Are you ready to dive into the exhilarating world of forex scalping? If you’re seeking to maximize your profits in the foreign exchange market, scalping in forex might be the strategy you’ve been searching for. Scalping is a high-frequency trading technique that involves making numerous small trades throughout the day to capitalize on minor price fluctuations. This method can be incredibly lucrative for those who master it, but it requires quick thinking, discipline, and a deep understanding of market dynamics.

In this comprehensive guide, we’ll explore everything you need to know about scalping forex trading, from its fundamental principles to advanced strategies used by professional scalpers. Whether you’re a seasoned trader looking to diversify your approach or a newcomer eager to learn, this article will equip you with the knowledge and tools to succeed in the fast-moving world of forex scalping. We’ll also discuss how choosing the right online forex broker can significantly impact your scalping success.

What is Scalping in Forex?

Scalping in forex is a trading strategy that aims to profit from small price changes in currency pairs. Scalpers in forex typically hold positions for very short periods, often just a few seconds to a few minutes. The goal is to make many small profits throughout the day, which can add up to substantial gains over time.

Key Characteristics of Forex Scalping

- High-Frequency Trading: Scalpers may execute dozens or even hundreds of trades per day.

- Quick Decision Making: Scalp trading in forex requires rapid analysis and execution.

- Small Profit Targets: Traders usually aim for 5-20 pips per trade.

- Tight Stop Losses: To manage risk, scalpers use very close stop-loss orders.

- Short Holding Periods: Positions are rarely held overnight.

How Scalping Differs from Other Forex Strategies

Unlike other trading strategies such as swing trading or position trading, which focus on capturing larger price movements over days, weeks, or even months, scalping forex trading zooms in on the smaller, intraday price movements. Scalpers often aim for price moves of 5-10 pips, which might seem small, but when combined with leverage, these small gains can compound into meaningful profits over time.

What is scalp trading in forex is fundamentally different from other strategies because of its sheer speed and intensity. Scalpers must be able to act decisively without hesitation, leveraging real-time data to make quick buy or sell decisions.

Key Principles of Scalping in Forex

1. Timeframes for Scalping

In scalping forex trading, the timeframes you trade on are much shorter compared to other strategies. The most commonly used timeframes are the 1-minute, 5-minute, and 15-minute charts. These timeframes allow traders to capture small price movements that occur within short periods. While it’s possible to scalp on longer timeframes, doing so may expose you to larger market risks, such as news events or sudden market reversals.

For example, on a 1-minute chart, each candle represents one minute of trading activity. Scalpers analyze these charts closely to spot short-term price trends, using indicators like moving averages or Bollinger Bands to make quick decisions. In contrast, traders operating on the 5-minute chart have a slightly broader view but are still focused on short-term price action.

One of the biggest challenges of scalping is timing – being able to get in and out of trades at the right moment is crucial to success. Scalpers need to have an acute sense of market dynamics and be able to make split-second decisions.

2. Volume and Liquidity: Why They Matter

Volume and liquidity are essential components for successful scalping in forex. Liquidity refers to how quickly and easily a currency pair can be bought or sold without affecting its price. High liquidity ensures that scalpers can enter and exit trades without large price differences between the bid and ask price, known as spread. The more liquid a currency pair is, the tighter the spread, which is critical for scalpers, as even a fraction of a pip can make a significant difference in profitability.

For instance, major currency pairs like EUR/USD or USD/JPY have extremely high liquidity, especially during peak trading hours, making them ideal for scalping. On the other hand, exotic pairs may have wider spreads and lower liquidity, making them less suitable for this strategy.

3. Risk Management for Scalping

One of the most important principles in scalping forex trading is effective risk management. Given the fast-paced nature of scalping, losses can add up quickly if proper risk controls aren’t in place. Scalpers must define their risk per trade and stick to it religiously. A common rule of thumb is to risk only 1-2% of your total capital on a single trade, allowing you to withstand a series of losses without significant damage to your account.

Risk management in scalping also involves using tight stop-loss orders to minimize losses. Since the price movements you’re targeting are small, it’s crucial to ensure that potential losses remain equally small. The tighter the stop-loss, the more controlled your risks become, but you must also balance this with giving the trade enough room to develop.

