The 20 EMA scalping strategy is a powerful forex trading technique that uses the 20-period Exponential Moving Average to identify short-term trends and execute quick, profitable trades. This article provides a comprehensive guide to mastering this strategy, helping you unlock its potential for consistent gains in the forex market.

The 20 EMA scalping strategy involves using the 20-period Exponential Moving Average as a dynamic support and resistance level to identify trend direction and potential entry points for scalp trades. By entering positions when price pulls back to the 20 EMA and quickly exiting with small profits, traders can capitalize on frequent, minor price movements throughout the trading day.

This guide will walk you through every aspect of the 20 EMA scalping strategy, from basic setup to advanced techniques, risk management, and practical implementation. Whether you’re a beginner looking to explore scalping or an experienced trader seeking to refine your skills, this article offers valuable insights to enhance your forex trading success.

As we delve into this potent trading method, it’s crucial to partner with a reliable online forex broker to execute your trades efficiently. Let’s embark on this journey to master the 20 EMA scalping strategy and potentially boost your forex trading performance.

Understanding the 20 EMA Scalping Strategy: The Foundation of Quick Profits

What is the 20 EMA? A Responsive Tool for Dynamic Market Analysis

The 20 EMA, or 20-period Exponential Moving Average, is a technical indicator that calculates the average price of an asset over the last 20 periods, giving more weight to recent price data. This responsiveness makes it an ideal tool for short-term trading strategies like scalping.

Key features of the 20 EMA:

- More reactive to recent price changes compared to simple moving averages

- Helps identify short-term trends and potential reversal points

- Acts as dynamic support and resistance levels

The Basics of Scalping: Capitalizing on Micro Market Movements

Scalping is a trading style that aims to profit from small price movements by making numerous trades throughout the day. This high-frequency approach requires quick decision-making and precise execution.

Characteristics of scalping:

- Short holding periods (seconds to minutes)

- High number of trades per day

- Small profit targets per trade

- Requires focus and discipline

How the 20 EMA Scalping Strategy Works: A Synergy of Indicator and Method

The 20 EMA scalping strategy combines the responsiveness of the 20 EMA with the principles of scalping to create a powerful trading system. Here’s a detailed breakdown of its key components:

- Trend Identification:

- The 20 EMA acts as a dynamic support and resistance level

- Price above the 20 EMA indicates an uptrend

- Price below the 20 EMA suggests a downtrend

- Entry Points:

- Look for price pullbacks to the 20 EMA in the direction of the trend

- Enter long positions when price bounces off the 20 EMA in an uptrend

- Enter short positions when price rejects the 20 EMA in a downtrend

- Exit Strategy:

- Set a fixed pip target (typically 10-20 pips)

- Use trailing stops to lock in profits as the trade progresses

- Exit when price reaches the next significant support or resistance level

- Risk Management:

- Place stop-loss orders 5-10 pips away from entry points

- Maintain a positive risk-reward ratio (aim for at least 1:1.5)

- Limit risk per trade to a small percentage of your account (1-2% maximum)

By mastering these components, traders can effectively implement the 20 EMA scalping strategy to potentially generate consistent profits in the forex market.

