Forex trading is a dynamic market that operates 24 hours a day, five days a week. Traders often need to hold positions overnight, leading to various costs and charges. One such charge is the Forex swap. This comprehensive guide will explore what a Forex swap is, its implications for traders, and how to manage these costs effectively. Partnering with a trusted online forex broker can also play a crucial role in navigating these charges efficiently.

What is a Forex Swap?

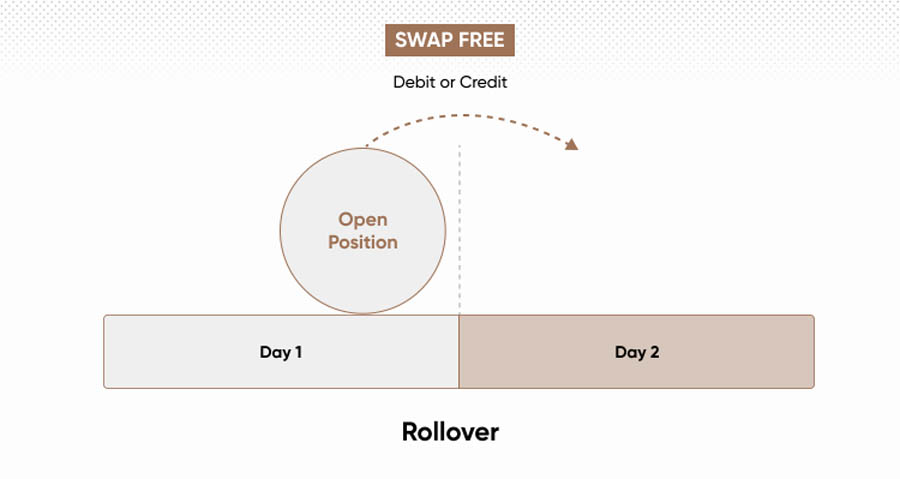

A Forex swap, also known as a rollover interest or overnight fee, is a crucial concept for anyone involved in Forex trading. It represents the cost of holding a trading position overnight, either as an interest paid or received by the trader. Understanding how Forex swaps work can significantly influence trading strategies and profitability.

Definition and Calculation

A Forex swap is essentially the cost associated with borrowing one currency to buy another in a Forex transaction. When you open a Forex trade, you are simultaneously buying one currency and selling another. Each currency in the pair has its own interest rate set by its central bank, and the difference between these interest rates determines the swap rate.

For instance, if you are trading the EUR/USD pair, the interest rates set by the European Central Bank (ECB) for the Euro (EUR) and the Federal Reserve for the US Dollar (USD) will influence the swap rate. If the interest rate for the Euro is higher than that for the US Dollar, and you are long on EUR/USD (buying EUR), you might receive a swap payment. Conversely, if you are short on EUR/USD (selling EUR), you might have to pay a swap fee.

Example: Imagine you buy EUR/USD, and the interest rate for the Euro is 0.5% while the interest rate for the US Dollar is 0.25%. The swap rate could be positive, meaning you would earn a small interest payment for holding this position overnight. Conversely, if the Euro’s interest rate were lower than the US Dollar’s, you would pay the difference.

Read More: What Is the Spread in Forex and How do you Calculate It ?

Daily Accrual

Forex swaps are accrued daily and are automatically deducted from or credited to your trading account. This accrual happens at the end of the trading day, typically around 5 PM New York time, which is considered the rollover time in Forex markets. Positions held past this time are subject to swap rates.

Positive vs. Negative Swaps

- Positive Swap: Occurs when the interest rate of the currency you are buying is higher than the interest rate of the currency you are selling. This results in an interest payment to your account.

- Negative Swap: Occurs when the interest rate of the currency you are buying is lower than the interest rate of the currency you are selling. This results in an interest charge to your account.

Example: If you are long on AUD/JPY and the interest rate for the Australian Dollar (AUD) is 1.5% while that for the Japanese Yen (JPY) is 0.1%, you might receive a positive swap. If you are short on the same pair, you might incur a negative swap.

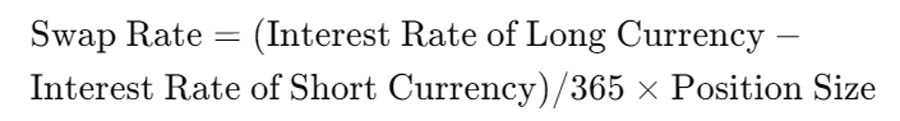

Swap Calculation Formula

While brokers often provide the swap rates directly, understanding the basic calculation can be insightful. The formula to calculate the swap rate usually involves:

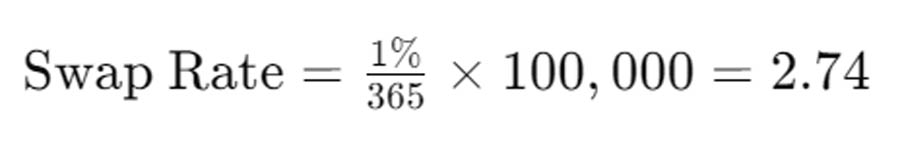

For example, if you hold a position size of 100,000 units in a pair where the interest rate differential is 1%, the daily swap rate would be:

This means you would receive $2.74 per day if it’s a positive swap, or pay $2.74 if it’s a negative swap.

