Are you tired of inconsistent results in your forex trading journey? Do you find yourself constantly searching for that elusive edge in the market? Look no further. ADX scalping strategy is the game-changing technique you need to potentially boost your trading profits and take your forex trading to new heights.

The Average Directional Index (ADX) is a powerful tool that, when combined with scalping techniques, can open up a world of opportunities in the fast-paced forex market. But what exactly is ADX scalping, and how can it benefit you as a trader?

ADX scalping is a short-term trading approach that harnesses the strength of trends to capitalize on small price movements. By using the ADX indicator, traders can identify strong trends and potential entry points with greater precision. This strategy allows you to potentially make quick profits while minimizing risk exposure – a perfect combination for those looking to optimize their trading performance.

In this comprehensive guide, we’ll dive deep into the world of ADX scalping, exploring five proven strategies that can transform your trading results. Whether you’re a seasoned trader looking to refine your skills or a newcomer eager to learn effective techniques, this article is designed to equip you with practical, actionable knowledge.

We’ll break down each strategy in detail, explaining not just the ‘what’ but also the ‘why’ and ‘how’. You’ll learn about the nuances of each approach, understand their pros and cons, and gain insights into their practical application in real market conditions. By the end of this guide, you’ll have a robust toolkit of ADX scalping strategies at your disposal, ready to be implemented in your trading routine.

So, if you’re ready to potentially supercharge your forex trading profits and gain a competitive edge in the market, let’s dive into these powerful ADX scalping strategies. Your journey to more informed, strategic, and potentially profitable trading starts here.

What is ADX Scalping?

ADX scalping is a short-term trading strategy that utilizes the Average Directional Index (ADX) indicator to identify strong trends and potential entry points in the forex market. This method aims to capitalize on small price movements within a larger trend, allowing traders to make quick profits with minimal risk exposure.

Understanding the ADX Indicator

The Average Directional Index, developed by J. Welles Wilder Jr., is a momentum indicator that measures the strength of a trend, regardless of its direction. It consists of three lines:

- ADX line (usually white)

- Positive Directional Indicator (+DI, usually green)

- Negative Directional Indicator (-DI, usually red)

The ADX line ranges from 0 to 100, with higher values indicating stronger trends. Generally:

- ADX values below 25 suggest a weak trend or range-bound market

- ADX values between 25 and 50 indicate a moderate trend

- ADX values above 50 signal a strong trend

Benefits of ADX Scalping Strategy

Implementing an ADX scalping strategy offers several advantages for forex traders:

- Quick Profits: By focusing on small price movements, traders can potentially achieve multiple profitable trades in a single day.

- Reduced Risk: Short holding periods minimize exposure to adverse market events and overnight risks.

- Clear Entry and Exit Points: The ADX indicator provides objective signals for entering and exiting trades, reducing emotional decision-making.

- Versatility: This strategy can be applied to various currency pairs and timeframes, offering flexibility for different trading styles.

- Trend Confirmation: ADX helps traders avoid false breakouts and confirms the strength of ongoing trends.

5 Powerful ADX Scalping Strategies

Let’s explore five effective ADX scalping strategies that can potentially revolutionize your forex trading approach:

1. The 2-Period ADX Breakout Strategy

The 2-Period ADX Breakout Strategy is a dynamic approach designed to capture market breakouts with precision. This strategy capitalizes on sudden bursts of momentum, allowing traders to ride the wave of new trends as they emerge.

How it works:

- When the 2-period ADX falls below 25 and approaches 0, it signals a potential bullish breakout. This indicates that the market has been consolidating or trending downwards and may be primed for an upward move.

- Conversely, when the 2-period ADX rises above 75 and approaches 100, it signals a potential bearish breakout. This suggests that the market has been in a strong uptrend and may be due for a reversal.

Implementation tips:

- Set your ADX indicator to a 2-period setting for increased sensitivity to short-term price movements.

- Monitor the ADX line closely for values approaching 0 or 100, as these extreme readings often precede significant price moves.

- Use additional confirmation tools such as support/resistance levels or candlestick patterns to validate the breakout.

- Place stop-losses just beyond the recent swing low (for long trades) or swing high (for short trades) to manage risk effectively.

Pros:

- Helps catch the beginning of new trends, potentially leading to larger profits

- Provides clear entry signals, reducing hesitation and emotional decision-making

Cons:

- May generate false signals in choppy markets, requiring careful risk management

- Demands quick decision-making due to the short-term nature of the indicator

By mastering the 2-Period ADX Breakout Strategy, you can position yourself to capitalize on sudden market movements and potentially profit from emerging trends before they become obvious to the majority of traders.

