Forex trading offers significant profit potential, but it also comes with substantial risks. One of the most dangerous pitfalls traders face is greed. This article will explore how to overcome greed in forex trading, detailing practical strategies to maintain control and make rational decisions.

Understanding Greed in Forex Trading

Greed is one of the most potent emotions that can affect a forex trader’s decision-making process. To effectively combat it, traders must first understand its nature, how it manifests, and the significant impact it can have on trading outcomes.

Defining Greed in Forex Trading

In the context of forex trading, greed is characterized by an overwhelming desire for excessive profits, often leading to irrational and high-risk trading behaviors. Unlike the controlled pursuit of growth, greed drives traders to chase gains beyond reasonable expectations. This can involve ignoring trading rules, increasing position sizes, and holding onto trades for too long, hoping for bigger profits. Greed is fundamentally rooted in the fear of missing out (FOMO) and the insatiable desire for more.

The Saying “Bulls and Bears Make Money; Hogs Get Slaughtered”

This well-known saying in the trading world highlights the perils of greed. “Bulls” (those who bet on rising markets) and “bears” (those who bet on falling markets) can both make money through disciplined and strategic trading. However, “hogs” (those driven by greed) often face severe losses. The saying underscores the importance of avoiding greed and maintaining a balanced, disciplined approach to trading. Traders who let greed drive their decisions are more likely to take excessive risks, leading to devastating losses.

The Psychological Aspect of Greed

Greed in forex trading is not just about the desire for more money; it is deeply rooted in human psychology. Several psychological factors contribute to greedy behavior in trading:

- Fear of Missing Out (FOMO): Traders often experience FOMO, where they fear missing out on potential profits. This fear can lead to impulsive trading decisions, driven by greed.

- Overconfidence: After a series of successful trades, traders might become overconfident. This overconfidence can fuel greed, leading them to believe they can achieve higher profits without adhering to their trading plan.

- Recency Bias: Traders might give more weight to recent successful trades, ignoring the overall picture. This bias can lead to greedy behavior, as traders expect continued success without considering potential risks.

- Loss Aversion: Greed can also be fueled by a desire to avoid realizing losses. Traders may hold onto losing positions in the hope of a turnaround, driven by the greed for recouping losses.

Recognizing Greed in Trading Behavior

Understanding how greed manifests in trading behavior is crucial for overcoming it. Some common signs of greed in trading include:

Greed can manifest in various ways in trading decisions. Recognizing these behaviors can help traders take steps to mitigate their impact.

- Ignoring Stop-Loss Orders

One of the most common manifestations of greed is ignoring stop-loss orders. Traders might refuse to close a losing position, hoping for a market reversal that will turn the trade into a profit. This behavior can lead to substantial losses as the market continues to move against the position. Implementing and adhering to stop-loss orders is crucial for protecting capital and limiting losses.

- Increasing Position Sizes Beyond Risk Tolerance

Greed can drive traders to increase their position sizes beyond what is prudent for their risk tolerance. This behavior can lead to significant financial losses if the trade moves unfavorably. Proper position sizing is essential for managing risk and avoiding the emotional strain of large losses.

- Overtrading

Overtrading, or taking on more positions than a trader can effectively manage, is another common manifestation of greed. This behavior can increase transaction costs and the likelihood of making poor trading decisions due to the lack of focus and attention to detail. Sticking to a well-defined trading plan and avoiding overtrading is crucial for maintaining discipline and managing risk.

- Chasing Losses

Greed can also lead to chasing losses, where traders continue to enter trades in an attempt to recover previous losses. This behavior often results in even greater losses as traders make impulsive decisions driven by the desire to regain lost capital. Accepting losses as part of trading and avoiding the temptation to chase them is essential for maintaining a rational and disciplined approach.

