Forex fundamental trading strategies are essential tools for traders looking to make informed decisions in the dynamic world of currency exchange. These strategies focus on analyzing economic, social, and political factors that influence currency values, providing a solid foundation for profitable trades. In this comprehensive guide, we’ll explore seven powerful fundamental forex trading strategies that can help you unlock success in the forex market. By understanding and implementing these techniques, you’ll be better equipped to navigate the complexities of fundamental analysis and make more informed trading decisions. Whether you’re a novice trader or an experienced professional, mastering these fundamental forex trading strategies will undoubtedly enhance your trading prowess and potentially boost your profits.

The 7 Most Effective Forex Fundamental Trading Strategies

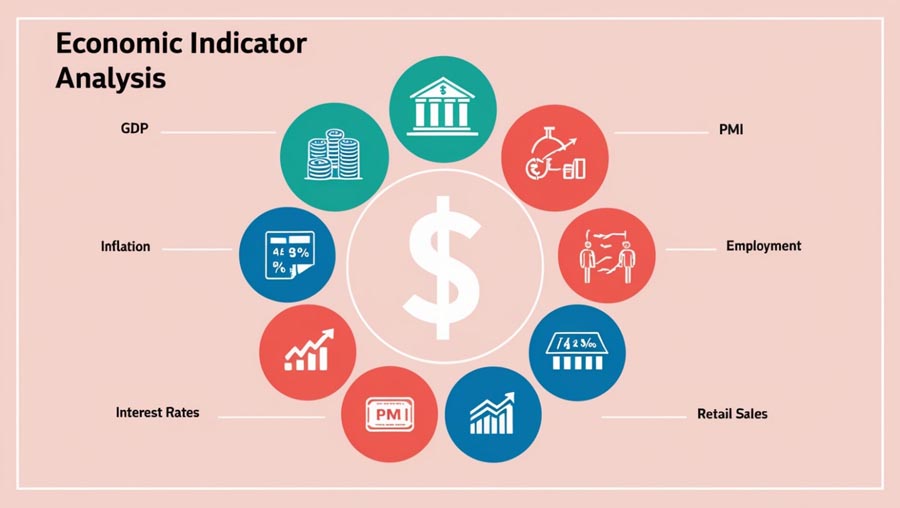

1. Economic Indicator Analysis

One of the cornerstone fundamental forex trading strategies is analyzing economic indicators. These data points provide invaluable insights into a country’s economic health and can significantly impact currency values. Key indicators to watch include:

- Gross Domestic Product (GDP): This measure of a country’s total economic output is a crucial indicator of economic growth or contraction. A rising GDP generally supports a stronger currency, while a declining GDP may lead to currency depreciation.

- Inflation rates: Measured by indices like the Consumer Price Index (CPI) or Producer Price Index (PPI), inflation rates can influence central bank policies and, consequently, currency values. Higher inflation often leads to currency depreciation, while controlled inflation can support currency strength.

- Employment figures: Data such as the unemployment rate, non-farm payrolls, and job creation numbers provide insights into the labor market’s health. Strong employment figures typically support currency appreciation.

- Interest rates: Central bank interest rate decisions have a direct impact on currency values. Higher interest rates tend to attract foreign investment, strengthening the currency, while lower rates may lead to currency depreciation.

- Retail sales: This indicator reflects consumer spending patterns and overall economic health. Strong retail sales figures often support currency appreciation.

- Purchasing Managers’ Index (PMI): This survey-based indicator provides insights into the manufacturing and services sectors. A PMI above 50 indicates expansion, which is generally positive for the currency.

By closely monitoring these indicators and understanding their implications, traders can anticipate potential currency movements and position themselves accordingly. It’s important to note that the impact of economic indicators can vary depending on market expectations. Often, it’s not just the actual figures that matter, but how they compare to forecasts and previous readings.

To effectively use economic indicator analysis, consider the following tips:

- Maintain an economic calendar to track upcoming releases.

- Understand the historical context and trends of each indicator.

- Consider the potential interplay between different economic indicators.

- Be prepared for market volatility around major indicator releases.