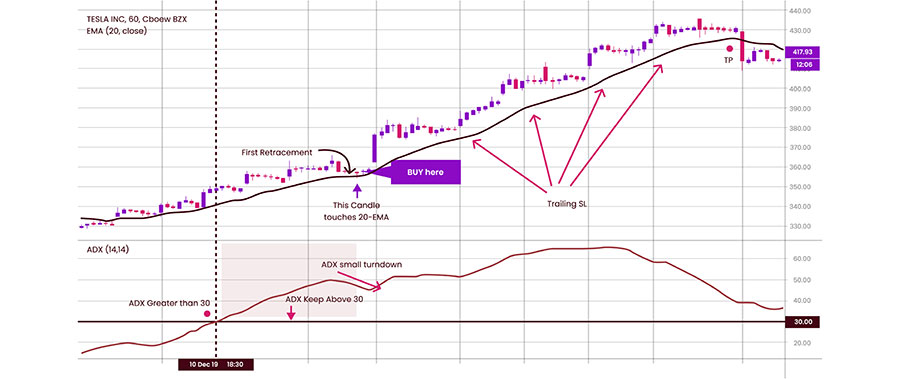

2. The Holy Grail ADX Strategy

The Holy Grail ADX Strategy combines the power of trend strength measurement with price action analysis, offering a comprehensive approach to identifying high-probability trading opportunities. This strategy is particularly effective for scalpers looking to enter trades in the direction of the main trend while minimizing false signals.

How it works:

- When ADX is above 30 and increasing, and prices retrace below the Simple Moving Average (SMA), it signals a potential long entry in an uptrend. This scenario indicates a strong uptrend with a temporary pullback, offering a potentially favorable entry point.

- When ADX is above 30 and increasing, and prices rise above the SMA, it signals a potential short entry in a downtrend. This situation suggests a strong downtrend with a brief retracement, presenting an opportunity to enter a short position.

Implementation tips:

- Set your ADX indicator to the standard 14-period setting for a balanced view of trend strength.

- Add a Simple Moving Average (SMA) to your chart. A 20-period SMA is common, but you can adjust based on your preferences and the timeframe you’re trading.

- Look for ADX readings above 30, which indicate a strong trend, and confirm the trend direction using the +DI and -DI lines.

- Wait for price pullbacks to the SMA before entering trades to potentially improve your risk-to-reward ratio.

Pros:

- Combines trend strength with price action for more reliable signals, potentially reducing false entries

- Helps traders enter on pullbacks, which can lead to better entry prices and improved risk-to-reward ratios

- Provides a systematic approach to identifying trades, promoting consistency in decision-making

Cons:

- May cause traders to miss some opportunities while waiting for all conditions to align

- Requires patience and discipline to avoid premature entries, which can be challenging in fast-moving markets

The Holy Grail ADX Strategy offers a balanced approach to scalping, allowing you to capitalize on strong trends while using price action to fine-tune your entries. By waiting for pullbacks, you can potentially enter trades with a more favorable risk-to-reward profile, a crucial factor in long-term trading success.

3. The ADX-Parabolic SAR Synergy Strategy

This strategy harnesses the combined power of the ADX indicator and the Parabolic Stop and Reverse (SAR) indicator to determine both trend direction and strength. It’s particularly useful for scalpers seeking multiple layers of confirmation before entering a trade, potentially reducing the risk of false signals.

How it works:

- When the +DI line crosses above the -DI line and Parabolic SAR dots appear below the candlesticks, it signals a potential long entry. This alignment suggests a strong bullish trend is forming or continuing.

- When the -DI line crosses above the +DI line and Parabolic SAR dots appear above the candlesticks, it signals a potential short entry. This configuration indicates a robust bearish trend is developing or persisting.

Implementation tips:

- Add both the ADX and Parabolic SAR indicators to your chart. Use default settings as a starting point (14 for ADX, 0.02 step and 0.2 maximum for Parabolic SAR).

- Look for crossovers of the DI lines to indicate potential trend changes. The ADX line itself should preferably be above 25 to confirm trend strength.

- Confirm the trend direction with the Parabolic SAR dots. They should be below the price in an uptrend and above the price in a downtrend.

- Consider using a minimum ADX reading (e.g., 25) to filter out weak trends and reduce the likelihood of false signals.