- Ignoring Profit Targets

Ignoring predefined profit targets is another way greed can impact trading decisions. Traders might hold onto winning positions longer than planned, hoping for additional gains. This can result in missed opportunities to lock in profits and increased risk if the market reverses. Sticking to predefined profit targets helps traders maintain discipline and manage risk effectively.

Read More: Trading Psychology in Forex

Why Greed is Particularly Dangerous in Forex

The forex market is known for its high volatility, leverage opportunities, and round-the-clock trading. While these features offer significant profit potential, they also amplify the risks, making greed particularly dangerous. Understanding the unique characteristics of the forex market and how greed can exacerbate these risks is crucial for any trader aiming to achieve long-term success.

Inherent Volatility of the Forex Market

The forex market is highly volatile due to rapid price fluctuations influenced by economic data, geopolitical events, central bank policies, and market sentiment. While volatility offers profit opportunities, it also increases the risk of substantial losses.

Impact of Greed on Volatility Risks

- Excessive Risk Taking: Greed can drive traders to increase position sizes in volatile markets, hoping for large gains. This approach can lead to significant losses if the market moves against them.

- Misuse of Leverage: Leverage, which magnifies profits and losses, can be misused by greedy traders who exceed their risk tolerance. This can result in margin calls and account liquidation.

Challenges of 24-Hour Trading and Greed

- Overtrading: The continuous nature of forex trading can tempt greedy traders to overtrade, chasing quick profits without proper analysis. This increases transaction costs and impairs decision-making.

- Psychological Pressure: Greed amplifies psychological pressure, leading to impulsive decisions driven by emotions like fear of missing out (FOMO) rather than rational analysis.

Role of Market Sentiment and Economic Data

- Influence on Decision-Making: Market sentiment and economic data significantly impact forex trading. Greedy traders may react impulsively to sentiment changes or trade excessively based on speculative news, risking significant losses.

- Trading on News: While trading on news can be profitable, it carries risks due to unpredictable market reactions. Greedy traders might take large positions before news events, hoping for quick gains but risking substantial losses if the market moves unfavorably.

The Impact of Greed on Trading Decisions

Greed is a powerful emotion that can significantly affect a trader’s decisions in the forex market. Understanding its impact is crucial for developing strategies to manage and mitigate its effects. When left unchecked, greed can cloud judgment, lead to irrational behavior, and result in substantial financial losses. Let’s explore how greed can influence trading decisions and some common examples of greedy trading behavior.

Clouding Judgment and Leading to Irrational Behavior

Greed can distort a trader’s perception of the market, causing them to see opportunities where there are none or to take on excessive risks in the pursuit of higher profits. This emotional state can override logical analysis and lead to impulsive decisions that deviate from a well-defined trading plan.

Overestimating Profits

Greed can cause traders to overestimate potential profits while underestimating the associated risks. This skewed risk-reward perception can lead to taking on trades that do not align with the trader’s strategy or risk tolerance. For example, a trader might enter a high-risk trade with the expectation of a significant profit, ignoring the potential for substantial losses.

Ignoring Market Analysis

When driven by greed, traders might neglect thorough market analysis, opting instead for hasty decisions based on gut feelings or the fear of missing out (FOMO). This can result in poorly timed entries and exits, leading to avoidable losses. Proper market analysis is crucial for identifying valid trading opportunities and minimizing risk, but greed can cause traders to bypass this essential step.

Read More:How to Overcome Fear in Forex Trading

Disregarding Risk Management

Effective risk management is a cornerstone of successful trading. However, greed can lead traders to disregard their risk management rules, such as ignoring stop-loss orders or exceeding their predetermined position sizes. This can expose traders to significant losses that could have been avoided with disciplined risk management practices.

The Psychological Cycle of Greed

Greed can create a psychological cycle that perpetuates irrational behavior and poor trading decisions. This cycle often starts with a few successful trades, leading to overconfidence and the desire for even greater profits. As traders take on more risk, they may experience significant losses, triggering a sense of desperation and the need to recover those losses. This desperation can further fuel greedy behavior, resulting in a downward spiral of poor decision-making and mounting losses.

