In the fast-paced world of forex trading, staying ahead requires not only skill but also the right tools. Ichimoku and Exponential Moving Averages (EMA) are two powerful indicators that can significantly enhance your trading strategy. Whether you’re a novice or an experienced trader, understanding how to effectively use Ichimoku and EMA can lead to improved trading decisions and increased profitability. In this comprehensive guide, we’ll explore the essentials of Ichimoku and EMA, providing you with actionable strategies to elevate your forex trading game in 2024.

Introduction

Are you striving to maximize your forex trading profits in 2024? Harnessing the combined power of Ichimoku and EMA could be your key to success. These technical indicators offer unique insights into market trends and momentum, enabling traders to make informed decisions with greater confidence. By integrating Ichimoku and EMA into your trading strategy, you can achieve a more nuanced understanding of market dynamics, ultimately leading to enhanced trading performance. Whether you’re looking to refine your existing strategies or develop new ones, this guide provides the essential knowledge and techniques you need to excel. Additionally, partnering with a regulated forex broker like Opofinance ensures that your trading environment is secure and professional, allowing you to focus solely on your trading strategies.

Understanding Ichimoku Cloud

What is Ichimoku?

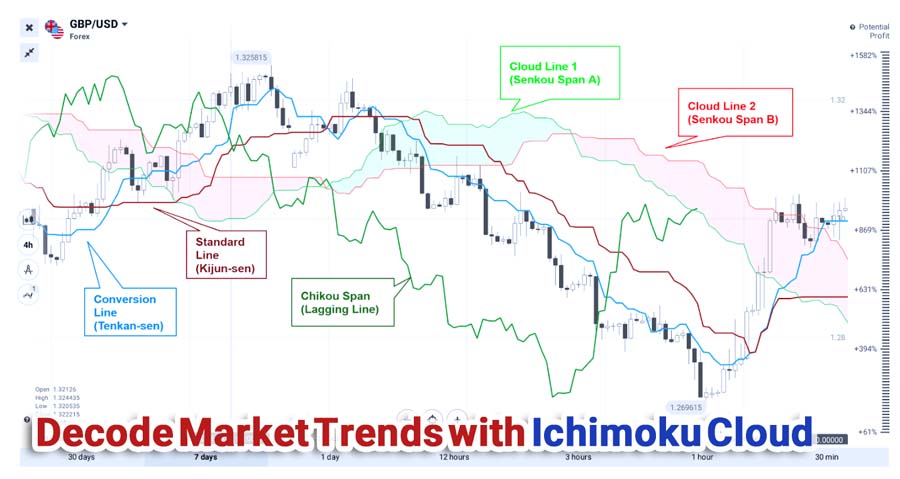

The Ichimoku Cloud, developed by Japanese journalist Goichi Hosoda, is a comprehensive indicator that provides a holistic view of the market. It comprises five main components: Tenkan-sen, Kijun-sen, Senkou Span A, Senkou Span B, and Chikou Span. Together, these elements help traders identify support and resistance levels, trend direction, momentum, and potential reversal points.

Key Components of Ichimoku

- Tenkan-sen (Conversion Line): Calculates the average of the highest high and lowest low over the past 9 periods.

- Kijun-sen (Base Line): A longer-term average, typically over 26 periods.

- Senkou Span A (Leading Span A): The average of Tenkan-sen and Kijun-sen, plotted 26 periods ahead.

- Senkou Span B (Leading Span B): The average of the highest high and lowest low over the past 52 periods, plotted 26 periods ahead.

- Chikou Span (Lagging Span): The closing price plotted 26 periods behind.

Understanding these components is crucial for effectively utilizing the Ichimoku Cloud in your trading strategy.

How Ichimoku Helps Traders

Ichimoku provides a visual representation of market conditions, making it easier to identify trends and potential reversal points. The cloud itself acts as dynamic support and resistance levels, while the interaction between the Tenkan-sen and Kijun-sen lines signals potential entry and exit points.

- Trend Identification: The position of the price relative to the cloud indicates the prevailing trend.

- Momentum: The distance between the Tenkan-sen and Kijun-sen lines reflects market momentum.

- Support and Resistance: The cloud’s boundaries serve as support and resistance zones.

By mastering the Ichimoku Cloud, traders can gain a competitive edge in analyzing and predicting market movements.

Exploring Exponential Moving Averages (EMA)

What is EMA?

The Exponential Moving Average (EMA) is a type of moving average that places greater weight on recent price data, making it more responsive to new information. Unlike the Simple Moving Average (SMA), which treats all data points equally, EMA reacts more quickly to price changes, providing timely signals for traders.

Benefits of Using EMA in Trading

- Quick Reaction to Price Changes: EMA’s sensitivity to recent prices helps traders spot trends and reversals early.

- Versatility: EMA can be used across different time frames and trading styles.

