The Forex market, also known as the foreign exchange market, is the world’s largest financial market, where currencies are bought and sold. It’s a global decentralized marketplace that operates 24 hours a day, five days a week, allowing traders to engage in currency transactions at any time. The Forex market is crucial for international trade and investments because it allows businesses to convert one currency into another.

Forex trading involves the exchange of one currency for another, aiming to profit from changes in exchange rates. Traders buy a currency pair when they believe the base currency will strengthen against the quote currency and sell it when they believe the base currency will weaken.

History of the Forex Market

The modern Forex market has its roots in the 1970s when countries shifted from the Bretton Woods Agreement, which pegged currencies to the US dollar, to floating exchange rates. This transition allowed currencies to be valued by supply and demand forces, leading to the establishment of the Forex market as we know it today.

What Is Forex Trading?

Forex trading is the act of buying and selling currencies to make a profit. As part of a comprehensive forex trading guide for beginners, it’s essential to understand that traders speculate on the price movements of currency pairs, such as EUR/USD (Euro/US Dollar) or GBP/JPY (British Pound/Japanese Yen), by predicting whether one currency will strengthen or weaken against another. The goal for beginners is to buy low and sell high, making a profit from the price difference. These fundamental forex tips for beginners are crucial for developing a successful trading strategy and gaining confidence in the Forex market.

How Forex Trading Works

Forex trading involves trading currency pairs, where one currency is exchanged for another. Each currency pair has a base currency and a quote currency. The base currency is the first currency listed in the pair, and the quote currency is the second. For example, in the EUR/USD pair, EUR is the base currency, and USD is the quote currency.

Traders profit from the fluctuations in exchange rates between currencies. For example, if a trader believes the EUR will strengthen against the USD, they will buy the EUR/USD pair. If the EUR/USD exchange rate rises, the trader can sell the pair at a higher price, making a profit.

Understanding Exchange Rates

Exchange rates are influenced by various factors, including economic indicators, geopolitical events, and market sentiment. Central banks, such as the Federal Reserve in the US or the European Central Bank in the Eurozone, also play a significant role in determining exchange rates through their monetary policies.

Types of Forex Orders

- Market Orders: Execute trades at the current market price.

- Limit Orders: Execute trades at a specified price or better.

- Stop Orders: Execute trades when the price reaches a specified level.

- Stop-Loss Orders: Automatically close a position to limit losses.

- Take-Profit Orders: Automatically close a position to lock in profits.

Is Forex Trading Good for Beginners?

Forex trading can be suitable for beginners, but it comes with significant risks. As highlighted in any thorough forex trading guide for beginners, it’s essential for new traders to educate themselves, understand the market dynamics, and develop a solid trading strategy. One of the most important forex tips for beginners is to start with a demo account to practice trading without risking real money. This allows beginners to gain experience and confidence before transitioning to live trading in the Forex market.

Benefits for Beginners

- Accessibility: Forex trading is accessible to anyone with an internet connection and a small amount of capital.

- Leverage: Brokers offer leverage, allowing traders to control larger positions with a smaller amount of capital.

- Flexibility: The Forex market operates 24 hours a day, providing flexibility for traders to trade at their convenience.

Challenges for Beginners

- Volatility: The Forex market can be highly volatile, leading to significant gains or losses.

- Complexity: Understanding the factors that influence exchange rates can be complex.

- Risk of Loss: High leverage can lead to substantial losses, especially for inexperienced traders.

How Much Money Do I Need to Start Trading Forex?

The amount of money needed to start trading Forex varies, but many brokers offer accounts with minimum deposits as low as $100. However, starting with a larger amount, such as $500 to $1,000, can provide more flexibility and better risk management. For those following a forex trading guide for beginners, it is crucial to understand that a higher initial deposit can help manage potential losses and capitalize on more trading opportunities. This is one of the key forex tips for beginners to ensure a smoother and potentially more profitable entry into the Forex market.

Factors to Consider

- Broker Requirements: Different brokers have different minimum deposit requirements.

- Leverage: Higher leverage allows traders to control larger positions with a smaller amount of capital.

- Risk Management: It’s important to have enough capital to manage risk effectively.

Risk Management Tips

- Use Stop-Loss Orders: Limit potential losses by setting stop-loss orders.