4. Mastering Psychology in Scalping

Beyond the technical aspects, one of the often-overlooked factors in successful scalping is the psychological aspect. Scalping is a high-stress, fast-paced activity that requires the ability to make quick decisions under pressure. It’s not uncommon for scalpers to experience emotional fatigue after long trading sessions.

Successful scalpers remain calm under pressure, sticking to their trading plan regardless of short-term market movements. Being disciplined and having a clear exit strategy for each trade helps reduce emotional decision-making, which can often lead to costly mistakes.

7 Proven Forex Scalping Strategies

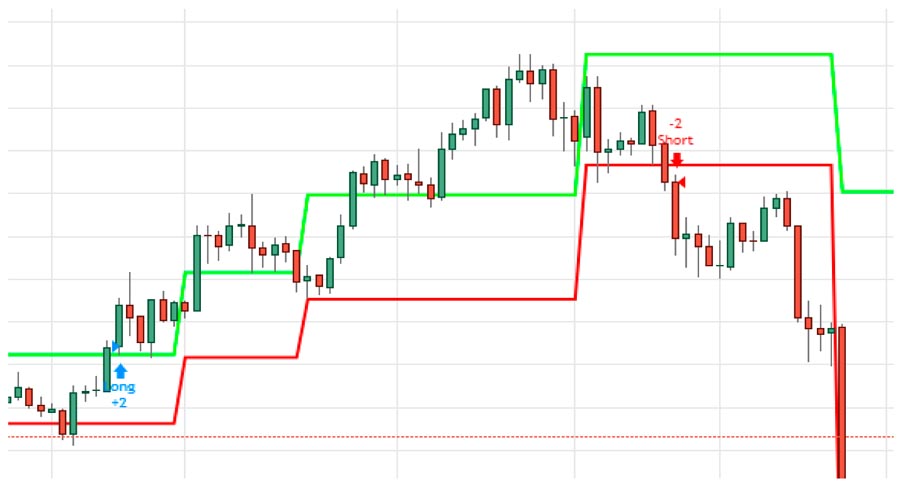

1. Trend Scalping

One of the most straightforward yet effective strategies in scalping forex trading is trend scalping. This strategy involves identifying the prevailing trend using indicators like moving averages or trendlines, and then making trades in the direction of that trend. The idea is to ride the momentum of the market for short-term gains.

For instance, a scalper might use a 200-period moving average on a 1-minute chart to determine the long-term trend direction, and then use a shorter-term moving average, such as the 5-period, to time entries in the direction of the trend. By following the dominant trend, scalpers can avoid the risk of trading against the market’s momentum.

Pros:

- Aligns with the market’s overall direction

- Can lead to consistent profits in strongly trending markets

Cons:

- May lead to losses in choppy or sideways markets

- Requires quick identification of trend reversals

2. Range Scalping

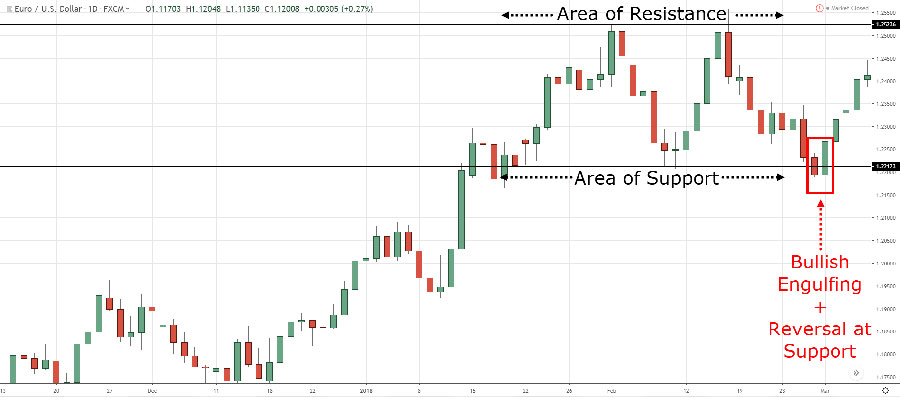

Range scalping is another popular approach for scalpers in forex. In this strategy, traders look for price ranges where a currency pair bounces between a defined support level and a resistance level. They aim to buy at support and sell at resistance, profiting from the price oscillations within the range.

