The liquidity sweep trading strategy is a powerful forex trading technique that capitalizes on the movement of large institutional orders in the market. This strategy involves identifying areas of high liquidity, anticipating price movements as these areas are swept, and executing trades based on these sweeps. By mastering liquidity zones and recognizing liquidity sweeps, forex traders can gain a competitive edge in the volatile currency markets, potentially uncovering secrets to market success.

In the fast-paced world of forex trading, understanding market dynamics is crucial for success. The liquidity sweep trading strategy offers a unique approach to navigating these dynamics. It focuses on the lifeblood of the market – liquidity – and how it influences price movements. This strategy goes beyond traditional technical analysis, providing traders with insights into the underlying forces driving market behavior.

For those new to the concept, liquidity in trading refers to the money or large counter orders that need to be fulfilled in the market. The liquidity sweep trading strategy involves identifying areas of high liquidity, known as “liquidity pools,” and anticipating price movements as these areas are swept. By understanding this strategy, traders can position themselves for favorable price movements and potentially improve their trading outcomes.

As you embark on your journey to master this strategy, it’s crucial to partner with a reliable online forex broker who can provide the necessary tools and support. A regulated forex broker can offer the platform stability, execution speed, and market access required to effectively implement the liquidity sweep trading strategy. With the right knowledge, resources, and broker partnership, the liquidity sweep trading strategy can become a game-changing addition to your forex trading arsenal, helping you uncover the secrets to market success.

Read more: Mastering ICT Liquidity Pool Trading

Understanding Liquidity in Forex Markets

Before diving into the specifics of the liquidity sweep trading strategy, it’s essential to grasp the concept of liquidity in forex markets.

What is Liquidity?

Liquidity refers to the money or large counter orders that need to be fulfilled in the market. It acts as the lifeblood of the market, influencing its overall dynamics and functioning. The market continually seeks to absorb this liquidity to generate momentum.

The Importance of Liquidity

High liquidity is crucial for several reasons:

- Facilitates smoother price movements

- Enables faster execution of trades

- Reduces slippage

- Enhances market stability

Identifying Liquidity Areas

Identifying liquidity areas is a crucial skill for traders employing the liquidity sweep strategy. These areas represent potential turning points in the market and can provide valuable insights into future price movements. Let’s explore the common liquidity areas in more detail:

- Equal Lows and Swing Lows

- Equal lows are formed when price reaches the same low point multiple times

- Swing lows are significant low points in price action

- Liquidity often accumulates below these levels as stop-loss orders cluster there

- A break below these levels can trigger a cascade of sell orders, leading to a sharp move down

- Equal Highs and Swing Highs

- Similar to equal lows, equal highs occur when price reaches the same high point multiple times

- Swing highs are significant high points in price action

- Liquidity pools above these levels as stop-loss orders and buy orders accumulate

- A break above can lead to a rapid upward movement as orders are triggered

- Dynamic Trend Lines and Channels

- Trend lines connect a series of higher lows (in an uptrend) or lower highs (in a downtrend)

- Channels are formed by parallel trend lines

- Traders often place orders near these lines, creating liquidity zones

- Breaks of trend lines or channel boundaries can lead to significant price movements

- Order Blocks and Order Flows

- Order blocks are areas where significant buying or selling pressure has occurred

- These zones often represent institutional order placement

- Identifying these blocks can help predict future price movements

- Order flows show the direction and strength of orders entering the market

- Support and Resistance Levels

- These are horizontal levels where price has previously reversed

- They often act as psychological barriers for traders

- Liquidity accumulates around these levels as traders anticipate reversals

- Breaks of strong support or resistance can lead to substantial price movements

- Daily Candle’s Body and Shadow

- The body of a daily candle represents the opening and closing prices

- The shadow (or wick) shows the high and low of the day

- Areas around the edges of candle bodies and the tips of shadows can act as liquidity zones

- Long shadows often indicate rejection of price levels and potential liquidity sweeps

- Session Highs and Lows

- These are the highest and lowest points reached during specific trading sessions (e.g., Asian, London, New York)

- They often act as short-term support and resistance levels

- Liquidity tends to cluster around these levels, especially at session opens and closes

- Breaks of session highs or lows can lead to trending moves

- Fibonacci Levels

- Fibonacci retracement and extension levels are widely used by traders

- Common levels include 23.6%, 38.2%, 50%, 61.8%, and 100%

- These levels often coincide with other technical indicators, creating strong liquidity zones

- Price reactions at these levels can provide insights into market sentiment

- Round Numbers

- Psychologically significant price levels (e.g., 1.3000, 1.3500 in forex pairs)

- Traders often place orders around these levels

- Can act as support or resistance and attract liquidity

- Breaks of round numbers can lead to quick price movements

- Previous Day’s High and Low

- These levels are significant reference points for many traders

- Often used as a basis for setting daily support and resistance levels

- Breaks of the previous day’s high or low can signal potential trend continuation or reversal

When identifying these liquidity areas, it’s important to consider the following:

- Multiple Time Frame Analysis: Liquidity areas identified on higher time frames often carry more significance

- Confluence: Areas where multiple liquidity factors align are typically stronger

- Volume: High volume near potential liquidity areas can confirm their importance

- Market Context: Consider the overall market trend and sentiment when evaluating liquidity zones

By mastering the identification of these liquidity areas, traders can gain valuable insights into potential market movements and improve their ability to execute the liquidity sweep trading strategy effectively.

