In the complex and dynamic world of forex trading, understanding smart money concepts is crucial for achieving consistent success. One of the most critical aspects of smart money trading is the ability to identify liquidity in the forex market. This comprehensive guide will delve deep into how professional traders and institutions (collectively known as “smart money”) approach liquidity and how retail traders can leverage this knowledge to enhance their trading strategies.

Smart money refers to the trading activities of large financial institutions, central banks, hedge funds, and professional traders who possess significant resources, advanced tools, and substantial market influence. These players often create, manipulate, and exploit liquidity pools in the forex market to execute their strategies effectively. By learning how to identify liquidity in forex through the lens of smart money concepts, you can potentially improve your trading decisions, minimize risks, and align your strategies with market-moving forces.

Throughout this article, we’ll explore:

- The fundamental principles of smart money and its relationship with market liquidity

- How smart money creates and interacts with liquidity in the forex market

- Key indicators and tools that help identify smart money liquidity zones

- Advanced techniques for spotting and capitalizing on liquidity pools

- Practical ways to incorporate smart money liquidity concepts into your trading strategy

- Common challenges and mistakes to avoid when applying these concepts

- Tips for successful implementation of smart money liquidity analysis in your trading

Whether you’re new to smart money concepts or looking to refine your understanding and application of these principles, this comprehensive guide will provide valuable insights into how to find, analyze, and utilize liquidity in forex trading from a smart money perspective.

Understanding Smart Money and Liquidity in Forex

To truly grasp the concept of smart money and its relationship with liquidity, it’s essential to understand the motivations and methods of institutional players in the forex market.

The Role of Smart Money in Forex

Smart money participants, including large banks, hedge funds, and central banks, often have access to privileged information, sophisticated analysis tools, and substantial capital. Their primary goals in the forex market include:

- Executing large transactions for clients

- Managing currency reserves

- Speculating on currency movements

- Hedging against currency risks

To achieve these objectives efficiently, smart money players need to operate in environments with sufficient liquidity.

How Smart Money Creates and Interacts with Liquidity

Smart money often creates liquidity zones to facilitate their large-scale trading operations. These zones are areas in the market where significant buying or selling can occur without causing dramatic price movements. Understanding how smart money interacts with liquidity is crucial for several reasons:

- Order Execution: Smart money needs liquidity to enter and exit large positions without significantly impacting the market. They often create liquidity pools to absorb their own orders.

- Price Manipulation: Institutions may create false liquidity pools to attract retail traders before making their real moves. This can lead to stop hunts or fake breakouts.

- Stop Hunt: Smart money often targets areas of high liquidity to trigger stop losses before reversing the market. This allows them to enter positions at more favorable prices.

- Market Stability: Large players provide liquidity that helps maintain overall market stability, especially during times of low retail trading activity.

- Accumulation and Distribution: Smart money uses liquidity to accumulate or distribute large positions over time without alerting the broader market to their intentions.

- Risk Management: By trading in liquid markets, smart money can quickly adjust positions in response to changing market conditions or unexpected events.

To effectively identify liquidity from a smart money perspective, traders need to recognize the footprints of institutional activity and understand how these players operate in the forex market. This involves studying price action, volume, and order flow to detect patterns that suggest smart money involvement.

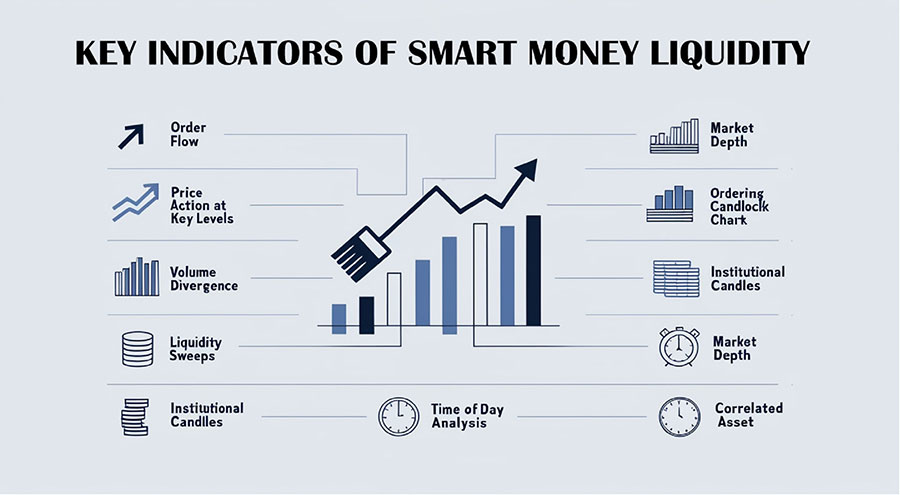

Key Indicators of Smart Money Liquidity

When learning how to identify liquidity in forex market through smart money concepts, consider these key indicators:

- Order Flow Analyze the flow of orders to detect large, institutional-sized trades that may indicate smart money activity. Look for sudden spikes in volume or large individual orders that can signify institutional involvement.