2. Central Bank Policy Tracking

Central banks play a crucial role in shaping monetary policy, which directly affects currency values. Fundamental traders pay close attention to:

- Interest rate decisions: Changes in interest rates can have immediate and significant impacts on currency values. Higher rates typically attract foreign investment, strengthening the currency.

- Quantitative easing programs: These unconventional monetary policies, involving large-scale asset purchases, can lead to currency depreciation by increasing the money supply.

- Forward guidance statements: Central banks often provide insights into future policy directions, which can influence market expectations and currency values.

- Minutes from monetary policy meetings: These documents offer detailed insights into the decision-making process and can provide clues about future policy changes.

- Speeches by central bank officials: Public statements by key figures like the central bank governor can move markets and influence currency values.

By analyzing central bank communications and policy changes, traders can gauge the potential direction of a currency pair and make informed trading decisions. It’s crucial to understand that central bank policies often have long-lasting effects on currency values and can set the tone for extended trends in the forex market.

To effectively track central bank policies:

- Follow official central bank websites and social media channels.

- Attend or watch live streams of press conferences following policy decisions.

- Read and analyze monetary policy statements and meeting minutes.

- Consider the broader economic context in which policy decisions are made.

- Be aware of the potential for policy divergence between different central banks.

3. Geopolitical Event Analysis

Political events and geopolitical tensions can have a significant impact on currency values. Fundamental traders stay informed about:

- Elections: The outcome of national elections can lead to significant policy changes, affecting economic outlook and currency values.

- Trade agreements: New trade deals or the dissolution of existing agreements can impact economic relationships between countries and influence currency values.

- International conflicts: Geopolitical tensions or outright conflicts can create uncertainty, often leading to currency volatility.

- Policy changes: Shifts in government policies related to taxation, regulation, or international relations can affect a country’s economic prospects and its currency.

- Diplomatic relations: Changes in relationships between countries can impact trade, investment flows, and currency values.

- Brexit-like events: Major political shifts that affect economic integration or isolation can have long-lasting impacts on currencies.

By understanding the potential consequences of these events, traders can anticipate market reactions and adjust their strategies accordingly. It’s important to note that geopolitical events can sometimes overshadow economic fundamentals in the short term, leading to rapid and significant currency movements.

To effectively analyze geopolitical events:

- Stay informed through reputable international news sources.

- Understand the historical context of ongoing geopolitical situations.

- Consider the potential economic impacts of political events.

- Be prepared for increased volatility during major political developments.

- Analyze how different currencies might be affected by the same geopolitical event.

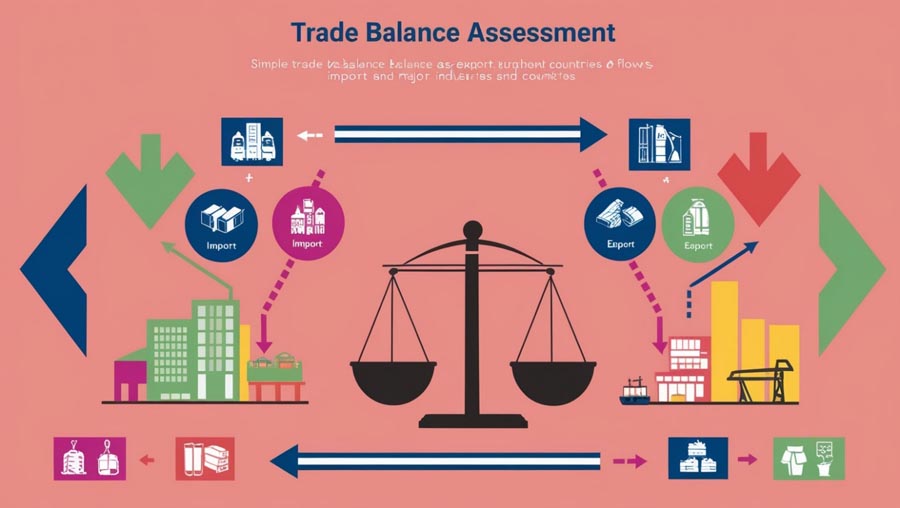

4. Trade Balance Assessment

A country’s trade balance, which measures the difference between its exports and imports, can provide valuable insights into currency strength. Fundamental traders analyze:

- Trade deficit or surplus trends: A persistent trade surplus often supports currency strength, while chronic deficits may lead to depreciation.