Read More: Mastering the 200 EMA Scalping Strategy

Implementing the 20 EMA Scalping Strategy: A Step-by-Step Guide to Execution

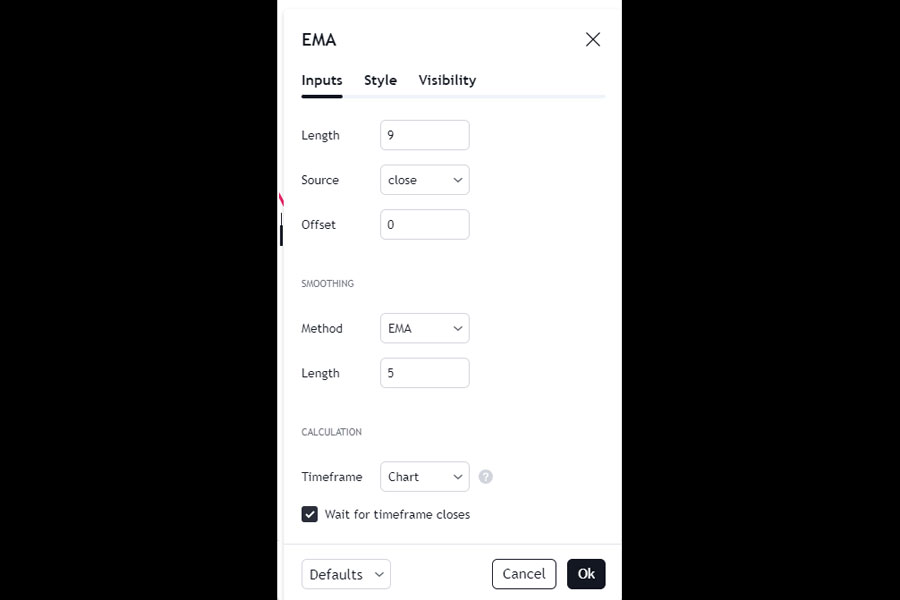

Step 1: Set Up Your Chart for Optimal Analysis

- Choose a forex pair with high liquidity and tight spreads (e.g., EUR/USD, GBP/USD, USD/JPY).

- Select a short-term timeframe (1-minute or 5-minute charts are common for scalping).

- Add the 20 EMA to your chart using your trading platform’s indicator tools.

- Consider adding volume indicators to confirm price movements.

Step 2: Identify the Trend with Precision

- If the price is consistently above the 20 EMA, the trend is considered bullish.

- If the price is consistently below the 20 EMA, the trend is considered bearish.

- Look for clear separation between price and the 20 EMA to confirm strong trends.

Step 3: Look for High-Probability Entry Opportunities

For Long Trades:

- Wait for a bullish trend (price above 20 EMA).

- Look for a pullback where the price touches or comes close to the 20 EMA.

- Enter a long position when the price bounces off the 20 EMA and starts moving upward.

- Confirm the entry with a bullish candlestick pattern or increased buying volume.

For Short Trades:

- Wait for a bearish trend (price below 20 EMA).

- Look for a pullback where the price touches or comes close to the 20 EMA.

- Enter a short position when the price bounces off the 20 EMA and starts moving downward.

- Confirm the entry with a bearish candlestick pattern or increased selling volume.

Step 4: Set Your Stop Loss and Take Profit with Precision

- Place a stop loss 5-10 pips below the entry point for long trades, or 5-10 pips above the entry point for short trades.

- Set a take profit target of 10-20 pips, depending on market volatility and your risk tolerance.

- Consider using a trailing stop to lock in profits as the trade moves in your favor.

Step 5: Monitor and Exit with Discipline

- Closely monitor your trade as it progresses, watching for any signs of trend reversal.

- Be prepared to exit manually if market conditions change rapidly or if your profit target is approaching a key support/resistance level.

- Use a trailing stop to protect profits while allowing the trade room to breathe.

- Close the trade immediately if your stop loss or take profit levels are reached.

Read More: Unveiling the 9 EMA Scalping Strategy

Advanced Techniques for 20 EMA Scalping: Elevating Your Trading Strategy

Multiple Timeframe Analysis: A Holistic Approach to Market Dynamics

Combine the 20 EMA strategy with higher timeframe analysis to confirm the overall trend direction and improve trade accuracy:

- Use a 15-minute or 30-minute chart to identify the broader trend.

- Switch to a 1-minute or 5-minute chart for precise entry and exit points using the 20 EMA.

- Ensure that your scalp trades align with the higher timeframe trend for increased probability of success.

Incorporating Additional Indicators: Enhancing Decision-Making

Enhance your 20 EMA scalping strategy by adding complementary indicators for confirmation:

- Stochastic Oscillator:

- Use it to confirm overbought or oversold conditions before entering a trade.

- Look for bullish or bearish divergences for potential trend reversals.

- Relative Strength Index (RSI):

- Look for divergences between price and RSI to identify potential trend reversals.

- Use RSI levels (e.g., above 70 or below 30) to confirm overbought or oversold conditions.

- Bollinger Bands:

- Use them to gauge market volatility and potential breakout opportunities.

- Look for price touches on the upper or lower bands for potential reversal points.

- MACD (Moving Average Convergence Divergence):

- Use MACD crossovers to confirm trend direction and potential entry points.

- Look for MACD histogram changes to identify shifts in momentum.

Price Action Confirmation: Reading the Market’s Language

Combine the 20 EMA with price action analysis for more robust trading decisions:

- Look for candlestick patterns (e.g., pin bars, engulfing patterns) at the 20 EMA to confirm entry points.

- Use support and resistance levels in conjunction with the 20 EMA to identify high-probability trade setups.

- Pay attention to the size and shape of candles near the 20 EMA for clues about market sentiment.

