A weekly swing trading strategy is a systematic approach to trading that focuses on holding positions for several days to weeks, aiming to capture medium-term price movements. By using this strategy, traders can benefit from the natural fluctuations in the market, often achieving higher returns with less stress compared to day trading. With minimal time commitment—usually 1-2 hours of analysis per day—weekly swing trading strategies enable traders to make informed decisions without the need for constant market monitoring. By incorporating these strategies, particularly under the guidance of a regulated forex broker, traders can enhance their profitability while maintaining a healthy work-life balance. This article explores seven highly effective weekly swing trading strategies designed to help you achieve trading success.

Whether you’re just starting out or are an experienced trader, this guide offers actionable insights into identifying profitable market opportunities. You’ll learn how to implement a weekly swing trading strategy with precision, leveraging the power of technical analysis and market trends to enhance your results. By the end of this article, you will have a clear framework for executing your trades more effectively, all while managing risk and improving overall trading performance.

Understanding Weekly Swing Trading

A weekly swing trading strategy is a highly effective trading method designed to capture medium-term price movements. Traders using this strategy typically hold positions for several days or even up to a few weeks, depending on market conditions and trends. The core objective is to identify and profit from price “swings” within a broader trend—whether upward or downward—before the market reverses direction.

What Sets the Weekly Swing Trading Strategy Apart?

The weekly swing trading strategy offers a distinct approach that sets it apart from other trading styles like day trading or long-term investing. Day trading, for example, requires constant monitoring of the markets and quick decision-making to capitalize on intraday price movements. This can be highly stressful and time-consuming.

On the other hand, the weekly swing trading strategy provides a more relaxed and flexible approach. Since positions are held over several days, traders can analyze price movements in a more deliberate manner. They don’t need to sit in front of their screens all day, watching every tick of the market. Instead, they can check their positions and market trends a few times a week, making it an ideal choice for those seeking profit opportunities while maintaining a manageable trading routine.

Read More: Fibonacci Retracement Swing Trading Strategy

Key Benefits of Weekly Swing Trading

- Reduced Time Commitment: Traders using a weekly swing trading strategy spend less time glued to their screens. Typically, it requires about 60-70% less time analyzing markets compared to day trading, which can be exhausting for those who need to manage other responsibilities. Swing traders only need to check the market a few times a week to adjust their positions.

- Lower Stress Levels: With fewer trades executed each week, traders using a weekly swing trading strategy experience less stress. The reduced trading frequency allows for better mental clarity and avoids the emotional fatigue associated with rapid decision-making required in day trading.

- Cost-Effective: Since the weekly swing trading strategy involves fewer trades, traders benefit from lower commission costs and fewer fees associated with transactions. This makes it a more economical option, especially for traders who want to minimize their trading costs without sacrificing profit potential.

- Better Work-Life Balance: One of the most attractive aspects of the weekly swing trading strategy is that it doesn’t demand constant market monitoring. Traders can pursue other interests, careers, or family time without being tethered to their screens, promoting a healthier work-life balance.

- Enhanced Analysis Quality: Having more time between trades allows swing traders to perform in-depth analysis of market conditions. Traders can better understand price patterns, technical indicators, and fundamental factors, resulting in more informed decision-making.

- Improved Risk Management: The weekly swing trading strategy provides ample time to plan entries and exits carefully. This leads to better risk management as traders can set well-thought-out stop-losses and take-profit levels, ensuring that they don’t overexpose their portfolios to market volatility.

Essential Weekly Swing Trading Strategies

1. Trend-Following Strategy

The trend-following strategy has shown a success rate of up to 65% when properly executed. To implement this strategy:

Implementation Steps:

- Identify the Primary Trend

- Use weekly charts to determine the overall market direction

- Apply 20-week and 50-week moving averages

- Look for clear higher highs and higher lows (uptrend) or lower lows and lower highs (downtrend)

- Find Entry Points

- Locate pullbacks to support levels in uptrends or resistance in downtrends

- Use momentum indicators like RSI to confirm oversold/overbought conditions

- Wait for candlestick patterns indicating trend resumption

- Set Up Your Trade

- Place stop losses 1-2 ATR below recent swing lows (for longs)