- Diversify Your Portfolio: Avoid putting all your capital into a single trade.

- Start Small: Begin with small positions to minimize risk.

Forex Tips for Beginners

- Educate Yourself: Learn the basics of Forex trading, including how the market works and key terminologies.

- Start with a Demo Account: Practice trading with virtual money to gain experience without financial risk.

- Develop a Trading Plan: Create a plan that includes your trading goals, risk tolerance, and strategies.

- Manage Risk: Use stop-loss orders and limit the amount of capital you risk on each trade.

- Stay Informed: Keep up with global economic news and events that can affect currency prices.

Importance of Continuous Learning

Forex trading is a continuous learning process. Market conditions and economic factors are always changing, requiring traders to stay informed and adapt their strategies.

Utilizing Educational Resources

- Books and eBooks: Numerous books on Forex trading provide in-depth knowledge and strategies.

- Online Courses: Many online platforms offer comprehensive courses on Forex trading.

- Webinars and Seminars: Participating in webinars and seminars can provide insights from experienced traders.

- Trading Forums: Engaging in trading forums allows beginners to learn from the experiences of other traders.

Which Currencies Can I Trade?

Forex traders can trade a wide range of currencies, including major pairs like EUR/USD, GBP/USD, and USD/JPY, minor pairs such as EUR/GBP and AUD/NZD, and exotic pairs like USD/TRY (US Dollar/Turkish Lira) and EUR/TRY (Euro/Turkish Lira). Understanding the different types of currency pairs is an essential part of any forex trading guide for beginners. One of the vital forex tips for beginners is to start by trading major pairs, as they tend to be more liquid and have tighter spreads, making them suitable for those new to the Forex market.

Major Currency Pairs

Major currency pairs involve the most traded currencies in the world, typically including the USD. These pairs are highly liquid and have tight spreads. Examples include:

- EUR/USD: Euro/US Dollar

- GBP/USD: British Pound/US Dollar

- USD/JPY: US Dollar/Japanese Yen

Minor Currency Pairs

Minor currency pairs do not involve the USD but include other major currencies. These pairs are less liquid than major pairs but still offer significant trading opportunities. Examples include:

- EUR/GBP: Euro/British Pound

- AUD/NZD: Australian Dollar/New Zealand Dollar

- GBP/JPY: British Pound/Japanese Yen

Exotic Currency Pairs

Exotic currency pairs involve a major currency and a currency from an emerging or smaller economy. These pairs are less liquid and have wider spreads. Examples include:

- USD/TRY: US Dollar/Turkish Lira

- EUR/TRY: Euro/Turkish Lira

- USD/ZAR: US Dollar/South African Rand

Pros and Cons of Trading Forex

Pros

- Liquidity: The Forex market is highly liquid, allowing for easy entry and exit of trades.

- 24-Hour Market: Traders can trade at any time during the week.

- Leverage: Brokers offer leverage, allowing traders to control larger positions with a smaller amount of capital.

- Variety of Currencies: There are numerous currency pairs to trade.

- Low Transaction Costs: Forex trading typically involves low transaction costs compared to other financial markets.

Cons

- High Risk: Forex trading can lead to significant losses, especially with high leverage.

- Complex Market: The market can be influenced by numerous factors, making it challenging to predict movements.

- Requires Discipline: Successful trading requires strict discipline and a well-thought-out strategy.

- Emotional Stress: The potential for significant financial loss can cause emotional stress.

- Scams and Fraud: The Forex market is not immune to scams and fraudulent activities, so it’s important to choose a reputable broker.

How Does the Forex Market Work?

The Forex market operates over-the-counter (OTC), meaning there is no centralized exchange. Instead, trading is conducted electronically via a network of banks, brokers, and financial institutions. Understanding this setup is crucial for anyone following a forex trading guide for beginners. The market is divided into four major trading sessions: Sydney, Tokyo, London, and New York, ensuring continuous trading. One of the essential forex tips for beginners is to familiarize themselves with these trading sessions, as knowing when the market is most active can help in making more informed trading decisions.

Key Participants in the Forex Market

- Central Banks: Influence the Forex market through monetary policy and currency interventions.

- Commercial Banks: Conduct currency transactions for their clients and engage in proprietary trading.