Importance in Trading

Understanding Forex swaps is essential for traders who hold positions overnight. Swaps can significantly impact the overall cost or profitability of a trade. For short-term traders or scalpers who close their positions before the rollover time, swaps may not be a significant concern. However, for swing traders and long-term investors, swaps can accumulate and affect the net returns from their trades.

Key Points:

- Definition: Interest charged or received for holding a Forex position overnight.

- Calculation: Based on the interest rate differential between the two currencies in the pair.

- Daily Accrual: Automatically deducted from or credited to your trading account.

- Positive vs. Negative Swaps: Dependent on the relative interest rates of the currencies involved.

- Importance: Affects the cost and profitability of holding positions overnight.

By comprehensively understanding what a Forex swap is and how it impacts your trades, you can make more informed decisions and better manage your trading costs. This knowledge is particularly crucial for those involved in overnight or longer-term trading, as it directly influences the overall profitability of your trading strategy.

Read More: What are Pips and Pipettes? Overview and Calculation

Understanding Long vs. Short Swaps

Forex swaps can be categorized into long swaps and short swaps, depending on the position you hold.

Long Swap

A long swap involves paying interest when holding a currency with a higher interest rate. This scenario occurs when you buy a currency pair and hold it overnight, and the bought currency has a higher interest rate than the sold currency.

Example: If you buy AUD/JPY and the interest rate for the Australian Dollar (AUD) is higher than the interest rate for the Japanese Yen (JPY), you will need to pay a swap rate for holding this position overnight.

Short Swap

A short swap involves receiving interest when holding a currency with a higher interest rate than the funding currency. This scenario occurs when you sell a currency pair and hold it overnight, and the sold currency has a higher interest rate than the bought currency.

Example: If you sell EUR/USD and the interest rate for the US Dollar (USD) is higher than the interest rate for the Euro (EUR), you will receive a swap rate for holding this position overnight.

Funding Currency

The funding currency is the currency used to margin your trade, often your base currency. The interest rate differential between the funding currency and the currency being traded determines the swap rates.

Key Points:

- Long Swap: Interest paid when holding a currency with a higher interest rate.

- Short Swap: Interest received when holding a currency with a higher interest rate than the funding currency.

- Funding Currency: Currency used to margin your trade.

Impact of Swaps on Trading

Forex swaps can have a significant impact on your trading, especially if you hold positions overnight or for extended periods. Understanding the implications of swaps is crucial for managing your trading costs and maximizing profitability. Here’s an in-depth look at how swaps affect various aspects of Forex trading.

Increased Costs for Holding Positions Overnight

One of the most direct impacts of swaps is the increased cost associated with holding positions overnight. Swaps are essentially interest charges that accumulate each day you keep a position open past the rollover time, typically around 5 PM New York time.

Example: If you hold a long position in EUR/USD and the swap rate is negative, you will incur a cost each night you hold the position. Over a month, these costs can add up, reducing your overall profitability.

Impact on Swing and Long-Term Traders

For swing traders and long-term investors, swap rates can significantly affect the bottom line. These traders often hold positions for days, weeks, or even months, making them more susceptible to the cumulative effect of swap charges.

- Swing Traders: Need to consider swap costs as part of their overall strategy. Holding a position for several days with a negative swap can erode potential profits.

- Long-Term Investors: For those holding positions for months, swaps can become a major expense. It’s crucial to calculate the expected swap costs before entering a trade to ensure that the potential profits outweigh these costs.

Less Relevant for Short-Term Scalpers

Short-term scalpers, who typically open and close trades within minutes or hours, are less affected by swaps. Since they close their positions before the end of the trading day, they do not incur overnight swap charges. For these traders, other factors like spreads and commission fees are more critical.

Influence on Trade Decisions

Swaps can influence your decision to hold or close a position. If you anticipate high swap costs, you might choose to close a position earlier than planned, even if the market conditions are favorable. Conversely, a positive swap might encourage you to hold a position longer.

Example: A trader holding a long position in AUD/JPY might decide to keep the position open longer because the positive swap provides additional profit. On the other hand, if the swap were negative, the trader might close the position sooner to avoid accumulating costs.

Considerations for High Swap Periods

Certain periods, such as weekends and holidays, can amplify the impact of swaps. For instance, the 3-day swap (triple rollover) that occurs when positions are held over Wednesday night into Thursday accounts for the weekend. This can lead to higher costs or earnings, depending on the swap rate.

Example: If you hold a position open past the rollover time on Wednesday, you will incur a swap charge for three days instead of one. This can significantly increase your holding costs if the swap is negative, or your earnings if the swap is positive.

