Are you a busy professional looking to capitalize on the forex market without dedicating hours to your trading screen? Look no further! This comprehensive guide unveils the power of a 30-minute forex trading strategy that can revolutionize your approach to the currency markets. By implementing this time-efficient method, you can potentially boost your profits while maintaining a healthy work-life balance.

A 30-minute forex trading strategy is a structured approach to analyzing and executing trades within a compact timeframe, typically focusing on the most active trading sessions. This strategy allows traders to capitalize on short-term market movements while minimizing the time investment required for successful trading. By concentrating on key currency pairs and utilizing price action techniques, traders can make informed decisions quickly and efficiently.

In this article, we’ll delve into the intricacies of this powerful strategy, exploring its benefits, implementation techniques, and essential tools for success. Whether you’re a seasoned trader looking to optimize your time or a newcomer eager to enter the forex market, this 30-minute strategy could be the game-changer you’ve been searching for.

Understanding the 30-Minute Forex Trading Strategy

What Is a 30-Minute Forex Trading Strategy?

At its core, a 30-minute forex trading strategy is designed to identify and capitalize on short-term market trends within a focused time window. This approach typically involves:

- Analyzing currency pairs during specific 30-minute intervals

- Utilizing price action techniques for short-term analysis

- Implementing strict entry and exit rules

- Managing risk effectively within a compressed timeframe

Benefits of a 30-Minute Trading Approach

- Time Efficiency: Perfect for busy professionals with limited trading time

- Reduced Emotional Involvement: Less time to overthink or second-guess decisions

- Frequent Opportunities: Multiple trading setups available throughout the day

- Improved Focus: Concentrated analysis leads to sharper decision-making

- Work-Life Balance: Allows for a structured trading routine without sacrificing personal time

Key Components of a Successful 30-Minute Forex Strategy

1. Choosing the Right Currency Pairs

For a 30-minute strategy to be effective, focus on major currency pairs with high liquidity and tight spreads. Popular choices include:

- EUR/USD

- GBP/USD

- USD/JPY

- USD/CHF

These pairs offer ample volatility and trading opportunities within short timeframes.

2. Identifying Optimal Trading Sessions

The forex market operates 24 hours a day, but not all hours are created equal. For a 30-minute strategy, concentrate on the most active trading sessions:

- London Session (3:00 AM – 12:00 PM EST)

- New York Session (8:00 AM – 5:00 PM EST)

- Overlap between London and New York (8:00 AM – 12:00 PM EST)

These periods typically offer the most liquidity and price movement, ideal for short-term strategies.

3. Essential Price Action Techniques

Incorporate these powerful price action techniques into your 30-minute strategy:

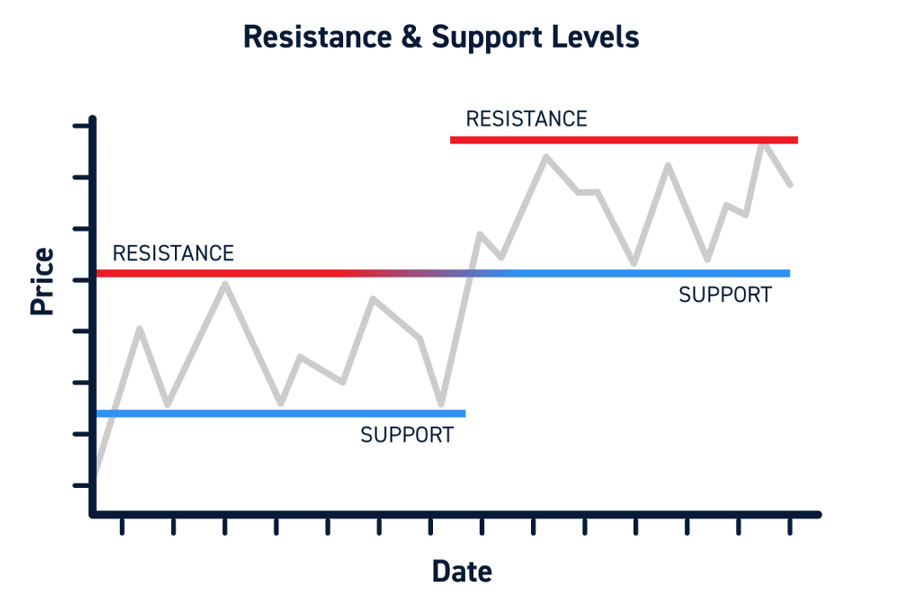

- Support and Resistance Levels: Identify key price levels where the market has previously reversed

- Trend Lines: Draw lines connecting highs or lows to visualize the current trend

- Candlestick Patterns: Recognize patterns like pin bars, engulfing candles, and doji formations

- Chart Patterns: Look for formations such as triangles, flags, and head and shoulders patterns

4. Entry and Exit Rules

Establish clear guidelines for entering and exiting trades:

- Entry: Look for confluence between multiple price action signals (e.g., a pin bar at a key support level)

- Exit: Set predefined take-profit and stop-loss levels based on recent price action and support/resistance levels

- Trailing Stop: Consider implementing a trailing stop to protect profits as the trade moves in your favor

5. Risk Management

Proper risk management is crucial in any trading strategy, especially in short timeframes:

- Limit risk to 1-2% of your account balance per trade

- Use a risk-reward ratio of at least 1:1.5, preferably 1:2 or higher

- Implement a daily stop-loss to prevent overtrading or chasing losses

30 Minute Forex Trading Strategies

Here are three effective 30-minute forex trading strategies that focus on price action:

1. The Momentum Breakout Strategy

This strategy capitalizes on strong price movements following a period of consolidation.