- Price Action at Key Levels Observe how price behaves around significant levels, as smart money often defends or breaks these areas. Watch for strong rejections or quick breakthroughs at major support and resistance levels.

- Volume Divergence Look for instances where volume doesn’t align with price movement, which may signal smart money accumulation or distribution. For example, high volume with little price movement could indicate accumulation.

- Liquidity Sweeps Identify quick price movements that sweep through key levels, often used by smart money to collect liquidity before reversing. These sweeps are typically characterized by sharp, short-lived price spikes.

- Orderblock Formation Recognize the formation of orderblocks, which are areas where smart money initiates large positions. These are often seen as strong candles against the prevailing trend, followed by a period of consolidation.

- Institutional Candles Spot large candles with significant wicks, often indicative of smart money entering or exiting positions. These candles usually have high volume and can signal potential reversals.

- Market Depth Analyze the market depth chart to identify large limit orders that may represent smart money liquidity. Clusters of orders at specific price levels can indicate potential liquidity zones.

- Time of Day Analysis Consider the time of day when analyzing liquidity, as smart money activity often increases during major market opens and overlaps between sessions.

- Correlated Asset Movement Monitor correlated assets for divergences that might indicate smart money activity in one market affecting another.

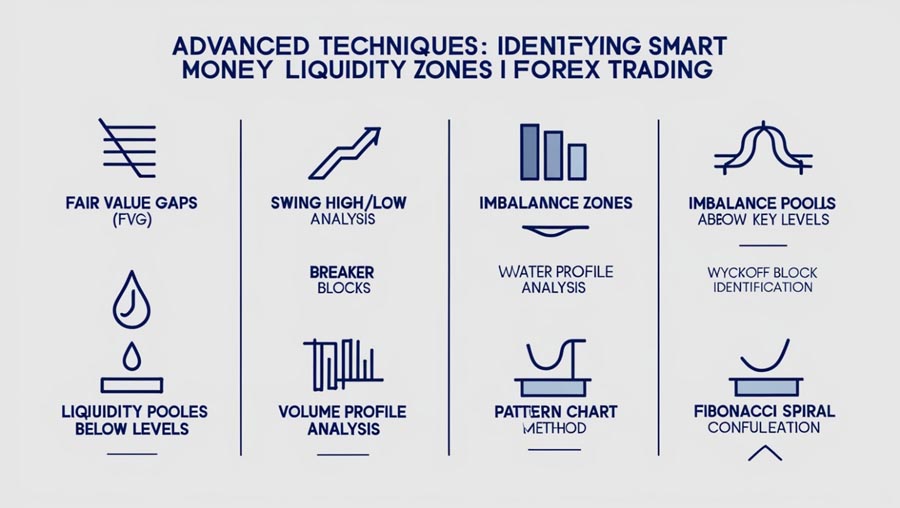

Advanced Techniques for Identifying Smart Money Liquidity Zones

To identify liquidity zones favored by smart money, consider these advanced techniques:

- Fair Value Gaps (FVG) Look for gaps in price that smart money may seek to fill, creating potential liquidity zones. These gaps often occur during low liquidity periods and are filled when liquidity returns to the market.

- Swing High/Low Analysis Identify significant swing points where smart money may place large orders. Pay special attention to swing points that align with other technical levels or round numbers.

- Breaker Blocks Recognize areas where price breaks structure, often used by smart money to enter positions. These blocks typically form after a strong move and can act as support or resistance in future price action.

- Imbalance Zones Spot areas of price imbalance where smart money may seek to restore equilibrium. These zones are characterized by quick, one-sided moves that leave “inefficiencies” in the market.

- Liquidity Pools Above/Below Key Levels Identify areas just beyond significant support and resistance levels where stop orders accumulate. Smart money often targets these pools to trigger stops before reversing the market.

- Volume Profile Analysis Use volume profile to identify high-volume nodes where smart money is likely to be active. These areas often represent zones of interest for institutional players.

- Order Block Identification Learn to spot order blocks, which are areas where smart money initiates positions. These blocks often appear as strong momentum candles against the prevailing trend.

- Wyckoff Method Application Apply Wyckoff method principles to identify accumulation and distribution phases, which often indicate smart money activity.

- Fibonacci Confluence Zones Look for areas where multiple Fibonacci levels converge, as these often attract smart money attention and create liquidity pools.