Breaking the Cycle

Breaking the psychological cycle of greed requires self-awareness and a commitment to disciplined trading practices. Traders can take several steps to break this cycle:

- Set Realistic Expectations: Establishing realistic profit targets and acknowledging the inherent risks of trading can help manage expectations and reduce the influence of greed.

- Develop a Solid Trading Plan: A well-defined trading plan with clear entry and exit points, risk management rules, and profit targets can provide a roadmap for making rational decisions.

- Practice Emotional Awareness: Recognizing the emotional triggers that drive greedy behavior, such as overconfidence and the fear of missing out, can help traders manage their emotions and make more disciplined decisions.

- Maintain a Trading Journal: Keeping a trading journal to document trades, decisions, and emotions can provide valuable insights into patterns of behavior and areas for improvement.

- Engage in Mindfulness Practices: Mindfulness practices, such as meditation and deep breathing exercises, can help traders stay calm and focused, reducing the impact of emotions on their trading decisions.

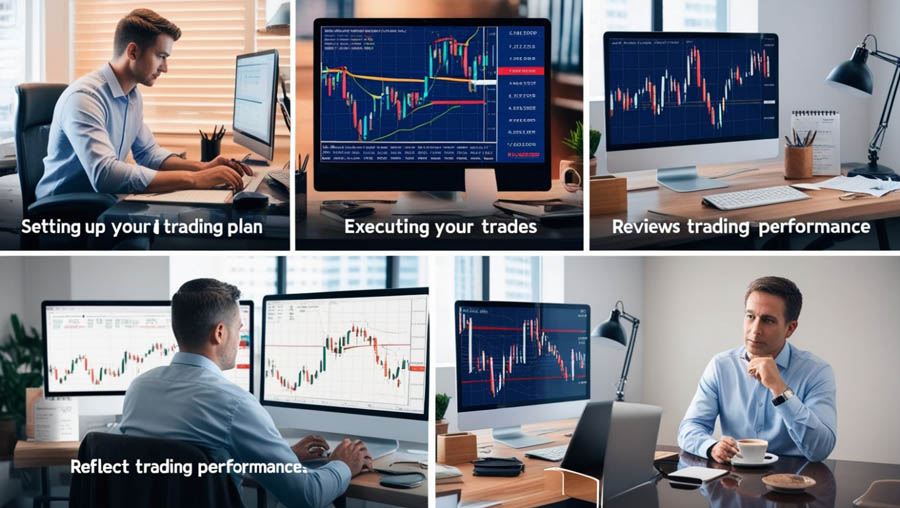

Developing a Trading Plan to Curb Greed

Importance of a Well-Defined Trading Plan

A well-defined trading plan is crucial for managing emotions and enforcing discipline. By outlining specific rules for entering and exiting trades, traders can mitigate the impact of greed on their decision-making.

A trading plan provides a roadmap for making trading decisions, helping traders stay focused and avoid impulsive actions driven by greed. It also helps traders manage risk by establishing guidelines for position sizing, stop-loss orders, and profit targets.

Key Elements of a Trading Plan

Predefined Entry and Exit Points: Sticking to the Signals

Establishing predefined entry and exit points based on a trading strategy can help prevent impulsive decisions driven by greed. Sticking to these signals ensures that trades are executed based on rational analysis rather than emotional reactions.

Predefined entry and exit points help traders avoid the temptation to enter or exit trades based on emotions or market noise. By adhering to these points, traders can maintain discipline and make decisions based on their trading strategy rather than greed.

Risk Management Strategies: Protecting Your Capital

Effective risk management is essential for curbing greed. This includes setting stop-loss orders to limit potential losses and implementing position sizing strategies to ensure that no single trade can significantly impact the overall trading account.

Risk management helps traders protect their capital and avoid significant financial losses. By setting stop-loss orders and using appropriate position sizing, traders can manage their risk and prevent greed from leading to excessive losses.

