In the fast-paced world of Forex trading, understanding and capitalizing on market volatility is crucial for success. One concept that has gained significant attention among traders is the ICT Killzone Times. These specific periods, identified by the Inner Circle Trader (ICT), represent windows of increased market activity and potential trading opportunities. This article delves into the world of ICT Killzone Times, exploring what they are, when they occur, and how traders working with a broker for forex trading can leverage them to enhance their trading strategies. By mastering these crucial time periods, Forex traders can position themselves to take advantage of heightened market volatility and potentially improve their trading outcomes.

What are ICT Killzones?

ICT Killzones are specific time periods in the Forex market characterized by increased volatility and trading activity. These windows of opportunity, identified by the Inner Circle Trader (ICT), are based on the opening and closing times of major financial centers around the world. During these periods, institutional traders and large market participants are most active, leading to potential price movements and trading opportunities.

The concept of ICT Killzones is rooted in the idea that major market moves often occur during these specific times, as large institutions and banks execute their trades. By understanding and focusing on these periods, retail traders can potentially align their strategies with the “smart money” and capitalize on significant price movements.

The Origin of ICT Killzones

The concept of ICT Killzones was popularized by the anonymous trader known as the Inner Circle Trader. This trader’s approach emphasizes the importance of understanding market structure and institutional order flow. The killzones were identified through extensive market analysis and observation of recurring patterns in trading activity.

Why Killzones Matter

Killzones are significant because they represent times when large institutional players are most active in the market. These institutions, including banks, hedge funds, and other financial entities, have the power to move markets due to the size of their trades. Their activity during these periods can lead to:

- Increased volatility

- Potential trend reversals

- Breakouts from key levels

- Completion of chart patterns

By focusing on these periods, retail traders can potentially “piggyback” on the moves of larger players, increasing their chances of successful trades.

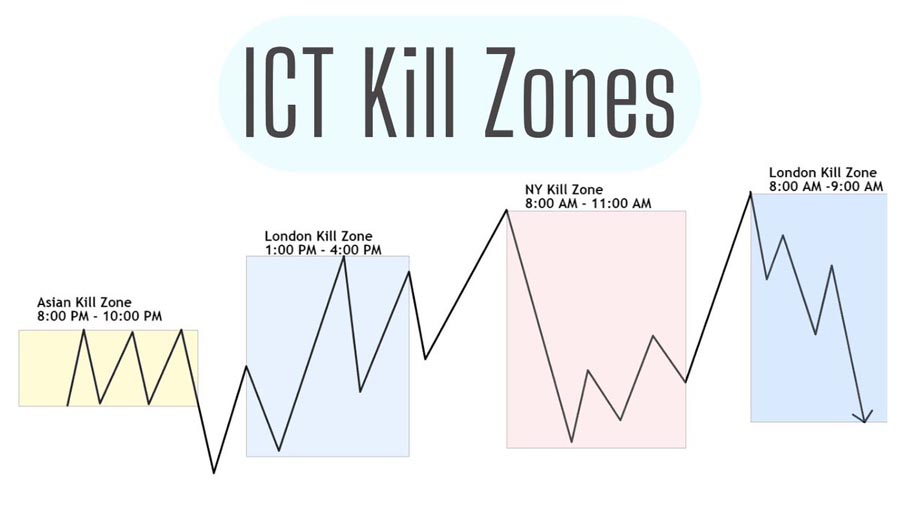

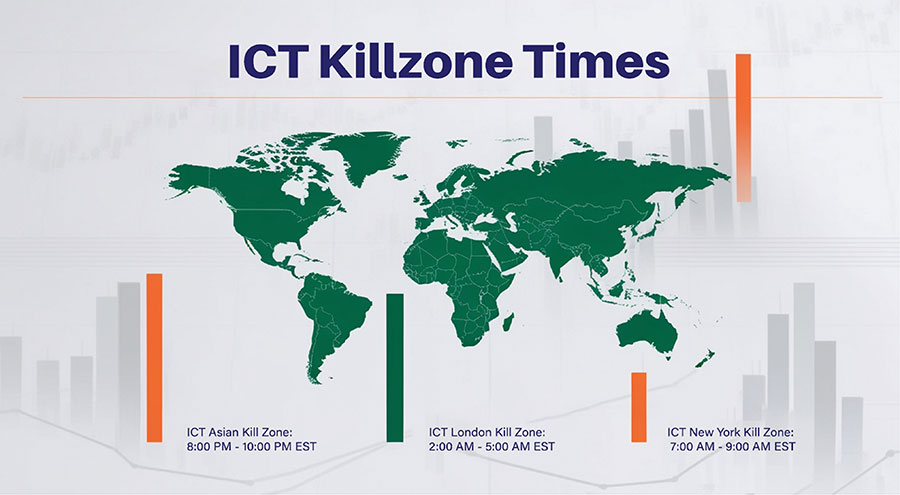

ICT Killzone Times

There are four primary ICT Killzones, each corresponding to the active hours of major financial centers. Here’s a breakdown of these killzones with their corresponding times in Eastern Standard Time (EST):