Using Smart Money Liquidity Information in Trading

Incorporate smart money liquidity concepts into your trading strategy:

- Counter-Trend Trading Look for opportunities to trade against the trend at key liquidity levels where smart money may reverse the market. This can offer high-reward trades if timed correctly.

- Breakout Confirmation Use liquidity sweeps as confirmation for breakout trades. Wait for price to sweep a liquidity zone and then reverse to confirm the breakout’s validity.

- Stop Placement Place stops beyond identified liquidity zones to avoid being caught in stop hunts. This may require wider stops but can protect against premature exit from trades.

- Entry Refinement Enter trades at or near smart money liquidity zones for potentially better price execution. This can improve your risk-to-reward ratio on trades.

- Anticipating Reversals Use identified liquidity zones to anticipate potential market reversals orchestrated by smart money. Look for price action confirmation before entering reversal trades.

- Scale-In Approach Consider scaling into positions around major liquidity zones to potentially capture better average entry prices.

- Time-Based Exits Use knowledge of when smart money is most active to time your exits, potentially avoiding unfavorable price movements during low liquidity periods.

- Correlation Trading Apply your understanding of smart money liquidity across correlated currency pairs to identify potential opportunities or confirm trade ideas.

Challenges and Common Mistakes

Be aware of these challenges when applying smart money liquidity concepts:

- Overcomplicating Analysis Avoid using too many indicators or concepts simultaneously. Focus on clear, high-probability setups to prevent analysis paralysis.

- Ignoring Fundamental Factors Remember that smart money also reacts to fundamental data. Don’t rely solely on technical analysis; consider the broader economic context.

- Misinterpreting Normal Market Fluctuations Not every price movement is smart money manipulation. Learn to distinguish between significant moves and normal market noise.

- Overlooking Time Frames Smart money operates across multiple time frames. Ensure your analysis considers both higher and lower time frames for a complete picture.

- Emotional Trading Don’t let the idea of “beating” smart money cloud your judgment. Stick to your trading plan and risk management rules.

- Neglecting Practice Identifying smart money liquidity takes practice. Spend time analyzing charts and back-testing strategies before risking real capital.

- Overconfidence Even with a solid understanding of smart money concepts, the market can be unpredictable. Maintain humility and always be prepared for unexpected moves.

Tips for Successful Liquidity Analysis

To enhance your skills in how to identify liquidity in forex trading, consider these tips:

- Practice Consistently Regular practice is key to mastering how to identify liquidity in forex. Use demo accounts to hone your skills.

- Keep a Trading Journal Document your observations as you learn how to find liquidity in forex. This will help you recognize patterns over time.

- Stay Informed Keep up with market news and events that can impact how to identify liquidity zones in forex.

- Continuous Learning The forex market evolves, so should your understanding of how to identify liquidity in forex market. Stay open to new concepts and strategies.

Conclusion

Mastering how to identify liquidity in forex trading through smart money concepts can significantly enhance your trading performance. By understanding how large institutions create and interact with liquidity, you can potentially align your trading with market-moving forces and improve your decision-making process.

Remember that smart money liquidity analysis is just one aspect of a comprehensive trading strategy. Combine these concepts with sound risk management, fundamental analysis, and continuous learning to develop a robust approach to forex trading.

As you continue to study and apply these principles, you’ll likely find that your ability to read the market and anticipate potential moves improves. However, always remain humble and adaptable, as the forex market is dynamic and can present unexpected challenges.

Ultimately, successful trading comes from a combination of knowledge, experience, and disciplined execution. Use the smart money liquidity concepts outlined in this guide as a foundation, but continue to develop and refine your own unique approach to the forex market.

How does the concept of smart money liquidity differ from traditional liquidity analysis?

Smart money liquidity analysis focuses on identifying areas where large institutional players are likely to be active, rather than just looking at overall market liquidity. It involves understanding the tactics and patterns of professional traders and institutions, and how they create and exploit liquidity pools. Traditional liquidity analysis might focus more on general market depth and volume, while smart money analysis delves deeper into the motivations and strategies behind institutional order flow.

Can retail traders really benefit from understanding smart money liquidity concepts?

Yes, retail traders can benefit significantly from understanding smart money liquidity. While they may not have the same resources as institutional players, recognizing smart money patterns and liquidity zones can help retail traders make more informed decisions and potentially align their trades with market-moving forces. This knowledge can improve trade timing, stop placement, and overall strategy development.

How often do smart money liquidity zones change in the forex market?

Smart money liquidity zones can change frequently, depending on market conditions, economic events, and the strategies of large players. Some zones may persist for extended periods, especially around key psychological levels or significant support/resistance areas, while others may shift rapidly. Continuous monitoring and analysis are necessary to stay updated on current smart money liquidity zones. It’s important to reassess these zones regularly, especially after major economic releases or significant market moves.