In the fast-paced world of forex trading, staying ahead of the curve is crucial for success. Enter the ICT Midnight Open Strategy, a powerful approach that leverages the unique dynamics of market openings to maximize profits. This innovative technique, developed by the Inner Circle Trader (ICT), focuses on capitalizing on the volatility and price movements that occur when major financial centers open for business. Working with a regulated forex broker can further support traders in successfully implementing such strategies.

The ICT Midnight Open Strategy is a systematic method for trading the forex market during the Asian session opening, typically around midnight GMT. This strategy exploits the increased liquidity and potential price gaps that occur as traders react to overnight news and events. By understanding and applying this approach, traders can potentially enhance their profitability and gain a competitive edge in the global forex market.

In this comprehensive guide, we’ll delve deep into the ICT Midnight Open Strategy, exploring its key components, benefits, and practical implementation. Whether you’re a seasoned trader or just starting your forex journey, this article will equip you with the knowledge and insights needed to leverage this powerful strategy effectively.

1. Understanding the Foundations of ICT Midnight Open Strategy

The ICT Midnight Open Strategy is built on a solid foundation of market analysis and strategic timing. At its core, this approach recognizes the significance of market openings, particularly the Asian session, which begins around midnight GMT. This period is characterized by:

- Increased liquidity as Asian financial centers come online

- Potential price gaps due to overnight news and events

- Heightened volatility as traders react to new information

By focusing on this specific time frame, traders can capitalize on these unique market conditions to identify high-probability trading opportunities.

The Importance of Market Opens

Market opens, especially the Asian session open, are critical periods in the forex market. They represent a time when fresh liquidity enters the market, and institutional players often make significant moves. Understanding the dynamics of these openings is crucial for the successful implementation of the ICT Midnight Open Strategy.

Read More: End of Day Forex Trading Strategy

The Role of Institutional Order Flow

A key aspect of the ICT methodology is the focus on institutional order flow. Large financial institutions, such as banks and hedge funds, often execute significant orders during market opens. By learning to identify and anticipate these moves, retail traders can potentially ride the waves created by these larger players.

2. Key Components of the ICT Midnight Open Strategy

To successfully implement the ICT Midnight Open Strategy, traders need to understand and master several key components:

a) Market Structure Analysis

Before entering any trade, it’s crucial to analyze the overall market structure. This involves identifying key support and resistance levels, trend directions, and potential reversal points. By understanding the bigger picture, traders can make more informed decisions about potential trade setups.

Identifying Support and Resistance

Support and resistance levels are critical in the ICT Midnight Open Strategy. These levels often act as barriers where price may pause, reverse, or break through. Traders should pay special attention to:

- Historical price levels where the market has repeatedly reversed

- Psychological round numbers (e.g., 1.3000, 1.3500)

- Recent swing highs and lows

Trend Analysis

Understanding the prevailing trend is essential for aligning trades with the overall market direction. Traders should analyze multiple time frames to get a comprehensive view of the trend:

- Higher time frames (e.g., daily, 4-hour) for the overall trend

- Lower time frames (e.g., 1-hour, 15-minute) for entry timing

b) Order Flow

Order flow analysis is a cornerstone of the ICT methodology. This involves studying the interaction between buying and selling pressure to anticipate potential price movements. In the context of the Midnight Open Strategy, traders pay close attention to order flow patterns that emerge as the Asian session begins.

Reading the Order Book

While retail traders may not have access to the full order book, they can still gain insights by observing:

- Large volume spikes

- Sudden price reversals

- Absorption of buy or sell orders at key levels

Footprint Charts

Advanced traders may use footprint charts to visualize order flow. These charts provide a detailed view of buying and selling activity at each price level, offering valuable insights into market sentiment and potential price direction.

c) Liquidity Levels

Identifying and targeting areas of high liquidity is essential for successful execution of the ICT Midnight Open Strategy. These liquidity zones often correspond to key support and resistance levels, as well as areas where large institutional orders are likely to be placed.

