In the fast-paced world of forex trading, understanding the nuances of various financial instruments is crucial for success. Among these concepts, fx swap points vs forward points stand out as pivotal elements that can significantly impact trading strategies and outcomes. This article will explore the fundamental differences between these two concepts, providing you with actionable insights to enhance your trading performance. Whether you are a novice or an experienced trader, comprehending these concepts can lead to better risk management and potentially higher profits, especially when partnered with a reliable forex broker.

So, what are fx swap points and forward points? FX swap points refer to the interest rate differentials between two currencies involved in a currency swap, while forward points are adjustments made to the spot exchange rate based on these interest rate differentials. Understanding these terms is essential for traders looking to navigate the complexities of the forex market effectively. By the end of this article, you will not only grasp the definitions and calculations of these points but also learn how to apply them strategically in your trading endeavors.

What Are FX Swap Points and Forward Points?

Forward Points

Forward Points serve a critical function in adjusting the spot rate to derive the forward rate in forex trading. The spot rate is the current exchange rate at which a currency pair can be traded immediately. However, traders and businesses often need to secure an exchange rate for a future date, which is where forward points come into play.

Calculation and Purpose

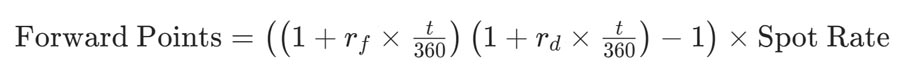

Forward points are calculated based on the interest rate differential between the two currencies involved in a forex transaction. The formula for calculating forward points is:

Where:

- rd is the domestic interest rate.

- rf is the foreign interest rate.

- t is the number of days until the forward contract matures.

The calculated forward points are then added to (or subtracted from) the spot rate to obtain the forward rate. Forward points can be either positive or negative:

- Positive forward points: Indicate that the forward rate is higher than the spot rate, typically when the domestic interest rate is higher than the foreign interest rate.

- Negative forward points: Indicate that the forward rate is lower than the spot rate, typically when the foreign interest rate is higher than the domestic interest rate.

The primary purpose of forward points is to hedge against potential adverse movements in exchange rates. Businesses and investors use forward contracts to lock in exchange rates for future transactions, thereby mitigating the risk associated with currency fluctuations. For example, a company expecting to receive payments in a foreign currency can use forward points to secure a favorable exchange rate, ensuring predictable revenue and protecting against unfavorable rate movements.

Swap Points

Swap Points, on the other hand, are utilized in the context of rolling over a forex position. In forex trading, a position can be held overnight or for several days. When this occurs, the trade incurs a cost or earns a profit due to the interest rate differential between the two currencies in the pair. This cost or profit is represented by swap points.

Calculation and Purpose

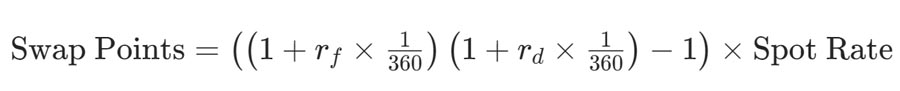

Swap points are determined based on the interest rate differential between the two currencies and the duration of the rollover. The formula for calculating swap points is similar to that for forward points but focuses on overnight interest rates:

Where:

- rd is the domestic overnight interest rate.

- rf is the foreign overnight interest rate.

Swap points can also be either positive or negative:

- Positive swap points: Occur when the interest rate of the currency being bought is higher than that of the currency being sold, resulting in the trader earning interest.

- Negative swap points: Occur when the interest rate of the currency being bought is lower than that of the currency being sold, resulting in the trader paying interest.

The primary purpose of swap points is to compensate traders for the interest rate differential when holding positions overnight. Swap points ensure that traders are either charged or credited the appropriate amount based on the currencies they are trading. This mechanism reflects the cost of borrowing one currency and lending another, allowing traders to manage the financial impact of their overnight positions.

Key Differences Between FX Swap Points and Forward Points

Understanding the differences between swap points and forward points is essential for several reasons:

1. Usage Context

- Forward Points: Used to adjust the spot rate to derive a forward rate for future transactions.

- Swap Points: Used to account for the cost or profit of holding a position overnight due to interest rate differentials.

2. Calculation Basis

- Forward Points: Based on interest rate differentials over a specified future period (days until contract maturity).

