Are overnight fees, also known as “swap,” slowly chipping away at your trading profits? Or perhaps, for reasons of faith, you are searching for a way to trade that is free from interest-based charges? The Islamic (Swap-Free) account at Opofinance is the perfect answer to both of these needs.

By completely eliminating nightly interest charges, this account not only allows Muslim traders to participate in the markets with a clear conscience but also offers a massive advantage for any trader with a long-term strategy.

In this comprehensive guide, we’ll show you exactly what a swap-free account is, explore its unique features at Opofinance, and walk you through the simple, step-by-step process to activate it for your own account in just a few minutes. Join us as we dive into all the details of this powerful and practical feature.

First, What is Swap (Overnight Interest)?

To truly appreciate the value of an Islamic account, we first need to get a solid grip on the concept of “swap.” Let’s break it down with a simple, real-world analogy.

Imagine you decide to buy the EUR/USD currency pair. In the world of Forex, this action means you are simultaneously buying the Euro and selling the US Dollar. Behind the scenes, you are essentially borrowing US Dollars to finance your purchase of Euros.

Now, every major currency in the world has an interest rate set by its country’s central bank.

- If the interest rate of the currency you bought (the Euro) is higher than the interest rate of the currency you sold (the Dollar), the broker will pay you a small amount of interest. This is called a positive swap.

- If the interest rate of the currency you bought (the Euro) is lower than the interest rate of thecurrency you sold (the Dollar), you will have to pay the broker a small amount of interest. This is called a negative swap.

This calculated amount is the swap, and it’s applied to your account every night at a specific time (usually at the close of the New York trading session) for as long as you keep your trade open.

A Real-World Example of Swap’s Impact

Let’s say your analysis shows that the price of Gold is set to rise over the next two weeks. You open a buy position on Gold. If you have a standard account, you’ll likely have to pay a negative swap fee every single night. Let’s imagine this fee is just $5 per day.

After 14 days, you will have paid $70 ($5 x 14) just for the privilege of keeping your trade open! This $70 is deducted directly from your profits. If the market didn’t move as much as you hoped, this swap cost could even turn a potentially profitable trade into a losing one. This is the hidden cost that swap-free accounts are designed to eliminate.

The Islamic (Swap-Free) Account: A Solution for Two Key Groups

Now that we understand the challenge of swap fees, the Islamic account enters the picture as a hero. As its name suggests, this account type completely removes swap, or overnight interest. But who is it really for?

1. Muslim Traders Seeking Halal Trading

The primary and most important group this account serves is Muslim traders who wish to conduct their financial activities in accordance with Islamic Sharia law. A core principle of Islamic finance is the prohibition of “Riba,” which translates to usury or interest.

Since swap is a form of interest, it presents a barrier for observant Muslims. The Opofinance Islamic account removes this barrier entirely. By eliminating both the paying and receiving of swap, it creates a trading environment that is considered “Halal,” or permissible. This allows Muslim traders to participate in the global financial markets with complete peace of mind, knowing their activities align with their religious principles.

2. Long-Term and Strategic Traders

The second group that benefits enormously from this account includes any trader whose strategy involves holding positions open for more than one day. These traders, often known as Swing Traders or Position Traders, can find their profits significantly eroded by accumulating swap fees.

A Real-World Example for a Strategic Trader:

Let’s meet “Alex,” a technical trader. After analyzing the chart for the GBP/JPY currency pair, he identifies a strong bullish pattern that he expects will hit its target over the next 10 days. He knows that this pair typically has a significant negative swap for buy positions.

- On a Standard Account: If Alex opens this trade, he’ll be charged a swap fee every night. By the end of the 10-day period, this accumulated cost will have taken a noticeable bite out of his final profit. He might even feel pressured to close the trade early to avoid further fees, potentially missing out on the full price move.

- On an Islamic Account: Alex opens the exact same trade in his swap-free account. Now, he can patiently wait for the trade to reach its full potential without worrying about a single cent in overnight fees. His final profit will be purely the result of the market’s movement, making his strategy far more effective and profitable.

Therefore, the Islamic account is not just a religious accommodation; it’s a smart strategic tool for anyone who wants to free themselves from the burden of overnight costs.

