A NASDAQ scalping strategy is a high-frequency trading approach that involves making numerous small trades throughout the day to capitalize on minor price fluctuations in NASDAQ-listed stocks. This technique aims to accumulate small profits that add up to significant gains over time. Mastering NASDAQ scalping requires precision, discipline, and access to a reliable online forex broker.

A well-executed NASDAQ scalping strategy can lead to consistent profits by exploiting short-term price movements in the highly liquid NASDAQ market. This article will delve into the intricacies of NASDAQ scalping, exploring seven powerful strategies, essential tools, and techniques to help you succeed in this challenging yet potentially rewarding trading style.

Whether you’re a seasoned trader or just starting out, understanding and implementing effective NASDAQ scalping strategies can significantly enhance your trading repertoire. We’ll cover everything from the basics of scalping to advanced techniques, common pitfalls to avoid, and even highlight the importance of choosing a regulated forex broker to support your scalping endeavors.

By the end of this comprehensive guide, you’ll have a solid foundation in NASDAQ scalping strategies and be better equipped to navigate the fast-paced world of day trading on one of the world’s most dynamic stock exchanges.

Understanding NASDAQ and Scalping

What is NASDAQ?

The NASDAQ (National Association of Securities Dealers Automated Quotations) is the second-largest stock exchange in the world by market capitalization. Founded in 1971, it was the world’s first electronic stock market and has since become synonymous with technology and growth companies.

Key features of NASDAQ:

- Technology Focus: Home to many of the world’s largest tech companies like Apple, Microsoft, and Amazon.

- Market Structure: Operates as a dealer market where market participants trade through a dealer rather than directly with one another.

- Trading Hours: Regular trading hours are from 9:30 AM to 4:00 PM Eastern Time, with pre-market and after-hours sessions available.

- Indices: Known for its flagship indices like the NASDAQ Composite and the NASDAQ-100.

Defining Scalping as a Trading Method

Scalping is a trading strategy that aims to profit from small price changes, typically holding positions for seconds to minutes. Scalpers make numerous trades throughout the day, with the goal of accumulating many small gains that add up to significant profits.

Characteristics of scalping:

- High Frequency: Scalpers may make dozens or even hundreds of trades per day.

- Small Profits: Each trade typically aims for small gains, often just a few cents per share.

- Short Timeframes: Positions are usually held for very brief periods, rarely exceeding a few minutes.

- High Concentration: Requires intense focus and quick decision-making.

- Technical Analysis: Heavily relies on technical indicators and chart patterns for entry and exit signals.

Why Scalp NASDAQ?

There are several compelling reasons to apply scalping strategies to NASDAQ-listed stocks:

- Liquidity: NASDAQ offers high liquidity, allowing traders to enter and exit positions quickly.

- Volatility: Many NASDAQ stocks experience significant intraday price movements, creating opportunities for scalpers.

- Popularity: The exchange’s focus on tech stocks attracts many traders, increasing potential trading opportunities.

Key Components of a Successful NASDAQ Scalping Strategy

Technical Analysis Tools

To effectively scalp NASDAQ stocks, traders rely on various technical analysis tools. These tools help identify trends, potential entry and exit points, and market sentiment. Let’s explore each in detail:

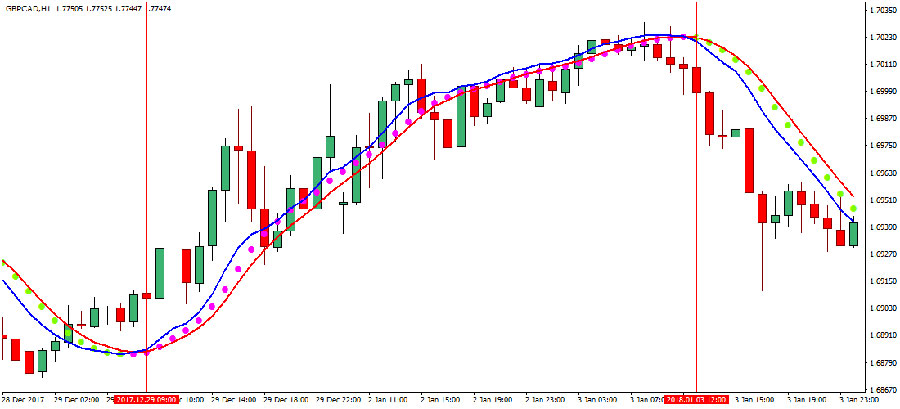

Moving Averages

Moving averages smooth out price data to create a single flowing line, making it easier to identify the direction of the trend.

