AUDUSD scalping is a fast-paced forex trading strategy that aims to capture small price movements in the Australian Dollar/US Dollar currency pair. This approach involves making multiple trades within short timeframes, typically minutes or even seconds, to accumulate profits. Scalping the AUDUSD pair can be highly lucrative for skilled traders who understand market dynamics and employ effective risk management techniques. As a popular forex trading strategy, AUDUSD scalping requires precision, discipline, and a deep understanding of technical analysis.

In this comprehensive guide, we’ll explore seven proven tactics to help you master AUDUSD scalping and potentially boost your forex trading success. These tactics include mastering short-term charts, employing technical indicators, utilizing support and resistance levels, exploiting news-based opportunities, and implementing rigorous risk management. By following these strategies and continuously refining your skills, you can develop a robust AUDUSD scalping approach that aligns with your trading goals and risk tolerance.

Whether you’re a beginner or an experienced trader looking to refine your skills, this article will provide valuable insights into the world of AUDUSD scalping. We’ll cover essential topics such as chart analysis, indicator use, risk management, and psychological factors that influence scalping success. To get started on your forex trading journey, consider choosing a reputable online forex broker that offers the tools and resources needed for successful scalping. With the right knowledge, tools, and mindset, you can potentially turn AUDUSD scalping into a profitable forex trading strategy.

Understanding AUDUSD Scalping

What is AUDUSD Scalping?

AUDUSD scalping is a short-term trading strategy focused on profiting from minor price fluctuations in the Australian Dollar/US Dollar currency pair. Scalpers aim to enter and exit trades quickly, often holding positions for just a few minutes or even seconds. The goal is to capitalize on small price movements and accumulate profits through high-frequency trading.

Why Choose AUDUSD for Scalping?

- High liquidity: The AUDUSD pair is one of the most liquid currency pairs, ensuring tight spreads and efficient order execution.

- Volatility: AUDUSD often exhibits sufficient price movement to create profitable scalping opportunities.

- Economic factors: The pair is influenced by diverse economic indicators from both Australia and the United States, providing multiple trading triggers.

- 24-hour market: The forex market’s round-the-clock nature allows for flexible trading hours.

Understanding AUD/USD Market Dynamics

To excel in AUDUSD scalping, it’s crucial to understand the fundamental factors that influence this currency pair. The AUD/USD, often referred to as the “Aussie,” is affected by various economic, political, and environmental factors in both Australia and the United States.

Fundamental Factors Influencing the AUD/USD Pair

- Interest Rate Differentials:

- The interest rate decisions by the Reserve Bank of Australia (RBA) and the U.S. Federal Reserve significantly impact the AUD/USD pair.

- Higher interest rates in Australia relative to the U.S. typically strengthen the AUD, while lower rates weaken it.

- Commodity Prices:

- Australia is a major exporter of commodities, particularly iron ore, coal, and gold.

- Rising commodity prices often lead to a stronger AUD, as they increase demand for the currency.

- Economic Indicators:

- Key economic data from both countries, such as GDP growth, employment figures, and inflation rates, can cause significant price movements.

- Strong economic data typically strengthens the respective country’s currency.

- Trade Relations:

- Australia’s trade relationships, especially with China (its largest trading partner), can impact the AUD.

- Positive trade news often boosts the AUD, while trade tensions can weaken it.

- Risk Sentiment:

- The AUD is considered a “risk currency,” meaning it often strengthens when global risk appetite is high and weakens during periods of market uncertainty.

- The USD, conversely, is seen as a safe-haven currency, often strengthening during times of global economic uncertainty.

- Political Stability:

- Political events and stability in both countries can influence investor confidence and, consequently, currency strength.

- Natural Disasters and Environmental Factors:

- Events like droughts, bushfires, or cyclones in Australia can impact its economy and currency.

Understanding these factors can help scalpers anticipate potential price movements and make more informed trading decisions.

