then meticulously seeks out robust reversal signals. These signals confirm the liquidity grab is complete, setting the stage to trade strategically *against* the initial breakout momentum, aligning instead with the underlying, prevailing trend. This nuanced approach is what distinguishes expert practitioners of types of liquidity in forex trading from the novice crowd.

Scenario in Action: Profiting from Trendline Liquidity in a Downtrend

Envision a currency pair entrenched in a definitive downtrend, its price action respectfully adhering to a descending trendline. Countless retail participants are poised at the trendline, anticipating textbook retests to initiate sell positions. However, you, armed with superior liquidity acumen, recognize the escalating concentration of sell orders and their corresponding stop-loss clusters strategically positioned above the trendline. You maintain vigilant observation as price makes a calculated surge above the trendline, precisely triggering these pre-set stop-loss orders—a classic liquidity sweep initiation.

Confirming this sweep with robust bearish reversal candlestick patterns materializing near a strategically identified supply zone, you confidently deploy a short entry. Your stop-loss is meticulously placed above the liquidity sweep’s high point, now validated as a zone of depleted buying interest. Your profit target? A conservatively placed previous swing low, accurately anticipating the overarching downtrend’s continuation. This is not just trendline trading; it’s high-probability trading fueled by a deep understanding of type of liquidity in forex.