- Simple Moving Average (SMA):

- Calculates the average price over a specified number of periods

- Useful for identifying overall trend direction

- Common periods: 10, 20, 50, 200

- Exponential Moving Average (EMA):

- Gives more weight to recent prices

- Responds more quickly to price changes than SMA

- Often used for short-term trading signals

Scalpers might use a combination of short-term (e.g., 5-period) and slightly longer-term (e.g., 20-period) moving averages to identify potential entry and exit points.

Bollinger Bands

Developed by John Bollinger, these bands consist of a middle band (usually a 20-period SMA) with an upper and lower band set two standard deviations away.

- Helps gauge volatility and potential overbought/oversold conditions

- Narrowing bands suggest decreased volatility, often preceding a sharp move

- Price touching or exceeding the bands may indicate potential reversal points

Scalpers can use Bollinger Bands to identify potential breakouts or mean reversion opportunities.

Relative Strength Index (RSI)

The RSI is a momentum oscillator that measures the speed and change of price movements.

- Oscillates between 0 and 100

- Traditional overbought/oversold levels are 70 and 30

- Can also be used to identify trend strength and potential reversals

Scalpers might look for oversold conditions in an uptrend to enter long positions, or overbought conditions in a downtrend for short entries.

MACD (Moving Average Convergence Divergence)

MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price.

- Consists of the MACD line, signal line, and histogram

- Helps identify trend direction and strength

- Signal line crossovers can provide entry and exit signals

Scalpers can use MACD for confirmation of short-term trends and potential reversal points.

Stochastic Oscillator

This momentum indicator compares a closing price of a security to its price range over a certain period of time.

- Oscillates between 0 and 100

- Overbought/oversold levels typically set at 80 and 20

- Can signal potential reversals when it diverges from price

Scalpers might use the stochastic oscillator in conjunction with other indicators to confirm entry and exit points.

Price Action Analysis

Price action analysis involves studying the movement of price to identify patterns and make trading decisions. It’s a crucial skill for NASDAQ scalpers.

Support and Resistance Levels

These are price levels where a stock has historically had difficulty moving above (resistance) or below (support).

- Can be identified using previous highs and lows, round numbers, or technical indicators

- Breakouts above resistance or below support can signal potential trades

- Often used to set stop-loss and take-profit levels

Scalpers can look for bounces off support or resistance for quick trades, or breakouts for potential trending moves.

Candlestick Patterns

Candlestick charts provide valuable information about price action within a specific time frame.

Key patterns include:

- Doji: Indicates indecision and potential reversal

- Engulfing: A larger candle that completely engulfs the previous one, suggesting a potential reversal

- Hammer and Hanging Man: Single-candle patterns that can signal potential reversals

- Morning Star and Evening Star: Three-candle patterns indicating potential trend reversals

Scalpers can use these patterns to identify potential entry and exit points for their trades.

Trend Lines

Trend lines are diagonal lines drawn on a chart to connect a series of prices.

- Uptrend lines connect higher lows

- Downtrend lines connect lower highs

- Can be used to identify the overall market direction and potential support/resistance levels

Scalpers might look for bounces off trend lines for potential trades or breaks of trend lines for reversal opportunities.

Chart Patterns

Larger chart patterns can provide valuable context for scalping decisions.