Types of Liquidity Levels

- Swing highs and lows

- Daily, weekly, and monthly opens

- Round numbers (e.g., 1.3000, 1.3500)

- Fibonacci retracement levels

d) Price Action

Observing and interpreting price action is crucial for timing entries and exits. The ICT Midnight Open Strategy emphasizes the importance of candlestick patterns, price rejections, and other technical indicators that can signal potential trade opportunities.

Key Price Action Signals

- Engulfing patterns

- Pin bars (bullish and bearish)

- Inside bars

- Double tops and bottoms

e) Time-Based Analysis

Given the strategy’s focus on a specific time frame, understanding how price behaves during the Asian session opening is paramount. Traders must develop a keen sense of timing and be prepared to act swiftly when opportunities arise.

Time Zones to Monitor

- Tokyo open (00:00 GMT)

- Sydney open (22:00 GMT)

- Early European pre-market (05:00 GMT)

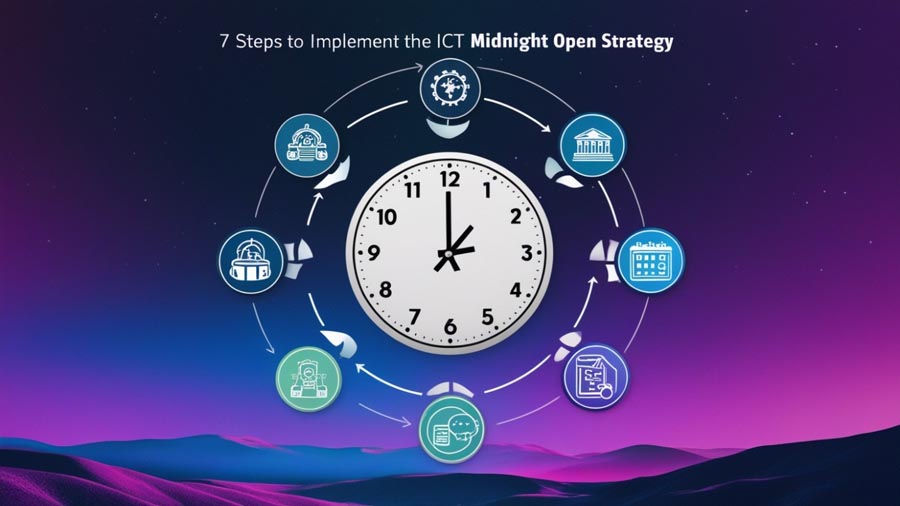

3. Implementing the ICT Midnight Open Strategy: Step-by-Step Guide

Now that we’ve covered the foundational elements, let’s explore how to put the ICT Midnight Open Strategy into practice:

Step 1: Prepare for the Asian Session

- Review any relevant news or events that occurred during the previous trading sessions

- Identify key support and resistance levels on your charts

- Note any significant price gaps that may have formed overnight

Step 2: Analyze Pre-Session Market Structure

- Determine the overall trend direction on higher time frames

- Identify potential areas of interest where price may react during the session open

Step 3: Monitor Order Flow as the Session Opens

- Observe the initial price movements and volume as Asian markets come online

- Look for signs of institutional activity, such as large buy or sell orders

Step 4: Identify High-Probability Trade Setups

- Look for price action signals that align with your analysis of market structure and order flow

- Pay attention to how price interacts with key liquidity levels

Step 5: Execute Trades with Precision

- Enter trades based on your predetermined criteria and risk management rules

- Set appropriate stop-loss and take-profit levels

Step 6: Manage Open Positions

- Monitor your trades closely, especially during the volatile opening period

- Be prepared to adjust your positions or exit trades based on evolving market conditions