- Hedge Funds: Use the Forex market for speculation and hedging purposes.

- Corporations: Engage in Forex transactions to manage international trade and investment activities.

- Retail Traders: Individual traders who participate in the Forex market through online brokers.

Major Forex Trading Sessions

- Sydney Session: Begins the trading week, with moderate liquidity and volatility.

- Tokyo Session: Overlaps with the Sydney session, increasing liquidity and volatility.

- London Session: One of the most active trading sessions, overlapping with both the Tokyo and New York sessions.

- New York Session: The most active trading session, overlapping with the London session and contributing to high liquidity and volatility.

Understanding Market Hours

The Forex market operates 24 hours a day, five days a week, due to the different time zones of the major trading sessions. The most significant trading activity occurs during the overlaps of these sessions, providing the best opportunities for traders.

How to Start Trading Forex

- Choose a Reliable Broker: Select a broker with a good reputation, solid customer service, and favorable trading conditions.

- Open an Account: Register for a trading account, providing necessary identification documents.

- Fund Your Account: Deposit funds into your trading account.

- Download Trading Platform: Use the broker’s platform or a third-party platform like MetaTrader 4 or 5.

- Start Trading: Begin trading with small positions to minimize risk.

Choosing the Right Broker

Selecting the right broker is crucial for successful Forex trading. Consider the following factors:

- Regulation: Ensure the broker is regulated by a reputable financial authority.

- Spreads and Fees: Compare the spreads and fees charged by different brokers.

- Trading Platform: Choose a broker with a user-friendly and reliable trading platform.

- Customer Support: Look for brokers with responsive and helpful customer support.

- Account Types: Check the variety of account types and the minimum deposit required.

Funding Your Trading Account

Different brokers offer various funding methods, including bank transfers, credit/debit cards, and online payment services like PayPal and Skrill. Ensure you choose a funding method that is convenient and cost-effective.

Setting Up a Trading Platform

Once your account is funded, download and set up the trading platform provided by your broker. Most brokers offer platforms like MetaTrader 4 (MT4) or MetaTrader 5 (MT5), which provide advanced charting tools, technical indicators, and automated trading capabilities.

Types of Markets

Spot Market

The spot market involves the immediate exchange of currencies at current market rates. Transactions are settled “on the spot,” typically within two business days. For those following a forex trading guide for beginners, it’s important to note that the spot market is the most common and straightforward way to trade Forex. Among the essential forex tips for beginners is understanding how the spot market works, as it provides a foundation for grasping more complex trading strategies and market dynamics.

Forward Market

The forward market involves contracts to buy or sell currencies at a future date and at a predetermined price. These contracts are customizable and can be tailored to meet the specific needs of the parties involved. The forward market is often used for hedging purposes.

Futures Market

The futures market involves standardized contracts to exchange currencies on a set future date. These contracts are traded on exchanges and are subject to regulation. The futures market provides transparency and reduces counterparty risk.

Options Market

The options market involves contracts that give traders the right, but not the obligation, to buy or sell currencies at a specified price before a certain date. Options can be used for speculation or hedging purposes, providing flexibility and risk management opportunities.

Forex Trading Strategies

Scalping

Scalping involves making numerous small trades to profit from minor price changes. Scalpers hold positions for a very short duration, often just a few seconds or minutes, and aim to accumulate small gains that add up over time.

Day Trading

Day trading involves opening and closing positions within the same trading day. Day traders capitalize on short-term price movements and avoid overnight risk. This strategy requires constant monitoring of the market and quick decision-making.

Swing Trading

Swing trading involves holding positions for several days to capitalize on short-term price trends. Swing traders use technical analysis to identify potential entry and exit points and aim to capture “swings” in the market.

Position Trading

Position trading involves holding positions for an extended period, ranging from weeks to months or even years. Position traders rely on fundamental analysis and macroeconomic factors to determine their trading decisions.

Carry Trade

A carry trade involves borrowing money in a currency with a low-interest rate and investing it in a currency with a higher interest rate. This strategy aims to profit from the interest rate differential, known as the “carry.”

Hedging

Hedging involves opening multiple positions to offset potential losses. For example, if you have a long position on EUR/USD, you might also open a short position on GBP/USD to mitigate risk.