- Trend Confirmation: EMA can confirm trends identified by other indicators, such as Ichimoku.

- Smooths Price Data: By reducing the lag compared to SMA, EMA provides a clearer view of the current market trend.

Incorporating EMA into your trading strategy can enhance your ability to make timely and informed trading decisions.

Combining Ichimoku and EMA for Optimal Trading

Synergizing Ichimoku and EMA

While both Ichimoku and EMA are powerful indicators on their own, combining them can provide a more comprehensive analysis of the market. Ichimoku offers a broad view of trend direction and support/resistance levels, while EMA provides precise entry and exit signals based on recent price movements.

Benefits of Combining Both Indicators

- Enhanced Trend Confirmation: Use Ichimoku to identify the overall trend and EMA to confirm the direction.

- Improved Signal Accuracy: Cross-referencing signals from both indicators reduces the likelihood of false signals.

- Comprehensive Market Analysis: Gain insights into both long-term trends (Ichimoku) and short-term momentum (EMA).

- Balanced Approach: Combining a trend-following indicator (Ichimoku) with a momentum indicator (EMA) offers a well-rounded strategy.

By leveraging the strengths of both Ichimoku and EMA, traders can develop a more robust and reliable trading strategy.

Practical Application: Step-by-Step Strategy

- Identify the Trend with Ichimoku:

- If the price is above the cloud, the market is in an uptrend.

- If the price is below the cloud, the market is in a downtrend.

- If the price is within the cloud, the market is in a consolidation phase.

- Confirm with EMA:

- Use a short-term EMA (e.g., 9-period) to gauge momentum.

- A bullish signal is generated when the price crosses above the EMA.

- A bearish signal is generated when the price crosses below the EMA.

- Execute the Trade:

- Enter a long position when both Ichimoku indicates an uptrend and the price crosses above the EMA.

- Enter a short position when both Ichimoku indicates a downtrend and the price crosses below the EMA.

- Set Stop-Loss and Take-Profit Levels:

- Use Ichimoku support/resistance levels to set stop-loss and take-profit points.

This strategy combines the comprehensive trend analysis of Ichimoku with the precise entry signals of EMA, providing a balanced approach to trading.

Step-by-Step Strategies Using Ichimoku and EMA

Strategy 1: Trend Following with Confirmation

- Determine the Trend:

- Use Ichimoku to identify the prevailing trend. The position of the price relative to the cloud is crucial:

- Above the cloud: Uptrend

- Below the cloud: Downtrend

- Within the cloud: Consolidation

- Use Ichimoku to identify the prevailing trend. The position of the price relative to the cloud is crucial:

- Wait for EMA Confirmation:

- Apply a short-term EMA (e.g., 9-period) to gauge momentum.

- A bullish signal is generated when the price crosses above the EMA.

- A bearish signal is generated when the price crosses below the EMA.

- Enter the Trade:

- Long Position: When Ichimoku indicates an uptrend and the price crosses above the EMA.

- Short Position: When Ichimoku indicates a downtrend and the price crosses below the EMA.

- Manage the Trade:

- Use Ichimoku support/resistance levels to set stop-loss and take-profit orders.

- Monitor the trade and adjust as necessary based on market conditions.

This strategy ensures that you trade in the direction of the dominant trend, increasing the probability of success.

Strategy 2: Reversal Signals

- Identify Overextended Conditions:

- Use Ichimoku to spot potential reversal points near the cloud boundaries.

- Look for situations where the price is significantly above or below the cloud.

- Look for EMA Crossovers:

- A crossover of a short-term EMA below a long-term EMA can signal a bearish reversal.

- Conversely, a crossover above can signal a bullish reversal.

- Confirm Reversal with Ichimoku:

- Ensure that the Ichimoku lines (Tenkan-sen and Kijun-sen) support the reversal direction.

- Look for the Chikou Span to cross the price from the opposite direction.

- Enter the Trade:

- Execute the trade based on confirmed reversal signals.

- Set Stop-Loss and Take-Profit:

- Place stop-loss orders beyond recent swing highs/lows.

- Set take-profit levels at key support/resistance zones identified by Ichimoku.

This strategy capitalizes on potential market reversals, allowing traders to enter trades at optimal points.

Strategy 3: Breakout Trading

- Identify Consolidation Zones:

- Use Ichimoku to identify periods when the price is within the cloud, indicating consolidation.

- Observe the narrowing of the cloud, signaling low volatility.

- Wait for Breakout:

- Monitor the EMA for a breakout signal as the price moves out of the consolidation zone.

- A breakout above the cloud suggests a potential uptrend, while a breakout below indicates a possible downtrend.

- Confirm with Ichimoku:

- Ensure that the breakout aligns with the overall trend indicated by Ichimoku.

- Check if the Tenkan-sen and Kijun-sen lines are moving in the direction of the breakout.