Step 7: Review and Refine

- After the session, analyze your trades and overall market performance

- Identify areas for improvement and refine your strategy accordingly

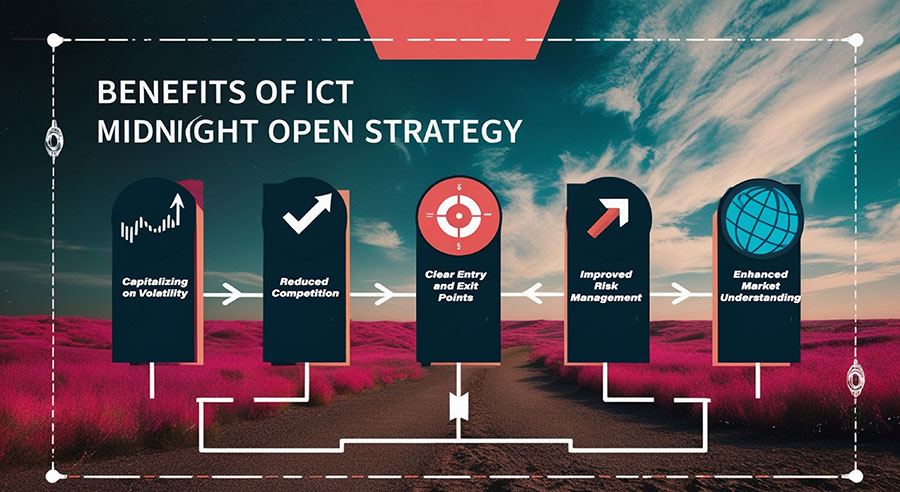

4. Benefits of the ICT Midnight Open Strategy

Implementing the ICT Midnight Open Strategy can offer several advantages to forex traders:

a) Capitalizing on Volatility

The strategy allows traders to exploit the increased volatility that often occurs during market openings, potentially leading to larger price movements and profit opportunities.

b) Reduced Competition

By focusing on the Asian session open, traders may face less competition from other retail traders, particularly those in Western time zones.

c) Clear Entry and Exit Points

The strategy’s emphasis on specific time frames and price action signals can provide traders with clearer entry and exit points for their trades.

d) Improved Risk Management

By concentrating on a specific session and having a well-defined strategy, traders can potentially improve their risk management and overall trading discipline.

e) Enhanced Market Understanding

Regularly trading the Asian session open can help traders develop a deeper understanding of global market dynamics and inter-market relationships.

5. Common Pitfalls and How to Avoid Them

While the ICT Midnight Open Strategy can be highly effective, there are several potential pitfalls that traders should be aware of:

a) Over-Trading

The excitement of the session open can lead to impulsive trading decisions. Stick to your predefined trading plan and avoid the temptation to over-trade.

b) Ignoring Fundamental Factors

While the strategy is primarily technical, it’s important not to ignore major fundamental factors that could impact price movements.

c) Lack of Preparation

Failing to properly prepare for the session can lead to missed opportunities or poor trade execution. Always do your homework before the markets open.

d) Emotional Trading

The fast-paced nature of the strategy can sometimes lead to emotional decision-making. Maintain discipline and adhere to your risk management rules.

e) Neglecting Other Time Frames

While focusing on the session open is important, don’t neglect analysis of higher time frames that can provide valuable context for your trades.

Read More: ICT Killzone Times

6. Advanced Techniques for Experienced Traders

For traders who have mastered the basics of the ICT Midnight Open Strategy, there are several advanced techniques to consider:

a) Multi-Pair Analysis

Analyze correlations between different currency pairs to identify potential opportunities across multiple markets. This can help diversify risk and increase the number of potential trade setups.

Currency Pair Correlations

- Positive correlations (e.g., EUR/USD and GBP/USD)

- Negative correlations (e.g., EUR/USD and USD/CHF)

- Commodity currency relationships (e.g., AUD/USD and gold prices)

b) Integration with Other Strategies

Combine the ICT Midnight Open Strategy with other complementary approaches, such as harmonic patterns or Elliott Wave analysis. This can provide additional confirmation and potentially increase the probability of successful trades.

