If you’re seeking lightning-fast trades and swift profit opportunities in the forex market, the AUDJPY 1 min strategy can provide exactly that. In a nutshell, AUDJPY 1 min strategy is a specific scalping approach that leverages the natural volatility between the Australian Dollar (AUD) and the Japanese Yen (JPY) on a one-minute chart. By focusing on micro-movements, traders can capture quick price fluctuations and aim for high-probability setups.

Why does this matter? The AUD/JPY pair is known for its responsiveness to economic events, market sentiment shifts, and daily session overlaps, making it an exciting pair for scalpers. If you pair this with a top-tier online forex broker or a regulated forex broker, you can gain real-time price feeds and fast order execution—key ingredients for success in high-speed trading environments.

In this comprehensive guide, you will discover a structured approach to AUDJPY 1 minute strategy using price action as your primary tool. We’ll delve into essential price action principles, key chart setups, and alternative strategies. Ultimately, you’ll walk away with a well-rounded plan for scalping AUD/JPY confidently on the 1-minute timeframe. Let’s dive right in.

Understanding Price Action for 1-Minute Trading

Before diving deep into specific tactics, it’s crucial to grasp the fundamentals behind price action. Price action, in simple terms, is the study of a market’s price movement over time, without heavy reliance on indicators. It’s about reading candlesticks, market structure, and momentum to anticipate future moves.

What Is Price Action in Forex?

Price action involves observing raw market data—open, high, low, and close (OHLC) on candlesticks—to make trading decisions. Instead of depending solely on indicators (which often lag the market), price action traders interpret candlestick patterns, support and resistance, and market structure to forecast where price might head next.

For AUD/JPY, price action is particularly revealing on the 1-minute chart due to frequent movements during active trading sessions (especially when the Asian and Australian markets overlap). By spotting micro-shifts and sudden momentum bursts, scalpers can enter and exit trades rapidly, potentially reaping small but consistent gains throughout the day.

Importance of Market Structure, Trend, and Key Levels

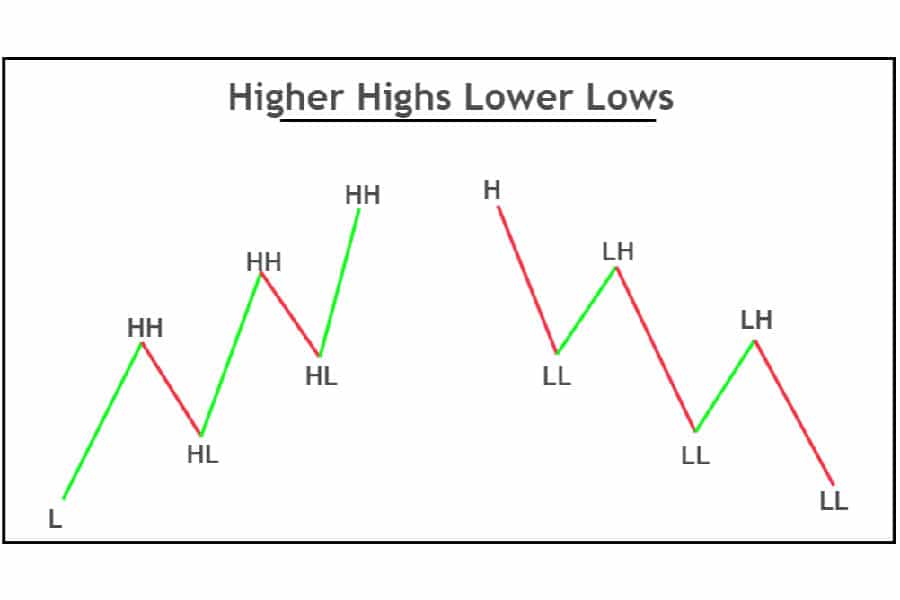

- Market Structure: Recognizing swings—higher highs and higher lows (in an uptrend) or lower highs and lower lows (in a downtrend)—helps identify the prevailing bias. On a 1-minute chart, these micro-trends can change rapidly, so the ability to read shifts in structure is paramount.

- Trend Identification: Even at the 1-minute level, there can be a short-term trend within a broader trend. Aligning these micro-trends with a higher timeframe can boost the probability of success. For example, if the 15-minute chart shows an uptrend, you might look for bullish signals on the 1-minute chart to scalp.