Read More: Swap in Forex

Step-by-Step: How to Activate a Swap-Free Account in the OpoFinance App

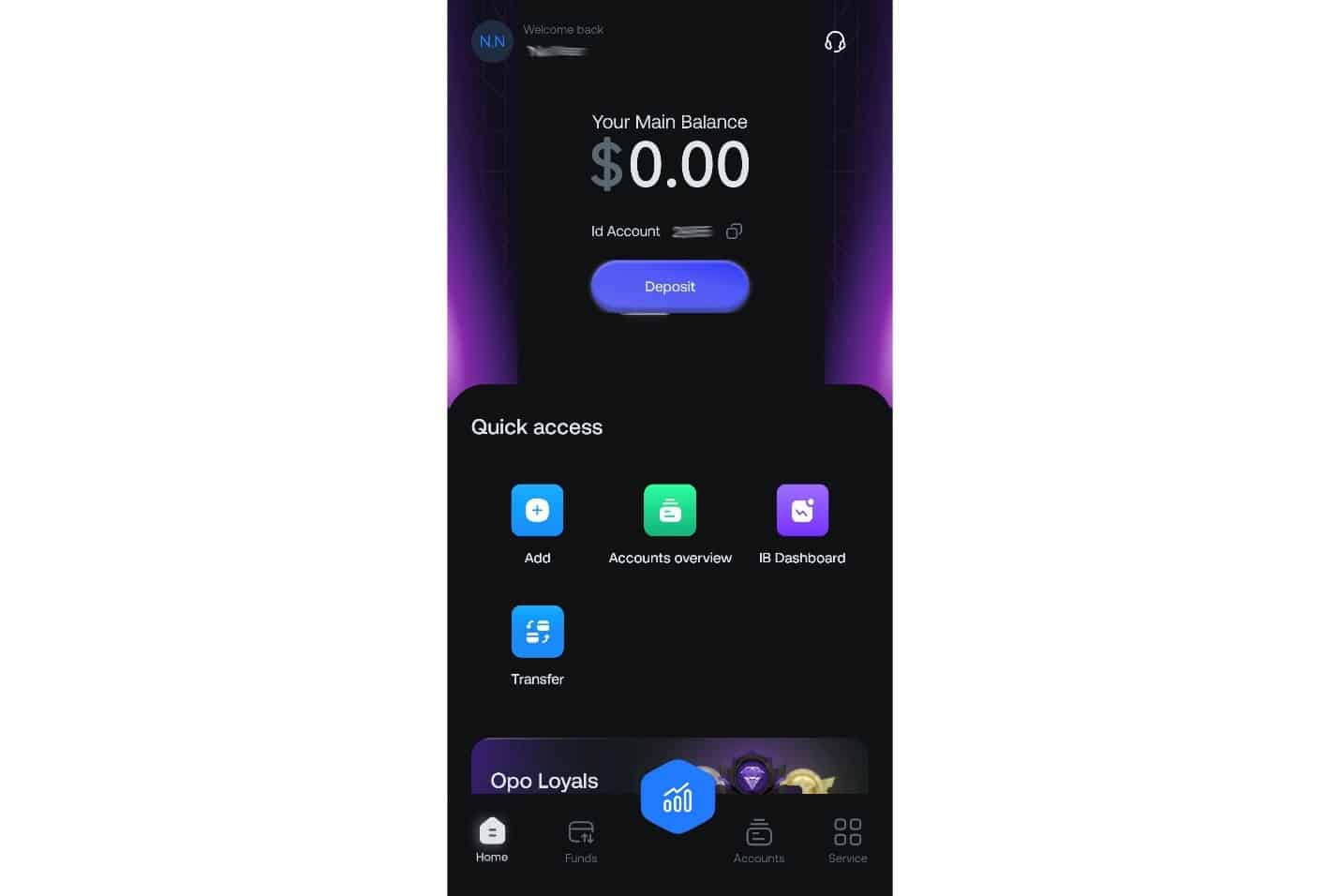

Step 1: Login and Access the Account Management Area

- Open your OpoFinance app and log in to your dashboard.

- Tap on Accounts from the bottom menu to visit the Account Overview screen.

- All your opened trading accounts will appear here.