Fibonacci Retracements: Precision Entry and Exit Points

Incorporate Fibonacci retracements to refine your 20 EMA scalping strategy:

- Draw Fibonacci retracement levels on your chart during clear trends.

- Look for confluences between the 20 EMA and key Fibonacci levels (e.g., 38.2%, 50%, 61.8%) for potential entry points.

- Use Fibonacci extension levels to set precise take profit targets.

Risk Management in 20 EMA Scalping: Protecting Your Capital and Maximizing Profits

Effective risk management is crucial for successful scalping. Here are some key principles to follow:

- Position Sizing:

- Never risk more than 1-2% of your trading account on a single trade.

- Calculate position sizes based on your account balance and the distance to your stop loss.

- Stop Loss Discipline:

- Always use stop-loss orders and stick to them rigorously.

- Avoid moving stop losses further away from your entry point.

- Risk-Reward Ratio:

- Aim for a minimum risk-reward ratio of 1:1.5 or higher.

- Be willing to pass on setups that don’t offer a favorable risk-reward ratio.

- Daily Loss Limit:

- Set a maximum daily loss limit (e.g., 3-5% of your account) and stop trading if you reach it.

- Use this as a circuit breaker to prevent emotional trading and protect your capital.

- Emotional Control:

- Avoid revenge trading or overtrading after a losing streak.

- Take regular breaks to maintain focus and avoid fatigue-induced errors.

- Use of Leverage:

- Be cautious with leverage, as it can amplify both gains and losses.

- Consider reducing leverage during volatile market conditions.

- Risk-Free Trades:

- Once a trade has moved significantly in your favor, consider moving your stop loss to breakeven.

- This creates a risk-free trade, protecting your initial capital.

Read More: Unlock Profitable Trading with the 3 EMA Scalping Strategy

Common Pitfalls to Avoid in 20 EMA Scalping: Navigating the Challenges

- Overtrading:

- Don’t feel compelled to take every potential setup. Quality over quantity is key.

- Set a maximum number of trades per day to avoid exhaustion and poor decision-making.

- Ignoring News Events:

- Be aware of major economic news releases that can cause sudden market volatility.

- Consider avoiding trading during high-impact news events or adjusting your strategy accordingly.

- Neglecting Spread Costs:

- Factor in the spread when calculating potential profits, especially for tight stop losses.

- Be particularly cautious during periods of wider spreads, such as market open or close.

- Chasing the Market:

- Avoid entering trades late after a significant move has already occurred.

- Stick to your predefined entry criteria and be patient for the next opportunity.

- Lack of Practice:

- Spend time demo trading to perfect your strategy before risking real capital.

- Regularly review and analyze your demo trades to identify areas for improvement.

- Inconsistent Execution:

- Develop a clear trading plan and stick to it consistently.

- Avoid making impulsive decisions based on emotions or hunches.

- Neglecting Market Context:

- Always consider the broader market context, including higher timeframe trends and key support/resistance levels.

- Be cautious when scalping against the dominant trend.

Optimizing Your 20 EMA Scalping Performance: Continuous Improvement and Adaptation

Backtesting and Forward Testing: Validating Your Strategy

- Use historical data to backtest your 20 EMA scalping strategy across different market conditions:

- Test on multiple currency pairs and timeframes.

- Analyze performance during trending and ranging markets.

- Identify optimal parameters for different market conditions.

- Forward test your strategy on a demo account to validate its effectiveness in real-time market conditions:

- Simulate real trading conditions, including spread and slippage.

- Practice proper risk management and trade execution.

- Refine your strategy based on live market feedback.

Keeping a Detailed Trading Journal: Your Path to Improvement

Maintain a comprehensive trading journal to track your performance and identify areas for improvement:

- Record entry and exit points, position sizes, and reasons for each trade.

- Analyze your winning and losing trades to refine your strategy:

- Identify patterns in successful trades.

- Pinpoint common mistakes in losing trades.

- Note any emotional factors that influenced your trading decisions:

- Recognize and address psychological barriers to success.

- Develop strategies to maintain emotional discipline.

Continuous Learning and Adaptation: Staying Ahead in a Dynamic Market

- Stay updated on market news and economic events that could impact your trading:

- Follow reputable financial news sources.

- Understand the impact of economic indicators on currency pairs.

- Regularly review and adjust your strategy based on changing market conditions:

- Be willing to adapt your approach as markets evolve.

- Experiment with new techniques and indicators to enhance your strategy.