- Key Psychological Price Levels: Round numbers (e.g., 90.00, 91.00, etc.) often hold psychological importance. For AUD/JPY, these round-figure levels frequently act as magnets for price. Scalpers watch these levels closely, anticipating strong support or resistance.

How Liquidity and Volatility Impact Short-Term Movements

- Liquidity: AUD/JPY tends to have decent liquidity, especially during the Asian session. High liquidity translates to tighter spreads, crucial for scalpers who enter and exit positions rapidly.

- Volatility: The pair can experience sharp moves during economic announcements, RBA (Reserve Bank of Australia) statements, or Bank of Japan updates. While volatility can mean more trading opportunities, it also increases risk—stop losses can be hit quickly if not placed strategically.

By understanding these price action elements—market structure, trends, key levels, liquidity, and volatility—you lay the foundation for a robust AUDJPY 1 minute strategy focused on scalping success.

Key Price Action Components for 1-Minute Scalping

To excel at scalping with AUDJPY 1 min strategy, you need to master the essential components of price action. Let’s break them down step by step.

1. Market Structure & Trend Identification

Scalpers often zero in on micro-trends:

- Higher Highs and Higher Lows: Signal a short-term uptrend. A scalper might look to buy dips or breakouts of local highs.

- Lower Highs and Lower Lows: Indicate a short-term downtrend. A scalper might look to sell rallies or breaks of local lows.

Using Multiple Timeframes

Even if you trade on the 1-minute chart, it’s wise to glance at higher timeframes (e.g., 5-minute, 15-minute) for confirmation. If the 15-minute timeframe shows strong bullish momentum, your 1-minute scalp trades have a greater chance of success if you trade in the same bullish direction.

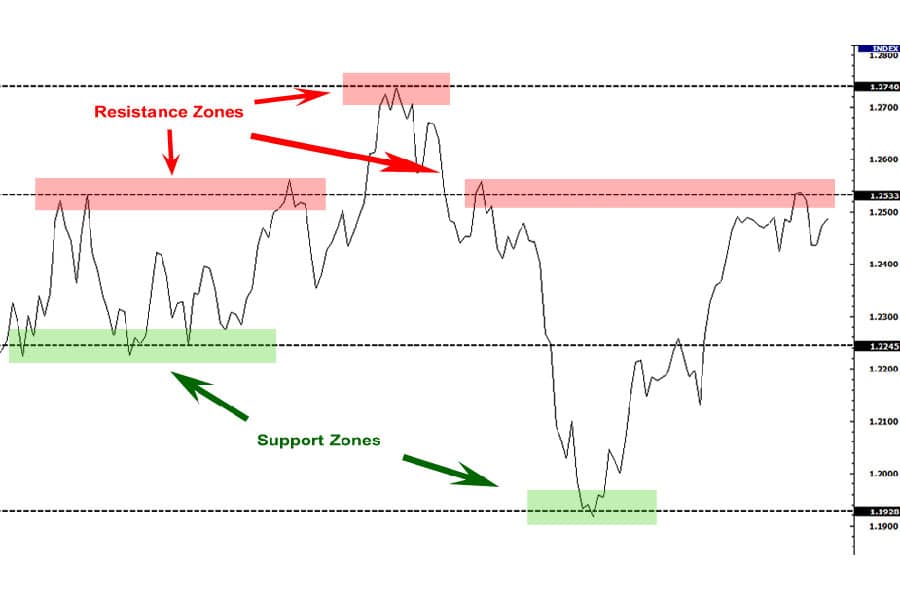

2. Support and Resistance Zones

Support and resistance (S/R) are crucial in any forex strategy, but they become even more critical in a AUDJPY 1 minute strategy because entry and exit points are razor-thin.

- Identifying Strong Intraday Levels: Look for horizontal levels where price has reacted multiple times. These levels often repeat intraday, especially on a smaller timeframe.

- Previous Highs/Lows: On a 1-minute chart, the most recent highs or lows often turn into immediate support or resistance zones. Keep an eye on them for potential bounces or breakouts.