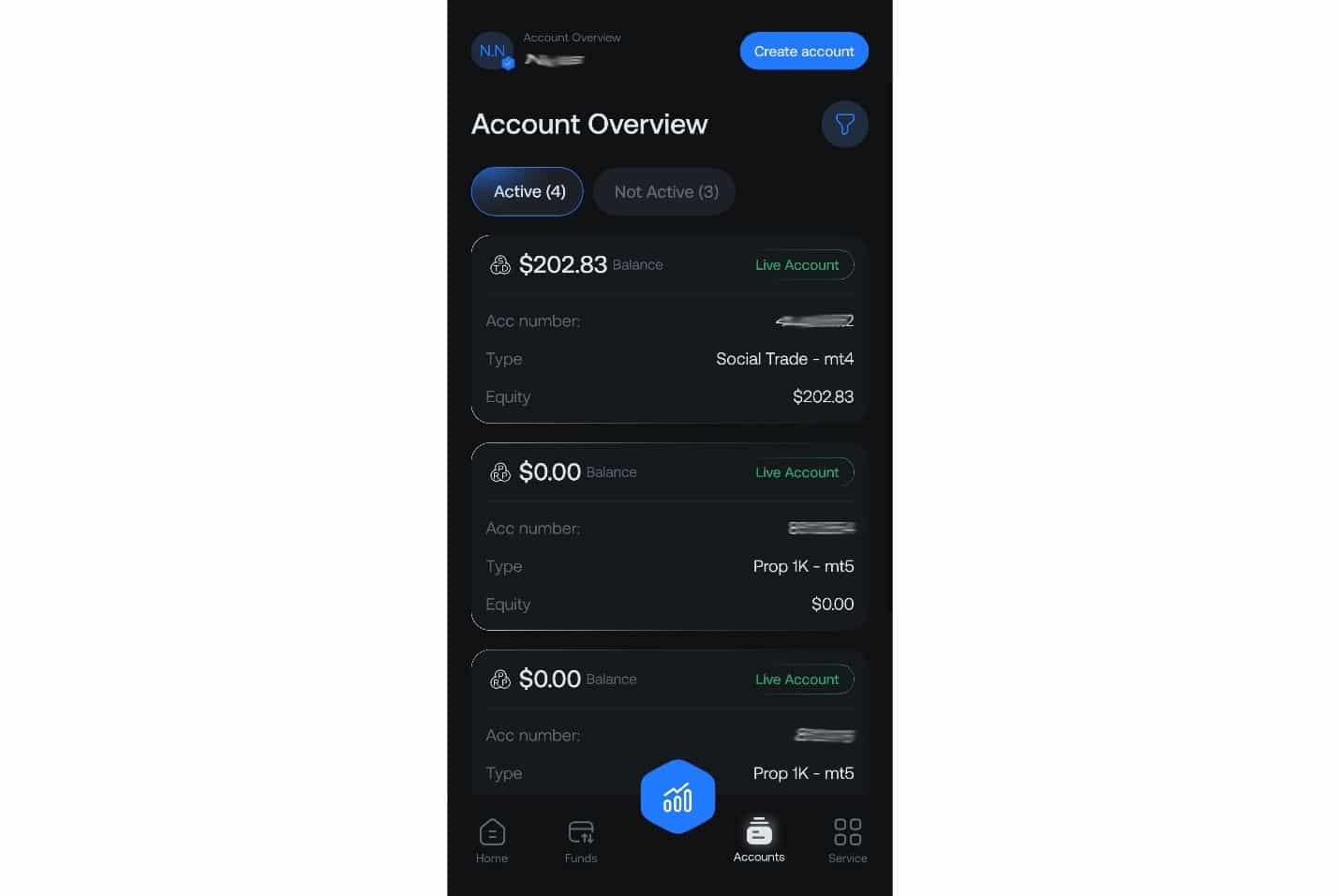

Step 2: Select the Account You Wish to Convert

- Tap on the trading account where you’d like to activate swap-free mode.

- This takes you to the Account Detail page, where you’ll see various settings (leverage, password management, etc.).

