Forex trading is a complex yet highly profitable arena that captivates millions of traders globally. Among these traders, a select group has amassed extraordinary wealth, earning legendary status in the financial world. This article delves into the richest Forex traders in the world, shedding light on their career trajectories, trading strategies, significant accomplishments, and the invaluable lessons they impart to aspiring traders. Discover who is the richest Forex trader, what sets them apart in the competitive world of Forex trading, and why choosing a regulated forex broker is essential for success.

Who is the Richest Forex Trader?

Forex, or foreign exchange trading, entails the buying and selling of currencies to capitalize on fluctuations in exchange rates. As one of the most liquid and dynamic markets worldwide, Forex trading attracts traders with its potential for substantial gains. By examining the strategies and successes of the richest Forex traders in the world, both novice and seasoned traders can gain valuable insights and inspiration. Learning who is the richest Forex trader and understanding their approach can significantly enhance one’s trading acumen.

When discussing the richest Forex traders in the world, one name invariably stands out: George Soros. Famously known as “The Man Who Broke the Bank of England,” Soros has profoundly influenced the Forex market. His strategic trades and keen understanding of macroeconomic trends have earned him billions, solidifying his reputation as the richest Forex trader and a legend in the financial world.

George Soros: The Man Who Broke the Bank of England

Early Life and Career Beginnings

George Soros was born in Budapest, Hungary, in 1930. After surviving the hardships of World War II, he emigrated to England and attended the London School of Economics. His education and early experiences significantly shaped his financial acumen and philosophical outlook, leading him to pursue a career in finance.

Key Achievements and Milestones

The 1992 British Pound Trade

Soros’ most famous and lucrative trade occurred in 1992, during the Black Wednesday crisis. He correctly predicted that the British pound was overvalued against the German mark and shorted the pound. This trade earned him an astonishing $1 billion in a single day, cementing his reputation as a master Forex trader.

The Quantum Fund

In 1973, Soros founded the Quantum Fund, a hedge fund that became renowned for its exceptional returns. Under Soros’ leadership, the fund achieved an average annual return of over 30% for several decades, significantly contributing to his immense wealth.

Current Net Worth and Financial Status

As of 2024, George Soros’ net worth is estimated at $8.6 billion, making him the richest Forex trader in the world. His wealth is a testament to his strategic brilliance, deep market understanding, and relentless pursuit of financial success.

Trading Strategies of George Soros

Soros’ Approach to Forex Trading

Soros is renowned for his macroeconomic analysis approach, which centers on examining global economic trends and their effects on currencies. By often taking large, calculated risks grounded in his thorough analysis, Soros has consistently achieved substantial profits. This strategic approach has significantly contributed to his status as one of the richest Forex traders in the world.

Importance of Macroeconomic Analysis

Soros’ trading strategy relies heavily on understanding the broader economic landscape. He analyzes factors such as interest rates, inflation, political events, and economic policies to predict currency movements. This macroeconomic perspective allows him to anticipate market shifts and capitalize on opportunities.

Read More: Can Forex Trading Make You Rich ?

Risk Management Techniques

Despite his bold trading style, Soros emphasizes the importance of risk management. He uses strategies such as stop-loss orders and diversification to protect his capital. By carefully managing risk, Soros ensures that his losses are limited, while his potential for gains remains high.

Notable Trades and Their Impacts

Beyond the famous 1992 trade, Soros has executed numerous successful trades throughout his career. His ability to anticipate market movements and act decisively has consistently yielded significant profits, solidifying his status as a Forex trading legend.

Other Notable Richest Forex Traders

While George Soros holds the title of the richest Forex trader, several other traders have also achieved remarkable success. Here are brief profiles of some of the richest Forex traders in the world:

| Rank | Trader | Nationality | Net Worth (USD) | Key Achievements | Trading Style |

| 1 | George Soros | Hungarian | $8.6 Billion | Made $1 billion in a single day in 1992 (Black Wednesday) | Speculative, macro trading |

| 2 | Paul Tudor Jones | American | $7.3 Billion | Predicted and profited from the 1987 market crash | Macro trading |

| 3 | Bruce Kovner | American | $6.6 Billion | Founder of Caxton Associates | Macro trading |