Read more: ICT Internal and External Range Liquidity

The Mechanics of Liquidity Sweep Trading Strategy

Now that we understand the role of liquidity and how to identify key areas, let’s explore how the liquidity sweep trading strategy works.

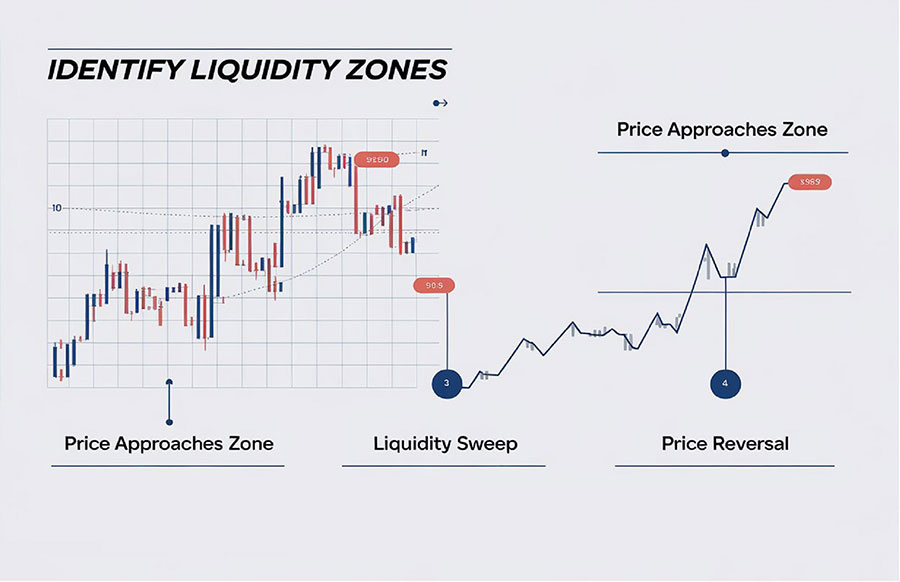

What is a Liquidity Sweep?

A liquidity sweep occurs when the price moves to take liquidity from specific areas. For example, when price reaches a high or low and takes out stop orders, this is known as a liquidity sweep. After sweeping liquidity, the price often shows a significant move in the opposite direction.

Theory Behind Liquidity Sweep

To effectively utilize liquidity zones in trading:

- Identify the underlying trend (e.g., bullish trend)

- Look for a valid break of structure

- Anticipate a price pullback towards a specific point of interest

- Spot a liquidity sweep pattern before the price reaches your point of interest

- Observe the price entering a higher time frame demand zone

- Look for a change of character on the lower time frame within this higher time frame point of interest (POI)

Executing the Trade

The liquidity sweep trading strategy involves:

- Entering positions after confirming a liquidity sweep

- Setting stop losses based on market structure

- Taking profits at predetermined targets, often at external liquidity areas

Risk Management

Proper risk management is crucial when implementing a liquidity sweep trading strategy. Traders should:

- Use appropriate position sizing

- Set stop losses based on market volatility

- Avoid overtrading by waiting for high-probability setups

Read more: Mastering ICT Draw on Liquidity

Advanced Techniques in Liquidity Sweep Trading

To take your liquidity sweep trading to the next level, consider these advanced techniques:

Multi-Timeframe Analysis

Combining multiple timeframes can provide a more comprehensive view of market liquidity:

- Higher timeframes for overall trend direction and demand zones

- Lower timeframes for precise entry and exit points and change of character

Refining Your Trading Zone

As you gain experience, learn to:

- Adjust your trading zone for improved accuracy

- Recognize subtle changes in price action that signal potential sweeps

Adapting to Market Conditions

Different market conditions require different approaches:

- Trending markets: Look for sweeps in the direction of the trend

- Ranging markets: Focus on sweeps at equal highs and lows

- Volatile markets: Be cautious and consider reducing position sizes

Integrating Liquidity Sweep Strategy with Your Trading Plan

To successfully incorporate the liquidity sweep trading strategy into your overall trading plan:

- Define clear entry and exit rules based on liquidity sweeps

- Determine appropriate position sizing and risk management guidelines

- Establish a routine for identifying potential liquidity pools

- Regularly review and adjust your strategy based on performance

Backtesting Your Strategies

Before applying any strategy to your real account, it is crucial to backtest it extensively. This helps account for various factors such as:

- Market conditions

- Trader psychology

- Trading sessions

- Risk management

- Time frame

Use platforms like Trader Edge for backtesting your strategies to ensure robustness and reliability. Remember, trading is a journey of learning and persistence.

