Diversification is a crucial concept in financial markets, particularly in the volatile world of forex trading. It involves spreading investments across various assets to reduce exposure to any single risk. This article explores the benefits of diversification in forex trading, different approaches to achieve a diversified forex portfolio, and additional considerations, such as selecting a regulated forex broker, to enhance diversification strategies.

Benefits of Diversification in Forex Trading

Diversification in forex trading offers a multitude of benefits, making it an essential strategy for both novice and experienced traders. By spreading investments across different assets, traders can mitigate risks and enhance the stability of their portfolios. This section delves deeper into the specific advantages of diversification.

Reducing Portfolio Risk

One of the primary benefits of diversification is the reduction of portfolio risk. Forex markets are inherently volatile, with currency prices influenced by a myriad of factors including economic data, geopolitical events, and market sentiment. By diversifying investments across multiple currency pairs, traders can reduce the impact of any single adverse event on their overall portfolio.

Protection Against Unexpected Economic Events in Forex Trading

The forex market’s vulnerability to unforeseen economic events underscores the importance of diversification. Here’s how it enhances portfolio stability and mitigates risks:

Mitigating Economic Event Risks:

- Event Sensitivity: Factors like interest rate changes, political turmoil, and natural disasters can significantly impact forex markets.

- Diversification Benefit: Spread investments across different currencies to minimize losses from events affecting specific pairs.

Enhancing Portfolio Stability:

- Mix of Risk Profiles: Include currencies with diverse economic drivers to stabilize portfolio performance.

- Consistent Returns: Reduce extreme value fluctuations and achieve steadier returns.

Statistical Evidence of Risk Reduction:

- Empirical Studies: Research confirms lower portfolio volatility with diversified, uncorrelated currency pairs.

- Lower Volatility: Smoother investment journey with reduced risk and more predictable performance.

Diversification in forex trading offers resilience against economic shocks, stabilizes portfolios, and supports consistent performance through risk mitigation strategies.