For example, if the EUR/USD pair is trading between 1.1700 (support) and 1.1800 (resistance), a scalper would buy when the price reaches 1.1700 and sell when it approaches 1.1800. Range scalping is particularly effective in quiet markets where there’s no strong trend but where price regularly bounces within a range.

Pros:

- Works well in non-trending markets

- Clear entry and exit points

Cons:

- Requires precise timing and a good understanding of support and resistance levels

- Risk of false breakouts

3. Breakout Scalping

Breakout scalping focuses on entering trades when prices break through key support or resistance levels, leading to sharp, short-term price movements. Scalpers in forex rely on volume and volatility to confirm breakouts and execute trades during these moments to capture quick profits.

Breakout scalping often happens around major news events or at the open of a trading session when volatility spikes. The key here is to identify levels where a breakout is likely to occur and to enter trades quickly when the breakout happens.

Pros:

- Can lead to significant profits in a short time

- Works well during high-volatility periods

Cons:

- Risk of false breakouts

- Requires quick reflexes and decision-making

4. News Scalping

News scalping involves taking advantage of the volatility that occurs immediately after important economic news releases. Scalpers using this strategy need to be well-informed about upcoming economic events and their potential impact on currency pairs.

Pros:

- Can lead to large price movements in a short time

- Predictable timing of trading opportunities

Cons:

- High risk due to extreme volatility

- Requires in-depth knowledge of economic indicators

5. Algorithmic Scalping

Algorithmic scalping uses pre-programmed trading algorithms to analyze market conditions and execute trades automatically based on predefined criteria. This strategy can process large amounts of data and place trades in milliseconds, giving scalpers an edge in fast-moving markets.

Pros:

- Eliminates emotional decision-making

- Can execute trades faster than manual trading

Cons:

- Requires programming skills or investment in trading software

- May not adapt well to unexpected market conditions

6. Grid Scalping

Grid scalping involves placing multiple buy and sell orders at predetermined price levels above and below the current market price. As the price moves up and down, it triggers these orders, potentially leading to multiple profitable trades.

Pros:

- Can profit from both upward and downward price movements

- Works well in ranging markets

Cons:

- Risk of significant losses if the market trends strongly in one direction

- Requires careful position sizing and risk management

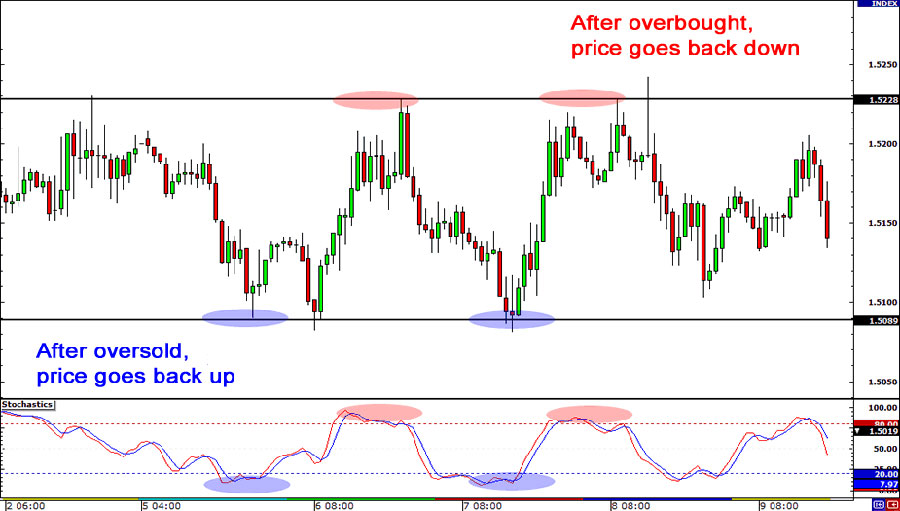

7. Reversal Scalping

Reversal scalping aims to profit from short-term price reversals. Traders using this strategy look for overbought or oversold conditions and enter trades in anticipation of a price reversal.