Common patterns include:

- Head and Shoulders: Indicates potential trend reversal

- Triangles (Ascending, Descending, Symmetrical): Suggest continuation or reversal depending on the breakout direction

- Flags and Pennants: Short-term continuation patterns

- Double Tops/Bottoms: Indicate potential trend reversals

While these patterns may take longer to form than a typical scalping timeframe, awareness of them can help scalpers understand the broader market context.

News and Economic Calendar Awareness

Even for short-term traders like scalpers, staying informed about market-moving news and economic events is crucial.

Key considerations:

- Economic Calendar: Be aware of scheduled economic releases that could impact the market

- Company-Specific News: Product launches, earnings reports, management changes, etc.

- Sector News: Developments that could affect multiple stocks in a sector

- Global Events: Geopolitical events, natural disasters, etc. that could impact market sentiment

Scalpers should be cautious around major news events, as they can lead to increased volatility and potential slippage.

Scalping Strategies for NASDAQ

1. Momentum Scalping

Momentum scalping involves capitalizing on strong price movements in either direction. This strategy is based on the idea that stocks tend to continue moving in the same direction for a short period once strong momentum is established.

Key aspects of momentum scalping:

- Entry: Enter trades when a stock shows significant momentum, often identified by sharp price movements and increased volume.

- Exit: Exit quickly once the momentum starts to wane, which can be identified by slowing price movement or reversal candlestick patterns.

- Indicators: Use momentum indicators like RSI or MACD to confirm the strength of the move.

- Time frames: Typically uses very short time frames, such as 1-minute or 5-minute charts.

2. Range Scalping

Range scalping focuses on stocks trading within a defined price range. This strategy takes advantage of the tendency of stocks to bounce between support and resistance levels during periods of consolidation.

Key aspects of range scalping:

- Identification: Look for stocks that have been trading within a clear range over a recent period.

- Entry: Buy near support levels and sell near resistance levels.

- Exit: Take profits quickly when the price approaches the opposite end of the range.

- Stop-loss: Place stops just outside the range to protect against breakouts.

- Indicators: Use tools like Bollinger Bands to help identify the range and potential reversal points.

3. News Scalping

News scalping involves trading based on breaking news or economic announcements that can cause rapid price movements in NASDAQ stocks.

Key aspects of news scalping:

- Preparation: Stay informed about scheduled economic releases and company events.

- Quick analysis: Rapidly assess the potential impact of news on stock prices.

- Fast execution: Enter positions quickly as news breaks.

- Risk management: Use tight stop-losses due to potential high volatility.

- Exit strategy: Have a clear plan for taking profits, often using a predetermined price target or time limit.

4. Trend-Following Scalping

Trend-following scalpers aim to capture small gains by trading in the direction of the prevailing trend. This strategy is based on the principle that trends are more likely to continue than to reverse.

Key aspects of trend-following scalping:

- Trend identification: Use tools like moving averages to confirm trend direction.

- Entry: Enter trades in the direction of the trend on small pullbacks or consolidations.

- Exit: Take profits when the price shows signs of losing momentum or reaching a predetermined target.

- Stop-loss: Place stops below recent swing lows for long trades or above recent swing highs for short trades.

- Time frames: Can be applied to various time frames, from 1-minute to 15-minute charts.

5. Breakout Scalping

Breakout scalpers look for stocks breaking out of established trading ranges or patterns, entering positions as the breakout occurs and exiting quickly for small profits.

Key aspects of breakout scalping:

- Pattern identification: Look for stocks forming clear chart patterns like triangles, flags, or rectangular ranges.

- Volume confirmation: Look for increased volume to confirm the validity of the breakout.

- Entry: Enter as soon as the price breaks above resistance or below support.

- Exit: Take profits quickly, often using a predetermined profit target based on the size of the pattern.

- False breakouts: Be aware of the possibility of false breakouts and use appropriate stop-losses.

Developing Your NASDAQ Scalping Strategy

Choose Your Timeframe

Deciding on the appropriate timeframe is crucial for successful NASDAQ scalping. Most scalpers focus on very short-term charts, typically ranging from 1-minute to 15-minute timeframes.