News Trading

News trading involves taking positions based on economic news releases and events. Traders aim to capitalize on the market volatility that often follows significant news announcements. This strategy requires staying updated with economic calendars and news sources.

Trend Following

Trend following strategies involve identifying and following the direction of the market trend. Traders use technical indicators like moving averages, trendlines, and the Moving Average Convergence Divergence (MACD) to confirm the trend and make trading decisions.

Basic Forex Terminology

- Pip: The smallest price move that a given exchange rate can make. In most currency pairs, a pip is equal to 0.0001.

- Lot: A standardized quantity of a currency pair. Standard lots are 100,000 units of the base currency.

- Leverage: Borrowing capital to increase the potential return of an investment. Leverage in Forex trading allows traders to control larger positions with a smaller amount of capital.

- Margin: The required amount of funds to open a leveraged position. Margin is a portion of the trader’s account balance set aside to cover potential losses.

- Spread: The difference between the bid and ask price. The spread represents the cost of trading and varies depending on market conditions and the broker.

- Bid Price: The price at which a trader can sell a currency pair.

- Ask Price: The price at which a trader can buy a currency pair.

- Currency Pair: Two currencies traded against each other in the Forex market. The first currency is the base currency, and the second is the quote currency.

- Exchange Rate: The rate at which one currency can be exchanged for another. Exchange rates fluctuate based on supply and demand forces.

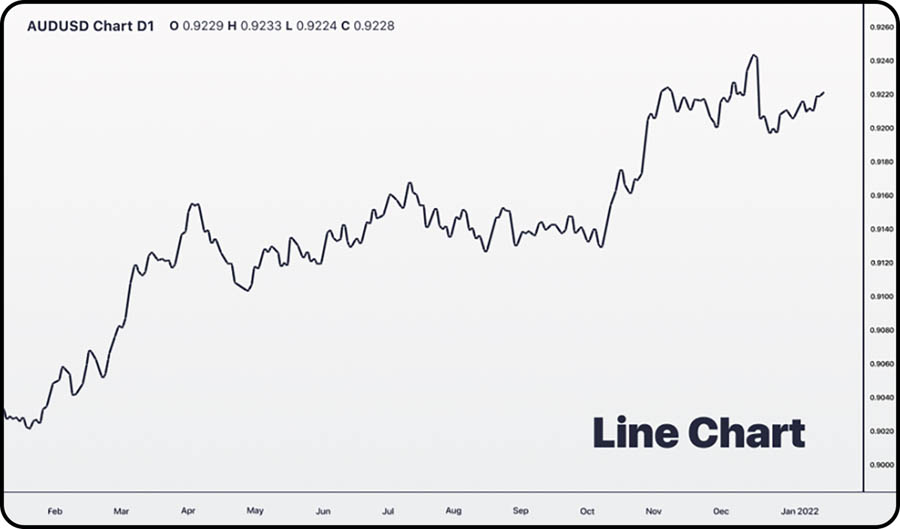

Charts Used in Forex Trading

Understanding the various charts used in Forex trading is essential for anyone looking to succeed in this market. Charts are a crucial tool for analyzing market trends, price movements, and making informed trading decisions. In this section of our forex trading guide for beginners, we will explore the different types of charts that are commonly used by Forex traders. By learning how to read and interpret these charts, beginners can gain valuable insights into market behavior and develop effective trading strategies.

For those just starting, one of the most important forex tips for beginners is to become familiar with the various chart types and their uses. Whether you’re looking at line charts, bar charts, or candlestick charts, each type provides unique information that can help you understand market trends and price action. Mastering these charts will not only enhance your trading skills but also give you the confidence to make more informed trading decisions.

In the following sections, we will delve deeper into the specifics of each chart type, highlighting their features and how they can be utilized in Forex trading. By incorporating this knowledge into your trading practice, you’ll be better equipped to navigate the complexities of the Forex market and improve your chances of success. This comprehensive overview will serve as a fundamental part of your forex trading guide for beginners, ensuring you have the essential tools and knowledge to start your trading journey.

Read More: Understanding Different Types of Forex Accounts

Line Chart

A line chart is the simplest form of chart used in Forex trading. It displays closing prices over a specified period, connected by a line. Line charts provide a clear and straightforward view of the market trend but lack detailed information.

