An automated trading platform is a software program that allows traders to execute market orders based on a set of predefined rules or advanced algorithms. It connects directly to a financial exchange or a regulated forex broker and can automatically manage trades, from entry to exit, without manual intervention. This guide explores how these platforms work, their benefits and risks, and a detailed review of the best options available today to help you determine if an automated trading platform is the right tool for your investment strategy.

Key Takeaways

- Definition: An automated trading platform uses software to execute trades based on user-defined criteria, removing the need for manual order placement.

- How It Works: Platforms use APIs to connect to exchanges and execute trades based on strategies, which can range from simple rules to complex AI models.

- Core Benefits: Key advantages include emotionless trading, high-speed execution, the ability to backtest strategies, and market diversification.

- Inherent Risks: Users must be aware of potential technical failures, the danger of creating an over-optimized strategy that fails in live markets, and sudden market events.

- Choosing a Platform: The best automated trading platform depends on your target market (crypto, forex, stocks), technical skill, and budget.

How Do Automated Trading Systems Work?

At its core, an automated trading platform acts as a bridge between your trading strategy and the market. Instead of you watching charts and clicking the “buy” or “sell” button, the software does it for you with incredible speed and precision. This process relies on a few key technological components working in harmony.

The Role of APIs in Automated Trading

The magic behind the connection is the Application Programming Interface (API). An API is a secure communication channel that allows the trading platform to send and receive information from your brokerage or exchange account. When you set it up, you generate a unique “API key” from your exchange, which you then input into the platform. This key grants the bot permission to perform specific actions, such as analyzing market data and executing trades, without ever having direct access to your account’s login credentials or withdrawal functions.

Pre-defined Rules vs. Machine Learning

The “brain” of an automated trading strategy can be simple or incredibly complex. Most retail platforms operate on pre-defined, “if-this-then-that” logic. For example, a rule could be: “IF the 50-day moving average crosses above the 200-day moving average AND the Relative Strength Index (RSI) is below 30, THEN buy 1 ETH.” More advanced systems, however, are starting to incorporate machine learning (ML) and artificial intelligence (AI) to analyze vast datasets and identify patterns that a human trader might miss, adapting their approach as market conditions evolve.

From Signal Generation to Execution

The entire automated process follows a clear sequence. First, the platform constantly ingests market data. Second, it checks this data against your defined strategy to find a trading opportunity or “signal.” Once a signal is confirmed, the platform instantly calculates position size based on your risk parameters and sends the trade order to the exchange via the API. This entire cycle can happen in milliseconds, a feat impossible for any human trader.

Key Benefits of Using an Automated Platform

The allure of automated trading is strong, and for good reason. When implemented correctly, these systems offer significant advantages over traditional manual trading methods. The benefits extend beyond mere convenience, touching upon the psychological, strategic, and efficiency aspects of trading.

Emotion-Free Trading & Discipline

One of the biggest hurdles for any trader is managing fear and greed. These emotions often lead to impulsive decisions, such as closing a winning trade too early or holding onto a losing position for too long. An automated trading platform operates without any emotion. It sticks to the predefined strategy with rigid discipline, ensuring that your trading plan is executed exactly as you designed it, protecting you from your own psychological biases.

High-Speed Execution & Backtesting

In volatile markets, seconds can make the difference between profit and loss. Automated systems can identify signals and execute trades at speeds far beyond human capability. Furthermore, a critical feature of any robust automated trading platform is backtesting. This allows you to test your trading strategy on historical market data to see how it would have performed in the past, giving you valuable insights and confidence before risking real capital.

Diversification Across Multiple Markets

A manual trader can only effectively monitor a handful of assets or markets at once. An automated system can simultaneously scan hundreds of markets—be it forex pairs, cryptocurrencies, or stocks—24/7. This allows you to diversify your strategies and capture opportunities across the global landscape without being chained to your screen.

The Inherent Risks & Downsides

While the benefits are compelling, it’s crucial to approach automated trading with a clear understanding of its risks. No system is perfect, and relying on technology to manage your capital requires vigilance and a healthy dose of realism. Ignoring these potential pitfalls is a common mistake for newcomers.

Read More: What is Forex Trading Robot?

Mechanical Failures & System Monitoring

An automated system is only as reliable as the technology it runs on. A power outage, loss of internet connectivity, or a server issue at the platform’s end can cause your bot to malfunction. It might miss a trade, fail to exit a position, or even generate erroneous orders. From my own experience, I’ve learned that you can’t just “set and forget” a trading bot. It requires periodic monitoring to ensure it’s running as expected.