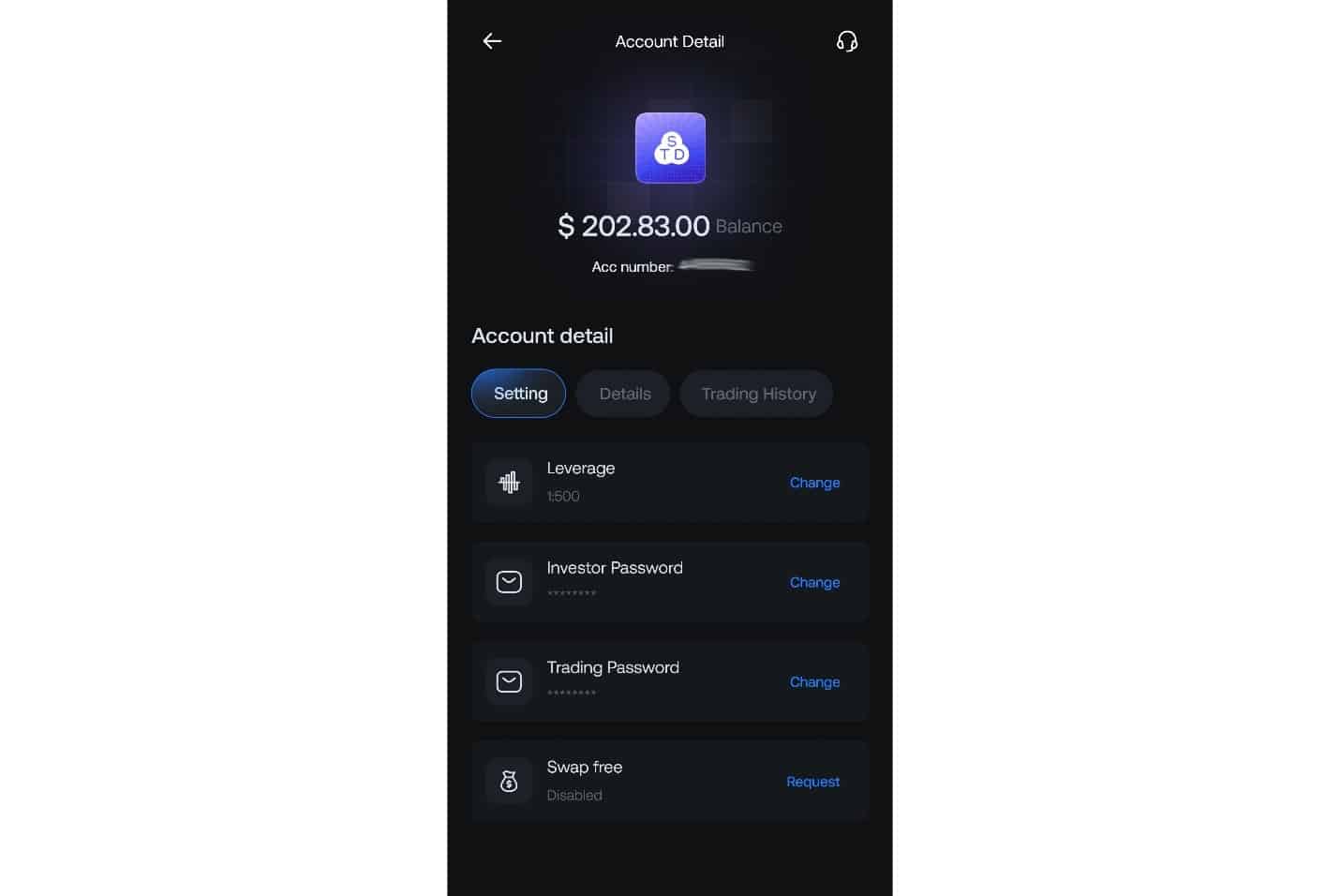

Step 3: Request to Enable Swap-Free (Islamic) Mode

- Scroll down until you find the Swap Free option (should say “Disabled” if not active).

- Tap the Request button to proceed.