Pros:

- Can lead to quick profits if reversals are accurately predicted

- Works in both trending and ranging markets

Cons:

- Higher risk as it goes against the current price movement

- Requires excellent timing and market analysis skills

Essential Tools for Scalping in Forex

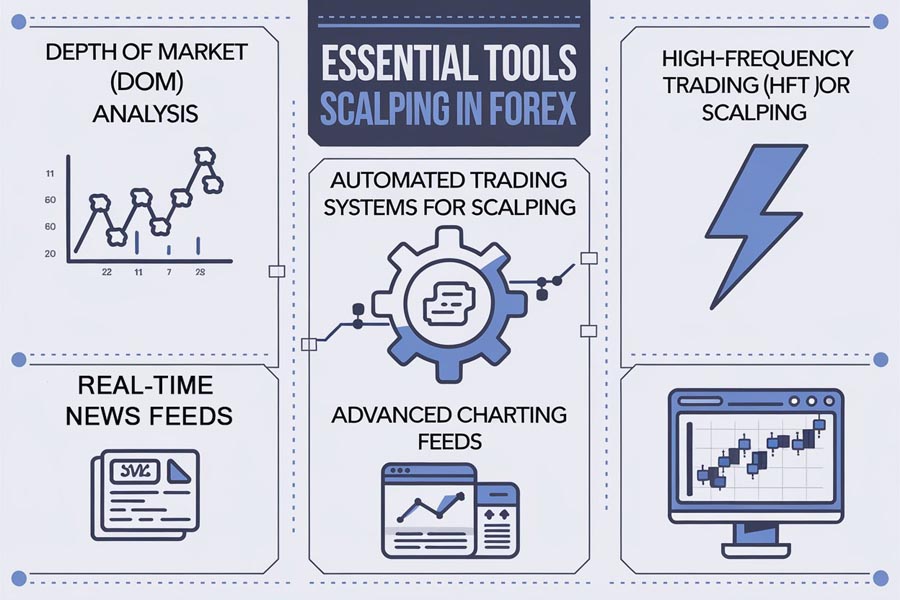

1. Depth of Market (DOM) Analysis

One of the most valuable tools for scalping in forex is Depth of Market (DOM) analysis, which provides a real-time view of buy and sell orders for a currency pair. This information helps scalpers understand the supply and demand dynamics at different price levels, allowing them to anticipate short-term price movements.

Using DOM, scalpers can gauge market sentiment and spot potential reversal points based on order flow, giving them an edge in their trading decisions.

2. Automated Trading Systems for Scalping

Automation plays a significant role in scalping forex trading. Automated trading systems allow traders to set specific criteria for entering and exiting trades, which can then be executed automatically without human intervention. These systems are especially useful in scalping because they eliminate the emotional aspect of trading, ensuring that trades are executed based on pre-determined rules.

Automated trading also ensures faster execution, which is crucial in scalping where seconds can make a difference between profit and loss.

3. High-Frequency Trading (HFT) for Scalping

For more advanced scalpers, high-frequency trading (HFT) is another tool worth considering. HFT involves using algorithms to execute trades in milliseconds, taking advantage of tiny price discrepancies that exist for only a fraction of a second. While HFT is typically reserved for institutional traders due to the technology and resources required, retail traders can adopt certain elements of it, such as using trading bots for faster order execution.

4. Real-Time News Feeds

Given the importance of staying informed about market-moving events, real-time news feeds are essential for scalpers. These feeds provide instant updates on economic indicators, geopolitical events, and other factors that can impact currency prices.

5. Advanced Charting Software

High-quality charting software with real-time data updates is crucial for scalpers. Look for platforms that offer customizable charts, a wide range of technical indicators, and the ability to set alerts for specific price levels or technical conditions.

How to Choose the Right Forex Broker for Scalping

Selecting the right forex broker is critical for scalpers because the broker’s trading conditions, spreads, and execution speed can directly impact profitability. Not all brokers are suitable for scalping, so it’s important to consider the following factors when choosing a broker:

1. Spreads and Commission

Scalping strategies rely on small price movements, so tight spreads are essential. The tighter the spread, the more likely you are to profit from small price moves. Some brokers offer commission-free trading with a markup on the spread, while others charge a commission per trade but offer lower spreads. It’s important to compare the overall trading costs to see which option works best for your scalping strategy.