- Target profit at 2-3 times your risk

- Consider scaling out of positions to lock in profits

Key Indicators:

- Moving Averages (20, 50, 200-period)

- Relative Strength Index (RSI)

- Average True Range (ATR)

- Volume

Read More: Master Bollinger Bands Swing Trading Strategy

2. Breakout Trading Strategy

Capitalize on significant price movements with this powerful approach:

Implementation Steps:

- Identify Consolidation Patterns

- Look for rectangular ranges, triangles, or wedges on weekly charts

- Ensure the pattern has been forming for at least 4-6 weeks

- Calculate the average volume during consolidation

- Prepare for the Breakout

- Draw clear support and resistance levels

- Set price alerts slightly above/below these levels

- Calculate position size based on the pattern’s height

- Execute the Trade

- Enter when price breaks out on volume 50% higher than average

- Place stop loss inside the consolidation pattern

- Target profit at 1-1.5 times the pattern’s height

Key Considerations:

- False breakouts are common; wait for confirmation

- Higher time frame breakouts are more reliable

- Use volume to validate breakout strength

3. Moving Average Crossover Strategy

A time-tested approach with proven results:

Implementation Steps:

- Set Up Your Charts

- Apply 10-week and 30-week exponential moving averages

- Add a 200-week simple moving average for trend context

- Include volume indicators for confirmation

- Identify Trading Signals

- Long entry: 10-week EMA crosses above 30-week EMA

- Short entry: 10-week EMA crosses below 30-week EMA

- Confirm signals with price action and volume

- Manage Your Trades

- Use the 30-week EMA as a trailing stop

- Take partial profits at key resistance/support levels

- Consider pyramiding in strong trends

Performance Metrics:

- Historical win rate: 55-60%

- Average Reward:Risk ratio: 2.1:1

- Typical holding period: 2-4 weeks

4. Fibonacci Retracement Strategy

Fibonacci retracement levels have been shown to predict potential reversal points with up to 70% accuracy in trending markets.

Implementation Steps:

- Identify Strong Trends

- Look for clear uptrends or downtrends on weekly charts

- Ensure the trend has made a significant move (at least 100 pips in forex)

- Wait for the trend to show signs of retracement

- Apply Fibonacci Levels

- Draw Fibonacci from swing low to high (uptrend) or high to low (downtrend)

- Focus on key levels: 38.2%, 50%, and 61.8%

- Look for confluence with other technical indicators

- Entry Execution

- Wait for price to reach a Fibonacci level

- Look for candlestick patterns confirming the reversal

- Enter when price action shows trend resumption

Risk Management:

- Place stops below the 78.6% retracement level

- Target the previous swing high/low

- Consider scaling out at different Fibonacci extension levels

5. Range Trading Strategy

Perfect for sideways markets, this strategy capitalizes on price oscillations between support and resistance.

Key Components:

- Range Identification

- Look for markets moving sideways for at least 4-6 weeks

- Identify clear support and resistance levels

- Ensure the range is wide enough to offer good risk/reward

- Entry Criteria

- Buy near support with bullish confirmation

- Sell near resistance with bearish confirmation

- Use momentum indicators to confirm oversold/overbought conditions

- Trading Rules

- Set stops outside the range (beyond support/resistance)

- Target the opposite side of the range

- Be cautious of potential breakouts

Performance Metrics:

- Typical success rate: 60-65% in stable market conditions

- Average holding time: 3-5 days

- Best performed in low volatility environments

6. Swing Failure Pattern Strategy

This advanced strategy capitalizes on failed breakouts and breakdowns, often leading to powerful moves in the opposite direction.