The Dangers of Over-Optimization

During the backtesting phase, it’s tempting to keep tweaking your strategy’s parameters until it shows spectacular results on historical data. This is known as “curve-fitting” or over-optimization. A strategy that is perfectly tailored to past data often falls apart when faced with live, unpredictable market conditions. A robust strategy should be simple and work reasonably well across various market conditions, not just a specific historical period.

Market Volatility & Black Swan Events

Automated strategies are built on historical patterns and statistical probabilities. However, they can be vulnerable to sudden, extreme market events, often called “black swan” events. A flash crash, a major geopolitical announcement, or a sudden regulatory change can create market conditions so far outside the norm that the bot’s logic breaks down, potentially leading to significant losses. This is why incorporating stop-loss orders into your automated strategy is non-negotiable.

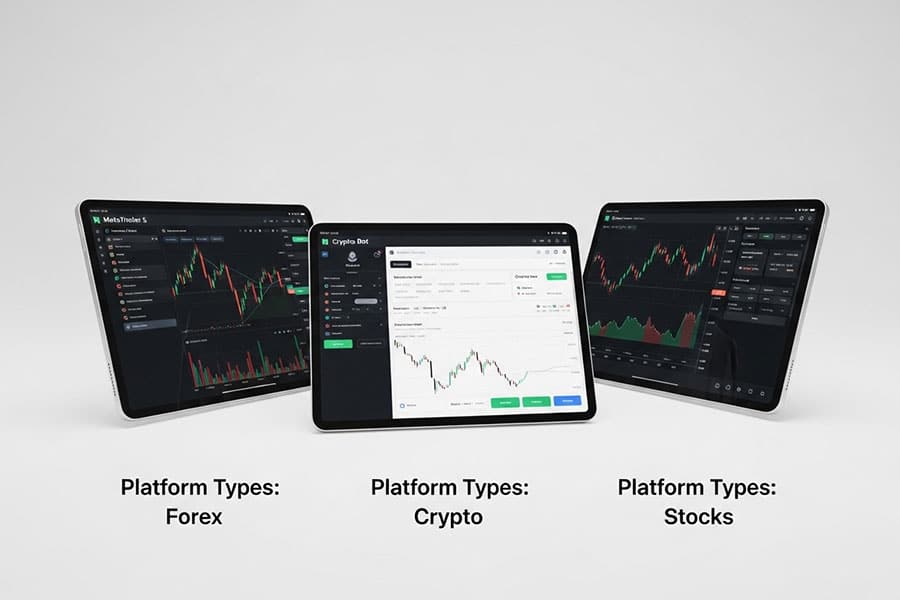

Types of Automated Trading Platforms

The world of automated trading is not one-size-fits-all. Platforms are often specialized to cater to the unique characteristics and demands of different financial markets. Understanding these distinctions is the first step in finding the right tool for your specific trading goals.

Platforms for Forex Trading

The foreign exchange market is the largest and most liquid market in the world, making it a prime candidate for automation. The most popular platforms here are MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These aren’t automated platforms by themselves, but they support automated trading through “Expert Advisors” (EAs). EAs are scripts written in the MQL4 or MQL5 programming language that can be installed on the platform to manage trades automatically.

Automated Crypto Trading Platforms

The 24/7 nature of the cryptocurrency market makes it nearly impossible to trade manually without interruption. This has led to a boom in the automated crypto trading platform space. These are typically web-based services that connect to popular exchanges like Binance, Coinbase, or Kraken via API. They often come with pre-built bots, such as Grid Trading Bots or DCA (Dollar-Cost Averaging) Bots, which are user-friendly even for beginners.

Stock & Options Auto-Trading Bots

Automating stock and options trading is also popular, though the platforms are often integrated directly with specific brokers. Platforms like TradeStation and Interactive Brokers offer powerful, proprietary scripting languages (EasyLanguage and IB API, respectively) that allow traders to build and automate highly sophisticated strategies for equities, options, and futures.