Bar Chart

A bar chart displays open, high, low, and close prices for a specified period. Each bar represents one period, such as a day or an hour. Bar charts provide more detailed information than line charts and help traders identify price patterns and trends.

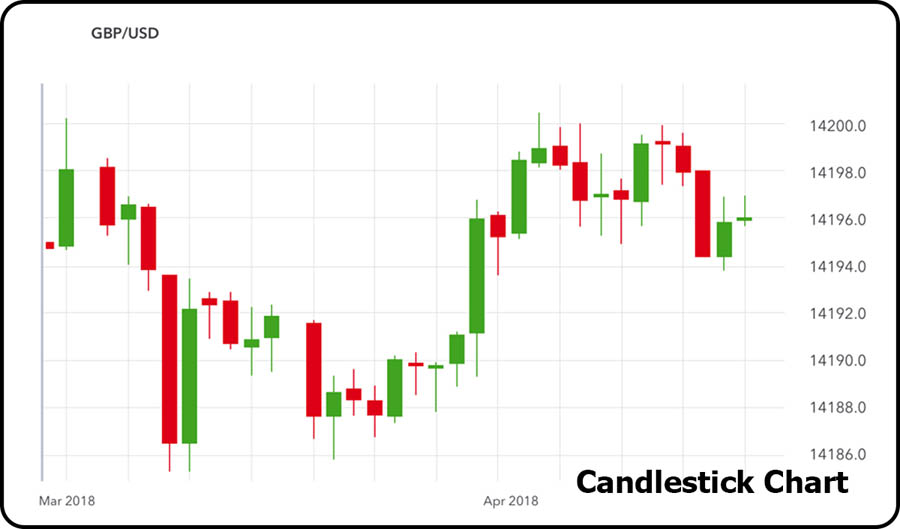

candlestick chart

A candlestick chart is similar to a bar chart but uses candlestick-shaped figures to represent price movements. Each candlestick displays the open, high, low, and close prices for a specific period. Candlestick charts are visually appealing and provide valuable information about market sentiment.

Renko Chart

Renko charts are based on price movement rather than time. They consist of bricks that represent a fixed price move. Renko charts help traders filter out market noise and identify significant trends.

Heikin-Ashi Chart

Heikin-Ashi charts are a modified version of candlestick charts that use averaged price data to create a smoother appearance. They help traders identify trends and potential reversal points by reducing market noise.

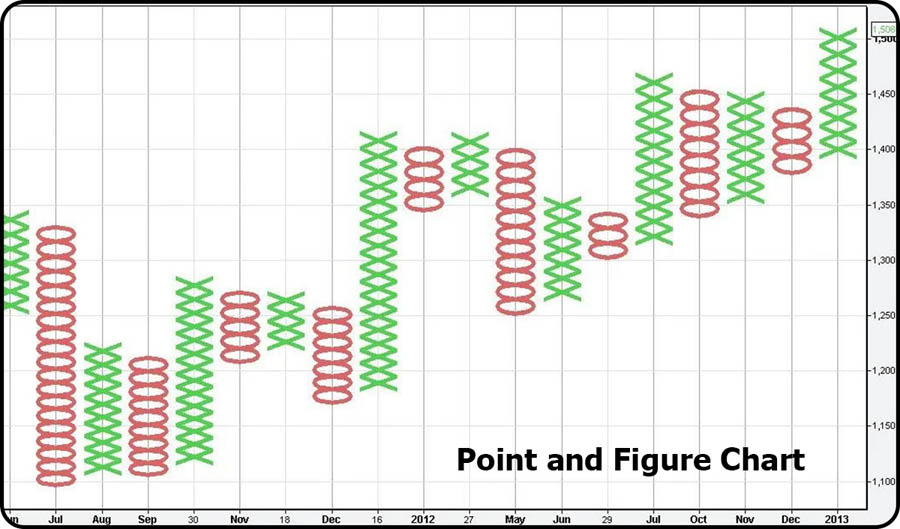

Point and Figure Chart

Point and figure charts focus on price movements without considering time. They use X’s and O’s to represent price increases and decreases, respectively. Point and figure charts help traders identify significant price levels and trends.

Are Forex Markets Regulated?