Read More: Forex Market Terminology for Beginners

3. Candlestick Patterns for 1-Minute Entries

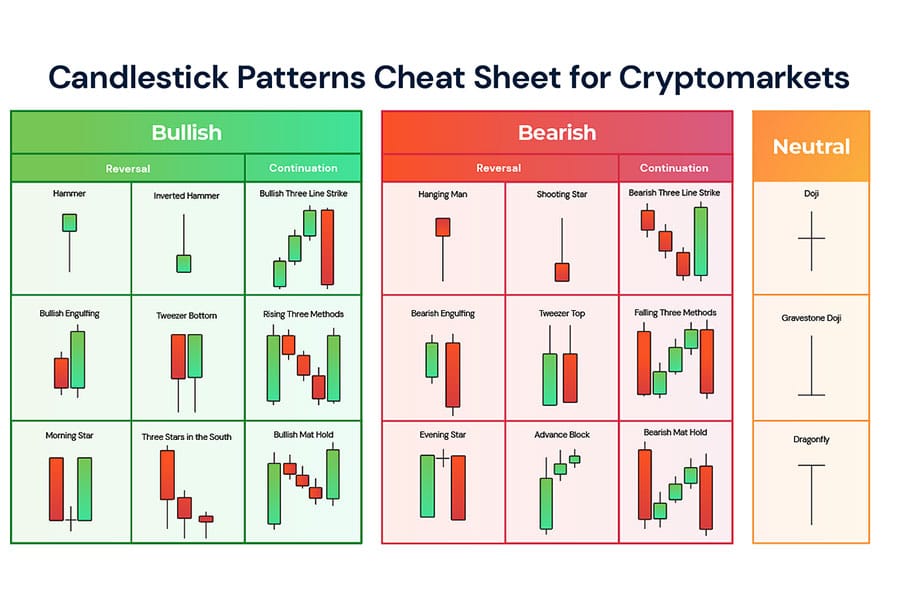

Candlestick formations offer some of the most immediate signals:

- Pin Bars: Long tail wicks suggest rejection at a particular level. If you spot a pin bar rejecting a support zone, it could hint at a quick bounce.

- Engulfing Candles: A larger bullish or bearish candle fully engulfs the previous candle, signifying strong buying or selling momentum.

- Rejection Wicks: When price tries to break a level but immediately snaps back, leaving a notable wick, it signals a possible reversal or continuation.

Confirm these patterns using context—trend direction, S/R levels, and volume—before diving in.

4. Volume & Order Flow Considerations

On a 1-minute chart, volume and order flow can hint at the real intentions of major players:

- Confirming Breakouts or Fakeouts: Spikes in volume often accompany genuine breakouts, while low-volume breakouts can be suspect (potential fakeouts).

- Spotting Institutional Moves: Sudden volume surges may indicate institutional participation, which can drive strong directional moves on lower timeframes.

Incorporating these price action components into your trading approach provides a strong framework for scalping AUDJPY 1 minute strategy. Next, let’s piece them together into a cohesive plan.

Read More: What is gbpusd in forex

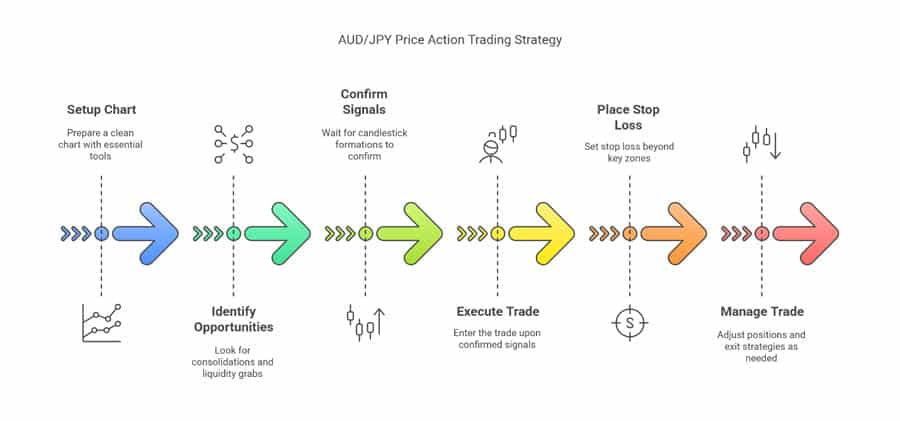

Step-by-Step Price Action Strategy for AUD/JPY (1-Minute Chart)

Below is a structured roadmap designed to help you capitalize on AUD/JPY’s short-term movements using pure price action.

1. Setup Your Chart

- Clean Chart: Strip away non-essential indicators. Keep it minimal so you can focus on the candlesticks.

- Essential Tools Only: Draw trendlines to highlight micro-trends, mark support and resistance zones for quick reference, and maybe add a volume indicator if your broker platform supports real volume data.