Steps:

- Identify a consolidation pattern on the 30-minute chart (e.g., a triangle or range)

- Wait for a breakout in either direction

- Enter the trade in the direction of the breakout

- Set a stop-loss just below the breakout level

- Target a take-profit at the next significant support/resistance level

2. The Reversal Candlestick Strategy

This approach focuses on identifying potential trend reversals using specific candlestick patterns.

Steps:

- Look for strong trending moves on the 30-minute chart

- Identify reversal candlestick patterns at key support/resistance levels (e.g., pin bars, engulfing patterns)

- Enter a trade in the direction of the potential reversal

- Place a stop-loss beyond the reversal candlestick’s high/low

- Set a take-profit at the next significant support/resistance level

3. The Trendline Bounce Strategy

This strategy aims to catch continuation moves within an established trend.

Steps:

- Identify a clear trend on the 30-minute chart

- Draw a trendline connecting the swing highs (downtrend) or lows (uptrend)

- Wait for price to pull back to the trendline

- Look for a rejection candlestick at the trendline (e.g., a pin bar or engulfing candle)

- Enter a trade in the direction of the main trend

- Set a stop-loss below the rejection candlestick

- Target a take-profit at the previous swing high/low

4. The Support and Resistance Bounce Strategy

This strategy capitalizes on price reactions at key support and resistance levels.

Steps:

- Identify strong support and resistance levels on the 30-minute chart

- Wait for price to approach these levels

- Look for confirmation candlesticks (e.g., dojis, hammers, or shooting stars)

- Enter a trade in the direction of the expected bounce

- Place a stop-loss just beyond the support or resistance level

- Set a take-profit at the next significant level or use a risk-reward ratio of 1:2

Key considerations:

- The strength of support/resistance increases with the number of times it has been tested

- Combine this strategy with overall trend direction for higher probability trades

- Be cautious of false breakouts; wait for confirmation before entering

5. The Moving Average Crossover Strategy

While this strategy uses a simple indicator, it’s based on price action principles and can be effective in trending markets.

Steps:

- Apply two moving averages to your 30-minute chart (e.g., 10-period and 20-period EMAs)

- Look for crossovers between the two moving averages

- Enter a long trade when the faster MA crosses above the slower MA

- Enter a short trade when the faster MA crosses below the slower MA

- Place a stop-loss at the recent swing low/high before the crossover

- Set a take-profit at the next significant support/resistance level

Key considerations:

- This strategy works best in trending markets; avoid using it in ranging conditions

- Combine with price action confirmations, such as breakouts or pullbacks to the moving averages

- Be aware of potential whipsaws in volatile markets

- Adjust the moving average periods based on your testing and preferences

When implementing these strategies, remember that no single approach works in all market conditions. It’s essential to:

- Practice extensively on a demo account before risking real capital

- Keep a trading journal to track your results and refine your approach

- Stay disciplined and adhere to your risk management rules

- Be prepared to adapt your strategy as market conditions change

Implementing Your 30-Minute Forex Trading Strategy

Step 1: Preparation (5 minutes)

- Review economic calendars for potential market-moving events

- Check for any significant news or geopolitical developments

- Analyze longer timeframes (1-hour, 4-hour) to understand the broader market context

Step 2: Chart Analysis (10 minutes)

- Load your chosen currency pair’s 30-minute chart

- Identify key support and resistance levels

- Draw relevant trendlines and chart patterns

- Look for potential trade setups based on your chosen strategy

Step 3: Trade Execution (5 minutes)

- If a valid setup is identified, place your trade with predetermined entry, stop-loss, and take-profit levels

- Double-check your position size to ensure proper risk management

- Set any necessary alerts or notifications

Step 4: Monitoring and Adjustment (10 minutes)

- Monitor open positions for potential adjustments (e.g., moving stop-loss to breakeven)

- Look for opportunities to scale in or out of positions

- Be prepared to close trades early if market conditions change rapidly

Advanced Techniques for 30-Minute Forex Trading

1. Multiple Timeframe Analysis

While focusing on the 30-minute chart, incorporate higher timeframes to confirm trends:

- 1-hour chart for overall trend direction

- 4-hour chart for key support and resistance levels

- Daily chart for major market structure

2. Volume Analysis

Incorporate volume data to confirm price action signals:

- Look for increasing volume during breakouts

- Be cautious of price movements on low volume

- Use volume to identify potential reversals

3. Market Structure

Pay attention to the overall market structure:

- Higher highs and higher lows indicate an uptrend

- Lower highs and lower lows suggest a downtrend

- Alternating highs and lows may signal a ranging market

4. Sentiment Analysis

Incorporate market sentiment indicators to gauge overall trader positioning:

- Commitment of Traders (COT) report

- Retail sentiment data from brokers

- Put/Call ratios for currency options

5. Automated Alerts

Utilize trading platform features or third-party tools to set up automated alerts for:

- Price levels

- Candlestick patterns

- Volatility spikes

- News releases

This allows you to stay informed without constantly watching the charts.