Read More: High Reward Low Risk Forex Trading Strategies

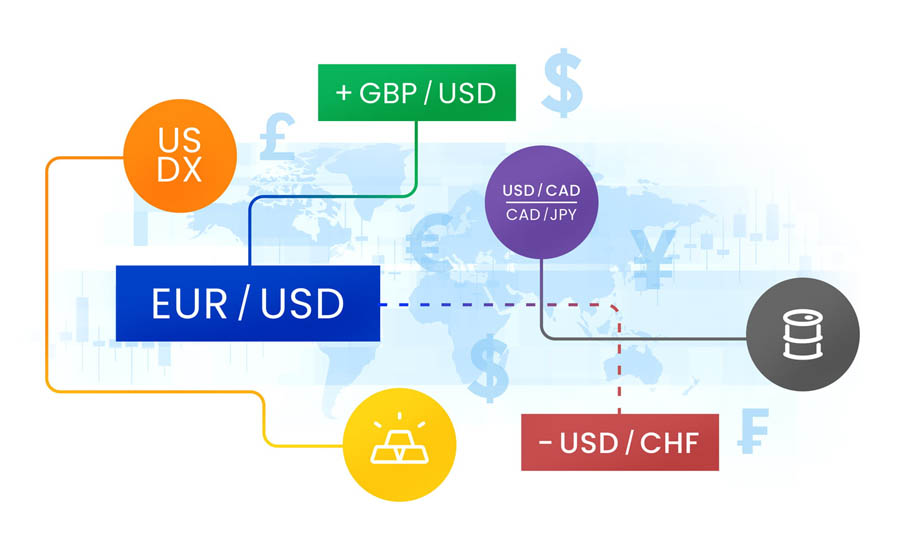

Diversification and Correlation

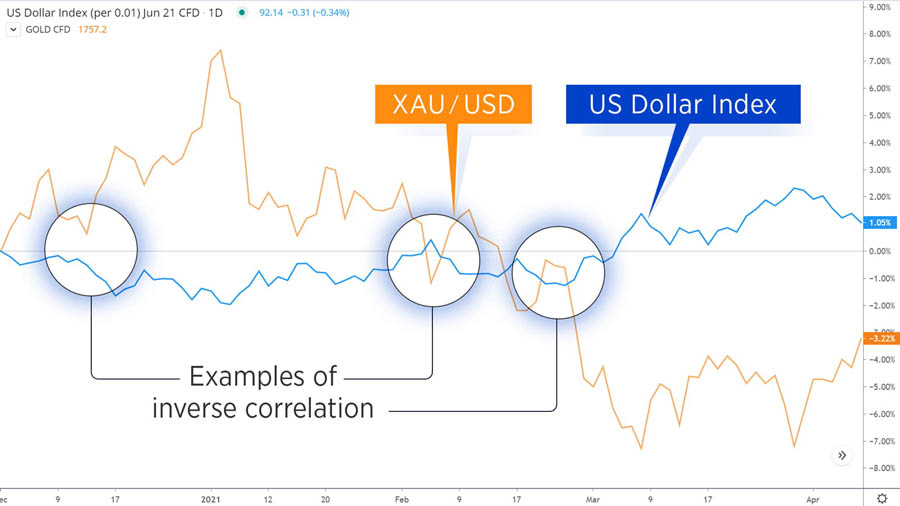

Understanding correlation is vital for effective diversification. Correlation measures the degree to which two currency pairs move in relation to each other. By selecting pairs with low or negative correlations, traders can enhance their diversification strategy and further reduce portfolio risk.

Long-Term Benefits of Diversification

Diversification in forex trading offers significant long-term advantages, contributing to sustainable growth and capital protection. Here’s how:

Risk Reduction and Capital Protection:

- Mitigating Short-Term Volatility: Diversification spreads risk across multiple currency pairs and assets.

- Resilience in Economic Uncertainty: During volatile periods, diversified portfolios are less susceptible to significant impact on overall performance.

Stability and Consistent Growth:

- Long-Term Stability: Diverse investments stabilize portfolio performance over time.

- Consistent Growth: Reduced drawdowns and enhanced stability support consistent growth in diverse market conditions.

Strategic Advantages:

- Leveraging Statistical Evidence: Statistical benefits of diversification include improved risk-adjusted returns.

- Understanding Correlation: Awareness of correlation among currency pairs enhances risk management and portfolio optimization.

Adapting to Market Complexity:

- Navigating Market Complexity: Diversification is foundational for managing forex market intricacies effectively.

- Achieving Sustainable Success: Beyond a strategy, diversification fosters resilience and sustainable success in forex trading.

Approaches to Forex Portfolio Diversification

Forex portfolio diversification involves spreading investments across various currency pairs, trading strategies, timeframes, and even different asset classes to reduce risk and enhance returns. This section explores several key approaches to achieve effective diversification in forex trading.

Currency Pair Diversification

Currency pair diversification is a fundamental strategy for mitigating risk and enhancing portfolio stability in forex trading. By investing in a range of currency pairs with different risk profiles and correlations, traders can protect their investments from volatility and unforeseen economic events. This section provides a detailed exploration of currency pair diversification, including the importance of spreading investments, understanding correlations, and practical strategies for selecting uncorrelated pairs.

Importance of Spreading Investments Across Currency Pairs

Mitigating Country-Specific Risks

Investing in a single currency pair exposes traders to the economic conditions, political stability, and monetary policies of the countries involved. By diversifying across multiple currency pairs, traders can mitigate the impact of country-specific risks and ensure that their portfolio is not overly dependent on the performance of one or two economies.

Understanding Correlation in Currency Pairs

The Concept of Correlation

Correlation measures the degree to which two currency pairs move in relation to each other. A positive correlation means that the pairs tend to move in the same direction, while a negative correlation indicates that they move in opposite directions. Understanding these relationships is crucial for effective diversification, as highly correlated pairs do not provide significant risk reduction.

