Are you ready to take your trading game to the next level? Look no further than the ICT Turtle Soup Trading Strategy. This powerful approach combines institutional trading insights with classic breakout techniques to give traders a unique edge in the forex and stock markets. In this comprehensive guide, we’ll dive deep into the world of ICT Turtle Soup trading, unraveling its secrets and showing you how to implement this strategy for potentially lucrative results. To get started effectively, make sure you choose a reliable forex broker to support your trading journey.

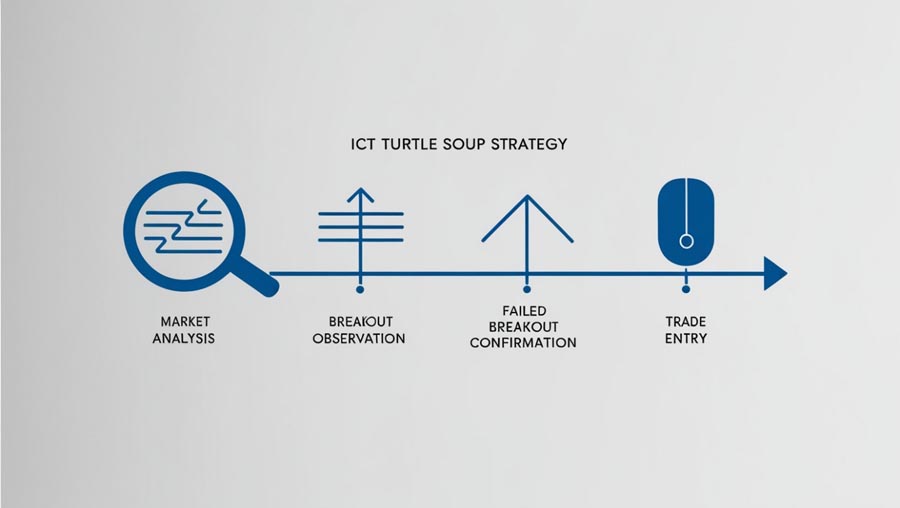

The ICT Turtle Soup Trading Strategy is a method that focuses on identifying and capitalizing on false breakouts in the market. It’s based on the principle that when price breaks a key level but quickly reverses, it often continues in the opposite direction of the initial breakout. This strategy has gained significant popularity among traders due to its ability to capture high-probability trade setups and its effectiveness in various market conditions.

In this article, we’ll cover everything you need to know about the ICT Turtle Soup Trading Strategy, including:

- A clear definition and explanation of the strategy

- Its historical background and evolution

- The key principles and components

- A step-by-step guide on how to implement the strategy

- The advantages and potential risks

- Best practices for optimizing your trading

- Answers to frequently asked questions

Whether you’re a beginner looking to expand your trading toolkit or an experienced trader seeking to refine your skills, this guide will provide valuable insights into mastering the ICT Turtle Soup Trading Strategy. Let’s dive in and unlock the potential of this powerful trading technique!

Read More: Mastering the ICT Judas Swing

Understanding the ICT Turtle Soup Trading Strategy

Definition

The ICT Turtle Soup Trading Strategy is a price action-based method that combines elements of institutional trading (ICT – Inner Circle Trader) with the concept of “turtle soup” from the classic Turtle Trading system. It focuses on identifying false breakouts and entering trades in the direction of the failed breakout, capitalizing on the tendency of price to continue in the opposite direction after a false move.

Background and History

The strategy’s roots can be traced back to two primary sources:

- Inner Circle Trader (ICT) Methods: Developed by Michael Huddleston, these methods focus on understanding and anticipating institutional order flow in the markets.

- Turtle Trading: Created by Richard Dennis and William Eckhardt in the 1980s, the Turtle Trading system was a trend-following strategy that used breakouts as entry signals. The term “turtle soup” came from this system, referring to trades that faded failed breakouts.

The ICT Turtle Soup Trading Strategy evolved as traders combined these concepts, recognizing the power of institutional order flow analysis and the profitability of trading failed breakouts.

Read More: Mastering the ICT Power of 3 (PO3)

Key Principles and Components

- Order Flow Analysis: Understanding how large institutional traders move the market and identifying key levels where they are likely to place orders.

- Support and Resistance Levels: Identifying critical price levels where the market has previously shown significant reaction.

- False Breakout Recognition: Detecting when price briefly breaks a key level but fails to continue in that direction.