- ICT Asian Kill Zone: 8:00 PM – 10:00 PM EST This killzone coincides with the opening of the Asian trading session, particularly the Tokyo market. It often sets the tone for the day’s trading and can be influenced by overnight news and economic releases. Key characteristics:

- Often sees moderate volatility

- Can be influenced by Australian and New Zealand economic data

- May show continuation or reversal of trends from the previous day’s close

- ICT London Kill Zone: 2:00 AM – 5:00 AM EST As one of the world’s largest financial centers, London’s opening brings significant volatility to the market. This killzone often sees increased trading volume and potential trend reversals. Key characteristics:

- Typically experiences high volatility

- Major currency pairs involving the Euro and British Pound are particularly active

- Often sees the completion of chart patterns that began forming during the Asian session

- ICT New York Kill Zone: 7:00 AM – 9:00 AM EST The New York session opening is crucial, as it marks the start of trading in the world’s largest economy. This killzone frequently experiences high volatility, especially when combined with important economic data releases. Key characteristics:

- Often the most volatile killzone

- Frequently coincides with major U.S. economic data releases

- Can see significant moves in USD-based currency pairs

- ICT London Close Kill Zone: 10:00 AM – 12:00 PM EST As London traders wind down their day, this killzone can see increased activity as positions are closed or adjusted, potentially leading to price reversals or consolidation. Key characteristics:

- Can see reversals of trends established earlier in the day

- Often experiences a reduction in volatility as the day progresses

- May present opportunities for range-bound trading strategies

Understanding these ICT Killzone times is essential for traders looking to capitalize on periods of heightened market activity. However, it’s important to note that while these times often correspond to increased volatility, they don’t guarantee profitable trading opportunities in every instance.

Read More: ICT Midnight Open Strategy

Overlap Periods

It’s worth noting that some of these killzones overlap with each other, creating periods of even higher potential volatility:

- Asian-London Overlap: 2:00 AM – 4:00 AM EST

- London-New York Overlap: 7:00 AM – 11:00 AM EST

These overlap periods can be particularly interesting for traders as they often see increased liquidity and potential for significant price movements.

Trading with ICT Killzones

Incorporating ICT Killzones into your trading strategy can potentially enhance your ability to identify high-probability trade setups. Here are some key considerations when trading during these periods:

- Higher Time Frame Bias Before entering trades during killzones, it’s crucial to understand the overall market direction on higher time frames. This bias can help you align your trades with the broader market trend, increasing the likelihood of successful outcomes. Example: If the daily chart shows an uptrend, you might look for buying opportunities during killzones rather than trying to short the market.

- Price Action Analysis Pay close attention to price action during killzones. Look for key support and resistance levels, candlestick patterns, and potential breakouts or reversals that may signal trading opportunities. Example: A bullish engulfing pattern forming at a key support level during a killzone could signal a potential buying opportunity.

- Volume and Liquidity Killzones typically feature increased trading volume and liquidity. This can lead to faster price movements and potentially tighter spreads, benefiting traders who are quick to identify and act on opportunities. Tip: Use volume indicators to confirm that price movements during killzones are backed by significant trading activity.

- News and Economic Releases Be aware of important economic data releases that coincide with killzone times. These events can significantly impact market volatility and may present both opportunities and risks. Example: The Non-Farm Payrolls report, released on the first Friday of each month at 8:30 AM EST, often creates significant volatility during the New York Killzone.

- Risk Management While killzones can offer increased trading opportunities, they also come with heightened risk due to increased volatility. Always use proper risk management techniques, including appropriate stop-loss orders and position sizing. Tip: Consider using wider stop-losses during killzones to account for increased volatility, but adjust your position size accordingly to maintain consistent risk levels.

- Multiple Time Frame Analysis Combine your analysis of killzone activity with multiple time frame analysis to get a comprehensive view of market conditions and potential trade setups. Example: Use the 4-hour chart for overall trend direction, the 1-hour chart for killzone analysis, and the 15-minute chart for precise entry timing.

- Trade Entry Opportunities Look for specific trade entry signals during killzones, such as breakouts from key levels, retracements to support or resistance, or the completion of chart patterns. Example: A breakout above a key resistance level during the London Killzone, confirmed by increased volume, could present a potential buying opportunity.

By incorporating these factors into your trading approach, you can potentially use ICT Killzones to identify high-probability trade setups and capitalize on periods of increased market activity.