Implementation Guide:

- Pattern Recognition

- Identify a recent swing high or low

- Watch for a break of this level

- Look for immediate failure to follow through

- Entry Tactics

- Enter when price returns back through the swing point

- Use aggressive stops above/below the failed break point

- Target previous support/resistance levels

- Risk Control

- Keep position sizes smaller due to faster moves

- Use time stops if the expected move doesn’t happen quickly

- Consider scaling into positions as the move confirms

Key Advantages:

- Excellent risk/reward ratios (often 3:1 or better)

- Clear invalidation points for stop losses

- Works in multiple timeframes and markets

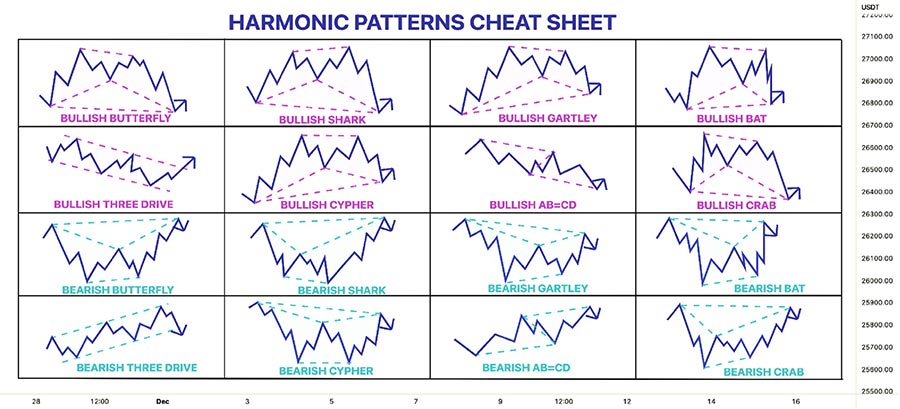

7. Harmonic Pattern Strategy

Utilizing precise Fibonacci ratios to identify potential reversal points.

Pattern Types:

- Bat Pattern

- Completion zone between 88.6% and 78.6% retracement

- Ideal for trending markets showing deep retracements

- Butterfly Pattern

- Extension beyond the initial move (127.2% to 161.8%)

- Often forms at potential trend reversal points

- Gartley Pattern

- Classic pattern completing at 78.6% retracement

- High probability setup when combined with trend analysis

Trading Approach:

- Pattern Validation

- Ensure all legs meet proper Fibonacci ratios

- Look for confluence with other technical factors

- Consider overall trend context

- Entry Methods

- Wait for price action confirmation at completion point

- Use limit orders near the predicted reversal zone

- Scale into positions for larger potential moves

- Risk Management

- Place stops beyond the final pattern point

- Use multiple targets based on Fibonacci extensions

- Consider time-based exits if reversal doesn’t occur

Success Factors:

- Requires patience and precision in pattern identification

- Most effective when combined with other forms of analysis

- Historical data suggests up to 68% accuracy when properly executed

Read More: 7 Best Time Frames for Scalping

Seasonal Analysis for Weekly Swing Trading

Incorporating seasonal patterns into your weekly swing trading strategy can significantly enhance your decision-making process and trading performance. Seasonal analysis involves understanding historical price movements and recognizing patterns that tend to recur during specific times of the year. Here’s how to effectively integrate seasonal analysis into your trading strategy:

Incorporating Seasonal Patterns into Your Strategy

- Research Historical Price Patterns: Analyze the historical price movements of your chosen markets to identify seasonal trends. Look for patterns that have occurred consistently over the years, focusing on specific months or quarters that yield reliable results.

- Identify Recurring Seasonal Trends and Cycles: Study the recurring cycles in your markets. Certain commodities, currencies, or indices may demonstrate predictable behaviors during specific seasons, such as higher demand during holidays or increased volatility during economic announcements.

- Use Seasonal Data to Support Your Trading Decisions: Leverage seasonal insights to inform your trade entries and exits. By understanding when to expect price increases or decreases, you can time your trades more effectively.

- Reliability of Seasonal Patterns: Studies show that certain markets can exhibit up to 70% reliability in seasonal patterns. This high level of reliability provides traders with a significant edge when planning trades around these periods.

Implementing Seasonal Analysis

- Create a Seasonal Calendar:

- Document monthly and quarterly patterns. Identify specific times of the year when certain assets tend to perform better or worse, allowing you to plan your trades accordingly.

- Note major economic events that impact your markets. Keep track of economic reports, earnings announcements, or other significant events that could influence market behavior during seasonal peaks.

- Identify historically volatile periods. Recognize times of the year that historically have experienced increased volatility, helping you to prepare for potential market swings.

- Combine with Technical Analysis:

- Use seasonal trends to confirm technical setups. When technical indicators align with seasonal trends, it can strengthen the validity of your trading signals.