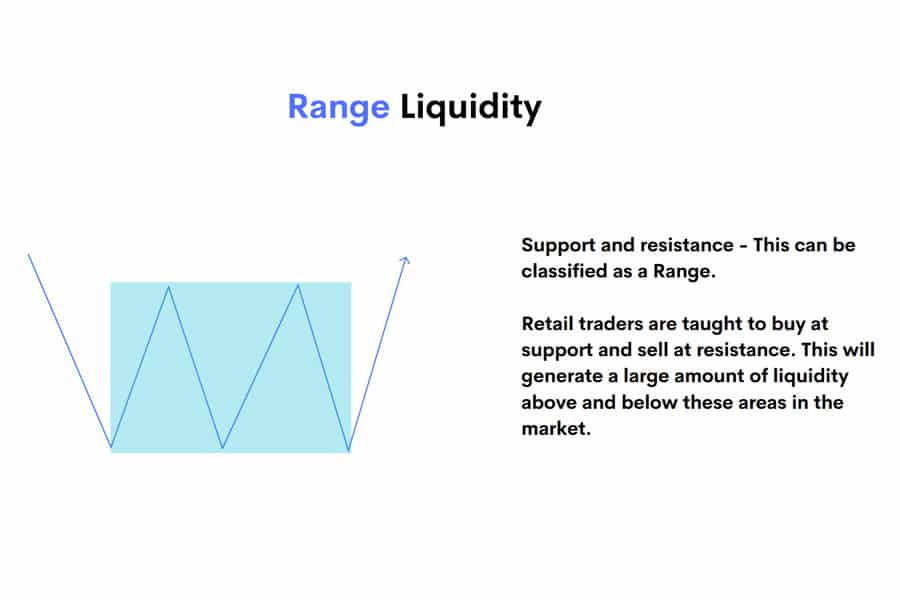

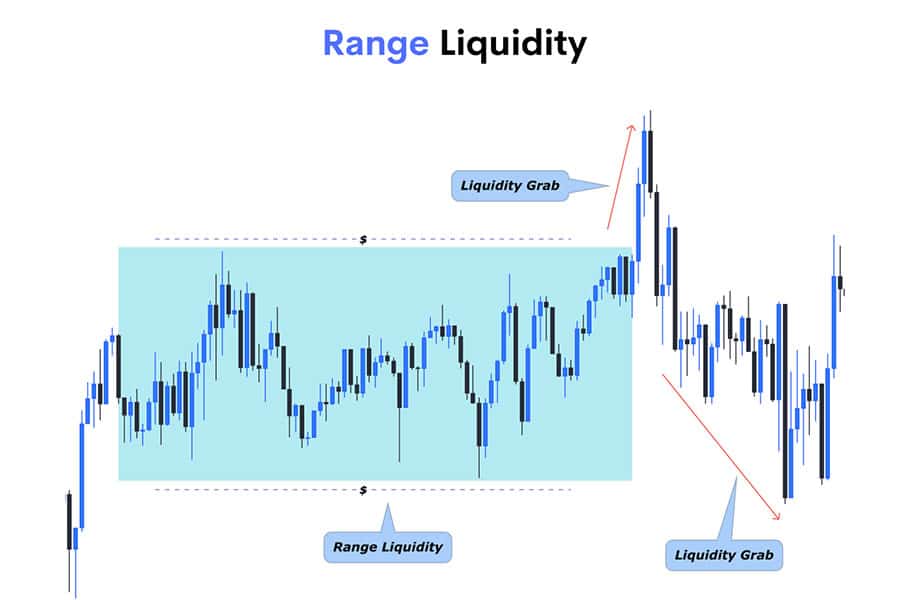

3. Range Liquidity: Trading the Rhythm of Consolidation

Financial markets, in their natural rhythm, rarely sustain unidirectional movement indefinitely. Extended periods of trending are inevitably punctuated by phases of consolidation—sideways price action where equilibrium battles dominate, price oscillating within clearly defined highs and lows. These seemingly indecisive ranges are, in fact, potent epicenters of type of liquidity in forex accumulation.

Within these ranges, a predictable pattern emerges: traders frequently attempt to establish long positions near range lows—perceived as support—and initiate shorts at range highs—acting as resistance. Stop-loss orders are almost axiomatically placed just outside these perceived boundaries. Breakout-oriented traders keenly monitor these ranges, prepared to trigger buy stop orders above range highs and sell stop orders below range lows, all anticipating explosive directional breakouts from the perceived consolidation.

Trading Strategy: Range Sweep Reversal Expertise

The astute range liquidity trader deeply understands the inherent rhythm of these consolidation zones. They recognize that ranges are not merely periods of market indecision, but rather sophisticated order accumulation phases preceding significant directional thrusts. Their core strategy revolves around skillfully predicting and capitalizing on range sweeps—deliberate, brief excursions of price beyond range highs or lows, orchestrated to gather resting liquidity—followed by a strategic reversal back within the range, and ultimately, a calculated breakout in the anticipated direction.

This advanced approach demands unwavering patience and keen observational prowess. The crucial element is waiting for unambiguous confirmation of a range sweep, validated by robust reversal signals. Entry timing is paramount, precisely aligned with the reversal, with profit targets strategically placed at the opposing range extreme or projected significantly beyond, anticipating a powerful, liquidity-fueled breakout. This strategic mastery of range dynamics separates the consistently profitable from the consistently frustrated, showcasing the power of understanding types of liquidity in forex.

Scenario Breakdown: Range Liquidity Trade for Breakout Profit

Consider a currency pair meticulously confined within a well-established trading range, its price action oscillating between defined range highs and lows over a sustained period. You correctly anticipate a range breakout event after sufficient liquidity accumulation. You keenly observe price subtly breach below the established range lows, a telltale sign of a liquidity sweep, engineered to activate stop-loss orders and trigger sell stop entries. Witnessing this low sweep, decisively confirmed by emergent bullish candlestick patterns coupled with a structural break of short-term bearish momentum within the range, you confidently execute a long entry.

Your stop-loss is meticulously positioned just below the liquidity-validated swept range lows. Your meticulously calculated profit target? A strategic level projected significantly beyond the range highs, accurately anticipating a substantial price expansion powered by the preceding liquidity-driven breakout event. This is range trading elevated – not just playing boundaries, but exploiting the liquidity engine that drives range dynamics, a hallmark of expert understanding of type of liquidity in forex.

Read More: ICT Draw on Liquidity

Pro Tips: Advanced Forex Liquidity Trading Tactics

Elevate your liquidity trading prowess with these expert-level tactics, designed to sharpen your edge and maximize profitability in the forex arena:

- Multi-Timeframe Liquidity Mapping: Liquidity density isn’t uniform across timeframes. Master the art of multi-timeframe analysis. Identify major liquidity zones on higher timeframes (H4, Daily), then drill down to lower timeframes (M15, M5) to pinpoint precise entry triggers following liquidity sweeps within those higher-level zones. This layered approach enhances both precision and probability in your trading.