Top 5 Automated Trading Platforms for 2025

Choosing the best automated trading platform is a critical decision that depends on your trading style, technical expertise, and preferred market. After extensive review and considering user feedback, here is a breakdown of five leading platforms, each with its unique strengths.

| Platform | Best For | Key Markets | Notable Feature |

|---|---|---|---|

| Pionex | Beginners in Crypto | Cryptocurrency | 16 free, built-in trading bots |

| 3Commas | Advanced Crypto Traders | Cryptocurrency | SmartTrade terminal & bot marketplace |

| MetaTrader 5 (MT5) | Forex & CFD Traders | Forex, CFDs, Stocks | Expert Advisors (EAs) & huge community |

| TradeStation | Stock & Futures Traders | Stocks, Options, Futures | Powerful EasyLanguage scripting |

| CryptoHopper | Strategy Marketplace Users | Cryptocurrency | Mirror trading and paper trading |

Pionex: Built-in Crypto Bots

Pionex stands out because it’s an exchange with a fully integrated automated crypto trading platform. This eliminates the need for complex API connections. It’s incredibly beginner-friendly, offering 16 free, pre-built trading bots that you can launch in a few clicks. Its most famous bot is the Grid Trading Bot, which is designed to profit from market volatility by placing a series of buy and sell orders within a specified price range.

3Commas: The All-in-One Terminal

3Commas is one of the most popular third-party trading terminals. It connects to over 16 major crypto exchanges and provides a suite of powerful tools. Its SmartTrade terminal allows for more advanced order types than exchanges offer, while its DCA, Grid, and Options bots are highly customizable. 3Commas also features a marketplace where you can subscribe to signals from other successful traders, making it a versatile automated trading platform.

MetaTrader 5: The Forex Standard

For anyone serious about forex automation, MetaTrader 5 (MT5) is essential. It’s the successor to the legendary MT4 and offers more timeframes, indicators, and a multi-threaded strategy tester for faster backtesting. Automation is achieved through Expert Advisors (EAs). You can either code your own EA using the MQL5 language, buy one from the massive MQL5 marketplace, or even hire a developer to build a custom one for you.

TradeStation: For Serious Equity Traders

TradeStation is a heavyweight in the world of stock and futures trading. It’s a broker and platform rolled into one, renowned for its institutional-grade tools and reliability. Its proprietary scripting language, EasyLanguage, is relatively simple to learn and allows you to design, test, and automate virtually any trading idea you can imagine for the stock and futures markets, making it a top-tier automated trading platform for equities.

CryptoHopper: Strategy and Signal Marketplace

CryptoHopper is another leading automated crypto trading platform that connects to all major exchanges. Its strength lies in its extensive marketplace, where users can buy and sell trading strategies and signals. It also offers powerful tools like mirror trading (copying the trades of pros), paper trading to test strategies without risk, and a sophisticated strategy designer for creating your own bots without needing to code.

Read More:

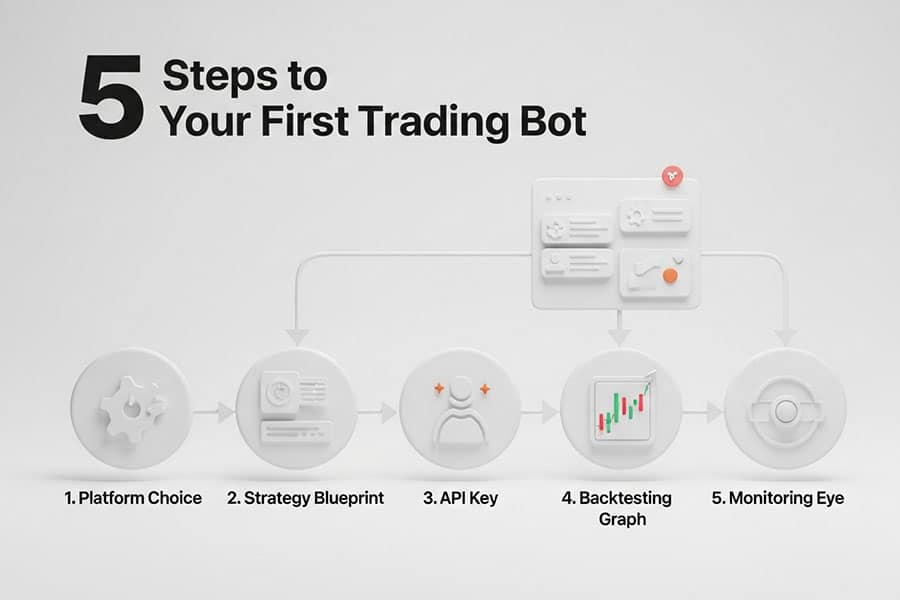

Setting Up Your First Trading Bot: 5 Steps

Diving into the world of automated trading can feel daunting, but it’s a systematic process. By breaking it down into manageable steps, you can go from having a strategy idea to a fully functioning trading bot. This guide will walk you through the essential stages.