2. Execution Speed

Fast execution is crucial for scalping in forex, as any delay can result in missing out on profitable trades. Look for brokers that offer low latency and no dealing desk (NDD) execution, which ensures that your orders are filled quickly without any interference from the broker.

Latency is particularly important for scalpers who rely on high-frequency trading or automated systems. A broker with slow execution can severely impact your profitability, as even a delay of a few seconds can turn a winning trade into a losing one.

3. Regulation and Trustworthiness

When engaging in scalping forex trading, it’s essential to choose a regulated and trustworthy broker. Brokers regulated by reputable authorities like the FCA (Financial Conduct Authority), ASIC (Australian Securities and Investments Commission), or CySEC (Cyprus Securities and Exchange Commission) are more likely to offer transparent pricing and fair trading conditions.

Choosing a regulated broker also gives you peace of mind knowing that your funds are protected and that the broker operates in a fair and transparent manner.

4. Trading Platform

The trading platform provided by your broker should be stable, user-friendly, and equipped with the tools necessary for scalping. Look for platforms that offer:

- Advanced charting capabilities

- Real-time price updates

- One-click trading

- Customizable interfaces

- Mobile trading options

5. Leverage and Margin Requirements

Scalpers often use leverage to magnify their profits from small price movements. However, leverage also increases risk. Choose a broker that offers suitable leverage options and clearly outlines their margin requirements.

Assets Suitable for Scalping in Forex Trading

When it comes to scalping, not all assets are created equal. Scalping relies on frequent trades and small price movements, so certain types of assets are more suited to this strategy than others. Liquidity, volatility, and trading costs are critical factors that determine whether an asset is ideal for scalping. Below are some of the most suitable assets for scalping:

1. Major Currency Pairs (Forex)

Currency pairs in the forex market are some of the most popular assets for scalping. This is primarily due to the high liquidity and tight spreads associated with major currency pairs. Major pairs like EUR/USD, GBP/USD, and USD/JPY experience high trading volumes, which leads to smaller bid-ask spreads—an important factor for scalpers who rely on rapid trade execution and minimal costs.

- EUR/USD: This is often the most liquid pair, making it perfect for scalping strategies. The spreads are usually tight, and price movements are frequent, offering numerous opportunities to enter and exit trades quickly.

- USD/JPY: Known for its stability and liquidity, this pair also provides opportunities for scalpers, especially during the Asian and U.S. trading sessions.

- GBP/USD: Although a bit more volatile than EUR/USD, this pair offers wider price swings, which can be favorable for scalpers looking for slightly bigger moves.

The liquidity of these pairs ensures that price slippage is minimized and that orders can be filled almost instantly, making them ideal for short-term traders.

2. Stock Indices

Another asset category well-suited for scalping is stock indices. Popular indices like the S&P 500, NASDAQ 100, and DAX 30 are highly liquid and volatile, providing numerous opportunities for quick trades. Stock indices tend to experience more predictable intraday trends, which scalpers can capitalize on.

- S&P 500: As one of the most heavily traded indices globally, it has high liquidity and allows scalpers to profit from frequent, small price movements.

- DAX 30: Known for its volatility, the DAX provides plenty of action for scalpers, particularly during the European trading session.

Scalping stock indices also benefits from lower overnight risk, as traders typically close their positions within the trading day, avoiding exposure to overnight market gaps.

3. Commodities

Some commodities, especially those that trade with high liquidity and volatility, are also good candidates for scalping. Gold (XAU/USD) and crude oil (WTI and Brent) are prime examples.

- Gold (XAU/USD): Gold is highly volatile, especially during times of economic uncertainty, providing opportunities for scalpers to profit from sharp intraday price fluctuations.

Crude Oil (WTI and Brent): Oil prices are influenced by various global factors , including supply and demand dynamics, geopolitical tensions, and inventory reports. The frequent price movements make crude oil suitable for short-term trading strategies like scalping.

One challenge with commodities is that they can have wider spreads compared to currencies or stock indices, but the volatility often compensates for this, allowing scalpers to find profitable opportunities.

4. Cryptocurrencies

While not traditionally considered by all scalpers, cryptocurrencies have emerged as a popular asset class for short-term traders due to their extreme volatility. Assets like Bitcoin (BTC/USD), Ethereum (ETH/USD), and Ripple (XRP/USD) can experience significant price swings within a short timeframe, making them ideal for scalping.