- Enter the Trade:

- Execute the trade in the direction of the breakout.

- Set Stop-Loss and Take-Profit:

- Place stop-loss orders just inside the consolidation zone.

- Set take-profit targets based on the expected range of the breakout.

Breakout trading with Ichimoku and EMA can help traders capitalize on significant market movements.

Risk Management with Ichimoku and EMA

Effective risk management is crucial for long-term trading success. Combining Ichimoku and EMA can aid in setting appropriate stop-loss and take-profit levels, thereby minimizing potential losses and maximizing gains.

Setting Stop-Loss Levels

- Using Ichimoku Support/Resistance:

- Place stop-loss orders just below the Senkou Span B for long positions or above it for short positions.

- Using EMA Levels:

- Set stop-loss based on the distance from the EMA to avoid being stopped out by normal market fluctuations.

- ATR-Based Stops:

- Utilize the Average True Range (ATR) to set dynamic stop-loss levels based on market volatility.

Implementing stop-loss orders based on Ichimoku and EMA levels helps in effectively managing risk and protecting your capital.

Determining Take-Profit Levels

- Target Previous Highs/Lows:

- Use Ichimoku support and resistance zones to identify potential take-profit points.

- Risk-Reward Ratio:

- Aim for a favorable risk-reward ratio, such as 1:2 or higher, to ensure profitable trades outweigh losses.

- Trailing Stops:

- Use trailing stops to lock in profits as the trade moves in your favor, allowing for maximum gain potential.

Strategically setting take-profit levels ensures that you capitalize on favorable market movements while managing your risk exposure.

Position Sizing

- Calculate Risk Per Trade:

- Determine the amount of capital to risk on each trade based on your overall trading plan, typically a small percentage of your total capital (e.g., 1-2%).

- Adjust Position Size:

- Adjust your position size to ensure that your risk remains consistent across trades, regardless of market volatility.

- Diversification:

- Spread your risk across multiple trades and currency pairs to minimize the impact of any single trade on your overall portfolio.

Proper position sizing is a fundamental aspect of risk management, ensuring that no single trade can significantly harm your trading capital.

Risk-Reward Ratio Optimization

- Balancing Risk and Reward:

- Strive for a risk-reward ratio that ensures your potential reward justifies the risk taken.

- Consistent Application:

- Apply your chosen risk-reward ratio consistently across all trades to maintain a disciplined trading approach.

- Regular Review:

- Periodically review and adjust your risk-reward ratio based on market conditions and trading performance.

Optimizing the risk-reward ratio is essential for achieving sustainable profitability in forex trading.

Implementing robust risk management techniques ensures that you protect your capital while pursuing trading opportunities.

Common Mistakes to Avoid

Overcomplicating the Strategy

Using too many indicators can lead to confusion and analysis paralysis. Focus on Ichimoku and EMA to maintain a clear and effective trading strategy. Avoid cluttering your charts with unnecessary tools that can obscure your analysis and lead to indecision.

Ignoring Market Conditions

Different market conditions require different strategies. Ensure that your approach with Ichimoku and EMA aligns with the current market environment, whether trending or ranging. Adapting your strategy to suit the market conditions increases the likelihood of successful trades.

Poor Risk Management

Neglecting to set stop-loss and take-profit levels can lead to significant losses. Always prioritize risk management to safeguard your trading capital. A well-defined risk management plan is the cornerstone of long-term trading success.

Relying Solely on Indicators

While Ichimoku and EMA are powerful, they should be complemented with other forms of analysis, such as fundamental analysis or market sentiment, for a more comprehensive view. Combining technical indicators with other analytical methods provides a more robust trading approach.

Overtrading

Entering too many trades in a short period can lead to increased transaction costs and potential losses. Maintain discipline by sticking to your trading plan and avoiding impulsive trades.

Avoiding these common mistakes can enhance the effectiveness of your Ichimoku and EMA trading strategies.

Pro Tips for Advanced Traders

Optimize Indicator Settings

Experiment with different Ichimoku and EMA settings to tailor the indicators to your specific trading style and the market you are trading. Customizing indicator parameters can enhance their accuracy and effectiveness in different market conditions.

Combine with Other Indicators

Integrate additional indicators, such as the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD), to confirm signals and enhance your analysis. Using complementary indicators can provide a more comprehensive view of market dynamics.

Automate Your Strategy

Use trading platforms that support automation to implement your Ichimoku and EMA strategies efficiently, reducing the potential for human error. Automating your trading strategy ensures consistency and can free up time for strategic analysis.

Backtest Your Strategy

Thoroughly backtest your strategies using historical data to assess their performance and make necessary adjustments before applying them in live trading. Backtesting helps identify potential flaws and optimizes your strategy for better performance.