- Swap Points: Based on overnight interest rate differentials.

3. Purpose

- Forward Points: Primarily for hedging future currency risks in business or investment transactions.

- Swap Points: Primarily for managing the cost or profit associated with rolling over positions in forex trading.

4. Impact on Traders

- Forward Points: Affect the forward rate, impacting long-term strategies and hedging plans.

- Swap Points: Affect the cost of holding positions overnight, impacting short-term trading strategies and daily profit/loss calculations.

Practical Examples

Forward Points Example

Consider a U.S. company that expects to receive Rs.1,000,000 in three months and wants to hedge against potential depreciation of the Euro. The current spot rate is 1.2000 USD/EUR, and the forward points for three months are 30 points. The forward rate would be calculated as follows:

Forward Rate=Spot Rate+Forward

Forward Rate=1.2000+0.0030=1.2030

This means the company can lock in a rate of 1.2030 USD/EUR for the future transaction, thereby protecting against unfavorable exchange rate movements.

Swap Points Example

A trader holds a long position in EUR/USD overnight. The interest rate for the Euro is 0.5%, and the interest rate for the USD is 2.0%. The spot rate is 1.2000. The swap points calculation would be:

Swap Points= ((1+0.005×1360)(1+0.02×1360)−1)×1.2000

The result, if negative, would indicate the trader needs to pay interest for holding the position overnight. Conversely, if the result is positive, the trader would earn interest. This calculation ensures that the trader is adequately compensated for the interest rate differential between the two currencies.

Why Understanding FX Swap Points vs Forward Points Matters

Understanding these concepts is essential for several reasons:

- Risk Management: Knowing how to utilize these points can help in managing risk more effectively. By understanding how swap points can affect overnight positions and how forward points can lock in rates, traders can make informed decisions that protect their capital.

- Cost Efficiency: Traders can minimize their costs by understanding how to leverage these points in their transactions. For instance, using swap points wisely can lower the cost of holding positions overnight, while forward points can provide a more favorable exchange rate for future transactions.

- Strategic Planning: A clear grasp of these concepts allows for better planning and execution of trades. With a solid understanding of how both points work, traders can develop strategies that align with their financial goals.

- Enhanced Profitability: By effectively managing both swap and forward points, traders can enhance their profitability. This can be particularly important for those who engage in high-frequency trading or who have significant exposure to currency fluctuations.

In the fast-paced world of forex, every point counts, and understanding these concepts can be the difference between profit and loss.

The Role of a Forex Broker in Managing Swap and Forward Points

Choosing the right forex broker is crucial for effectively managing swap points and forward points. A reputable broker can provide you with the tools and resources necessary to understand these concepts and implement effective trading strategies. Here are some factors to consider when selecting a broker:

1. Regulation and Trustworthiness

Ensure that the broker is regulated by a reputable authority, such as ASIC, to guarantee the safety of your funds and the integrity of their trading practices. A regulated forex broker provides a layer of security that can give you peace of mind as you engage in trading activities.

2. Competitive Spreads

Look for brokers that offer competitive spreads on currency pairs, as this can impact the overall cost of your trades, including swap and forward points. Lower spreads mean that you can enter and exit trades more efficiently, maximizing your potential profits.

3. Advanced Trading Tools

A good broker should provide access to advanced trading tools and platforms that allow you to analyze swap points and forward points effectively. This can include real-time data, charts, and analytical tools that can help you make informed decisions in a timely manner.

4. Educational Resources

Many brokers offer educational resources, including webinars and articles, to help traders understand complex concepts like swap points and forward points. Take advantage of these resources to enhance your knowledge and improve your trading strategies.

5. Customer Support

Effective customer support is vital for any trading operation. Choose a broker that offers responsive customer service to assist you with any questions or issues that may arise during your trading journey.

By choosing the right broker, you can improve your trading experience and make informed decisions regarding swap and forward points.

Opofinance: Your ASIC Regulated Forex Trading Partner

If you’re looking for a reliable forex trading broker, consider Opofinance. As an ASIC regulated broker, Opofinance offers a secure trading environment with competitive spreads and advanced trading tools. Their social trading service is particularly noteworthy, allowing you to follow and copy the strategies of successful traders. This feature can be especially beneficial for those looking to enhance their trading knowledge and performance.