Forex markets are regulated by financial authorities in different countries to ensure fair trading practices and protect investors. This is a vital aspect to understand as part of any comprehensive forex trading guide for beginners. Regulations vary by region, with prominent regulators including the Commodity Futures Trading Commission (CFTC) in the US, the Financial Conduct Authority (FCA) in the UK, and the Australian Securities and Investments Commission (ASIC).

One of the key forex tips for beginners is to always choose a broker that is regulated by a reputable financial authority. Regulatory bodies enforce strict standards and guidelines to prevent fraudulent activities and to ensure that brokers operate with transparency and integrity. Understanding the role of these regulatory bodies can help beginners navigate the Forex market more safely and confidently.

By adhering to these regulations, Forex brokers provide a secure trading environment, which is crucial for both new and experienced traders. This section of our forex trading guide for beginners emphasizes the importance of regulatory oversight in maintaining the integrity of the Forex market and safeguarding trader investments.

Read More: Forex Charts: A Comprehensive Guide for Beginners

Key Regulatory Bodies

- Commodity Futures Trading Commission (CFTC): Regulates Forex trading in the United States and ensures market integrity.

- Financial Conduct Authority (FCA): Regulates financial markets in the United Kingdom, including Forex trading.

- Australian Securities and Investments Commission (ASIC): Oversees Forex trading and financial markets in Australia.

- European Securities and Markets Authority (ESMA): Regulates Forex trading within the European Union.

- Swiss Financial Market Supervisory Authority (FINMA): Regulates financial markets, including Forex trading, in Switzerland.

Importance of Regulation

Regulation is crucial for maintaining market integrity and protecting traders from fraudulent activities. Regulated brokers are required to adhere to strict standards, including segregating client funds, providing transparent pricing, and maintaining adequate capital reserves.

How to Choose a Forex Broker

Choosing the right Forex broker is a crucial step in your journey as a trader. This is a fundamental aspect of any forex trading guide for beginners, as the broker you select can significantly impact your trading experience and success. Here are some forex tips for beginners on how to choose a Forex broker:

Regulation

Ensure the broker is regulated by a reputable financial authority, such as the Commodity Futures Trading Commission (CFTC) in the US, the Financial Conduct Authority (FCA) in the UK, or the Australian Securities and Investments Commission (ASIC). Regulation provides a level of security and transparency, protecting you from fraud and ensuring that the broker adheres to industry standards.

Trading Platform

Choose a broker with a user-friendly and reliable trading platform. Popular platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5) offer advanced charting tools, technical indicators, and automated trading capabilities, which are essential for both beginners and experienced traders.

Spreads and Fees

Compare the spreads and fees charged by different brokers. Lower spreads and fees can save you money in the long run and improve your overall profitability. Make sure to understand all the costs involved, including any hidden fees.

Customer Support

Look for brokers with responsive and helpful customer support. Good customer service is crucial, especially for beginners who might need assistance with account setup, platform issues, or general trading inquiries.

Account Types

Check the variety of account types offered by the broker and their minimum deposit requirements. Some brokers provide micro or mini accounts with lower minimum deposits, which can be ideal for beginners who want to start with a smaller investment.

Execution Speed

Ensure the broker offers fast and accurate order execution. Delays in execution can result in missed opportunities or unexpected losses, so it’s important that your trades are executed promptly.

Educational Resources

Select a broker that provides educational resources and tools for traders. Many brokers offer webinars, tutorials, and trading guides that can help beginners learn the basics of Forex trading and develop their skills.

Demo Account

Ensure the broker offers a demo account for practice trading. A demo account allows beginners to practice trading with virtual money, helping them to gain experience and confidence without risking real money.

Evaluating Broker Reputation

- Reviews and Testimonials: Read reviews and testimonials from other traders to gauge the broker’s reputation.

- Regulatory History: Check the broker’s regulatory history for any past violations or issues.

- Longevity: Consider brokers that have been in the industry for several years and have a solid track record.

Read More: Forex Market Terminology for Beginners

Importance of Customer Support

Effective customer support is crucial for resolving issues and answering questions. Ensure the broker offers multiple support channels, such as phone, email, and live chat, and provides support in your preferred language.

Choosing the right broker is a critical decision in your forex trading journey. By following these forex tips for beginners and thoroughly researching your options, you can find a broker that meets your needs and helps you start trading with confidence. This section of our forex trading guide for beginners aims to provide you with the essential information to make an informed choice and set a solid foundation for your trading career.