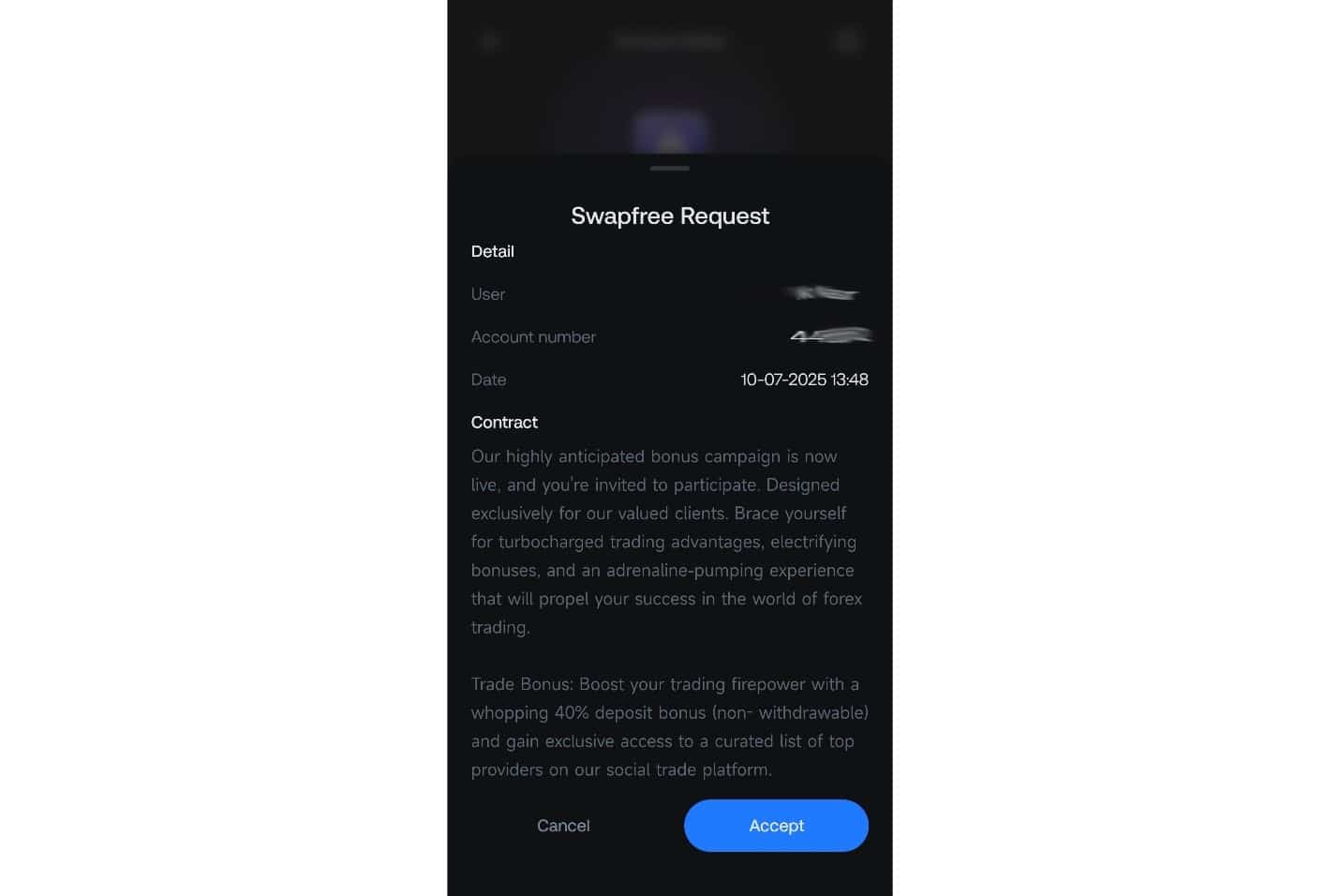

Step 4: Carefully Read and Accept the Swap-Free Agreement

- A pop-up window called Swapfree Request will appear.

- Here you will see the full “Contract” describing all terms, limitations, and conditions for swap-free trading in OpoFinance.

What to Check:

- Are there any limits on how long you can hold swap-free positions?

- When (if at all) do administrative fees kick in, and how much per lot or position?

- Which trading instruments are eligible or excluded (sometimes exotics, indices, or commodities may be excluded)?

Tip: Always read these contracts attentively to avoid future surprises. For detailed, up-to-date clarifications, you can always reach out to OpoFinance support.

- If you agree, press Accept to finalize.

Step 5: Wait for Manual Approval and Confirmation

- Your request goes to OpoFinance staff for review (this step adds security and prevents abuse).

- Once approved, your account’s swap-free status will update, and you’ll be notified by email or in-app message.

Read More: Understanding Different Types of Forex Account

The Fine Print: Limitations of the Opofinance Islamic Account

While the Opofinance Islamic account is an excellent solution for many traders, like any financial tool, it comes with specific limitations and rules that you absolutely must be aware of before you activate it. Understanding these points will help you make a fully informed decision.