- Bitcoin (BTC/USD): The most popular cryptocurrency, Bitcoin is known for its large intraday price fluctuations. However, due to its wide spreads, scalping Bitcoin requires careful risk management.

- Ethereum (ETH/USD): Ethereum also exhibits sharp intraday price movements, providing opportunities for scalpers to capitalize on quick trades. Its spreads are often narrower than Bitcoin’s, making it more accessible for scalpers.

Cryptocurrency markets operate 24/7, which means that scalpers can trade any time, offering flexibility. However, the high volatility in crypto also makes it riskier, and traders need to be prepared for sudden and unpredictable price shifts.

5. Highly Liquid Stocks

In equity markets, certain individual stocks can be suitable for scalping, particularly those with high daily trading volumes and narrow bid-ask spreads. Tech giants like Apple (AAPL), Microsoft (MSFT), and Amazon (AMZN) are frequently chosen by scalpers due to their liquidity and daily volatility.

- Apple (AAPL): As one of the most traded stocks globally, Apple sees high liquidity, making it ideal for quick in-and-out trades.

- Amazon (AMZN): Known for its volatility, Amazon stock often experiences sharp price movements within short periods, presenting opportunities for scalpers.

Scalping stocks often requires access to a direct market access (DMA) platform to ensure quick execution and minimal slippage, as even small delays can impact the profitability of each trade.

Advanced Scalping Techniques for Forex Traders

1. Algorithmic Scalping Strategies

Algorithmic trading has become increasingly popular among scalpers, thanks to its ability to process large amounts of data and execute trades in milliseconds. Algorithmic scalping strategies use pre-programmed algorithms to analyze market conditions and automatically place trades based on predefined criteria.

For example, a simple algorithmic scalping strategy might use a combination of moving averages and momentum indicators to identify short-term trends. When the algorithm detects a strong uptrend, it automatically places a buy order, and when the trend reverses, it sells.

Advanced algorithms can also incorporate machine learning to improve their performance over time, making them more effective at identifying profitable opportunities.

2. Using Market Microstructure for Scalping

The market microstructure refers to the way financial markets operate at the most granular level, including the behavior of market participants and the mechanisms of order execution. By understanding how market participants place orders and how these orders affect price movements, scalpers can gain valuable insights into short-term price action.

For instance, by studying order flow and liquidity, scalpers can predict where the market is likely to move next and position themselves accordingly.

3. Multi-Timeframe Analysis

While scalpers primarily focus on short-term charts, incorporating multi-timeframe analysis can provide a broader context for trades. By analyzing higher timeframes, scalpers can identify the overall trend and potential support/resistance levels, which can then be used to refine entry and exit points on lower timeframes.

4. Sentiment Analysis

Incorporating sentiment analysis into scalping strategies can give traders an edge. By monitoring social media, news sentiment, and market positioning data, scalpers can gauge market sentiment and anticipate potential short-term price movements.

5. Arbitrage Scalping

Arbitrage scalping involves taking advantage of price discrepancies between different brokers or markets. While these opportunities are often fleeting, they can be highly profitable when executed correctly. This technique requires advanced technology and extremely fast execution to be successful.

Risks and Challenges in Scalping Forex Trading

1. Overtrading and Fatigue

Because scalping forex trading involves making numerous trades throughout the day, there’s a risk of overtrading, where traders place too many trades in a short period of time. Overtrading can lead to poor decision-making, increased transaction costs, and emotional exhaustion.

To avoid overtrading, it’s important to have a clear trading plan in place and to stick to it, even when the market is tempting you to make impulsive trades. Taking regular breaks and setting daily trade or profit limits can help maintain focus and prevent burnout.

2. Slippage and Order Execution

Slippage occurs when a trade is executed at a different price than expected, usually due to a delay in order execution. For scalpers, slippage can have a significant impact on profitability, especially when trading in fast-moving markets.

To minimize slippage, it’s important to use a broker with fast execution speeds and low latency, as well as to avoid trading during periods of high volatility, such as news events.