Correlation Coefficients

Correlation coefficients range from +1 to -1. A coefficient of +1 indicates a perfect positive correlation, meaning the currency pairs move in the same direction, while -1 indicates a perfect negative correlation, meaning they move in opposite directions. A coefficient close to 0 suggests no significant correlation.

Practical Application of Correlation Analysis

Traders can use tools like correlation matrices to analyze the relationships between different currency pairs and make informed decisions about diversification.

Selecting Uncorrelated Currency Pairs

Identifying Uncorrelated or Negatively Correlated Pairs

To maximize the benefits of diversification, traders should look for currency pairs with low or negative correlations. This can help reduce overall portfolio risk and smooth out returns.

Tools and Resources for Correlation Analysis

Utilizing Online Tools and Platforms

Numerous online tools and trading platforms offer correlation analysis features that can help traders identify suitable pairs for diversification. These tools provide real-time data and historical correlation statistics, making it easier to make informed decisions.

Read More: How to Make Consistent Profits in Forex Trading

Integrating Correlation Analysis into Trading Strategy

Regular Review and Adjustment

To maintain effective diversification, traders should regularly review their portfolios and adjust their positions based on changing correlations. Market conditions and economic relationships between currencies can evolve, affecting correlation patterns.

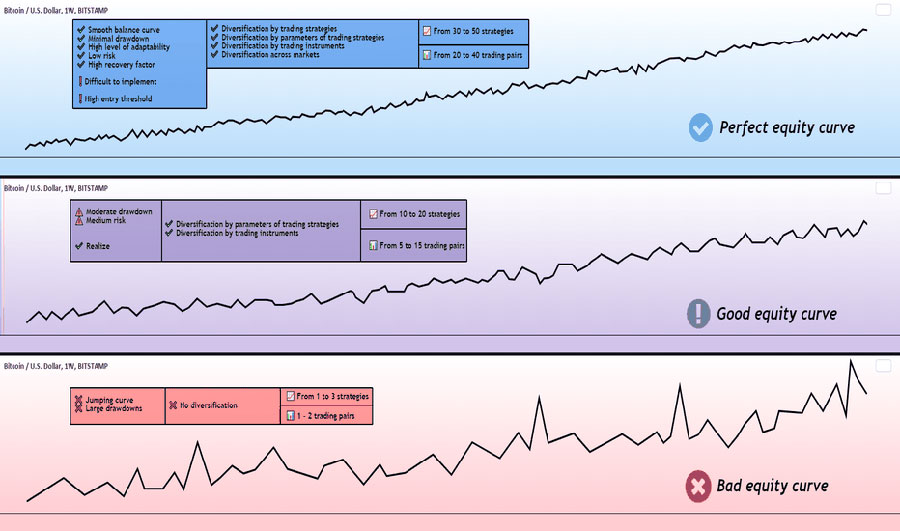

Trading Strategy Diversification

Trading strategy diversification is an essential component of a robust forex portfolio. By incorporating various trading strategies, traders can better navigate different market conditions, reduce risk, and enhance overall returns. This section delves into the importance of trading strategy diversification, explores different types of strategies for integrating multiple approaches into a forex portfolio.

Incorporating Various Strategies

Importance of Strategy Diversification

Different trading strategies perform well under different market conditions. By diversifying strategies, traders can achieve a more balanced performance and reduce the likelihood of significant losses during unfavorable market phases. This approach helps traders capitalize on a broader range of opportunities and mitigates the impact of market volatility.

Combining Strategies for Effective Diversification

Blending Different Approaches

By combining various trading strategies, traders can balance the strengths and weaknesses of each approach, resulting in a more resilient and adaptable portfolio. This blending allows traders to take advantage of diverse market conditions and reduce overall portfolio risk.

Detailed Strategy Implementation

Trend Following with Scalping

A trader identifies a strong uptrend in the USD/JPY pair and opens a long position for trend following. Simultaneously, they use scalping to capitalize on short-term price fluctuations within the trend. The trend-following position captures long-term gains, while scalping adds incremental profits and helps manage risk during minor retracements.