Read More: ichimoku scalping strategy

7 Proven AUDUSD Scalping Tactics

1. Master the 1-Minute and 5-Minute Charts

Successful AUDUSD scalping relies heavily on short-term chart analysis, with the 1-minute and 5-minute timeframes being the most crucial. To implement this tactic:

- Focus on identifying key support and resistance levels

- Look for clear trend directions and potential reversal points

- Use multiple timeframes to confirm signals (e.g., 15-minute chart for overall trend)

Advanced chart reading techniques:

- Identify chart patterns such as flags, pennants, and double tops/bottoms

- Use candlestick patterns like doji, engulfing, and hammer/shooting star for entry and exit signals

- Incorporate volume analysis to confirm price movements and trend strength

Entry Rules:

- Enter a long trade when price breaks above a significant resistance level with increased volume.

- Enter a short trade when price breaks below a significant support level with increased volume.

Exit Rules:

- Exit the trade when price reaches the next support/resistance level.

- Use a tight stop-loss of 5-10 pips, depending on market volatility.

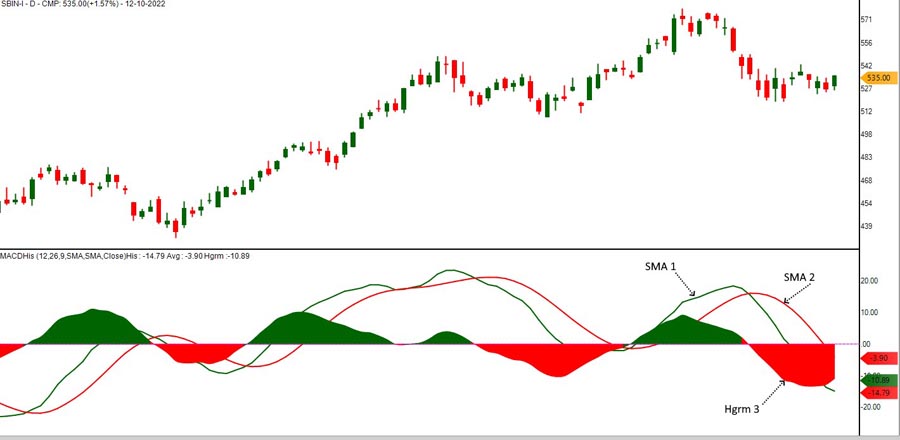

2. Employ Moving Average Convergence Divergence (MACD)

The MACD indicator is particularly effective for AUDUSD scalping:

- Set MACD parameters to 5, 13, and 1 for faster signals

- Look for MACD line crossovers with the signal line for entry points

- Use MACD histogram for momentum confirmation

Advanced MACD strategies:

- Identify MACD divergences for potential trend reversals

- Combine MACD with other indicators like RSI for stronger confirmation

- Use MACD histogram color changes as early warning signals for potential trend shifts

Entry Rules:

- Enter a long trade when the MACD line crosses above the signal line in oversold territory.

- Enter a short trade when the MACD line crosses below the signal line in overbought territory.

Exit Rules:

- Exit the trade when the MACD line crosses back over the signal line.

- Set a stop-loss at the recent swing low for long trades or swing high for short trades.

3. Utilize Bollinger Bands for Volatility Measurement

Bollinger Bands help identify potential breakouts and trend reversals:

- Set Bollinger Bands to 2 standard deviations on a 1-minute chart

- Look for price touches or breaks of the upper or lower bands

- Use band width to gauge volatility and potential for larger moves

Advanced Bollinger Band techniques:

- Implement the Bollinger Band “squeeze” strategy for breakout trades

- Use Bollinger Band “walks” to identify strong trends

- Combine Bollinger Bands with momentum indicators for more accurate entry and exit points

Entry Rules:

- Enter a long trade when price touches the lower Bollinger Band and starts to move upward.

- Enter a short trade when price touches the upper Bollinger Band and starts to move downward.

Exit Rules:

- Exit the trade when price reaches the middle Bollinger Band.

- Place a stop-loss just outside the Bollinger Band that was touched at entry.