| 4 | Stanley Druckenmiller | American | $6.4 Billion | Managed George Soros’s Quantum Fund | Macro trading |

| 5 | Joe Lewis | British | $5.6 Billion | Bet against the British pound with Soros | Speculative, macro trading |

| 6 | Andrew Krieger | American | $600 Million | Profited from the 1987 market crash | Aggressive trading |

| 7 | Michael Marcus | American | $1.2 Billion | Early trader for Commodities Corporation | Trend following |

| 8 | Bill Lipschutz | American | $800 Million | Famous for his success at Salomon Brothers | Risk management focused |

| 9 | Richard Dennis | American | $300 Million | Co-creator of the Turtle Trading System | Trend following |

| 10 | Ed Seykota | American | $200 Million | Pioneer in system trading | System trading |

| 11 | Larry Hite | American | $100 Million | Co-founder of Mint Investments | System trading |

| 12 | John R. Taylor Jr. | American | $300 Million | Founder of FX Concepts | Macro trading |

| 13 | Steve Cohen | American | $16 Billion | Founder of SAC Capital Advisors | Short-term trading |

| 14 | Kenneth Griffin | American | $35 Billion | Founder of Citadel LLC | Quantitative trading |

| 15 | James Simons | American | $29 Billion | Founder of Renaissance Technologies | Quantitative trading |

| 16 | David Tepper | American | $12.5 Billion | Founder of Appaloosa Management | Distressed assets trading |

| 17 | Louis Bacon | American | $2 Billion | Founder of Moore Capital Management | Macro trading |

| 18 | Jim Rogers | American | $300 Million | Co-founder of Quantum Fund with Soros | Commodity trading |

| 19 | Martin Schwartz | American | $100 Million | Winner of the U.S. Trading Championship | Day trading |

| 20 | Urs Schwarzenbach | Swiss | $1.3 Billion | Successful Forex and property investments | Long-term investments |

| 21 | Alexander Elder | Estonian | $400 Million | Author and professional trader | Psychological trading |

| 22 | Joe DiNapoli | American | $50 Million | Known for DiNapoli Levels | Technical trading |

| 23 | Linda Raschke | American | $50 Million | Market Wizard and trading educator | Technical trading |

| 24 | Nick Leeson | British | – | Infamous for causing the collapse of Barings Bank | Risky, high-leverage trading |

| 25 | Chuck LeBeau | American | $10 Million | Developer of the Chandelier Exit trading strategy | Technical trading |

| 26 | Peter Brandt | American | $50 Million | Known for classical chart trading | Technical trading |

| 27 | Kathy Lien | American | $50 Million | Managing Director of FX Strategy at BK Asset Management | Fundamental and technical |

| 28 | Boris Schlossberg | American | $50 Million | Managing Director at BK Asset Management | Fundamental and technical |

| 29 | John Bollinger | American | $50 Million | Developer of Bollinger Bands | Technical trading |

| 30 | Raghee Horner | American | $20 Million | Currency and commodity trader | Trend following |

This table highlights some of the wealthiest and most influential traders in the Forex market, along with their nationalities, net worth, key achievements, and trading styles.

Detailed Biographies of the Top 10 Traders

1. George Soros

Early Life

Born in Hungary in 1930, George Soros survived the Nazi occupation during World War II. His experiences during this tumultuous period profoundly influenced his later philanthropic endeavors and philosophical outlook.

Career and Achievements

Soros began his financial career in various merchant banks in the UK and US, before starting his first hedge fund, Double Eagle, in 1969. Profits from this fund provided the seed money to start the Quantum Fund. Under his guidance, the Quantum Fund generated an annualized return of 30% over several decades.

Read More: The Mindset of a Successful Trader

Notable Trades

- Black Wednesday (1992): Shorting the British pound, earning $1 billion.

- Asian Financial Crisis (1997): Profitable short positions on Thai baht and Malaysian ringgit.

2. Paul Tudor Jones

Early Life

Paul Tudor Jones, one of the richest Forex traders in the world, was born in 1954 in Memphis, Tennessee. He graduated from the University of Virginia with a degree in economics, laying the foundation for his successful career in finance.

Career and Achievements

Jones founded Tudor Investment Corporation in 1980, which became one of the most successful hedge funds. He is renowned for his macro trading strategies and his ability to predict market crashes.