Step 1: Choosing the Right Platform

Your first decision is the most critical. As discussed, the best automated trading platform for you depends on what you want to trade. If you’re focused on Bitcoin and Ethereum, a platform like Pionex or 3Commas is ideal. If your interest is in major currency pairs like EUR/USD, you’ll be looking at brokers that support MetaTrader 5. For stocks, a platform like TradeStation is your target.

Step 2: Defining Your Trading Strategy

A bot is only as good as the strategy it executes. You must define clear, unambiguous rules. What technical indicators will you use (e.g., Moving Averages, RSI, MACD)? What are your precise entry conditions? What are your exit conditions, including both a take-profit target and a stop-loss level? This is the intellectual core of your entire automated trading endeavor.

Step 3: Securely Connecting to Your Exchange

Once you have a platform and a strategy, you need to connect them. This is done via API keys. Go to your exchange or broker’s website, navigate to the API settings, and generate a new key. Crucially, when setting permissions, grant the key rights to “read data” and “execute trades,” but never enable withdrawal permissions. This is a vital security measure.

Step 4: Backtesting Your Strategy

Never deploy a new strategy with real money without backtesting it first. Use the platform’s backtesting tool to run your strategy against historical data for the asset you want to trade. Analyze the results: Is it profitable? What is the maximum drawdown (the largest peak-to-trough decline)? This step helps you refine your strategy and build confidence in its viability.

Step 5: Going Live & Continuous Monitoring

After successful backtesting, you can deploy your bot. It’s often wise to start with a small amount of capital to observe its performance in a live market environment. Remember, automation doesn’t mean abdication. You must monitor the bot’s performance, check its trade logs, and ensure it’s functioning correctly. Markets change, and a strategy that works today may need adjustments tomorrow. This vigilance is a key part of using an automated trading platform successfully.

Read More: Create forex trading robot

Are Automated Trading Platforms Profitable?

This is the ultimate question for anyone considering an automated trading platform. The honest answer is: they can be, but profitability is not guaranteed. A platform is merely a tool. A hammer doesn’t build a house; a skilled carpenter does. Similarly, an automated platform doesn’t generate profits on its own; a well-designed, robust, and properly managed trading strategy does. Profitability depends entirely on the quality of your strategy, your risk management, and your discipline to stick to the plan, even when the bot is doing the executing.

Security: How to Protect Your Funds

Entrusting a piece of software with your trading capital requires a strong focus on security. While reputable platforms have robust security measures in place, the ultimate responsibility for protecting your funds lies with you. Adhering to best practices is not optional; it’s essential.

Two-Factor Authentication (2FA)

This is the most fundamental layer of security. Enable 2FA on both your exchange account and your automated trading platform account. Using an authenticator app like Google Authenticator or Authy is far more secure than SMS-based 2FA, which can be vulnerable to SIM-swapping attacks.

Understanding API Key Permissions

As mentioned earlier, this is a critical point. When you generate an API key for your trading bot, you must restrict its permissions. The bot only needs access to read market data and place trades. It should never, under any circumstances, have withdrawal permissions. This ensures that even if the platform were compromised, malicious actors could not steal your funds.

Spotting Scam Platforms

The popularity of automated trading has attracted scammers. Be wary of platforms promising guaranteed, impossibly high returns. Conduct thorough research before signing up for any service. Look for independent reviews, check their security protocols, and be skeptical of any platform that is not transparent about its fees or team. A legitimate automated trading platform will focus on the quality of its technology, not on hype.

Read More: Trading bots pros and cons

The Future of Trading: AI and ML

The evolution of the automated trading platform is far from over. The next frontier is the deeper integration of Artificial Intelligence (AI) and Machine Learning (ML). While current bots primarily follow rigid, pre-programmed rules, future systems will be more adaptive. They will be able to analyze news sentiment, identify complex correlations across different asset classes, and adjust their strategies in real-time based on changing market dynamics. This shift promises a future where trading is not just automated, but truly intelligent.

