In the dynamic world of forex and financial market trading, staying ahead of the curve is crucial for success. One strategy that has gained significant traction among savvy traders is the ICT Power of 3 (PO3), developed by the renowned Inner Circle Trader, Michael J. Huddleston. This powerful approach to market analysis and trading, which many forex broker platforms now recognize as a game-changer, has revolutionized the way traders view and interact with the markets.

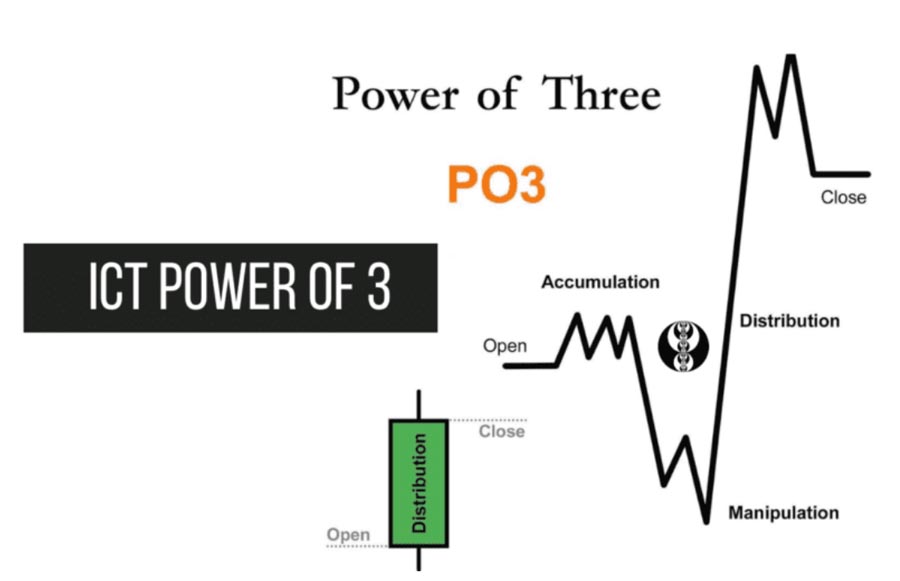

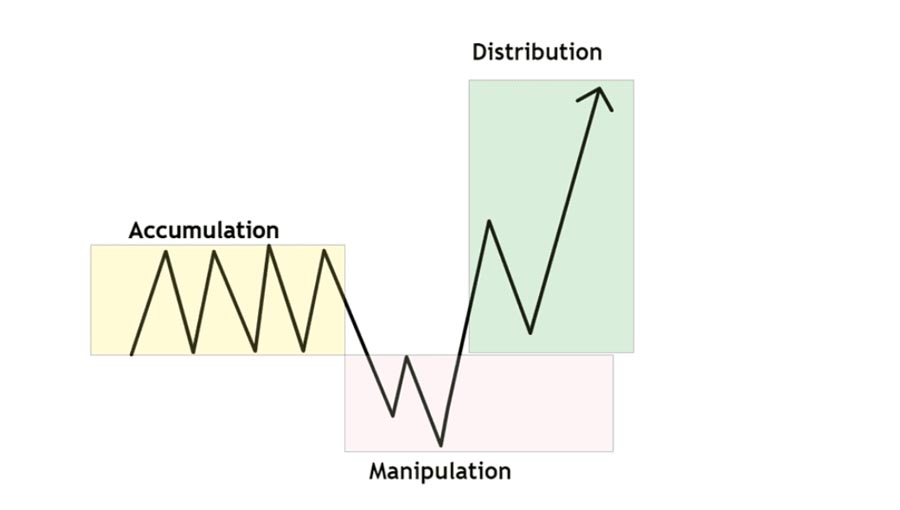

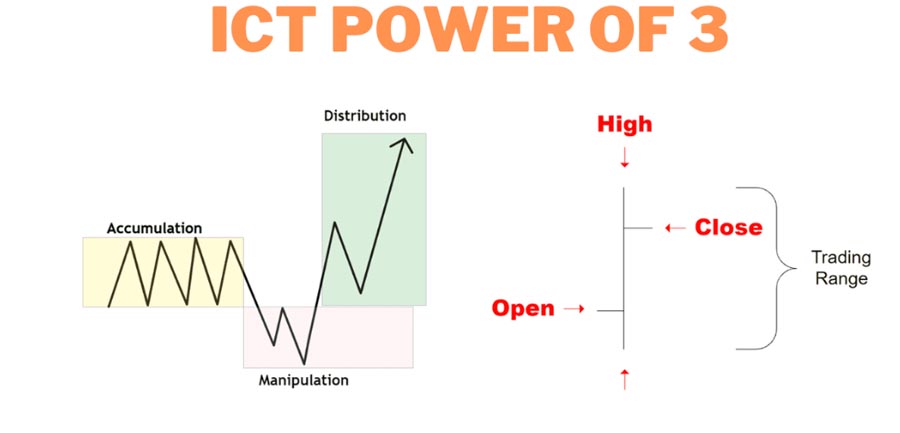

The ICT Power of 3 strategy is more than just a set of rules; it’s a comprehensive framework that helps traders understand the underlying mechanics of market movements. By breaking down market cycles into three distinct phases – Accumulation, Manipulation, and Distribution – the PO3 strategy provides traders with a roadmap to navigate the complex landscape of financial markets.

In this article, we’ll delve deep into the intricacies of the ICT Power of 3 strategy, exploring its core principles, practical applications, and the benefits it offers to traders. Whether you’re a seasoned forex professional or a trading enthusiast looking to enhance your skills, understanding the PO3 strategy can significantly improve your trading performance and decision-making process.

What is ICT Power of 3 (PO3)?

The ICT Power of 3 (PO3) is a sophisticated trading strategy developed by Michael J. Huddleston, the founder of Inner Circle Trader (ICT). This approach is based on the premise that market movements follow a predictable pattern consisting of three distinct phases: Accumulation, Manipulation, and Distribution.

Huddleston, drawing from his extensive experience in institutional trading, developed the PO3 concept to provide retail traders with insights into how large market players operate. The strategy aims to level the playing field by helping individual traders understand and anticipate the actions of institutional traders and market makers.

Core Principles of PO3

- Market Cyclicality: PO3 recognizes that markets move in cycles, repeating patterns that can be identified and exploited.

- Institutional Perspective: The strategy focuses on understanding and emulating the actions of large institutional traders, who are often the primary drivers of market movements.

- Phase Recognition: PO3 emphasizes the importance of identifying which phase the market is currently in – Accumulation, Manipulation, or Distribution.

- Price Action Analysis: Rather than relying heavily on indicators, PO3 prioritizes the study of raw price action and volume.

- Risk Management: The strategy incorporates stringent risk management principles to protect traders from significant losses.