Considerations for choosing your timeframe:

- 1-minute charts:

- Pros: Provide the most trading opportunities

- Cons: Higher noise levels, more prone to false signals

- Best for: Experienced scalpers with quick execution capabilities

- 5-minute charts:

- Pros: Balance between number of opportunities and signal clarity

- Cons: Still requires quick decision-making

- Best for: Intermediate scalpers or those looking for slightly longer holding periods

- 15-minute charts:

- Pros: Clearer signals, less noise

- Cons: Fewer trading opportunities

- Best for: Beginners or those combining scalping with other day trading strategies

Remember, the chosen timeframe should align with your trading style, risk tolerance, and ability to focus intensely for extended periods.

Set Clear Entry and Exit Rules

Establishing specific criteria for entering and exiting trades is essential to maintain discipline and consistency in your NASDAQ scalping strategy.

Example entry rules:

- Price breaks above a key moving average with increased volume

- RSI crosses above 50 in an uptrend (or below 50 in a downtrend)

- A bullish candlestick pattern forms at a support level

Example exit rules:

- Price reaches a predetermined profit target (e.g., 0.5% gain)

- A reversal candlestick pattern forms

- RSI reaches overbought/oversold levels

Consistently applying these rules helps remove emotion from trading decisions and improves overall performance.

Implement Proper Risk Management

Use stop-loss orders and adhere to strict risk-reward ratios to protect your capital.

Practice and Refine

Utilize demo accounts to practice your strategies and refine your approach before risking real capital.

OpoFinance Services: Your Partner in NASDAQ Scalping

When it comes to executing your NASDAQ scalping strategy, having a reliable and regulated broker is crucial. OpoFinance, an ASIC-regulated broker, offers a range of features tailored to meet the needs of scalpers:

- Lightning-fast execution: Execute trades with minimal slippage, essential for successful scalping.

- Advanced charting tools: Access a suite of technical analysis tools to support your scalping strategy.

- Competitive spreads: Benefit from tight spreads to maximize your profit potential.

- Robust risk management: Utilize stop-loss and take-profit orders to manage your risk effectively.

- Social trading service: Learn from and copy successful traders to enhance your scalping skills.

OpoFinance’s ASIC regulation ensures a secure trading environment, giving you peace of mind as you implement your NASDAQ scalping strategy.

Conclusion

Mastering NASDAQ scalping strategy requires dedication, practice, and a deep understanding of market dynamics. By implementing the strategies and techniques outlined in this article, you can develop a robust approach to scalping NASDAQ stocks.

Remember that successful scalping demands:

- Quick decision-making

- Disciplined risk management

- Continuous learning and adaptation

- A reliable broker like OpoFinance

As you embark on your NASDAQ scalping journey, stay informed, remain disciplined, and always prioritize risk management. With persistence and the right approach, you can potentially turn NASDAQ scalping into a profitable trading method.

How much capital do I need to start NASDAQ scalping?

The capital required for NASDAQ scalping can vary depending on your broker’s requirements and your risk tolerance. Generally, a minimum of $5,000 to $10,000 is recommended to allow for proper position sizing and risk management. However, some traders start with less, while others use significantly more. It’s crucial to only trade with capital you can afford to lose.

Is NASDAQ scalping suitable for beginner traders?

While NASDAQ scalping can be lucrative, it’s generally not recommended for complete beginners due to its fast-paced nature and the need for quick decision-making. Beginners should first familiarize themselves with basic trading concepts, practice with demo accounts, and consider starting with longer-term strategies before transitioning to scalping. If you’re determined to try scalping as a beginner, start with very small positions and focus on learning rather than profits.

How do I handle taxes on profits from NASDAQ scalping?

Tax implications for NASDAQ scalping can be complex due to the high frequency of trades. In most jurisdictions, profits from scalping are typically treated as short-term capital gains and taxed at your ordinary income tax rate. It’s crucial to keep detailed records of all your trades for tax purposes. Consider using trading software that can generate tax reports, and consult with a tax professional familiar with trading to ensure you’re handling your taxes correctly and taking advantage of any applicable deductions or strategies.