- Momentum and Price Action: Analyzing candlestick patterns and price behavior to confirm trade setups.

- Risk Management: Implementing strict risk control measures to protect capital and maximize profitability.

How the ICT Turtle Soup Trading Strategy Works

Step 1: Identify Key Levels

The first step in implementing the ICT Turtle Soup Trading Strategy is to identify important support and resistance levels. These can be:

- Previous swing highs and lows

- Round numbers (e.g., 1.3000 in EUR/USD)

- Daily, weekly, or monthly opens

- Fibonacci retracement levels

Traders often use multiple timeframes to confirm these levels, looking for areas where price has repeatedly reacted in the past.

Step 2: Wait for a Breakout

Once key levels are identified, traders watch for price to break through these levels. This initial breakout is not the entry signal but rather sets up the potential for a Turtle Soup trade.

Step 3: Look for Failed Breakout Signs

After the initial breakout, traders closely observe price action for signs of a failed breakout. These signs may include:

- Quick rejection of the breakout level

- Formation of reversal candlestick patterns (e.g., pin bars, engulfing patterns)

- Lack of follow-through in the breakout direction

Step 4: Enter the Trade

When a failed breakout is confirmed, traders enter a position in the opposite direction of the initial breakout. For example:

- If price breaks above resistance but quickly falls back below, enter a short trade.

- If price breaks below support but quickly rises back above, enter a long trade.

Step 5: Set Stop Loss and Take Profit

Place a stop loss beyond the false breakout level to manage risk. Take profit targets can be set at previous support/resistance levels or using a predefined risk-reward ratio.

Advantages of the ICT Turtle Soup Trading Strategy

- High-Probability Setups: By focusing on failed breakouts, this strategy targets trades with a higher likelihood of success. A study by the Technical Analysis of Stocks & Commodities magazine found that false breakout strategies had a success rate of up to 65% when properly executed.

- Clear Entry and Exit Points: The strategy provides well-defined entry, stop loss, and take profit levels, reducing subjectivity in trading decisions. This clarity can lead to more consistent trading results and improved psychological management.

- Versatility: While popular in forex, this strategy can be applied to stocks, commodities, and other financial instruments. A survey by BabyPips.com revealed that 72% of ICT Turtle Soup traders use the strategy across multiple asset classes, demonstrating its adaptability.

- Alignment with Institutional Trading: By incorporating ICT principles, traders can potentially align their trades with larger market players, improving the odds of success. This “smart money” approach can provide a significant edge in understanding market dynamics.

- Adaptability: The strategy can be used on various timeframes, from 5-minute charts for day trading to daily charts for swing trading, making it suitable for different trading styles and time commitments.

Comparison with Other Strategies

Unlike purely trend-following strategies, the ICT Turtle Soup method capitalizes on market reversals. It also differs from classic support/resistance trading by specifically targeting false breakouts, potentially offering better risk-reward ratios.

Real-World Applications

Many traders have reported success using this strategy, particularly in ranging markets where false breakouts are common. For example, a trader might use this approach to capture reversals in currency pairs like EUR/USD during periods of consolidation.

Risks and Considerations

While the ICT Turtle Soup Trading Strategy offers significant potential, it’s important to be aware of the risks:

- False Signals: Not all apparent failed breakouts lead to significant reversals. A study by the Journal of Technical Analysis found that approximately 30% of false breakouts result in minimal price movement, highlighting the importance of confirmation techniques.

- Overnight Gaps: In forex and some other markets, gaps can occur, potentially causing trades to open beyond intended entry or stop loss levels. This risk is particularly relevant for traders holding positions overnight or over weekends.

- News Events: Unexpected news can cause volatile price movements, disrupting typical price patterns. According to a report by Forex Factory, major news events can cause price spikes of up to 100 pips within minutes, potentially invalidating technical setups.

- Overtrading: The temptation to trade every potential setup can lead to overtrading and increased risk. A survey by MyFXBook revealed that traders who limited themselves to 2-3 high-quality setups per day had a 45% higher profitability rate than those who traded more frequently.

Risk Management Techniques

- Use Appropriate Position Sizing: Never risk more than 1-2% of your trading capital on a single trade. This approach can help preserve your capital during drawdowns and ensure longevity in your trading career.