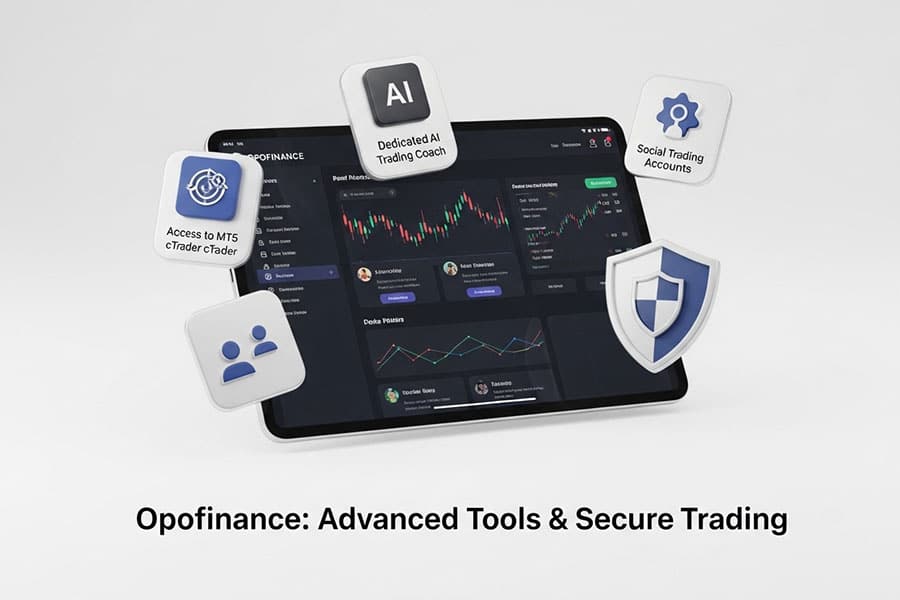

Opofinance Services

For traders seeking a sophisticated and secure environment, Opofinance, an ASIC-regulated broker, presents a compelling suite of tools. This broker integrates advanced technology with a user-centric approach, making it an excellent hub for modern trading.

- Advanced Trading Platforms: Gain an edge by trading on industry-leading platforms like MT4, MT5, and cTrader, alongside the intuitive proprietary OpoTrade platform.

- Innovative AI Tools: Leverage the power of artificial intelligence with exclusive tools such as an AI Market Analyzer, a personalized AI Coach, and responsive AI Support to enhance your decision-making.

- Social & Prop Trading: Engage with a community of traders through social trading features or take on the challenge of proprietary trading to manage larger capital.

- Secure & Flexible Transactions: Experience seamless account funding with safe and convenient deposit and withdrawal methods, including crypto payments, all with zero fees charged by Opofinance.

Explore a smarter way to trade and elevate your strategy by partnering with a forward-thinking broker. Discover the Opofinance advantage today!

Final Verdict

An automated trading platform is a powerful instrument that can provide a significant edge by enforcing discipline, enabling high-speed execution, and opening up diversification opportunities. However, it is not a “get rich quick” solution. Success requires a solid strategy, rigorous backtesting, and diligent risk management. For traders willing to put in the work, automation can transform their approach to the markets and unlock new levels of efficiency and potential. The key is to see it as a tool to execute a great strategy, not as the strategy itself.

Is using an automated trading platform legal?

Yes, using an automated trading platform is completely legal in most jurisdictions, including for retail traders. Major financial markets and regulators permit their use, provided they interact with the market through legitimate, regulated brokers and exchanges.

What is the minimum capital I need to start?

This varies greatly by platform and market. For crypto platforms like Pionex, you can start with as little as $100. For forex trading using EAs on MT5, brokers typically require a minimum deposit of $100-$500. More advanced platforms for stocks may require a higher starting capital.

Can a bot trade while my computer is off?

For web-based platforms (like 3Commas, Pionex), yes. The bots run on their cloud servers, so your computer does not need to be on. For platform-based bots like MetaTrader EAs, you either need to keep your computer running 24/7 or use a Virtual Private Server (VPS) to host the platform.

What is the difference between a bot and a platform?

An automated trading platform is the underlying software or service that provides the tools and infrastructure for automation (e.g., CryptoHopper, TradeStation). A “bot” is the specific set of rules or the individual strategy that runs on that platform to execute trades.

Do I need to know how to code to use these platforms?

Not necessarily. Many modern platforms, especially in the crypto space, offer visual strategy builders and pre-built bots that require no coding. However, for platforms like MetaTrader or TradeStation, knowing their respective scripting languages (MQL5, EasyLanguage) allows for maximum customization and power.