Pros:

- Provides multiple layers of confirmation for trend changes, potentially increasing the reliability of signals

- Can help reduce false signals in ranging markets by requiring agreement between two different indicators

- Offers clear visual cues for both trend direction (Parabolic SAR) and strength (ADX), simplifying decision-making

Cons:

- May lag behind price action in fast-moving markets, potentially causing delayed entries

- Requires monitoring multiple indicators simultaneously, which can be challenging for some traders

The ADX-Parabolic SAR Synergy Strategy offers a robust framework for identifying trending markets and potential entry points. By requiring confirmation from both indicators, this strategy aims to filter out weaker signals and focus on high-probability trading opportunities.

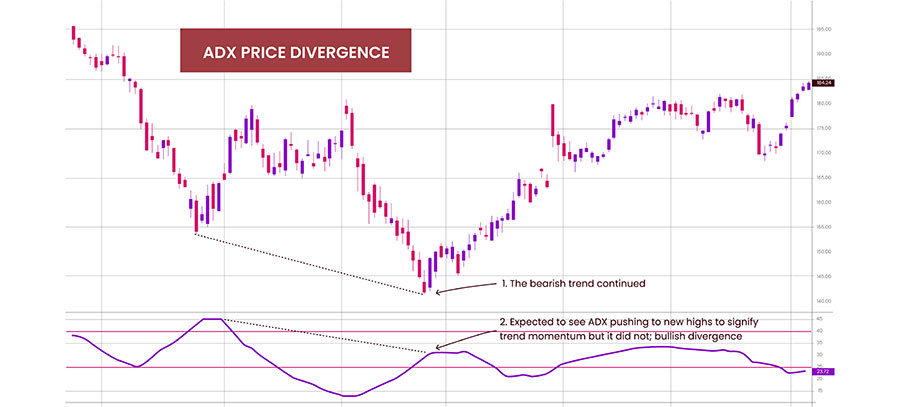

4. The ADX Price Divergence Detective Strategy

The ADX Price Divergence Detective Strategy is an advanced technique that focuses on identifying discrepancies between price action and ADX readings. This approach can be particularly effective for spotting potential trend reversals before they become obvious to the majority of traders.

How it works:

- When price makes higher highs, but ADX forms lower highs, it signals a potential bearish reversal. This divergence suggests that despite rising prices, the trend strength is actually weakening, which could precede a downturn.

- When price makes lower lows, but ADX forms higher lows, it signals a potential bullish reversal. This scenario indicates that although prices are decreasing, the strength of the downtrend is waning, potentially setting the stage for an upturn.

Implementation tips:

- Monitor price action and ADX movement on your chosen timeframe. Higher timeframes (1-hour, 4-hour) can provide more reliable divergence signals.

- Look for clear divergences between price highs/lows and corresponding ADX highs/lows. The more pronounced the divergence, the stronger the potential reversal signal.

- Use additional confirmation signals (e.g., candlestick patterns, support/resistance levels, or momentum oscillators) before entering trades to increase the probability of success.

- Place stop-losses beyond recent swing points to protect against false signals and unexpected market movements.

Pros:

- Can help identify potential trend reversals early, offering opportunities for excellent risk-reward trades

- Works well in conjunction with other technical analysis tools, allowing for a more comprehensive trading approach

- Encourages traders to think critically about the relationship between price and trend strength, fostering a deeper understanding of market dynamics

Cons:

- Divergences don’t always lead to reversals, so additional confirmation is crucial to avoid false signals

- Requires practice and experience to spot divergences accurately, especially in real-time trading situations

The ADX Price Divergence Detective Strategy provides a unique perspective on market movements by focusing on the relationship between price action and trend strength. By mastering this technique, you can potentially anticipate trend changes before they occur, positioning yourself for high-probability trades with favorable risk-reward ratios.

5. The ADX Rapid Fire Day Trading Strategy

The ADX Rapid Fire Day Trading Strategy is a simplified yet potent approach that uses a more sensitive ADX setting to capture short-term price fluctuations. This strategy is ideal for scalpers and day traders who prefer a straightforward, easy-to-follow method for quick decision-making in fast-moving markets.

How it works:

- When ADX rises above 50 and price is increasing, it signals a potential long entry. This scenario indicates a strong upward trend is in progress, offering opportunities to buy.

- When ADX falls below 50 and price is decreasing, it signals a potential short entry or exit. This situation suggests a strong downward trend, presenting chances to sell or close existing long positions.

Implementation tips:

- Set your ADX indicator to a 3-period setting for increased sensitivity to short-term price movements.

- Focus on short-term charts (e.g., 1-minute, 5-minute) for day trading and scalping. These timeframes provide more frequent signals suitable for rapid-fire trading.