Complementary Strategies

- Fibonacci retracements and extensions

- Moving average convergence divergence (MACD)

- Relative strength index (RSI)

c) Automated Trading

Develop and implement algorithmic trading systems based on the principles of the ICT Midnight Open Strategy. This can help remove emotions from trading decisions and allow for consistent execution of the strategy.

Benefits of Automation

- Consistent strategy execution

- Ability to backtest and optimize

- Potential for 24/7 trading

d) Advanced Order Flow Analysis

Utilize more sophisticated order flow analysis techniques, such as footprint charts or order book heat maps. These tools can provide deeper insights into market dynamics and potential price movements.

Advanced Order Flow Tools

- Volume profile analysis

- Cumulative delta

- Market depth visualization

e) Intermarket Analysis

Incorporate analysis of related markets (e.g., commodities, indices) to gain a more comprehensive view of potential price movements. This can help identify broader market trends and potential catalysts for currency movements.

Key Intermarket Relationships

- Stock market indices and risk sentiment

- Commodity prices and commodity currencies

- Bond yields and interest rate expectations

7. Tools and Resources for ICT Midnight Open Strategy Traders

To effectively implement the ICT Midnight Open Strategy, traders should consider utilizing the following tools and resources:

a) Advanced Charting Platforms

Use robust charting software that allows for multi-time frame analysis and custom indicators. Popular options include:

- TradingView

- MetaTrader 4/5

- NinjaTrader

b) Economic Calendars

Stay informed about important economic events that could impact the Asian session open. Reliable sources include:

- ForexFactory

- Investing.com

- FXStreet

c) Order Flow Analysis Tools

Invest in specialized software for advanced order flow analysis and visualization, such as:

- Bookmap

- Jigsaw Trading

- Sierra Chart

d) Trading Journals

Maintain detailed records of your trades to track performance and identify areas for improvement. Consider using:

- Edgewonk

- TraderVue

- MyFxBook

e) Educational Resources

Continuously educate yourself through books, courses, and webinars focused on ICT methodologies and forex trading strategies. Some recommended resources include:

- “Trading in the Zone” by Mark Douglas

- “The Art and Science of Technical Analysis” by Adam Grimes

- Online courses and webinars from reputable forex educators

Read More: Counter Trend Trading Strategy

Conclusion

The ICT Midnight Open Strategy offers forex traders a powerful approach to capitalize on the unique opportunities presented by the Asian session opening. By mastering the key components of this strategy and adhering to disciplined trading practices, traders can potentially enhance their profitability and gain a competitive edge in the global forex market.

Remember that success with the ICT Midnight Open Strategy requires dedication, continuous learning, and consistent practice. As with any trading approach, it’s essential to thoroughly backtest and demo trade the strategy before implementing it with real capital. Additionally, always prioritize risk management and maintain a balanced perspective on your trading activities.

By incorporating the insights and techniques outlined in this guide, you’ll be well-equipped to unlock the full potential of the ICT Midnight Open Strategy and take your forex trading to the next level. Stay focused, remain disciplined, and embrace the journey of continuous improvement as you navigate the exciting world of forex trading.

How does the ICT Midnight Open Strategy differ from other forex trading approaches?

The ICT Midnight Open Strategy focuses specifically on the Asian session opening, capitalizing on increased volatility and potential price gaps. It combines market structure analysis, order flow interpretation, and precise timing to identify high-probability trade setups during this particular market phase.

Can the principles of the ICT Midnight Open Strategy be applied to other financial markets besides forex?

While primarily developed for forex, many principles of the ICT Midnight Open Strategy can be adapted to other markets. However, traders should carefully study the unique dynamics of those markets and adjust the strategy accordingly, always backtesting before trading with real capital.