Monitor Market Sentiment

Incorporate market sentiment analysis into your trading strategy to gauge the overall mood of the market. Understanding market sentiment can provide additional context for your technical analysis and improve your trading decisions.

These advanced strategies can take your Ichimoku and EMA trading to the next level, providing greater precision and efficiency.

Opofinance Services: Your Trusted ASIC Regulated Forex Broker

When it comes to executing your Ichimoku and EMA strategies, partnering with a reliable forex broker is essential. Opofinance stands out as an ASIC regulated broker, ensuring your trades are handled with the utmost security and professionalism. Opofinance offers a comprehensive suite of services, including advanced social trading features that allow you to follow and replicate the strategies of successful traders.

Why Choose Opofinance?

- ASIC Regulation: Ensures that Opofinance adheres to strict regulatory standards, providing a secure trading environment.

- Social Trading Services: Leverage the power of community by following and copying the trades of experienced traders, enhancing your own trading performance.

- MT5 Platform: Officially featured on the MT5 brokers list, Opofinance provides access to a robust trading platform with enhanced functionality, including advanced charting tools and automated trading capabilities.

- Safe and Convenient Deposits and Withdrawals: Enjoy a variety of secure and efficient methods for managing your funds, ensuring that your deposits and withdrawals are handled smoothly and safely.

- Customer Support: Benefit from dedicated customer support that assists you with any trading-related inquiries or issues, ensuring a seamless trading experience.

Choose Opofinance for a seamless trading experience that supports your journey towards forex success.

Social Trading with Opofinance

Opofinance’s social trading platform allows you to connect with a community of traders, share insights, and replicate successful trading strategies. This feature is particularly beneficial for those looking to learn from experienced traders and enhance their own trading performance. By leveraging social trading, you can gain valuable insights and improve your trading outcomes with less effort.

Advanced Trading Tools on MT5

The MetaTrader 5 (MT5) platform offered by Opofinance provides a wide range of advanced trading tools, including:

- Enhanced Charting Capabilities: Access to multiple time frames, customizable charts, and a variety of technical indicators.

- Automated Trading: Utilize Expert Advisors (EAs) to automate your trading strategies, ensuring consistent execution without emotional interference.

- Comprehensive Market Analysis: Benefit from integrated market news, economic calendars, and analytical tools to stay informed about market developments.

The MT5 platform empowers you with the tools needed to execute sophisticated trading strategies effectively.

Secure Fund Management

Opofinance ensures that your funds are managed securely with multiple layers of protection, including:

- Segregated Accounts: Your funds are kept separate from the company’s operational funds, ensuring their safety.

- Encryption and Security Protocols: Advanced encryption technologies protect your financial transactions and personal data.

- Transparent Transactions: Clear and transparent processes for deposits and withdrawals, ensuring that you have full control over your funds.

Secure fund management is a top priority at Opofinance, giving you peace of mind as you trade.

Key Takeaways

- Ichimoku and EMA are powerful indicators that, when combined, offer comprehensive insights into market trends and momentum.

- Effective strategies involve trend following, reversal signals, and breakout trading, all enhanced by robust risk management.

- Avoid common trading mistakes by keeping your strategy simple, aligning with market conditions, and prioritizing risk management.

- Advanced traders can optimize their strategies by customizing indicator settings, integrating additional tools, leveraging automation, and continuously learning.

- Choosing the right broker like Opofinance, which is ASIC regulated and offers advanced trading features, is crucial for successful trading.

- Risk management techniques such as setting stop-loss and take-profit levels, position sizing, and hedging are essential for protecting your capital.

- Opofinance’s social trading services and MT5 platform provide the tools and support needed to implement Ichimoku and EMA strategies effectively.

Mastering Ichimoku and EMA can transform your forex trading approach, leading to increased profitability and trading confidence.

How Can Ichimoku and EMA Help in Volatile Markets?

In volatile markets, Ichimoku provides a clear picture of support and resistance levels, while EMA offers timely entry and exit signals based on recent price movements. Together, they help traders navigate rapid price changes by identifying key trend directions and momentum shifts. This combination allows for more informed and strategic trading decisions, even in the most unpredictable market conditions.

What Time Frames Work Best with Ichimoku and EMA?

While Ichimoku can be applied to various time frames, it is most effective on daily and weekly charts for long-term trends. EMA is versatile and can be used on shorter time frames, such as 5-minute or 15-minute charts, making it suitable for day traders seeking quick signals. Using multiple time frames in conjunction with Ichimoku and EMA can enhance the accuracy and reliability of your trading strategy.

Can Ichimoku and EMA Be Used for All Forex Pairs?

Yes, Ichimoku and EMA can be applied to all forex pairs. However, it’s important to adjust the indicator settings based on the specific characteristics of each currency pair to optimize their effectiveness. Different pairs may exhibit varying levels of volatility and trend behavior, so tailoring your indicators ensures more precise trading signals.