Notable Trades

- 1987 Stock Market Crash: Anticipated and profited from the crash, earning significant returns.

3. Stanley Druckenmiller

Early Life

Stanley Druckenmiller, one of the most prominent and richest Forex traders in the world, was born in 1953 in Pittsburgh, Pennsylvania. He attended Bowdoin College, where he pursued studies in English and economics, setting the stage for his distinguished career in the financial sector.

Career and Achievements

Druckenmiller began his career in finance at Pittsburgh National Bank. He later founded Duquesne Capital Management, which consistently delivered high returns. He also worked with George Soros at the Quantum Fund.

Notable Trades

- Black Wednesday (1992): Alongside Soros, he played a crucial role in shorting the British pound.

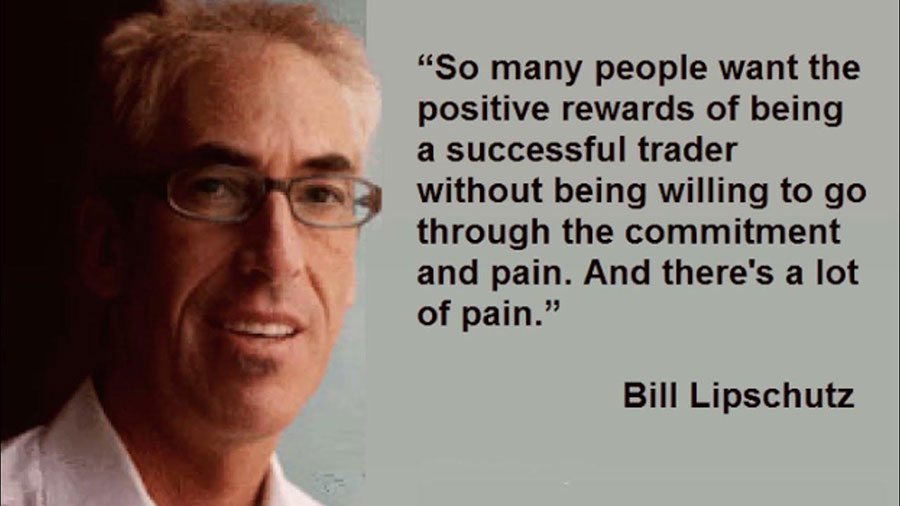

4. Bill Lipschutz

Early Life

Born in 1956 in Farmingdale, New York, Bill Lipschutz demonstrated an early aptitude for mathematics and finance. This natural talent paved the way for his future success, eventually making him one of the richest Forex traders in the world.

Career and Achievements

Lipschutz began his trading career at Salomon Brothers, where he turned a $12,000 inheritance into millions. He later founded Hathersage Capital Management, focusing on G10 currencies.

Notable Trades

- Salomon Brothers: Built a reputation as a top currency trader by turning a small inheritance into substantial profits.

5. Andrew Krieger

Early Life

Andrew Krieger, one of the richest Forex traders in the world, graduated from the prestigious Wharton School of Business before embarking on his career in finance. His academic background provided a solid foundation for his future achievements in the financial markets.

Career and Achievements

Krieger gained fame for his aggressive trading style and significant profits. He worked at Banker’s Trust, where he made his most notable trades.

Notable Trades

- New Zealand Dollar (1987): Made large profits shorting the currency during the market crash.

6. Bruce Kovner

Early Life

Bruce Kovner, born in 1945 in Brooklyn, New York, pursued his education at Harvard University before venturing into a successful career in finance. His academic background equipped him with the knowledge and skills necessary to excel in the competitive world of trading, ultimately leading him to become one of the richest Forex traders globally.

Career and Achievements

Kovner founded Caxton Associates, one of the most successful hedge funds. His trading strategy included macroeconomic analysis and risk management.

Notable Trades

- Early 1980s: Profited from trends in commodities and currencies, establishing his reputation as a successful trader.

7. Michael Marcus

Early Life

Michael Marcus, a prominent figure among the richest Forex traders, was born in the mid-20th century. He initially pursued studies in psychology at Johns Hopkins University before transitioning into the field of finance. This diverse educational background likely contributed to his success in understanding market psychology and making astute trading decisions

Career and Achievements

Marcus began his trading career under the mentorship of Ed Seykota. He worked at Commodities Corporation, where he turned a modest sum into millions.