Read More: atr scalping strategy

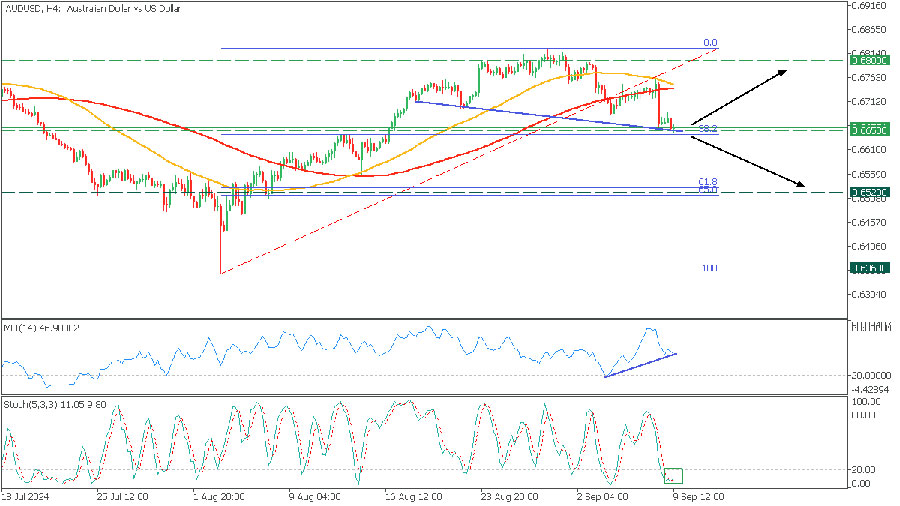

4. Implement a Stochastic Oscillator Strategy

The Stochastic Oscillator can help identify overbought and oversold conditions:

- Set Stochastic parameters to 5, 3, 3 for quicker signals

- Look for crossovers in the overbought (above 80) or oversold (below 20) zones

- Combine with trend analysis for more accurate entry and exit points

Advanced Stochastic Oscillator applications:

- Use Stochastic divergences to identify potential trend reversals

- Implement a “stochastic pop” strategy for trend continuation trades

- Combine Stochastic Oscillator with price action analysis for high-probability setups

Entry Rules:

- Enter a long trade when the Stochastic lines cross upwards below the 20 level.

- Enter a short trade when the Stochastic lines cross downwards above the 80 level.

Exit Rules:

- Exit long trades when Stochastic reaches above 80, and short trades when it reaches below 20.

- Set a stop-loss at the recent swing low for long trades or swing high for short trades.

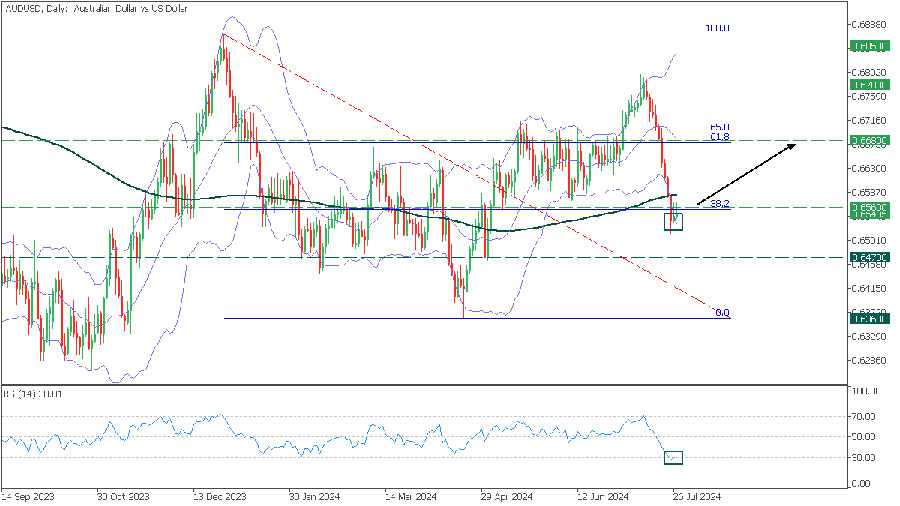

5. Harness the Power of Support and Resistance Levels

Identifying key support and resistance levels is crucial for AUDUSD scalping:

- Use horizontal line tools to mark significant price levels

- Look for price reactions at these levels for potential entry points

- Combine with other indicators for confirmation

Advanced support and resistance techniques:

- Incorporate dynamic support and resistance using moving averages

- Use Fibonacci retracement levels to identify potential reversal points

- Implement pivot point analysis for intraday support and resistance levels

Entry Rules:

- Enter a long trade when price bounces off a strong support level.