3. Technical Failures

Given the reliance on technology in scalping, technical failures can be particularly damaging. Internet outages, platform crashes, or other technical issues can lead to missed trades or inability to close positions.

To mitigate this risk, consider having backup internet connections, using mobile trading apps as a backup, and choosing a broker with reliable infrastructure and customer support.

4. Market Volatility

While volatility can create opportunities for scalpers, extreme market volatility can also lead to significant losses. Sudden price spikes or gaps can trigger stop losses or result in trades being executed at unfavorable prices.

Scalpers should be prepared for sudden market moves and adjust their strategies accordingly during highly volatile periods.

5. Regulatory Risks

Some regulatory bodies have imposed restrictions on certain scalping practices, particularly those involving high-frequency trading. Staying informed about regulatory changes in your jurisdiction is crucial to ensure your trading activities remain compliant.

Developing Your Forex Scalping Strategy

Creating a successful forex scalping strategy requires careful planning and continuous refinement. Here are some steps to help you develop your own scalping approach:

- Choose Your Timeframe: Decide whether you’ll focus on 1-minute, 5-minute, or other short-term charts.

- Select Your Currency Pairs: Focus on liquid pairs with tight spreads.

- Define Your Entry and Exit Rules: Establish clear criteria for entering and exiting trades.

- Set Risk Management Parameters: Determine your risk per trade and daily loss limits.

- Choose Your Technical Indicators: Select indicators that work well for short-term analysis, such as moving averages, RSI, or Bollinger Bands.

- Practice on a Demo Account: Test your strategy in a risk-free environment before trading live.

- Keep a Trading Journal: Track your trades to identify areas for improvement.

- Continuously Educate Yourself: Stay updated on market trends and refine your skills.

Remember, successful scalping strategies often evolve over time as market conditions change and you gain more experience.

OpoFinance Services: Your Partner in Forex Scalping Success

When it comes to forex scalping, having the right broker by your side can make all the difference. OpoFinance, an ASIC-regulated forex broker, offers a suite of services tailored to meet the needs of scalpers and high-frequency traders.

With OpoFinance, you’ll benefit from ultra-low spreads, lightning-fast execution, and a robust trading platform designed for scalping efficiency. Their advanced order types and risk management tools allow you to implement your scalping strategies with precision and confidence.

One standout feature of OpoFinance is their innovative social trading service. This platform allows you to connect with and learn from successful scalpers, providing valuable insights and the opportunity to copy their trades. Whether you’re a novice looking to learn or an experienced trader seeking to diversify your approach, OpoFinance’s social trading feature can enhance your scalping journey.

By choosing OpoFinance as your forex broker, you’re not just getting a trading platform – you’re gaining a partner committed to your success in the fast-paced world of forex scalping.

Conclusion

Scalping in forex offers exciting opportunities for traders who thrive in fast-paced environments and have the discipline to stick to a well-defined strategy. By mastering the techniques outlined in this guide and continuously refining your approach, you can potentially achieve consistent profits through forex scalping.

Remember, success in scalping requires a combination of knowledge, skill, and the right tools. Choose your broker wisely, practice diligently, and always prioritize risk management. With dedication and perseverance, you can join the ranks of successful forex scalpers and potentially achieve your financial goals.

Are you ready to take your forex trading to the next level with scalping? Start by implementing these strategies on a demo account, and when you’re confident, consider partnering with a reputable broker like OpoFinance to begin your live trading journey. Happy scalping!

What are the best currency pairs for scalping in forex?

The best currency pairs for scalping are those with high liquidity and tight spreads, such as EUR/USD, USD/JPY, and GBP/USD. These pairs typically have lower transaction costs, which is crucial for scalping, where small price movements are targeted.

Can beginners succeed with scalping in forex?

While scalping can be profitable, it’s not the best strategy for beginners due to the high level of skill, focus, and discipline required. Beginners may find it challenging to manage the fast-paced nature of scalping and could benefit from practicing on a demo account before attempting it in a live market.

How much capital do I need to start scalping?

The amount of capital required for scalping depends on the broker’s margin requirements and the trader’s risk tolerance. Some brokers allow traders to start with as little as $100, but it’s generally recommended to have a larger account to absorb losses and take advantage of leverage. A starting capital of $1,000 to $5,000 is often suggested for serious scalpers.