Read More: Market Makers in Forex Market

Practicing Emotional Awareness

Emotional awareness is crucial for managing greed and making rational trading decisions in forex:

Recognizing Emotional Triggers:

- Identify triggers like fear of missing out (FOMO), overconfidence after wins, and frustration from losses.

- Awareness helps in addressing emotions before they affect trading decisions.

Signs of Greed in Trading Behavior:

- Manifestations include excessive excitement after wins, reluctance to take profits, overtrading, and deviating from trading plans.

- Recognizing these signs allows traders to mitigate the impact of emotions on trading.

Techniques for Managing Emotional Responses:

- Taking Breaks: Clear the mind and refocus during trading sessions.

- Trading Journal: Reflect on decisions and detect behavioral patterns.

- Mindfulness Practices: Such as meditation, to reduce stress and enhance concentration.

Focusing on Process over Outcome

Emphasizing adherence to the trading plan and accepting the realities of trading can help manage emotions and improve decision-making:

Prioritizing Adherence to the Trading Plan:

- Focus on following the trading plan consistently, regardless of short-term gains or losses.

- Helps maintain objectivity and discipline, reducing the impact of greed on decisions.

Accepting Not Every Trade Will Be a Winner:

- Recognize that losses are part of trading; avoid chasing losses or making impulsive decisions.

- Emphasizes sticking to the trading strategy and avoiding emotional reactions to losses.

Building Consistency Through Discipline

Discipline is crucial for building consistency in forex trading. By following a trading plan and avoiding impulsive decisions, traders can mitigate the impact of greed and improve their overall performance.

Consistency is key to long-term success in forex trading. By maintaining discipline and adhering to their trading plan, traders can build a track record of consistent performance and avoid the pitfalls of greed.

Additional Strategies for Taming Greed

Setting Realistic Profit Targets:

- Establish achievable goals to manage expectations and avoid risky, greed-driven decisions.

- Helps traders maintain discipline and focus on their trading strategy rather than chasing unrealistic gains.

Using Smaller Position Sizes:

- Limits potential losses and reduces emotional strain per trade.

- Enables a more objective trading approach and mitigates the impact of greed on decision-making.

Practicing with a Demo Account:

- Gain experience and confidence without financial risk.

- Refine trading strategies and develop discipline to manage emotions and avoid impulsive decisions.

Mindfulness Practices for Managing Emotions:

- Techniques like meditation reduce stress and enhance focus.

- Promotes calmness and rational decision-making, minimizing the influence of emotions like greed.

Conclusion

Overcoming greed in forex trading is essential for achieving long-term success. Greed can cloud judgment, lead to irrational decisions, and result in significant financial losses. By understanding the dangers of greed and implementing strategies to manage it, traders can improve their decision-making and increase their chances of success in the forex market.

Developing a well-defined trading plan, practicing emotional awareness, and focusing on the process rather than short-term outcomes are crucial steps in overcoming greed. Additionally, setting realistic profit targets, using smaller position sizes, and practicing with a demo account can help traders manage their risk and avoid impulsive decisions driven by greed.

What are some common emotional triggers in forex trading?

Common emotional triggers in forex trading include fear of missing out (FOMO), overconfidence after a winning streak, and frustration from consecutive losses. Recognizing these triggers can help traders manage their emotions more effectively.

How can I develop more discipline in my trading?

Developing discipline in trading involves adhering to a well-defined trading plan, setting realistic profit targets, and practicing self-awareness. Regularly reviewing trading performance and maintaining a trading journal can also help reinforce disciplined behavior.

Are there any tools or resources that can help manage greed in forex trading?

Several tools and resources can help manage greed in forex trading, including trading journals, risk management calculators, and trading psychology books. Additionally, joining trading communities or seeking mentorship from experienced traders can provide valuable support and guidance.

One Response

he blog was how do i say it… relevant, finally something that helped me. Thanks