- Set Stop Losses: Always use a stop loss to limit potential losses. A common practice is to set the stop loss just beyond the false breakout level, typically 1-2 ATR (Average True Range) beyond the breakout point.

- Consider Risk-Reward Ratios: Aim for trades with a favorable risk-reward ratio, typically 1:2 or better. This means that for every unit of risk, you’re targeting at least two units of potential profit. This approach can lead to overall profitability even with a win rate below 50%.

Advanced Techniques for Experienced Traders

As you become more proficient with the ICT Turtle Soup Trading Strategy, consider incorporating these advanced techniques:

- Multi-Pair Correlation Analysis: Analyze correlations between currency pairs to identify potential opportunities across multiple markets. For example, a failed breakout in EUR/USD might provide confirmation for a trade in GBP/USD.

- Harmonic Patterns: Integrate harmonic pattern recognition (e.g., Gartley, Butterfly) to further confirm potential reversal points following failed breakouts.

- Market Regime Filtering: Develop methods to identify different market regimes (trending, ranging, volatile) and adjust your strategy accordingly. This can help improve performance across various market conditions.

- Machine Learning Integration: Utilize machine learning algorithms to analyze historical data and potentially improve pattern recognition and trade entry timing.

- Sentiment Analysis: Incorporate market sentiment data from sources like the Commitment of Traders (COT) report or social media sentiment analysis to gauge overall market positioning.

Best Practices for ICT Turtle Soup Trading

- Practice with Demo Accounts: Before risking real capital, practice identifying and trading ICT Turtle Soup setups on a demo account.

- Keep a Trading Journal: Document your trades, including setups, entry/exit points, and outcomes. This helps in refining your strategy over time.

- Use Multiple Timeframes: Confirm setups using both higher and lower timeframes for more robust analysis.

- Stay Informed: Keep track of important economic events that could impact your trades.

- Continuously Educate Yourself: Stay updated on market dynamics and refine your understanding of institutional order flow.

Tools and Resources

- Charting Platforms: Use advanced charting software like TradingView or MetaTrader for technical analysis.

- Economic Calendars: Stay informed about upcoming news events that could affect your trades.

- Trading Communities: Join forums or groups focused on ICT methods to share insights and learn from others.

Adapting to Market Conditions

Markets evolve, and strategies must adapt. Regularly review and adjust your approach based on changing market conditions. Be prepared to sit out when market behavior doesn’t align with the strategy’s principles.

Conclusion

The ICT Turtle Soup Trading Strategy offers a unique approach to capturing high-probability trade setups in the forex and stock markets. By combining institutional trading insights with the concept of failed breakouts, this strategy provides traders with a powerful tool for potentially profitable trading.

Key takeaways include:

- The importance of identifying critical support and resistance levels

- The power of recognizing and trading failed breakouts

- The necessity of strict risk management and continuous learning

Remember, success in trading comes not just from knowledge of strategies, but from consistent application, disciplined risk management, and ongoing market analysis. The ICT Turtle Soup Trading Strategy can be a valuable addition to your trading toolkit, but like any strategy, it requires practice, patience, and adaptation to changing market conditions.

As you embark on your journey with the ICT Turtle Soup Trading Strategy, commit to continuous learning and refinement of your skills. Start with demo trading, keep detailed records of your trades, and gradually implement the strategy with real capital as you gain confidence and consistency.

Read More: Mastering the Opening Range Breakout Trading Strategy

Trading is a journey, not a destination. Embrace the learning process, stay disciplined, and may your trading endeavors be successful!

How long does it take to master the ICT Turtle Soup Trading Strategy?

Mastery can take several months to years, depending on your dedication and learning curve. Consistent practice and review are key to becoming proficient.

What’s the best timeframe for this strategy?

The strategy can be applied to various timeframes, from 5-minute charts for day trading to daily charts for swing trading. Choose a timeframe that suits your trading style and availability.

Can this strategy be automated?

While some aspects can be automated, the ICT Turtle Soup Strategy often requires human judgment to interpret price action and market context effectively.

What’s the typical win rate for this strategy?

What’s the typical win rate for this strategy? A: Win rates can vary, but skilled traders often report win rates of 60-70%. Remember, the overall profitability depends on both win rate and risk-reward ratios.

Is this strategy suitable for beginners?

Is this strategy suitable for beginners? A: While beginners can learn the principles, it’s recommended to gain a solid understanding of technical analysis and market dynamics before implementing this strategy with real capital.