2. Identify Key Trading Opportunities

- Look for Consolidations: Price often moves sideways before significant breakouts. On a 1-minute chart, a tight consolidation can indicate an explosive upcoming move.

- Watch for Liquidity Grabs: Price may spike briefly beyond a support or resistance level (a “stop hunt”) and then reverse. This can offer high-reward entries if you trade in the direction of the reversal.

- Confirm with Candlestick Formations: Wait for a pin bar, engulfing candle, or strong rejection wick to signal a likely shift.

3. Trade Execution & Risk Management

- Entry: Execute the trade once you see a confirmed signal (e.g., bullish pin bar at support or bearish engulfing near resistance).

- Stop Loss Placement: Set it slightly beyond a key zone—this helps avoid being stopped out by minor spikes or stop hunts.

- Risk-to-Reward Ratios: Aim for at least 1:2 or 1:3. Because you’re on a 1-minute chart, you need the potential reward to justify any single loss.

4. Exit Strategy & Trade Management

- Scaling Out: Once the trade moves in your favor, consider closing part of your position to lock in profits. Move your stop loss to breakeven or a small profit.

- Trailing Stop: As price continues in your direction, trail your stop below (in a long trade) or above (in a short trade) key short-term swing points. This helps you capture bigger moves if they happen.

This straightforward process is enough to get you started with AUDJPY 1 min strategy. But remember: consistency in applying your rules and strict discipline in managing risk are what separate consistent scalpers from occasional lucky wins.

Read More: What is aud jpy in forex

Alternative 1-Minute Trading Strategies for AUD/JPY

While price action trading is highly effective, it might not suit everyone’s style. If you’re seeking different methods, consider these alternative AUDJPY 1 minute strategy approaches:

1. Moving Average Crossover Strategy

- Short-Term MAs: Use two moving averages, like the 9 EMA (Exponential Moving Average) and the 21 EMA.

- Crosses: When the 9 EMA crosses above the 21 EMA, it’s a bullish signal; when it crosses below, it’s a bearish signal.

- Stop Loss & Targets: Place stops just beyond recent swing points, and aim for a minimum 1:2 risk-to-reward.

2. Bollinger Band Breakout Strategy

- Setup: Apply Bollinger Bands (default setting of 20-period SMA with ±2 standard deviations) on the 1-minute chart.

- Breakouts: When price closes decisively outside the upper or lower band on strong volume, it can indicate a momentum trade.

- Confirmation: Watch for a spike in volume or candle size. Many false breakouts occur on low volume.

3. RSI & Stochastic Oscillator Scalping

- Overbought/Oversold Zones: RSI above 70 or Stochastic above 80 suggests potential overbought conditions (bearish setups). RSI below 30 or Stochastic below 20 points to oversold (bullish setups).

- Divergence: If price makes a new high while the oscillator fails to make a new high (bearish divergence), it can be an early signal of a reversal.

4. VWAP Reversal Strategy

- VWAP: Volume Weighted Average Price helps identify average price levels where most trading occurs.

- Mean Reversion: If price drifts far from VWAP on the 1-minute chart, look for quick reversion trades back toward the VWAP line.

- Stops: Place stops just beyond recent extremes, as mean reversion trades can fail quickly if the market trend is strong.

5. News Event Scalping

- High Volatility: Scheduled news events (e.g., Australian employment data, Bank of Japan statements) can trigger sharp moves.

- Fast Reaction: Have your trading platform ready. Typically, you set very tight stops because slippage can be a factor.

- Trade Management: If you catch a favorable move, lock in profits quickly to avoid sudden reversals.

Common Mistakes to Avoid

Scalping demands precision. These common pitfalls can quickly derail your success:

- Overtrading: The 1-minute chart offers numerous candle formations every hour. Exercising patience and sticking to high-quality setups is vital.

- Ignoring Market Context: Major news events, time-of-day factors (like low liquidity sessions), and broader technical trends all matter. Don’t trade in a vacuum.

- Loose Stop Losses: In scalping, you must be deliberate with stops. Placing them too wide can lead to large losses. Placing them too tight can lead to constant stop-outs.

- Letting Emotions Take Over: Fear and greed can be especially rampant in rapid trading. Trust your system, not your impulses.