- Major import/export partners: Understanding a country’s key trading relationships can help predict how external events might impact its currency.

- Changes in trade policies: New tariffs, trade agreements, or sanctions can significantly affect a country’s trade balance and currency value.

- Commodity prices: For countries that are major exporters of specific commodities, price fluctuations in these goods can impact the trade balance and currency value.

- Global demand patterns: Changes in international demand for a country’s goods and services can influence its trade balance and currency strength.

A strong trade balance often correlates with a stronger currency, while persistent deficits may lead to currency depreciation. However, it’s important to consider the trade balance in conjunction with other economic factors, as its impact can sometimes be offset by capital flows or other economic dynamics.

To effectively assess trade balances:

- Regularly review trade balance reports from national statistical agencies.

- Understand the composition of a country’s exports and imports.

- Monitor global economic trends that might impact demand for a country’s goods and services.

- Consider how changes in exchange rates might affect future trade balances.

- Analyze the potential impact of trade policies on long-term trade balance trends.

5. Market Sentiment Analysis

Understanding market sentiment is crucial for fundamental forex traders. This strategy involves:

- Monitoring financial news and media: Regular analysis of financial news can provide insights into prevailing market attitudes and potential trend shifts.

- Analyzing social media trends: Platforms like Twitter can offer real-time insights into trader sentiment and potential market movements.

- Assessing institutional investor behavior: Large-scale buying or selling by institutional investors can indicate shifts in market sentiment.

- Tracking positioning data: Reports like the Commitment of Traders (COT) can provide insights into how different market participants are positioned.

- Analyzing volatility indices: Measures like the VIX (for stock markets) can indicate overall market sentiment and potential currency impacts.

- Monitoring risk-on/risk-off dynamics: Understanding how investors are balancing risk can provide insights into potential currency movements.

By gauging overall market sentiment, traders can identify potential turning points and capitalize on shifts in investor confidence. It’s important to remember that sentiment can sometimes diverge from fundamental realities, potentially creating opportunities for contrarian traders.

To effectively analyze market sentiment:

- Use sentiment indicators in combination with other analytical tools.

- Be aware of potential sentiment extremes that might signal market reversals.

- Consider how different news events might impact market sentiment.

- Analyze sentiment across different timeframes to identify potential trends.

- Be prepared to adjust your strategy if sentiment shifts rapidly.

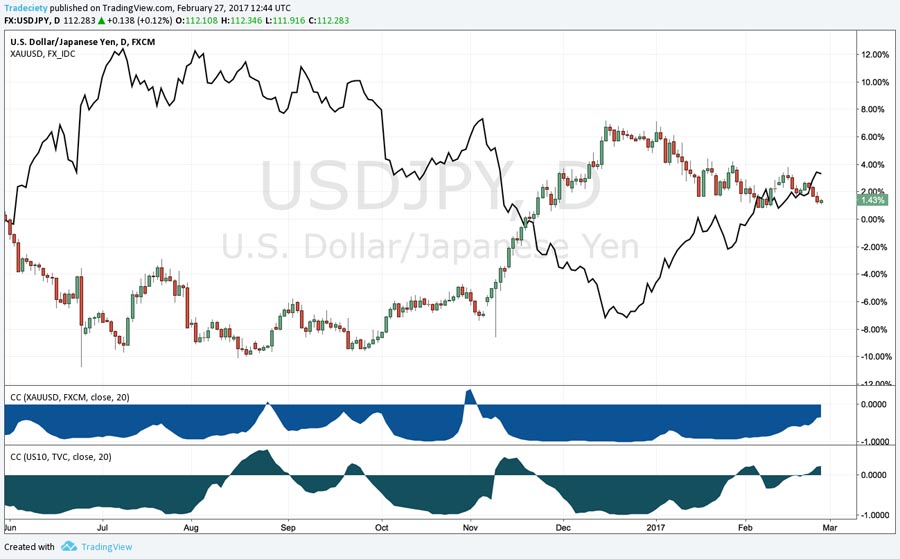

6. Correlation Analysis

Currencies often move in relation to other financial instruments, such as commodities or stock indices. Fundamental traders study:

- Currency pair correlations: Understanding how different currency pairs move in relation to each other can help in diversification and risk management.