- Confluence Amplification: Liquidity as the Cornerstone: Liquidity is potent alone, but exponentially more powerful when strategically combined with other high-conviction technical and fundamental indicators. Seek confluence—align liquidity zones with robust supply and demand areas, validate with order block analysis, confirm with classical chart patterns, and synchronize with high-impact economic news releases. Confluence trading amplifies signal strength, dramatically increasing your trade probability and reward potential when trading type of liquidity in forex.

- Cultivate Liquidity Pattern Recognition: Sharpen your visual acuity. Dedicate focused study to recognize recurring liquidity patterns—equal highs/lows, trendline formations, range consolidations—across diverse currency pairs and multiple timeframes. Develop a visual library of these patterns. The faster and more intuitively you identify these setups, the quicker you’ll seize high-probability liquidity-driven opportunities, reacting with informed speed and accuracy.

- Paramount Risk Discipline: Precision and Protection: Liquidity trading, while strategically sophisticated, is not risk-free. Implement ironclad risk management protocols. Employ precision position sizing tailored to volatility, utilize meticulously placed stop-loss orders strategically positioned *outside* validated liquidity zones (never within them), and steadfastly adhere to your predetermined risk tolerance. Protect your capital with the same rigor you pursue profit.

- Relentless Practice & Backtesting: The Path to Intuition: Commit to rigorous, continuous practice. Devote substantial time to paper trading and exhaustive backtesting of your liquidity-based trading strategies. Quantify your results, refine your parameters, and iterate relentlessly. The more data-driven practice you accumulate in identifying and trading type of liquidity in forex, the more deeply ingrained your intuition will become, leading to consistently profitable execution.

By internalizing these advanced techniques and relentlessly honing your liquidity awareness, you evolve from a reactive market participant to a proactive orchestrator of high-probability trades. Master liquidity, and you master a fundamental edge in forex.

OpoFinance: Your Premier Partner in Forex Liquidity Mastery

Unlocking the full potential of type of liquidity in forex trading demands a brokerage environment that empowers strategic execution and provides superior tools. Opofinance, rigorously regulated by ASIC, emerges as the discerning trader’s choice, meticulously engineered to enhance your liquidity-focused strategies. Opofinance provides a suite of sophisticated features precisely aligned with the needs of the liquidity-conscious trader:

- Cutting-Edge Trading Platforms: Execute trades with unparalleled precision on industry-benchmark platforms—MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader. These platforms are celebrated for their advanced charting capabilities, lightning-fast order execution, and customizable analytical tools—essential for capturing fleeting liquidity-driven opportunities. Explore the intuitive interface and powerful features of OpoTrade, Opofinance’s proprietary platform, designed for optimal trading efficiency.

- Revolutionary AI-Powered Tools: Gain an asymmetrical advantage with Opofinance’s suite of artificial intelligence tools. Deploy the AI Market Analyzer to proactively scan the forex landscape for emergent liquidity zones and high-probability trading setups. Leverage the AI Coach for personalized, data-driven trading insights and strategy refinement. Access AI Support for immediate, intelligent assistance, ensuring seamless trading operations and optimized decision-making.

- Strategic Social & Prop Trading Ecosystem: Connect with a network of elite traders, fostering collaborative learning and idea exchange. Explore proprietary trading opportunities, potentially gaining access to expanded capital and advanced trading resources. Accelerate your trading trajectory through strategic community engagement and capital scaling.

- Unrivaled Transaction Security & Flexibility: Trade with absolute confidence, knowing your transactions are secured by robust protocols and flexible options. Benefit from a wide spectrum of deposit and withdrawal methods, including seamless cryptocurrency integrations. Opofinance eliminates deposit and withdrawal fees, maximizing your capital deployment and profitability.

Ready to transform your forex trading with a broker meticulously designed for strategic, liquidity-focused execution? Explore Opofinance today and unlock the definitive trading advantage.