Pro Tips for Advanced Scalpers

Looking to take your AUDJPY 1 minute strategy to the next level? Here are some high-level tactics to refine your edge even further:

- Use Multi-Session Analysis: Observe how AUD/JPY behaves in different sessions (Asian vs. London vs. New York) to identify times of day that yield the most predictable price movements.

- Run a Scalping Journal: Document every trade—entry, stop, outcome, and a screenshot of the chart. Reviewing these trades helps you pinpoint recurring errors and refine your approach.

- Partial Profits Technique: If you notice consistent partial swings, lock in half your position at 1:1 or 1:1.5 risk-to-reward, and let the rest ride for bigger gains.

- Adapt to Spreads: During quieter times, spreads can widen. Make sure your trade potential covers the spread plus enough room for profit.

- Combine Order Flow Tools: If you have access to advanced tools (like a depth-of-market (DOM) view or Level 2 data), watch how orders stack up at key levels. This can give you an extra layer of insight.

These approaches serve as catalysts for advanced traders eager to push their scalping skills to a higher echelon. Blend them with your existing strategy to sharpen your precision and consistency.

Opofinance Services

When executing a AUDJPY 1 minute strategy, having the right trading environment can dramatically boost your chances of success. If you’re looking for a reliable partner, consider exploring ASIC regulated opofinance broker services at opofinance.com. They offer:

- Advanced Trading Platforms

MT4, MT5, cTrader, and OpoTrade — these platforms cater to scalpers by delivering fast execution speeds and stable performance. - Innovative AI Tools

Utilize AI Market Analyzer to gauge real-time market dynamics, AI Coach for personalized guidance, and AI Support for quick issue resolution. - Social & Prop Trading

Take advantage of copy trading or test your own strategies in a prop trading environment, especially useful for new scalpers wanting to learn from experienced pros. - Secure & Flexible Transactions

Safe and convenient deposit and withdrawal methods, including crypto payments, with zero fees from Opofinance. This means you keep more of your profits in your pocket. - ASIC Regulatory Oversight

Trade with peace of mind knowing your broker is regulated by one of the world’s strictest financial authorities.

Visit opofinance.com today and experience a premium trading environment designed for modern scalpers like you.

Conclusion

In the hyper-paced world of AUDJPY 1 min strategy, precision and discipline are everything. By incorporating price action tactics—such as market structure analysis, support and resistance identification, candlestick patterns, and volume confirmation—you equip yourself with a reliable blueprint. The goal is to strike quickly, manage risk tightly, and secure small but consistent wins that add up over time.

No strategy is a guarantee of profits, especially in fast-moving markets. However, a carefully tested plan, coupled with strict risk management and unwavering discipline, can lead to consistent success. If you fine-tune your approach, backtest thoroughly, and adapt to changing market conditions, you’ll be well on your way to mastering AUDJPY 1 minute strategy for scalping gains.

Key Takeaways

- Focus on Price Action: Prioritize raw market data—structure, trend, candlesticks—over lagging indicators.

- Tight Risk Management: On a 1-minute chart, volatility can be intense. Use precise stop-loss placements and aim for a solid risk-to-reward ratio.

- Multiple Timeframe Alignment: Even for scalping, checking higher timeframes can reduce false signals.

- Learn From Alternatives: Strategies like moving averages, Bollinger Bands, RSI, VWAP, and news trading can supplement or replace pure price action if desired.

- Choose a Reputable Broker: Reliable execution and low spreads are critical. Consider an ASIC regulated option like Opofinance.

References: +

Can I Start Scalping AUD/JPY With a Very Small Account?

Yes, you can start scalping AUD/JPY with a small account as many brokers offer micro-lots (0.01 lot size). However, ensure that your position sizing, risk management, and potential profits justify the trading costs (spreads, commissions). It’s critical to avoid over-leveraging, even if your goal is to capture small moves.

Do I Need Any Special Trading Software for a 1-Minute Strategy?

While a standard platform like MT4 or MT5 often suffices, specialized tools can enhance scalping. Some traders prefer cTrader for its advanced order capabilities, while others like OpoTrade’s integrated AI features. High-speed execution, tight spreads, and stable connectivity are the main software essentials for rapid scalping.

How Many Trades Should I Aim for in a Single Session?

There is no hard rule, as the number of trades depends on market conditions and your personal strategy. Some scalpers take only 2-3 high-quality trades per session, while others might take 10-20. Quality trumps quantity—focus on clear, high-probability setups to avoid overtrading and emotional strain.