Common Pitfalls to Avoid in 30-Minute Forex Trading

- Overtrading: Resist the urge to take every potential setup

- Ignoring the bigger picture: Don’t neglect longer-term trends and key levels

- Emotional decision-making: Stick to your predefined rules and avoid impulsive trades

- Neglecting risk management: Always prioritize capital preservation over potential gains

- Failure to adapt: Be prepared to adjust your strategy as market conditions evolve

Tools and Resources for Successful 30-Minute Trading

- Economic Calendars: Stay informed about upcoming events that could impact your trades

- Trading Journals: Track your performance and identify areas for improvement

- VPS (Virtual Private Server): Ensure consistent execution and reduce latency

- Chart Drawing Tools: Utilize trendlines, Fibonacci retracements, and other visual aids

- Position Size Calculators: Quickly determine appropriate lot sizes based on your risk parameters

Developing Your Own 30-Minute Forex Strategy

While the guidelines provided here offer a solid foundation, the most successful traders often develop personalized strategies. Consider these steps to create your own 30-minute forex trading approach:

- Backtesting: Use historical data to evaluate potential strategies

- Paper Trading: Practice with a demo account to refine your approach

- Continuous Learning: Stay updated on market trends and trading techniques

- Performance Analysis: Regularly review your trading results to identify strengths and weaknesses

- Gradual Implementation: Start with small position sizes and gradually increase as you gain confidence

OpoFinance Services: Your Trusted Forex Trading Partner

As you embark on your 30-minute forex trading journey, partnering with a reliable and regulated broker is crucial. OpoFinance, an ASIC-regulated broker, offers a comprehensive suite of services tailored to meet the needs of both novice and experienced traders. With cutting-edge trading platforms, competitive spreads, and a wide range of tradable instruments, OpoFinance provides the tools and support necessary for successful forex trading.

Key benefits of trading with OpoFinance include:

- Advanced trading platforms optimized for fast execution

- Educational resources to enhance your trading skills

- 24/5 customer support from experienced professionals

- Strict regulatory compliance ensuring the safety of your funds

- Competitive spreads and low trading costs

By choosing OpoFinance as your forex broker, you can focus on implementing your 30-minute trading strategy with confidence, knowing that you have a trusted partner supporting your trading journey.

Conclusion

Mastering a 30-minute forex trading strategy can be a game-changer for busy professionals seeking to capitalize on the currency markets. By focusing on key currency pairs, utilizing powerful price action techniques, and implementing strict risk management protocols, traders can potentially achieve consistent profits while maintaining a balanced lifestyle.

Remember, success in forex trading requires dedication, continuous learning, and disciplined execution. As you implement this 30-minute strategy, remain patient and adaptable, always prioritizing risk management and long-term profitability over short-term gains.

With practice and persistence, you can develop a powerful 30-minute forex trading strategy that aligns with your goals and trading style. Embrace the journey, stay committed to improvement, and watch as your trading skills flourish in the dynamic world of forex.

Can I use a 30-minute forex trading strategy with a full-time job?

Yes, a 30-minute forex trading strategy is particularly well-suited for those with full-time jobs. By focusing on specific trading sessions and utilizing efficient analysis techniques, you can potentially profit from the forex market without interfering with your work schedule. Consider trading during your lunch break or after work hours, aligning your strategy with the most active market sessions that fit your availability.

How much capital do I need to start with a 30-minute forex trading strategy?

The capital required to start with a 30-minute forex trading strategy can vary depending on your risk tolerance and financial situation. While some brokers offer micro-accounts with minimal deposits, it’s generally recommended to start with at least $1,000 to $5,000. This allows for proper risk management and provides a buffer against potential losses. Remember, it’s crucial to only trade with money you can afford to lose and to start with smaller position sizes as you gain experience.

Is automated trading suitable for a 30-minute forex strategy?

Automated trading can be suitable for a 30-minute forex strategy, but it requires careful consideration and testing. While automation can execute trades based on predefined rules without emotional interference, it’s essential to thoroughly backtest and forward test any automated system before using it with real money. Additionally, automated strategies may require regular monitoring and adjustments to adapt to changing market conditions. For many traders, a semi-automated approach—using automation for alerts and analysis while maintaining manual control over trade execution—can be an effective compromise for a 30-minute strategy.