- Participate in forex trading communities to exchange ideas and learn from other traders:

- Join online forums and social media groups dedicated to forex trading.

- Attend webinars and trading seminars to gain new insights.

- Consider working with a mentor or joining a trading group:

- Learn from experienced traders who have mastered scalping techniques.

- Gain exposure to different trading styles and strategies.

OpoFinance: Your Trusted Partner for 20 EMA Scalping

When implementing the 20 EMA scalping strategy, choosing the right broker is crucial for your success. OpoFinance stands out as an excellent choice for forex traders, particularly those focusing on scalping techniques.

Why Choose OpoFinance for Your 20 EMA Scalping Strategy?

- ASIC Regulation: As an ASIC-regulated broker, OpoFinance offers a secure and transparent trading environment, ensuring your funds and trades are protected.

- Advanced Trading Platforms: OpoFinance provides access to state-of-the-art trading platforms, including MetaTrader 5, which is ideal for implementing and executing your 20 EMA scalping strategy.

- Tight Spreads and Fast Execution: Benefit from competitive spreads and lightning-fast execution speeds, essential for successful scalping.

- Social Trading Service: Take advantage of OpoFinance’s social trading feature to learn from and copy the trades of experienced scalpers, accelerating your learning curve.

- Safe and Convenient Deposits and Withdrawals: Enjoy peace of mind with secure and efficient payment methods for funding your account and withdrawing your profits.

- Educational Resources: Access a wealth of educational materials to refine your 20 EMA scalping skills and stay updated on market trends.

By choosing OpoFinance as your forex trading partner, you’re equipping yourself with the tools and support needed to maximize the potential of your 20 EMA scalping strategy. Their commitment to trader success and regulatory compliance makes them an excellent choice for both novice and experienced scalpers alike.

Conclusion

The 20 EMA scalping strategy offers a powerful approach to forex trading, combining simplicity with effectiveness. By mastering this technique, you can potentially capitalize on short-term price movements and enhance your trading performance. Remember that successful scalping requires discipline, practice, and continuous learning.

As you embark on your journey with the 20 EMA scalping strategy, keep these key points in mind:

- Always prioritize risk management and emotional control.

- Continuously refine your strategy through backtesting and live practice.

- Stay informed about market conditions and adapt your approach accordingly.

- Choose a reliable broker like OpoFinance to ensure smooth execution of your trades.

With dedication and the right tools at your disposal, the 20 EMA scalping strategy can become a valuable addition to your forex trading arsenal. Start small, stay consistent, and watch as your skills and potentially your profits grow over time.

How does the 20 EMA scalping strategy differ from other scalping techniques?

The 20 EMA scalping strategy stands out for its simplicity and effectiveness. Unlike other scalping techniques that may rely on multiple indicators or complex setups, the 20 EMA strategy focuses primarily on a single, responsive indicator. This approach allows traders to quickly identify trends and potential entry points, making it particularly suitable for the fast-paced nature of scalping. The 20 EMA also adapts more quickly to price changes compared to longer-period moving averages, giving traders a more current view of market dynamics.

Can the 20 EMA scalping strategy be applied to other financial markets besides forex?

While the 20 EMA scalping strategy is particularly popular in forex trading due to the market’s high liquidity and 24-hour nature, it can indeed be applied to other financial markets. Traders have successfully used this strategy in stock trading, cryptocurrency markets, and even some commodity futures. However, it’s important to note that the effectiveness may vary depending on the market’s characteristics. Factors such as liquidity, volatility, and trading hours should be considered when adapting this strategy to different asset classes. Always backtest and practice the strategy in your chosen market before committing real capital.

How do I adjust the 20 EMA scalping strategy for different market conditions?

Adapting the 20 EMA scalping strategy to various market conditions is crucial for consistent success. In highly volatile markets, you might consider widening your stop loss and take profit levels to accommodate larger price swings. During periods of low volatility, tightening these parameters can help capture smaller moves. Additionally, you can adjust the timeframe of your charts; using a 5-minute chart instead of a 1-minute chart during slower market periods can help filter out noise. Some traders also incorporate additional indicators like the ATR (Average True Range) to gauge market volatility and adjust their strategy accordingly. Remember, flexibility and continuous market analysis are key to successfully adapting your 20 EMA scalping approach across different market conditions.

2 Responses

Nice blog! Is your theme custom made or did you download it from somewhere? A theme like yours with a few simple adjustements would really make my blog stand out. Please let me know where you got your design. Thanks a lot

tnx, its custom made.