Carry Trade with Scalping

A trader holds a long-term carry trade position in AUD/JPY, benefiting from the interest rate differential. To enhance returns, they engage in scalping on intraday price movements in the same pair. This combination leverages the steady income from carry trade and the frequent profit opportunities from scalping.

Timeframe Diversification

Timeframe diversification is a key strategy in forex trading that involves spreading investments across different time horizons. This section explores the concept of timeframe diversification, the benefits it offers, and how traders can implement it in their trading strategies.

The Concept of Timeframe Diversification

Definition and Importance

Timeframe diversification involves trading on different timeframes, such as short-term, medium-term, and long-term horizons. Each timeframe offers unique opportunities and risks, and by diversifying across these.

Benefits of Timeframe Diversification

Capturing Various Market Movements

Different timeframes capture different aspects of market behavior. Short-term timeframes highlight immediate price action, while long-term timeframes reveal broader market trends. By diversifying across timeframes, traders can capitalize on a wider range of market movements.

Reducing Exposure to Short-Term Volatility

Short-term trading can be highly volatile, with prices subject to rapid and unpredictable changes. By incorporating longer-term trades, traders can reduce the impact of short-term volatility on their overall portfolio.

Tools and Resources for Timeframe Diversification

Utilizing Technical Analysis Tools

Various technical analysis tools can assist traders in implementing timeframe diversification effectively. Moving averages, trend lines, and support/resistance levels are commonly used across different timeframes to identify trading opportunities.

Leveraging Trading Platforms

Modern trading platforms offer features that support multi-timeframe analysis. Platforms like MetaTrader 4 and 5, TradingView, and others provide tools for viewing and analyzing multiple timeframes simultaneously.

Integrating Timeframe Diversification into Trading Strategy

Developing a Comprehensive Trading Plan

To effectively implement timeframe diversification, traders should develop a comprehensive trading plan that outlines their objectives, risk tolerance, and strategies for different timeframes. This plan should include criteria for entering and exiting trades, position sizing, and risk management techniques.

Asset Class Diversification in Forex Trading

Asset class diversification is a strategic approach that involves spreading investments across different types of assets beyond traditional forex pairs. This section explores the concept of asset class diversification, its benefits in forex trading, and strategies for integrating various asset classes to enhance overall portfolio stability and performance.

Understanding Asset Class Diversification

Definition and Importance

Asset class diversification in forex trading extends beyond currency pairs to include other financial instruments such as stocks, bonds, commodities, and even cryptocurrencies. This strategy aims to reduce overall portfolio risk by investing in assets that do not move in sync with each other, thus mitigating the impact of adverse market conditions on the entire portfolio.

Benefits of Asset Class Diversification

Risk Reduction and Portfolio Stability

Investing across different asset classes with low correlations can smooth out portfolio returns and reduce volatility. When one asset class underperforms, others may perform better, balancing overall portfolio risk.

Enhanced Opportunity for Returns

Diversifying into multiple asset classes increases the likelihood of capturing profitable opportunities across different sectors and markets. This approach allows traders to benefit from varying market conditions and economic cycles.

Strategies for Implementing Asset Class Diversification

Risk Management Integration

Description and Benefits

Effective risk management practices, such as setting stop-loss orders and diversifying asset classes, are crucial for protecting capital and optimizing portfolio performance. These strategies help traders mitigate downside risk while maximizing potential returns.

Correlation Analysis

Description and Benefits

Analyzing correlations between asset classes helps traders identify diversification opportunities and avoid overconcentration in correlated assets. Understanding these relationships is essential for constructing a well-balanced and resilient portfolio.

Building a Diversified Forex Portfolio

Building a diversified forex portfolio is essential for managing risk, optimizing returns, and achieving long-term success in the dynamic forex market. This section explores strategies and considerations for constructing a diversified forex portfolio, including asset allocation, risk management techniques, and guide traders in building a robust and resilient investment portfolio.

Understanding Diversification in Forex Trading

Definition and Benefits

Diversification in forex trading involves spreading investments across different currency pairs and possibly other asset classes to reduce overall portfolio risk. By diversifying, traders can mitigate the impact of adverse market movements on their investments and capitalize on a broader range of opportunities.