When backtesting your liquidity sweep strategy, consider the following steps:

- Choose a representative time period: Select a period that includes various market conditions

- Define clear rules: Establish specific criteria for identifying liquidity areas and sweep patterns

- Record all trades: Keep detailed logs of entries, exits, and reasons for each trade

- Analyze performance: Calculate key metrics like win rate, risk-reward ratio, and maximum drawdown

- Refine and optimize: Use the insights gained to improve your strategy

- Forward test: Apply the refined strategy to new data to validate its effectiveness

The Future of Liquidity Sweep Trading

As markets evolve, so too will liquidity sweep trading strategies. Some potential developments to watch for include:

- Increased use of artificial intelligence in identifying liquidity pools

- Greater transparency in orderbook data for retail traders

- New regulations that may impact market liquidity

- Evolution of high-frequency trading and its impact on liquidity dynamics

- Integration of blockchain technology in forex markets, potentially altering liquidity patterns

Staying informed about these trends will be crucial for traders looking to maintain their edge in the forex markets.

OpoFinance Services: A Trusted Partner for Forex Traders

When implementing advanced strategies like liquidity sweep trading, having a reliable and regulated forex broker is essential. OpoFinance, an ASIC-regulated broker, offers a comprehensive suite of services tailored to meet the needs of both novice and experienced traders.

One standout feature of OpoFinance is its innovative social trading service. This platform allows traders to connect with and learn from successful peers, sharing strategies and insights. For those looking to refine their liquidity sweep trading techniques, the social trading feature can be an invaluable resource, providing real-time examples and expert guidance.

OpoFinance’s commitment to regulatory compliance ensures that traders can focus on their strategies with peace of mind, knowing their funds are secure and their trades are executed fairly. With competitive spreads, advanced trading platforms, and dedicated customer support, OpoFinance provides the ideal environment for traders to thrive in the dynamic world of forex trading.

Key features of OpoFinance that benefit liquidity sweep traders include:

- Advanced charting tools for identifying liquidity zones

- Fast execution speeds to capitalize on liquidity sweeps

- Competitive spreads to minimize trading costs

- Robust risk management tools for proper position sizing

- Educational resources to help traders master advanced strategies

Conclusion

The liquidity sweep trading strategy offers a powerful approach for forex traders looking to capitalize on market dynamics. By understanding the mechanics of liquidity in forex markets and implementing advanced techniques, traders can position themselves for success in this highly competitive arena.

Remember, mastering the liquidity sweep strategy requires patience, practice, and continuous learning. As you refine your approach, always prioritize risk management and stay adaptable to changing market conditions. With dedication and the right tools at your disposal, you can harness the power of liquidity sweeps to enhance your forex trading performance.

Whether you’re just starting out or looking to take your trading to the next level, the liquidity sweep trading strategy provides a valuable addition to your forex trading toolkit. By combining this approach with a solid overall trading plan and partnering with a reputable broker like OpoFinance, you’ll be well-equipped to navigate the exciting world of forex trading.

As you continue your journey in mastering the liquidity sweep trading strategy, remember these key takeaways:

- Develop a keen eye for identifying liquidity areas across multiple time frames

- Practice patience in waiting for high-probability setups

- Continuously refine your strategy through backtesting and analysis

- Stay informed about market trends and evolving trading technologies

- Prioritize risk management in every trade

- Leverage the resources and tools provided by your broker to enhance your trading

With consistent effort and a commitment to ongoing learning, you can turn the liquidity sweep trading strategy into a powerful tool for achieving your forex trading goals.

How does the liquidity sweep trading strategy differ from other forex trading approaches?

The liquidity sweep trading strategy stands out from other approaches by focusing specifically on areas of high liquidity in the market. Unlike strategies that rely solely on technical indicators or fundamental analysis, liquidity sweep trading aims to anticipate and capitalize on the movements of large institutional orders. This approach allows traders to potentially benefit from the price action created by these significant market players, offering a unique perspective on market dynamics.

How can I improve my ability to identify liquidity zones and potential sweeps?

Improving your ability to identify liquidity zones and potential sweeps comes with practice and experience. Start by regularly mapping out points of interest on your charts, such as equal highs and lows, swing points, and key support and resistance levels. Pay close attention to price action around these areas and how the market reacts after sweeping them. Consider joining trading communities or forums where you can discuss and share insights about liquidity sweeps with other traders. Additionally, reviewing historical charts and backtesting your strategies can help train your eye to spot these setups in real-time trading.

What role does market manipulation play in liquidity sweeps, and how can traders account for it?

Market manipulation can play a significant role in liquidity sweeps, often orchestrated by large financial institutions or central banks. These entities may create scenarios that deceive traders into misunderstanding price action. To account for this, traders should:

Be aware of key economic events and news releases that might trigger manipulation

Look for unusual volume spikes or price movements that don’t align with typical market behavior

Use multiple time frame analysis to get a broader perspective on market dynamics

Implement strict risk management practices to protect against unexpected market moves

Continuously educate yourself on market microstructure and institutional trading practices