Notable Trades

- 1970s-1980s: Focused on commodities and currency trading, achieving extraordinary returns.

8. Richard Dennis

Early Life

Richard Dennis, born in 1949 in Chicago, Illinois, began his trading journey in his early twenties with a loan from his family. This early start laid the groundwork for his future success in the financial markets, eventually leading him to become one of the richest Forex traders globally.

Career and Achievements

Dennis is famous for the Turtle Trading experiment, where he proved that trading could be taught. He amassed a significant fortune through his trading strategies.

Notable Trades

- 1970s-1980s: Known for his success in futures trading and his role in the Turtle Trading experiment.

9. Ed Seykota

Early Life

Ed Seykota, born in 1946 in the Netherlands, later relocated to the United States, where he pursued studies at the Massachusetts Institute of Technology (MIT). This international upbringing and academic background contributed to his diverse perspective and laid the foundation for his remarkable career as one of the richest Forex traders in the world.

Career and Achievements

Seykota is a pioneer in computerized trading systems. His use of algorithms and technical analysis revolutionized trading strategies.

Notable Trades

- 1970s-1980s: Achieved exceptional returns using computerized trading systems.

10. Joe Lewis

Early Life

Joe Lewis, born in 1937 in London, England, initially embarked on a career in his family’s catering business. However, he later transitioned into currency trading, demonstrating his entrepreneurial spirit and adaptability. This career shift ultimately paved the way for his success as one of the richest Forex traders globally.

Career and Achievements

Lewis is a reclusive billionaire who made his fortune through currency trading. He collaborated with George Soros on significant trades.

Notable Trades

- 1992: Profited from shorting the British pound alongside George Soros during Black Wednesday.

How Much Do Leading Forex Traders Earn?

Factors Influencing Earnings

Top Forex traders have the potential to earn staggering amounts of money, with some accumulating billions of dollars in net worth. However, the exact earnings vary significantly and are influenced by numerous factors such as the trader’s strategies, risk tolerance, prevailing market conditions, and the scale of capital they manage. This variability underscores the dynamic nature of Forex trading and the diverse approaches employed by the richest Forex traders in the world.

Examples of Earnings

- George Soros: Made $1 billion in a single trade.

- Paul Tudor Jones: Achieved consistent high returns, contributing to his $5.3 billion net worth.

- Stanley Druckenmiller: Maintained an average annual return of 30% over 30 years.

Forex traders often manage significant amounts of capital, allowing them to leverage their positions and maximize profits. This high level of capital, combined with their sophisticated trading strategies, enables them to generate substantial earnings.

Read More: Market Makers in Forex Market

Key Skills for Successful Forex Trading

1. Risk Management

Effective risk management is paramount in Forex trading. Successful traders prioritize protecting their capital by implementing strategies such as setting stop-loss orders and carefully managing their risk-to-reward ratio. By doing so, they minimize potential losses and ensure longevity in the trading arena, enabling them to sustain their success over the long term.

2. Discipline

Maintaining discipline in executing trades according to a well-thought-out plan is essential. Emotional decisions often lead to significant losses. Traders like Bill Lipschutz emphasize the importance of sticking to a trading plan and avoiding impulsive actions.

3. Market Knowledge

A deep understanding of market dynamics, including economic indicators and geopolitical events, is vital for making informed trading decisions. Traders like Stanley Druckenmiller invest considerable time in studying market trends and economic factors.

4. Adaptability

The ability to adapt to changing market conditions is a key trait of successful traders. Flexibility in strategy can lead to sustained profitability. Paul Tudor Jones is known for his ability to adjust his strategies based on market developments.

5. Use of Technology

Leveraging advanced trading platforms and data analysis tools can significantly enhance trading performance. Automated trading systems are also widely used for efficiency. Ed Seykota, one of the first to use computer algorithms, exemplifies the importance of technology in modern trading.