- Enter a short trade when price rebounds from a strong resistance level.

Exit Rules:

- Exit the trade at the next identified support/resistance level.

- Place a stop-loss just below the support for long trades or above the resistance for short trades.

6. Exploit News-Based Scalping Opportunities

Economic news releases can create volatile price movements ideal for scalping:

- Focus on high-impact news events from Australia and the United States

- Be prepared for increased volatility during news releases

- Use a news calendar to plan your trading schedule

Advanced news-based scalping strategies:

- Develop a “fade the move” strategy for overextended price reactions to news

- Implement a breakout strategy for trading strong trends following news releases

- Use options strategies to hedge against potential gaps or extreme volatility during major news events

Entry Rules:

- Enter in the direction of the initial price movement within 1-2 minutes after a high-impact news release.

- Ensure the news-driven move aligns with the overall trend.

Exit Rules:

- Exit the trade when price shows signs of reversal or within 5-10 minutes after entry.

- Use a wider stop-loss (15-20 pips) due to increased volatility during news events.

7. Implement a Rigorous Risk Management Strategy

Effective risk management is essential for long-term scalping success:

- Set strict stop-loss and take-profit levels for each trade

- Limit risk to 1-2% of your trading capital per trade

- Use a risk-reward ratio of at least 1:1, preferably 1:1.5 or higher

Advanced risk management techniques:

- Implement a trailing stop strategy to lock in profits on winning trades

- Use position sizing calculators to optimize trade size based on account balance and risk tolerance

- Develop a comprehensive trading journal to track performance and identify areas for improvement

Read More: adx scalping strategy

Best Time for AUD/USD Scalping

Timing is crucial in AUDUSD scalping. The best times to scalp this pair typically align with periods of high liquidity and volatility. Here are the optimal times for AUDUSD scalping:

- Sydney/Tokyo Overlap (22:00 – 02:00 GMT):

- This is when the Australian market opens and overlaps with Tokyo.

- Liquidity starts to increase, providing good scalping opportunities.

- London Open (08:00 GMT):

- While not directly related to AUD/USD, the London session open often sees increased volatility across all major pairs.

- New York/London Overlap (13:00 – 17:00 GMT):

- This is often the most volatile and liquid period for AUD/USD.

- Major economic releases from both the U.S. and Australia are often scheduled during this time.

- U.S. Economic Data Releases:

- Typically occur between 12:30 – 16:00 GMT.

- These can cause significant short-term price movements, ideal for scalping.

- RBA Interest Rate Decisions:

- Usually announced at 03:30 GMT on the first Tuesday of each month (except January).

- Can lead to substantial volatility and trading opportunities.

Key Points to Remember:

- Avoid scalping during quiet market periods, typically from 19:00 – 22:00 GMT.

- Be cautious during major holidays in Australia or the U.S., as liquidity may be reduced.

- Always be aware of scheduled economic releases that could impact the AUD/USD pair.

By focusing your scalping efforts during these optimal times, you can potentially increase your chances of finding profitable trading opportunities in the AUD/USD market.