Why Choose Opofinance?

- Regulatory Compliance: Opofinance is regulated by ASIC, ensuring that your funds are protected and that the broker adheres to strict financial standards.

- User-Friendly Platform: The trading platform is designed for both beginners and experienced traders, making it easy to navigate and execute trades efficiently.

- Diverse Trading Instruments: Opofinance offers a wide range of trading instruments, allowing you to diversify your portfolio and explore various trading strategies.

- Educational Support: With a wealth of educational resources, Opofinance empowers traders to enhance their skills and knowledge, making informed decisions in the forex market.

- Competitive Trading Conditions: Enjoy low spreads and fast execution speeds, ensuring that you can capitalize on market opportunities without excessive costs.

With Opofinance, you can trade with confidence, knowing you are supported by a regulated broker that prioritizes your trading success.

Conclusion

Understanding the differences between fx swap points vs forward points is crucial for forex traders and businesses involved in international transactions. While both concepts revolve around interest rate differentials, their applications and impacts differ significantly.

Forward Points are essential for hedging future currency risks, allowing businesses and investors to lock in favorable exchange rates for future transactions. This hedging mechanism provides predictability and stability in revenue and costs, protecting against adverse exchange rate movements.

Swap Points, on the other hand, are crucial for managing the costs or profits associated with holding positions overnight in forex trading. By reflecting the interest rate differential between the currencies, swap points ensure that traders are either charged or credited appropriately. This mechanism influences short-term trading strategies and daily profit/loss calculations, making it an integral part of forex trading.

Key Differences Summarized

- Context of Use:

- Forward Points: Used for forward contracts to hedge future currency risks.

- Swap Points: Used in rollover trades to manage overnight interest rate differentials.

- Calculation Period:

- Forward Points: Calculated over the contract’s duration (days until maturity).

- Swap Points: Calculated based on overnight rates.

- Financial Impact:

- Forward Points: Affect the forward rate, thus influencing long-term hedging strategies.

- Swap Points: Impact daily trading costs or profits, influencing short-term trading strategies.

Practical Considerations

For businesses engaged in international trade, understanding forward points is vital for effective risk management. By locking in future exchange rates, companies can ensure stable revenue and cost projections, avoiding potential losses from unfavorable currency movements. For forex traders, swap points play a critical role in daily trading operations. The overnight interest rate differentials reflected in swap points can significantly affect the profitability of holding positions, making it essential for traders to factor these costs or earnings into their strategies.

In essence, while forward points and swap points are both derived from interest rate differentials, their distinct roles in forex trading serve different purposes. Mastery of these concepts enables traders and businesses to make informed decisions, manage risks effectively, and optimize their trading strategies. Whether hedging long-term currency risks or managing short-term trading costs, understanding forward points and swap points is vital for success in the forex market.

How do FX Swap Points affect my trading strategy?

FX Swap Points can significantly influence your trading strategy by affecting the cost of holding positions overnight. If you’re using a forex broker that charges swap fees, understanding how these points work can help you minimize costs and maximize profits.

Can I use both FX Swap Points and Forward Points simultaneously?

Yes, many traders use both FX Swap Points and Forward Points in their strategies. For instance, you might use swap points for short-term trades while employing forward points for longer-term hedging strategies. This dual approach can provide greater flexibility and risk management.

What factors influence the calculation of FX Swap and Forward Points?

Several factors can influence the calculation of both FX Swap and Forward Points, including interest rates, economic indicators, and market sentiment. Changes in these variables can lead to fluctuations in the points, impacting trading decisions.

How can I effectively manage swap and forward points in my trading?

To effectively manage swap and forward points, consider the following strategies:

Stay informed about interest rate changes and economic indicators that may affect the currencies you are trading.

Use a regulated forex broker that provides transparent information about swap rates and forward points.

Incorporate these points into your overall trading strategy to enhance your risk management and profitability.

Are there any tools available to help me calculate swap and forward points?

Many online forex brokers provide tools and calculators that can help you determine swap and forward points based on current market conditions. Additionally, trading platforms often include built-in calculators to assist you in making informed decisions.

By leveraging the insights provided in this article, you can enhance your trading strategies and achieve your financial goals in the forex market.