1. The 14-Day Holding Period Limit

This is the most significant restriction. As stated in the terms, if you keep a single trade open for more than 14 days, it may no longer be exempt from swap fees. At that point, the broker may begin applying the standard swap rate or an equivalent administrative fee. This rule is in place to prevent traders from using the swap-free account for very long-term arbitrage strategies (trying to profit from interest rate differentials without paying the associated costs), which is not the intended use of the account. For most swing traders holding positions for a few days to a couple of weeks, this is not an issue. But for long-term position traders, it’s a critical factor.

2. Potential for Higher Costs via Spreads or Commissions

This is a general point for the industry. When a broker removes swap as a source of revenue, they might compensate for it in other ways. This can sometimes take the form of slightly wider spreads (the difference between the buy and sell price) or a fixed commission per trade. While Opofinance states that there are no extra charges, traders should always be vigilant. It’s a good practice to compare the spreads on your swap-free account with those on a standard account to ensure the trading conditions remain competitive for your strategy. For short-term scalpers who trade frequently, even a small increase in spread can have a bigger impact than daily swap fees.

3. Restrictions on Tradable Instruments

In some brokerages, Islamic account status only applies to a limited list of assets, typically major currency pairs. While most Opofinance accounts can be converted, it’s not guaranteed that every single tradable instrument will be swap-free. Exotic currency pairs or certain commodities have higher holding costs for the broker, and they might be excluded from the swap-free offering. Before activating, it’s wise to confirm if the specific assets you trade are covered.

4. No Potential for Positive Swap Earnings

On a standard account, some trades generate a positive swap, meaning the broker pays you interest every night. Some traders build entire strategies (known as “carry trades”) around earning this interest. On an Islamic account, this potential income is eliminated along with the costs. Both negative and positive swaps are removed. If your strategy relies on capturing positive swaps, the Islamic account is not suitable for you.

5. Strict “No Abuse” Policy

When you activate the Islamic account, you agree not to exploit the system. What does “abuse” mean? It can include activities like using hedging strategies between a swap-free account and a standard account to create a risk-free interest-earning machine (arbitrage). If the broker detects any unusual trading patterns that suggest you are trying to abuse the swap-free privilege, they reserve the right to immediately revoke your Islamic account status and retroactively apply all accrued swap fees.

6. No Islamic Demo Account

Opofinance does not offer the ability to make a demo (practice) account swap-free. The feature is only available for live, real-money accounts. This means you cannot fully test the exact trading conditions of an Islamic account (like checking for any minute changes in spreads) in a risk-free environment before committing real capital.

Conclusion: Is the Opofinance Islamic Account Right for You?

The Opofinance Islamic account is an excellent, necessary solution for Muslim traders who want to align their trading with their faith. It is also a powerful strategic tool for swing and position traders who want to execute their strategies without being penalized by daily swap fees.

However, it’s not a one-size-fits-all solution.

- If you are a very short-term trader (scalper), the spread is your biggest cost, and you should ensure it remains competitive.

- If your strategy involves earning positive swaps (carry trading), this account is not for you.

- If you plan to hold trades for many months, you must be aware of the 14-day limit.

Before activating, read the terms and conditions carefully. Make sure this account type is truly compatible with your personal trading style, strategy, and principles.

Reference: +

What is a Forex Islamic Account?

An Islamic, or Swap-Free, account is a type of trading account where no overnight interest (swap) is charged or paid on positions held overnight. It’s ideal for Muslim traders following Sharia law and for any trader with a long-term strategy.

Is the Islamic account only for Muslims?

No. Although it was designed based on Islamic principles, any trader who wants to avoid paying swap fees, especially those who hold trades for several days or weeks, can benefit from and use this account type.

Does the Islamic account at Opofinance have extra fees?

According to Opofinance, activating the Islamic account does not come with any extra fees or an increase in spreads. You will trade with the same conditions as a standard account, but with the swap fee removed.

What is the main limitation of the Islamic account at Opofinance?

The most important limitation is the 14-day rule. If a trade remains open for more than 14 days, the broker may apply swap fees to it. This rule is in place to prevent misuse of the feature.

How do I make my Opofinance account swap-free?

The process is very simple and fast. Just log into your client portal, go to the settings for your desired live account, click on “Swapfree Activation,” and confirm the terms.