Conclusion: Embrace the Liquid Edge and Transform Your Forex Results

Mastering the types of liquidity in forex transcends basic technical analysis; it’s a fundamental paradigm shift that recalibrates your entire trading approach. By moving beyond superficial chart patterns and deeply understanding the intricate dynamics of liquidity, you position yourself to operate with enhanced precision, anticipate market inflections with greater accuracy, and, most critically, cultivate consistent profitability within the often-turbulent forex markets. The pursuit of liquidity mastery demands dedicated study and rigorous application. However, the returns—manifest in mitigated losses and amplified profits—are unequivocally transformative. Embrace the liquid edge. Revolutionize your forex trading trajectory today.

Key Takeaways:

- Forex liquidity is the driving force behind price action and trade execution, making understanding type of liquidity in forex essential.

- In-depth knowledge of liquidity empowers traders to foresee market shifts, refine trade entries, and enhance profitability.

- The primary liquidity types—Equal Highs/Lows, Trendline Liquidity, and Range Liquidity—are consistently exploitable patterns.

- Liquidity sweeps, or stop hunts, are not random market noise, but predictable mechanisms for order accumulation and strategic reversals.

- Advanced liquidity trading demands multi-timeframe analysis, confluence-based strategy, and robust risk management protocols.

- Brokers like Opofinance provide the sophisticated platforms and AI-powered tools necessary to effectively capitalize on liquidity dynamics.

- Consistent, data-driven practice is the cornerstone of transforming liquidity awareness into consistent trading success.

Beyond volume, what are other key indicators that can help traders gauge real-time forex liquidity fluctuations?

While trading volume offers a general liquidity overview, astute traders utilize more granular indicators to detect real-time shifts. Spread analysis is crucial: narrowing spreads signal increased liquidity and tighter bid-ask prices, whereas widening spreads warn of thinning liquidity and potential volatility spikes. Order book depth, available on advanced platforms, directly visualizes buy and sell orders at different price levels, revealing immediate liquidity concentrations and potential price impact zones. Additionally, monitoring volatility indices like VIX or currency-specific volatility measures can indirectly reflect liquidity conditions; higher volatility often correlates with reduced liquidity and wider trading ranges. By synthesizing these indicators, traders gain a more comprehensive, real-time understanding of forex liquidity dynamics, going beyond simple volume metrics to refine their trading decisions.

How do different forex market sessions (Asian, London, New York) typically exhibit variations in liquidity, and how should traders adapt their strategies accordingly?

Forex liquidity displays distinct session-based patterns, directly impacting trading strategy effectiveness. The Asian session, characterized by lower volume and tighter ranges, generally presents the thinnest liquidity, often favoring range-bound strategies and scalping techniques. The London session witnesses a surge in liquidity and volatility as European financial centers open, offering robust opportunities for breakout and trend-following strategies. The New York session overlaps with London, maintaining high liquidity, but with potentially different dominant currency flows linked to North American economic news, necessitating adaptable strategy based on prevalent currency pairs and news catalysts. Understanding these session-specific liquidity profiles enables traders to tailor their approach, optimizing entry and exit timing, and selecting appropriate currency pairs for each trading window, thereby maximizing session-specific advantages.

Are there specific currency pairs that are consistently more or less liquid than others, and what factors contribute to these differences in liquidity profiles?

Yes, a clear liquidity hierarchy exists within forex currency pairs, fundamentally impacting trading conditions. Major pairs (EUR/USD, GBP/USD, USD/JPY, etc.), involving the most globally traded currencies, consistently exhibit the highest liquidity due to massive interbank activity, corporate hedging, and speculative flows. This translates to tighter spreads, smoother price action, and greater order execution efficiency. Minor pairs (EUR/GBP, AUD/JPY, etc.) and exotic pairs (USD/TRY, EUR/ZAR, etc.) inherently possess lower liquidity due to reduced trading volume and narrower participation bases. This results in wider spreads, increased price volatility, and potential slippage, especially during off-peak hours or during high-impact news events. Factors driving these disparities include the economic size and global trade significance of the involved economies, the depth of their financial markets, and the level of speculative interest. Traders must meticulously consider these liquidity profiles when selecting currency pairs, aligning their choices with their risk tolerance, trading style, and desired execution precision.