Phases of ICT Power of 3

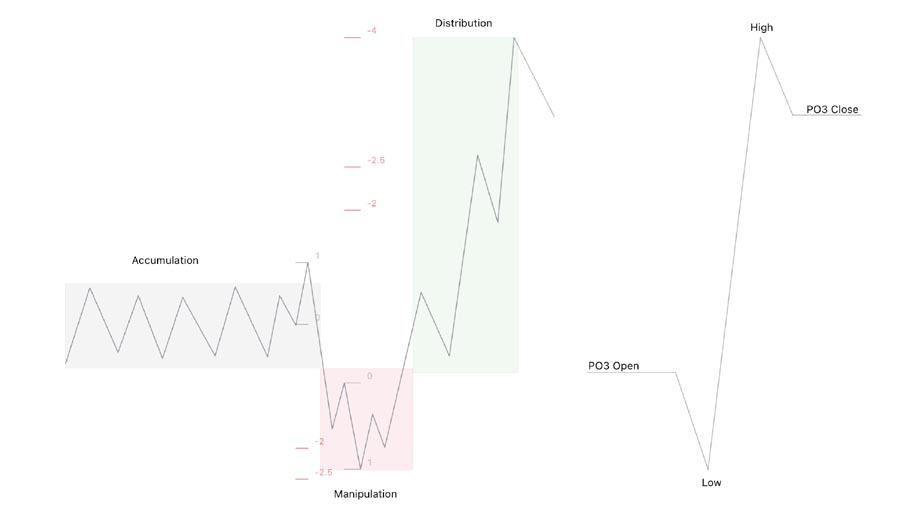

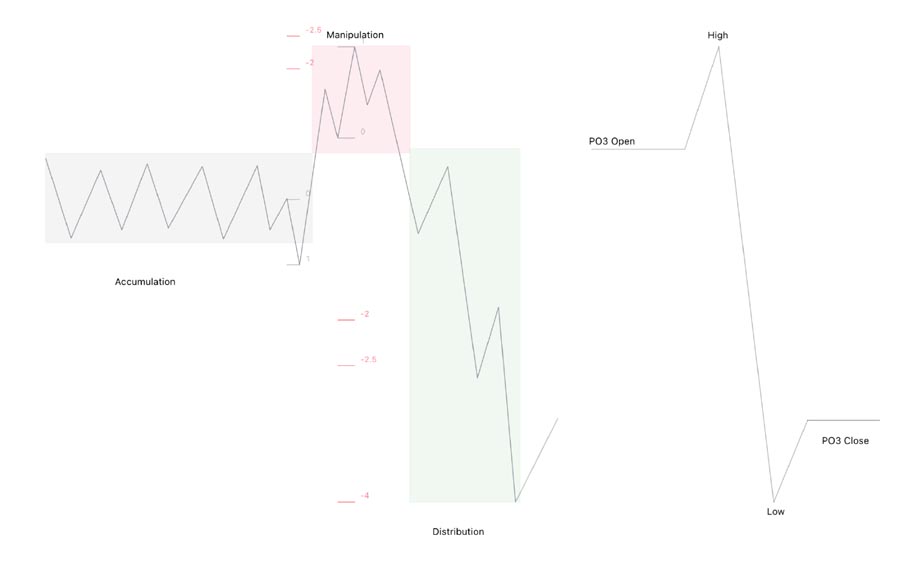

The heart of the ICT Power of 3 strategy lies in its three distinct phases: Accumulation, Manipulation, and Distribution. Let’s explore each of these phases in detail:

1. Accumulation

The Accumulation phase is the starting point of the market cycle in the PO3 strategy. During this phase, large institutional traders and market makers begin to build positions in anticipation of future price movements.

Characteristics of the Accumulation phase include:

- Market Quietness: Trading volume is typically low, and price action may appear to be ranging or moving sideways.

- Support and Resistance Levels: Clear support and resistance levels often emerge during this phase.

- Volume Analysis: Despite overall low volume, there may be sporadic increases in volume as institutions accumulate positions.

Example: In the forex market, you might observe the EUR/USD pair trading within a tight range for several days or weeks. During this time, the price repeatedly tests a specific support level but doesn’t break below it. This could indicate accumulation by large players at that support level.

2. Manipulation

The Manipulation phase is where the market becomes more volatile and unpredictable. During this phase, large players attempt to move the price in a way that triggers retail traders’ stop losses and creates liquidity for their larger positions.

Key characteristics of the Manipulation phase include:

- False Breakouts: Price may briefly break above or below key levels before quickly reversing.

- Stop Hunts: Sharp price movements designed to trigger stop losses of retail traders.

- Emotional Reactions: Retail traders often make impulsive decisions based on these volatile movements.

Example: Continuing with the EUR/USD scenario, after accumulation at support, you might see a sudden, sharp drop below the support level. This move could trigger stop losses of traders who went long at support. However, the price quickly reverses and moves higher, leaving many traders stopped out of potentially profitable positions.

Read More: Mastering the Opening Range Breakout Trading Strategy

3. Distribution

The Distribution phase is where the large players who accumulated positions begin to sell (or buy back short positions) into the newly created trend.

Characteristics of the Distribution phase include:

- Trend Initiation: A clear trend begins to emerge in the direction of the institutional traders’ positions.

- Increased Volatility: Price movements become larger and more directional.

- Volume Confirmation: Trading volume typically increases as more market participants join the trend.

Understanding OLHC and OHLC in ICT Power of 3

An essential aspect of implementing the ICT Power of 3 strategy is understanding and analyzing price action. Two key concepts in this analysis are OLHC (Open, Low, High, Close) and OHLC (Open, High, Low, Close) candlestick patterns. These patterns provide valuable insights into market sentiment and can help traders identify the different phases of the PO3 strategy.