- Look for ADX readings crossing above or below the 50 level in conjunction with price movement. The 50 level is key as it indicates exceptionally strong trends.

- Use tight stop-losses and take-profit levels due to the short-term nature of this strategy. Quick decision-making and exit strategies are crucial.

Pros:

- Simple to understand and implement, making it accessible for traders of all experience levels

- Provides clear entry and exit signals, reducing ambiguity in decision-making

- Well-suited for capturing quick profits in volatile market conditions

Cons:

- May generate more frequent signals, increasing the risk of overtrading if not managed properly

- Requires quick decision-making and execution, which can be challenging for some traders

- The increased sensitivity can sometimes lead to false signals, especially in choppy market conditions

The ADX Rapid Fire Day Trading Strategy offers a dynamic approach to capitalizing on strong short-term trends. Its simplicity and clear signals make it an attractive option for traders who thrive in fast-paced environments. However, it’s crucial to maintain strict discipline and robust risk management practices when employing this strategy due to its aggressive nature.

Best Practices for ADX Scalping

To maximize your success with ADX scalping, consider these best practices:

- Use Multiple Timeframes: Confirm trends on higher timeframes before entering trades on lower timeframes.

- Combine Strategies: Consider using elements from multiple ADX strategies to create a more robust trading approach.

- Practice Risk Management: Always use stop-losses and maintain a favorable risk-to-reward ratio.

- Focus on Liquid Pairs: Stick to major currency pairs with tight spreads for optimal scalping conditions.

- Avoid News Events: Stay away from trading during major economic releases to minimize unpredictable volatility.

- Keep a Trading Journal: Track your trades and analyze your performance to continually improve your strategy.

- Start Small: Begin with a demo account or small position sizes until you’re comfortable with the strategy.

OpoFinance Services: Your Trusted ASIC-Regulated Forex Broker

When it comes to implementing your ADX scalping strategy, choosing the right forex broker is crucial. OpoFinance stands out as an ASIC-regulated broker, offering traders a secure and reliable platform for executing their trades. With tight spreads, fast execution, and advanced trading tools, OpoFinance provides the ideal environment for scalpers to thrive.

One of OpoFinance’s standout features is its innovative social trading service. This platform allows you to connect with experienced traders, observe their strategies, and even automatically copy their trades. For those looking to refine their ADX scalping technique, social trading offers a unique opportunity to learn from successful traders and potentially improve your own results.

By combining OpoFinance’s robust trading infrastructure with the power of ADX scalping, you’ll be well-equipped to navigate the forex markets with confidence and precision.

Conclusion

ADX scalping strategies offer powerful approaches to forex trading, combining trend strength analysis with short-term profit opportunities. By mastering these five strategies – the 2-Period ADX, Holy Grail, ADX and Parabolic SAR, ADX Price Divergence, and ADX Day Trading – you can potentially enhance your trading results and navigate the markets with greater confidence.

Remember that success in ADX scalping requires practice, discipline, and continuous learning. Start by thoroughly understanding each strategy, then practice in a demo account before risking real capital. As you gain experience, you may find that certain strategies work better for your trading style or preferred currency pairs.

Always prioritize risk management, stay informed about market conditions, and be prepared to adapt your approach as needed. With dedication and the right tools, ADX scalping could become a valuable addition to your forex trading arsenal, potentially leading to more consistent profits and trading success.

As you embark on your ADX scalping journey, consider leveraging the services of a regulated forex broker like OpoFinance to ensure you have the tools and support needed for success. With the right strategy, platform, and mindset, you’ll be well-positioned to capitalize on the opportunities that ADX scalping can offer in the dynamic world of forex trading.

Can ADX scalping be used for cryptocurrency trading?

Yes, ADX scalping can be applied to cryptocurrency trading. The ADX indicator works well in any market with sufficient liquidity and volatility. However, keep in mind that cryptocurrency markets can be more volatile than forex, so you may need to adjust your risk management strategies accordingly.

How does ADX scalping compare to other scalping strategies?

ADX scalping differs from other scalping strategies by focusing specifically on trend strength. While many scalping techniques rely solely on price action or momentum indicators, ADX scalping provides a clearer picture of trend dynamics. This can help traders avoid false signals and focus on high-probability setups.

Is it possible to automate ADX scalping with an Expert Advisor (EA)?

Absolutely. ADX scalping can be programmed into an Expert Advisor for automated trading. However, it’s crucial to thoroughly backtest and forward test any EA before using it with real money. Additionally, market conditions change over time, so regular monitoring and adjustment of your automated strategy is essential.