Strategies for Building a Diversified Forex Portfolio

Asset Allocation Approach

Description and Benefits

Asset allocation involves determining the proportion of capital allocated to different currency pairs based on risk tolerance, investment goals, and market outlook. A balanced allocation strategy aims to optimize risk-adjusted returns while maintaining portfolio stability.

Strengths

- Risk Mitigation: Diversifying across currency pairs reduces dependency on a single market or economic event.

- Enhanced Opportunity: Exposure to multiple currency pairs allows traders to capitalize on diverse market conditions and economic trends.

Weaknesses

- Over-Diversification: Excessive diversification can dilute potential returns and complicate portfolio management.

- Currency-Specific Risks: Unexpected political or economic developments in specific countries can impact currency performance.

Risk Management Integration

Description and Benefits

Effective risk management is integral to building a diversified forex portfolio. Strategies such as setting stop-loss orders, position sizing, and portfolio rebalancing help traders protect capital, optimize returns, and navigate market volatility.

Correlation Analysis

Description and Benefits

Analyzing correlations between currency pairs helps traders identify and mitigate overconcentration risks. Understanding how currency pairs move in relation to each other allows for strategic diversification to minimize portfolio volatility.

Read More: Top Forex Trading Books for Professionals

Additional Considerations for Diversification in Forex Trading

Building a diversified forex portfolio involves several crucial factors to align with financial goals and risk tolerance. Here are key considerations:

Account Size and Risk Tolerance:

Influence on Diversification Strategy:

- Account size and risk tolerance shape the complexity and extent of diversification.

- Larger accounts allow for more sophisticated strategies, while smaller accounts benefit from simpler approaches.

Balancing Risk and Reward:

- Risk tolerance determines the level of volatility and potential loss a trader can accept.

- Diversification decisions should balance higher return potential with capital protection.

Simplicity in Initial Diversification:

- Start Simple and Gradually Expand:

- New traders should begin with basic diversification to avoid complexity.

- Focus on a few key currency pairs initially and expand gradually with growing confidence.

Gradual Portfolio Expansion:

- As experience and account size increase, add more currency pairs and asset classes.

- Incremental expansion supports better risk management and adapts to market conditions.

Staying Informed and Adapting:

Importance of Market Monitoring:

- Continuously monitor market conditions and economic news.

- Stay informed to adjust portfolios in response to market dynamics and emerging risks.

Adapting to Market Changes:

- Markets are dynamic; flexibility is essential for a successful diversification strategy.

- Adjust portfolios based on performance reviews and evolving risk tolerance.

Reviewing Portfolio Performance:

Regular Performance Reviews:

- Assess portfolio performance to identify strengths and weaknesses.

- Evaluate the impact of different currency pairs and asset classes on overall returns and risk.

Conclusion

Diversification is a vital strategy for forex traders, offering numerous benefits such as reduced portfolio risk, protection against unexpected economic events, and enhanced performance through various market conditions. By employing currency pair diversification, trading strategy diversification, timeframe diversification, and asset class diversification, traders can build a robust and resilient forex portfolio. Integrating strong risk management practices, understanding correlations, and staying informed are essential for successful diversification. As traders gain experience, they can expand and refine their strategies to achieve optimal results in the dynamic forex market.

How often should I review and rebalance my diversified forex portfolio?

It’s advisable to review and rebalance your forex portfolio at least quarterly or whenever there are significant market changes. Regular reviews help ensure that your portfolio remains aligned with your investment goals and risk tolerance.

Can I use automated trading systems to diversify my forex portfolio?

Yes, automated trading systems can help diversify your forex portfolio by executing multiple strategies simultaneously across various currency pairs. These systems can enhance efficiency and consistency in your trading approach.

What are some common mistakes traders make when diversifying their forex portfolios?

Common mistakes include over-diversification, neglecting to monitor correlations, and failing to adjust strategies based on market conditions. These errors can lead to increased risk and reduced returns.