OLHC vs OHLC: What’s the Difference?

OLHC and OHLC are two different ways of presenting price action data:

- OLHC (Open, Low, High, Close): This order represents the chronological sequence of price movements within a given time frame.

- OHLC (Open, High, Low, Close): This is the more commonly used format in most charting software and financial data feeds.

While both formats provide the same information, the order can affect how traders interpret the data, especially when considering the ICT Power of 3 strategy.

Applying OLHC and OHLC to ICT Power of 3

During Accumulation Phase:

- Look for OLHC patterns that show tight ranges with small bodies and short wicks, indicating low volatility.

- OHLC charts might reveal accumulation through a series of higher lows or lower highs, suggesting institutional buying or selling.

During Manipulation Phase:

- OLHC patterns may show sudden spikes in either direction, often with long wicks, indicating stop hunts.

- On OHLC charts, look for candles with long upper or lower shadows that quickly reverse, potentially signaling manipulation.

During Distribution Phase:

- OLHC patterns might show a series of higher highs and higher lows (in an uptrend) or lower highs and lower lows (in a downtrend).

- OHLC charts could reveal distribution through increasing volume and larger candle bodies as the trend progresses.

Tips for Using OLHC and OHLC in PO3 Strategy

- Use multiple time frames: Analyze OLHC/OHLC patterns on different time frames to get a comprehensive view of market phases.

- Combine with volume analysis: Look at volume in conjunction with OLHC/OHLC patterns to confirm accumulation, manipulation, or distribution phases.

- Consider candle sequencing: Pay attention to the sequence of candles, as this can provide clues about institutional activity and potential phase transitions.

- Use OLHC for chronological analysis: When trying to understand the exact sequence of price movements, especially during manipulation phases, OLHC can be more insightful.

- Rely on OHLC for quick visual assessment: For a quick overview of price action and trend direction, OHLC is often more intuitive and widely available in trading platforms.

By incorporating OLHC and OHLC analysis into the ICT Power of 3 strategy, traders can gain a deeper understanding of market structure and improve their ability to identify and capitalize on the different phases of market cycles. Remember, proficiency in reading these patterns comes with practice and experience, so dedicate time to studying historical charts and real-time market movements.

Practical Applications of ICT PO3

Now that we’ve explored the theoretical aspects of the ICT Power of 3 strategy, let’s dive into its practical applications. Understanding how to implement PO3 in real trading scenarios is crucial for maximizing its benefits.

Tips for Identifying Accumulation Zones

- Look for periods of low volatility and sideways price action.

- Pay attention to support and resistance levels that are repeatedly tested but not broken.

- Use volume analysis to spot sporadic increases in trading activity.

- Watch for subtle signs of bullish or bearish bias within the ranging price action.

Strategies for Recognizing Manipulation Moves

- Be alert for sudden, sharp price movements that quickly reverse.

- Watch for price action that briefly breaks key support or resistance levels before returning.

- Pay attention to price movements during typically low-liquidity periods, as these are often prime times for manipulation.

- Use multiple timeframes to gain a broader perspective on potential manipulation.

Best Practices for Entering Trades During the Distribution Phase

- Wait for clear confirmation of trend direction before entering.

- Use pullbacks to key support or resistance levels as potential entry points.

- Implement tight stop losses to protect against unexpected reversals.

- Scale into positions gradually rather than entering with full size immediately.

Benefits of Mastering ICT PO3

Mastering the ICT Power of 3 strategy can provide traders with numerous advantages in their trading journey. Let’s explore some of the key benefits:

1. Improved Market Entry and Exit Points

By understanding the three phases of market cycles, traders can more accurately identify optimal entry and exit points. This can lead to:

- Better risk-to-reward ratios on trades

- Increased probability of entering trends early

- More effective profit-taking strategies

2. Enhanced Ability to Avoid Common Trading Pitfalls

The PO3 strategy helps traders recognize and avoid:

- False breakouts during the manipulation phase

- Premature entries before accumulation is complete

- Chasing trends that are nearing distribution

3. Better Risk Management and Higher Profitability

Understanding market phases allows for:

- More precise stop loss placement

- Improved position sizing based on market conditions

- Higher win rates and larger average wins

4. Deeper Understanding of Market Dynamics

PO3 provides insights into:

- How large institutional players move the market

- The psychology behind different market phases

- The importance of patience and discipline in tradin

Read More: Mastering the ICT Judas Swing

Challenges and Solutions in Implementing ICT PO3

While the ICT Power of 3 strategy offers numerous benefits, implementing it effectively can present certain challenges. Here are some common obstacles traders face when applying PO3, along with practical solutions:

1. Challenge: Difficulty in Identifying Market Phases

Solution:

- Practice phase identification on historical charts

- Use multiple timeframes to confirm phase transitions

- Develop a checklist of characteristics for each phase

- Join trading communities or forums to discuss and validate phase identifications

2. Challenge: Emotional Management During Manipulation Phases

Solution:

- Implement strict risk management rules

- Use smaller position sizes until confidence in phase identification improves

- Practice mindfulness or meditation to maintain emotional equilibrium

- Keep a trading journal to track emotional responses and improve self-awareness

3. Challenge: Premature Entry or Exit from Trades

Solution:

- Develop and stick to a clear set of entry and exit rules

- Use limit orders to avoid impulsive entries

- Implement trailing stops to capture more of trending moves

- Review trades regularly to identify patterns of premature decisions

4. Challenge: Overcomplicating the Strategy

Solution:

- Start with the basic principles of PO3 before adding additional indicators

- Focus on mastering one market or instrument initially

- Regularly revisit the core concepts of accumulation, manipulation, and distribution

- Seek mentorship or guidance from experienced PO3 traders

Read More: Mastering the ICT Turtle Soup Trading Strategy

Conclusion

The ICT Power of 3 (PO3) strategy, developed by Michael J. Huddleston of Inner Circle Trader, offers a powerful framework for understanding and navigating the complexities of financial markets. By breaking down market movements into the phases of Accumulation, Manipulation, and Distribution, PO3 provides traders with invaluable insights into the actions of large institutional players and market makers.

Throughout this article, we’ve explored the core principles of PO3, its practical applications, and the numerous benefits it offers to traders. We’ve also addressed common challenges in implementing the strategy and discussed potential future trends that may shape its evolution.

Mastering the ICT Power of 3 is not an overnight process. It requires dedication, practice, and a willingness to continually learn and adapt. However, for those who commit to understanding and applying its principles, PO3 can be a game-changer in their trading journey.

As you move forward in your trading career, we encourage you to:

- Practice identifying market phases on historical charts

- Start small and gradually increase your application of PO3 principles

- Join communities of like-minded traders to share insights and experiences

- Stay informed about emerging trends and innovations in trading technology

- Continuously refine your understanding and application of the PO3 strategy

Remember, the journey to mastering any trading strategy is ongoing. The ICT Power of 3 provides a solid foundation, but your success will ultimately depend on how you adapt and apply these principles to your unique trading style and market conditions.

We invite you to take the next step in your trading evolution by diving deeper into the ICT Power of 3 strategy. Whether through further study, practice, or joining the ICT community, the path to becoming a more informed and successful trader begins with understanding the power of market phases.

Happy trading, and may the power of 3 be with you!

How long does it typically take to master the ICT Power of 3 strategy?

The time it takes to master PO3 varies depending on individual dedication and prior trading experience. Many traders report significant improvements in their understanding within 3-6 months of consistent study and practice. However, truly mastering the strategy can take years of application and refinement.

Can the ICT Power of 3 strategy be applied to all financial markets?

While PO3 was originally developed for forex markets, its principles can be applied to various financial markets, including stocks, commodities, and cryptocurrencies. However, traders should be aware that the specific characteristics of each market may require some adaptation of the strategy.

Is special software required to implement the ICT Power of 3 strategy?

No special software is required to implement PO3. The strategy is based on understanding market structure and price action, which can be observed on standard trading charts. However, some traders find certain tools, such as volume profile indicators or order flow analysis software, helpful in applying PO3 principles.