Key Considerations for AUDUSD Scalping Success

Choosing the Right Broker

Selecting a suitable broker is crucial for AUDUSD scalping success:

- Look for brokers offering tight spreads on AUDUSD

- Ensure fast execution speeds and reliable platforms

- Check for regulatory compliance and financial stability

Developing a Solid Trading Plan

A well-defined trading plan is essential for consistent results:

- Set clear entry and exit criteria

- Define risk management rules

- Establish daily profit targets and loss limits

Mastering Emotional Control

Emotional discipline is critical in the fast-paced world of scalping:

- Stick to your trading plan regardless of short-term outcomes

- Avoid revenge trading after losses

- Take regular breaks to maintain focus and prevent burnout

Continuous Learning and Improvement

The forex market is dynamic, requiring ongoing education:

- Stay updated on economic factors affecting AUDUSD

- Regularly review and analyze your trading performance

- Attend webinars and read expert analysis to refine your skills

Common Pitfalls to Avoid in AUDUSD Scalping

- Overtrading: Avoid the temptation to trade excessively, even in quiet market conditions.

- Ignoring spread costs: Factor in spread costs when calculating potential profits.

- Neglecting proper risk management: Never risk more than you can afford to lose on a single trade.

- Chasing losses: Accept that losses are part of trading and avoid increasing risk to recover losses.

- Failing to adapt: Be prepared to adjust your strategy as market conditions change.

OpoFinance: Your Trusted Partner for AUDUSD Scalping

When it comes to executing your AUDUSD scalping strategy, choosing the right broker is paramount. OpoFinance stands out as an ASIC-regulated forex broker, offering traders a secure and reliable platform for their scalping needs. With tight spreads on AUDUSD and lightning-fast execution speeds, OpoFinance provides the ideal environment for successful scalping operations.

One of OpoFinance’s standout features is its innovative social trading service. This platform allows traders to connect with and learn from experienced AUDUSD scalpers, offering valuable insights and the opportunity to replicate successful trading strategies. Whether you’re a novice looking to learn from the pros or an experienced trader seeking to diversify your approach, OpoFinance’s social trading feature can be a game-changer in your AUDUSD scalping journey.

Conclusion

Mastering AUDUSD scalping can be a rewarding endeavor for forex traders willing to put in the time and effort. By implementing the seven proven tactics outlined in this guide and staying mindful of key considerations and potential pitfalls, you can develop a robust scalping strategy tailored to the AUDUSD pair. Remember that success in scalping requires discipline, continuous learning, and effective risk management.

As you embark on your AUDUSD scalping journey, keep in mind that consistency is key. Start with small position sizes and gradually increase as you gain confidence and experience. Regularly review your trading performance, identify areas for improvement, and be willing to adapt your strategy as market conditions evolve.

Leverage the power of technology and tools available to modern traders, such as advanced charting platforms, automated trading systems, and risk management software. However, never forget that these tools are meant to complement your skills and decision-making, not replace them entirely.

Lastly, remember that successful AUDUSD scalping is as much about mindset as it is about strategy. Develop a positive trading psychology, manage your emotions effectively, and approach each trading day with a clear and focused mind. With practice, persistence, and a commitment to continuous improvement, you can harness the power of AUDUSD scalping to potentially enhance your forex trading performance and achieve your financial goals.

How much capital do I need to start AUDUSD scalping?

While there’s no fixed minimum, it’s generally recommended to start with at least $1,000 to $5,000 for AUDUSD scalping. This allows for proper risk management and the ability to withstand potential losing streaks. However, some brokers offer micro-accounts that allow you to start with less capital. Always ensure you’re trading with money you can afford to lose.

Can I use automated trading systems for AUDUSD scalping?

Yes, automated trading systems or Expert Advisors (EAs) can be used for AUDUSD scalping. These systems can execute trades based on pre-programmed rules, potentially eliminating emotional decision-making. However, it’s crucial to thoroughly backtest and forward test any automated system before using it with real money. Additionally, human oversight is still necessary to monitor performance and make adjustments as market conditions change.

How does the time of day affect AUDUSD scalping opportunities?

The time of day can significantly impact AUDUSD scalping opportunities due to varying levels of liquidity and volatility. The most active periods typically occur during the overlap of major market sessions, particularly when both the Australian and US markets are open. This overlap usually happens between 9:00 PM and 6:00 AM GMT. During these hours, you’re likely to see increased volatility and tighter spreads, potentially creating more profitable scalping opportunities. However, it’s important to note that high-impact news releases can create unpredictable market conditions at any time of day.