Additional Insights for Forex Trading Beginners

Understanding Forex Trading Costs

Forex trading costs include spreads, commissions, and overnight financing charges (swap rates). Understanding these costs can help you manage your trading expenses and improve profitability. Always compare the fee structures of different brokers before opening an account.

Leveraging Technology

Modern technology has revolutionized Forex trading, making it more accessible and efficient. Automated trading systems, mobile trading apps, and advanced charting tools are some of the technological advancements that can enhance your trading experience.

Developing a Trading Journal

Keeping a trading journal helps you track your trades, analyze performance, and identify areas for improvement. Record details such as entry and exit points, trade size, and the rationale behind each trade. Regularly reviewing your journal can help you refine your strategies and become a better trader.

Importance of Discipline

Discipline is critical in Forex trading. Stick to your trading plan, manage risk effectively, and avoid emotional decision-making. Consistent discipline can significantly impact your long-term success in the Forex market.

Read More: How do I start trading forex?

Networking with Other Traders

Engaging with other traders through forums, social media, or local trading groups can provide valuable insights and support. Learning from the experiences of others can help you avoid common pitfalls and improve your trading skills.

Utilizing Analytical Tools

Advanced analytical tools, such as economic calendars, sentiment indicators, and custom indicators, can provide a deeper understanding of market dynamics. Utilizing these tools can help you make more informed trading decisions.

Psychological Aspects of Trading

Understanding the psychological aspects of trading, such as fear, greed, and overconfidence, is essential. Developing a strong mindset and emotional resilience can help you navigate the challenges of Forex trading.

Conclusion:

Forex trading offers numerous opportunities for profit, but it also comes with substantial risks. As a beginner, it’s crucial to educate yourself, develop a solid trading plan, and practice with a demo account before committing real money. By following this forex trading guide for beginners and understanding the market dynamics, you can navigate the complexities of the Forex market more effectively.

One of the key forex tips for beginners is to manage risk effectively by using proper risk management techniques such as setting stop-loss orders and diversifying your portfolio. Additionally, staying informed about global economic news and events that can affect currency prices is essential for making informed trading decisions.

Remember, discipline and continuous learning are key components of becoming a successful Forex trader. The Forex market is constantly evolving, so it’s important to adapt your strategies and stay updated with the latest market trends and developments.

By incorporating these principles into your trading practice and remaining disciplined in your approach, you can increase your chances of success in the Forex market. With dedication, patience, and a commitment to learning, you can embark on a rewarding journey towards financial independence through Forex trading.

What is the best time to trade Forex?

The best time to trade Forex is during the overlap of major trading sessions, such as the London-New York overlap, as it offers the highest liquidity and volatility.

Can I trade Forex without a broker?

No, you need a broker to access the Forex market and execute trades.

How long does it take to become a profitable Forex trader?

The time it takes varies for each individual, but it generally requires months to years of learning, practice, and experience.

Is it possible to trade Forex part-time?

Yes, many traders trade Forex part-time. The flexibility of the market’s hours allows for part-time trading around a regular job or other commitments.

What tools do I need to trade Forex?

Essential tools include a computer or mobile device, a reliable internet connection, a trading platform, and access to market news and analysis.

What is the difference between fundamental and technical analysis?

Fundamental analysis evaluates economic indicators and news events to determine a currency’s value, while technical analysis uses historical price data and charts to predict future price movements.

How can I avoid emotional trading?

Developing a trading plan, setting realistic goals, and sticking to your strategy can help minimize emotional trading. Regularly reviewing your trades and taking breaks also help.

What are exotic currency pairs?

Exotic currency pairs involve a major currency paired with a currency from a developing or small economy, such as USD/TRY (US Dollar/Turkish Lira).

How important is a demo account?

A demo account is crucial for beginners to practice trading without financial risk, allowing them to test strategies and gain experience.

Can Forex trading be automated?

Yes, Forex trading can be automated using trading robots and algorithms, which can execute trades based on predefined criteria. However, it’s essential to monitor automated systems regularly to ensure they perform as expected. By understanding the basics of Forex trading and following these guidelines, beginners can start their trading journey with a solid foundation and a higher chance of success.