- Commodity price movements: Currencies of commodity-exporting countries often correlate with the prices of their major exports (e.g., the Canadian dollar and oil prices).

- Global equity market trends: Risk-on/risk-off sentiment in equity markets can impact currency values, particularly for safe-haven currencies.

- Bond yield differentials: Differences in government bond yields between countries can drive currency movements.

- Economic growth correlations: Currencies of countries with closely linked economies often show correlated movements.

By identifying and leveraging these correlations, traders can make more informed decisions and potentially diversify their trading strategies. It’s important to note that correlations can change over time, so regular reassessment is necessary.

To effectively use correlation analysis:

- Regularly calculate and update correlation coefficients between currency pairs and other assets.

- Be aware of the fundamental reasons behind observed correlations.

- Use correlation data to inform portfolio diversification strategies.

- Consider how changes in one market might impact correlated assets.

- Be prepared for correlations to break down during periods of market stress.

7. Long-Term Trend Analysis

While many traders focus on short-term fluctuations, fundamental analysis excels in identifying long-term trends. This strategy involves:

- Analyzing multi-year economic cycles: Understanding where an economy is in its long-term growth cycle can provide insights into potential currency trends.

- Assessing structural changes in economies: Major shifts, such as transitions from manufacturing to service-based economies, can drive long-term currency trends.

- Evaluating long-term policy shifts: Changes in government or central bank policies can set the stage for extended currency movements.

- Demographic trend analysis: Long-term population changes can impact economic growth and currency values.

- Technological advancement assessment: Countries leading in technological innovation may see long-term currency appreciation.

By taking a broader perspective, traders can position themselves to benefit from major economic trends and potentially reduce the impact of short-term market noise. Long-term trend analysis can be particularly useful for position traders or investors looking to make strategic currency allocation decisions.

To effectively analyze long-term trends:

- Regularly review long-term economic forecasts from reputable sources.

- Consider the potential impact of technological disruptions on different economies.

- Analyze demographic trends and their potential economic impacts.

- Be aware of long-term shifts in global economic power and their currency implications.

- Use long-term trend analysis to provide context for shorter-term trading decisions.

Opofinance Services

The Opofinance social trading platform brings a new world of trading to you. By following professional traders and copying their trades, you can trade like them and benefit from their experiences. This innovative platform allows you to review the trading histories of successful traders, copy their trades into your own account, and achieve sustainable profits in this way.

Regulation and Reliability

Opofinance has obtained regulation from ASIC Australia and has become an onshore broker. This ensures a high level of security and reliability for your trading activities.

Professional Tools for Market Analysis and Risk Control

In addition, Opofinance provides professional tools for market analysis and risk control, making your trading easier and more secure.

Conclusion

Mastering forex fundamental trading strategies is essential for success in the currency markets. By implementing the seven powerful strategies outlined in this article – economic indicator analysis, central bank policy tracking, geopolitical event analysis, trade balance assessment, market sentiment analysis, correlation analysis, and long-term trend analysis – you’ll be better equipped to navigate the complexities of forex trading.

Remember, successful fundamental trading requires patience, diligence, and continuous learning. Stay informed about global economic events, develop a systematic approach to analyzing data, and always be prepared to adapt your strategies as market conditions evolve. With practice and persistence, you can harness the power of fundamental analysis to make more informed trading decisions and potentially improve your forex trading results.

Start incorporating these fundamental forex trading strategies into your trading plan today, and take the first step towards unlocking your potential for forex success. The world of currency trading awaits – are you ready to seize the opportunities it presents?

How can I effectively combine technical and fundamental analysis in forex trading?

Combine fundamental analysis for overall market direction and technical analysis for entry/exit points. Use economic indicators to determine long-term trends, then apply chart patterns or technical indicators for precise timing.

What are some reliable sources for fundamental forex data and analysis?

Utilize official central bank websites, economic calendars from reputable financial sites, government statistical agencies, international organizations like the IMF, and trusted financial news outlets such as Bloomberg and Reuters.

How often should I update my fundamental analysis when trading forex?

The frequency depends on your trading timeframe. Long-term traders may review weekly or monthly, while day traders should update daily. Always be prepared to reassess when significant events occur.