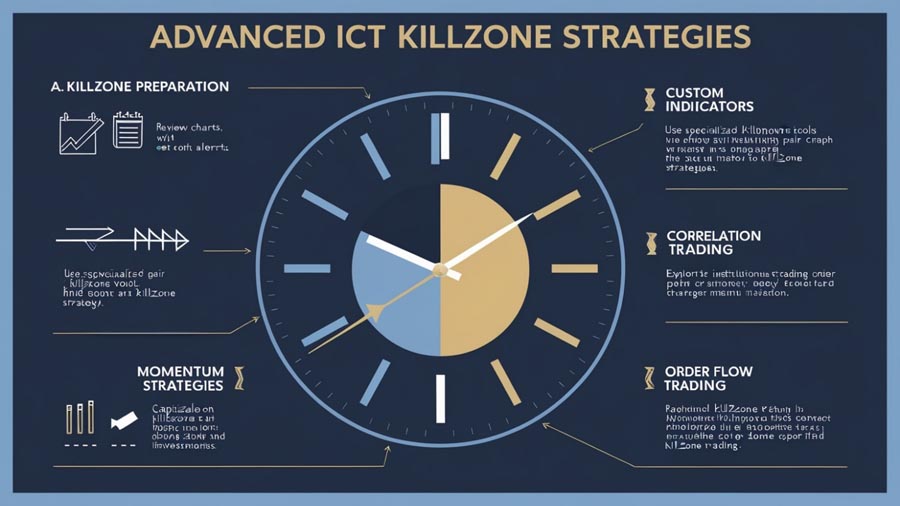

Advanced ICT Killzone Strategies

As traders become more comfortable with the basic concepts of ICT Killzones, they can explore more advanced strategies to refine their approach:

- Killzone Preparation Develop a pre-killzone routine to prepare for potential trading opportunities. This might include reviewing higher time frame charts, identifying key levels, and setting price alerts.

- Killzone-Specific Indicators Some traders use custom indicators designed specifically for killzone trading. These might include modified volatility indicators or tools that highlight historical price action during killzone periods.

- Correlation Trading During killzones, correlations between related currency pairs may strengthen or weaken. Advanced traders can look for opportunities to exploit these changing correlations.

- Order Flow Analysis Some traders attempt to gauge institutional activity during killzones by analyzing order flow data, such as the volume of limit orders at specific price levels.

- Killzone Momentum Strategies Develop strategies that capitalize on the increased momentum often seen during killzones, such as breakout trades or trend-following approaches.

- Counter-Killzone Trading While many traders focus on trading with the increased volatility during killzones, some advanced traders look for opportunities to trade against the crowd, seeking potential reversals at the end of killzone periods.

Read More: Counter Trend Trading Strategy

Additional Considerations

When working with ICT Killzone times, keep the following points in mind:

- Time Zone Differences The killzone times mentioned in this article are based on Eastern Standard Time (EST). Adjust these times according to your local time zone to accurately align with market activity. Tip: Use a Forex market hours tool or world clock to easily track killzone times in your local time zone.

- Seasonal Time Changes Be aware of daylight saving time changes in different countries, as they can affect the exact timing of killzones throughout the year. Example: The timing of the London Killzone relative to EST may shift by an hour when the UK and US switch to and from daylight saving time on different dates.

- Trading Indicators Consider using a trading indicator or tool that visually represents ICT Killzones on your charts. This can help you quickly identify these periods and plan your trades accordingly. Suggestion: Some traders create custom vertical lines or shaded areas on their charts to mark killzone periods.

- Market Conditions Remember that while killzones often correspond to increased volatility, market conditions can vary. Always analyze current market dynamics and adjust your strategy accordingly. Example: During periods of low overall market volatility, such as holiday seasons, killzones may not exhibit their typical characteristics.

- Continuous Learning The concept of ICT Killzones is just one aspect of a comprehensive trading strategy. Continue to educate yourself on various trading techniques and market analysis methods to refine your approach. Suggestion: Keep a trading journal to track your killzone trades and identify patterns in your performance during these periods.

Read More: End of Day Forex Trading Strategy

Conclusion

- ICT Killzone Times offer a unique perspective on Forex market dynamics, providing traders with a framework to potentially capitalize on periods of increased volatility and institutional activity. By understanding the timing and characteristics of these killzones, traders can align their strategies with major market movements and potentially improve their trading outcomes.

- However, it’s crucial to remember that ICT Killzones are not a guaranteed path to trading success. They should be viewed as one tool among many in a comprehensive trading approach. Successful trading requires a combination of technical analysis, fundamental understanding, risk management, and psychological discipline.

- As with any trading strategy, it’s essential to thoroughly test and validate the effectiveness of trading during ICT Killzones for your personal trading style and risk tolerance. Use demo accounts to practice and refine your approach before committing real capital, and always be prepared to adapt your strategy as market conditions evolve.

- By combining the insights provided by ICT Killzones with sound trading principles and continuous learning, traders can work towards developing a robust and potentially profitable approach to the Forex market. Remember, the key to long-term trading success lies not just in identifying opportunities, but in managing risk and continuously refining your skills as a trader.

How do ICT Killzones differ from regular trading sessions?

ICT Killzones are specific windows within trading sessions that often experience heightened volatility and institutional activity. While regular trading sessions span longer periods, killzones focus on the most active times when major financial centers open or close.

Can ICT Killzones be applied to other financial markets besides Forex?

While ICT Killzones were primarily developed for the Forex market, the concept of increased volatility during specific time periods can be applied to other markets. However, the exact timing and effectiveness may vary depending on the market structure and participant behavior.

How should novice traders approach ICT Killzones?

Novice traders should approach ICT Killzones with caution and thorough preparation. It’s advisable to practice identifying these periods on demo accounts, study their characteristics, and gradually incorporate them into a well-rounded trading strategy that includes proper risk management.