Enhancing Your Forex Trading Performance

1. Educate Yourself Continuously

Continuous learning is indispensable in the constantly evolving landscape of Forex trading. It is imperative to stay abreast of the latest market trends, immerse oneself in trading literature, and enroll in courses to expand one’s knowledge base. By embracing new strategies and comprehending market dynamics, traders can gain a competitive advantage and adapt effectively to the ever-changing Forex environment. This commitment to ongoing education is a hallmark of successful traders and a key factor in achieving long-term profitability.

2. Develop a Trading Plan

Create a comprehensive trading plan that outlines your strategy, risk management rules, and goals. Stick to this plan to avoid emotional trading decisions. A well-defined plan provides structure and helps maintain discipline.

3. Practice Patience and Persistence

Success in Forex trading doesn’t happen overnight. Be patient, learn from your mistakes, and remain persistent in your efforts. Michael Marcus’ story of turning $30,000 into $80 million over years illustrates the importance of persistence.

4. Analyze Your Trades

Regularly review your trades to understand what works and what doesn’t. This analysis will help you refine your strategies and improve your performance. Keeping a trading journal can be an effective way to track progress and identify areas for improvement.

5. Stay Informed

Keep yourself informed about global economic events and their potential impact on the Forex market. This knowledge will help you make more informed trading decisions. Subscribing to financial news sources and participating in trading forums can keep you updated.

Biggest Lessons from Top Traders to New Traders

1. Prioritize Risk Management

Drawing from the wisdom of George Soros, it’s crucial to prioritize protection against substantial losses in Forex trading. Risk management serves as the foundation for sustained success in the long term. By implementing robust strategies aimed at minimizing potential losses and safeguarding capital, traders can navigate the volatile Forex market with greater resilience and confidence. This proactive approach to risk management not only preserves capital but also lays the groundwork for consistent profitability and longevity in trading endeavors.

2. Maintain Discipline

Following Bill Lipschutz’s example, stick to your trading plan and avoid emotional decisions to ensure consistency and profitability. Discipline in trading actions prevents costly mistakes.

3. Understand Market Dynamics

Like Stanley Druckenmiller, invest time in understanding economic indicators and market trends to make informed trading decisions. A thorough knowledge of market forces allows for strategic positioning.

4. Leverage Technology

Emulate Ed Seykota by using advanced trading platforms and data analysis tools to enhance your trading strategies. Technology can provide an edge through automated trading and real-time data analysis.

5. Be Patient and Persistent

Inspired by Michael Marcus, remember that trading success takes time. Be patient, learn from your experiences, and continuously improve your skills. Persistent effort and resilience are crucial in overcoming challenges.

6. Adapt to Market Changes

Following Paul Tudor Jones’ lead, be flexible and ready to adjust your strategies based on market developments and trends. Adaptability ensures that you remain profitable in different market conditions.

Conclusion

Comprehending the approaches of the wealthiest Forex traders, along with their strategies and paths to success, offers invaluable insights and motivation for aspiring traders. Among them, George Soros shines as the foremost figure, renowned for his exceptional achievements and strategic acumen. His emphasis on macroeconomic analysis, stringent risk management, and adaptability imparts critical lessons for those aspiring to excel in Forex trading. By studying the methodologies of top traders and persistently refining their own skills, individuals can elevate their performance and realize their financial aspirations in the dynamic realm of Forex trading.

Who is the richest Forex trader in the world?

George Soros is considered the richest Forex trader, with an estimated net worth of $8.6 billion. He is famous for his profitable trade shorting the British pound in 1992.

How did George Soros achieve his wealth in Forex trading?

Soros made his fortune through strategic trades and macroeconomic analysis. His most notable achievement was earning $1 billion in a single day by shorting the British pound in 1992.

What are the essential skills for successful Forex trading?

Key skills include effective risk management, maintaining discipline, understanding market dynamics, adaptability, and leveraging technology for informed trading decisions.

Can Forex trading be learned?

Yes, Forex trading can be taught. Richard Dennis’s Turtle Trading experiment demonstrated that novices could become proficient traders through proper training and strategy implementation.

How does technology impact modern Forex trading?

Technology plays a critical role in modern Forex trading, with traders using advanced platforms, data analysis tools, and automated trading systems to enhance their strategies and efficiency.

Why is risk management important in Forex trading?

Risk management is crucial to protect against significant losses and ensure long-term profitability. It involves setting stop-loss orders and managing the risk-to-reward ratio effectively.