- Be cautious when technicals conflict with seasonality. If technical analysis and seasonal patterns provide opposing signals, consider the broader market context and prioritize current market conditions.

- Give more weight to current market conditions. While seasonal patterns are valuable, they should be used in conjunction with real-time data and market analysis to ensure informed trading decisions.

Advanced Weekly Swing Trading Techniques

Multiple Timeframe Analysis

Enhance your trading decisions:

- Start with weekly charts for trend direction

- Use daily charts for entry timing

- Confirm with 4-hour charts for precise entries

- Traders using multiple timeframe analysis report up to 40% improved accuracy in their trades

Volume Analysis

Validate your trading decisions:

- Look for volume confirmation on breakouts

- Identify potential reversals with volume divergence

- Use volume to gauge trend strength

- Consider On-Balance Volume (OBV) for trend confirmation

Risk Management for Weekly Swing Trading

Position Sizing

Protect your capital:

- Never risk more than 1-2% of your account per trade

- Calculate position size based on stop loss distance

- Use a position size calculator for accuracy

- Consider scaling into positions for larger moves

Stop Loss Placement

Strategic stop loss placement is crucial:

- Place stops below recent swing lows for long positions

- Use Average True Range (ATR) for stop loss distances

- Consider time-based stops for range-bound markets

- Implement trailing stops to lock in profits as trades move in your favor

Psychology of Swing Trading

Maintaining Discipline

Successful swing trading requires:

- Sticking to your trading plan

- Avoiding emotional decisions

- Accepting that some trades will lose

- Maintaining a trading journal

- Regularly reviewing and improving your strategy

Common Psychological Pitfalls

Be aware of:

- Fear of missing out (FOMO)

- Revenge trading after losses

- Overtrading in quiet markets

- Holding losing positions too long

Opofinance Services

When it comes to executing your weekly swing trading strategy, choosing the right broker is crucial for success. Opofinance, an ASIC-regulated forex broker, offers a robust platform tailored for swing traders, including:

- Social Trading Service: Learn from and copy successful swing traders, enhancing your trading results and accelerating your learning curve.

- MT5 Broker Listing: As an officially featured broker on the MT5 brokers list, Opofinance provides a secure and professional trading environment.

- Versatile Trading Platform: Supports various trading strategies, making it an ideal choice for effectively implementing your weekly swing trading strategies.

- Safe Deposit and Withdrawal Methods: Ensures your funds are easily accessible and transactions are secure.

- Reliable Execution: Guarantees dependable execution of your swing trading strategies, backed by regulatory compliance and customer protection.

With Opofinance, you can trade confidently, knowing that you have the support of a reputable broker dedicated to your trading success.

Conclusion

A weekly swing trading strategy offers traders a balanced approach to the financial markets, allowing them to capture medium-term price movements without the time constraints of day trading. By utilizing the proven techniques and strategies outlined in this guide, you can maximize your potential for significant profits while maintaining a healthy work-life balance.

Choosing a reliable broker, such as Opofinance, is also essential in ensuring the success of your trading journey. Regulated brokers provide the necessary tools and support, helping you develop a trading system that aligns with your goals and risk tolerance.

Remember, successful swing trading requires patience, discipline, and the consistent application of your chosen strategy. By sticking to these principles, traders can increase their chances of long-term profitability while enjoying the flexibility and freedom that a weekly swing trading strategy offers.

How much capital should I start with for weekly swing trading?

While you can start swing trading with any amount, it’s recommended to begin with at least $5,000 to allow for proper position sizing and risk management. This amount provides enough cushion to withstand normal market fluctuations while still allowing for meaningful profits.

Can I swing trade while working a full-time job?

Yes, weekly swing trading is ideal for those with full-time jobs. Since positions are held for several days or weeks, you don’t need to monitor the markets constantly. Most swing traders spend 30-60 minutes each evening analyzing charts and adjusting positions.

What is the typical win rate for experienced swing traders?

Experienced swing traders often achieve win rates between 40-60%. However, the key to profitability isn’t necessarily having a high win rate, but rather maintaining a favorable risk-to-reward ratio. Successful swing traders typically aim for reward-to-risk ratios of 2:1 or higher.