Hedging Strategies

Some traders use hedging strategies to mitigate the impact of swap rates. By holding positions in currency pairs with favorable swap rates, traders can offset the costs of other positions with negative swaps. This requires careful planning and analysis to ensure that the hedging strategy is effective.

Example: A trader might hold a long position in a currency pair with a positive swap while simultaneously holding a short position in another pair with a negative swap. The positive swap can help offset the costs of the negative swap, balancing the overall expenses.

Key Points:

- Increased Costs: Holding positions overnight incurs additional swap costs.

- Swing and Long-Term Traders: Must factor swap costs into their strategies due to the cumulative effect over time.

- Short-Term Scalpers: Less impacted by swaps since they close positions before the rollover time.

- Trade Decisions: Swaps can influence whether to hold or close a position based on the cost or profit they generate.

- High Swap Periods: Times like weekends and holidays can amplify swap impacts due to the 3-day swap.

- Hedging Strategies: Using positions with favorable swaps to offset those with negative swaps can help manage costs.

Read More: Margin in Forex: A Comprehensive Guide

Practical Tips for Managing Swap Impact

- Monitor Swap Rates: Regularly check the swap rates provided by your broker. These rates can change based on market conditions and central bank policies.

- Trade During Favorable Times: Avoid holding positions during high-swap periods unless the potential gains justify the costs.

- Use Swap-Free Accounts: Consider using swap-free accounts if you are unable to manage or avoid swap charges effectively.

- Strategic Trade Planning: Incorporate swap considerations into your overall trading strategy, particularly for long-term positions.

Managing Swap Costs

Managing swap costs is crucial for maintaining profitability in Forex trading. Here are some strategies to consider:

Closing Positions Before Rollover Time

One way to avoid swap charges is to close positions before the swap rollover time, typically around 5 PM New York time. By doing so, you can avoid the interest charges associated with holding positions overnight.

Utilizing Swap-Free Accounts

Some brokers offer swap-free accounts, also known as Islamic accounts, which do not incur swap charges. These accounts are designed for traders who cannot earn or pay interest due to religious reasons. However, they may come with other restrictions or fees.

Example: A trader using a swap-free account might not pay overnight interest charges, but the broker could impose higher spreads or other administrative fees to compensate.

Careful Trade Evaluation

When evaluating potential trades, carefully consider the swap costs. This consideration is particularly important for trades that may be held overnight or longer, as the cumulative effect of swap charges can impact overall profitability.

Key Points:

- Closing Positions: Avoid swaps by closing positions before rollover time.

- Swap-Free Accounts: Available for traders who cannot pay or receive interest.

- Careful Trade Evaluation: Consider swap costs when planning trades.

What is a 3-Day Swap?

A 3-day swap, or triple rollover charge, occurs when a Forex position is held open over Wednesday night into Thursday. This charge is applied to account for the weekend settlement, as no interest is charged over the weekend. As a result, interest for three days is charged or credited instead of one.

Key Points:

- Definition: Occurs when a Forex position is held open over Wednesday night into Thursday.

- Triple Rollover Charge: Interest charged for three days due to weekend settlement.

- Applicability: Applies to all positions open past the swap rollover time on Wednesday.

Impact of 3-Day Swap

The 3-day swap significantly increases the holding costs for positions carried over the weekend. Traders need to be aware of this charge and factor it into their trading strategies, particularly if they plan to hold positions over the weekend.

Key Points:

- Increased Holding Costs: Triple rollover charge for positions held over the weekend.

- Weekend Consideration: Important for traders planning to hold positions over the weekend.

Conclusion

Understanding Forex swaps is crucial for effective trading, particularly for those holding positions overnight or longer. By managing swap costs and factoring them into your trading strategies, you can maintain profitability and make informed decisions. Remember to consider both long and short swaps, the impact of 3-day swaps, and utilize strategies to manage swap costs effectively.

This comprehensive guide has provided an in-depth look at Forex swaps, their impact on trading, and ways to manage these costs. By incorporating this knowledge into your trading approach, you can navigate the Forex market more effectively and achieve your trading objectives.

Reference: +

How do swap rates affect my trading strategy?

Swap rates can impact your overall trading strategy, especially if you hold positions overnight or for extended periods. Positive swap rates can add to your profits, while negative swap rates can erode them. It’s essential to consider swap rates when planning your trades and choose currency pairs that align with your trading goals and holding periods.

Example: If you are a long-term trader holding a position in a pair with a negative swap rate, you might find your profits significantly reduced by the accumulated swap charges over time.

Can I avoid swap charges altogether?

While it is challenging to avoid swap charges completely, you can minimize them by:

Closing positions before the swap rollover time.

Using swap-free accounts offered by some brokers.

Choosing currency pairs with favorable swap rates.

Example: A trader might opt for swap-free accounts or carefully plan trade entry and exit points to minimize the impact of swap charges.